Month of January 2023

| Indicator | 1/31/2023 | 12/30/2022 | Change | Mo % Chg | YTD % Chg | Analysis |

| Gold Bullion1 | $1,928.36 | $1,824.02 | $104.34 | 5.72% | 5.72% | Best January since 2015, best three months since 2011 |

| Silver Bullion2 | $23.73 | $23.95 | ($0.22) | (0.94)% | (0.94)% | First negative month since August |

| NYSE Arca Gold Miners (GDM)3 | 897.17 | 805.50 | 91.67 | 11.38% | 11.38% | Now up 47.7% from the lows |

| Bloomberg Comdty (BCOM Index)4 | 111.80 | 112.81 | (1.01) | (0.89)% | (0.89)% | Narrow range since August |

| DXY US Dollar Index5 | 102.10 | 103.52 | (1.43) | (1.38)% | (1.38)% | Largest three-month drop since 2009 |

| S&P 500 Index6 | 4,076.60 | 3,839.50 | 237.10 | 6.18% | 6.18% | Breaking out from year-long downtrend |

| U.S. Treasury Index | $2,243.23 | $2,188.39 | $54.84 | 2.51% | 2.51% | Oversold cyclical low |

| U.S. Treasury 10 YR Yield* | 3.51% | 3.87% | (0.37)% | -37 BPS | -37 BPS | Testing rising 200-day moving average |

| U.S. Treasury 10 YR Real Yield* | 1.26% | 1.57% | (0.31)% | -31 BPS | -31 BPS | Topping process |

| Silver ETFs** (Total Known Holdings ETSITOTL Index Bloomberg) | 760.17 | 749.00 | 11.18 | 1.49% | 1.49% | First real uptick since summer selling |

| Gold ETFs** (Total Known Holdings ETFGTOTL Index Bloomberg) | 93.17 | 93.75 | (0.58) | (0.62)% | (0.62)% | Last positive month was April 2022 |

Source: Bloomberg and Sprott Asset Management LP. Data as of January 31, 2023.

*Mo % Chg and YTD % Chg for this Index are calculated as the difference between the month end’s yield and the previous period end’s yield, instead of the percentage change. BPS stands for basis points. **ETF holdings are measured by Bloomberg Indices; the ETFGTOTL is the Bloomberg Total Known ETF Holdings of Gold Index; the ETSITOTL is the Bloomberg Total Known ETF Holdings of Silver Index.

January Review

Gold had another strong month and the best start to a year since 2015 as spot gold rose $104.34 (or 5.72%) to close January at $1,928.36. While the gold price was supported by the decline in the U.S. dollar (USD) and real yields in January, the magnitude and persistence of the bid for gold were high. Gold bullion trading desks have confirmed this strong interest is a continuation of flow demand from China since early November 2022, and the estimated tonnages bought would align with the most significant numbers since 2017. Price action and trading desk anecdotes denote large buying from China’s “official sector” (possibly any combination of People’s Bank of China, central bank-related entities or state banks) for undisclosed reasons.

January was a solid month for risk assets as investment funds were underexposed for a positive, right-tail8 outcome. The significant left-tail risks of 2022 quickly faded or reversed as we headed toward the new year. In the U.S., fears of hyperinflation and additional Federal Reserve (“Fed”) rate hikes ended abruptly as the Fed signaled it would slow its rate hikes just as inflation data finally moderated. In Europe, a far warmer-than-expected winter prevailed, allowing the EU to dodge the worst of an energy-spiking-induced hard landing and associated stress events. After years of a strict zero-COVID policy, China quickly reversed to a full re-opening, instantly giving the world an unexpected growth shock. With all three major economic regions experiencing a sudden reversal from left-tail (negative) to right-tail (positive) outcomes, massive forced buying was triggered.Gold has outperformed U.S. Treasuries over the past two decades despite the bond market having the advantages of a dovish accommodative Fed.

