Vancouver, British Columbia–(Newsfile Corp. – July 24, 2023) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) is pleased to announce the execution of an option agreement for EMX’s Flåt and Bamble nickel-copper sulfide projects in Norway (the “Projects“) (see Figure 1) to Londo Nickel Limited (“Londo Nickel“), a public unlisted Australian Company. The agreement provides EMX with 2.5% Net Smelter Return (“NSR“) royalty interests, cash and equity payments, work commitments and other considerations. In conjunction with this transaction, Londo Nickel intends to establish a public listing on the Australian Securities Exchange (ASX) later in 2023.

The Flåt and Bamble Projects belong to a belt of Proterozoic mafic intrusions in southern Norway that hosts a variety of nickel-copper sulfide deposits and occurrences (see Figure 1). These deposits were mined in the 20th century to help feed the nearby Nikkelverk smelter, which is now owned and operated by Glencore. During this period Norway was a major supplier of nickel to the world. The mines in southern Norway are also thought to have provided the majority of global nickel production in the late 19th century, and although over 40 mines have operated in the area historically, there has been very little modern exploration. In a broader context, the belt in southern Norway is considered to be the eastern extension of the same geologic trend that hosts the Voisey’s Bay nickel deposits in Labrador, Canada (the regions of modern-day Fennoscandia and Canada were once adjoined in the middle Proterozoic era).

The Projects will provide Londo Nickel with a strong pair of battery metal assets in advance of its proposed ASX listing. EMX and Londo Nickel will work together to apply modern exploration methods and deposit models to advance the Projects.

Commercial Terms Overview (terms are in Australian dollars (AUD) unless otherwise noted). Upon execution, Londo Nickel will make a cash payment of $30,000. During a seven-month option period, Londo Nickel can acquire a 100% interest in the EMX subsidiary company that controls the Projects by paying EMX an additional $20,000. Upon commencement of the IPO and ASX-listing process, Londo Nickel will make an additional cash payment of up to $100,000 and issue 750,000 shares of Londo Nickel to EMX along with 1,000,000 options with each option being exercisable for one share of Londo Nickel at a price of $0.25 for 48 months. Upon the first anniversary of the IPO, Londo Nickel will also pay EMX $50,000 in cash.

Upon completing the option requirements, Londo Nickel will earn 100% interest in each Project with EMX retaining:

- A 2.5% NSR royalty interest in each Project.

- Annual advance royalty (“AAR“) payments per each Project that commence on the third anniversary of the IPO. These will start at $30,000, with AAR payments increasing by 15% per year on subsequent anniversaries of the IPO until reaching $75,000.

- Milestone payments of $250,000 in cash upon announcement via the ASX of a maiden JORC resource for each Project. Additional milestone payments of $500,000 in cash will be made to EMX upon the delivery of a feasibility study for each Project.

To maintain its interest in the Flåt and Bamble Projects, Londo Nickel will also spend a minimum of $300,000 and $100,000, respectively, by the first anniversary of the IPO, and $300,000 each year starting on the second anniversary of the IPO1.

Flåt Project Overview. EMX’s exploration licenses surround the historical Flåt Mine (see Figure 2), which was one of the largest nickel producers in Europe from 1872 through the end of World War II. Total reported production from the mine was 2.7 Mtonnes at average grades of 0.72% Ni, 0.48% Cu, and 0.06% Co2, and was the major source of nickel for the nearby Nikkelverk smelter in the first half of the 20th century. EMX’s land position covers the lateral and downward extensions of the mineralized body exploited by historical mining at Flåt, as well as other nearby historical mine workings. Falconbridge completed the most recent drill program in the 1970’s, but failed to reach the exploration target at depth. Beyond the near-mine targets, Falconbridge also investigated and drill tested other prospects within the intrusive complex, including Mølland and Oreknappen, which are also within the EMX land position. Drill results at Mølland, which include a historical intercept of 6.78 m @ 1.07% Ni, 0.27% Cu from 103.96 m depth (true width unknown), demonstrate additional upside potential on the project.3

