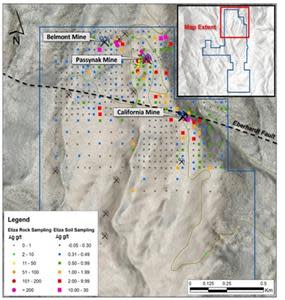

Figure 1

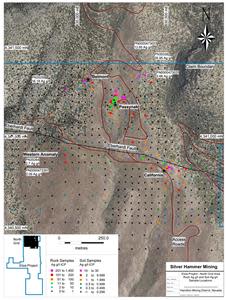

Figure 2

VANCOUVER, British Columbia, Oct. 25, 2022 (GLOBE NEWSWIRE) — Silver Hammer Mining Corp. (CSE: HAMR; OTCQB: HAMRF) (the “Company” or “Silver Hammer”) is pleased to report that soil sampling results at the Eliza Project (“Eliza” or the “Project”) have defined significant anomalies that extend well beyond the small historical mine areas.

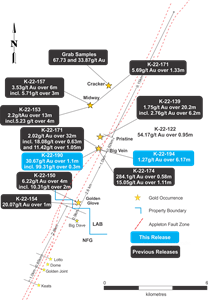

A total of 518 soil samples were collected from the northern area of Eliza with results ranging from below detection limit to 26.95 grams per tonne (“g/t”) silver (“Ag”). Thirty-nine samples returned grades higher than 1 g/t silver. Results with over 0.5 g/t Ag are highly anomalous and can be considered a tracer of potential larger systems. The purpose of the soil sampling program was to further define the extent of mineralization within the northern area and examine any geochemical patterns that may exist. The soil sampling program has outlined four distinct target areas, which are now being further evaluated. The historic mining areas include the California, Passynak and Belmont mines; a new fourth area, the Western Anomaly will be added to our focus going forward.

President and CEO, Morgan Lekstrom commented: “Our thesis has always been that a methodical and modern exploration approach in districts with small-scale, high-grade historical production can lead to the discovery of much larger mineralized systems. Soil sampling does not typically return silver results greater than 1 g/t, so we are very encouraged not only by the widespread nature of mineralization, but by the highly anomalous values from this program.” Lekstrom added, “This type of low-cost, high-impact exploration work aligns with our current view towards maintaining a strong treasury during the current market environment and we have initiated preliminary discussions with prospective partners on our Nevada assets as we advance these projects toward a drill-ready stage.”

Soil samples are commonly used as a targeting tool to find major discoveries and these results provide evidence supporting the potential for widespread mineralization well beyond the small historical mines dating back to the1860’s Hamilton Silver Rush.

Eliza North Soil Grid

To date, 518 soil samples have been collected from the Eliza North Grid Area, which includes the Passynak, Belmont and California historical mines. The mines are accessible by road and are situated within 670 m of each other. Each mine has a distinct geochemical anomaly collectively stretching over 700 m.

Passynak

The Passynak area is the strongest multi-element anomaly. Significant soil sample results were found over a broad 200 m diameter area. Twelve soil samples show greater than 1 g/t Ag with anomalous copper, lead, antimony, and zinc. Care and attention were given to eliminate any samples collected from past mine dumps or transported surface debris.

Table 1. Sample Result Highlights from Passynak Anomaly

| Sample_ID | Silver ICP g/t | Copper ICP g/t | Lead ICP g/t | Antimony ICP g/t | Zinc ICP g/t |

| PN35339 | 26.95 | 23.4 | 72 | 9.81 | 63 |

| PN0000473023 | 13.95 | 18.9 | 42 | 5.68 | 83 |

| PN35342 | 4.88 | 18.3 | 36 | 4.69 | 76 |

| PN0000473137 | 4.46 | 313.7 | 289 | 17.39 | 555 |

| PN0000473125 | 3.83 | 301.8 | 581 | 38.58 | 398 |

| PN0000473025 | 3.66 | 19.5 | 25 | 3.00 | 86 |

| PN0000473120 | 3.51 | 559.3 | 1223 | 27.83 | 1316 |

| PN35314 | 2.51 | 153.8 | 207 | 14.24 | 339 |

| PN35336 | 1.27 | 14.0 | 29 | 2.22 | 96 |

| PN35333 | 1.25 | 204.8 | 130 | 9.29 | 395 |

| PN0000473143 | 1.22 | 141.9 | 138 | 6.49 | 299 |

| PN0000473135 | 1.09 | 60.3 | 120 | 15.74 | 107 |

Belmont

The Belmont area is characterized by high silver-in-soil values, plus accessory copper, lead, antimony, and zinc. Further work in this area is required to define the zone and the nature of the mineralization.

