I am honored to be mentioned among legendary wealth builders and awesome, awesome human beings. Thank you to both Mr. Andy Schectman and David Morgan!

Category: Base Metals

Discovers A1 Shear Extension 3.2km South of JR

Kelowna, British Columbia–(Newsfile Corp. – October 29, 2024) – F3 Uranium Corp (TSXV: FUU) (OTC Pink: FUUFF) (“F3” or “the Company“) is pleased to announce assay results for thirteen drillholes of the ongoing 2024 drill program on the PLN Property, including PLN24-161 at the JR Zone (see NR August 13, 2024) which returned 10.5m of 2.66% U3O8, including a high grade 2.0m interval averaging 12.0% U3O8, further including an ultra-high grade core of 0.5m of 20.7% U3O8. Significant mineralization over a 13.5m interval was intersected in PLN24-184 on line 105S at JR, including 1.5m off-scale radioactivity (>65,535 cps) between 235.60 and 240.10m.

Exploration drilling focused mainly on the B1 area close to, and south of the Harrison Fault, with a number of very prospective drill holes, highlighted by PLN24-187 which was drilled on line 3240S, approximately 400m south of the Harrison Fault, and on section with PLN24-183. PLN24-183 was the first hole to intersect what is interpreted to be the southern extension of the A1 shear zone hosting the JR Zone. Due to encouraging alteration and intense shearing a down dip hole was drilled, and PLN24-187 encountered intense alteration and anomalous radioactivity (see Table 1 and Photo 1).

Sam Hartmann, Vice President Exploration, commented:

“Today’s update includes scintillometer results of drilling in the JR Zone, where three holes successfully targeted high grade mineralization in areas of lower drill hole density, as well as high-grade assay results of drillholes completed and previously announced earlier in the program. Exploration drilling south of the Harrison Fault discovered the A1 Shear Extension, ~400m beyond the previously interpreted southern extent of the A1 shear, as a discrete continuation, and parallel to the B1 structures. This potential for stacked and parallel structure south of Harrison Fault provides further high priority drill targets for high grade uranium mineralization.”

JR Zone Assay Highlights:

PLN24-161 (line 035S):

- 10.5m @ 2.66% U3O8 (206.5m to 217.5m), including:

- 2.0m @ 12.0% U3O8 (207.5m to 209.5m), further including:

- 0.5m @ 20.7% U3O8 (208.0m to 208.5m)

PLN24-163 (line 095S):

- 13.0m @ 0.45% U3O8 (197.0m to 210.0m), including:

- 2.5m @ 1.77 % U3O8 (204.0m to 206.5m)

JR Zone Handheld Spectrometer Highlights:

PLN24-184 (line 105S):

- 13.5m mineralization from 228.5m – 242.0m, including

- 3.80 m cumulative mineralization of >10,000 cps radioactivity between 233.00m – 240.30m, including 1.5m cumulative off-scale radioactivity (>65,535 cps) between 235.60 -240.10m

PLN24-185 (line 025S)

- 13.0m mineralization from 218.0m – 231.0m, including

- 2.30 m cumulative mineralization of >10,000 cps radioactivity between 223.00m – 230.50m, including 0.5m cumulative off-scale radioactivity (>65,535 cps) between 223.00 -2424.00m

Exploration Handheld Spectrometer Highlights:

PLN24-178 (line 2835S): B1 Exploration

- 0.5m radioactivity from 446.5m – 447m with a peak of 310 cps

PLN24-180 (line 1125S): A1 South Exploration

- 0.5m radioactivity from 319.0m – 319.5m with a peak of 700 cps

PLN24-181 (line 2880S): B1 Exploration

- 0.5m radioactivity from 377.5m – 378.0m with a peak of 360 cps

PLN24-187 (line 3240S): B1 Exploration

- 0.5m radioactivity from 549.0m – 549.5m with a peak of 300 cps

Figure 1: JR Zone Assay and Spectrometer Results

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8110/228040_figure1.jpg

Figure 2: 2024 Drilling on A1 and B1 Shear Zones and new A1 Shear Extension

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8110/228040_plndrill2.jpg

Photo 1. A1 Extension in PLN24-187

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8110/228040_2deb68b6544e78ce_003full.jpg

Table 1. Drill Hole Summary and Uranium Assay Results

Collar Information | Assay Results | |||||||||

| Hole ID | Grid Line | Easting | Northing | Elevation | Az | Dip | From (m) | To (m) | Interval (m) | U3O8 weight % |

| PLN24-153 | 555S | 588064.37 | 6410321.99 | 534.56 | -72.0 | 55.6 | A1 Exploration; no mineralization >0.05 | |||

| PLN24-154 | 2100S | 587534.07 | 6408053.06 | 531.83 | -60.2 | 35.9 | A3 Exploration; no mineralization >0.05 | |||

| PLN24-155 | 1215S | 588507.31 | 6409827.87 | 536.43 | -69.9 | 58.0 | A1 Exploration; no mineralization >0.05 | |||

| PLN24-156 | 1335S | 588571.28 | 6409726.11 | 543.90 | -70.0 | 53.2 | A1 Exploration; no mineralization >0.05 | |||

| PLN24-157 | 2745S | 589215.28 | 6408451.38 | 540.75 | -65.3 | 54.2 | A1 Exploration; no mineralization >0.05 | |||

| PLN24-158 | 2040S | 588934.86 | 6409122.90 | 543.88 | -70.1 | 56.5 | A1 Exploration; no mineralization >0.05 | |||

| PLN24-159 | 2235S | 589041.26 | 6408957.53 | 543.16 | -70.5 | 52.4 | A1 Exploration; no mineralization >0.05 | |||

| PLN24-160 | 2430S | 589122.80 | 6408773.08 | 543.36 | -71.5 | 59.0 | A1 Exploration; no mineralization >0.05 | |||

| PLN24-161 | 035S | 587790.97 | 6410763.91 | 546.37 | -80.3 | 57.0 | 206.50 | 207.50 | 1.00 | 0.19 |

| 207.50 | 209.50 | 2.00 | 12.0 | |||||||

| incl | 208.00 | 208.50 | 0.50 | 20.7 | ||||||

| 209.50 | 217.00 | 7.50 | 0.49 | |||||||

| incl | 215.50 | 216.00 | 0.50 | 2.31 | ||||||

| PLN24-162 | 2850S | 589301.35 | 6408383.61 | 538.03 | -67.9 | 54.5 | A1 Exploration; no mineralization >0.05 | |||

| PLN24-163 | 095S | 587813.11 | 6410709.84 | 546.85 | -78.5 | 52.4 | 197.00 | 204.00 | 7.00 | 0.09 |

| 204.00 | 206.50 | 2.50 | 1.77 | |||||||

| incl | 205.50 | 206.00 | 0.50 | 3.32 | ||||||

| 206.50 | 210.00 | 3.50 | 0.24 | |||||||

| PLN24-164 | 2880S | 589259.50 | 6408356.75 | 538.22 | -65.3 | 68.9 | A1 Exploration; no mineralization >0.05 | |||

| PLN24-165 | 3195S | 589613.77 | 6408183.67 | 535.01 | -72.4 | 55.0 | B1 Exploration; no mineralization >0.05 | |||

Assay composite parameters:

1: Minimum Thickness of 0.5 m

2: Assay Grade Cut-Off: 0.05% U3O8 (weight %)

3. Maximum Internal Dilution: 2.0 m

Table 2. Drill Hole Summary and Handheld Spectrometer Results

| Collar Information | * Hand-held Spectrometer Results On Mineralized Drillcore (>300 cps / >0.5m minimum) | Athabasca Unconformity Depth (m) | Total Drillhole Depth (m) | |||||||||

| Hole ID | Section Line | Easting | Northing | Elevation | Az | Dip | From (m) | To (m) | Interval (m) | Max CPS | ||

| PLN24-178 | 2835S | 589250.1 | 6408364.9 | 537.6 | -66.5 | 53.5 | 446.50 | 447.00 | 0.50 | 310 | 175.4 | 554 |

| PLN24-179 | 4245S | 590177.8 | 6407292.3 | 542.2 | -64.3 | 54.2 | B1 MSZ Exploration; no radioactivity >300 cps | 372.8 | 533 | |||

| PLN24-180 | 1125S | 588192.3 | 6409710.1 | 542.3 | -60.1 | 54.4 | 319.00 | 319.50 | 0.50 | 700 | n.a. | 556 |

| PLN24-181 | 2880S | 589300.5 | 6408383.0 | 539.6 | -65.1 | 79.3 | 377.50 | 378.00 | 0.50 | 360 | 200.0, 308.6, 360.3 | 466 |

| PLN24-182 | 5280S | 590644.1 | 6406355.3 | 539.2 | -71.8 | 53.6 | B1 MSZ Exploration; no radioactivity >300 cps | 342.7 | 446 | |||

| PLN24-183 | 3240S | 589413.8 | 6407982.6 | 530.1 | -59.0 | 54.1 | B1 MSZ Exploration; no radioactivity >300 cps | 392.6 | 743 | |||

