Vancouver, British Columbia–(Newsfile Corp. – March 3, 2025) – Goldshore Resources Inc. (TSXV: GSHR) (OTCQB: GSHRF) (FSE: 8X00) (“Goldshore” or the “Company“), is pleased to announce its latest assay results from its ongoing 15,000-meter drill program and first results from the Superion prospect on the north side of the Moss Gold Project in Northwest Ontario, Canada (the “Moss Gold Project“). The encountered mineralization at the Superion target is situated at the margin of the conceptual open pit at 60 meters depth; the Company believes this target has the potential to significantly add to the current mineral resource estimate within the top 200 meters from surface with continued drilling and to reduce the overall strip ratio of the deposit.

Michael Henrichsen, CEO of Goldshore commented, “We are very pleased with our first drill hole into the Superion target. The high grades encountered at shallow depths extending mineralization 335 meters vertically upward from a deep 2022 intercept clearly demonstrates the potential for resource growth at Moss and has the potential to significantly impact the economic performance of the deposit moving forward. The current 15,000-meter winter drill program is delivering outstanding results, exceeding our expectations and highlighting the potential for a much larger mineralized system which will be pursued in the near future through additional drilling.”

Highlights

Superion Target

- First results from the Superion prospect with MQD-25-148 have discovered a new gold-mineralized shear approximately 60m from surface and 225m north of the QES Zone with an intercept of:

- 17.6m of 3.03 g/t Au from 76.4m, including

- 6.8m of 7.06 g/t Au from 79.1m

- 17.6m of 3.03 g/t Au from 76.4m, including

- Scout drilling continues at Superion exploring the 1,500m by 400m sparsely tested and muskeg-covered area immediately north of the QES Zone where previously extended QES holes, from Goldshore’s drilling in 2021 and 2022, have intersected the Superion structure at depth with the following intercepts:

- 16.0m of 2.69 g/t Au from 477m in MQD-22-014, including

- 5.25m of 7.87 g/t Au from 477.75m

- 40.0m of 0.71 g/t Au from 607m in MQD-21-009, including

- 7.85m of 1.18 g/t Au from 607m and

- 9.0m of 1.42 g/t Au from 638m

- 16.0m of 2.69 g/t Au from 477m in MQD-22-014, including

Southwest Zone

- Two of three drill holes continued to extend mineralized shears toward surface at the Southwest Zone with intercepts of:

- 10.0m of 0.79 g/t Au from 50.0m in MMD-25-144, and

- 12.0m of 0.98 g/t Au from 76.0m, including

- 3.6m of 2.77 g/t Au from 79.0m

- 27.0m of 0.44 g/t Au from 32.0m in MMD-25-145, and

- 6.0m of 1.34 g/t Au from 141.0m, including

- 3.8m of 1.89 g/t Au from 142.2m, and

- 35.35m of 0.41 g/t Au from 263.0m

Technical Overview

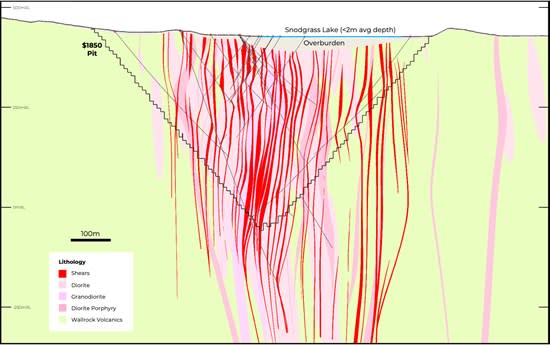

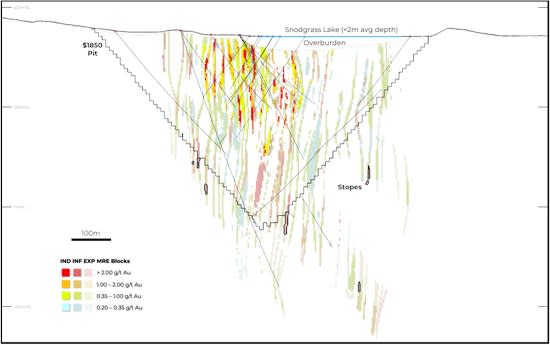

Figure 1 shows the location of the drill holes being reported with respect to the planned winter drill program, while Figure 2 illustrates a cross section through drill hole MQD-25-148 that demonstrates significant mineralization on the northern flank of the current mineral resource. Tables 1 & 2 summarize significant intercepts and drill hole locations, respectively.

