If you like the value proposition of Silver. Check out Metallic Minerals latest press release enclosed below. Proven and Probable will be conducting an interview with Metallic Minerals later this week.

Author: admin

Cobalt27 just launched a new website. Click below to visit the site and be sure to watch our interview issued in March. Cobalt27 presents a unique value proposition for speculators in the Natural Resource Space.

Visit New Site Here

Proven and Probable

Where we deliver Mining Insights & Bullion Sales, in form of physical delivery, offshore depositories, and private blockchain distributed ledger technology you may reach us at contact@provenandprobable.com.

Maurice Jackson of Proven and Probable sits down with Michael Rowley the President and CEO of Group Ten Metals (TSX.V: PGE | NYSE: PGEZF) to discuss the latest Platinum, Palladium, Nickel, Copper and Cobalt Intercepts from the Camp Zone Target Area, Stillwater West Project, Montana, USA.

Irving Resources just issued a new press release click the button below to view the exciting details.

Maurice Jackson of Proven and Probable sits down with David Cole the President and CEO of EMX Royalty (TSX.V: EMX | NYSE: EMX) to discuss the virtues of the companies highly successful business model that incorporates Royalty Generation, Royalty Acquisition, and Strategic Investments. Mr. Cole will address how the company is strategically positioning itself on the continued global demand for Copper. And equally important, what actions the company will take from the proceeds of the $67 Million U.S. just received on the sale from the Malmyzh Project in Russia. Equally important, Mr. Cole will highlight the enormous value proposition at Cukaru Peki located in Serbia. EMX Royalty continues to demonstrate business and geological acumen, which has produced spectacular results on their balance sheet and their project portfolio.

Proven and Probable:

Where we deliver Mining Insights & Bullion Sales, in form of physical delivery, offshore depositories, and private blockchain distributed ledger technology you may reach us at contact@provenandprobable.com.

April 18, 2019

Vancouver, British Columbia, April 18, 2019 (TSX Venture: EMX; NYSE American: EMX) – EMX Royalty Corporation (the “Company” or “EMX”) is pleased to announce that it has received a US $2 million escrow distribution, which in addition to the initial US $65.15 million payment in 2018, brings the total cash paid to EMX to US $67.15 million from the sale of the Malmyzh project. A second distribution of up to US $2 million, subject to certain conditions, is due to EMX later in 2019 as remaining funds are released from escrow. Malmyzh was sold by IG Copper LLC (“IGC”) to Russian Copper Company for US $200 million in October 2018.1.

IGC’s Malmyzh project was an important EMX strategic investment that exemplifies the portfolio effect of the Company’s diversified business model. Proceeds from the sale of Malmyzh, combined with ongoing royalty and pre-production payments, have yielded a robust balance sheet. EMX is utilizing this strong position to take advantage of new royalty generation, royalty acquisition, and investment opportunities to grow the portfolio and build shareholder value.

About EMX. EMX is a precious and base metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to the risks inherent to operating companies. The Company’s common shares are listed on the TSX Venture Exchange and the NYSE American Exchange under the symbol EMX. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 979-6666

Email: Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

Email: SClose@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the year ended December 31, 2018 (the “MD&A”), and the most recently filed Form 20-F for the year ended December 31, 2018, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the 20-F and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

VANCOUVER, British Columbia, April 16, 2019 (GLOBE NEWSWIRE) — Nevada Copper Corp. (TSX: NCU) (“Nevada Copper” or the “Company”) is pleased to announce the filing of a new technical report for its 100%-owned Pumpkin Hollow property near Yerington, Nevada (“Pumpkin Hollow” or the “Property”). This technical report, entitled “NI 43-101 Technical Report: Nevada Copper Corp., Pumpkin Hollow Project, Open Pit and Underground Mine Prefeasibility Study (PFS)” (the “Technical Report”), has an effective date of January 21, 2019 and supersedes all previously filed technical reports for the Property.

The Technical Report describes the Pumpkin Hollow Property and its advancement based on a phased development approach of the underground and open pit deposits as stand-alone projects. The Technical Report includes a pre-feasibility study for the stand-alone underground project (the “Underground Project”) initially completed in 2017, and a newly completed pre-feasibility study (the “Open Pit PFS”) for the open pit project (the “Open Pit Project”) at Pumpkin Hollow. The Underground Project is currently in construction, with initial production forecast for the end of 2019, while the Open Pit Project is in a study phase of development. Development options and timing of the Open Pit Project construction and operations remain flexible.

The Open Pit PFS demonstrates enhanced economics for Nevada Copper’s Open Pit Project as Nevada Copper continues to advance the Open Pit Project towards an ultimate construction decision. The Open Pit PFS continues to apply the Company’s philosophy of phased development, and low-capital intensity growth. The Open Pit Project has all the material permits required for mine construction and operations.

