North Vancouver, British Columbia–(Newsfile Corp. – October 19, 2023) – Lion One Metals Limited (TSXV: LIO) (OTCQX: LOMLF) (ASX: LLO) (“Lion One” or the “Company”) is pleased to report significant new high-grade gold results from ongoing infill and grade control drilling at its 100% owned Tuvatu Alkaline Gold Project in Fiji.

Assay results are presented here for infill and grade control drilling completed in the Zone 2 area of Tuvatu, focusing primarily on the Murau lode system. Mining of the Murau lode system has commenced and grade control drilling is being conducted in advance of further mining in this area. Infill drilling is being conducted to target the up-dip and down-dip extensions of the Murau lodes. The results reported here represent material that is scheduled to be mined in Q4 2023 and throughout 2024.

Lion One Chairman and CEO Walter Berukoff commented: “After celebrating our first gold pour at Tuvatu on October 10th, we now turn our focus back to grade control and infill drilling. These drill programs continue to yield positive results and to strengthen our understanding of the mineralization at Tuvatu. We are pleased to present yet another batch of high-grade results from the Zone 2 area of Tuvatu, an area which will serve to feed our brand-new mill in the mid-to-near term future.”

Highlights of Zone 2 drilling (3.0 g/t cutoff):

- 84.96 g/t Au over 1.2 m (TGC-0092, from 4.5 m depth)

- 20.69 g/t Au over 4.2 m (including 40.22 g/t Au over 0.9 m) (TUDDH-677, from 76.5 m depth)

- 13.60 g/t Au over 5.1 m (including 98.87 g/t Au over 0.3 m) TUDDH-663, from 89.1 m depth)

- 13.22 g/t Au over 5.1 m (including 50.54 g/t Au over 0.3 m) (TGC-0085, from 56.5 m depth)

- 15.64 g/t Au over 3.9 m (including 23.48 g/t Au over 1.2 m) (TUDDH-680, from 140.9 m depth)

- 38.26 g/t Au over 1.5 m (including 41.99 g/t Au over 0.6 m) (TUDDH-663, from 177.3 m depth)

- 34.77 g/t Au over 0.9 m (including 35.67 g/t Au over 0.3 m) (TUDDH-680, from 146.6 m depth)

- 31.25 g/t Au over 1.2 m (TUDDH-680, from 148.7 m depth)

- 15.12 g/t Au over 2.1 m (including 22.42 g/t Au over 1.2 m) (TUDDH-678, from 135.3 m depth)

- 13.61 g/t Au over 2.1 m (including 42.48 g/t Au over 0.6 m) (TUDDH-666, from 184.6 m depth)

- 11.19 g/t Au over 2.4 m (including 30.75 g/t Au over 0.6 m) (TGC-0090, from 45.3 m depth)

- 9.26 g/t Au over 2.7 m (including 13.11 g/t Au over 0.9 m) (TGC-0089, from 48.8 m depth)

- 82.33 g/t Au over 0.3 m (TGC-0092, from 28.2 m depth)

Figure 1. Location of Zone 2 Grade Control and Infill Drillholes. Plan view of Tuvatu showing the Zone 2 grade control and infill drillholes included in this news release in relation to the mineralized lodes at Tuvatu. Drillholes are shown in black, mineralized lodes in grey, and underground developments in red.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/184530_7a7b2314041049c6_001full.jpg

Table 1. Highlights of composited grade control and infill drill results in the Zone 2 area. Composites are calculated using a 3 g/t Au cutoff with maximum internal dilution intervals of 1 m at <3 g/t Au. For full results see Table 2 in the appendix.