| PLN24-184 | 105S | 587752.6 | 6410654.2 | 544.6 | -62.1 | 53.2 | 207.50 | 208.00 | 0.50 | 540 | 194.4 | 290 |

| 228.50 | 229.00 | 0.50 | 980 | |||||||||

| 229.00 | 229.50 | 0.50 | 560 | |||||||||

| 229.50 | 230.00 | 0.50 | 1100 | |||||||||

| 230.00 | 230.50 | 0.50 | 540 | |||||||||

| 230.50 | 231.00 | 0.50 | <300 | |||||||||

| 231.00 | 231.50 | 0.50 | 2400 | |||||||||

| 231.50 | 232.00 | 0.50 | 690 | |||||||||

| 232.00 | 232.50 | 0.50 | 680 | |||||||||

| 232.50 | 233.00 | 0.50 | 540 | |||||||||

| 233.00 | 233.50 | 0.50 | 36100 | |||||||||

| 233.50 | 233.80 | 0.30 | 22100 | |||||||||

| 233.80 | 234.00 | 0.20 | 9900 | |||||||||

| 234.00 | 234.50 | 0.50 | 350 | |||||||||

| 234.50 | 235.00 | 0.50 | 7200 | |||||||||

| 235.00 | 235.50 | 0.50 | 8700 | |||||||||

| 235.50 | 235.60 | 0.10 | 65500 | |||||||||

| 235.60 | 235.90 | 0.30 | >65535 | |||||||||

| 235.90 | 236.00 | 0.10 | 65500 | |||||||||

| 236.00 | 236.50 | 0.50 | 550 | |||||||||

| 236.50 | 237.00 | 0.50 | 16900 | |||||||||

| 237.00 | 237.50 | 0.50 | 730 | |||||||||

| 237.50 | 238.00 | 0.50 | 1700 | |||||||||

| 238.00 | 238.15 | 0.15 | 65500 | |||||||||

| 238.15 | 238.50 | 0.35 | >65535 | |||||||||

| 238.50 | 238.65 | 0.15 | 65500 | |||||||||

| 238.65 | 239.00 | 0.35 | >65535 | |||||||||

| 239.00 | 239.20 | 0.20 | 23300 | |||||||||

| 239.20 | 239.50 | 0.30 | 9900 | |||||||||

| 239.50 | 239.60 | 0.10 | 65500 | |||||||||

| 239.60 | 240.00 | 0.40 | >65535 | |||||||||

| 240.00 | 240.10 | 0.10 | >65535 | |||||||||

| 240.10 | 240.30 | 0.20 | 65500 | |||||||||

| 240.30 | 240.50 | 0.20 | 9900 | |||||||||

| 240.50 | 241.00 | 0.50 | 520 | |||||||||

| 241.00 | 241.50 | 0.50 | 620 | |||||||||

| 241.50 | 242.00 | 0.50 | 440 | |||||||||

| 244.00 | 244.50 | 0.50 | 750 | |||||||||

| 244.50 | 245.00 | 0.50 | 810 | |||||||||

| PLN24-185 | 025S | 587736.8 | 6410738.8 | 545.3 | -65.9 | 52.9 | 218.00 | 218.50 | 0.50 | 570 | 197.2 | 278 |

| 218.50 | 219.50 | 1.00 | <300 | |||||||||

| 219.50 | 220.00 | 0.50 | 800 | |||||||||

| 220.00 | 220.50 | 0.50 | 630 | |||||||||

| 220.50 | 221.00 | 0.50 | 380 | |||||||||

| 221.00 | 222.00 | 1.00 | <300 | |||||||||

| 222.00 | 222.50 | 0.50 | 6100 | |||||||||

| 222.50 | 223.00 | 0.50 | 5600 | |||||||||

| 223.00 | 223.30 | 0.30 | >65535 | |||||||||

| 223.30 | 223.50 | 0.20 | 59400 | |||||||||

| 223.50 | 223.80 | 0.30 | 58700 | |||||||||

| 223.80 | 224.00 | 0.20 | >65535 | |||||||||

| 224.00 | 224.50 | 0.50 | 46700 | |||||||||

| 224.50 | 224.85 | 0.35 | 23200 | |||||||||

| 224.85 | 225.00 | 0.15 | 9800 | |||||||||

| 225.00 | 225.25 | 0.25 | 17600 | |||||||||

| 225.25 | 225.50 | 0.25 | 9100 | |||||||||

| 225.50 | 226.00 | 0.50 | 8300 | |||||||||

| 226.00 | 226.50 | 0.50 | 4600 | |||||||||

| 226.50 | 227.00 | 0.50 | 8000 | |||||||||

| 227.00 | 227.50 | 0.50 | 800 | |||||||||

| 227.50 | 228.00 | 0.50 | 380 | |||||||||

| 228.00 | 228.50 | 0.50 | 800 | |||||||||

| 228.50 | 230.00 | 1.50 | <300 | |||||||||

| 230.00 | 230.30 | 0.30 | 5200 | |||||||||

| 230.30 | 230.50 | 0.20 | 33000 | |||||||||

| 230.50 | 231.00 | 0.50 | 1100 | |||||||||

| PLN24-186 | 035S | 587810.1 | 6410777.2 | 545.7 | -79.2 | 50.9 | 186.50 | 187.00 | 0.50 | 360 | 175.0 | 263 |

| 187.00 | 187.50 | 0.50 | 810 | |||||||||

| 187.50 | 188.00 | 0.50 | 310 | |||||||||

| 188.00 | 188.50 | 0.50 | 350 | |||||||||

| 188.50 | 189.00 | 0.50 | <300 | |||||||||

| 189.00 | 189.50 | 0.50 | 560 | |||||||||

| 189.50 | 190.00 | 0.50 | 1100 | |||||||||

| 190.00 | 190.50 | 0.50 | 1400 | |||||||||

| 190.50 | 191.00 | 0.50 | 1700 | |||||||||

| 191.00 | 191.50 | 0.50 | 2400 | |||||||||

| 191.50 | 191.65 | 0.15 | 4100 | |||||||||

| 191.65 | 192.00 | 0.35 | 13100 | |||||||||

| 192.00 | 192.50 | 0.50 | 2600 | |||||||||

| 192.50 | 193.00 | 0.50 | 2000 | |||||||||

| 193.00 | 193.50 | 0.50 | 13300 | |||||||||

| 193.50 | 194.00 | 0.50 | 9400 | |||||||||

| 194.00 | 194.50 | 0.50 | 7000 | |||||||||

| 194.50 | 195.00 | 0.50 | 2800 | |||||||||

| 195.00 | 195.50 | 0.50 | 3500 | |||||||||

| 195.50 | 196.00 | 0.50 | 330 | |||||||||

| 196.00 | 196.50 | 0.50 | 1700 | |||||||||

| 196.50 | 197.00 | 0.50 | 1300 | |||||||||

| 197.00 | 197.50 | 0.50 | 470 | |||||||||

| PLN24-187 | 3240S | 589410.2 | 6407980.4 | 530.8 | -65.4 | 53.8 | 549.00 | 549.50 | 0.50 | 300 | 373.0 | 713 |

Handheld spectrometer composite parameters:

1: Minimum Thickness of 0.5m

2: CPS Cut-Off of 300 counts per second

3: Maximum Internal Dilution of 2.0m

Natural gamma radiation in the drill core that is reported in this news release was measured in counts per second (cps) using a handheld Radiation Solutions RS-125 scintillometer. The Company considers greater than 300 cps on the handheld spectrometer as anomalous, >10,000 cps as high grade and greater than 65,535 cps as off-scale. The reader is cautioned that scintillometer readings are not directly or uniformly related to uranium grades of the rock sample measured and should be used only as a preliminary indication of the presence of radioactive materials.

Composited weight % U3O8 mineralized intervals are summarized in Table 1. Samples from the drill core are split in half sections on site. Where possible, samples are standardized at 0.5m down-hole intervals. One-half of the split sample is sent to SRC Geoanalytical Laboratories (an SCC ISO/IEC 17025: 2005 Accredited Facility) in Saskatoon, SK while the other half remains on site for reference. Analysis includes a 63 element suite including boron by ICP-OES, uranium by ICP-MS and gold analysis by ICP-OES and/or AAS.

The Company considers uranium mineralization with assay results of greater than 1.0 weight % U3O8 as “high grade” and results greater than 20.0 weight % U3O8 as “ultra-high grade.”

All depth measurements reported are down-hole and true thickness are yet to be determined.

About Patterson Lake North:

The Company’s 4,078-hectare 100% owned Patterson Lake North property (PLN) is located just within the south-western edge of the Athabasca Basin in proximity to Fission Uranium’s Triple R and NexGen Energy’s Arrow high-grade world class uranium deposits which is poised to become the next major area of development for new uranium operations in northern Saskatchewan. PLN is accessed by Provincial Highway 955, which transects the property, and the new JR Zone uranium discovery is located 23km northwest of Fission Uranium’s Triple R deposit.

Qualified Person:

The technical information in this news release has been prepare in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and approved on behalf of the company by Raymond Ashley, P.Geo., President & COO of F3 Uranium Corp, a Qualified Person. Mr. Ashley has verified the data disclosed.

About F3 Uranium Corp:

F3 Uranium is a uranium exploration company advancing its newly discovered high-grade JR Zone and exploring for additional mineralized zones on its 100%-owned Patterson Lake North (PLN) Project in the southwest Athabasca Basin. PLN is accessed by Provincial Highway 955, which transects the property, and the new JR Zone discovery is located ~25km northwest of Fission Uranium’s Triple R and NexGen Energy’s Arrow high-grade uranium deposits. This area is poised to become the next major area of development for new uranium operations in northern Saskatchewan. The PLN project is comprised of the PLN, Minto and Broach properties. The Broach property incorporates the former PW property which was obtained from CanAlaska as a result of a property swap.

Forward-Looking Statements

This news release contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, including statements regarding the suitability of the Properties for mining exploration, future payments, issuance of shares and work commitment funds, entry into of a definitive option agreement respecting the Properties, are “forward-looking statements.” These forward-looking statements reflect the expectations or beliefs of the management of the Company based on information currently available to it. Forward-looking statements are subject to a number of risks and uncertainties, including those detailed from time to time in filings made by the Company with securities regulatory authorities, which may cause actual outcomes to differ materially from those discussed in the forward-looking statements. These factors should be considered carefully, and readers are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements and information contained in this news release are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

The TSX Venture Exchange and the Canadian Securities Exchange have not reviewed, approved or disapproved the contents of this press release, and do not accept responsibility for the adequacy or accuracy of this release.

