Well now, gather ’round, folks, and lend an ear to a tale I’ve just fetched back from the scorching, sun-drenched bosom of Arizona. I’ve seen my share of ground, from the muddy banks of rivers where fortunes were plucked like ripe berries, to the high, lonesome stretches where men chased whispers of silver. But this journey, this recent pilgrimage to the Copper Springs Project, well, it’s got a particular glint to it, like a freshly panned nugget winking in the sun. And it involves a company, mind you, called Copper Bullet Mines, a name that just sings of purpose and potential.

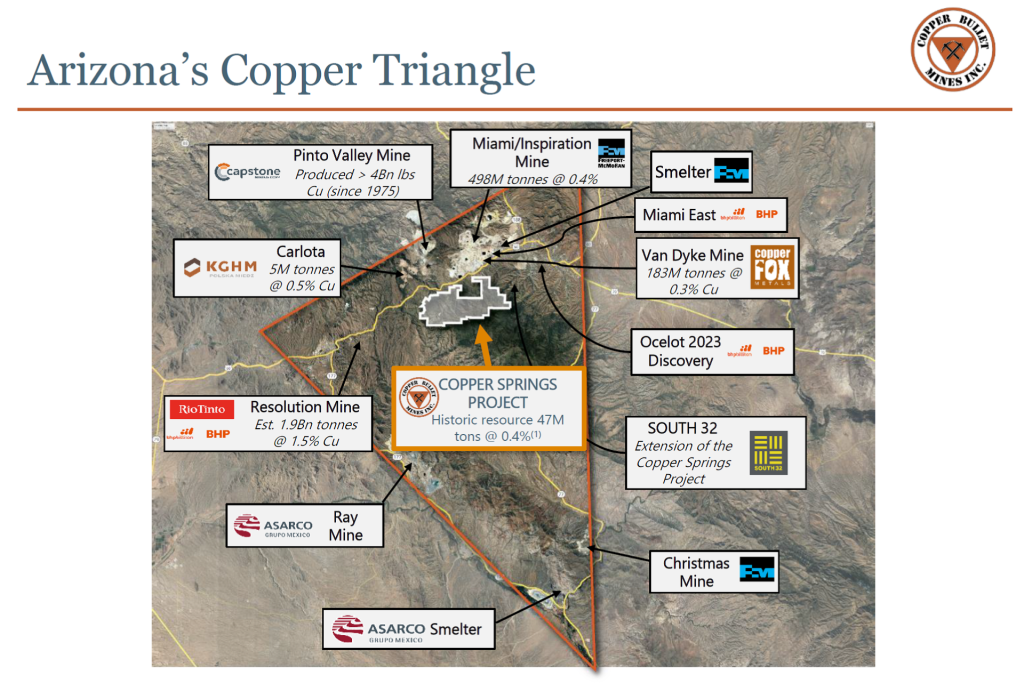

