Riverside Resources: (TSX.V: RRI | OTCQB: RVSDF)

Website: https://www.rivres.com/

Corporate Presentation: https://bit.ly/3gJ9YC6

For investor questions please call or email:

Communications Team 778-327-6671

Email info@rivres.com

Riverside Resources: (TSX.V: RRI | OTCQB: RVSDF)

Website: https://www.rivres.com/

Corporate Presentation: https://bit.ly/3gJ9YC6

Communications Team 778-327-6671

Email info@rivres.com

PARTNERING THE MOST HIGH RISK, HIGH-COST STAGES OF EXPLORATION Millrock (TSX.V: MRO.V) is a project generator company focused on the discovery and development of high-value metallic mineral deposits in two jurisdictions with outstanding potential: the State of Alaska and Mexico – primarily the state of Sonora. The company’s main emphasis has been on gold and copper, focusing on porphyry and high-grade vein style deposits. Our objective is to discover a world-class ore body, building further shareholder value through the exploration and development of existing projects and exploration joint ventures.

Millrock Resouces (TSX.V: MRO | OTCQX: MLRKF) Website: www.millrockresources.com Corporate Presentation: https://www.millrockresources.com/investors/corporate-presentation

Figure 1

Figure 2

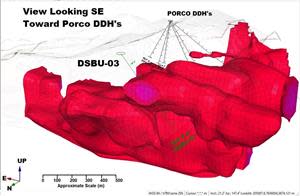

Figure 3

TORONTO, March 01, 2022 (GLOBE NEWSWIRE) — Eloro Resources Ltd. (TSX-V: ELO; OTCQX: ELRRF; FSE: P2QM) (“Eloro”, or the “Company”) is pleased to announce assay results from an additional diamond drill hole from its on-going drilling program at the Iska Iska silver-tin polymetallic project in the Potosi Department, southern Bolivia. Hole DSBU-03, an underground hole drilled due west from the Santa Barbara adit at -50 degrees, has discovered major new depth extensions of the already large Santa Barbara mineralized zones.

The Company has completed 45,779m in 81 drill holes, including three holes in progress as shown in Figure 1. Table 1 lists significant assay results. Prices used for calculating Ag equivalent grades are as outlined in Eloro’s February 1, 2022, press release. Table 2 summarizes drill holes with assays pending. Highlights are as follows:

Underground Metallurgical Hole, Santa Barbara Mineral Resource Target Area

Underground hole DSBU-03, collared in the Santa Barbara adit and drilled at an azimuth of 270 degrees at -50 degrees dip, intersected significant mineralization including substantial tin suggesting proximity to a major intrusive source (Figures 1, 2 and 3 and Table 1):

Tom Larsen, CEO of Eloro, commented: “This new underground hole is the longest and highest-grade intersection obtained thus far in our diamond drill program and further highlights the major potential of the Santa Barbara target area to host significant higher-grade mineral resources, especially with tin. In order to more aggressively drill this major new extension of the Santa Barbara deposit, a third surface diamond drill is being brought onto site bringing the total operating drills to four (3 surface and 1 underground).

Dr. Bill Pearson, P.Geo., Eloro’s Executive Vice President Exploration, added: “The 3D inverse magnetic susceptibility model is proving to be an important indicator for targeting areas of potential tin mineralization at depth. Work by Dr. Arce and his geological team indicates that in deeper levels tin occurs as cassiterite associated with pyrrhotite which is magnetic. Tin at higher levels is associated with silver, which likely has been remobilized, and generally occurs with pyrite that is non-magnetic.” “In addition to the outstanding drill results, work is moving forward on the metallurgical testing with Blue Coast Research Ltd. We are also working closely with Micon International Limited to develop appropriate parameters for the mineral resource estimation. The bore hole induced polarization program is continuing with additional holes being surveyed to expand our coverage and determine the continuity of mineralization between drill holes. The GeologicAI scanner is expected to be on site and fully operational by the end of March.”

Dr. Osvaldo Arce, P.Geo., General Manager of Eloro’s Bolivian subsidiary Minera Tupiza S.R.L. (“Minera Tupiza”), further commented: “At Iska Iska we are rapidly defining a massive porphyry-epithermal silver-tin polymetallic mineralized system. The grade and extent of tin mineralization increases considerably with depth which is typical of the deeper parts of tin porphyries in Bolivia. Superimposed on this extensive tin porphyry system is a higher-level silver-zinc-lead epithermal mineralized system that is principally hosted in the major breccia pipes and intensely fractured dacitic domes surrounding these breccia pipes.”

“The entire package has been subjected to later deformation and remobilization which has substantially altered many of the primary relationships. The southern area of Santa Barbara where we already have two impressive holes with 300m+ long intersections and southeast to the Porco area appears to be the potential centre of the porphyry-epithermal system. We are now on our 81st hole and all holes reported to date have multiple reportable intersections, which is remarkable. The system remains open along strike to the northwest and to the southeast. Geological mapping and diamond drilling suggest that the potential strike length of the entire system may be as much as 4km, the width up to 2km, with a depth extent of 1km or more.”

Table 1: Significant Results, Diamond Drilling, Santa Barbara Resource Definition Target Area as at March 1, 2022.

| SANTA BARBARA RESOURCE DEFINITION TARGET ZONE | ||||||||||||

| UNDERGROUND DRILL HOLE | ||||||||||||

| Hole No. | From (m) | To (m) | Length (m) | Ag | Au | Zn | Pb | Cu | Sn | Bi | Cd | Ag eq |

| g/t | g/t | % | % | % | % | % | % | g/t | ||||

| DSBU-03 | 0.00 | 373.38 | 373.40 | 12.04 | 0.06 | 0.29 | 0.22 | 0.03 | 0.22 | 0.003 | 0.007 | 171.57 |

| Incl. | 192.72 | 221.3 | 28.58 | 31.46 | 0.05 | 0.01 | 0.19 | 0.02 | 0.61 | 0.003 | 0.005 | 401.81 |

| Incl. | 272.27 | 367.41 | 95.16 | 4.91 | 0.01 | 0.01 | 0.02 | 0.01 | 0.43 | 0.001 | 0.005 | 261.83 |

