Highlights:

- Millrock will become an energy metal explorer – developer focused on its Nikolai project in Alaska, targeting a potentially large resource of nickel, copper, cobalt, chromium, iron, and platinum group elements.

- The Company will be renamed Alaska Energy Metals Corporation and effect a 10:1 stock consolidation following receipt of TSX Venture Exchange (“TSX-V”) approval.

- Gregory Beischer will continue to lead the company and key employees have been promoted to executive positions.

- The Company intends to undertake an equity financing with the amount and terms to be determined. Existing Millrock shareholders will have priority participation.

- Non-core assets may be sold and proceeds directed to the Nikolai project.

- Historical drilling shows thick intersections of disseminated sulfide mineralization over wide intervals and extensive strike length. Drilling is planned in 2023 and 2024 to establish an initial resource of nickel, copper, cobalt, and platinum group elements.

- The Nikolai project also features indications of exceptionally high-grade, massive sulfide nickel, copper, and platinum group element occurrences that will be brought to drill readiness in 2023.

VANCOUVER, British Columbia, March 01, 2023 (GLOBE NEWSWIRE) — Millrock Resources Inc. (TSX-V: MRO, OTCQB: MLRKF) (“Millrock” or the “Company”) announces that, subject to receipt of TSX-V approval, it plans to change its name to Alaska Energy Metals Corporation and consolidate its share capital on a 10 for 1 basis. The Company will have approximately 15.5 million common shares issued and outstanding on a post-consolidated basis. In this news release, the post-consolidated Company is referred to as “Alaska Energy Metals” or the “Company”.

The Company also plans to undertake an equity financing to raise capital for drilling and metallurgical testing of nickel (Ni), copper (Cu), cobalt (Co), chrome (Cr), iron (Fe), platinum (Pt), palladium (Pd), gold (Au), and silver (Ag) mineralization on its Nikolai project in Alaska. Details will be announced when finalized.

President & CEO Gregory Beischer stated: “Despite strong execution of the Project Generator model over the past few years, Millrock’s share price has declined. Bold changes are necessary and the Nikolai project presents a timely opportunity. Historical drilling at Nikolai indicates potential for a very large, low grade, polymetallic deposit dominated by nickel sulfide mineralization. The demand for nickel and cobalt for electric vehicle battery manufacture has been growing rapidly and is projected to increase significantly. It will be necessary for the mining industry to mine bulk tonnage nickel – cobalt deposits to meet the demand. Alaska Energy Metals is positioning itself to supply domestic markets with a source of critical and strategic metals. Located in the USA, we intend to help North America transition to electrical power for vehicles and other rechargeable battery powered products.”

Nikolai Project

The Nikolai project consists of two claims blocks, the Eureka block and the Canwell block, totaling 9,477 hectares. The Eureka claim block, which is 100% owned by the Company, covers the Eureka Zone, where historical drilling indicates the presence of a thick zone of disseminated mineralization over a 15-kilometer (km) strike length.

Alaska Energy Metals has an option to purchase a 100% interest in the Canwell claim block where sulfide occurrences with high grade Ni, Cu, Au, Pt, Pd and the rarer platinum group elements are documented.

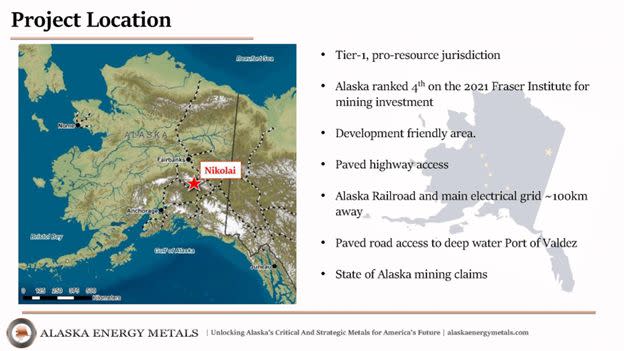

Figure 1. Nikolai Project Location, Alaska

The Nikolai project is well-situated. The paved Richardson Highway leads to the project area, which is a 2.5-hour drive south of the city of Fairbanks. An old mining trail leads from the Richardson Highway close to the Eureka claim block, which sits on rolling hills on the leading southern edge of the Alaska Range mountains. A series of gravel roads and trails traverse the Canwell claim block, which exhibits more rugged terrain at higher elevations in the Alaska Range mountains.