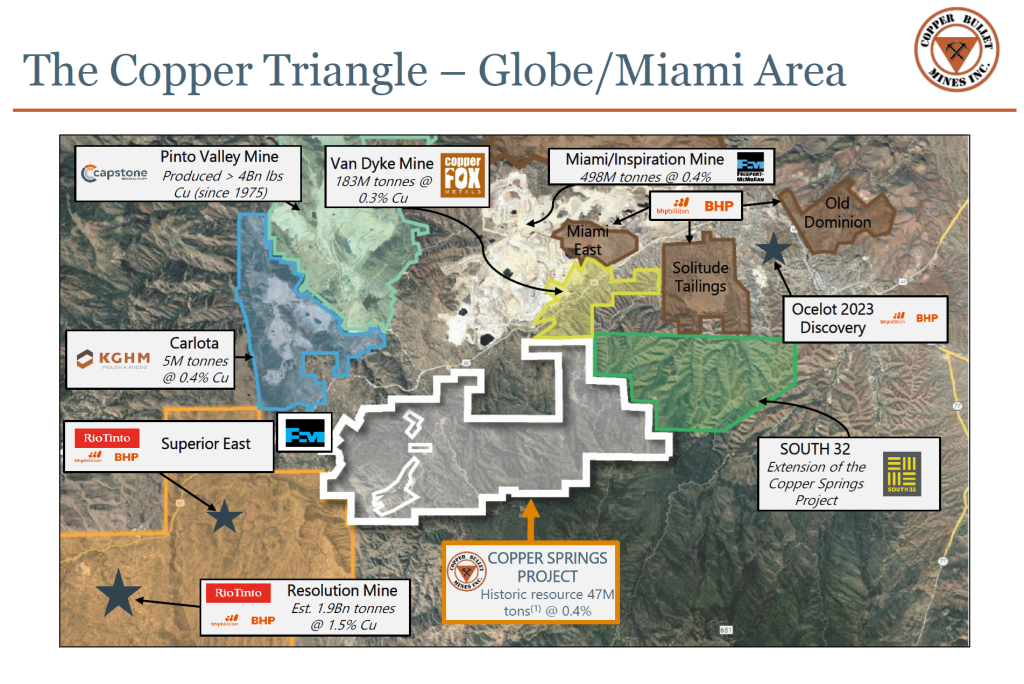

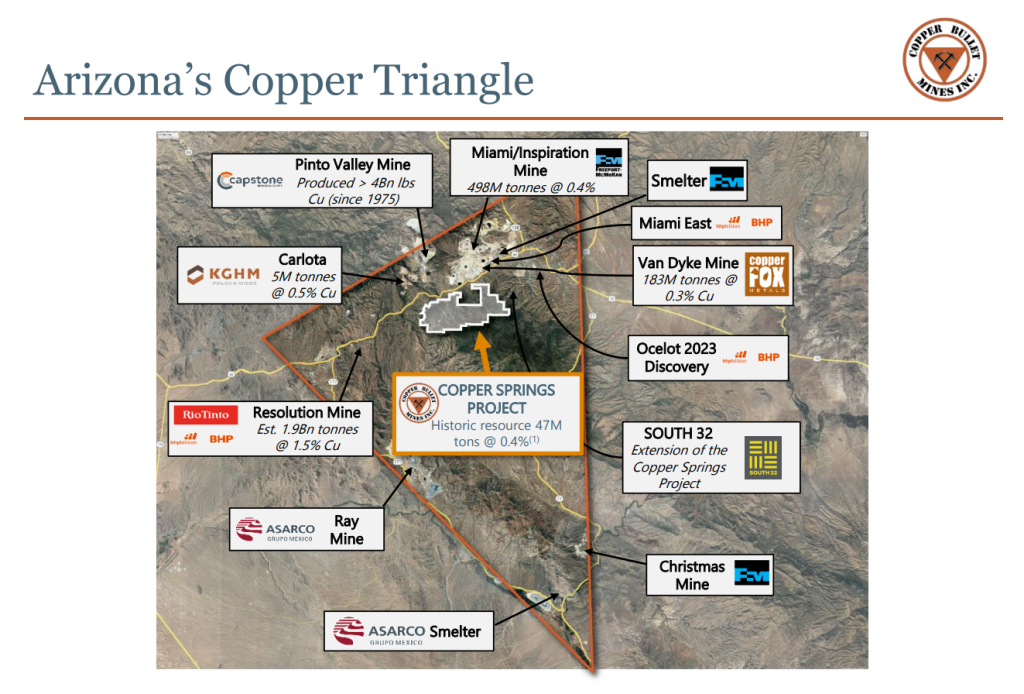

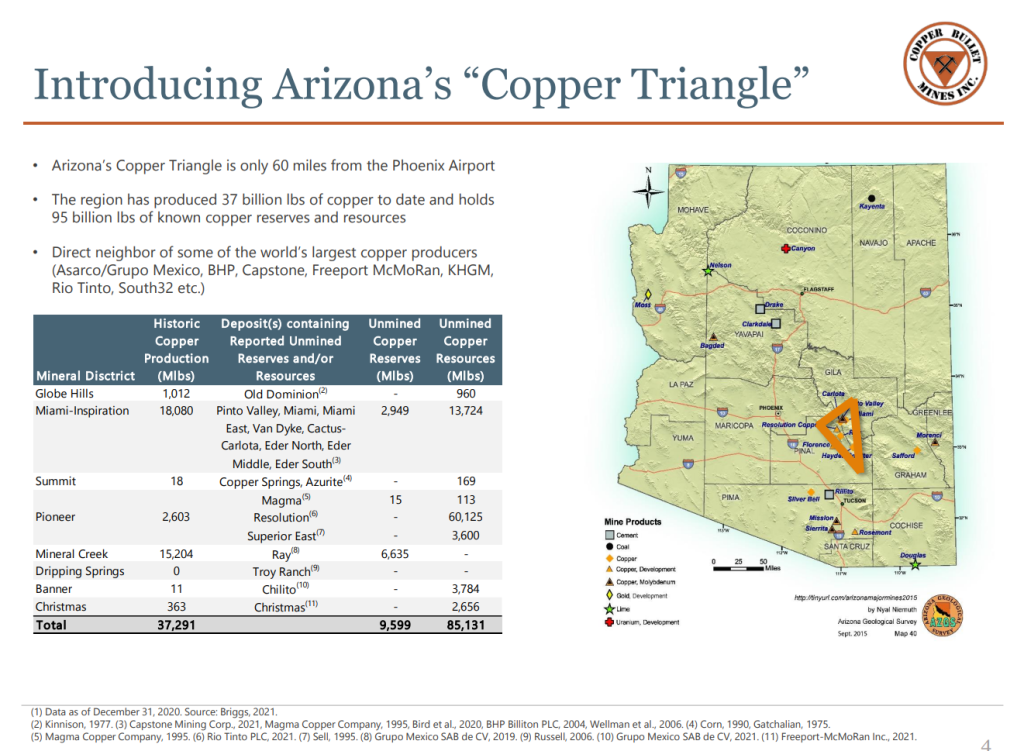

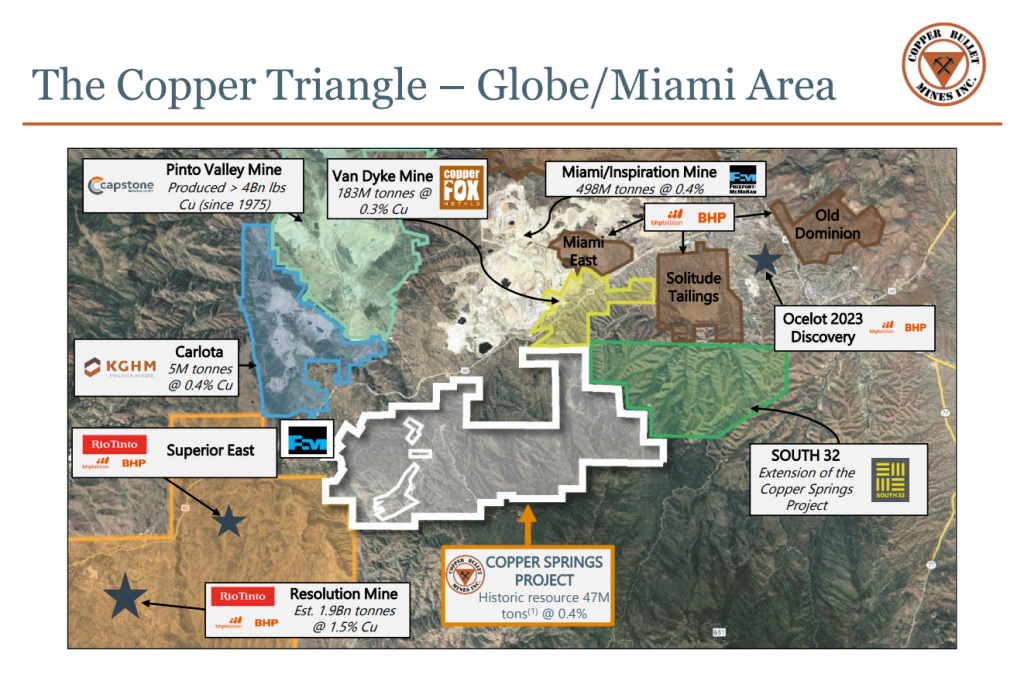

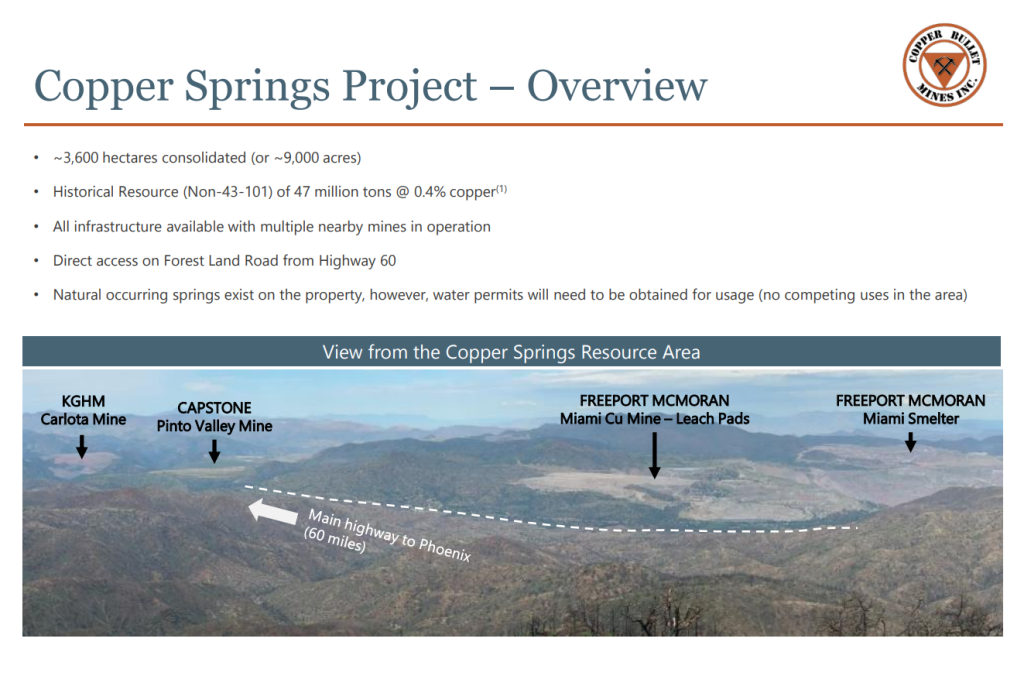

I tell you, the air out there near the Copper Springs Project – it’s thick with history, a real palimpsest of ambition and discovery. This ain’t some greenhorn’s hopeful dig in the backyard, no sir. This is the Arizona Copper Triangle, a place where the earth has been generous, spilling forth its metallic bounty for generations. You drive through that country, and you see the monuments to past triumphs: the grand, gaping