| 391.22 | 395.83 | 4.61 | 1.00 | 0.01 | 0.01 | 0.02 | 0.01 | 0.16 | 0.001 | 0.005 | 98.99 | |

| 418.80 | 479.3 | 60.50 | 1.79 | 0.05 | 0.02 | 0.06 | 0.09 | 0.28 | 0.083 | 0.005 | 197.61 | |

| 493.11 | 494.61 | 1.50 | 3.00 | 0.45 | 0.01 | 0.00 | 0.01 | 0.15 | 0.001 | 0.005 | 129.35 | |

| 514.30 | 515.72 | 1.42 | 8.00 | 0.21 | 0.01 | 0.10 | 0.07 | 0.11 | 0.034 | 0.005 | 110.16 | |

| 520.24 | 524.76 | 4.53 | 3.67 | 0.02 | 0.00 | 0.01 | 0.11 | 0.09 | 0.027 | 0.005 | 79.57 | |

| 547.40 | 560.85 | 13.45 | 4.57 | 0.10 | 0.01 | 0.03 | 0.12 | 0.05 | 0.045 | 0.005 | 69.80 | |

| 578.90 | 581.83 | 2.93 | 1.50 | 0.26 | 0.01 | 0.00 | 0.08 | 0.03 | 0.001 | 0.005 | 54.94 | |

| 599.90 | 601.45 | 1.55 | 3.00 | 0.78 | 0.01 | 0.02 | 0.10 | 0.09 | 0.029 | 0.005 | 139.37 | |

| 614.97 | 617.97 | 3.00 | 1.97 | 0.04 | 0.01 | 0.02 | 0.51 | 0.07 | 0.009 | 0.005 | 115.65 | |

| 625.41 | 631.41 | 6.00 | 1.00 | 0.04 | 0.01 | 0.03 | 0.40 | 0.00 | 0.001 | 0.005 | 61.52 |

Note: True width of the mineralization is not known at the present time, but based on the current understanding of the relationship between drill orientation/inclination and the mineralization within the breccia pipes and the host rocks such as sandstones and dacites, it is estimated that true width ranges between 70% and 90% of the down hole interval length but this will be confirmed by further drilling and geological modelling.

Chemical symbols: Ag= silver, Au = gold, Zn = zinc, Pb = lead, Cu = copper, Sn = tin, Bi = bismuth, Cd = cadmium and g Ag eq/t = grams silver equivalent per tonne. Quantities are given in percent (%) for Zn, Pb Cu, Sn, Bi and Cd and in grams per tonne (g/t) for Ag, Au and Ag eq.

Metal prices and conversion factors used for calculation of g Ag eq/t (grams Ag per grams x metal ratio) are as follows (Prices updated as of February 1, 2022, to more accurately reflect current metal prices):

| Element | Price $US (per kg) | Ratio to Ag |

| Ag | $722.56 | 1.0000 |

| Sn | $42.56 | 0.0589 |

| Zn | $3.30 | 0.0046 |

| Pb | $2.33 | 0.0032 |

| Au | $57,604.00 | 79.7221 |

| Cu | $9.68 | 0.0134 |

| Bi | $12.76 | 0.0177 |

| Cd | $5.50 | 0.0076 |

In calculating the intersections reported in this press release a sample cutoff of 30 g Ag eq/t was used with generally a maximum dilution of 3 continuous samples below cutoff included within a mineralized section unless more dilution is justified geologically.

The equivalent grade calculations are based on the stated metal prices and are provided for comparative purposes only, due to the polymetallic nature of the deposit. Metallurgical tests are in progress by Blue Coast Ltd. to establish levels of recovery for each element reported but currently the potential recovery for each element has not yet been established. While there is no assurance that all or any of the reported concentrations of metals will be recoverable, Bolivia has a long history of successfully mining and processing similar polymetallic deposits which is well documented in the landmark volume “Yacimientos Metaliferos de Bolivia” by Dr. Osvaldo R. Arce Burgoa, P.Geo.

Table 2: Summary of Diamond Drill Holes Completed with Assays Pending and Drill Holes in Progress at Iska Iska from March 1, 2022 press release.

| Hole No. | Type | Collar Easting | Collar Northing | Elev | Azimuth | Angle | Hole Length m |