OPEN PIT PFS HIGHLIGHTS

- Further improved project economics versus previous studies1:

° Project IRR increased to 23% pre-tax (21% post-tax)

° NPV7.5% of US$1,042M pre-tax (US$829M post-tax)2

° EBITDA $252M per annum life of mine average (excluding ramp-up period) ° Peak annual copper production of 111,000 tonnes (244Mlbs)

° Copper grades of 0.69% Cu-eq. over first five years

° C1 Cash Costs of US$1.73/lb net of by-product credits

° Continued focus on low operational risk, including traditional mining methods and dry stack tailings

° Life of mine over 19 years - Demonstrated scope for deposit expansion:

° The 2018 drilling has successfully extended the deposit, to the north and west (within and beyond as per the figure below) the North pit shell and demonstrated further expansion potential in multiple directions

° Open pit Inferred Resources3 have increased as a result of the new resource estimate

° As previously announced in connection with the 2019 exploration program, further drilling is planned to test the full extent of the open pit deposit and to seek to upgrade Inferred resources for inclusion in the Open Pit mine plan (see news release dated April 11, 2019) - Favorable upfront cost, simplified build and phased expansion:

° Initial Capex of US$672M

° Low capital intensity of US$9,544/annual tonne4 Cu-eq.5 production

° Phased production growth comprising an initial production scale of 37kstpd6 with expansion to 70kstpd and flexibility over timing of expansion

° Potential to fund ongoing development work and construction through future cash flows from the stand-alone Underground Project at Pumpkin Hollow, reducing need to access equity capital markets - Attractive whole of property (stand-alone Underground Project and stand-alone Open Pit Project) economics7:

° Combined IRR of 24% pre-tax (22% post-tax)

° Combined NPV of US$1,320M pre-tax (US$1,062M post-tax)

° Combined Cu-eq production of 150,000 tonnes (330Mlbs) per annum at peak production.

Matt Gili, President and Chief Executive Officer of Nevada Copper, commented:

“We are very pleased with the new PFS for our Open Pit Project at Pumpkin Hollow. The results clearly illustrate the potential to put this large, open pit project into production with a further improved internal rate of return and continued low capital and operating costs.

The 2018 completed drill program included in the Open Pit PFS has successfully extended the open pit mineralization. Importantly, it also highlights the need for further drilling to test the full extent of the deposit and to continue expanding and upgrading the open pit resources.

We continue to apply our strategy of pursuing low-capital intensity and staged production growth to generate shareholder returns. This same philosophy was applied in the development of the Underground Project, which we expect to commence production in Q4 2019. The study’s focus of generating project value through an improved internal rate of return, has resulted in a higher grade driven mine plan. This means we expect the open pit project to be more robust with regards to lower copper prices, while also affording potential flexibility for mining more of the mineral resource under differing market conditions.”

OPEN PIT PROJECT PFS SUMMARY

The PFS proposes development of the Open Pit Project independently from the Company’s Underground Project currently under construction. The Open Pit Project was studied with a phased approach with an initial 37kstpd mining rate, with later expansion to 70kstpd. This phased development plan for the Open Pit Project yields a substantially lower upfront capital cost compared to previous studies8. This plan is aligned with the Company’s philosophy of focusing on capital efficiency and maximizing economic returns by staged development and a similar “margin-over-tons” philosophy that has been used to optimize the Underground Project.

The PFS utilizes data gathered over the recent years on drilling, metallurgy, environmental design, with a focus on delivering maximum project value and economic returns. The proposed Open Pit Project plan includes additional drilling in areas that have mineralization open within the pit boundary that are currently Inferred resources, as well as areas where the boundary of mineralization remains open.

Golder Associates Ltd. (“Golder”), Sedgman Canada Limited, part of the CIMIC Group (“Sedgman”) and Tetra Tech Inc. (“Tetra Tech”) prepared the Open Pit PFS and the Technical Report, supported by the Nevada Copper project team.

Geology and Mineralization

The Property is located within the Walker Lane mineral belt of western Nevada. Within the Property, the Western deposits, comprising the North and South deposits, represent the proposed Open Pit Project. The North deposit is a Cu-rich, magnetite-poor skarn breccia body hosted by hornfels of the Gardnerville Formation. The South deposit is a magnetite-chalcopyrite body closely associated with an intrusive contact of granodiorite into limestones of the Mason Valley Formation.

The Open Pit PFS incorporated the 2015 and 2018 drilling results in the updated Open Pit resource. Both programs intersected new mineralization, successfully upgrading waste and Inferred resource material into Indicated resources. High grade mineralization was also intersected within and outside the current pit boundaries and remains open at depth, generating new underground targets.

