A respected analyst report has recently commented on the value proposition of EMX Royalty. The decision seems to have merit based on this week’s recent news announcement on the 3rd Quarter Results for 2023. A projected 12-month price point of C$5.75 was the target by the analyst. At the present EMX Royalty is trading at C$2.22. We highly regard EMX Royalty, we’ve been long-term shareholders since 2016/17. In our opinion EMX Royalty is a legacy company that you buy and pass along to your children. It’s the Goose that keeps laying the Golden Egg.

Highlights from Q3 2023 include the following:

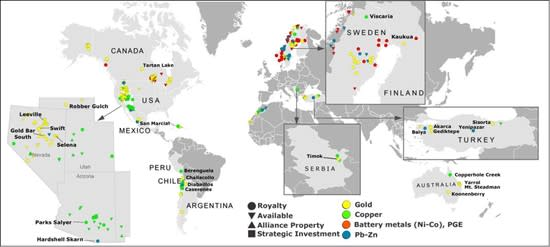

- EMX earned approximately $1,955,000 in royalty revenue from the Gediktepe Mine as production continued from the oxide gold deposit. Partner Lidya Madencilik Anayi ve Ticaret A.S. (“Lidya”) also notified EMX that it has completed an internal Feasibility Study for development of the underlying polymetallic sulfide deposit. A decision regarding financing and construction for the sulfide project is pending.

- The Caserones (effective) royalty distribution for Q3 totaled approximately $1,741,000. Lundin Mining Corporation (“Lundin”), in connection with their acquisition of fifty-one percent (51%) of the issued and outstanding equity of SCM Minera Lumina Copper Chile SpA (see Lundin news release dated July 13, 2023), filed a technical report on SEDAR titled “NI 43-101 Technical Report on the Caserones Mining Operation, Atacama Region, Chile” that included current mineral resource and reserve estimates. Lundin also provided Caserones H1 production and H2 production guidance.

- Leeville revenue earned by EMX totaled approximately $773,000 from royalty production that totaled 403 ounces of gold. Q3 2023 marked another strong quarter of Leeville royalty production along with robust gold prices.

- EMX recognized $568,000 in royalty revenue from the Balya property in Q3 2023 which included $212,000 from Q2 production and $356,000 from Q3 production subsequently received. Production began to ramp up again in Q2 2023 with 99,185 tonnes of mineralized material produced from Balya North. Production continued to accelerate in Q3 2023, with 161,133 tonnes of mineralized material produced according to calculations provided by Esan at the end of Q3.

- EMX received $134,000 from Gold Bar South for royalty revenue earned in Q1 2023 and Q2 2023, and earned royalty revenue of $59,000 from Q3 2023 production, which was subsequently received.

- AbraSilver Resource Corp. (“AbraSilver”) reported final results from the Phase III drill program at the Diablillos silver-gold royalty property. Phase III drill holes will be incorporated into an updated mineral resource estimate to be included in the Diablillos PFS scheduled for completion in H2 of 2023. As part of its ongoing PFS work, AbraSilver also reported on positive results from metallurgical optimization test work conducted for the Oculto deposit.

- Arizona Sonoran Copper continued to report infill drilling results from the Parks-Sayler porphyry copper royalty property. Subsequent to quarter-end, Arizona Sonoran announced updated mineral resource estimates for the Parks-Sayler deposit, which is partially covered by an EMX royalty, as well as other deposits that constitute its Cactus Project.

- Exploration drilling by South32 at the Hermosa Project’s Peake prospect returned mineralized intercepts covered by EMX’s Hardshell royalty property that included the best copper intercept to date of 139 meters averaging 1.88% copper, 0.51% lead, 0.34% zinc, and 52 g/t silver (true width not reported).

- EMX’s U.S. royalty generation portfolio progressed with 13 partner-funded work programs consisting of five drill programs, the expansion of properties through the staking of new claims, and the permitting of key projects in preparation for three additional drill programs to be conducted in Q4 2023 and early 2024. EMX has 39 projects in partnership in the western U.S and received various option, AAR, and management fee payments during the quarter.

- Scout Discoveries Corp. (“Scout”) (a private Idaho company) and EMX closed on an amended transaction, originally announced in Q1 2023 (see EMX news release dated March 8, 2023) for the sale of EMX’s Erickson Ridge, South Orogrande, Lehman Butte, and Jackknife precious and base metal projects to Scout.

- In Canada, EMX executed two new agreements to partner the Jean Lake property to Canada Nickel Company, and the Ear Falls property to Beyond Lithium. EMX and its partners conducted summer field programs to continue advancing the properties in the portfolio. EMX received $104,000 in cash payments during the quarter from partnered projects.