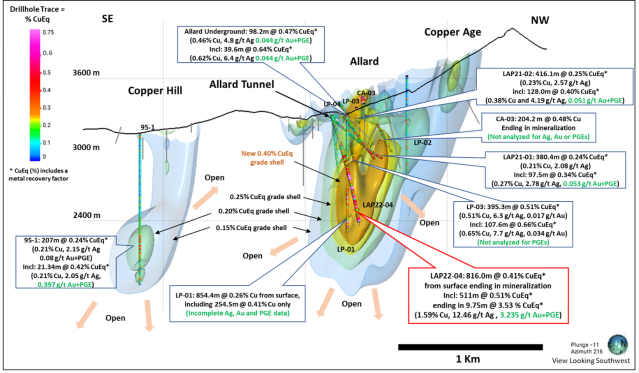

At the Eureka Zone, a 3.4 km strike length (red ellipse in Figure 2) shows more substantial metal concentrations in historical drill holes. Drilled intervals range between 95 meters (m) and 320 meters, and nickel equivalent (NiEq) grades range between 0.29% and 0.47%. Typical nickel grade is ~0.22%.

Historical drilling is sparse, but metal concentration appears consistent over long distances. Calculating an initial inferred resource from some more closely spaced historical holes may be possible. The Company does not presently have access to the assay certificates from holes drilled by a former explorer (Pure Nickel Inc.). It is possible that the Company may be able to obtain this data.

Alaska Energy Metals envisions a 4,200-m drill program in summer 2023, which may result in the calculation of an initial inferred resource in compliance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The Alaska Department of Natural Resources has approved drilling permits and temporary water use authorizations. Initial deportment studies indicate nickel is present primarily in the form of the sulfide mineral pentlandite but also as Ni-Fe alloy, both of which may be readily recovered by standard milling methods.

An important part of the anticipated 2023 program will include additional Ni-Cu-PGE-Au deportment studies, crystallography studies of Ni-Fe Alloys, and bench-scale, closed-circuit flotation studies.

Note: The potential quantity and grade of mineralized rock targeted by Alaska Energy Metals, as mentioned in Figure 2, is conceptual in nature. There has been insufficient exploration drilling to estimate an Inferred Mineral Resource (as defined in CIM Definition Standards for Mineral Resources & Mineral Reserves), and it is uncertain if further exploration will result in the calculation of in an Inferred Resource estimate.

Figure 2. Eureka Zone of the Nikolai Project. Historical drilling indicates thick intersections of disseminated sulfides over a 15-km strike length. Metal prices used for NiEq calculation are: $7.00/lb. Ni, $3.50/lb. Cu, $25.00/lb. Co, $900/oz Pt, $1800/oz Pd and $1600/oz Au. (Source: Millrock files and data published in various press releases by prior explorer Pure Nickel Inc. from 2007 to 2014).

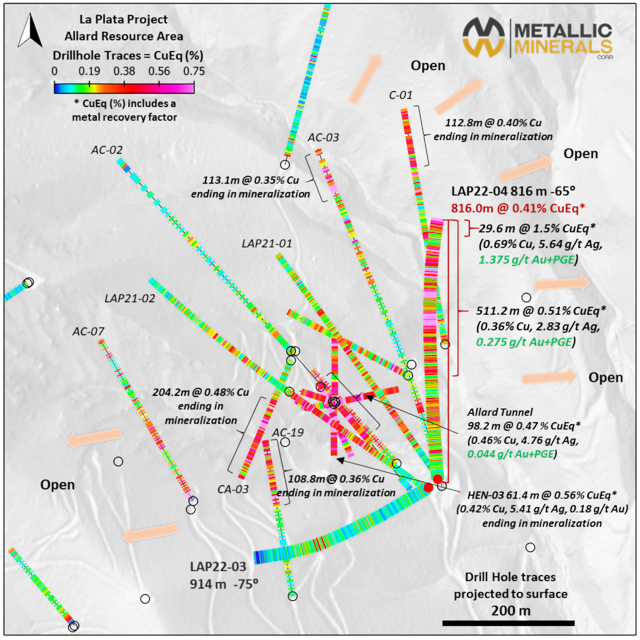

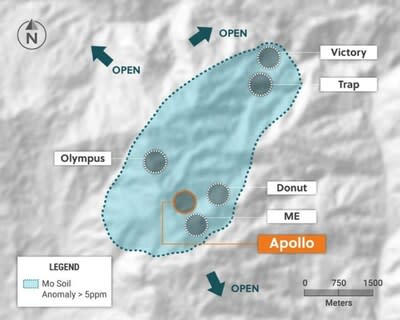

There are several sulfide occurrences exposed at surface on the Canwell block of claims. Exceptional grades of nickel, copper, gold, platinum, palladium, and the rarer platinum-related metals osmium, iridium, ruthenium and rhodium have historically been reported from outcrop grab, float and chip samples. These samples are selective in nature and not necessarily representative of mineralization. Little drilling has been done and all holes are very shallow tests of surface anomalies.

In 2023, Alaska Energy Metals intends to carry out an extensive rock and soil sampling program and a modern, detailed airborne electromagnetic survey on the Canwell Block in preparation for a 2024 drilling program.