Figure 1: Illustrates the 2025 ongoing winter drill program targeting resource expansion within the conceptual open pit outlined in grey. Drill holes being reported are highlighted in red.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/242996_64eac14474540b1a_002full.jpg

Figure 2: Drill section through MQD-25-148 illustrating the discovery of a new high-grade gold-mineralized shear that potentially connects with shears intercepted at 400-450 meters depth on the northern side of the QES Zone

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/242996_64eac14474540b1a_003full.jpg

Drilling at the Superion target aims to quantify the near surface potential of previous deep intercepts and untested soil anomalies north of the QES Zone across a 1,500m x 400m area of sparsely tested muskeg. A significant portion of this area lies within the conceptual open pit and is currently flagged as waste material. Any discoveries in this area will immediately reduce the potential strip ratios and potentially support an overall expansion of the QES conceptual open pit.

Hole MQD-25-148 was drilled to test the immediate up dip potential of shears intersected in hole MQD-22-014, which was previously extended past the QES Zone, and intersected 16.0m of 2.69 g/t Au from 477m in MQD-22-014, including 5.25m of 7.87 g/t Au from 477.75m. Hole MQD-25-148 collared into a wide zone of generally undeformed epidote-chlorite altered diorite containing 2-3% pyrite before encountering a series of close spaced shear zones containing strong sericite-silica alteration, numerous highly deformed cm-scale quartz veins and 4-5% pyrite-chalcopyrite mineralization from 82.15-93.45m. The hole returned to an epidote-chlorite diorite with 2-3% pyrite and 10cm scale patches of strong silicification for the remainder of the hole.

The shear zone returned a significant high-grade interval of 17.6m of 3.03 g/t Au & 9.62 g/t Ag from 76.4m including 6.80m of 7.06 g/t Au & 23.9 g/t Ag from 79.1m (Figure 3). The 1:3 Au-Ag ratio in these results is notably higher than the typical 1:1.5 Au-Ag ratio encountered at the Moss Deposit, highlighting the need to resample historical drill core to build the silver database as it has the potential to add value to the Moss Gold Project.

Figure 3: Hole MQD-25-148: Wide high-grade strongly sheared sericite-silica altered diorite within a broad epidote-chlorite altered diorite intrusion returning 17.6m of 3.03 g/t Au & 9.62 g/t Ag from 76.4m.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8051/242996_64eac14474540b1a_004full.jpg

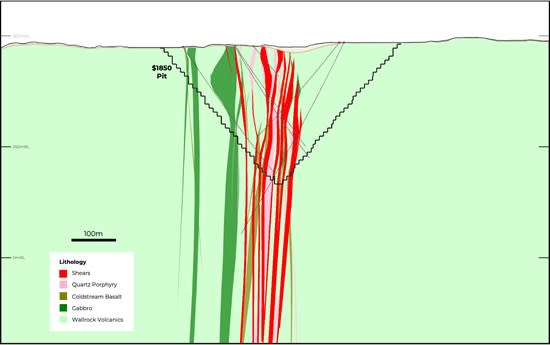

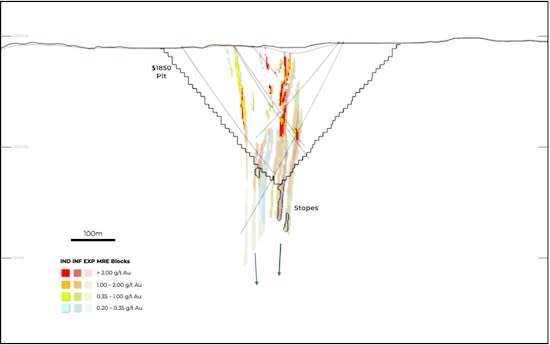

Drilling at the Southwest Zone continues its focus on adding to the mineral resource by infilling gaps within the current model created by sparse drilling. Drilling at shallow depths of 100-200 meters will allow for mineralized shear zones to be extended to the surface. Drilling at depths of 200 to 400 meters will allow the expansion of the open pit resource to a similar depth as the Main-QES pit (~500 meters).

Hole MMD-25-143 was drilled beneath shallowly defined mineralization from the eastern side of the Southwest Zone collaring into a sequence of brecciated dacitic volcanic rocks with a swarm of narrow chlorite altered diorite dykes. At 140m depth, the hole entered the typical altered and locally sheared diorite package for the remainder of the hole yielding intercepts such as 10.8m of 0.43 g/t Au from 155.2m and 18.6m of 0.56 g/t Au from 256.5m, including 2.0m of 1.40 g/t Au from 266.0m.