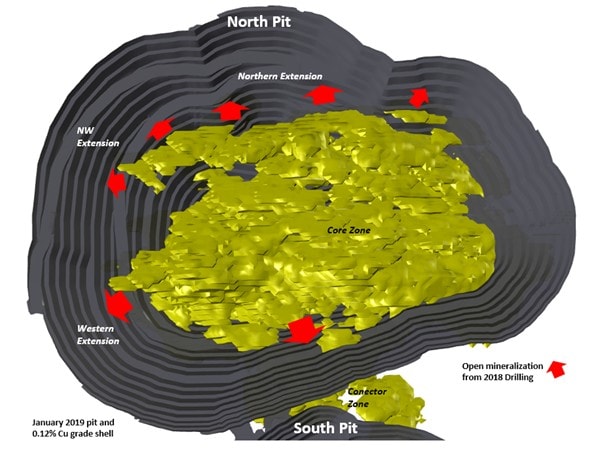

The areas of open mineralization are shown in the figure below for the North deposit. The arrows indicate the zones of mineralization that remain open and are targets for further drilling to potentially expand the mineralization boundary, as well as potentially continue to upgrade mineral categories from Inferred to Indicated mineral resources in a range of zones.

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/ef452e94-0bf1-49c8-984b-50f433010479

North Deposit – Plan View of Mineralization and Open Zones

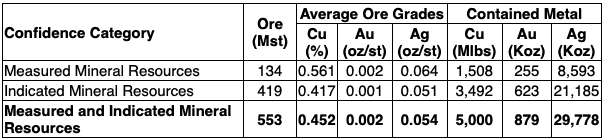

Open Pit Mineral Resources

The Mineral Resource estimate9 used as the basis for the Open Pit PFS is summarized below. Mineral Resources are subdivided into classes of Measured, Indicated and Inferred, with the level of confidence reducing with each class respectively. Mineral Resources are reported as in situ tonnage and are not adjusted for mining losses or mining recovery. The Mineral Resources reported are inclusive of those reported in Mineral Reserves. The reader is cautioned that Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Note: Effective date of Open Pit Mineral Resource is January 21, 2019.

CIM industry best practices were followed in the development of Mineral Resources:

- Totals may not total due to rounding.

- Cu Eq. calculated Mineral Resources were estimated at a cutoff grade of 0.12% Cu

- Resources were contained within a pit shell produced using a Cu price of $3.75/lb, Au $1,343/Troy Oz and Ag at $19.86/ Troy Oz

- Includes North, South and South-East deposits.

- Excludes materials that are oxidized, transition or volcanics.

- Columns using prices / recoveries: Cu $3.20/lb & 89.3%; Au $1,325/Oz & 67.3%; and Ag $20.01/Oz & 56.3%.

The updated resource model has resulted in an increased amount of Inferred resource tonnage compared to previous resource estimates (please refer to footnote 7 to this press release). This material may potentially be upgraded to Indicated Resources with further technical work, but there is no certainty that Inferred resources will ever be upgraded.

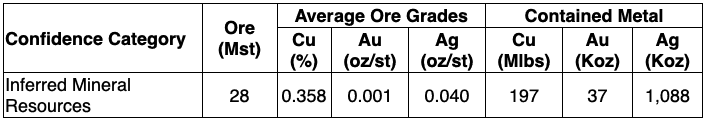

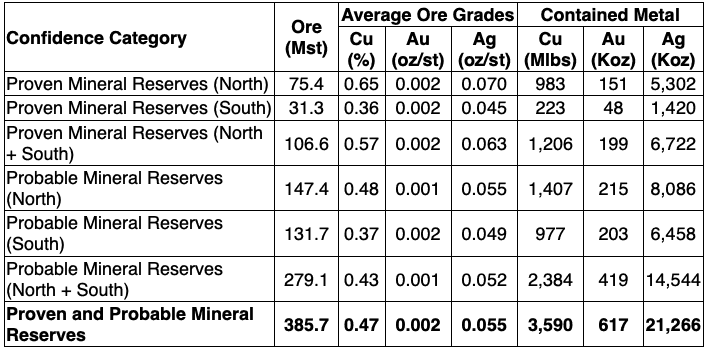

Open Pit Mineral Reserves

The tons, grades, and classification of the Mineral Reserves estimate10 in the Open Pit PFS mine plan are tabled below.

Note: Effective date of Open Pit Mineral Reserve is January 21, 2019.

CIM industry best practices were followed in the development of the Mineral Reserve

- Inferred Mineral Resource was considered waste for the open pit reserve estimate.

- The cutoff 0.129% Cu for the North Pit and 0.132% Cu for the South Pit is based on the copper processing recoveries (90% for the North Pit, 88% for the South Pit) and costs. Dilution was assumed 5% and mining recovery of 98%

- Calculations used price forecast/recoveries: Cu $2.75/lb & described above, Au $1,343/toz & 67%, and Ag $19.86/toz & 56%.