| Hole ID | From | To | Interval (m) | Au (g/t) | |

| TGC-0092 | 4.5 | 5.7 | 1.2 | 84.96 | |

| TUDDH-677 | 76.5 | 80.7 | 4.2 | 20.69 | |

| including | 78.3 | 80.7 | 2.4 | 32.81 | |

| which includes | 78.3 | 79.2 | 0.9 | 40.22 | |

| and | 79.2 | 79.8 | 0.6 | 13.08 | |

| and | 79.8 | 80.7 | 0.9 | 38.56 | |

| TUDDH-663 | 89.1 | 94.2 | 5.1 | 13.6 | |

| including | 89.1 | 90.6 | 1.5 | 35.51 | |

| which includes | 89.1 | 89.4 | 0.3 | 13.99 | |

| and | 89.4 | 89.7 | 0.3 | 40.56 | |

| and | 89.7 | 90 | 0.3 | 12.09 | |

| and | 90 | 90.3 | 0.3 | 12.03 | |

| and | 90.3 | 90.6 | 0.3 | 98.87 | |

| and also including | 93.6 | 94.2 | 0.6 | 15.25 | |

| TGC-0085 | 56.5 | 61.6 | 5.1 | 13.22 | |

| including | 57.1 | 57.7 | 0.6 | 35.68 | |

| and | 58.6 | 59.5 | 0.9 | 20.89 | |

| and | 60.1 | 60.4 | 0.3 | 50.54 | |

| TUDDH-680 | 140.9 | 144.8 | 3.9 | 15.64 | |

| including | 140.9 | 142.1 | 1.2 | 21.38 | |

| and | 143.6 | 144.8 | 1.2 | 23.48 | |

| TUDDH-663 | 177.3 | 178.8 | 1.5 | 38.26 | |

| including | 177.3 | 178.2 | 0.9 | 35.78 | |

| and | 178.2 | 178.8 | 0.6 | 41.99 | |

| TUDDH-680 | 146.6 | 147.5 | 0.9 | 34.77 | |

| including | 146.6 | 147.2 | 0.6 | 34.33 | |

| and | 147.2 | 147.5 | 0.3 | 35.67 | |

| TUDDH-680 | 148.7 | 149.9 | 1.2 | 31.25 | |

| TUDDH-678 | 135.3 | 137.4 | 2.1 | 15.12 | |

| including | 136.2 | 137.4 | 1.2 | 24.63 | |

| TUDDH-666 | 184.6 | 186.7 | 2.1 | 13.61 | |

| including | 186.1 | 186.7 | 0.6 | 42.48 | |

| TGC-0090 | 45.3 | 47.7 | 2.4 | 11.19 | |

| including | 47.1 | 47.7 | 0.6 | 30.75 | |

| which includes | 47.1 | 47.4 | 0.3 | 25.52 | |

| and | 47.4 | 47.7 | 0.3 | 35.89 | |

| TGC-0089 | 48.8 | 51.5 | 2.7 | 9.26 | |

| including | 48.8 | 49.7 | 0.9 | 13.11 | |

| and | 50.6 | 51.5 | 0.9 | 10.21 | |

| TGC-0092 | 28.2 | 28.5 | 0.3 | 82.33 | |

| TUDDH-663 | 169.2 | 171.6 | 2.4 | 7.96 | |

| including | 170.1 | 171.3 | 1.2 | 11.92 | |

| which includes | 170.7 | 171.3 | 0.6 | 15.55 | |

| TGC-0095 | 60.3 | 60.6 | 0.3 | 62.38 |

Murau Lodes

The Murau lodes are located within the Zone 2 area of Tuvatu, along the upper portion of the western decline in the northwest part of the deposit. The Zone 2 area encompasses a number of distinct lode systems, including the URW1, URA1, and Murau lode systems. The Zone 2 area was the first to commence mining at Tuvatu and mining is ongoing in all three of these lode systems.

The current round of infill and grade control drilling in the Zone 2 area is focused on the Murau lode system, which is modelled as a series of stacked relatively flat lying lodes that strike approximately east-west and dip moderately to the south. The portion of the Murau lode system that is currently targeted for mining consists of a vertical extent of 55 m, an east-west strike length of 110 m, and a down-dip extension of 100 m.

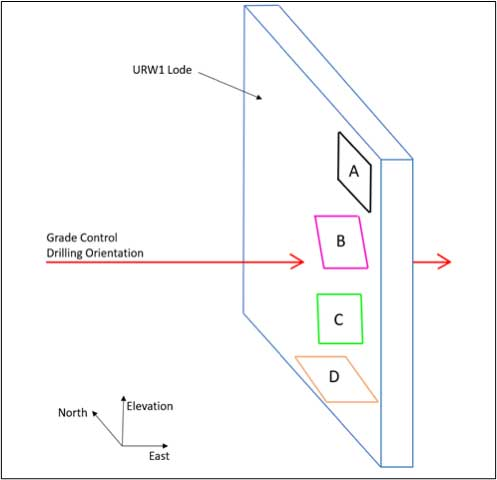

Figure 2. Murau Lode System. Oblique section of the Murau lode system in relation to the infill and grade control drillholes reported here. View is to the ESE and slightly down dip along the Murau lodes. The stacked nature of the Murau lodes is visible in the image. Grade control drilling is focused on near-term mining whereas infill drilling is focused on the up-dip and down-dip extensions of the lodes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/184530_7a7b2314041049c6_002full.jpg