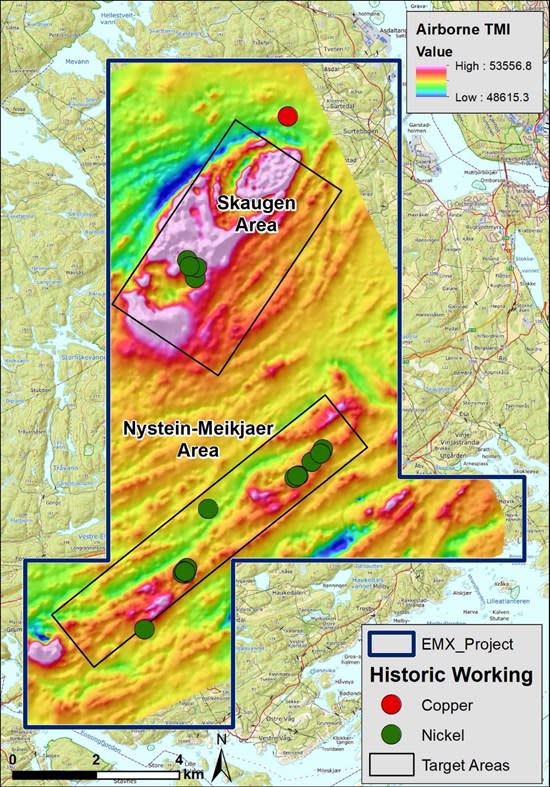

Bamble Project Overview. The Bamble nickel-copper-cobalt project covers a 20-kilometer trend of mafic intrusions in the Bamble Belt. Multiple nickel and copper occurrences have been documented on the Bamble property, many of which have historical mine workings including the Skaugen and Nystein-Meikjaer target areas (see Figure 3). The Skaugen target is a 5 x 2 km magnetite-rich gabbroic pluton with a strong geophysical signature. There are disseminated sulfide occurrences around the periphery of the intrusion, with conductive EM anomalies in the center, many of which have never been drill tested.

More information on the Projects can be found at www.EMXroyalty.com.

Comments on Nearby and Adjacent Properties. The mines and deposits discussed in this news release provide context for EMX’s Projects, which occur in a similar geologic setting, but this is not necessarily indicative that the Projects host similar quantities, grades or styles of mineralization.

Dr. Eric P. Jensen, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”, and also trade on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 973-8585

Dave@emxroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@emxroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward-looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserve and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended March 31, 2023 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2022, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

Figure 1. Location Map of EMX Royalty Properties

To view an enhanced version of Figure 1, please visit:

https://images.newsfilecorp.com/files/1508/174487_1d491acdb4ceeb05_002full.jpg

Figure 2. Overview Map of Flåt Project with Historical Production Annotated

(see footnote 2 for historical production reference)

To view an enhanced version of Figure 2, please visit:

https://images.newsfilecorp.com/files/1508/174487_1d491acdb4ceeb05_003full.jpg

Figure 3. Overview Map of Bamble Project on TMI Magnetics

To view an enhanced version of Figure 3, please visit:

https://images.newsfilecorp.com/files/1508/174487_1d491acdb4ceeb05_004full.jpg

1 The work commitment for the Bamble project will increase to $300,000 per year following the 3rd anniversary of the IPO.

2 Historical production values provided by the Norwegian Geologic Survey in “The Ore Database”. (https://aps.ngu.no/pls/oradb/minres_deposit_fakta.Main?p_objid=5253&p_spraak=E). EMX has not performed sufficient work to verify the published assay data reported above, and these data cannot be verified as compliant with NI 43-101 standards, however EMX considers them reliable and relevant.

3 The historical drilling was completed by Sulfidmalm in 1968 and 1970 as reported to NGU in ‘The Sulfidemalm 2005 Annual Report’. EMX has not performed sufficient work to verify the historical drill results. However, from independent assessment, EMX considers the historical results to be reliable and relevant as an example providing general context for mineralization occurring on the property.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/174487