| Surface Drilling Northwest Extension Santa Barbara | |||||||

| DSB-14 | S | 205283.0 | 7656587.2 | 4175.0 | 225 | -65 | 968.5 |

| DSB-16 | S | 204973.1 | 7657053.8 | 4165.0 | 225 | -65 | 862.0 |

| DSB-17 | S | 7656765.4 | 205131.3 | 4173.0 | 225 | -40 | 841.0 |

| DSB-18 | S | 7656676.3 | 205207.1 | 4175.0 | 225 | -40 | 890.4 |

| DSB-19 | S | 7656676.3 | 205207.1 | 4175.0 | 225 | -65 | 803.3 |

| DSB-22 | S | 7657208.4 | 204799.4 | 4145.0 | 225 | -40 | 258.4 |

| DSB-23 | S | 205341.0 | 7656535.0 | 4177.0 | 225 | -40 | 661.3 |

| DSB-24 | S | 205341.0 | 7656535.0 | 4177.0 | 225 | -65 | 343.4 |

| DSB-25 | S | 205283.0 | 7656587.2 | 4175.0 | 225 | -40 | 615.3 |

| DSB-26 | S | 205044.5 | 7656982.6 | 4150.0 | 225 | -40 | 815.4 |

| DSB-27 | S | 205044.5 | 7656982.6 | 4150.0 | 225 | -65 | 800.4 |

| Subtotal | 7859.4 | ||||||

| Underground Drilling Santa Barbara Adit | |||||||

| DSBU-4 | UG | 205285.2 | 7656074.8 | 4165.0 | 180 | -20 | 570.0 |

| DSBU-5 | UG | 205285.2 | 7656074.8 | 4165.0 | 0 | -40 | 491.7 |

| DSBU-6 | UG | 205285.2 | 7656074.8 | 4165.0 | 0 | -65 | 253.5 |

| DSBU-7 | UG | 205284.5 | 7656080.0 | 4167.1 | 235 | -50 | 800.9 |

| Subtotal | 2116.1 | ||||||

| DSBU-8 | UG | 205284.5 | 7656080.0 | 4167.1 | 200 | -50 | In progress |

| Underground Metallurgical Drill Holes Santa Barbara | |||||||

| METSBU-01 | UG | 205285.2 | 7656074.8 | 4165.0 | 10 | -35 | 351.0 |

| Subtotal | 351.0 | ||||||

| Surface Drilling South Extension Santa Barbara | |||||||

| DSBS-01 | S | 205300.0 | 7655563.0 | 4204.0 | 30° | -30 | 700.8 |

| Subtotal | 700.8 | ||||||

| DSBS-02 | S | 205300.0 | 7655563.0 | 4204.0 | 0° | -45 | In progress |

| Porco Target Area – Surface Drill Program | |||||||

| DPC-04 | S | 205457.2 | 7655110.9 | 4175.0 | 0 | -60 | 371.4 |

| DPC-05 | S | 205457.2 | 7655110.9 | 4175.0 | 90 | -60 | 407.5 |

| DPC-06 | S | 205457.2 | 7655110.9 | 4175.0 | 243 | -60 | 716.4 |

| DPC-08 | S | 205456.2 | 7655113.4 | 4175.9 | 243 | -60 | 800.4 |

| Subtotal | 2295.7 | ||||||

| DPC-07 | S | 205090.0 | 7655343.7 | 4310.0 | 235 | -65 | In progress |

| TOTAL | 13,323 |

S = Surface UG=Underground; collar coordinates in metres; azimuth and dip in degrees. Total drilling completed since the start of the program on September 13, 2020 to December 17, 2021 is 40,468 m in 73 holes (26 underground holes and 47 surface holes). From re-start of drilling on January 17, 2022, an additional 5,311m has been completed bringing the overall total to 45,779m in 81 drill holes (27 underground drill holes and 54 surface drill holes) including 3 holes in progress.

Figure 1: Geology of the Iska Iska Caldera Complex showing locations of Major Breccia Pipe targets, the Santa Barbara Resource Definition Target Zone and diamond drill holes completed and planned.

https://www.globenewswire.com/NewsRoom/AttachmentNg/c76d310b-6996-445f-b60c-372aef74d01f

Figure 2: Preliminary W-E Geological Cross Section with Drill Hole DSBU-03 (looking north)

https://www.globenewswire.com/NewsRoom/AttachmentNg/abe4a4b7-49af-4c5f-b33e-951ce8e2f5fd

Figure 3: 3D Inverse Magnetic Susceptibility Model Showing How Hole DSBU-03 Intersected the Northern tip of this Massive Anomaly that extends to the Southeast from the Santa Barbara area to beneath the Porco area.

https://www.globenewswire.com/NewsRoom/AttachmentNg/389e27fe-e2aa-4157-bb36-ea1723bfed63

Qualified Person

Dr. Osvaldo Arce, P. Geo., General Manager of Minera Tupiza, and a Qualified Person in the context of NI 43-101, has reviewed and approved the technical content of this news release. Dr. Bill Pearson, P.Geo., Executive Vice President Exploration Eloro, and who has more than 45 years of worldwide mining exploration experience including extensive work in South America, manages the overall technical program working closely with Dr. Osvaldo Arce, P.Geo., Manager of Minera Tupiza. Dr. Quinton Hennigh, P.Geo., Senior Technical Advisor to Eloro and Independent Technical Advisor, Mr. Charley Murahwi P. Geo., FAusIMM of Micon International Limited are regularly consulted on technical aspects of the project.

The magnetic survey was carried out by MES Geophysics using a GEM Systems GSM-19W Overhauser magnetometer. Dr. Chris Hale, P.Geo. and Mr. John Gilliatt, P.Geo. of Intelligent Exploration provided the survey design, preparation of the maps and interpretation from data processed and quality reviewed by Rob McKeown, P. Geo. of MES Geophysics. Messrs. Hale, Gilliatt and McKeown are Qualified Persons as defined under NI 43-101 Mr. Joe Mihelcic, P.Eng., P.Geo., a QP under NI 43-101, of Clearview Geophysics completed the 3D magnetic inversion model in consultation with Dr. Chris Hale, P.Geo. and Mr. John Gilliatt, P.Geo. of Intelligent Exploration.

Eloro is utilizing both ALS and AHK for drill core analysis, both of whom are major international accredited laboratories. Drill samples sent to ALS are prepared in both ALS Bolivia Ltda’s preparation facility in Oruro, Bolivia and the preparation facility operated by AHK in Tupiza with pulps sent to the main ALS Global laboratory in Lima for analysis. More recently Eloro has had ALS send pulps to their laboratory at Galway in Ireland. Eloro employs an industry standard QA/QC program with standards, blanks and duplicates inserted into each batch of samples analyzed with selected check samples sent to a separate accredited laboratory.

Drill core samples sent to AHK Laboratories are prepared in a preparation facility installed and managed by AHK in Tupiza with pulps sent to the AHK laboratory in Lima, Peru. Au and Sn analysis on these samples is done by ALS Bolivia Ltda in Lima. Check samples between ALS and AHK are regularly done as a QA/QC check. AHK is following the same analytical protocols used as with ALS and with the same QA/QC protocols. Turnaround time continues to improve and it is hoped that most of the sample backlog will be cleared in the next 4-6 weeks.

About Iska Iska

Iska Iska silver-tin polymetallic project is a road accessible, royalty-free property, wholly controlled by the Title Holder, Empresa Minera Villegas S.R.L. and is located 48 km north of Tupiza city, in the Sud Chichas Province of the Department of Potosi in southern Bolivia. Eloro has an option to earn a 99% interest in Iska Iska.

Iska Iska is a major silver-tin polymetallic porphyry-epithermal complex associated with a Miocene possibly collapsed/resurgent caldera, emplaced on Ordovician age rocks with major breccia pipes, dacitic domes and hydrothermal breccias. The caldera is 1.6km by 1.8km in dimension with a vertical extent of at least 1km. Mineralization age is similar to Cerro Rico de Potosí and other major deposits such as San Vicente, Chorolque, Tasna and Tatasi located in the same geological trend.