Holes MMD-25-144 and MMD-25-145 collared in the centre of the Southwest Zone and drilled towards the southeast to extend the previously defined shear zones toward surface. Both holes collared into the wide multi-stage silica-sericite and epidote-chlorite altered diorite intrusion package, as is typical of the peripheral areas of the Southwest Zone, yielding broad lower grade intercepts such as 12.0m of 0.98 g/t Au from 76.0m, including 3.6m of 2.77 g/t Au from 79.0m in MMD-25-144, and 35.35m of 0.14 g/t Au from 263m, before ending in the dacitic volcanic rocks depicting the end of the zone.

Table 1: Significant intercepts

| HOLE ID | FROM | TO | LENGTH (m) | TRUE WIDTH (m) | CUT GRADE (g/t Au) | UNCUT GRADE (g/t Au) |

| MMD-25-143 | 16.00 | 18.00 | 2.00 | 1.2 | 0.40 | 0.40 |

| 42.00 | 44.00 | 2.00 | 1.2 | 0.60 | 0.60 | |

| 155.20 | 166.00 | 10.80 | 6.8 | 0.43 | 0.43 | |

| 179.15 | 182.00 | 2.85 | 1.8 | 0.41 | 0.41 | |

| 204.55 | 208.00 | 3.45 | 2.2 | 0.32 | 0.32 | |

| 213.00 | 215.00 | 2.00 | 1.3 | 0.50 | 0.50 | |

| 231.00 | 234.00 | 3.00 | 1.9 | 0.54 | 0.54 | |

| 253.50 | 282.00 | 28.50 | 18.6 | 0.56 | 0.56 | |

| incl | 266.00 | 269.00 | 3.00 | 2.0 | 1.40 | 1.40 |

| 289.00 | 292.95 | 3.95 | 2.6 | 0.59 | 0.59 | |

| 339.35 | 342.10 | 2.75 | 1.8 | 0.31 | 0.31 | |

| 351.85 | 364.80 | 12.95 | 8.6 | 0.42 | 0.42 | |

| 387.00 | 390.00 | 3.00 | 2.0 | 0.39 | 0.39 | |

| 421.35 | 423.90 | 2.55 | 1.7 | 0.42 | 0.42 | |

| 446.00 | 449.00 | 3.00 | 2.1 | 0.47 | 0.47 | |

| 519.00 | 522.00 | 3.00 | 2.1 | 0.75 | 0.75 | |

| 528.00 | 541.00 | 13.00 | 9.1 | 0.35 | 0.35 | |

| 547.30 | 550.50 | 3.20 | 2.2 | 0.80 | 0.80 | |

| MMD-25-144 | 33.00 | 45.00 | 12.00 | 8.6 | 0.34 | 0.34 |

| 50.00 | 60.00 | 10.00 | 7.2 | 0.79 | 0.79 | |

| 69.00 | 72.00 | 3.00 | 2.2 | 0.34 | 0.34 | |

| 76.00 | 88.00 | 12.00 | 8.7 | 0.98 | 0.98 | |

| incl | 79.00 | 82.60 | 3.60 | 2.6 | 2.77 | 2.77 |

| 208.75 | 211.00 | 2.25 | 1.7 | 0.44 | 0.44 | |

| 231.35 | 242.00 | 10.65 | 8.0 | 0.34 | 0.34 | |

| 257.30 | 262.00 | 4.70 | 3.5 | 0.34 | 0.34 | |

| MMD-25-145 | 32.00 | 59.00 | 27.00 | 19.6 | 0.44 | 0.44 |

| 77.00 | 83.40 | 6.40 | 4.7 | 0.40 | 0.40 | |

| 141.00 | 147.00 | 6.00 | 4.6 | 1.34 | 1.34 | |

| incl | 142.20 | 146.00 | 3.80 | 2.9 | 1.89 | 1.89 |

| 156.25 | 167.10 | 10.85 | 8.5 | 0.49 | 0.49 | |

| 178.20 | 182.00 | 3.80 | 3.0 | 0.70 | 0.70 | |

| 263.00 | 298.35 | 35.35 | 29.6 | 0.41 | 0.41 | |

| MQD-25-148 | 76.40 | 94.00 | 17.60 | 12.7 | 3.03 | 3.03 |

| incl | 79.10 | 85.90 | 6.80 | 4.9 | 7.06 | 7.06 |

| incl | 82.15 | 85.90 | 3.75 | 2.7 | 12.4 | 12.4 |

| and | 93.15 | 93.45 | 0.30 | 0.2 | 12.1 | 12.1 |

| Intersections calculated above a 0.3 g/t Au cut off with a top cut of 30 g/t Au and a maximum internal waste interval of 5 metres. Shaded intervals are intersections calculated above a 1.0 g/t Au cut off. Intervals in bold are those with a grade thickness factor exceeding 20 gram x metres / tonne gold. True widths are approximate and assume a subvertical body. | ||||||

