Edmonton, Alberta–(Newsfile Corp. – February 26, 2026) – Grizzly Discoveries Inc. (TSXV: GZD) (FSE: G6H) (OTCQB: GZDIF) (“Grizzly” or the “Company”) is pleased to announce that preliminary results have been received from Peter E. Walcott and Associates from an Induced Polarization (IP) program conducted in February 2026 to follow up excellent prior results from both surface sampling and historical drilling at the Sappho Critical Minerals Target (Figure 1). In light of the current escalating metal prices for critical minerals/metals including copper (Cu), platinum (Pt), palladium (Pd), gold (Au) and silver (Ag), the Sappho Skarn/Porphyry Target warrants follow-up exploration including drilling. A total of four lines of IP for 4.5 line-kms were completed. Further IP work is being planned prior to the commencement of drilling. Due to current weather conditions and the desire to complete more IP, the fully funded drilling of 4 to 6 drillholes and about 1,500 to 2,000 m at Sappho is slated to commence approximately early to mid-April.

Highlights

- The IP survey has yielded a significant near surface conductivity anomaly on Lines 9600 and 9700 North coincident with Main Showings and the Skarn intersected in drilling in holes 10SP02 and 10SP03 in 2010 (Figures 2 and 3).

- Follow-up drilling (fully funded) is planned to test the conductive zone this April.

- The IP Survey has detected a new significant deeper chargeability anomaly on the southeast part of the grid – likely up against one of the Main Sappho faults (Figures 4 to 6). The chargeability anomaly is not closed off and is on the order of 20 to 30 millivolts per volt and is consistent with a number of porphyry targets that have yielded new discoveries in BC recently.

- Five (5) new sulphide showings were discovered during 2022 field work, with 4 of the 5 showings yielding rock grab samples with >1% copper (Cu) up to as high as 7.25% Cu (Figure 1 and see Grizzly news release dated November 3rd, 2022).

- A total of 17 rock grab samples returned values >1% Cu up to 9.06% Cu, many also with anomalous gold (Au), silver (Ag), platinum (Pt) and palladium (Pd).

- A total of 11 samples have yielded >500 parts per billion (ppb) Pt and Pd up to 4.64 grams per tonne (g/t) Pt and up to 2.28 g/t Pd.

- The Geological Setting is the East Fault Contact of the Toroda Graben with numerous pyroxenite-monzonite-diorite (older) and younger QFP-diorite (Tertiary) intrusions into intermediate-mafic volcanics along with a complex magnetic feature at the Sappho CG area (Figure 1).

- The East and West Faults of the Toroda Graben likely played a role in controlling the Au-Ag mineralization for the Buckhorn Skarn and Mine to the southwest and the Cu-Au-Ag mineralization for the Motherlode/Greyhound skarns to the north (Figure 2).

- Skarn and porphyry style alteration and mineralization along with Cu-PGE’s-Au-Ag are observed in outcrop and drill core along with a complex magnetic signature in the Main Sappho CG area.

The Sappho area is being targeted for copper-gold skarn and porphyry type targets associated with a Jurassic alkalic intrusive complex and several younger diorite intrusions (Figure 1). A total of five new showings of copper oxide mineralization were found during the 2022 program (Figure 1). Previous surface sampling and drilling by Grizzly has yielded significant anomalous copper, gold, silver along with platinum and palladium. Numerous historical and new rock grab samples have yielded greater than 1% Cu, 1 g/t Au, 1 g/t Ag, 1 g/t Pt and 1 g/t Pd (Figure 1).

Historical 2010 drilling by the Company (4 core holes) yielded up to 0.31% Cu, 0.75 g/t Au, 0.34 g/t Pt, 0.39 g/t Pd and 6.57 g/t Ag over 6.5 m core length in skarn at Sappho (in hole 10SP03), including a 1 m core length intersections of 3.82 g/t Au and 199 g/t Ag, and in a separate sample 1.83 g/t Pt and 2.09 g/t Pd across 1 m – these results all are associated with >1% Cu in those samples. These higher grade zones were contained within a 63.5 m core length zone logged as a pyroxene – sulphide skarn with a grade approaching 0.7% copper equivalent derived from current metal prices for Cu, Au, Ag, Pt and Pd. Drillhole 10SP03 targeted a magnetic anomaly and had no indications of surface mineralization at the time of drilling. One of the new 2022 showings has been found proximal to drillhole 10SP03 and the targeted magnetic anomaly.

Figure 1: Sappho Rock Sampling Summary 2026 and Planned IP and Drillhole Locations.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/285545_0a04322da4d288e2_002full.jpg

Brian “Griz” Testo, President & CEO of Grizzly Discoveries, states: “Anomalous ground magnetics and now IP has outlined multiple new targets across the Sappho Project. I am excited to see what the next phase of IP work and drilling might show us – Grizzly will continue to refine these targets to the drill ready stage for drilling in the next couple of months and I look forward to identifying some new discoveries.”