- A selling cost of $0.55/lb was applied to the Cu in concentrate to account for NSR. No selling costs were applied to Au or Ag. NSR and CuEq calculations

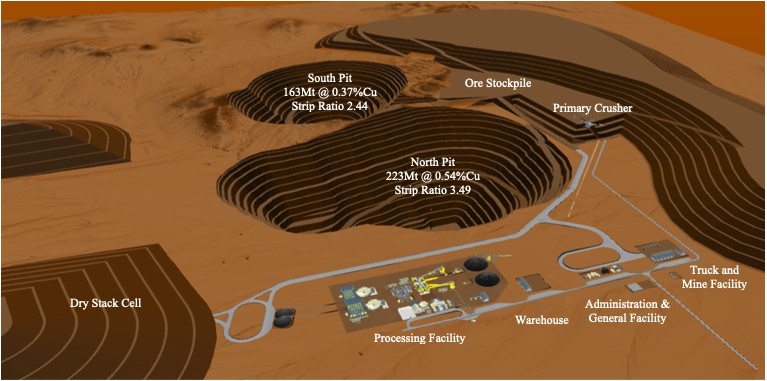

Open Pit Project Mining Plan

The Open Pit Project has been designed to be a conventional truck-and-shovel operation with a combination of hydraulic and electric cable shovels and haul trucks. The Open Pit Project mineral reserves are found in the North and South deposits. The Mine Plan has been phased and developed to minimize pre-production stripping to deliver material as soon as possible and provide an attractive life of mine grade profile of 0.50% Cu-eq (0.47%Cu) and the first five years with a grade average of 0.69% Cu-eq (0.65% Cu). Mining is planned to commence in the higher-grade North pit, with the South pit being mined after the North. Stockpiling of ore is used in the mine plan to optimize the grade profile for the mill feed. The Mine and Mill Plan produces at 37kstpd rate for production years 1 to 6, before expanding to 70kstpd rate from year 7 to 19. Material is delivered by haul truck to a primary crusher, with discharge from the crusher conveyed to a coarse stockpile adjacent to the mill.

Mining is planned to be conducted using 50 ft. benches with variable inter-ramp pit slope angles (49° to 55°) depending on geotechnical domain. The PFS utilized the Geovia Whittle™ pit optimization process to define ultimate pit limits and target the most economic ore early in the mine life. Over the mine life, a total of 1,561Mst will be moved, which includes 386Mst of ore as mill feed.

The mining fleet includes 320ton class trucks, loaded by 64 yd3 electric shovels, 47 yd3 diesel-hydraulic and 30 yd3 wheel loaders. Drill and blast will be undertaken with track-mounted drill rigs drilling 10¾ inch holes. Explosives are planned as down hole service by explosives supplier. Haul roads are designed to be 119 ft. wide to allow for two-way traffic at a maximum gradient of 10%. Strip ratios vary over life of mine with an average of 2.8 excluding pre-strip (3.0 including pre-strip). The Figure below illustrates a long-section of the Open Pit Project showing the ultimate pit as set out in the PFS and the resource model grades.

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/e3fa3659-dc34-444c-bfdf-c78eddbc29fd

Long-section Looking East of PFS Ultimate Pit

Long-section Looking East of PFS Ultimate Pit

Open Pit Processing Plant

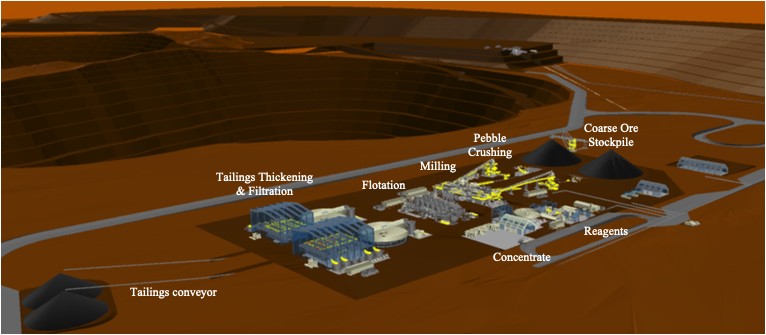

The treatment technology proposed for the project is conventional flotation concentration. The processing plant will consist of crushing and grinding circuits, followed by a flotation process to recover and upgrade copper, gold and silver from the feed material at a daily production rate of 37kstpd for the first 6 years of production before expanding to 70kstpd for the remaining 13 years of production.

Crushed material with the approximate size P80 of 6 inch will be fed to the grinding circuit via SAG Mill feed conveyor. Oversized material from the SAG Mill trommel screen will be conveyed to the pebble crusher. The pebble crusher will discharge to the SAG Mill. The product from the SAG Mill will be fed into the grinding cyclone feed pump-box, from where it will be pumped to the primary cyclone cluster. The cyclone underflow product will report via chute to the ball mill for further grinding. The cyclone overflow product with the approximate particle grind size P80 of 150 microns will report to rougher flotation.