Table 2: Drill Collars

| HOLE | EAST | NORTH | RL | AZIMUTH | DIP | EOH |

| MMD-25-143 | 668,306 | 5,378,340 | 451 | 140 | -54 | 551 |

| MMD-25-144 | 668,350 | 5,378,084 | 428 | 135 | -45 | 276 |

| MMD-25-145 | 668,420 | 5,378,214 | 438 | 135 | -45 | 300 |

| MQD-25-148 | 669,904 | 5,379,917 | 428 | 155 | -45 | 252 |

| MQD-21-009 | 670,216 | 5,379,509 | 429 | 335 | -48 | 686 |

| MQD-22-014 | 670,104 | 5,379,469 | 427 | 335 | -47 | 1008 |

Analytical and QA/QC Procedures

All samples were sent to ALS Geochemistry in Thunder Bay for preparation and analysis was performed in the ALS Vancouver analytical facility. ALS is accredited by the Standards Council of Canada (SCC) for the Accreditation of Mineral Analysis Testing Laboratories and CAN-P-4E ISO/IEC 17025. Samples were analysed for gold via fire assay with an AA finish (“Au-AA23“) and 48 pathfinder elements via ICP-MS after four-acid digestion (“ME-MS61“). Samples that assayed over 10 ppm Au were re-run via fire assay with a gravimetric finish (“Au-GRA21“).

In addition to ALS quality assurance / quality control (“QA/QC“) protocols, Goldshore has implemented a quality control program for all samples collected through the drilling program. The quality control program was designed by a qualified and independent third party, with a focus on the quality of analytical results for gold. Analytical results are received, imported to our secure on-line database and evaluated to meet our established guidelines to ensure that all sample batches pass industry best practice for analytical quality control. Certified reference materials are considered acceptable if values returned are within three standard deviations of the certified value reported by the manufacture of the material. In addition to the certified reference material, certified blank material is included in the sample stream to monitor contamination during sample preparation. Blank material results are assessed based on the returned gold result being less than ten times the quoted lower detection limit of the analytical method. The results of the on-going analytical quality control program are evaluated and reported to Goldshore by Orix Geoscience Inc.

Qualified Person

Peter Flindell, PGeo, MAusIMM, MAIG, Vice-President, Exploration, of the Company, and a qualified person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has approved the scientific and technical information contained in this news release.

Mr. Flindell has verified the data disclosed. To verify the information related to the winter drill program at the Moss Gold Project, Mr. Flindell has visited the property several times; discussed and reviewed logging, sampling, bulk density, core cutting and sample shipping processes with responsible site staff; discussed and reviewed assay and QA/QC results with responsible personnel; and reviewed supporting documentation, including drill hole location and orientation and significant assay interval calculations. He has also overseen the Company’s health and safety policies in the field to ensure full compliance, and consulted with the Project’s host indigenous communities on the planning and implementation of the drill program, particularly with respect to its impact on the environment and the Company’s remediation protocols.