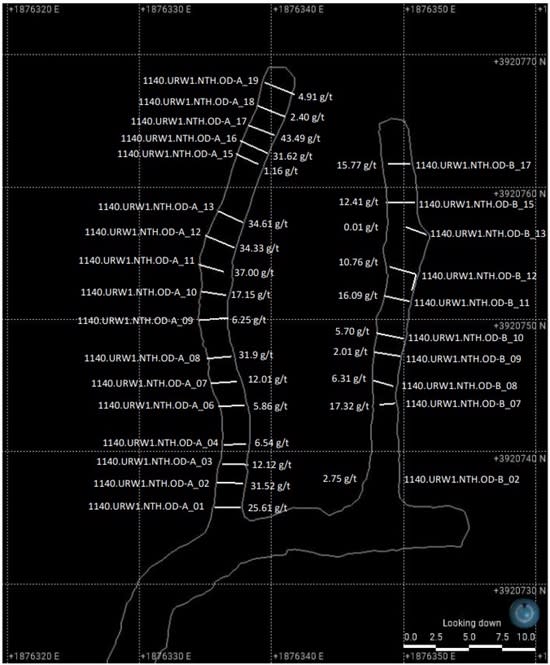

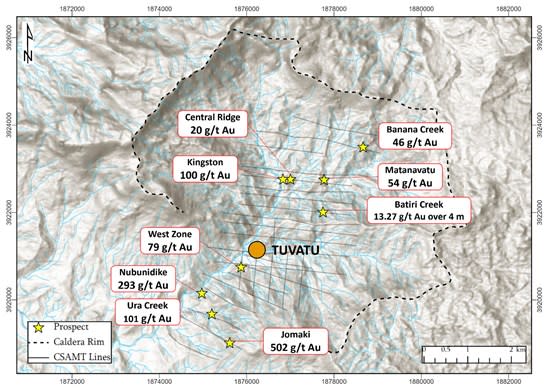

A total of 10 infill and 11 grade control drillholes are included in this release. The infill drill program was conducted from surface and was designed to target the up-dip and down-dip extension of the Murau lodes on approximately 20 m centers. The goal of the program is to provide an increased understanding of the system’s mineralization and geometry in these areas. The grade control drill program was conducted from underground on 5-10 m centers and was designed to provide much higher resolution of the Murau lode system in advance of mine development and extraction. The location of high-grade intercepts is shown in Figure 3 while examples of Murau lode mineralization are shown in Figure 4. The Zone 2 infill and grade control drill programs are ongoing. Previous drill results from the Zone 2 area can be seen in the news releases dated September 14, 2023, June 14, 2023, and April 25, 2023.

Figure 3. Location of High-Grade Intercepts from Zone 2 Infill and Grade Control Drilling, 3.0 g/t Au cutoff. Oblique section view of the Murau lode system highlighting the high-grade intercepts from the Zone 2 infill and grade control drill program in the Murau system. View is to the ESE and slightly down dip along the Murau lodes. Downhole composite intervals with grades between 3 and 10 g/t Au are shown in orange, intervals with grades between 10 and 30 g/t Au are shown in red, and intervals over 30 g/t Au are shown in purple. Select high-grade intervals are identified. Grades shown are gold grades in g/t.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/184530_7a7b2314041049c6_003full.jpg