F3 Uranium Corp.

750-1620 Dickson Avenue

Kelowna, BC V1Y9Y2

Contact Information

Investor Relations

Telephone: 778 484 8030

Email: ir@f3uranium.com

ON BEHALF OF THE BOARD

“Dev Randhawa”

Dev Randhawa, CEO

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/228040

Akiko Fujita · Host

Sun, October 27, 2024

Small modular reactors (SMRs) have long held the promise of cheaper, more efficient nuclear energy. Their smaller, standardized designs were expected to usher in a new era for an industry historically plagued by cost overruns and safety concerns.

But as major tech firms, including Google (GOOG) and Amazon (AMZN), turn to advanced technologies in hopes of powering their AI ambitions with a low carbon footprint, skeptics are raising questions about their viability, largely because no commercial SMR has been built in the US yet.

Despite the talk of a simplified process, there are only three SMRs operational worldwide — two in Russia and one in China.

“Nobody knows how long they’re going to take to build,” said David Schlissel, an analyst at the Institute for Energy Economics and Financial Analysis who has been critical of SMRs. “Nobody knows how expensive they’re going to be to build. We don’t know how effective they will be in addressing climate change because it may take them 10 to 15 years to build them.”

Nuclear power has received renewed interest because of the global push to move away from fossil fuels to reduce harmful emissions driving climate change. Although wind and solar power offer prevalent, low-cost energy options, nuclear remains an attractive clean alternative, in large part because it can run 24/7 in any season and has a smaller footprint.

SMRs have offered the most promise. Unlike traditional nuclear plants that have been costly and time-consuming, modular reactors are one-third the size, with a power capacity of 300 megawatts or less. The nuclear industry has touted their efficiency and cost savings, as SMRs are built in factories and assembled on-site.

“It reduces the risk associated with the project,” said Jacopo Buongiorno, a professor of nuclear engineering at MIT. “For an investor, … you may recover your investment quicker and with fewer uncertainties in terms of project execution.”

‘The technology is evolving’

Yet, in many ways, the hurdles facing this new generation of reactors have mirrored the old. Advanced reactor designs have taken longer than projected. Those delays have added to cost overruns.

Oregon-based NuScale (SMR) became the first company to get approval from the Nuclear Regulatory Commission to build SMRs in 2022, but the company canceled plans to deploy six reactors in Idaho last year. The announcement came after costs for the project, scheduled for completion in 2030, ballooned from $5 billion to $9 billion.

Buongiorno said the buildout has been complicated by the array of technologies tested within individual projects. While all SMRs utilize uranium as fuel, its form and application within reactors differ depending on the company and its technology. That’s dramatically different from existing nuclear power plants, which all use uranium dioxide, he said.

“The technology is evolving. We expect the performance of these reactors to be different. But the big question marks are … what’s going to be the reliability? How reliable this technology is going to be, given that we don’t have a lot of experience?” Buongiorno said. “Equally, if not more important, what’s going to be the cost?”

AI a ‘game changer’

X-energy CEO Clay Sell said demand has been part of the problem until now.

Artificial intelligence has changed that calculation, largely because of the energy needs associated with powering data centers that drive AI models, Sell said. Goldman Sachs estimates the advanced technology will contribute to a 160% increase in data center power demand by 2030.

Earlier this month, Amazon announced a $500 million investment in the development of SMRs, including funding for X-energy. That funding will help X-energy complete the design of its standard plant and construct the first facility that will manufacture the fuel used in those plants, Sell said, calling the investment a “game changer.”

“A significant portion of the increased electricity demand in the United States for the next 25 years is going to come from AI,” Sell said. “It could be as high as 10%, 20%.”

Kairos Power CEO Mike Laufer, who inked a purchase agreement deal with Google, said his company is still in the process of pursuing non-nuclear demonstrations of the technology. Any “cost certainty” would hinge on a successful demonstration and the company’s ability to manufacture in-house, he said.

“[Cost certainty] has been very elusive in this space,” he said.

There are other challenges beyond cost, including a lengthy regulatory approval process and what to do with all of the nuclear waste.

While nuclear companies maintaining a smaller footprint will mean less waste, a study by Stanford University found that SMRs would increase the volume of nuclear waste “by factors of 2 to 30.”

Schlissel argues that all of the money spent on small reactors should instead go to wind and solar power and battery storage, which are proven to reduce carbon emissions and cost less to produce.

Buongiorno countered that nuclear reactors have a longer shelf life. While the upfront costs may be higher, reactors have a lifespan of 60 to 100 years, he said. With the smaller footprint, SMRs can also be built closer to data centers, minimizing infrastructure costs, he added.

The Department of Energy says nuclear energy is critical to transitioning the country away from fossil fuels. The agency has set aside $900 million in funding for the development of SMRs.

The Energy Department estimates the US will need approximately 700-900 GW of additional clean, firm power generation capacity to reach net-zero emissions by 2050, adding that nuclear energy already provides nearly half of carbon-free electricity in the country.

Bloomberg News

Fri, October 25, 2024 at 1:31 AM EDT 1 min read

(Bloomberg) — China’s copper demand growth will fade in coming years before topping out around the end of this decade, according to a state-backed government researcher, offering a potential counterpoint to bullish views on the metal’s prospects.

While Beijing Antaike Information Development Co. forecasts substantial growth in demand from the renewables sector, a key focus of copper optimists, it also sees an impact from a slowing Chinese economy and from buyers switching over to aluminum.

China’s demand growth in the five years up to 2030 will average 1.1%, down from 3.9% in the five years to 2025, Antaike analyst Yang Changhua said at the group’s conference in Wuhan. The copper intensity of renewables investment is falling as industries bid to reduce usage or find alternative materials, he said.

For the past half-decade, there have been a series of eye-watering forecasts for copper, largely resting on the idea that the world’s mines will struggle to keep up with a long demand boom. Prices reached a record earlier this year amid emerging signs of supply tightness.

Key risks to the “peak by 2030” forecast include the future strength of China’s manufacturing exports, or the relocation of factories overseas, Yang said. He didn’t give an outlook for global copper demand.

China’s combined consumption of copper from electric vehicles plus the solar and wind industries will rise to 3.1 million tons by 2030, Yang said. That will be 26% of the nation’s total demand, up from 15% in 2023.

©2024 Bloomberg L.P.

Source: https://finance.yahoo.com/news/china-copper-demand-peak-2030-053139126.html

David Lawder Thu, October 24, 2024 at 2:06 PM EDT 4 min read:

WASHINGTON (Reuters) – International Monetary Fund Managing Director Kristalina Georgieva warned on Thursday that the world is in danger of becoming mired in a low-growth, high-debt path that will leave governments with fewer resources to improve opportunities for their people and tackle climate change and other challenges.

The result is increasingly dissatisfied populations, Georgieva said during a press conference during the IMF and World Bank annual meetings in Washington.

The meetings are clouded by the looming Nov. 5 U.S. presidential election, which raises the specter that Americans, stung by high inflation during Democratic President Joe Biden’s administration, could return Republican candidate Donald Trump to the White House, ushering in a new era of protectionist trade policies and trillions of dollars in new U.S. debt.

Dissatisfaction is not unique to the U.S., Georgieva said, despite the global economy showing some resilience in the face of threats from wars, weak demand in China, and the lagged effects of tight monetary policy.

“For most of the world, a ‘soft landing’ is in sight, but people are not feeling good about their economic prospects,” Georgieva said, referring to a scenario in which high inflation is tamed without a painful recession or large job losses. “Everybody I ask here, how is your economy? The answer is good. How is the mood of your people? The answer is not so good. Families are still hurting from high prices and global growth is anemic.”

The IMF on Tuesday released new economic forecasts showing that global GDP growth will decline slightly by 2029 to 3.1% from 3.2% this year, well below its 2000-2019 average of 3.8%, as current U.S. strength fades.

At the same time, the IMF’s Fiscal Monitor showed global government debt is set to top $100 trillion for the first time this year and continue rising as political sentiment increasingly favors more government spending and is resistant to tax increases. It also predicts that government debt as a share of GDP, now 93%, is set to reach 100% by 2030, exceeding its peak during the COVID pandemic.

“So here is the bottom line: the global economy is in danger of getting stuck on a low-growth, high-debt path,” Georgieva said. “That means lower incomes and fewer jobs. It also means lower government revenues, so less resources for families and to fight long-term challenges like climate change. These are anxious times with these problems in mind.”

Finance chiefs from G20 major economies separately expressed optimism for a soft landing, and urged resistance to protectionism.

“We observe good prospects of a soft landing of the global economy, although multiple challenges remain,” the G20 finance ministers and central bank governors said in a joint statement issued after a meeting on the sidelines of the meetings in Washington.

The communique did not mention Russia’s invasion of Ukraine, long a point of division for the G20, or Israel’s military conflicts with the Palestinian militant group Hamas in Gaza and the Iran-backed Hezbollah organization in Lebanon.

A separate statement issued by Brazil, which currently holds the G20 presidency, said members disagreed on whether the conflicts should be discussed within the group, but added that it would continue such talks among lower-level officials ahead of a G20 leaders summit in Rio de Janeiro in November.

CHINA’S PATH

Georgieva said that China’s growth could slow to “way below 4%” unless its government takes decisive action to shift its economic model towards consumer demand from exports and manufacturing investment.

After long maintaining Chinese growth forecasts at or above Beijing’s 5% target, the IMF this week cut China’s 2024 growth outlook to 4.8%, with a projection slowdown to 4.5% in 2025. China’s GDP grew at a 7.4% rate in 2014.