About Goldshore

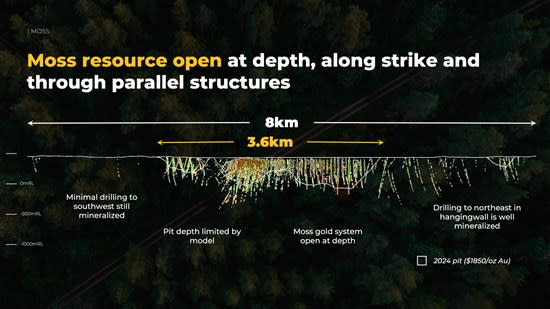

Goldshore is a growth-oriented gold company focused on delivering long-term shareholder and stakeholder value through the acquisition and advancement of primary gold assets in tier-one jurisdictions. It is led by the ex-global head of structural geology for the world’s largest gold company and backed by one of Canada’s pre-eminent private equity firms. The Company’s current focus is the advanced stage 100% owned Moss Gold Project which is positioned in Ontario, Canada, with direct access from the Trans-Canada Highway, hydroelectric power near site, supportive local communities and skilled workforce. The Company has invested over $60 million of new capital and completed approximately 80,000 meters of drilling on the Moss Gold Project, which, in aggregate, has had over 235,000 meters of drilling. The 2024 updated NI 43-101 mineral resource estimate (“MRE“) has expanded to 1.54 million ounces of Indicated gold resources at 1.23 g/t Au and 5.20 million ounces of Inferred gold resources at 1.11 g/t Au. The MRE only encompasses 3.6 kilometers of the 35+ kilometer mineralized trend, remains open at depth and along strike and is one of the few remaining major Canadian gold deposits positioned for development in this cycle. Please see NI 43-101 technical report titled: “Technical Report and Updated Mineral Resource Estimate for the Moss Gold Project, Ontario, Canada,” dated March 20, 2024 with an effective date of January 31, 2024 available under the Company’s SEDAR+ profile at www.sedarplus.ca. For more information, please visit SEDAR+ (www.sedarplus.ca) and the Company’s website (www.goldshoreresources.com).

For More Information – Please Contact:

Michael Henrichsen

President, Chief Executive Officer and Director

Goldshore Resources Inc.

E: mhenrichsen@goldshoreresources.com

W: www.goldshoreresources.com

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains statements that constitute “forward-looking statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur. Forward-looking statements in this news release include, among others, statements relating to expectations regarding the exploration and development of the Moss Gold Project; the potential mineralization at the Moss Gold Project based on the winter drill program, including the potential for additional mineral resources; the enhancement of the Moss Gold Project; statements regarding the Company’s future drill plans, including the expected benefits and results thereof; that the Superion target has the potential to significantly add to the current mineral resource estimate within the top 200 meters from surface with continued drilling and to reduce the overall strip ratio of the deposit; the potential for resource growth at Moss and the fact that the results have the potential to significantly impact the economic performance of the deposit moving forward; the potential for a much larger mineralized system and that it will be pursued in the near future through additional drilling; and other statements that are not historical facts.

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors and risks include, among others: uncertainty and variation in the estimation of mineral resources; risks related to exploration, development, and operation activities; exploration and development of the Moss Gold Project will not be undertaken as anticipated; the Company may require additional financing from time to time in order to continue its operations which may not be available when needed or on acceptable terms and conditions acceptable; the economic performance of the deposit may not be consistent with management’s expectations; the Company’s exploration work may not deliver the results expected; the fluctuating price of gold; unknown liabilities in connection with acquisitions; compliance with extensive government regulation; delays in obtaining or failure to obtain governmental permits, or non-compliance with permits; environmental and other regulatory requirements; domestic and foreign laws and regulations could adversely affect the Company’s business and results of operations; risks related to natural disasters, terrorist acts, health crises, and other disruptions and dislocations; global financial conditions; uninsured risks; climate change risks; competition from other companies and individuals; conflicts of interest; risks related to compliance with anti-corruption laws; the Company’s limited operating history; intervention by non-governmental organizations; outside contractor risks; the stock markets have experienced volatility that often has been unrelated to the performance of companies and these fluctuations may adversely affect the price of the Company’s securities, regardless of its operating performance; the Superion target may not add to the current mineral resource; and other risks associated with executing the Company’s objectives and strategies as well as those risk factors discussed in the Company’s continuous disclosure documents filed under the Company’s SEDAR+ profile at www.sedarplus.ca.

The forward-looking information in this news release is based on management’s reasonable expectations and assumptions as of the date of this news release. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding: the future price of gold; anticipated costs and the Company’s ability to fund its programs; the Company’s ability to carry on exploration, development and mining activities; prices for energy inputs, labour, materials, supplies and services; the timing and results of drilling programs; mineral resource estimates and the assumptions on which they are based; the discovery of mineral resources and mineral reserves on the Company’s mineral properties; the timely receipt of required approvals and permits; the costs of operating and exploration expenditures; the Company’s ability to operate in a safe, efficient, and effective manner; the Company’s ability to obtain financing as and when required and on reasonable terms; that the Company’s activities will be in accordance with the Company’s public statements and stated goals; that the Superion target will add to the current mineral resource; that the Company’s exploration work will deliver the results expected; and that there will be no material adverse change or disruptions affecting the Company or its properties.

The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. There can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/242996