The flotation circuit will consist of roughing and two stages of cleaner flotation, with the single regrind mill being used for the fine grinding of the rougher concentrate. The copper concentrate will be thickened using a hi-rate thickener and the underflow pumped to the agitated stock tank prior to filtration, and the thickener overflow will be collected in the process water tank. The tailings will be disposed of by dry stacking of filtered tailings. The tailings will be thickened prior to the tailings filtration plant. The PFS metallurgical test work is based on a range of test work carried out during previous studies of the deposit metallurgy and additional metallurgical test work conducted during the Open Pit PFS.

Photos accompanying this announcement are available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/b8768620-71dc-4609-bc1f-05a6cee86cdf

http://www.globenewswire.com/NewsRoom/AttachmentNg/975b7635-79e2-49ef-ae51-3b6ac22a9dad

Isometric Illustration (Looking SE) of Processing Related Facilities for the Stand-alone Open Pit PFS

Isometric Illustration (Looking SE) of Processing Related Facilities for the Stand-alone Open Pit PFS

Isometric Illustration (Looking SE) of the Stand-alone Open Pit PFS Project.

Isometric Illustration (Looking SE) of the Stand-alone Open Pit PFS Project.

Open Pit Infrastructure

The Pumpkin Hollow site is currently accessible via an existing network of roads, designed for accommodating heavy equipment and other vehicles. Power for the Open Pit Project will be drawn from the existing network of transmission lines located adjacent to the site. The site infrastructure for the Open Pit Project will include fencing, temporary facilities, network of onsite roads, water associated infrastructure including tanks and pumps, treatment plant, 120kV line with tie into nearby high voltage infrastructure, various site buildings including truck shop, warehouse, a mine dry facility, and operations offices, as well as items such as fuel storage and distribution facility and wash bay.

The Open Pit Project is estimated to provide direct employment of 400 to 500 hourly and staff personnel across the different phases of the life of mine, which would be expected to be drawn from the surrounding communities to provide support to the project. During the construction phase, the peak work force is expected to be approximately 600 to 800. The Open Pit Project construction will provide additional employment opportunities to the surrounding communities.

Open Pit Project Economic Analysis and Sensitivity Analysis

A discounted cash flow model (economic model) was prepared to analyze project economics. The model forecasts annual cash flows over the whole Open Pit Project period, including two years of construction and 19 years of production. Mine closure costs occur during the production years as ongoing reclamation and bond costs, as well as additional closure costs and bond related reclamation credits that incur minor negative and positive cashflow after production ceases for ten years. All costs and cash flows are in nominal Q4 2018 dollars; the model excludes inflation adjustments. Additional operating assumptions and results from the economic model for the Open Pit Project are presented in the table below.

1 Includes mining equipment lease costs and stockpiling. Excludes capitalized waste stripping2 Includes environmental, water and other administration costs3 C1 cash costs represents cash cost from mining through to recoverable metal delivered to the market, net of by-product credits.4 AISC represents C1 Cash Costs plus taxes and sustaining capital costs.5 All prices are held constant over the producing life of the open pit mine.

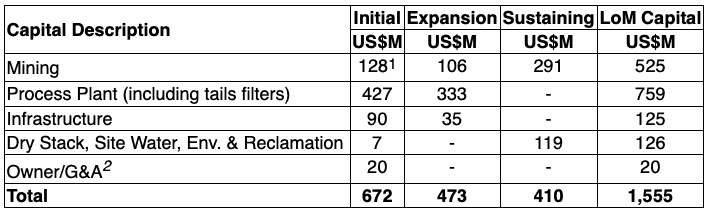

The economic analysis included U.S. federal income taxes estimated based on a stand-alone Open Pit Project and using recent U.S. tax reform legislation, including 21% tax rate, elimination of the Alternative Minimum Tax, and an 80% annual income limitation was applied to tax loss carry forward.A breakdown of the project capital costs is shown below.

1 Includes pre-production mobile equipment leasing cost2 Includes concentrate handling offsite and bond for external power construction