Furthermore, with the pause in Fed rate hikes in sight, both the USD and interest rates declined sharply, easing financial conditions and paving the way for a rebound in many financial assets. Whether this rally is the beginning of the consensus-desired soft landing or yet another bear market rally remains to be seen. We expect that macro volatility will likely remain high in the months ahead.

Gold Bullion Update

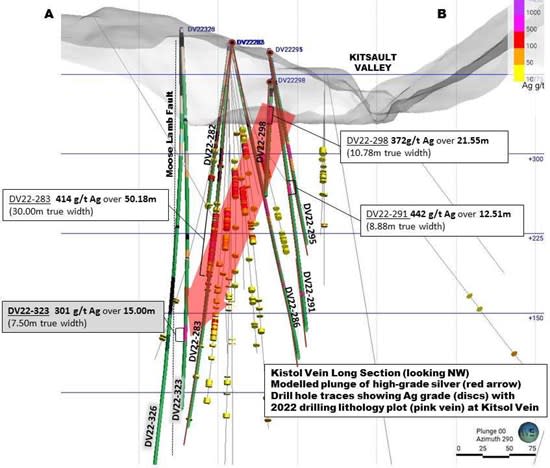

Gold bullion since the autumn lows, based on a three-month rate of change, had the most significant increase since 2011. Since the lows, the gold price has broken through technical resistance levels and Fibonacci retracement levels9 with remarkable ease, reinforcing the evidence that the buyer(s) are not likely financial market types. From gold’s early November lows of approximately $1,625 to $1,775, the price action has the look and feel of short covering in the face of an aggressive buyer. But since gold has reached the $1,775 level, the narrow up-channel and low bid-ask dispersion indicate a persistent large bid in gold that is not concerned with market-related overbought conditions. Lastly, the weekly Relative Strength Index (RSI)10 put in a positive divergence during the autumn lows and has broken above the RSI downtrend line (lower panel of Figure 1).

Figure 1. Gold Bullion Rally with Technical Strength

Source: Bloomberg. Data as of 1/31/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Gold Investment Positioning Remains Low

Despite the rise in gold, the long gold CFTC(Commodity Futures Trading Commission) net non-commercial positions and ETF holdings remain muted, like a deer caught in a headlight (Figure 2). Gold held in ETFs (mainly retail and smaller funds) remain near +2.5-year lows and has not shown any buying indication yet. CFTC non-commercial long gold positioning, too, remains near the low end of its 10-year range. Neither of these two sources of investment “longs” is likely to sell off further as they are more trend-following than leading. The last source of investment flows, short positions, are even less likely to add to selling flows. Firstly, there is no overriding primary bearish macro driver (interest rate hikes are near the end, and the USD is weakening); secondly, shorting into massive buying is outright dangerous. The combined CFTC gold longs plus ETF gold holdings are now at their -2 standard deviation lows (lower panel, Figure 2) with macro drivers positive and massive buying from China and central banks. The risk from long positioning remains skewed to increasing longs, not divestment.

Figure 2. Gold Investment Demand Remains Muted

Source: Bloomberg. Data as of 1/31/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

U.S. Dollar Strength and U.S. Treasury Liquidity Functioning

The US Dollar Index (DXY) reached the upper end of its 16-year-long uptrend and has now fallen at a remarkable pace last seen in the volatile years of 2008 to 2010. The 3-month rate of change of DXY has recorded its second sharpest decline in the past 20 years. This dramatic fall in the USD has also eased financial conditions, creating a powerful tailwind for gold and other risk assets. Typically, policy coordination comes to mind when currencies sharply reverse from levels detrimental to market functioning quickly, with such high correlations. Unfortunately, if policymakers have decided on a coordinated USD strength reduction policy, we won’t know until much later when it becomes evident in hindsight.