Georgieva said more details on China’s stimulus plans were needed to assess whether they would improve its outlook. The IMF’s chief economist, Pierre-Olivier Gourinchas, and U.S. Treasury Secretary Janet Yellen said on Tuesday they have not seen anything from Beijing that would materially raise China’s domestic demand.

The IMF and World Bank meetings also have been marked by new worries about an escalation of the war in the Middle East, which was triggered a year ago by Hamas’ surprise attack on Israel.

A wider escalation of the conflict could increase spillovers to economies in the region, Georgieva said, including Egypt, which earlier this year won a $3 billion increase to its IMF loan program.

Georgieva said she will travel to Egypt in the next 10 days to assess economic conditions for possible further changes to the program amid a severe drop in the country’s Suez Canal revenues.

Jihad Azour, the director of the IMF’s Middle East and Central Asia Department, told a briefing that the size of the program was still appropriate, but Georgieva would assess the effectiveness of the country’s social protection programs in the current environment.

(Reporting by David Lawder; Editing by Paul Simao)

Source: https://finance.yahoo.com/news/imf-chief-says-world-economy-180635326.html

Daniel Howley · Technology Editor

Updated Wed, October 23, 2024 at 4:14 PM EDT 7 min read

Artificial Intelligence has driven shares of tech companies like Microsoft (MSFT), Amazon (AMZN), Nvidia (NVDA), and Google (GOOG, GOOGL) to new highs this year. But the technology, which companies promise will revolutionize our lives, is driving something else just as high as stock prices: energy consumption.

AI data centers use huge amounts of power and could increase energy demand by as much as 20% over the next decade, according to a Department of Energy spokesperson. Pair that with the continued growth of the broader cloud computing market, and you’ve got an energy squeeze.

But Big Tech has also set ambitious sustainability goals focused on the use of low-carbon and zero-carbon sources to reduce its impact on climate change. While renewable energy like solar and wind are certainly part of that equation, tech companies need uninterruptible power sources. And for that, they’re leaning into nuclear power.

Tech giants aren’t just planning to hook into existing plants, either. They’re working with energy companies to bring mothballed facilities like Pennsylvania’s Three Mile Island back online and looking to build small modular reactors (SMRs) that take up less space than traditional plants and, the hope is, are cheaper to construct.

But there are still plenty of questions as to whether these investments in nuclear energy will ever pan out, not to mention how long it will take to build any new reactors.

A nuclear AI age

While solar and wind power projects provide clean energy, they still aren’t the best option for continuous power. That, experts say, is where nuclear energy comes in.

“Nuclear energy is, effectively, carbon-free,” explained Ed Anderson, Gartner distinguished vice president and analyst. “So it becomes a pretty natural choice given they need the energy, and they need green energy. Nuclear [power] is a good option for that.”

The US currently generates the bulk of its electricity via natural gas plants that expel greenhouse gases. As of 2023, nuclear power produced slightly more electricity than coal, as well as solar power plants.

Last week, Google signed a deal to purchase power from Kairos Power’s small modular reactors, with Google saying the first reactor should be online by 2030, with plants expected to be deployed in regions to power Google’s data centers, though Kairos didn’t provide exact locations.

Amazon quickly followed by saying just two days later that it is investing in three companies — Energy Northwest, X-energy, and Dominion Energy — to develop SMRs. The plan is for Energy Northwest to build SMRs using technology from X-energy in Washington State and for Amazon and Dominion Energy to look at building an SMR near Dominion’s current North Anna Power Station in Virginia.

Last month, Microsoft entered into a 20-year power purchasing agreement with Constellation Energy, under which the company will source energy from one of Constellation’s previously shuttered reactors at Three Mile Island by 2028.

Three Mile Island suffered a meltdown of its other reactor in 1979, but according to the Nuclear Regulatory Commission, there was no serious impact to nearby people, plants, or animals, as the plant itself kept much of the dangerous radiation from escaping.

In 2023, Microsoft announced it would source power from the Sam Altman-chaired nuclear fusion startup Helion by 2028. Altman also chairs the nuclear fission company Oklo, which plans to build a micro-reactor site in Idaho. Nuclear fusion is the long-sought process of combining atoms that produces power without dangerous nuclear waste. No commercial applications of such plants currently exist.

Microsoft founder Bill Gates has also founded and currently chairs TerraPower, a company working to develop an advanced nuclear plant at a site in Wyoming.

Nuclear is expensive and some technologies are still untested

Nuclear power output has remained stagnant for years. According to US Energy Information Administration press officer, Chris Higginbotham, nuclear power has contributed about 20% of US electricity generation since 1990.

Part of the reason has to do with the fear of meltdowns, like the one at Three Mile Island, as well as the meltdowns at Chernobyl in Ukraine in 1986 and the Fukushima Daiichi plant in Japan in 2011.

Chernobyl was the worst meltdown ever, spreading radioactive contamination across areas of Ukraine, the Russian Federation, and Belarus, resulting in thyroid cancer in thousands of children who drank milk that was contaminated with radioactive iodine, according to the Nuclear Regulatory Commission.

Plant workers and emergency personnel were also exposed to high levels of radiation at the scene. The Fukushima plant suffered multiple meltdowns as a result of a massive earthquake and subsequent tsunami, which caused significant damage to three of the plant’s six reactors.

But according to the United Nations Scientific Committee on the Effects of Atomic Radiation (UNSCEAR) as of 2021, “no adverse health effects among Fukushima residents have been documented that could be directly attributed to radiation exposure from the accident.”

Outside of the perception, nuclear plants are expensive and take time to construct.

Georgia Power’s two Vogtle reactors came online in 2023 and 2024, after years of delays and billions in cost overruns. The reactors, known as Unit 3 and Unit 4 were originally expected to be completed in 2017 and cost $14 billion, but the second reactor only started commercial operations in April this year. The final price tag for the work is estimated to top out at $31 billion, according to the Associated Press.

The explosion in cheap energy from natural gas has also made it difficult for nuclear plants to compete financially. Now nuclear companies are hoping SMRs will lead the way in building out new nuclear energy capacity. But don’t expect them to start popping up for a while.

“The SMR conversation is really long term,” Jefferies managing director and research analyst Paul Zimbardo told Yahoo Finance. “I’d say almost all of the projections are into the 2030s. The Amazons, the Googles, some of the standalone SMR developers, 2030 to 2035, which is also what some of the utilities are saying as well.”

What’s more, Zimbardo says, power generated by SMRs is expected to cost far more than traditional plants, not to mention wind and solar projects.

“Some of the projections are well above $100 a megawatt hour,” Zimbardo explained. “To put it in context, an existing nuclear plant has a cost profile of around $30 a megawatt hour. Building new wind, solar, depending on where you are in the country, can be as low as $30 a megawatt hour, or $60 to $80 a megawatt hour. So it’s a very costly solution.”

Not everyone is buying the promise of SMRs, either. Edwin Lyman, director of nuclear power safety at the Union of Concerned Scientists, says the small-scale reactors are still an untested technology.

“Despite what one might think of all the brain power at these tech companies, I don’t think they’ve done their due diligence,” Lyman told Yahoo Finance. “Or they’re willing to entertain this as a kind of side show just so they have all their bases covered to deal with this postulated massive expansion and demand for data centers.”

Lyman also takes issue with the idea that SMRs will be able to get up and running quickly and begin providing reliable power around the clock at low cost.

“The historical development of nuclear power shows that it’s a very exacting technology, and it requires time, requires effort, requires a lot of money and patience,” he said. “And so I think the nuclear industry has been trying to make itself look relevant, despite their recent failures to meet cost and timeliness targets.”

Still, with tech companies promising an AI revolution that requires power-hungry data centers, nuclear may be the only realistic green choice until solar and wind can take over permanently.

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

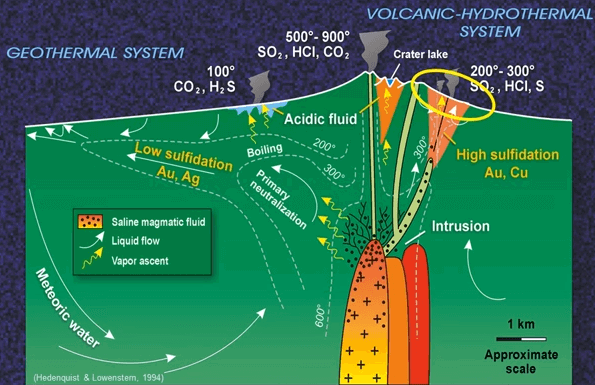

If we start with VMS Volcanogenic Massive Sulphide Ore Deposits and their Mineralization we see from this image shows some of the sulphide chimneys associated with the model black smoker VMS deposit.

VMS will emit black plume of hot water venting from one of the chimneys. You’ll remember this cross section from reads on both porphyry deposits and epithermal, in the case of VMS deposit, we are basically looking at a submarine high sulfidation epithermal deposit venting from an underlying hot chamber into the sea.

VMS deposits are dominated by copper and zinc, but there are a number of other minor minerals, including: lead, silver, gold, cobalt, tin, selenium, magnesium, cadmium and a whole host of other ones that are associated with them.