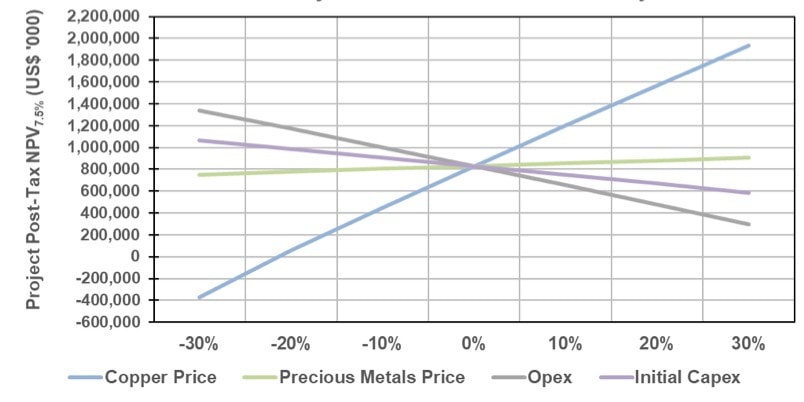

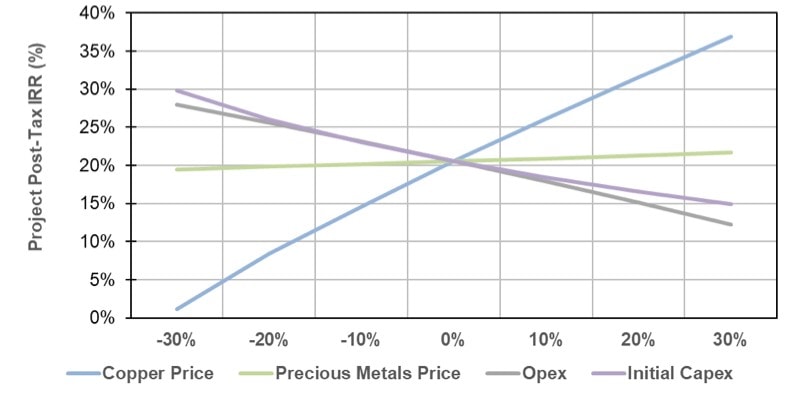

A sensitivity analysis was performed. The impacts on the results are shown in the following graphs. While the copper price change has the largest impact to the overall economic model, other inputs were tested and were shown to have a smaller impacts.

Photos accompanying this announcement are available at:

http://www.globenewswire.com/NewsRoom/AttachmentNg/78bfd1d0-0059-4915-9877-06b208969210

http://www.globenewswire.com/NewsRoom/AttachmentNg/18ccec18-4dd2-4285-b53e-e60b12ddc861

Project Post-Tax NPV7.5% Sensitivity

Project Post-Tax NPV7.5% Sensitivity

Open Pit Project Post-Tax IRR Sensitivity

Open Pit Project Post-Tax IRR Sensitivity

Conference Call and Webcast Details

Date: Wednesday, April 17, 2019

Time: 11:00 AM Eastern time (8:00 AM Pacific time)

Details to access the call live are as follows:

- Via telephone by calling 1 (888) 231-8191 in North America, or by calling +1 (647) 427-7450 outside of North America

- Via webcast at: https://event.on24.com/wcc/r/1976907/FB09C3DF44E955630E93DF32A19DD0C7

The webcast will be archived for 14 days following the call at the above-noted link. The conference call will also be recorded and available for replay until Wednesday, May 1, 2019. To access the replay, dial 1 (855) 859-2056 in North America or +1 (416) 849-0833 outside of North America and use playback passcode 7079595 to hear the recording.

Qualified Persons

The written technical disclosure and data in this news release was approved by Gregory French, P.G., Vice-President Exploration & Project Development of Nevada Copper, Robert McKnight, P.Eng., Executive Vice-President of Nevada Copper, both of whom are non-independent Qualified Persons within the meaning of NI 43-101, together with the following independent qualified persons:

- Edward Minnes P.E., Golder Associates, consultant, responsible for mine planning, mine design and cost estimation.

- Ronald Turner, PG, Golder Associates, consultant, responsible for geology and mineral resource estimation.

- Aleksandar Petrovic, P.Eng. Sedgman, consultant, responsible for design and cost estimation of the mineral processing facility and associated infrastructure.

- Vicki Scharnhorst, PE, Tetra Tech, consultant, responsible for environmental, water management and tailings management.

About Nevada Copper

Nevada Copper’s (TSX: NCU) Pumpkin Hollow project is in construction with a view to the commencement of copper production in Q4, 2019. Located in Nevada, USA, Pumpkin Hollow has substantial reserves and resources including copper, gold and silver. Its two fully-permitted projects include a high-grade underground project (under construction) and a large-scale open pit project.

Additional Information

For further information please visit the Nevada Copper corporate website (www.nevadacopper.com).

NEVADA COPPER CORP.

Matthew Gili, President and CEO

For further information call:

Rich Matthews,VP Marketing and Investor Relations

Phone: 604-355-7179

Toll free: 1-877-648-8266

Email: rmatthews@nevadacopper.com

We seek safe harbour.

________________________________

1 Source: Nevada Copper Pumpkin Hollow Project NI 43-101 Technical report: Pumpkin Hollow Development Options – pre-feasibility Study 5,000 tons/day Underground Project; Feasibility Study for a 70,000 tons/day Open Pit /Underground Project, amended report date of January 3, 2018.

2 Utilizes analyst consensus long-term copper price of $3.20/lb.

3 References to Inferred, Indicated and Measured Resources are based on the Canadian Institute of Mining (CIM) definitions

4 Based on 37kstpd mill feed period of copper production, after ramp-up.

5 Cu-eq. calculated using prices with process recoveries based on pit location: Cu $3.20/lb with 90% process recovery for North ore and 88% process recovery for South ore; Au $1,325/Oz & 67.3% process recovery for both North and South ore; and Ag $20.01/Oz & 56.3% process recovery for both North and South ore.

