JACOB ZIMBA

Fri, October 11, 2024 at 10:11 PM EDT

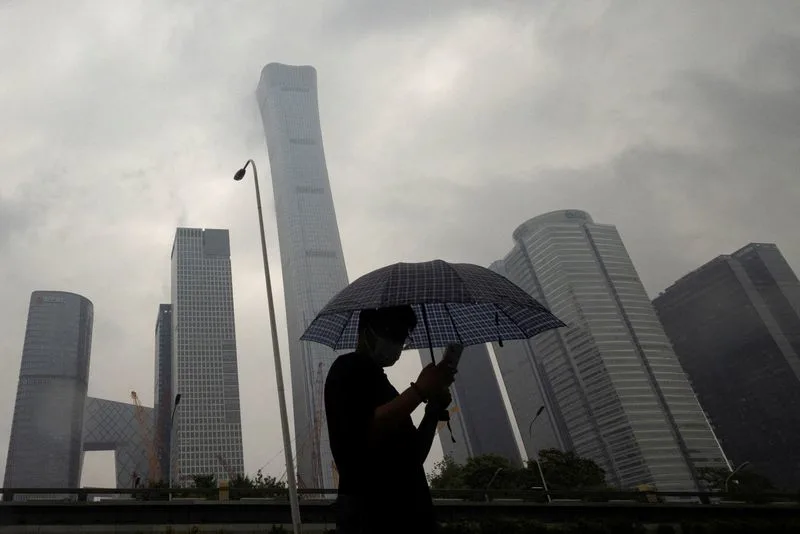

LAKE KARIBA, Zambia (AP) — Tindor Sikunyongana is trying to run a welding business which these days means buying a diesel generator with costly fuel he can’t always afford.

Like everyone in Zambia, Sikunyongana is facing a daily struggle to find and afford electricity during a climate-induced energy crisis that’s robbed the southern African country of almost all its power.

“Only God knows when this crisis will end,” said Sikunyongana. His generator ran out of diesel and spluttered to a halt as he spoke. “You see what I mean?” he said.

Zambia’s worst electricity blackouts in memory have been caused by a severe drought in the region that has left the critical Kariba dam, the source of Sikunyongana’s woes, with insufficient water to run its hydroelectric turbines. Kariba is the largest man-made lake in the world by volume and lies 200 kilometers (125 miles) south of Lusaka on the border between Zambia and Zimbabwe.

The massive dam wall was built in the 1950s and more than 80 workers died during construction. It was meant to revolutionize the countries’ energy supplies by trapping the water of the Zambezi River, turning a valley into a huge lake and providing an endless supply of renewable hydroelectric power.

That’s not the case anymore as months of drought brought by the naturally occurring El Nino weather pattern and exacerbated by warming temperatures have put Zambia’s hydroelectric station on the brink of completely shutting down for the first time.

The water level is so low that only one of the six turbines on Zambia’s side of the dam is able to operate, cutting generation to less than 10% of normal output. Zambia relies on Kariba for more than 80% of its national electricity supply, and the result is Zambians have barely a few hours of power a day at the best of times. Often, areas are going without electricity for days.

Edla Musonda is so exasperated that she’s taken to lugging her entire desktop computer — hard drive, monitor, everything — to a local cafe so she can work.

Musonda and others cram into the Mercato Cafe in the Zambian capital of Lusaka, not for the sandwiches or the ambiance but because it has a diesel generator. Tables are cluttered with power strips and cables as people plug in cell phones, laptops and in Musonda’s case, a home office. This is the only way her small travel business is going to survive.

Less than half of Zambia’s 20 million people had access to electricity before Kariba’s problems. Millions more have now been forced to adjust as mothers find different ways to cook for their families and children do their homework by candlelight. The most damaging impact is during the daylight hours when small businesses, the backbone of the country, struggle to operate.

“This is also going to increase poverty levels in the country,” said economist Trevor Hambayi, who fears Zambia’s economy will shrink dramatically if the power crisis is prolonged. It’s a warning call to the Zambian government and the continent in general about the danger to development of relying heavily on one source of energy that is so climate dependent.

The power crisis is a bigger blow to the economy and the battle against poverty than the lockdowns during the COVID-19 pandemic, said Zambia Association of Manufacturers president Ashu Sagar.

Africa contributes the least to global warming but is the most vulnerable continent to extreme weather events and climate change as poor countries can’t meet the high financials costs of adapting. This year’s drought in southern Africa is the worst in decades and has parched crops and left millions hungry, causing Zambia and others to already declare national disasters and ask for aid.

Hydroelectric power accounts for 17% of Africa’s energy generation, but that figure is expected to rise to 23% by 2040, according to the International Energy Agency. Zambia is not alone in that hydroelectric power makes up over 80% of the energy mix in Mozambique, Malawi, Uganda, Ethiopia and Congo, even as experts warn it will become more unreliable.

“Extreme weather patterns, including prolonged droughts, make it clear that overreliance on hydro is no longer sustainable,” said Carlos Lopes, a professor at the Mandela School of Public Governance at the University of Cape Town in South Africa.

The Zambian government has urged people and businesses to embrace solar power. But many Zambians can’t afford the technology, while the government itself has turned to more familiar but polluting diesel generators to temporarily power hospitals and other buildings. It has also said it will increase its electricity from coal-fired stations out of necessity. While neighboring Zimbabwe has also lost much of its electricity generation from Kariba and blackouts there are also frequent, it gets a greater share of its power from coal plants.

At Kariba, the 128-meter-high (420-feet) dam wall is almost completely exposed. A dry, reddish-brown stain near the top marks where the water once reached in better times more than a decade ago.

Leonard Siamubotu, who has taken tourists on boat cruises on the picturesque lake for more than 20 years, has seen the change. As the water level dropped, it exposed old, dead trees that were completely submerged for years after the wall was built. “I’m seeing this tree for the first time,” he said of one that’s appeared in the middle of the lake.

The lake’s water level naturally rises and recedes according to the season, but generally it should go up by around six meters after the rains. It moved by less than 30 centimeters after the last rainy season barely materialized, authorities said. They hope this year’s rains, which should start in November, will be good. But they estimate that it’ll still take three good years for Kariba to fully recover its hydroelectric capability.

Experts say there’s also no guarantee those rains will come and it’s dangerous to rely on a changing climate given Zambia has had drought-induced power problems before, and the trend is they are getting worse.

“That’s not a solution … just to sit and wait for nature,” said Hambayi.

___

Associated Press journalist Taiwo Adebayo in Abuja, Nigeria contributed to this report.

___

For more news on Africa and development: https://apnews.com/hub/africa-pulse

___

The Associated Press receives financial support for global health and development coverage in Africa from the Gates Foundation. The AP is solely responsible for all content. Find AP’s standards for working with philanthropies, a list of supporters and funded coverage areas at AP.org.

___

The Associated Press’ climate and environmental coverage receives financial support from multiple private foundations. AP is solely responsible for all content. Find AP’s standards for working with philanthropies, a list of supporters and funded coverage areas at AP.org.

Original Source: https://finance.yahoo.com/news/tiktok-aware-risks-kids-teens-000147202.html