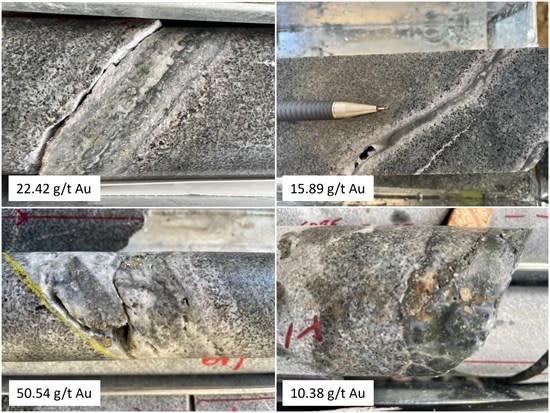

Figure 4. Example Mineralization from Zone 2 Infill and Grade Control Drilling. Top left: Monzonite-hosted quartz vein with coarse grained pyrite and honey-sphalerite (TUDDH-678, 136.3 m). Top right: Vuggy chalcedony-pyrite veinlet with well-developed alteration selvage (TUDDH-667, 156.3 m). Bottom left: Vuggy quartz vein with coarse-grained pyrite and honey sphalerite within a 5.1 m zone of 13.22 g/t Au (TGC-0085, 60.2 m). Bottom right: Monzonite-hosted quartz-pyrite-sphalerite vein (TUDDH-661, 131.7 m). Core diameter is 4.76 cm in each photo.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/184530_7a7b2314041049c6_004full.jpg

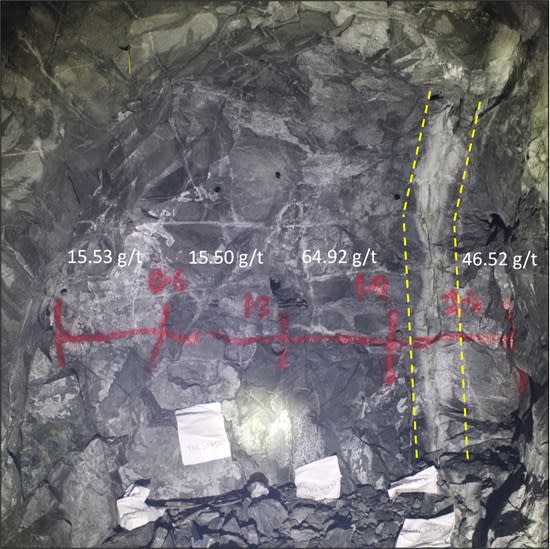

About Tuvatu

The Tuvatu Alkaline Gold Project is located on the island of Viti Levu in Fiji. The January 2018 mineral resource for Tuvatu as disclosed in the technical report “Technical Report and Preliminary Economic Assessment for the Tuvatu Gold Project, Republic of Fiji”, dated September 25, 2020, and prepared by Mining Associates Pty Ltd of Brisbane Qld, comprises 1,007,000 tonnes indicated at 8.50 g/t Au (274,600 oz. Au) and 1,325,000 tonnes inferred at 9.0 g/t Au (384,000 oz. Au) at a cut-off grade of 3.0 g/t Au. The technical report is available on the Lion One website at www.liononemetals.com and on the SEDAR website at www.sedarplus.ca.

Qualified Person

In accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43- 101”), Sergio Cattalani, P.Geo, Senior Vice President Exploration, is the Qualified Person for the Company and has reviewed and is responsible for the technical and scientific content of this news release.

QAQC Procedures

Lion One adheres to rigorous QAQC procedures above and beyond basic regulatory guidelines in conducting its sampling, drilling, testing, and analyses. The Company utilizes its own fleet of diamond drill rigs, using PQ, HQ and NQ sized drill core rods. Drill core is logged and split by Lion One personnel on site. Samples are delivered to and analyzed at the Company’s geochemical and metallurgical laboratory in Fiji. Duplicates of all samples with grades above 0.5 g/t Au are both re-assayed at Lion One’s lab and delivered to ALS Global Laboratories in Australia (ALS) for check assay determinations. All samples for all high-grade intercepts are sent to ALS for check assays. All samples are pulverized to 85% passing through 75 microns. Gold analysis is carried out using fire assay with an AA finish. Samples that have returned grades greater than 10.00 g/t Au are then re-analyzed by gravimetric method. For samples that return greater than 0.50 g/t Au, repeat fire assay runs are carried out and repeated until a result is obtained that is within 10% of the original fire assay run. Lion One’s laboratory can also assay for a range of 71 other elements through Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES), but currently focuses on a suite of 9 important pathfinder elements. All duplicate anomalous samples are sent to ALS labs in Townsville QLD and are analyzed by the same methods (Au-AA26, and Au-GRA22 where applicable). ALS also analyses 33 pathfinder elements by HF-HNO3-HClO4 acid digestion, HCl leach and ICP-AES (method ME-ICP61).