Eloro began underground diamond drilling from the Huayra Kasa underground workings at Iska Iska on September 13, 2020. On November 18, 2020, Eloro announced the discovery of a significant breccia pipe with extensive silver polymetallic mineralization just east of the Huayra Kasa underground workings and a high-grade gold-bismuth zone in the underground workings. On November 24, 2020, Eloro announced the discovery of the SBBP approximately 150m southwest of the Huayra Kasa underground workings.

Subsequently, on January 26, 2021, Eloro announced significant results from the first drilling at the SBBP including the discovery hole DHK-15 which returned 129.60 g Ag eq/t over 257.5m (29.53g Ag/t, 0.078g Au/t, 1.45%Zn, 0.59%Pb, 0.080%Cu, 0.056%Sn, 0.0022%In and 0.0064% Bi from 0.0m to 257.5m. Subsequent drilling has confirmed significant values of Ag-Sn polymetallic mineralization in the SBBP and the adjacent CBP. A substantive mineralized envelope which is open along strike and down-dip extends around both major breccia pipes. Continuous channel sampling of the Santa Barbara Adit located to the east of SBBP returned 442 g Ag eq/t (164.96 g Ag/t, 0.46%Sn, 3.46% Pb and 0.14% Cu) over 166m including 1,092 g Ag eq/t (446 g Ag/t, 9.03% Pb and 1.16% Sn) over 56.19m. The west end of the adit intersects the end of the SBBP.

Since the initial discovery hole, Eloro has released a number of significant drill results in the SBBP and the surrounding mineralized envelope which along with geophysical data has defined a target zone 1400m along strike, 500m wide and that extends to a depth of 600m. This zone is open along strike to the northwest and southeast as well as to the southwest. The Company’s nearer term objective is to outline a maiden NI 43-101 compliant mineral resource within this large target area. This work is advancing well with the mineral resource targeted to be completed in Q2 2022. Exploration drilling is also planned on other major targets in the Iska Iska Caldera Complex including the Porco and Mina 2 areas.

About Eloro Resources Ltd.

Eloro is an exploration and mine development company with a portfolio of gold and base-metal properties in Bolivia, Peru and Quebec. Eloro has an option to acquire a 99% interest in the highly prospective Iska Iska Property, which can be classified as a polymetallic epithermal-porphyry complex, a significant mineral deposit type in the Potosi Department, in southern Bolivia. Eloro commissioned a NI 43-101 Technical Report on Iska Iska, which was completed by Micon International Limited and is available on Eloro’s website and under its filings on SEDAR. Iska Iska is a road-accessible, royalty-free property. Eloro also owns an 82% interest in the La Victoria Gold/Silver Project, located in the North-Central Mineral Belt of Peru some 50 km south of Barrick’s Lagunas Norte Gold Mine and Pan American Silver’s La Arena Gold Mine. La Victoria consists of eight mining concessions and eight mining claims encompassing approximately 89 square kilometres. La Victoria has good infrastructure with access to road, water and electricity and is located at an altitude that ranges from 3,150 m to 4,400 m above sea level.

For further information please contact either Thomas G. Larsen, Chairman and CEO or Jorge Estepa, Vice-President at (416) 868-9168.

Information in this news release may contain forward-looking information. Statements containing forward-looking information express, as at the date of this news release, the Company’s plans, estimates, forecasts, projections, expectations, or beliefs as to future events or results and are believed to be reasonable based on information currently available to the Company. There can be no assurance that forward-looking statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements. Readers should not place undue reliance on forward-looking information.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Vancouver, British Columbia–(Newsfile Corp. – February 24, 2022) – Riverside Resources Inc. (TSXV: RRI) (OTCQB: RVSDF) (FSE: 5YY) (“Riverside” or the “Company”), is pleased to report it has signed an agreement with Agnico Eagle Mines Limited (TSX:AEM) for the sale of the Pima Property located in Sonora, Mexico, where Riverside will receive cash and completes the pass through royalty transfer with Millrock Resources Inc (TSV:MRO). The Pima Project is part of the Santa Teresa Gold Mining District which includes the Santa Gertrudis Gold Mine owned by Agnico Eagle.

The Pima mineral concession is located inside Agnico’s property tenure and south of the known mine operation. Acquiring the Pima project allows Agnico to consolidate another part of its property concession and provides cash to Riverside. As a reminder, this project was originally added to Riverside’s portfolio as part of the 2019 purchase of the Millrock’s set of 5 (five) assets that included the Cuarentas and La Union projects (see press release September 11, 2019). This current transaction with Agnico allows Riverside to recover the amount of the Millrock transaction with profit and pass on the royalty to Millrock who has been a positive partner with the Company in Mexico.

Riverside is now focusing on its 100% owned projects within its portfolio, including the Cuarentas Gold Project, which is located southeast of Agnico’s property and where drilling in 2021 discovered gold in intermediate sulfidation veins. Riverside plans to progress further work at the Cuarentas project in 2022.

About Riverside Resources Inc.:

Riverside is a well-funded exploration company driven by value generation and discovery. The Company has over $4.5M in cash, no debt and less than 75M shares outstanding with a strong portfolio of gold-silver and copper assets and royalties in North America. Riverside has extensive experience and knowledge operating in Mexico and Canada and leverages its large database to generate a portfolio of prospective mineral properties. In addition to Riverside’s own exploration spending, the Company also strives to diversify risk by securing joint-venture and spin-out partnerships to advance multiple assets simultaneously and create more chances for discovery. Riverside has properties available for option, with information available on the Company’s website at www.rivres.com.

ON BEHALF OF RIVERSIDE RESOURCES INC.