Figure 2: Sappho IP Results Showing Conductivity Anomaly Lines 9600 and 9700.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/285545_0a04322da4d288e2_003full.jpg

Figure 3: Sappho IP Results Showing Modelled Conductivity Anomaly on Line 9600.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/285545_0a04322da4d288e2_004full.jpg

Figure 4: Sappho IP Results Showing Chargeability Anomaly Lines 9400 and 9500.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/285545_0a04322da4d288e2_005full.jpg

Figure 5: Sappho IP Results Showing the Modelled Chargeability Anomaly on Line 9500.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/285545_0a04322da4d288e2_006full.jpg

Figure 6: Sappho 3D IP Model Showing Chargeability Anomaly on Lines 9400 and 9500.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/285545_0a04322da4d288e2_007full.jpg

The Company is continuing with surface exploration in the Greenwood area. Crews from APEX Geoscience Ltd. completed rock sampling in August through to November and again in January. The exploration work is ongoing and includes prospecting and rock sampling at targets in the Rock Creek area, the Midway area, the Copper Mountain area, the Overlander-Attwood area and the Sappho (Figure 7). Additional groundwork including ground geophysical surveys are being planned and will comprise IP, magnetics and Loupe electromagnetics (EM) for the Sappho, the Midway and Motherlode areas (Figure 7). Rock sampling results (>220 samples) from the 2025 fieldwork are pending and will be released as they are received.

Figure 7: Exploration Targets 2026.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4488/285545_0a04322da4d288e2_008full.jpg

ABOUT GRIZZLY DISCOVERIES INC.

Grizzly is a diversified Canadian mineral exploration company with its primary listing on the TSX Venture Exchange focused on developing its approximately 72,700 ha (approximately 180,000 acres) of precious and base metals properties in southeastern British Columbia. Grizzly is run by a highly experienced junior resource sector management team, who have a track record of advancing exploration projects from early exploration stage through to feasibility stage.

QUALIFIED PERSON STATEMENT

The technical content of this news release and the Company’s technical disclosure has been reviewed and approved by Michael B. Dufresne, M. Sc., P. Geol., P.Geo., who is a non-independent Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

On behalf of the Board,

GRIZZLY DISCOVERIES INC.

Brian Testo, CEO, President

Suite 363-9768 170 Street NW

Edmonton, Alberta T5T 5L4

For further information, please visit our website at www.grizzlydiscoveries.com or contact:

Nancy Massicotte

Corporate Development

Tel: 604-507-3377

Email: nancy@grizzlydiscoveries.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Caution concerning forward-looking information

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws. This information and statements address future activities, events, plans, developments and projections. All statements, other than statements of historical fact, constitute forward-looking statements or forward-looking information. Such forward-looking information and statements are frequently identified by words such as “may,” “will,” “should,” “anticipate,” “plan,” “expect,” “believe,” “estimate,” “intend” and similar terminology, and reflect assumptions, estimates, opinions and analysis made by management of Grizzly in light of its experience, current conditions, expectations of future developments and other factors which it believes to be reasonable and relevant. Forward-looking information and statements involve known and unknown risks and uncertainties that may cause Grizzly’s actual results, performance and achievements to differ materially from those expressed or implied by the forward-looking information and statements and accordingly, undue reliance should not be placed thereon.

Risks and uncertainties that may cause actual results to vary include but are not limited to the availability of financing; fluctuations in commodity prices; changes to and compliance with applicable laws and regulations, including environmental laws and obtaining requisite permits; political, economic and other risks; as well as other risks and uncertainties which are more fully described in our annual and quarterly Management’s Discussion and Analysis and in other filings made by us with Canadian securities regulatory authorities and available at www.sedarplus.ca. Grizzly disclaims any obligation to update or revise any forward-looking information or statements except as may be required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/285545