- In Chile, Pampa Metals announced assay results from its initial three hole drill program totaling 1,957 meters at the Buena Vista target on the Block 4 property. Anomalous copper, molybdenum and precious metals were intercepted, indicative of shallow levels of a porphyry system. Elsewhere within the portfolio, EMX was notified by Pampa Metals that it was abandoning the Arrieros, Redondo-Veronica, Cerro Blanco, Cerro Buena Aries, and Block 3 properties, resulting in EMX gaining 100% control of each property. These properties are now available for partnership.

- In Northern Europe the Company continued to develop and advance its portfolio of projects, with summer field programs continuing on numerous properties in Q3 2023. EMX has 37 projects in partnership with other companies in Northern Europe. New partnerships were established for the Bamble and Flåt battery metals projects in Norway (Londo Nickel plc) and the Njuggträskliden and Mjövattnet battery metals projects in Sweden (Kendrick Resources plc).

- The Company optioned the Copperhole Creek project in Queensland, Australia to Lumira Energy LTD, a private Australian company. The agreement provides EMX with a 2.5% NSR royalty interest, cash and equity payments, work commitments and other considerations. In conjunction with the transaction, Lumira Energy intends to establish a public listing on the Australian Securities Exchange (ASX) by mid-year 2024.

- Also in Q3 2023 in Australia, partner companies executed drill programs comprising over 5,000 meters on three EMX royalty properties (Yarrol, Mt Steadman and Koonenberry) and field programs continued to advance the Queensland Gold and Copperhole Creek projects.

- Royalty generation programs continued in the Balkans and in Morocco in Q3 2023, where multiple exploration license applications have been filed by the Company. Surface sampling programs commenced on several new exploration licenses awarded to EMX in Morocco targeting a variety of styles of mineralization. EMX also continued to assess projects and opportunities in the Balkans.

Investment Updates

As at September 30, 2023, the Company had marketable securities of $6,830,000 (December 31, 2022 – $9,966,000), and $5,313,000 (December 31, 2022 – $4,591,000) in private investments. The Company will continue to generate cash flow by selling certain of its investments when appropriate.

OUTLOOK

The 2023 year will continue to see revenue and other income coming from our cash flowing royalties, including Leeville and Gold Bar South in Nevada, Gediktepe and Balya in Turkey, and Timok in Serbia, and our effective royalty interest on Caserones in Chile. As in previous years, production royalties will continue to be complemented by option, advance royalty, and other pre-production payments from partnered projects across the global asset portfolio.

The Company will continue to strengthen its balance sheet over the course of the year by looking to retire portions of our long-term debt, continuing to evaluate equity markets, and the ongoing monetization of the Company’s marketable securities.

EMX is well positioned to identify and pursue new royalty and investment opportunities, while further filling a pipeline of royalty generation properties that provide opportunities for additional cash flow, as well as exploration, development, and production success.

Marketing Consulting Services

The Company is also pleased to announce that it has entered into an agreement with LFG Equities Corp. (“LFG”), an independent contractor with a business address at 402-9140 Leslie St., Richmond Hill, ON, L4B 0A9. Commencing on September 10th, 2023 for an initial term of six months, under the terms of the Agreement, LFG will provide marketing consulting services to the Company to communicate to the financial community information about EMX by way of newsletters and be paid US$50,000 plus applicable taxes.

QUALIFIED PERSONS

Michael P. Sheehan, CPG, a Qualified Person as defined by NI 43-101 and employee of the Company, has reviewed, verified and approved the above technical disclosure on North America, Latin America, and Strategic Investments. Eric P. Jensen, CPG, a Qualified Person as defined by NI 43-101 and employee of the Company, has reviewed, verified and approved the above technical disclosure on Europe, Turkey, and Australia.

About EMX. EMX is a precious, base and battery metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”, and also trade on the Frankfurt exchange under the symbol “6E9”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and CEO

Phone: (303) 973-8585

Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@EMXroyalty.com

Isabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended September 30, 2022 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2021, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedarplus.ca and on the SEC’s EDGAR website at www.sec.gov.

1Adjusted revenue and other income and adjusted cash provided by operating activities are non-IFRS financial measures with no standardized meaning under IFRS and might not be comparable to similar financial measures disclosed by other issuers. Refer to the “Non-IFRS financial measures” section on page 24 of the Q3-2023 MD&A for more information on each non-IFRS financial measure.

Be sure to perform your due diligence, we are biased.