“John-Mark Staude”

Dr. John-Mark Staude, President & CEO

For additional information contact:

John-Mark Staude

President, CEO

Riverside Resources Inc.

info@rivres.com

Phone: (778) 327-6671

Fax: (778) 327-6675

Web: www.rivres.com

Raffi Elmajian

Corporate Communications

Riverside Resources Inc.

relmajian@rivres.com

Phone: (778) 327-6671

TF: (877) RIV-RES1

Web: www.rivres.com

Certain statements in this press release may be considered forward-looking information. These statements can be identified by the use of forward-looking terminology (e.g., “expect”,” estimates”, “intends”, “anticipates”, “believes”, “plans”). Such information involves known and unknown risks — including the availability of funds, the results of financing and exploration activities, the interpretation of exploration results and other geological data, or unanticipated costs and expenses and other risks identified by Riverside in its public securities filings that may cause actual events to differ materially from current expectations. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Vancouver, British Columbia–(Newsfile Corp. – February 18, 2022) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company“, or “EMX“) is pleased to announce that its wholly-owned subsidiary, Bullion Monarch Mining, Inc., (“Bullion”) has reached a settlement with Barrick Gold Corporation (“Barrick”) and Barrick affiliates and subsidiaries (“Barrick Entities”) with respect to Bullion’s claim of non-payment of royalties by the Barrick Entities to Bullion on production from properties in the Carlin trend, Nevada. Bullion initiated litigation in 2008, before EMX acquired Bullion in 2012. Pursuant to the settlement, Barrick will pay Bullion US$ 25 million, of which US$ 6.175 million is owed as payment of the contingency fee to Bullion’s Reno, Nevada lawyers. The settlement of the lawsuit does not affect our 1% gross smelter return royalty from portions of Nevada Gold Mine’s Leeville, Turf and other underground gold mining operations, which will continue to be paid.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”, as well as on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 973-8585

Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@EMXroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

Ibelger@EMXroyalty.com

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding completion of the transaction, perceived merits of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential”, “upside” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors. It is possible EMX may not complete the transaction, as a result of failure to fulfill conditions of closing, unavailability of financing or for other reasons EMX cannot anticipate at this time.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2021 and the year ended December 31, 2020 (the “MD&A”), and the most recently filed Revised Annual Information Form (the “AIF”) for the year ended December 31, 2020, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

VANCOUVER, BC / ACCESSWIRE / February 17, 2022 / (CSE:ROO)(OTC PINK:JNCCF)(Frankfurt:5VHA) – RooGold Inc. (“RooGold” or the “Issuer“).

To Our Shareholders & Prospective Investors:

On February 9th 2022 RooGold announced their appointment of Carlos Espinosa as Chief Executive Officer (CEO), President and member of the Board of Directors, effective March 4th, 2022.

Carlos Espinosa comments, “As I transition into my role as CEO and President of RooGold, and with reconnaissance field work commencing at one of the Company’s flagship projects, I would like to take this opportunity to reach out to all RooGold shareholders and prospective investors. Specifically, I would like to recap RooGold’s substantial achievements in 2021, outline the Company’s immediate exploration plans for the first half of 2022 and importantly discuss the Company’s project acquisition strategy and commitment to value creation by reducing exploration risk”.

2021 Highlights

In 2021 RooGold consolidated a significant portfolio of high grade gold and silver properties in New South Wales Australia comprising 13 concessions within the prolifically mineralized New England and the Lachlan Orogens (Figure 1).

Figure 1: RooGold NSW concessions (Red) on a 90 m Digital Terrane Model showing showing gold (yellow) and silver (blue) occurrences and mines.

2022 Q1 & Q2 Work Program

RooGold’s immediate focus in 2022 will be rapid field reconnaissance of six high priority concessions that have been identified from the comprehensive data base review. RooGold’s work program will initially comprise of:

Alexandra Bonner, RooGold’s Chief Operations Manager, comments, “The Company is preparing to commence its first field reconnaissance program at the end of February 2022 which will focus on the southern part of the Peel-Manning Fault system. RooGold will update investors in due course”.

Project Acquisition Strategy

RooGold’s acquisition strategy focused on reducing exploration risk through the acquisition of a large and diverse exploration portfolio of gold and silver targets, each hosting high grade showings, prospects and historical mines. Specifically:

Figure 2: RooGold NSW concessions (Red) on an aeromagnetic base map. Note that regional scale structures exert a fundamental control on gold and silver mineralization.

Most of RooGold’s concessions are spatially associated with the major crustal structures, all of which are significantly gold mineralized along their length. Many of these structures have also shed significant gold alluvials, which is often a vector to hard rock mineralization.

Carlos Espinosa notes, “RooGold’s extensive and highly prospective, yet largely under explored land holdings, in a stable and mining friendly country such as Australia, was an important factor in my decision to join RooGold as CEO. By owning multiple concessions, all 100% owned, with low holding and work commitment costs, and all with multiple high grade historical gold and silver showings, RooGold has sufficient exploration targets to significantly reduce the overall exploration risk”.

RooGold will be providing regular updates as the field program ramps up during Q1 of 2022.

ROOGOLD is a Canadian based junior venture mineral exploration issuer which is uniquely positioned to be a dominant player in New South Wales, Australia, through a growth strategy focused on the consolidation and exploration of high potential, mineralized precious metals properties in this prolific region of Australia. Through its announced acquisitions of Southern Precious Metals Ltd., RooGold Ltd. and Aussie Precious Metals Corp. properties, RooGold commands a portfolio of 13 high-grade potential gold (9) and silver (4) concessions covering 1,380 km2 which have 137 historic mines and prospects.

For further information please contact:

Ryan Bilodeau

T: 416-910-1440

info@roogoldinc.com

Forward-Looking Statements

This press release may contain forward-looking statements within the meaning of applicable securities law. Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur.

Although the Issuer believes that the expectations reflected in applicable forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in such statements.

NEITHER THE CANADIAN SECURITIES EXCHANGE NOR ITS REGULATION SERVICES PROVIDER ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

SOURCE: RooGold Inc.

VANCOUVER, BC / ACCESSWIRE / February 17, 2022 / Metallic Minerals (TSX.V:MMG | US OTCQB:MMNGF) (“Metallic Minerals“, or the “Company“) is pleased to announce drill results from the Central Keno target area, which intercepted high-grade silver mineralization within broad, bulk tonnage intervals akin to those recently discovered at East Keno but previously unknown in this part of Keno Hill. The Caribou target, in particular, is a top priority for resource definition and the Company is currently updating its 3D model based on drilling to date in anticipation of a robust 2022 campaign.

A total of 2,965 meters in 37 reverse circulation (“RC”) holes were completed throughout the Central Keno target areas out of 53 holes in the 6,200 meter (“m”) total 2021 Keno Silver program, along with 20.3 line-kilometers of deep-penetrating IP geophysical surveys. Results from the 26 holes from East and West Keno drilling remain pending.

