VANCOUVER, BC / ACCESSWIRE / June 23, 2023 / Stillwater Critical Minerals Corp. (TSXV:PGE)(OTCQB:PGEZF) (the “Company” or “Stillwater”) announced today that it has executed a definitive agreement for a strategic equity investment by Glencore Canada Corporation, a wholly-owned subsidiary of Glencore plc (“Glencore”) in the form of a non-brokered private placement financing (the “Placement) for exploration and development activities at the Company’s North American nickel projects, as well as for working capital and general and administrative expenses.

Pursuant to the Placement, Glencore has agreed to purchase 19,758,861 units of Stillwater at a price of $0.25 per unit for gross proceeds of $4.94 million, with each unit comprising one common share and 0.70 of a common share purchase warrant. Each full warrant shall entitle Glencore to purchase one common share at an exercise price of $0.375, providing up to approximately $5.2 million additional funding, if exercised in full. The warrants shall be exercisable for three years from the date of issue and contain a customary acceleration provision, which shall be effective if the volume weighted average trading price of the common shares on the TSX-V is greater than $0.5625 for a period of 20 consecutive trading days.

Following closing of the investment, Glencore will have ownership and control of 9.99% of the outstanding common shares of Stillwater on a non-diluted basis and, including the warrants, 15.87% of the outstanding common shares on a partially diluted basis. Glencore does not currently own or control any securities of the Company.

Stillwater Critical Minerals President and CEO, Michael Rowley, stated, “We are very pleased to welcome Glencore, one of the top five largest mining companies in the world, as a major investor. This represents a major step forward for Stillwater as we advance our flagship Stillwater West project with the vision of becoming a large-scale source of battery and precious minerals that are now listed as critical in the US, and elsewhere. There are very few projects globally, and especially located within the United States, that offer the combination of grade and scale in a producing district that we see at Stillwater West. We are now booking drills and crews for our 2023 drill campaign with a focus on expansion of the high-grade nickel-copper sulphides identified in our past campaigns. We look forward to announcing further details in the coming weeks, along with the start of drilling.”

In connection with the Placement, Stillwater and Glencore have agreed to enter into an investor rights agreement, pursuant to which Glencore will be entitled to certain customary rights including participation in future equity issuances and a right to maintain its pro-rata position in Stillwater.

In addition, a technical committee will be formed with representatives from each company.

Net proceeds of the private placement are intended to be used for exploration and development activities at the Company’s North American nickel projects, as well as for working capital and general and administrative expenses.

The Placement is expected to close, subject to customary conditions, upon acceptance by the TSX Venture Exchange. All securities issued pursuant to the Placement will be subject to a four-month hold period from the date of issuance in accordance with applicable securities laws.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States of America. The common shares of Stillwater Critical Minerals have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.

About Glencore and its Holdings in the Company

Glencore is one of the world’s largest global diversified natural resource companies and a major producer and marketer of more than 60 commodities that advance everyday life. Through a network of assets, customers and suppliers that spans the globe, Glencore produces, processes, recycles, sources, markets and distributes the commodities that support decarbonisation while meeting the energy needs of today.

With around 140,000 employees and contractors and a strong footprint in over 35 countries in both established and emerging regions for natural resources, Glencore’s marketing and industrial activities are supported by a global network of more than 40 offices.

Glencore’s customers are industrial consumers, such as those in the automotive, steel, power generation, battery manufacturing and oil sectors. Glencore also provides financing, logistics and other services to producers and consumers of commodities.

Glencore is proud to be a member of the Voluntary Principles on Security and Human Rights and the International Council on Mining and Metals. Glencore is an active participant in the Extractive Industries Transparency Initiative and is working to decarbonise its operational footprint.

Certain information in this news release is provided by Glencore in satisfaction of the early warning requirements of National Instrument 62-104 – Take-Over Bids and Issuer Bids. Glencore is acquiring the common shares and warrants for investment purposes and will continue to monitor the business, prospects, financial condition and potential capital requirements of the Company. Depending on its evaluation of these and other factors, Glencore may from time to time in the future decrease or increase its direct or indirect ownership, control or direction over securities of the Company through market transactions, private agreements, subscriptions from treasury or otherwise, or may in the future develop plans or intentions relating to any of the other actions listed in (a) through (k) of National Instrument 62-103F1- Required Disclosure Under the Early Warning Requirements.

For the purposes of this press release and early warning disclosure, the number and percentages of outstanding common shares owned and controlled by Glencore following completion of the investment is based on 197,786,398 outstanding common shares following completion of the investment.