About Lion One Metals Limited

Lion One’s flagship asset is 100% owned, fully permitted high grade Tuvatu Alkaline Gold Project, located on the island of Viti Levu in Fiji. Lion One envisions a low-cost high-grade underground gold mining operation at Tuvatu coupled with exciting exploration upside inside its tenements covering the entire Navilawa Caldera, an underexplored yet highly prospective 7km diameter alkaline gold system. Lion One’s CEO Walter Berukoff leads an experienced team of explorers and mine builders and has owned or operated over 20 mines in 7 countries. As the founder and former CEO of Miramar Mines, Northern Orion, and La Mancha Resources, Walter is credited with building over $3 billion of value for shareholders.

On behalf of the Board of Directors of

Lion One Metals Limited

“Walter Berukoff“, Chairman and CEO

Contact Investor Relations

Toll Free (North America) Tel: 1-855-805-1250

Email: info@liononemetals.com

Website: www.liononemetals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider accepts responsibility for the adequacy or accuracy of this release

This press release may contain statements that may be deemed to be “forward-looking statements” within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “proposed”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited’s current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-Looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labour or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Appendix 1: Full Drill Results and Collar Information

Table 2. Composited results from grade control and infill drillholes in the Zone 2 area (grade >3.0 g/t Au)