Central Keno Highlights

Caribou Target Highlights

Metallic Minerals Chairman & CEO, Greg Johnson, stated, “We are very encouraged by the results from our work in 2021 which has brought major new insights into the mineralizing controls across the Keno District, particularly at Central and East Keno. Our team has identified significant structural features indicative of regional scale thrust faults that appear to form important permeable zones for hosting high-tenor epithermal-style silver mineralization throughout the central and eastern parts of the Keno District. Work planned for 2022 will follow up on the confluence of these newly identified zones of thrust-associated high-grade epithermal-style silver mineralization with the main phase of Keno-style mineralization and its potential to host high-grade and bulk-tonnage resources.”

“Central Keno continues to show exceptional resource potential through the continued expansion of areas of known high-grade Keno-style silver mineralization, along with this newly recognized epithermal silver mineralization. Drilling in 2021 extended the Caribou target a further 400 meters along strike to the south as well as to the north and down dip, making it, along with the Formo target, a top priority for resource definition of significant scale. Drilling and surface sampling has similarly extended the Homestake target by more than a kilometer along strike, making this historic producer another focus for the 2022 program. Both the advanced-stage, historically productive Caribou and Homestake targets are host to well-defined areas with bonanza grades. Additional results from targets at East and West Keno are anticipated to be reported in the coming weeks, preceded by key updates with respect to our La Plata project in Colorado.”

Figure 1 – Keno Silver District Geology and Deposits

Central Keno Hill Silver District

The central part of the Keno Hill Silver District is host to over 100 million ounces of past production and current Indicated resources in shallow deposits that to date have not previously seen systematic exploration to depth or along strike. Central Keno was one of the original discovery areas in the region and hosted the historic producing Keno Hill mine, along with 8 other high-grade deposits including those on Metallic Minerals land holdings. Metallic Minerals’ work to date in this area shows the presence of a major structural corridor that is comparable in surface expression and structural setting to the +150 million-ounce Bermingham-Calumet system in the more extensively explored western part of the district.

Caribou Target Area

The Caribou target in the central part of the district is one of the most advanced individual targets at the Keno Silver Project. The Caribou deposit historically produced very high-grade material grading more than 1,000 g/t silver from near surface and is interpreted to be a significant connecting structure between the main shear structures in the Keno Summit structural corridor. The Caribou deposit spatially occurs within a high-level silver-in-soil anomaly of over 10 g/t AgEq that extends over 2.5 km long by 1.5 km in width and that remains open to expansion.

As part of the exploration program in 2021, Metallic Minerals completed the first-ever application of deep-sensing IP geophysics on the Keno Silver project using Simcoe Geoscience’s Alpha IPTM system. Two deep-looking IP lines were completed across the Central Keno area, which identified significant conductive features that spatially correspond with the newly mapped regional scale thrust fault structures and associated epithermal style silver mineralization. This IP survey in combination with the drilling and detailed mapping has allowed the Metallic Minerals technical team to identify major conductive features that are spatially associated with kilometer-scale soil and magnetic anomalies and significant silver mineralization. This combination of utilizing drilling, geophysics and soil sampling is a highly effective tool set for targeting mineralization across the Keno Hill silver district.

Figure 2 – Caribou Vein Long Section

Drilling in 2021 returned significant step out extensions of mineralization from the main Caribou deposit to the north, south and down dip. Eight of these holes intersected continuous mineralized zones from 15 to 64 m width including a 400-meter step out that encountered 15.2 m grading 97.2 g/t AgEq with 1.5 m grading 628 g/t AgEq (500 g/t Ag, 0.13 g/t Au, 2.35% Pb, 0.45% Zn). This zone appears to be spatially associated with the location of one of the newly mapped regional thrust faults that can host high-grade epithermal silver mineralization. The high-level silver-in-soil anomaly continues for another 1.5 km to the south along strike from this southernmost drill hole at Caribou.

In addition, holes KS21-46 and -47 tested extension of the Caribou deposit to the north and downdip. These holes both confirmed the continuation of strong silver tenor both on strike to the north and at depth with KS21-47 returning one of the highest-grade down dip holes drilled to date intersecting 1597 g/t AgEq over 1.5 meters within a mineralized zone of 27.4 m width grading 146 g/t AgEq.

Table 1- Highlight 2021 Drill Results from the Caribou Target

| Hole | From (m) | To (m) | Width (m) | AgEq (g/t) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) |