Glencore’s address is 100 King Street West, Suite 6900, P.O. Box 403, Toronto, Ontario, Canada, M5X 1E3. Glencore is incorporated under the laws of Ontario. An early warning report in respect of the investment will be filed under the Company’s profile on SEDAR at www.sedar.com. For a copy of the report or for further Glencore information, please contact Peter Fuchs at (416) 305-9273, peter.fuchs@glencore.ca.

About Stillwater Critical Minerals Corp.

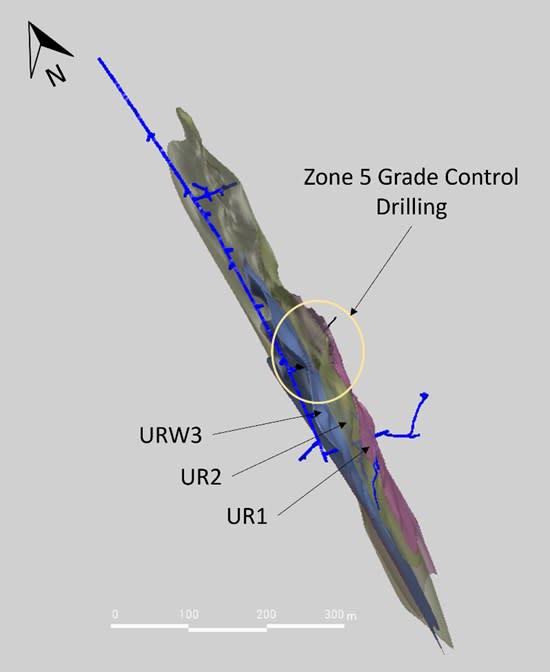

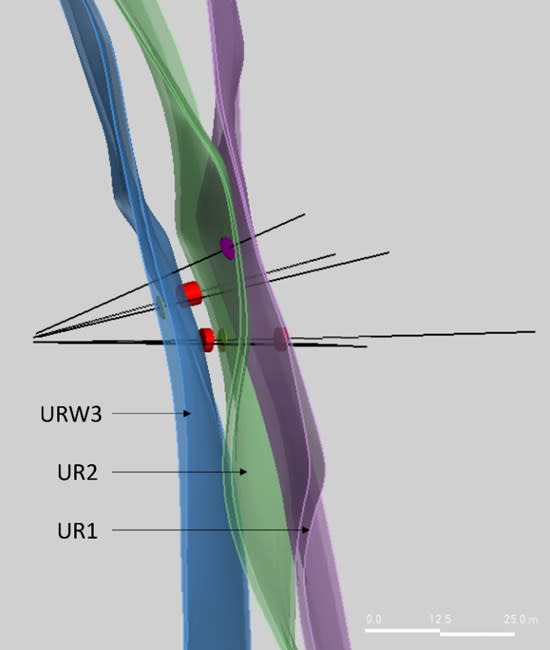

Stillwater Critical Minerals (TSX.V: PGE | OTCQB: PGEZF) is a mineral exploration company focused on its flagship Stillwater West Ni-PGE-Cu-Co + Au project in the iconic and famously productive Stillwater mining district in Montana, USA. With the addition of two renowned Bushveld and Platreef geologists to the team, the Company is well positioned to advance the next phase of large-scale critical mineral supply from this world-class American district, building on past production of nickel, copper, and chromium, and the on-going production of platinum group and other metals by neighboring Sibanye-Stillwater. An expanded NI 43-101 mineral resource estimate, released January 2023, delineates a compelling suite of critical minerals contained within five Platreef-style nickel and copper sulphide deposits at Stillwater West, which host a total of 1.6 billion pounds of nickel, copper and cobalt, and 3.8 million ounces of palladium, platinum, rhodium, and gold, and remains open for expansion along trend and at depth.

Stillwater Critical Minerals also holds the high-grade Black Lake-Drayton Gold project adjacent to Treasury Metals’ development-stage Goliath Gold Complex in northwest Ontario, currently under an earn-in agreement with Heritage Mining, and the Kluane PGE-Ni-Cu-Co critical minerals project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory.

The Company’s address is 904, 409 Granville Street, Vancouver, British Columbia, V6C 1T2.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director – Stillwater Critical Minerals

Email: info@criticalminerals.com

Web: http://criticalminerals.com

Phone: (604) 357 4790

Toll Free: (888) 432 0075

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Stillwater believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Stillwater and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Stillwater Critical Minerals

View source version on accesswire.com:

https://www.accesswire.com/763305/Stillwater-Critical-Minerals-Announces-999-Strategic-Investment-by-Glencore