| Hole ID | From | To | Interval (m) | Au (g/t) | |

| TGC-0085 | 45.7 | 46.6 | 0.9 | 3.3 | |

| TGC-0085 | 47.5 | 48.7 | 1.2 | 4.69 | |

| TGC-0085 | 50.5 | 51.7 | 1.2 | 4.7 | |

| TGC-0085 | 54.4 | 54.7 | 0.3 | 15.23 | |

| TGC-0085 | 56.5 | 61.6 | 5.1 | 13.22 | |

| including | 57.1 | 57.7 | 0.6 | 35.68 | |

| and | 58.6 | 59.5 | 0.9 | 20.89 | |

| and | 60.1 | 60.4 | 0.3 | 50.54 | |

| TGC-0087 | 23.4 | 24 | 0.6 | 10.82 | |

| including | 23.7 | 24 | 0.3 | 14.44 | |

| TGC-0087 | 39.6 | 40.8 | 1.2 | 3.12 | |

| TGC-0087 | 49.8 | 50.1 | 0.3 | 3.72 | |

| TGC-0089 | 38.7 | 39.6 | 0.9 | 3.49 | |

| TGC-0089 | 41.6 | 41.9 | 0.3 | 12.45 | |

| TGC-0089 | 44.6 | 45.5 | 0.9 | 6.26 | |

| TGC-0089 | 48.8 | 51.5 | 2.7 | 9.26 | |

| including | 48.8 | 49.7 | 0.9 | 13.11 | |

| and | 50.6 | 51.5 | 0.9 | 10.21 | |

| TGC-0090 | 0 | 0.9 | 0.9 | 3.86 | |

| TGC-0090 | 34.8 | 35.4 | 0.6 | 6.74 | |

| TGC-0090 | 45.3 | 47.7 | 2.4 | 11.19 | |

| including | 47.1 | 47.7 | 0.6 | 30.75 | |

| which includes | 47.1 | 47.4 | 0.3 | 25.52 | |

| and | 47.4 | 47.7 | 0.3 | 35.89 | |

| TGC-0091 | 27 | 27.3 | 0.3 | 7.94 | |

| TGC-0091 | 33.6 | 34.2 | 0.6 | 5.59 | |

| TGC-0091 | 44.1 | 44.4 | 0.3 | 14.89 | |

| TGC-0092 | 4.5 | 5.7 | 1.2 | 84.96 | |

| TGC-0092 | 28.2 | 28.5 | 0.3 | 82.33 | |

| TGC-0092 | 39 | 39.6 | 0.6 | 11.7 | |

| including | 39.3 | 39.6 | 0.3 | 15.64 | |

| TGC-0092 | 42.6 | 43.5 | 0.9 | 5.18 | |

| TGC-0094 | 12.2 | 13.1 | 0.9 | 5.11 | |

| TGC-0094 | 49.1 | 50.3 | 1.2 | 15.29 | |

| TGC-0095 | 39 | 40.2 | 1.2 | 13.7 | |

| including | 39.3 | 39.6 | 0.3 | 20.22 | |

| and | 39.9 | 40.2 | 0.3 | 30.52 | |

| TGC-0095 | 42.6 | 43.5 | 0.9 | 15.49 | |

| TGC-0095 | 54.9 | 55.2 | 0.3 | 6.72 | |

| TGC-0095 | 60.3 | 60.6 | 0.3 | 62.38 | |

| TGC-0100 | 8.4 | 9.3 | 0.9 | 3.64 | |

| TGC-0100 | 48.6 | 48.9 | 0.3 | 35.93 | |

| TGC-0100 | 60.9 | 61.2 | 0.3 | 9.85 | |

| TGC-0100 | 68.4 | 68.7 | 0.3 | 15.02 | |

| TGC-0100 | 72.9 | 73.5 | 0.6 | 5.3 | |

| TUDDH-661 | 118.9 | 120.1 | 1.2 | 3.03 | |

| TUDDH-661 | 131.5 | 132.1 | 0.6 | 7.09 | |

| including | 131.5 | 131.8 | 0.3 | 10.38 | |

| TUDDH-663 | 50.7 | 51.3 | 0.6 | 4.01 | |

| TUDDH-663 | 89.1 | 94.2 | 5.1 | 13.6 | |

| including | 89.1 | 90.6 | 1.5 | 35.51 | |

| which includes | 89.1 | 89.4 | 0.3 | 13.99 | |

| and | 89.4 | 89.7 | 0.3 | 40.56 | |

| and | 89.7 | 90 | 0.3 | 12.09 | |

| and | 90 | 90.3 | 0.3 | 12.03 | |

| and | 90.3 | 90.6 | 0.3 | 98.87 | |

| and also including | 93.6 | 94.2 | 0.6 | 15.25 | |

| TUDDH-663 | 101.1 | 102 | 0.9 | 10.98 | |

| TUDDH-663 | 154.5 | 154.8 | 0.3 | 16.89 | |

| TUDDH-663 | 159.9 | 160.2 | 0.3 | 3.43 | |

| TUDDH-663 | 162 | 162.3 | 0.3 | 8.37 | |

| TUDDH-663 | 164.7 | 165 | 0.3 | 15.64 | |

| TUDDH-663 | 169.2 | 171.6 | 2.4 | 7.96 | |

| including | 170.1 | 171.3 | 1.2 | 11.92 | |

| which includes | 170.7 | 171.3 | 0.6 | 15.55 | |

| TUDDH-663 | 173.1 | 175.5 | 2.4 | 3.87 | |

| TUDDH-663 | 177.3 | 178.8 | 1.5 | 38.26 | |

| including | 177.3 | 178.2 | 0.9 | 35.78 | |

| and | 178.2 | 178.8 | 0.6 | 41.99 | |

| TUDDH-664 | 73.7 | 74.3 | 0.6 | 3.07 | |

| TUDDH-664 | 76.7 | 77.3 | 0.6 | 20.79 | |

| TUDDH-664 | 121.8 | 122.7 | 0.9 | 18.99 | |

| TUDDH-664 | 124.5 | 126 | 1.5 | 8.17 | |

| including | 125.4 | 126 | 0.6 | 11.44 | |

| TUDDH-666 | 101.8 | 102.1 | 0.3 | 3.55 | |

| TUDDH-666 | 167.5 | 170.2 | 2.7 | 6.65 | |

| including | 169.3 | 170.2 | 0.9 | 13.33 | |