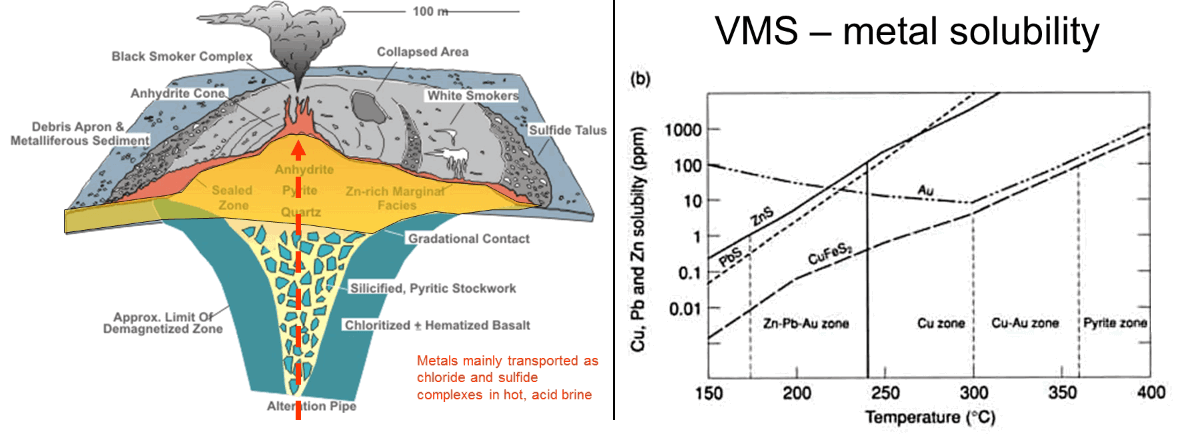

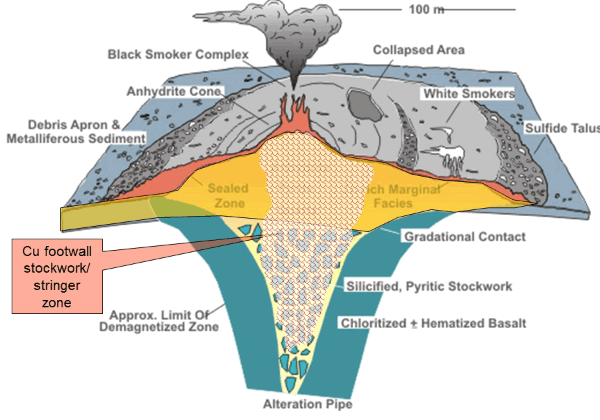

The deposits consist of a massive sulphide cap that formed on the seafloor and sort of lies parallel between two stratigraphy and an underlying feeder zone or streamer zone as it is usually called. VMS is basically mushroom shaped, Streamer zone tends to be copper rather than zinc rich. VMS deposits often form as clusters over a large intrusive heat source. If the heat chamber is long-lived you may get flat lenses of massive sulphide, each fed from the same fault, beginning successively younger as you go up through the stratigraphy. The deposits are pretty common although, as with any deposit type. There are only a few big enough or high enough grade to be economic. In spite of that, they really are economically significant with 27% of Canada’s copper production and almost 50% of its historical zinc production, and 20% of the Pb having come from this group of deposits.

VMS deposits have been forming throughout geological history and they still are forming on the seafloor today. Here’s a bunch of the better-known deposits you may have heard of. As you can see they are scattered all around the world, but I’m going to talk a little bit about the distribution later on. This is a cartoon 3D viewer of an active VMS black smoker developing on the oceanic crust on the seafloor (good rock crusher). Some of the metals are contributed by the underlying magma chamber, but as the hydrothermal fluids rise above the hot magma it sucks in cool sea water, this is then heated and mixing with the magnetic water, rises to the vent returning to the sea forming large circulation cells that maybe several kilometres across. It is the seawater circulation through the host volcanic that provides the remainder of the metal inputs. Leaching metals particularly iron there’s also bases metals and sulphur on the volcanic. Metal concentration in the hydrothermal fluids, volcanic and recycled seawater, are really low- just fractions of a percent. So how do we end up with the ore that makes up 20- 30% metal?

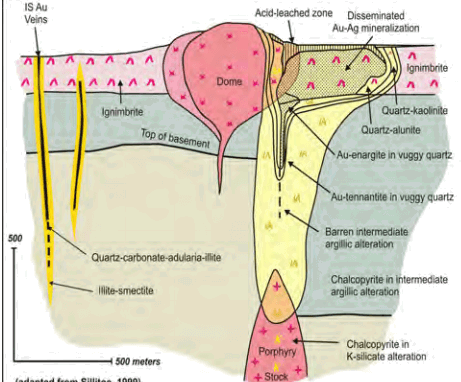

The next slide will be on the seafloor to explain this. You can see there is a neck of fractured rock below the seafloor caused by the violent boiling of the hot fluids as the pressure is reduced, that in turn is surmounted by a series of chimneys that allow the fluid escape into the cold sea, at the bottom of the thermocline is really very cold, it’s often only a few degrees above freezing even in the tropical areas. Surrounding the chimney is an exhalative length of sulphuric material that forms on the floor. The secret of the high grade of the ore lies in rapid cooling of the hydrothermal fluid when it reaches the full seafloor.

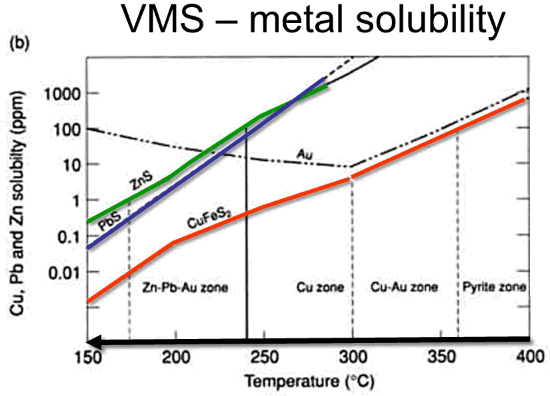

As in porphyry deposits, the main focus of trend in deposits is the drop in temperature rather than changes in EH or pH. Different metal sulphides tend to drop out a metal solution at different temperatures- copper and gold first, followed by zinc, then lead and finally iron. There’s an overlap in the metal deposition, but that’s the broad trend. Copper starts to drop out as the temperature starts to drop from 400 degrees Celsius down to 300 degrees. The Iron and the copper drops out before the fluids actually reach the seafloor. Precipitating is a stockwork of veins in the brecciated funnel also called stringer zone, beneath the sulphide lens.

The fluids are hot, and because they are from a high sulfidation source, they’re moderately acid. This acidity alters the feldspars and host rocks to clays, some of which are washed out the rock and others metamorphous form sericite mica. Dissolved silica in the hot solutions distributes deposits such as quartz along with iron sulphide. You may hear geologist referring to this characteristic leach quartz, sericite pyrite assemblage the results are either QSP or folic alteration.

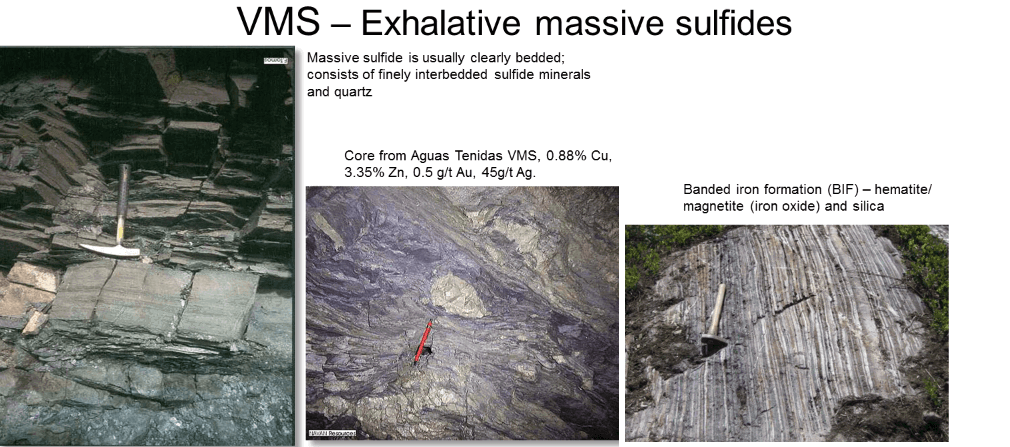

As the hydrothermal fluids reach the cold seawater, the temperature drops within seconds from 300 degrees down to 100 degrees and less. The lead and the zinc sulphite precipitates along with along with the remainder of copper. The sulfides dissolve along the sides and at the top of the vents, extending them and then bellow out to form black and white smoke as you see in National Geographic pictures. The fine clouds of sulphide cool and settles on the seafloor, building up a finely banded layers of pure sulphate which are closest to the vent, galena and sphalerite next. Pyrite deposits throughout the sequence and most desolate from the bed that is the only sphalerite still available to deposit. Beyond that the sulphur is exhausted and iron-oxide or hematite and silica is all that’s left to precipitate.

The massive sulphide is made up of a combination of finely interbedded sulphides that settle out of the black smokers and fragments of chimneys that have broken off and rolled down the slope. Here are couple of shots of massive sulphides in outcrop, note the typical, fine rhythmic banding just below the hammer on the left hand photo. The photo in the bottom right shows abandoned iron formation, developed very distantly to a VMS vent, as you can see it is made of hematite or magnetite which is oxide, rather than sulphide and white silica.

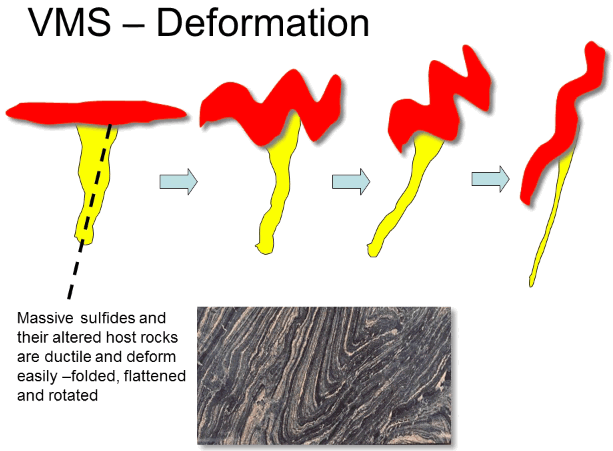

The fluids that form VMS deposits usually reach the seafloor of faults, because those faults represent zones of weakness when the stratigraphy is subsequently subject to deformation, the area around the faults is often particularly deformed. Combine this with the highly ductile nature of massive sulphides, we find that massive sulphide lenses themselves often exhibits extreme deformation. Very often the stringy cap which started off with a very high angle to the massive sulphide mushroom cap, is flattened and rotated to a much more acute angle and the massive sulphide may end up squeezed into a cigar shaped broad.