The Bloomberg US Government Securities Liquidity Index (a measure of liquidity condition for U.S. Treasuries) surpassed the crisis levels of March 2020, the last time the Fed was forced to intervene to restore market functioning with interest rate cuts, liquidity injections, swap facilities, etc. Generally, a strong USD reduces systematic market liquidity, and Figure 3 highlights this relationship. The U.S. Treasury Market is the world’s largest and most liquid market. If it were to cease functioning properly, the spillover effects could be catastrophic in an overleveraged financial system under the wrong conditions. We would expect the days of runaway USD strength will not be allowed due to liquidity functioning alone.

Figure 3. U.S. Dollar Index and U.S. Treasury Liquidity Index

Source: Bloomberg. Data as of 1/31/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Foreign Selling of U.S. Treasuries is Accelerating

Foreign holdings of U.S. Treasuries as a percentage of total holdings peaked in 2013, a decade ago. Most of this time, the Fed provided QE (quantitative easing) programs, negating the need for foreign funding of Treasuries. In Figure 4, we highlight foreign ownership of U.S. Treasuries and the rapidly decreasing percentage of foreign ownership of U.S. Treasuries. In March 2022, foreign holders saw notable selling (~$516 billion). There were several reasons, including 1) the Fed ending its latest QE program; 2) geopolitics (the Russia-Ukraine war and intensifying de-globalization; 3) the start of an aggressive string of Fed rate hikes along with tightening by other central banks; 4) USD weaponization had been occurring for several years, but the seizure of Russia’s foreign exchange (FX) reserves was likely the final straw. After these events, U.S. Treasury Liquidity began to deteriorate, even worse than in March 2020. Without liquidity support for U.S. Treasuries, the probability of another QE program (or a variation built around YCC, i.e., yield curve control) within the next few years is no longer remote, even in the face of high inflation.

Figure 4. Foreign Buyers are Dumping U.S. Debt

Source: Bloomberg. Data as of 1/31/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

China Replacing U.S. Treasuries with Gold?

Since 2008, China has been the largest foreign holder of U.S. Treasuries. Though the peak has been in place since 2013, China has recently accelerated its selling of Treasuries. The reason for China selling U.S. Treasury securities are varied and not disclosed. Still, since the U.S. sanctioned Russia’s FX reserves, China has a tremendous incentive to diversify its foreign exchange reserves. Figure 5 highlights the cumulative change in China’s gold imports and U.S. Treasures since 2018, measured in USD. 2018 was the first year of the U.S.-China trade war. The recent accelerated selling in U.S. Treasuries occurred at the start of the Russia-Ukraine war and in response to sanctions on Russia’s FX reserves. We expect China to continue reducing its U.S. Treasuries holdings as the economic war extends and intensifies, and the risk of future U.S. sanctions on China’s FX reserves remains present.

Since 2018, we estimate that China has sold $310 billion of U.S. Treasuries ($199 billion in 2022 alone) and has imported $230 billion of gold. China is estimated to have the seventh-largest global bond market, with the top six positions held by the U.S. and its allies. The list of the most liquid tradeable currencies has the same size ranking. In terms of market liquidity, safety as outside money and convertibility (sanctions resistant), gold remains a highly desirable asset for China.

Figure 5. China Buys Gold and Sells U.S. Bonds

Source: Bloomberg. Data as of 11/30/2022. Included for illustrative purposes only. Past performance is no guarantee of future results.

Japan Yield Curve Control (YCC) and Selling U.S. Treasuries

The Bank of Japan (BoJ) began yield curve control in 2016 (0.25% cap on its 10-year yield) to achieve an inflation target of 2% and stimulate economic growth by controlling long-term interest rates. By late 2022, the BoJ did “technically” achieve its goals, although not the hoped-for “virtuous growth cycle” outcome. However, the costs were enormous as global yields soared while Japanese government bond (JGB) yields were capped at 0.25% by the BoJ. The yen had fallen in value by 22.5%, driving import cost inflation so high that the Ministry of Finance had to intervene in the currency market to defend the yen, while at the same time, the BoJ continued with YCC weakening the yen. If this makes no sense, then you have read this correctly.