maw of the Miami-Inspiration Mine, a titan of copper production in its day; the storied hills around Superior, where the mighty Resolution Copper Project is set to redefine the very notion of a “big find.” And let’s not forget the enduring prowess of the Ray Mine, still humming along, pulling copper from the ground with the steady hand of an old pro.

Now, why does a seasoned old bird like myself, who’s seen more rock than a pebble on a riverbed, get a glint in his eye over Copper Bullet Mines? It’s the “blue sky potential,” my friends, a phrase that makes a prospector’s heart beat a little faster than a drummer at a Fourth of July parade.

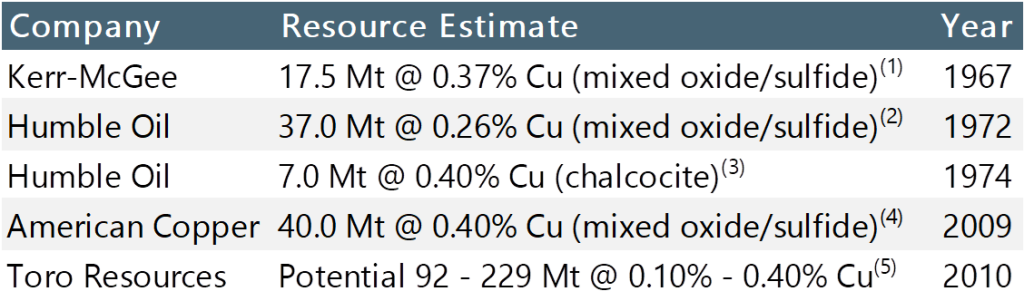

I just returned from walking that ground, feeling the sun bake the dust on my boots, and what I saw wasn’t just dirt and creosote bush. I saw opportunity. Copper Springs isn’t just sitting near these giants; it’s sitting in the same neighborhood. And in mining, as in life, a good neighborhood counts for a whole lot. These weren’t just random rock formations; they were geological kin to the very deposits that made fortunes for others. The historical data, the old drill holes, the very whispers of the wind seemed to confirm it: there’s more copper in them thar hills.