So not we know a little more about how VMS deposits are formed, let’s consider; where they occur; how common they are; and more importantly how big they are and what metal grades can we expect.

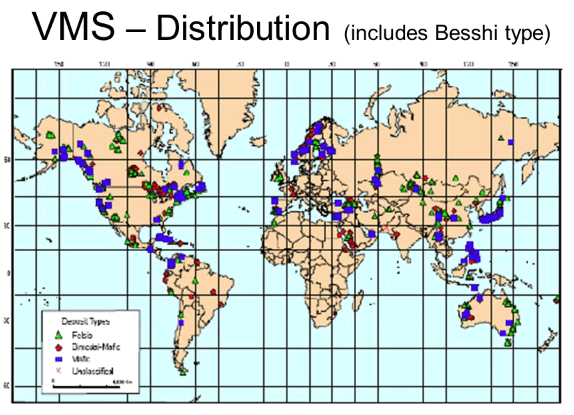

VMS deposits have been forming since the earliest of times in the Earth’s history and they are still forming today on the seafloor. As you might expect, they are found all over the world and in all ages of rocks. However, there are few areas in history where they seem to be particularly prevalent- the late Archean and the Tertiary, seem to be very prolific times. The blue, green and red symbols mark some of the more important VMS deposits worldwide.

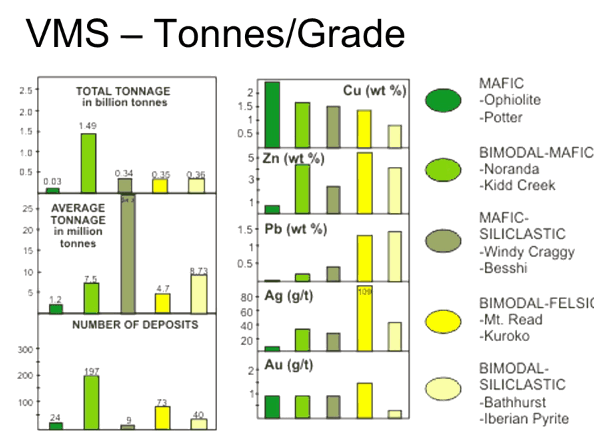

Ok, what about size and grade? There are a number of different classes of VMS, each with somewhat very different characteristics.

It’s nice to say that economic VMS deposits generally range in size from 4- 25 million tonnes with an average of about 5 million tonnes, although there are a few monsters such as Peak Creek in Ontario which is 150 million tonnes.

Average Volcanogenic Massive Sulphide Ore Deposits Grades:

- 5% copper

- 4% zinc

- < 1% lead

- Maybe 1 gram per tonne of gold.

Again there are a few outlines with far higher grades than these.

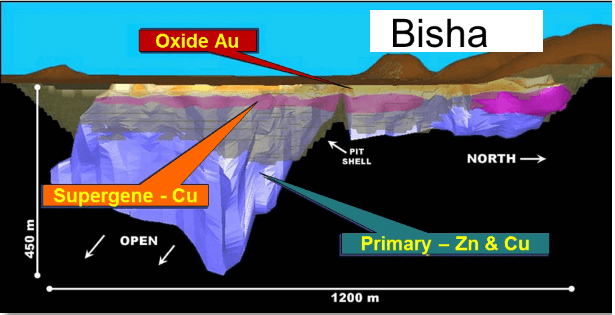

Let’s look now at a few examples of VMS deposits. Nevsun’s Bisha deposit near Eritrea is a superb example of a VMS deposit.

It was discovered in January in 2003, construction began in 2008 and production in 2011. This is a view of the Bisha deposit looking south, before development began. The dark brown material in the foreground is a zinc rich deposit the without the outcrop of the mineralization. Not surprisingly, the way the mineralization is being folded and it plunges to the south, where the stringer zone smeared out, parallel to the massive sulphides. The massive sulphide material varies from 1- 70 meters thick, this is unusual as most VMS deposits are less than 20 meters in thickness. Bisha is a footprint that’s about 1 kilometre long and 200 meters wide. In spite of the steep dip to the mineralization which results in a pit with a high stripping ratio the deposit has one big advantage. So there is a leach gold zone on the surface, underlain by a secondary enrich copper zone with the primary zinc dominated, primary zone below that.

The advantage of this is the expense is concentrated and does not have to be booked by start-up and could be constructed just a few years later when the primary sulphides are reached and funded, most importantly from cash flow, rather than debt. Most attractive of all in Bisha, is the size:

- With reserves of 26 million tonnes

- at 1.8% copper

- 6.3% zinc

- 0.9 grams per tonne gold

- and 41 grams per tonne silver.

This is 5 times the average VMS site. VMS deposits occur in clusters/groups and Bisha is no exception. With at least 7 other VMS deposits discovered within 20 kilometres. Although Bisha is the only one in production so far.

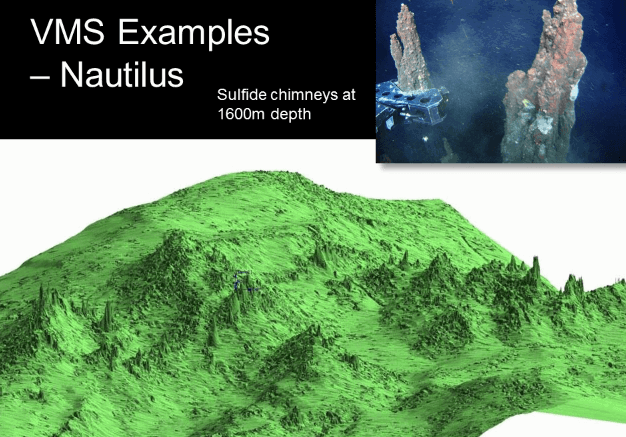

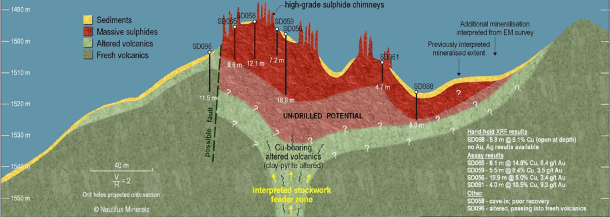

The second example we are going to talk about today is kind of unusual, it’s actually a group of deposits that only recently been formed, in fact they are so young they are still on the ocean floor and will have to be mined remotely from floating platforms. They were discovered by Nautilus Mining Company using a combination of both metrics and EM geophysics. To date it gives and fascinating insight to the nature of the black smoker fields.This image is taken from Nautilus’ 43 101 report and it shows an amazing isometric view of the chimney of Salwara 1 target off the coast of Papua New Guinea derived from the symmetry.The image covers about 800 meters from left to right and the individual chimneys are clearly visible. The small image shows remote operating vehicles claws, removing a sample of a smoker chimney for for assay. For environmental reasons only extinct smokers were targeted. Once the hot water stop flowing, the cold and lack of nutrients causes the once abundant sea life to move away or to die. Extinct smokers are therefore devoid of significant sea life, and environmentally not an issue. In the cross section of the Solwara 1 VMS based on mapping and drilling of deposits we can see the massive sulphides in red, the alterations associated with stringer zones in pale green. Although the resource is relatively small, just two and a half million tonnes, the grades are exceptionally high- with a copper grade of almost 8% and a gold grade of over 6 grams per tonne, as is typical there has been at least 18 other deposits discovered in this particular cluster.The Solwara 1 VMS is at a depth, 1600 meters below sea level. Submarine VMS deposits have never been mined before but the equipment that Nautilus plants use has a proven record, excavating trenches for submarine cables and mining marine diamonds off the South African coast. Its practicality is well established. This is another piece of mining equipment that Nautilus is considering having custom built, you will notice the proposed completion date in this old material, to my knowledge this construction is still on hold which gives the indication that funding and mining will not be straight forward. Once the material is remotely mined, its plan to pump it to the surface as a slurry then to transfer debarked or to transport to lower a sure base concentrator.

Also see another worthwhile resource https://sites.google.com/site/ctbageoconsultants/

Source: https://www.911metallurgist.com/blog/vms-volcanogenic-massive-sulphide-deposits-ore-mineralization/

Vancouver, British Columbia–(Newsfile Corp. – October 23, 2024) – EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the “Company” or “EMX”) is pleased to announce that its royalty partner at Timok in Serbia, Zijin Mining Group Co., Ltd. (“Zijin”), released unaudited interim results that show markedly increased levels of copper and gold production at Timok in the first half of 2024. Zijin reported 90,008 tonnes of copper and 2,894 kilograms of gold produced from Timok’s Cukaru Peki Mine in H1, 2024 (see Zijin Mining Group Co., Ltd. Interim Report 2024). This aligns with the record Q2 royalty revenues of $1,586,000 reported by EMX in its Q2 MD&A filings. On page seven of its 2024 Interim Report, Zijin also states that the combined Serbia Zijin Copper (which includes Zijin’s Bor operations, which are not covered by EMX’s royalties) and Serbia Zijin Mining projects (which includes the Timok/Cukaru Peki Mine which is covered by an EMX royalty), now have a capacity to produce 450,000 tonnes of copper on an annual basis. This is a significant increase compared with previous years.