In December 2022, in a surprise move, the BoJ lifted the YCC cap to 0.50% from 0.25%, signaling to the market that the BoJ YCC had likely reached its best-before date. Since then, the yen has strengthened by ~15%, contributing to USD weakness. Capping JGB yields in the second half of 2022 as global yields soared required massive purchases of JGBs via quantitative easing. This 2H 2022 QE event was a monetary stimulus of 76 trillion yen or $550 billion (~14% of GDP, i.e., gross domestic profit). The end of this stimulus is likely to act as a defacto global tightening. Raising the yield cap also removed a global “low-yield anchor” on global rates. Not only is this yield anchor fading, but Japanese institutional investors, one of the world’s largest foreign bond buyers, are returning to JGBs. Year to date as of this writing, U.S. Treasury holdings in Japan have declined ~$220 billion since the start of 2022. For various reasons, the two largest holders of U.S. Treasuries have sold $420 billion, or 17.5% of their combined holdings, in 2022.

Foreign selling of U.S. Treasuries is increasing, and the Fed in quantitative tightening (QT )mode leaves U.S. domestic investors as the primary buyers for U.S. Treasuries. Maintaining U.S. Treasury liquidity is now more critical than ever, and the looming debt ceiling standoff will be the next challenge. For gold, the immediate bullish catalyst is a weaker USD and lower real yields. Rising JGB yields will lead to higher U.S. nominal yields but lower breakeven yields (removal of stimulus weakens growth), resulting in lower real yields.

Figure 6. U.S. Treasuries Held by Japan and China, $Billions

Source: Bloomberg. Data as of 1/31/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Gold vs. Bonds, Heresy Anyone?

Thus far in 2023, there have been near-record capital inflows into the bond market after 2022 recorded the worst year for bond returns in 48 years of available data. In Figure 7a, we update the gold bullion to the U.S. Treasury Index ratio, highlighting that gold has outperformed over the past several years since 2016 and even over the past 20 years. The gold-Treasury ratio is testing the upper resistance level, and we expect an eventual break higher. Figure 7b highlights the performance of gold versus U.S. equities and U.S. bonds over the past five and 20 years, with performance and portfolio metrics highlighting how well gold has performed and behaved.

Despite these positive metrics, gold is still not widespread in investment portfolios. In the past five years, gold compared to both equities and bonds, has a better Sharpe ratio (risk-adjusted return), a better Sortino ratio (lower downside volatility) and the lowest market correlation (increased diversification).

Gold has outperformed U.S. Treasuries over the past two decades despite the bond market having the advantages of a dovish accommodative Fed (QE, ZIRP, NIRP)11 with volatility-destroying practices (forward guidance, Fed put). Furthermore, most of the past 20 years were dominated by low inflation, low macro volatility, negative stock-bond correlations, etc., all favoring bond performance. In our 2023 Top 10 Watch List, we highlighted several significant macro changes underway, all pointing to higher inflationary pressures and increasing volatility. If gold outperformed U.S. Treasuries in the past decades, we believe the chances are excellent that it is likely to do so in the next several years.

Figure 7a. Gold to U.S. Treasury Index Ratio: Gold Significantly Outperforming U.S. Treasuries

Source: Bloomberg. Data as of 1/31/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Figure 7b. Gold vs. Equities and Bonds: 5 & 20-Year Returns and Metrics

| Dec. 2017 to Dec. 2022 | 5 YR CAGR* | Standard Deviation | Max Drawdown | Sharpe Ratio | Sortino Ratio | Market Correlation |

| U.S. Stock Market | 8.67% | 19.06% | -24.94% | 0.46 | 0.68 | 1.00 |

| Total U.S. Bond Market | 0.02% | 5.09% | -17.57% | -0.23 | -0.29 | 0.34 |

| Gold | 6.86% | 13.45% | -18.06% | 0.47 | 0.85 | 0.16 |

| Dec. 2002 to Dec. 2022 | 20 YR CAGR* | Standard Deviation | Max Drawdown | Sharpe Ratio | Sortino Ratio | Market Correlation |

| U.S. Stock Market | 9.52% | 15.29% | -50.89% | 0.59 | 0.87 | 1.00 |

| Total U.S. Bond Market | 3.06% | 3.95% | -17.57% | 0.48 | 0.7 | 0.12 |

| Gold | 8.65% | 16.87% | -42.91% | 0.51 | 0.83 | 0.08 |

*CAGR refers to compound annual growth rate.