Figure 3. Canwell Zone of Nikolai Project. Surface occurrences of massive sulfide indicate very high grades of Ni, Cu, Au, Pt, Pd, and the rare platinum group elements Os, Ir, Ru and Rh.

Management Changes

Phil St. George has stepped down as Chief Exploration Officer of Millrock but will continue as a technical advisor to Alaska Energy Metals. Millrock is grateful for Mr. St. George’s contributions to the Company, and Alaska Energy Metals looks forward to his continued support.

Long-standing senior employees of Millrock will now fill executive roles within Alaska Energy Metals.

Greg Beischer will continue to lead the Company. Mr. Beischer has a long history with the Nikolai project. In 1995, his first employer, International Nickel Company (INCO), transferred him to Alaska to explore the state with a focus on the Nikolai project area. As a geologist (Laurentian University, Sudbury, Ontario, Canada) and a mining engineering technologist (Haileybury School of Mines, Haileybury, Ontario, Canada) and an experienced executive, Mr. Beischer has the capability to lead the re-focused company as an energy metal explorer and developer.

Kyle Negri has been appointed Vice-President of Exploration. Mr. Negri started his career with Millrock as a geology student at the University of Alaska in 2008. He is now an accomplished exploration geologist and operations director that will lead Alaska Energy Metals’s exploration efforts.

Traci Hartz has been appointed Vice-President of Administration. As an experienced and dedicated landwoman and administrative professional, Ms. Hartz began her career in mining in 2011 with Millrock. Ms. Hartz has risen rapidly to become expert in mineral land management and is well-versed in resource-related legal contracts. Ms. Hartz ably handles all matters relating to tenure management, service contracts, human resources, and office management.

Gabe Graf has been appointed Chief Geoscientist. As an economic geologist (M.S. New Mexico Institute of Mining and Technology – 2008) with an MBA (University of Alaska Fairbanks – 2018), Mr. Graf is an accomplished exploration and mining geologist. As the Exploration Superintendent at Alaska’s Pogo mine, he made significant gold deposit discoveries. Mr. Graf has been involved with Millrock for several years and will now play a pivotal role in target generation and 3-D geological modeling.

Non-Core Assets

The Company owns a portfolio of exploration stage royalty assets in Alaska and a portfolio of shares in other junior exploration companies. Additionally, the Company owns a 49% interest in the 64North gold project surrounding the Pogo gold mine in Alaska, and also other mineral property interests. The Company will consider selling these assets for fair prices to bolster the treasury and contribute to exploration and development at the Nikolai project.

Qualified Person

The scientific and technical information disclosed within this document has been prepared, reviewed, and approved by Gregory A. Beischer, President, CEO, and a director of Millrock. Mr. Beischer is a qualified person, as defined in NI 43-101. Mr. Beischer was an exploration manager for INCO in the 1990s and directly supervised drilling and sampling operations on the project. The drill core samples and rock samples collected at the time were analyzed by ALS Chemex labs and all standard quality control and quality assurance methods were used. The qualified person has recently reviewed all assay certificates from the historical drilling and sampling done by INCO. The Company has done check sampling of the INCO drill cores, which are stored at the Geologic Materials Center in Anchorage, Alaska. New assay data confirmed historical values. Some historical data presented in this press release include drill intercepts that were reported by Pure Nickel Inc. in press releases. The Company does not have access to this data and cannot therefore independently verify the information. However, Pure Nickel Inc. was known by the qualified person to be a high-caliber company that employed strong, industry-standard methods, and the qualified person has no reason to doubt the validity of the publicly reported Pure Nickel Inc. results.

About Alaska Energy Metals

Alaska Energy Metals Corporation will be focused on delineating and developing a large polymetallic deposit containing Ni, Cu, Co, Cr, Fe, Pt, and Pd. Located in development-friendly central Alaska near existing transportation and power infrastructure, the project is well-situated to become a significant, domestic source of critical and strategic energy-related metals. The Company intends to delineate a major metal resource by the end of 2024.

ON BEHALF OF THE BOARD

“Gregory Beischer”

Gregory Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:

Gregory A. Beischer, President & CEO

Toll-Free: 877-217-8978 | Local: 604-638-3164

Some statements in this news release may contain forward-looking information (within the meaning of Canadian securities legislation), including, without limitation, TSX-V approval of the Company’s proposed name change and consolidation of shares, and the Company’s successful realization of adequate financing to explore and develop the Nikolai project and to successfully achieve milestones. The potential quantity and grade of mineralized rock targeted by Alaska Energy Metals is conceptual in nature. There has been insufficient exploration drilling to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation a Mineral Resource. The Company has stated its intention to liquidate non-core assets but there is no assurance that it will be successful in doing so. All these statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Forward-looking statements speak only as of the date those statements are made. Except as required by applicable law, the Company assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. If the Company updates any forward-looking statement(s), no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.