Zijin has previously announced that the throughput of its processing plant at Cukaru Peki is being expanded from 12,000 tonnes per day to 15,000 tonnes per day1. The expansion of capacity and production at Cukaru Peki is part of an ongoing effort by Zijin to de-bottleneck their operations in Serbia, and by doing so, will unlock additional potential in the greater district. In addition to the ongoing production from the Upper Zone at Cukaru Peki, Zijin is also working to develop the underlying Lower Zone porphyry copper-gold deposit. The Lower Zone at Cukaru Peki will be developed through block caving, and EMX believes that the Cukaru Peki Mine will become one of the more important block cave development projects in the world.

On page 6 of the interim report, Zijin also highlights high grade copper gold exploration potential at its “MG Zone” in the “southern part of the Cukaru Peki Copper and Gold Mine”. We do not yet know whether Zijin’s exploration efforts will be successful and become material to EMX. However, it is notable that a discussion of the newly described MG Zone appeared in the interim report.

EMX congratulates Zijin on its outstanding performance in the Bor and Timok districts in Serbia. EMX currently holds a 0.3625% NSR royalty over Zijin’s Brestovac exploration permit area (including the Cukaru Peki Mining licenses), as well as portions of Zijin’s Jasikovo-Durlan Potak exploration license north of the currently active Bor Mine. EMX also owns a 2% NSR royalty on precious metals and a 1% NSR royalty on base metals on the Brestovac West License, which lies immediately adjacent and to the west of the Brestovac Mining License and the Cukaru Peki Mine (see Figure 1). All of EMX’s Timok royalties are uncapped and cannot be repurchased or reduced. The Company is currently receiving quarterly royalty payments from Zijin for copper and gold production from the Cukaru Peki Mine.

Dr. Eric P. Jensen, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious and base metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol “EMX”. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and CEO

Phone: (303) 973-8585

Dave@EMXroyalty.com

Isabel Belger

Investor Relations

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the quarter ended June 30, 2024 (the “MD&A”), and the most recently filed Annual Information Form (“AIF”) for the year ended December 31, 2023, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedarplus.ca and on the SEC’s EDGAR website at www.sec.gov.

Figure 1

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1508/227459_f20a2ca6c4648872_002full.jpg

1 According to the Čukaru Peki Copper-Gold Mine Operations Page on the Zijinmining.com website.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/227459

TORONTO, Oct. 22, 2024 /PRNewswire/ – Collective Mining Ltd. (NYSE: CNL) (TSX: CNL) (“Collective” or the “Company”) is pleased to announce the discovery of a new high-grade gold zone at the Apollo system (“Apollo”), located within the Company’s Guayabales Project in Caldas, Colombia. This new discovery, which has been named the Ramp Zone, is interpreted to be the first intercept into a major new high-grade gold system at depth and can be classified as a partially reduced intrusion related Au-Ag-Cu system. Although the Ramp Zone begins at or near 1,000 metres below surface, the discovery hole is in close proximity to a conceptual underground access tunnel connecting Apollo to mining related infrastructure in a potential future development scenario for the project.

Ari Sussman, Executive Chairman commented: “The fact that Apollo is now transitioning into a bulk zone of high-grade gold mineralization at depth is extremely exciting and will no doubt add materially to the mineral resource endowment of Apollo. The Guayabales Project and the neighbouring Marmato mine form a giant precious metal rich district which continues to yield new major discoveries. Equally exciting is that the Apollo system, which outcrops at surface, now boasts a vertical dimension of approximately 1,150 metres with further expansion dead-ahead. I am proud of our team who continue to deliver remarkable exploration success. The Company is planning an expanded drilling program to follow up on the Ramp Zone discovery with further details to be provided in due course.”

To watch a video of David Reading, Special Advisor to the Company, discuss the Ramp Zone discovery, click here.

The Company currently has five diamond drill rigs in operation within the Guayabales Project as part of its fully funded 40,000 metres drill program for 2024 with two rigs drilling at the Apollo system, two rigs drilling at Trap and one rig currently mobilizing to the X Target.

Highlights (see Table 1-2 and Figures 1-6)

Drill Hole APC99-D5

Diamond drill hole APC99-D5, which was drilled southwest from Pad16 (See Figure 1) to test for continuity and extend Apollo at depth, intersected significant mineralization as follows:

- 517.35 metres @ 1.97 g/t gold equivalent from 351.55 metres in the Apollo system, including:

- 31.30 metres @ 3.43 g/t gold equivalent from 353.60 metres

- 24.60 metres @ 2.68 g/t gold equivalent from 575.10 metres

- 30.60 metres @ 3.99 g/t gold equivalent from 729.25 metres

- 57.65 metres @ 8.18 g/t gold equivalent from 811.25 metres (New high-grade discovery named the Ramp Zone)

APC99-D5 on a grade accumulation bases averaged 1,021 grams x metres and is the twelfth and deepest intercept to date at Apollo with grade accumulation at over 1,000 grams x metres.

The New High-Grade Ramp Zone Discovery (at the Bottom of Drill Hole APC99-D5)

The final 57.65 metres of drill hole APC99-D5 cut a new style of mineralization in the deepest drill hole to date at Apollo with results as follows:

- 57.65 metres @ 8.18 g/t gold equivalent from 811.25 metres including:

- 18.85 metres @ 20.21 g/t gold equivalent

- The high-grade Ramp Zone discovery was made at a depth of 1,150 metres below surface and is located approximately 480 metres laterally to the southwest from drill hole APC88-D1, which intersected 15.60 metres @ 20.34 g/t gold equivalent and was the prior deepest interval at Apollo (see press release dated January 30, 2024). No drilling at this deeper elevation between or below holes APC99-D5 and APC88-D1 has taken place indicating the high-grade Ramp Zone might have significant lateral extent as well as being open in all directions for expansion including at depth. Lateral step-out drilling is presently underway to expand this new discovery with assay results potentially available towards the end of Q4, 2024.

- The Company named this new discovery the “Ramp Zone” because it is located close in elevation to the conceptual underground haulage tunnel for a future mine at the Guayabales Project (see Figure 4). Due to the proximity, it is possible that the high-grade mineralization encountered in holes APC99-D5 and earlier in hole APC88-D1 may be mined early in the mine life of a future underground mining scenario for the project (subject to completing a successful NI 43-101 compliant economic study and mine plan).

Although at significantly higher grades, the Ramp Zone shares some geological characteristics with Aris Mining’s multi-million-ounce Marmato Deeps deposit. The Ramp Zone mineralization also begins at a similar elevation to the top of Marmato Deeps with details as follows:

- The Ramp Zone locates, coincidentally, at the same elevation level as the top of the Marmato Deeps deposit at approximately 1,000 metres above sea level (see Figure 3) and hosts similar bismuth and tellurium bearing sulphide minerals. The Marmato mine is located only 1.75 kilometres southeast of Apollo and hosts Measured and Indicated Resources of 5.99 million ounces at 3.03 g/t gold (61.5 million tonnes) and Inferred Resources of 2.79 million ounces at 2.43 g/t gold (35.6 million tonnes).

- The Ramp Zone mineralogy and geochemistry, which consists of pyrite bearing veins and veinlets containing bismuth, tellurium and copper bearing sulphides, is similar to precious metal deposits classified as belonging to those referred to as Reduced Intrusion Related Gold Systems (“RIRGS”). In the case of the Ramp Zone discovery, the Company’s geological advisors have referred to this high-grade discovery as a Partially Reduced Intrusion Related Au-Ag-Cu System (“PRIRS”) due to the additional presence of copper bearing chalcopyrite along with the more typical bismuth and tellurium bearing sulphides seen in RIRGS deposits. Potential geological comparable PRIRS deposits to Apollo include the Telfer, Havieron and Winu deposits in Australia.

Table 1: Assays Results for Drill Hole APC99-D5

| Hole # | From (m) | To (m) | Length (m) | Au g/t | Ag g/t | Cu % | Zn % | AuEq g/t* |

| APC99-D5 | 241.45 | 250.80 | 9.35 | 1.91 | 11 | 0.01 | 0.03 | 2.02 |

| and | 351.55 | 868.90 | 517.35 | 1.84 | 10 | 0.03 | 0.06 | 1.97 |

| Incl. | 353.60 | 384.90 | 31.30 | 3.24 | 16 | 0.05 | 0.04 | 3.43 |

| & incl | 575.10 | 599.70 | 24.60 | 2.49 | 12 | 0.04 | 0.16 | 2.68 |

| & incl | 729.25 | 759.85 | 30.60 | 3.89 | 9 | 0.03 | 0.17 | 3.99 |

| RAMP ZONE | ||||||||

| & incl | 811.25 | 868.90 | 57.65 | 7.83 | 33 | 0.09 | 0.12 | 8.18 |

| Incl. | 819.10 | 837.95 | 18.85 | 19.39 | 83 | 0.21 | 0.16 | 20.21 |

| *AuEq (g/t) is calculated as follows: (Au (g/t) x 0.97) + (Ag (g/t) x 0.015 x 0.85) + (Cu (%) x 1.44 x 0.95) + (Zn (%) x 0.43 x 0.85) utilizing metal prices of Ag – US$30/oz, Zn – US$1.25/lb, Cu – US$4.2/lb and Au – US$2,000/oz and recovery rates of 97% for Au, 85% for Ag, 95% for Cu and 85% for Zn. Recovery rate assumptions for metals are based on metallurgical results announced on October 17, 2023, April 11, 2024, and October 3, 2024. The recovery rate assumption for zinc is speculative as limited metallurgical work has been completed to date. True widths are unknown, and grades are uncut. |