| KS21-46 | 42.67 | 44.2 | 1.53 | 71.6 | 1.5 | 0.73 | 0.01 | 0.00 |

| 79.25 | 94.49 | 15.24 | 81.9 | 18.7 | 0.04 | 0.17 | 1.11 | |

| incl | 79.25 | 88.39 | 9.14 | 85.6 | 24.0 | 0.03 | 0.23 | 1.05 |

| incl | 80.77 | 82.3 | 1.53 | 448.7 | 125.0 | 0.13 | 1.29 | 5.51 |

| incl | 92.96 | 94.49 | 1.53 | 260.4 | 31.0 | 0.20 | 0.22 | 4.29 |

| KS21-47 | 92.96 | 120.4 | 27.44 | 146.0 | 70.6 | 0.18 | 0.40 | 0.88 |

| incl | 109.73 | 112.78 | 3.05 | 1150.8 | 562.1 | 1.48 | 3.00 | 6.96 |

| incl | 109.73 | 111.25 | 1.52 | 1597.1 | 850.0 | 1.05 | 2.57 | 11.46 |

| KS21-52 | 0 | 62.48 | 62.48 | 35.3 | 21.9 | 0.01 | 0.23 | 0.07 |

| incl | 1.52 | 25.91 | 24.39 | 79.7 | 51.9 | 0.02 | 0.55 | 0.09 |

| incl | 7.62 | 12.19 | 4.57 | 297.0 | 191.3 | 0.09 | 2.16 | 0.26 |

| incl | 9.14 | 10.67 | 1.53 | 500.6 | 340.0 | 0.22 | 2.94 | 0.49 |

| KS21-54 | 16.76 | 42.67 | 25.91 | 53.4 | 35.2 | 0.01 | 0.30 | 0.11 |

| incl | 21.34 | 36.58 | 15.24 | 83.8 | 57.4 | 0.01 | 0.50 | 0.12 |

| incl | 22.86 | 24.38 | 1.52 | 517.0 | 387.0 | 0.07 | 2.74 | 0.30 |

| KS21-55 | 44.2 | 76.2 | 32 | 75.6 | 14.8 | 0.19 | 0.09 | 0.82 |

| incl | 44.2 | 64.01 | 19.81 | 119.1 | 22.7 | 0.30 | 0.15 | 1.30 |

| incl | 50.29 | 60.96 | 10.67 | 210.8 | 37.1 | 0.55 | 0.26 | 2.34 |

| incl | 50.29 | 54.86 | 4.57 | 467.2 | 75.8 | 1.29 | 0.58 | 5.21 |

| incl | 51.82 | 53.34 | 1.52 | 1009.8 | 147.0 | 3.24 | 0.99 | 10.90 |

| KS21-57 | 33.53 | 54.86 | 21.33 | 147.3 | 100.4 | 0.07 | 0.93 | 0.09 |

| incl | 33.53 | 42.67 | 9.14 | 332.4 | 227.7 | 0.16 | 2.15 | 0.15 |

| incl | 35.05 | 41.15 | 6.1 | 486.9 | 335.2 | 0.23 | 3.12 | 0.20 |

| incl | 35.05 | 38.1 | 3.05 | 694. 9 | 476.4 | 0.40 | 4.23 | 0.37 |

| KS21-61 | 33.53 | 77.72 | 44.19 | 24.9 | 11.0 | 0.01 | 0.04 | 0.23 |

| incl | 50.29 | 59.44 | 9.15 | 102.6 | 47.7 | 0.05 | 0.16 | 0.92 |

| incl | 51.82 | 53.34 | 1.52 | 337.1 | 170.0 | 0.21 | 0.30 | 2.83 |

| KS21-63 | 30.48 | 45.72 | 15.24 | 97.2 | 75.2 | 0.02 | 0.40 | 0.08 |

| incl | 30.48 | 38.1 | 7.62 | 160.1 | 125.2 | 0.03 | 0.65 | 0.12 |

| incl | 33.53 | 35.05 | 1.52 | 627.8 | 500.0 | 0.13 | 2.35 | 0.45 |

1Silver equivalent (Ag Eq) values assume Ag $19/oz, Pb $1.05/lb, Zn $1.30/lb, Au $1,800/oz and 100% metallurgical recovery. Sample intervals are based on measured drill intercept lengths.

Exploration to date has hit more than 70 mineralized intersections on the Caribou system over a strike distance of 700 m and down to 100 m depth. The Caribou deposit remains open to expansion to the south, north and down dip making it a top priority for resource focused drilling efforts in 2022. The highlighted results in Table 1 above build upon prior diamond drilling on the Caribou target by Metallic Minerals, results of which can be found here.

Metallic will look to follow up the 2021 success with diamond drilling in 2022 with intent to establish an initial resource at Caribou. Additional diamond drilling will be planned to test the newly extended southern strike and provide context for its association with the thrust structure. Importantly, 2021 drilling encountered ultra-high-grade, Keno-style vein intersects within much broader, bulk tonnage intervals similar to those discovered previously at East Keno in 2020.

Homestake

The historically productive Homestake target is located south of the Keno Summit target area along a parallel structural corridor. The style of the Homestake structure is comparable to those seen at the Keno Summit and in the more developed Western Keno areas. Homestake is comprised of two parallel vein structures within a broad structural corridor over 200 meters wide that has a demonstrated strike length of over 1 km in the host Keno Hill quartzite. Homestake #1 vein shows classic Keno-style, high-grade silver-lead-zinc mineralization, while the #2 vein can also show high gold grades with silver, which is characteristic of some structures in the larger deposits within the Keno Hill Silver District. The highest grades to date include assays of 4,027 g/t silver from drilling and 4,717 g/t silver from trenching on the Homestake #1 vein, and 22.1 g/t gold with 332 g/t silver from trenching on the Homestake #2 vein Prior drill results from Homestake can be found here.

To date there are 21 drilled vein intersections grading more than 600 g/t silver equivalent on the Homestake structures, including five that exceed 10 g/t gold on the Homestake #2 structure. Work in 2021 at Homestake focused on wide-spaced reconnaissance drilling along the main trends as well as extension of the open-ended soil anomalies. The soil sampling work expanded the high-level silver-in-soil anomaly associated with the Homestake mineralized system to 3 km in length by 1.5 km in width with the anomalies still open to further expansion. Intersections of anomalous silver over significant widths indicate a strike length of 1.5 km for the Homestake system. The next phase of systematic testing of these structures will be designed to delineate areas of the high-grade and bulk-tonnage toward development of an initial resource at Homestake.

About the Keno Silver Project

Exploration by Metallic Minerals at the Keno Silver project continues to systematically build on the Company’s 3D geologic database covering the east, central and western portions of the prolific Keno Hill silver district. The project includes eight high-grade, shallow past-producing mines that have yet to be subjected to modern exploration due to previously unconsolidated land ownership. Along the known, historically productive trends in the central and western parts of the district, the Company has advanced three targets towards an initial resource estimate along with identifying 12 priority multi-kilometer-scale early-stage targets in the under-explored eastern and southern parts of the district where initial drilling has returned significant high-grade Keno-style mineralization as well as bulk-tonnage style silver mineralization.