Table 2. Sample Result Highlights from Belmont Anomaly

| Sample_ID | Silver ICP g/t | Copper ICP g/t | Lead ICP g/t | Antimony ICP g/t | Zinc ICP g/t |

| PN35258 | 16.18 | 21.0 | 66 | 7.07 | 89 |

| PN0000473286 | 8.03 | 91.6 | 171 | 19.15 | 157 |

| PN0000473288 | 1.68 | 12.5 | 26 | 2.54 | 91 |

| PN35286 | 1.02 | 36.2 | 82 | 6.02 | 128 |

California

The California prospect area is as widespread as Passynak and crosses the Eberhardt Fault on both the north and south. The Eberhardt Fault is considered a main structure and integral to the mineralizing system. Antimony remained fairly consistent; however, gold appeared in minor values in surface soil samples.

Table 3. Sample Result Highlights from California Anomaly

| Sample_ID | Silver ICP g/t | Copper ICP g/t | Lead ICP g/t | Gold FA ICP ppb | Zinc ICP g/t |

| PN35361 | 15.57 | 25.7 | 30 | 48 | 87 |

| PN35331 | 9.31 | 22.5 | 47 | -3 | 80 |

| PN0000473259 | 7.66 | 17.8 | 25 | 15 | 90 |

| PN35371 | 4.09 | 16.8 | 26 | 6 | 95 |

| PN0000473163 | 4.00 | 16.2 | 22 | 36 | 98 |

| PN0000473152 | 2.44 | 21.9 | 17 | -3 | 99 |

| PN0000473166 | 2.35 | 24.1 | 19 | 14 | 94 |

| PN35330 | 2.32 | 15.9 | 40 | 5 | 95 |

| PN35318 | 1.94 | 19.1 | 39 | 18 | 131 |

| PN0000473106 | 1.81 | 16.1 | 18 | 3 | 54 |

| PN0000473095 | 1.66 | 17.8 | 24 | 17 | 112 |

| PN0000473260 | 1.63 | 18.4 | 24 | 4 | 99 |

| PN35344 | 1.51 | 16.7 | 23 | -3 | 68 |

| PN35370 | 1.48 | 15.6 | 41 | 22 | 89 |

| PN35357 | 1.38 | 16.1 | 48 | 3 | 91 |

| PN0000473164 | 1.20 | 20.5 | 15 | 3 | 85 |

New Western Anomaly

Two samples south of the Eberhardt Fault on the west side of the grid reported silver and gold anomalies. This area is on the edge of a wider spaced soil grid, but adjacent to the prospective fault zone and will be investigated further in near future work with prospecting and geochemistry.

Table 4: Sample Result Highlights from New Western Anomaly

| Sample_ID | WGS East | WGS North | Silver ICP g/t | Copper ICP g/t | Lead ICP g/t | Gold FA ICP ppb | Zinc ICP g/t |

| PN0000473397 | 630525.1 | 4340803 | 2.09 | 26.9 | 27 | 0.233 | 161 |

| PN35264 | 630304.6 | 4340950 | 2.70 | 21.9 | 30 | 0.298 | 89 |

Sampling Protocol

Soil samples were collected from the “B Horizon” every 75 metres (“m”) on 75m line spacing and then infilled on a 37.5 m spacing in areas of greater interest. Typical sample depths ranged between 30 and 45 centimetres.

Quality Assurance/Quality Control

Assays were processed by American Assay Laboratories Inc. in Sparks, Nevada. The laboratory has its own QA/QC protocols running standards and blanks with duplicate samples in each batch stream. Silver Hammer geological staff inserted a system of field duplicates, blanks and lab standards into the sample stream every 10 samples to ensure QA/QC of the work. A multi-element assay method was used for silver and all other elements called ICP-5AM48 with an ICP-OES/MS finish and reported in ppm. Gold was assayed by fire assay with an ICP finish and reported down to 3 ppb in method FA-PB30-ICP.

Qualified Person

Technical aspects of this press release have been reviewed and approved by Philip Mulholland, a Certified Professional Geologist (CPG) with the American Institute of Professional Geologists, a contractor of the Company and the designated Qualified Person (QP) under National Instrument 43-101.

About Silver Hammer Mining Corp.

Silver Hammer Mining Corp. is a junior resource company advancing the flagship past-producing Silver Strand Mine in the Coeur d’Alene Mining District in Idaho, USA, as well both the Eliza Silver Project and the Silverton Silver Mine in one of the world’s most prolific mining jurisdictions in Nevada and the Lacy Gold Project in British Columbia, Canada. Silver Hammer’s primary focus is defining and developing silver deposits near past-producing mines that have not been adequately tested. The Company’s portfolio also provides exposure to copper and gold discoveries.

Disclaimer note: Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company’s projects.

On Behalf of the Board of Silver Hammer Mining Corp.

Morgan Lekstrom, President and CEO

Corporate Office: 551 Howe Street, Vancouver, British Columbia V6C 2C2, Canada

For investor relations inquiries, contact:

Kristina Pillon, High Tide Consulting Corp.

T: 604.908.1695

E: investors@silverhammermining.com

For media inquiries, contact:

Adam Bello, Primoris Group Inc.

T: 416.489.0092

E: media@primorisgroup.com

The CSE does not accept responsibility for the adequacy or accuracy of this release.

The Canadian Securities Exchange has neither approved nor disapproved the contents of this press release.

Photos accompanying this announcement are available at