Table 2: Assays Results for the New High-Grade Subzone Within the Ramp Zone Discovery

| From(m) | To(m) | Length(m) | Aug/t | Agg/t | Cu% | Bippm | Teppm |

| 819.10 | 819.90 | 0.80 | 11.60 | 83 | 0.07 | 116.50 | 5.56 |

| 819.90 | 820.80 | 0.90 | 35.60 | 168 | 0.13 | 248.00 | 10.80 |

| 820.80 | 821.80 | 1.00 | 6.98 | 25 | 0.02 | 33.10 | 1.50 |

| 821.80 | 822.85 | 1.05 | 3.36 | 18 | 0.04 | 20.90 | 1.17 |

| 822.85 | 824.00 | 1.15 | 4.21 | 15 | 0.03 | 13.60 | 0.74 |

| 824.00 | 825.00 | 1.00 | 2.75 | 7 | 0.01 | 6.83 | 0.41 |

| 825.00 | 826.10 | 1.10 | 3.59 | 28 | 0.13 | 10.20 | 0.56 |

| 826.10 | 827.10 | 1.00 | 53.70 | 342 | 0.92 | 316.00 | 10.50 |

| 827.10 | 828.10 | 1.00 | 59.70 | 288 | 0.94 | 205.00 | 9.54 |

| 828.10 | 829.15 | 1.05 | 40.20 | 100 | 0.19 | 77.70 | 2.81 |

| 829.15 | 830.15 | 1.00 | 5.73 | 44 | 0.12 | 33.70 | 0.94 |

| 830.15 | 831.25 | 1.10 | 24.80 | 72 | 0.18 | 44.80 | 2.22 |

| 831.25 | 832.10 | 0.85 | 25.00 | 87 | 0.22 | 81.10 | 3.13 |

| 832.10 | 833.20 | 1.10 | 15.60 | 64 | 0.16 | 48.80 | 2.21 |

| 833.20 | 834.20 | 1.00 | 12.50 | 70 | 0.25 | 34.00 | 1.46 |

| 834.20 | 835.20 | 1.00 | 24.60 | 91 | 0.29 | 47.20 | 3.76 |

| 835.20 | 836.20 | 1.00 | 20.60 | 34 | 0.09 | 18.75 | 1.02 |

| 836.20 | 837.10 | 0.90 | 1.91 | 11 | 0.04 | 6.31 | 0.27 |

| 837.10 | 837.95 | 0.85 | 18.40 | 46 | 0.11 | 34.60 | 1.49 |

| Weighted Average | 18.85 | 19.39 | 83 | 0.21 |

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, Collective is a copper, silver, gold and tungsten exploration company with projects in Caldas, Colombia. The Company has options to acquire 100% interests in two projects located directly within an established mining camp with ten fully permitted and operating mines.

The Company’s flagship project, Guayabales, is anchored by the Apollo system, which hosts the large-scale, bulk-tonnage and high-grade copper-silver-gold-tungsten Apollo porphyry system. The Company’s 2024 objective is to expand the Apollo system, step out along strike to expand the recently discovered Trap system and make a new discovery at either the Tower, X or Plutus targets.

Management, insiders, a strategic investor and close family and friends own nearly 50% of the outstanding shares of the Company and as a result, are fully aligned with shareholders. The Company is listed on the NYSE under the trading symbol “CNL”, on the TSX under the trading symbol “CNL”, on the FSE under the trading symbol “GG1”.

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock, soils and core samples have been prepared and analyzed at ALS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

Information Contact:

Follow Executive Chairman Ari Sussman (@Ariski73) on X

Follow Collective Mining (@CollectiveMini1) on X, (Collective Mining) on LinkedIn, and (@collectivemining) on Instagram

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking statements” and “forward-looking information” within the meaning of applicable securities legislation (collectively, “forward-looking statements”). All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussion with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always using phrases such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to: the anticipated advancement of mineral properties or programs; future operations; future recovery metal recovery rates; future growth potential of Collective; and future development plans.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding future events including final listing mechanics and the direction of our business. Management believes that these assumptions are reasonable. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others: risks related to the speculative nature of the Company’s business; the Company’s formative stage of development; the Company’s financial position; possible variations in mineralization, grade or recovery rates; actual results of current exploration activities; conclusions of future economic evaluations; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, precious and base metals or certain other commodities; fluctuations in currency markets; change in national and local government, legislation, taxation, controls regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formation pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties, as well as those risk factors discussed or referred to in the annual information form of the Company dated March 27, 2024. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements and there may be other factors that cause results not to be anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements.

View original content to download multimedia:https://www.prnewswire.com/news-releases/collective-mining-announces-a-new-high-grade-discovery-at-apollo-by-drilling-57-65-metres-at-8-18-gt-aueq-including-18-85-metres–20-21-gt-aueq-302283630.html

SOURCE Collective Mining Ltd.

Edmonton, Alberta–(Newsfile Corp. – October 22, 2024) – Grizzly Discoveries Inc. (TSXV: GZD) (FSE: G6H) (OTCQB: GZDIF) (“Grizzly” or the “Company”) is pleased to provide an update on the acquisition of the Motherlode Crown Grants from First Majestic Silver Corp. (“First Majestic”) and includes highlights of the recently compiled historical information for the Motherlode Crown Grants, located near the town of Greenwood, South-Central British Columbia (BC). The Motherlode Crown Grants host the historical Motherlode, Sunset, Sunrise and Greyhound mines that at various times during the early and middle 1900’s produced copper (Cu), gold (Au) and silver (Ag) from both open pit and underground workings (Figures 1 and 2). The Motherlode Mine is reported to have produced 76,975,111 pounds of Cu, 173,319 ounces of Au and 688,203 ounces of Ag during the active periods of mining from 1900 to 1920 and then from 1957 to 1962 (BC Minfile 082ESE034). The Motherlode mine is road accessible and is approximately 2.5 km (1.5 miles) northwest of the town of Greenwood (Figure 1).

Highlights

- First Majestic to transfer Motherlode to Grizzly. First Majestic has completed the re-instatement of the Motherlode Crown Grant owner and wholly owned subsidiary Veris Gold Corp. and in concert with advice from the BC Ministry of Energy, Mines & Low Carbon Innovation has submitted a petition to re-vest the Crown Grants with the subsurface mineral rights back to Veris Gold, at which time once approved, will allow First Majestic to transfer the Crown Grants with the subsurface mineral rights to the Company.

- Motherlode Historical MRE. A historical MRE1 constructed in 1967 by Allen Geological Engineering Ltd.2 after the last period of mining on behalf of two companies, Aabro Mining and Oils Ltd. and Cumberland Mining Ltd., is described as Drill Proven (Assured), Indicated and Inferred and totals 2.8 million tonnes with a grade of 1.6% Cu equivalent (CuEq3) (0.8% Cu, 1.06 g/t Au).

- Additional Cu-Au Mineralization. In addition to the historical MREs, drilling in 1996 by Strathcona Mineral Services on behalf of YGC Resources (Veris Gold) intersected several zones of Cu-Au mineralization targeting the gold bearing halo to the Motherlode Skarn along the east side of the Motherlode pit in the vicinity of the historical underground workings (Figures 2 and 3).

- Drillhole 96-8 encountered gold in almost every sample over the entire 154.23 m (506 ft) length drillhole with a number of higher grade zones in proper skarn towards the bottom of the hole (Figures 3 and 4). The results include 2.5 g/t (0.073 ounces per ton [opt]) Au along with significant Cu over 4.88 m (16 ft) intersecting the Main Motherlode skarn at the bottom of the drillhole within altered Brooklyn limestone. The skarn mineralization is associated with a strong AeroTEM conductivity anomaly (Figure 2).

- The hole was terminated prior to completion due to technical difficulties and concerns over intersecting the existing underground stopes. Strathcona Mineral Services recommended follow-up drilling which has never been completed.

Figure 1: Land position and targets of interest for future exploration, Greenwood Project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/227407_d5be86a374d2daf6_002full.jpg

Figure 2: Motherlode Crown Grants, Historical Drilling and AeroTEM Survey Greenwood Project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/227407_d5be86a374d2daf6_003full.jpg

Brian Testo, President and CEO of Grizzly Discoveries, stated, “We are excited with the acquisition of the historical Motherlode Crown Grants and the potential battery metal and precious metal targets that they provide. We look forward to an aggressive 2024 drilling campaign at the Motherlode area and other high grade Au-Ag-Cu showings and historical mines in our current 170,000+ acre holdings in the Greenwood District.“

Figure 3: Motherlode Historical Drillhole ML96-8 Greenwood Project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/227407_d5be86a374d2daf6_004full.jpg

The Company currently has an active land use permit for drilling at the Motherlode area and has designed a confirmation and exploration core drilling program for the Motherlode and Sunset pit areas based upon a compilation of historical information. The planned program consists of approximately 2,000 m 13 core holes and is focused on targets beneath and along strike from the Motherlode Pit (Figure 4).

Additional planned drilling is being considered for the Greyhound Pit area once a geological and mineralization model have been completed for the Greyhound target.

Summary of the Motherlode Crown Grants and Purchase Terms

The Motherlode Crown Grants near the town of Greenwood, South-Central British Columbia (BC) consist of 13 Crown Grants covering a total of 300 acres (121.4 hectares) that all retain the subsurface mineral rights and date back to the late 1800’s early 1900’s when they were granted. The Crown Grants take precedence over normal mineral claims registered under the BC Mineral Titles Act. The Crown Grants cover a number of historical mines, including the Motherlode Mine. The Motherlode mine is road accessible and is approximately 2.5 km northwest of the town of Greenwood (Figure 1).

Figure 4: Motherlode Mineralized Zone Orthogonal View and Proposed Drilling.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/227407_d5be86a374d2daf6_005full.jpg

- Grizzly will provide First Majestic 250,000 common shares of the Company upon successful transfer of the Crown Grants to the Company.

- The Company will cover the costs to re-instate and transfer the Crown Grants from YGC Resources Ltd. (Veris Gold Corp.) a wholly owned sub of First Majestic to First Majestic and then to the Company.