The land itself, a canvas of reds and browns under an endless sky, tells a story of volcanic activity, of ancient forces that squeezed and cooked and concentrated the very stuff we now clamor for. And in this modern age, where every gadget and every electric vehicle demands more copper than we’re currently producing, finding a new, significant source isn’t just a good idea – it’s a necessity. That’s the blue sky I’m talking about: the potential for a new major discovery in a world that’s thirsting for it.

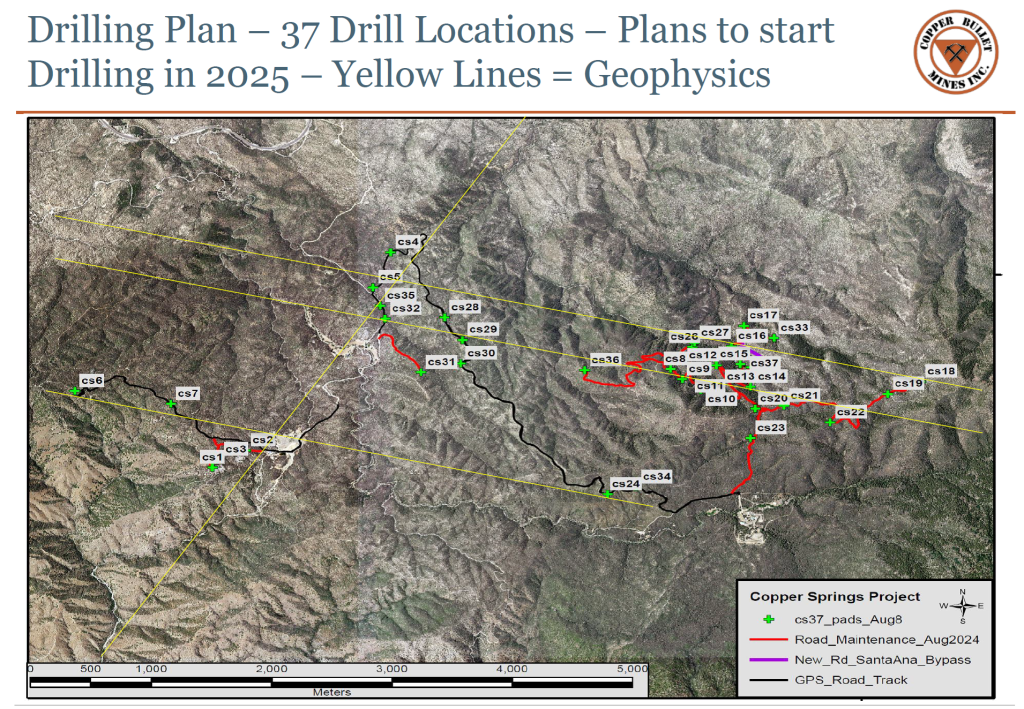

Now, here’s where the rubber meets the road, or rather, where the shovel meets the ore. Copper Bullet Mines is on the cusp of something rather exciting. They’re in the midst of a raise for C$0.14 cents per share. A modest sum, perhaps, for a piece of what could be the next great Arizona copper story. And soon, they’ll be shedding the chrysalis of a private endeavor and going public. That, my friends, is when the wider world gets its chance to hitch its wagon to this particular star.

It’s not often you get a front-row seat to a potential discovery in such a pedigreed district. The big boys, the established mines around them, they’re not just neighbors; they’re proof of concept. They’re the living, breathing evidence that this ground can yield riches. And Copper Bullet, with its Copper Springs Project, is looking to join that distinguished company.

So, if you’ve got an adventurous spirit and an eye for what might lie beneath the surface, keep a keen watch on Copper Bullet Mines. For in that Arizona dust, beneath that boundless blue sky, there might just be another chapter in the grand, old tale of copper. And I, Maurice Jackson, for one, am mighty keen to see how it unfolds.

I’ve been a shareholder since 2022 and own a significant amount of shares. I am biased.

if you are accredited and want to find out more contact:

Dan Weir

danweir@bulletmined.com

+1 (416) 720-0754

www.copperbulletmines.com

PS: Company will have a face lift. New branding, website, corporate deck etc. I am working on getting them in New Orleans Investment Conference (pending).