About Metallic Minerals

Metallic Minerals Corp. is a growth-stage exploration company, focused on high-grade silver and gold projects in underexplored, brownfields mining districts of North America. Our objective is to create shareholder value through a systematic, entrepreneurial approach to exploration in the Keno Hill silver district, La Plata silver-gold-copper district, and Klondike gold district through new discoveries and advancing resources to development. Metallic Minerals has consolidated the second-largest land position in the historic Keno Hill silver district of Canada’s Yukon Territory, directly adjacent to Alexco Resource Corp’s operations, with nearly 300 million ounces of high-grade silver in past production and current M&I resources. In addition, exploration at the recently acquired La Plata silver-gold-copper project in southwestern Colorado is targeting a silver and gold-enriched copper porphyry and adjacent high-grade silver and gold epithermal systems. The Company also continues to add new production royalty leases on its holdings in the Klondike gold district in the Yukon. All three districts have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits, as well as having large-scale development, permitting and project financing expertise.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry’s highest-grade producers of silver and gold, platinum and palladium, and copper. Member companies include Metallic Minerals in the Yukon’s high-grade Keno Hill silver district and La Plata silver-gold-copper district of Colorado, Group Ten Metals in the Stillwater PGM-nickel-copper district of Montana, and Granite Creek Copper in the Yukon’s Minto copper district. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorer/developers and major producers. With this expertise, the companies are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven, but under-explored, mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada, and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: mmgsilver.com Phone: 604-629-7800

Email: cackerman@mmgsilver.com Toll Free: 1-888-570-4420

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

Vancouver, British Columbia–(Newsfile Corp. – February 17, 2022) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) is pleased to announce the execution of an agreement on February 14, 2022 to sell its Mo-i-Rana volcanogenic massive sulfide (“VMS“) project in Norway (the “Project“) to Mahvie Minerals AB (“Mahvie“), a private Swedish Company. In return for the transfer of the Project to Mahvie, the agreement provides EMX with a 9.9% equity interest in Mahvie, annual advance royalty payments, 2.5% Net Smelter Return (“NSR“) royalty interests, work commitments, and other considerations. In conjunction with the Mo-i-Rana transaction, Mahvie intends to establish a public listing on one of the Nordic exchanges. This is anticipated sometime in Q2, 2022.

The Mo-i-Rana VMS belt was acquired by EMX in 2021 (see EMX News Release dated April 6, 2021). This VMS belt is situated in central Norway and contains numerous polymetallic (zinc-lead-copper-silver-gold) occurrences and historical mines (see Figures 1 and 2). Over 200 mines and prospects with VMS and carbonate replacement (“CRD“) styles of mineralization are located within the Mo-i-Rana project area, including ten former producing mines.

EMX and Mahvie will work together to explore the Project, where considerable exploration upside exists at many of the historical occurrences and mines. Much of the historical exploration work was done at a time when VMS models were only poorly understood and only limited portions of the nine individual VMS horizons that exist in the belt have been tested to date. Additionally, most historical drilling was shallow (i.e., less than 100 meters) and clustered around the historical mine workings. EMX and Mahvie will apply modern exploration methods and deposit models to seek additional discoveries in the belt.

Commercial Terms Overview. Via an arm’s length transaction, Mahvie will acquire a 100% interest in the EMX subsidiary company that controls the Project, subject to the following terms:

Mo-i-Rana VMS Belt. VMS and CRD style polymetallic deposits are developed in the Rana-Hemmes metallogenic region of Norway, which is also host to the prolific Rana Gruber iron mines as well as the nearby Bleikvassli Zn-Pb-Cu-Ag deposit, an EMX royalty property (see Figure 1). This metallogenic area represents a tectonically displaced continuation of the Cambrian-Ordovician VMS belts in northeastern North America, which includes the Buchans and Bathurst VMS camps in eastern Canada, and also the Avoca VMS district in Ireland. As such, this represents one of the more prolific VMS belts in the world in terms of total production from its various mining districts, albeit now tectonically displaced and occurring along opposite sides of the Atlantic Ocean.

The most notable historical producer within the Project area is the Mofjell Mine (the core of which remains covered by state-owned mining licenses) which produced 4.35 million tonnes at 3.61% Zn, 0.71% Pb, and 0.31% Cu from 1928-1987[1]. The deposit consists of three rod-shaped elongate VMS lenses, approximately 100 meters wide that extend for lengths of up to 2.8 kilometers. Just prior to mine closure, high gold and silver grades were discovered as disseminations in wall rocks within the historical mine workings (such as 2.8 meters averaging 3.88 g/t gold and 44.3 g/t silver in underground drill hole DD1313 and 3.7 meters averaging 2.30 g/t gold and 75.7 g/t silver in underground drill hole DD781A; true widths unknown[2]) but were never followed up[3]. This underscores the potential for additional discoveries of precious-metal enriched zones of mineralization in the belt.

In 2008, a partnership between industry, the Norwegian Geological Survey (NGU) and the local county administration was formed to investigate additional potential in the Mo-i-Rana belt. This effort generated high resolution airborne geophysical data sets, as well as district scale mapping and geochemical sampling campaigns carried out by the NGU. These represent key data sets that EMX and Mahvie intend to utilize for further advancement of the Project.

More information on the Project can be found at www.EMXroyalty.com.

Comments on Sampling, Assaying and Adjacent Properties. Samples and geochemical assays mentioned in this news release are reported by Norwegian Geologic Survey. EMX has not performed sufficient work to verify the Project’s historical drill results or production data, but considers this information as reliable and relevant based upon the Company’s reviews of data from multiple independent sources. Additional drilling and sampling would be required to confirm these results.

The Mofjell Mine and other nearby mines and deposits discussed in this news release provide context for EMX’s Project, which occurs in a similar geologic setting, but this is not necessarily indicative that the Company’s Project hosts similar mineralization.

Dr. Eric P. Jensen, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and the TSX Venture Exchange under the symbol EMX, as well as on the Frankfurt Exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 973-8585

Dave@emxroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@emxroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward-looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserve and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2021 and the year ended December 31, 2020 (the “MD&A”), and the most recently filed Revised Annual Information Form (the “AIF”) for the year ended December 31, 2020, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

Figure 1: Location map for the Mo-i-Rana VMS belt in Norway.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/1508/114046_d2f35c60d4c96a3a_002full.jpg

Figure 2: Geology, Mineral Occurrences and Historic Mines in the Mo-i-Rana VMS belt

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/1508/114046_d2f35c60d4c96a3a_003full.jpg

[1] Bjerkgård, et. al (2013). The Mofjell Project: Summary and conclusions. NGU (Norwegian Geological Survey) Report 2013.048.

[2] Bergverkselskapet Nord-Norge A/S, 1987. As Reported by Directorate of Mining Norway. The historical drilling was completed by Bergverkselskapet Nord-Norge A/S, 1987 and archived by the NGU. EMX believes these results to be reliable and relevant.

[3] Bjerkgård, et al (2001). Ore Potential with emphasis on gold in the Mofjellet deposit, Rana, Nordland, Norway. NGU Report 2001.050.