6 kstpd = thousand short tons per day.

7 Economic input assumptions draw from the details provided throughout the Technical Report for each stand-alone underground and open pit component of the Property. The assumed timeline for the Underground Project assumes production commencing end 2019 and assumes Open Pit Project construction starting in 2021 with production ramping up in 2023. The results are based from a combination of production, revenue, costs and cashflows as in each stand-alone economic model. The “Combined NPVs” are the arithmetic sum of the individual case NPVs, however, note that the NPVs have differing start dates and will not match the NPV of the combined annual net cashflows.

8 Source: Nevada Copper Pumpkin Hollow Project NI 43-101 Technical report: Pumpkin Hollow Development Options – pre-feasibility Study 5,000 tons/day Underground Project; Feasibility Study for a 70,000 tons/day Open Pit /Underground Project, amended report date of January 3, 2018.

At Miles Franklin we strive to find unique values or anomalies in our marketplace to offer our clients. Many consider the twenty-dollar gold piece designed by Augustus Saint-Gaudens to be the most beautiful U.S. Coin.

Compared to a 2019 American Gold Eagle selling at $83-$70 over 1oz spot gold (depending on volume), We are offering this magnificent coin in two MS grades:

- MS63 (PCGS or NGC Graded) Saint Gaudens (1907-1933) at $63 over 1 oz spot gold each.

- MS62 (PCGS or NGC Graded) Saint Gaudens (1907-1933) at $49 over 1 oz spot gold each.

Currently 1 oz Spot gold is $1275.

These numismatic gold coins historically sold for 50-300% above bullion gold prices. Recently many of our clients have been exchanging bullion gold bars and coins for numismatic gold coins. This offer represents the very best opportunity to exchange or purchase outright these pieces of history.

Call your broker Today or call our main line at 800-822-8080.

Purchase Offer not available for Minnesota Residents. Standard insured shipping rates apply.

Sincerely-

Maurice Jackson

Miles Franklin

tel: 800.505.1900

maurice@milesfranklin.com

www.milesfranklin.com

What Does the Future Hold for Miramont?

Bob Moriarty

Archives

Apr 16, 2019

After some dreadful timing and miscommunication to the market, shares in Miramont plummeted from $.47 a share to $.12 in two days at the end of March. The company dumped some poor results from six holes onto the market and the market gagged. But the scout program consisted of nine holes and on the 12th of April Miramont released the assays from the last three holes.

Companies post dismal drill results all the time and it is not a big deal. Especially with a scout drill program, hitting anything is a victory. But the market was told that three areas were being drilled and three holes would be released at a time and was surprised when six holes were announced in one press release. Actually one of the holes, hole five had some interesting potential, but that was lost in the smoke from the forest fire.

Hole number nine showed 249 meters of 0.68 g/t gold equivalent and that’s better than interesting. That says there could be something big nearby. 0.68 g/t gold equivalent would be worth about $28.22 a ton in theory. But you couldn’t mine at that depth and mill that at a profit. Now if you had a starter pit or higher-grade material nearby, 0.68-g/t material would change from being waste to being ore if you had to move it anyway.

Investors are always hoping for a giant home run hole but they happen once in a blue moon. In general a drill program is successful as long as each hole advances the project one way or another.

Had the last three holes been duds, Miramont would have had only two alternatives. They could put the project on a back burner and go look for something easier or cheaper to advance and come back to Cerro Hermoso later or they could go find a major to partner with to advance the project. In either case, the share price would be deader than a doornail until something took place to move the needle off TDC.

Naturally a third alternative might be a lot more attractive. Cerro Hermoso is in the Puno district and they grow herds of elephants there. The chance certainly exists that the property has elephant potential. But the scout program has to advance the quality and quantity of knowledge about the potential.

The first six holes barely showed sniffs but hole nine was a great hole. The very best alternative would be for Miramont to use some of that $3.5 million they still have in the bank to fund another 10-15 holes in an attempt to find that magic “Discovery” hole. The press release talking about the first six holes almost put Cerro Hermoso on hold but hole nine brought it back to life.

The company is an advertiser. I am a shareholder from both Puno and in the PP and naturally that makes me biased.

Miramont Resources

MONT-C $.15 (April 12, 2019)

54.8 million shares

Miramont Resources website

###

Bob Moriarty

President: 321gold

Archives

April 17, 2019

Vancouver, BC, Canada, April 17, 2019, Allegiant Gold Ltd. (“ALLEGIANT”) (AUAU: TSX-V) (AUXXF: OTCQX) reports that it has completed drilling at its Adularia Hill gold project located in Nevada. ALLEGIANT completed 21 RC holes totaling 3,170 meters at Adularia Hill; assays are pending.