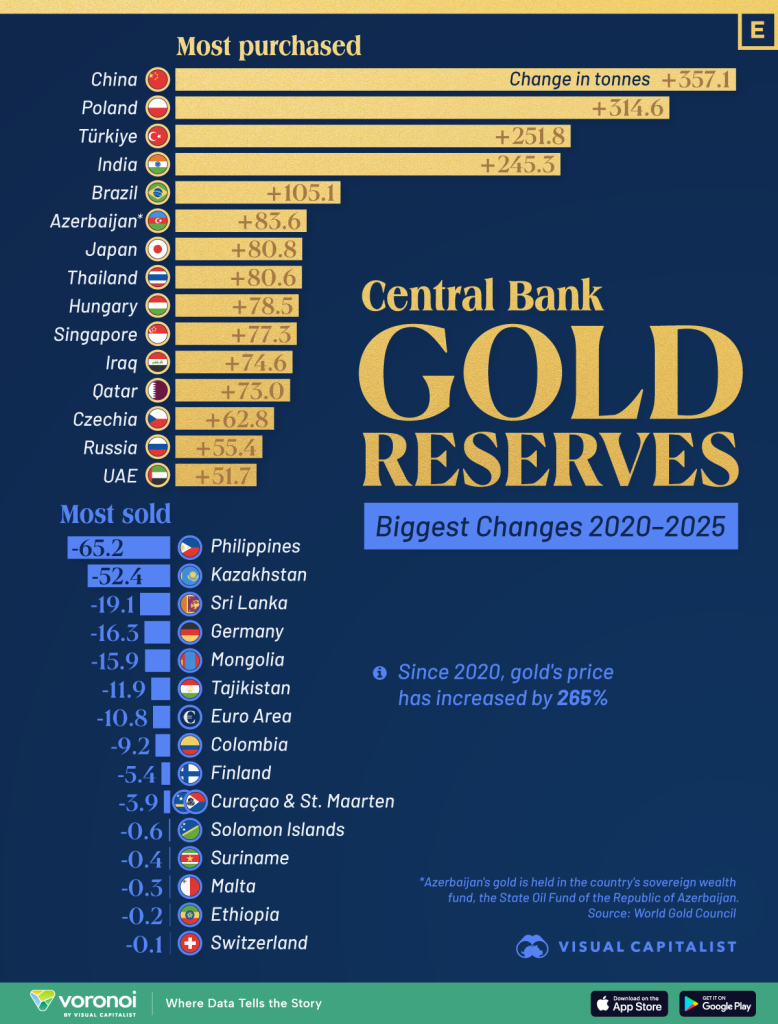

China

China Philippines

Philippines Poland

Poland Kazakhstan

Kazakhstan Türkiye

Türkiye Sri Lanka

Sri Lanka India

India Germany

Germany Brazil

Brazil Mongolia

Mongolia Azerbaijan

Azerbaijan Tajikistan

Tajikistan Japan

Japan Euro Area (average)

Euro Area (average) Thailand

Thailand Colombia

Colombia Hungary

Hungary Finland

Finland Singapore

Singapore Curaçao & St. Maarten

Curaçao & St. Maarten Iraq

Iraq Solomon Islands

Solomon Islands Qatar

Qatar Suriname

Suriname Czech Rep.

Czech Rep. Malta

Malta Russia

Russia Ethiopia

Ethiopia United Arab Emirates

United Arab Emirates Switzerland

Switzerland

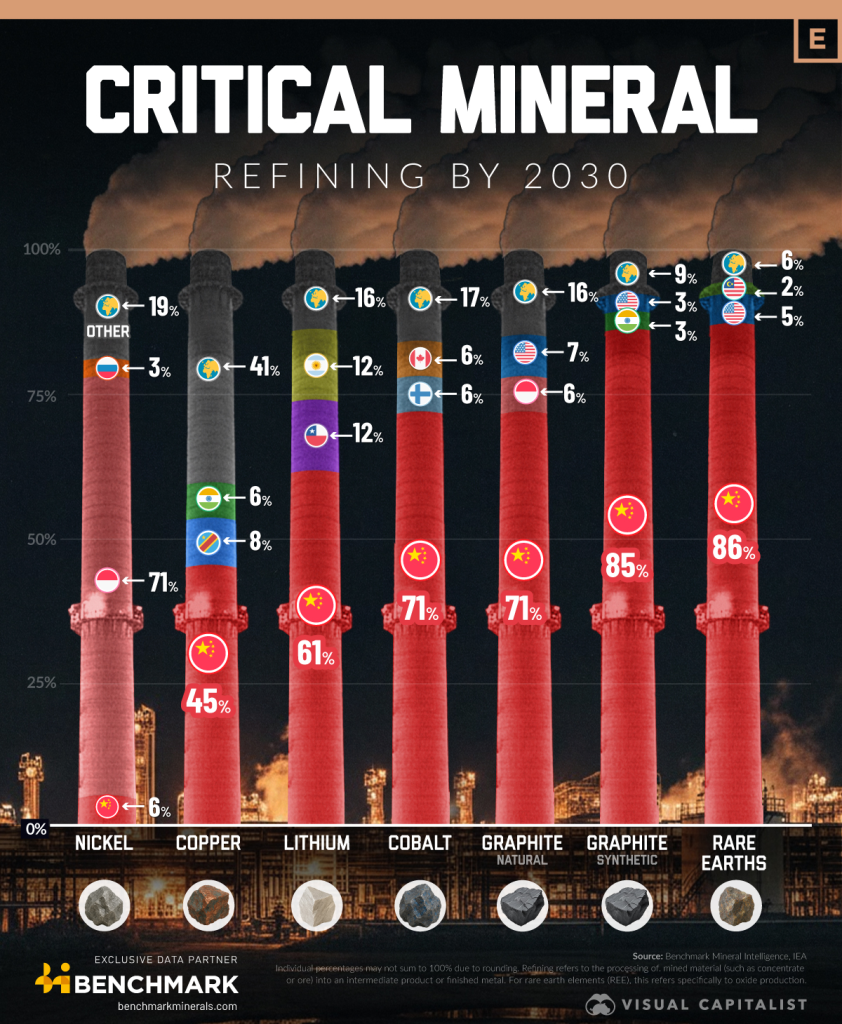

Indonesia

Indonesia DRC

DRC Chile

Chile Argentina

Argentina United States

United States Malaysia

Malaysia Canada

Canada South Korea

South Korea Australia

Australia Sweden

Sweden Morocco

Morocco Saudi Arabia

Saudi Arabia Uganda

Uganda Tanzania

Tanzania