| 1 | Gold bullion is measured by the Bloomberg GOLDS Comdty Spot Price. |

| 2 | Silver bullion is measured by Bloomberg Silver (XAG Curncy) U.S. dollar spot rate. |

| 3 | The NYSE Arca Gold Miners Index (GDM) is a rules-based index designed to measure the performance of highly capitalized companies in the Gold Mining industry. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index distributed by Bloomberg Indices. |

| 5 | The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners’ currencies. |

| 6 | The S&P 500 or Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 7 | Any event that is extremely rare, beyond the sixth standard deviation in a normal distribution, is known as a six sigma event. |

| 8 | Source: Investopedia. Tail risk is the chance of a gain/loss occurring due to a rare event, as predicted by a probability distribution. Right-tail risks are associated with substantial investment gains, while left-tail risks are associated with unexpected losses. |

| 9 | Source: Investopedia. Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. They are based on Fibonacci numbers. Each level is associated with a percentage. The percentage is how much of a prior move the price has retraced. The Fibonacci retracement levels are 23.6%, 38.2%, 61.8% and 78.6%. While not officially a Fibonacci ratio, 50% is also used. The indicator is useful because it can be drawn between any two significant price points. |

| 10 | Source: Investopedia. The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to analyze overbought or oversold conditions. |

| 11 | QE-ZIRP-NIRP is Fed speak and refers to “quantitative easing”, “zero interest rate policy” and “negative interest rate policy”. |

Paul Wong, CFA, Market Strategist

Paul has held several roles at Sprott, including Senior Portfolio Manager. He has more than 30 years of investment experience, specializing in investment analysis for natural resources investments. He is a trained geologist and CFA holder.

Read Bio

Sign-Up Now:

Insights from Sprott

First Name*

Last Name*

Email Address*

Investor Type* Asset Manager Financial Advisor Individual Investor Institutional Investor Other

Country* United States Canada Argentina Australia Austria Belgium Brazil China Denmark Finland France Germany India Ireland Italy Japan Netherlands New Zealand Norway South Africa Spain Sweden Switzerland United Kingdom Other

* Required.

I am not a robot.

Please slide to unlock.

More on Gold

- 2/7/2023

Strong China Demand Boosts Gold Rally - 1/9/2023

2023 Top 10 Watch List - 1/5/2023

Connecting a Few Dots - 12/23/2022

Gold Mining: Community Relations are the Foundation for ESG - 12/7/2022

Gold Higher After Peak Fed Hawkishness

Important Disclosure

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and statements are that of the author and may not be reflective of investments and commentary in other strategies managed by Sprott Asset Management USA, Inc., Sprott Asset Management LP, Sprott Inc., or any other Sprott entity or affiliate. Opinions expressed in this commentary are those of the author and may vary widely from opinions of other Sprott affiliated Portfolio Managers or investment professionals.

This content may not be reproduced in any form, or referred to in any other publication, without acknowledgment that it was produced by Sprott Asset Management LP and a reference to sprott.com. The opinions, estimates and projections (“information”) contained within this content are solely those of Sprott Asset Management and are subject to change without notice. SAM LP makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, SAM LP assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. SAM LP is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Sprott Asset Management LP. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell.

The information provided is general in nature and is provided with the understanding that it may not be relied upon as, nor considered to be, the rendering or tax, legal, accounting or professional advice. Readers should consult with their own accountants and/or lawyers for advice on their specific circumstances before taking any action.

© 2023 Sprott Inc. All rights reserved.