ALLEGIANT also reports that it has received assays from drilling carried-out at its Monitor Hills project, located in Nevada. Drilling at Monitor Hills encountered broad zones of anomalous gold but better grade gold was only present in narrow 1.5 to 3 meter intervals. Overall the drilling results are considered too low-grade, and in the context of prioritizing expenditures on ALLEGIANT’S large portfolio of prospective exploration properties, ALLEGIANT will assess its future plans for Monitor Hills.

ALLEGIANT plans drilling at a total of six “discovery potential” projects located principally in the world-class gold mining jurisdiction of Nevada. The drilling campaign was initiated at the Red Hills project in August 2018; Adularia Hill was the 5th project to be drilled.

Adularia Hill is located within ALLEGIANT’s Eastside claim block, about 12 km south of the Original Zone gold deposit, approximately 2 km north of the past producing open-pit-heap-leach Boss Mine, and some 2 km north of Castle, which hosts an historical gold resource. The Adularia Hills target was discovered during geologic and alteration mapping by ALLEGIANT followed by surface sampling of outcrop and float. ALLEGIANT collected 150 surface samples in an ovoid area about 1,400 meters by 850 meters. Thirty of the 140 samples contained gold values ranging from 0.1 to a maximum of 1.5 g/t gold. Gold occurs in and along structures and silica ribs with associated stockworks of quartz and adularia veining. The mineralized structures cut Tertiary andesite, tuffs, rhyolite plugs and flow domes, and Ordovician basement rocks. Outcrops make up about 20-30% of the target area with the rest covered by shallow alluvium.

There was no previous drilling at Adularia Hill.

Qualified Person

Andy Wallace is a Certified Professional Geologist (CPG) with the American Institute of Professional Geologists and is a Qualified Person as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Wallace has reviewed and approved the technical content of this press release.

About ALLEGIANT

ALLEGIANT owns 100% of 11 highly-prospective drill-ready gold projects in the United States, 8 of which are located in the mining-friendly jurisdiction of Nevada. ALLEGIANT is one of the most active explorers in the gold sector; five projects with “discovery potential” have been drilled since August 2018. ALLEGIANT’s flagship Eastside project hosts a large and expanding gold resource, is district scale, and is located in an area of excellent infrastructure. Preliminary metallurgical testing indicates that both oxide and sulphide gold mineralization at Eastside is amenable to heap leaching.

Further information regarding ALLEGIANT can be found at www.allegiantgold.com

ON BEHALF OF THE BOARD,

Robert F. Giustra

Chairman & CEO

For more information contact:

Investor Relations

(604) 634-0970 or

1-888-818-1364

ir@allegiantgold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain statements and information contained in this press release constitute “forward-looking statements” within the meaning of applicable U.S. securities laws and “forward-looking information” within the meaning of applicable Canadian securities laws, which are referred to collectively as “forward-looking statements”. The United States Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for certain forward-looking statements. Forward-looking statements are statements and information regarding possible events, conditions or results of operations that are based upon assumptions about future economic conditions and courses of action. All statements and information other than statements of historical fact may be forward-looking statements. In some cases, forward-looking statements can be identified by the use of words such as “seek”, “expect”, “anticipate”, “budget”, “plan”, “estimate”, “continue”, “forecast”, “intend”, “believe”, “predict”, “potential”, “target”, “may”, “could”, “would”, “might”, “will” and similar words or phrases (including negative variations) suggesting future outcomes or statements regarding an outlook. Forward-looking statements in this and other press releases include, but are not limited to statements and information regarding: Allegiant’s property holding costs savings or income generated from optioning out certain properties; Allegiant’s drilling and exploration plans for its properties, including anticipated costs and timing thereof; the potential of hosting good grade gold mineralization or expansion; Allegiant’s belief with respect to North Brown anomalies and the related transportation of mineralized fragments, including the discovery of the source of the mineralized breccia fragments; indications of mineralization that is amenable to heap leaching; Allegiant’s plans for growth through exploration activities, acquisitions or otherwise; and expectations regarding future maintenance and capital expenditures, working capital requirements; and Barrian’s plan to complete an initial public offering and its acquisition of certain properties. Such forward-looking statements are based on a number of material factors and assumptions and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to differ materially from those anticipated in such forward-looking information. You are cautioned not to place undue reliance on forward-looking statements contained in this press release. Some of the known risks and other factors which could cause actual results to differ materially from those expressed in the forward-looking statements are described in the sections entitled “Risk Factors” in Allegiant’s Listing Application, dated January 24, 2018, as filed with the TSX Venture Exchange and available on SEDAR under Allegiant’s profile at www.sedar.com. Actual results and future events could differ materially from those anticipated in such statements. Allegiant undertakes no obligation to update or revise any forward-looking statements included in this press release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.