| which includes | 169.3 | 169.6 | 0.3 | 27.99 | |

| TUDDH-666 | 184.6 | 186.7 | 2.1 | 13.61 | |

| including | 186.1 | 186.7 | 0.6 | 42.48 | |

| TUDDH-666 | 193.3 | 193.9 | 0.6 | 4.73 | |

| TUDDH-667 | 153.1 | 154.9 | 1.8 | 9.99 | |

| including | 153.7 | 154.9 | 1.2 | 11.87 | |

| which includes | 153.7 | 154 | 0.3 | 29.47 | |

| TUDDH-667 | 156.1 | 156.4 | 0.3 | 15.89 | |

| TUDDH-670 | 69.4 | 70 | 0.6 | 25.68 | |

| TUDDH-670 | 74.5 | 75.4 | 0.9 | 4.37 | |

| TUDDH-673 | 87.2 | 87.8 | 0.6 | 20.26 | |

| TUDDH-673 | 150.8 | 151.7 | 0.9 | 15.73 | |

| TUDDH-673 | 157.7 | 158.6 | 0.9 | 3.4 | |

| TUDDH-673 | 162.2 | 162.8 | 0.6 | 12.27 | |

| TUDDH-677 | 69.6 | 70.5 | 0.9 | 4.41 | |

| TUDDH-677 | 76.5 | 80.7 | 4.2 | 20.69 | |

| including | 78.3 | 80.7 | 2.4 | 32.81 | |

| which includes | 78.3 | 79.2 | 0.9 | 40.22 | |

| and | 79.2 | 79.8 | 0.6 | 13.08 | |

| and | 79.8 | 80.7 | 0.9 | 38.56 | |

| TUDDH-677 | 82.2 | 82.8 | 0.6 | 4.35 | |

| TUDDH-678 | 67.4 | 67.7 | 0.3 | 4.14 | |

| TUDDH-678 | 83.4 | 84 | 0.6 | 19.71 | |

| including | 83.7 | 84 | 0.3 | 35.99 | |

| TUDDH-678 | 135.3 | 137.4 | 2.1 | 15.12 | |

| including | 136.2 | 137.4 | 1.2 | 24.63 | |

| TUDDH-678 | 144.6 | 144.9 | 0.3 | 3.13 | |

| TUDDH-680 | 135.5 | 136.7 | 1.2 | 3.6 | |

| TUDDH-680 | 138.8 | 139.7 | 0.9 | 5.91 | |

| TUDDH-680 | 140.9 | 144.8 | 3.9 | 15.64 | |

| including | 140.9 | 142.1 | 1.2 | 21.38 | |

| and | 143.6 | 144.8 | 1.2 | 23.48 | |

| TUDDH-680 | 146.6 | 147.5 | 0.9 | 34.77 | |

| including | 146.6 | 147.2 | 0.6 | 34.33 | |

| and | 147.2 | 147.5 | 0.3 | 35.67 | |

| TUDDH-680 | 148.7 | 149.9 | 1.2 | 31.25 |

Table 3. Collar coordinates for grade control drillholes reported in this release. Coordinates are in Fiji map grid.

| Hole ID | Easting | Northing | Elevation | Azimuth | Dip | Depth |

| TGC-0085 | 1876267 | 3920759 | 151 | 77.3 | -62.0 | 81.7 |

| TGC-0087 | 1876264 | 3920768 | 152 | 353.3 | -52.3 | 65.6 |

| TGC-0089 | 1876264 | 3920768 | 152 | 356.2 | -67.4 | 65.5 |

| TGC-0090 | 1876264 | 3920768 | 153 | 357.2 | -38.6 | 65.7 |

| TGC-0091 | 1876264 | 3920768 | 152 | 8.1 | -46.1 | 71.7 |

| TGC-0092 | 1876265 | 3920768 | 152 | 17.4 | -37.1 | 71.6 |

| TGC-0094 | 1876266 | 3920767 | 151 | 48.0 | -79.6 | 60.8 |

| TGC-0095 | 1876266 | 3920768 | 152 | 42.1 | -27.6 | 77.1 |

| TGC-0097 | 1876267 | 3920768 | 153 | 42.1 | -8.2 | 80.6 |

| TGC-0099 | 1876267 | 3920768 | 153 | 48.1 | -12.4 | 80.2 |

| TGC-0100 | 1876267 | 3920768 | 153 | 46.6 | -19.2 | 76.4 |

Table 4. Collar coordinates for infill drillholes reported in this release. Coordinates are in Fiji map grid.

| Hole ID | Easting | Northing | Elevation | Azimuth | Dip | Depth |

| TUDDH-661 | 1876179 | 3920731 | 199 | 63.1 | -51.2 | 173.7 |

| TUDDH-663 | 1876178 | 3920730 | 199 | 61.1 | -73.4 | 197.3 |

| TUDDH-664 | 1876177 | 3920731 | 199 | 52.4 | -59.3 | 185.7 |

| TUDDH-666 | 1876177 | 3920729 | 199 | 74.1 | -77.1 | 201.3 |

| TUDDH-667 | 1876177 | 3920728 | 199 | 83.2 | -57.8 | 185.9 |

| TUDDH-670 | 1876259 | 3920803 | 203 | 54.3 | -55.3 | 98.6 |

| TUDDH-673 | 1876177 | 3920728 | 199 | 88.3 | -64.3 | 194.7 |

| TUDDH-677 | 1876259 | 3920803 | 203 | 60.3 | -63.6 | 101.9 |

| TUDDH-678 | 1876225 | 3920709 | 218 | 30.5 | -61.0 | 151.4 |

| TUDDH-680 | 1876225 | 3920709 | 218 | 34.1 | -64.1 | 165.0 |

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/184530