Brent Cook of Exploration Insights sits down with Maurice Jackson of Proven and Probable to discuss the positives and negatives of the mining sector in 2020. Mr. Cook will address the importance for every speculator to have boots on the ground via site visits. Find out which precious and base metals have Mr. Cook’s attention in 2020.

Category: Project Generators

EMX Royalty

(TSX.V: EMX | NYSE: EMX)

Here is another example of the business acumen that makes EMX Royalty the Royalty Generator.

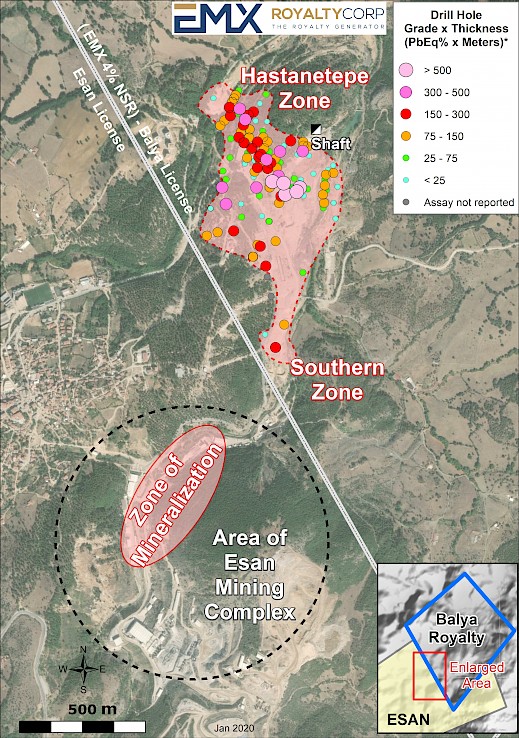

The Balya royalty property is a prime example of the execution of EMX’s royalty generation business model. EMX initially acquired Balya from a government auction in Turkey, having recognized the potential for new discoveries of mineralization on the Property. EMX then conducted several phases of exploration on the Property and subsequently established a royalty partnership with Dedeman (and now Esan), who funded further advancement of the project through the exploration and development phases. Esan expects to combine production from the EMX royalty property and its own mining operation on the adjacent license to feed its mill and processing facilities in the Balya mining district. This would represent enhanced royalty revenue from an organically generated EMX royalty asset.

Investor Relations

Mr. Scott S. Close

Email: sclose@emxroyalty.comPhone: +1 (303) 973-8585

Riverside Resources

(TSX.V: RRI | OTCQB: RVSDF)

In this exclusive interview CEO Dr. John-Mark Staude of Riverside Resources sits down with Maurice Jackson of Proven and Probable to provide updates on the Oakes Project, located in Western Ontario, Canada. Dr. Staude will discuss identified target areas, JV partners, mapping, geophysics, strike length. Riverside Resources is making some impressive strategic moves, find out more here.

For investor questions please call or email:

Communications Team 778-327-6671 Email info@rivres.com

Riverside Resources

(TSX.V: RRI | OTCQB: RVSDF)

Riverside’s President and CEO, John-Mark Staude, stated: “2019 Summer field work at the Oakes Project shows good continuity and rich surface grades with large size potential. The continuity of strike along the greenstone gold belt is similar to other known major deposit targets. This was a project generated out of data integration and regional knowledge, which was then staked by Riverside as part of our Prospect Generative business. The historical drilling that hit gold provides potential for expansion. Our aim was to define compelling drill targets, which we have achieved, and we now look to develop exploration partnerships and provide our shareholders with additional discovery opportunities.”

Contact Riverside Resources:

Communications Team 778-327-6671

Email info@rivres.com

Skyharbour Resources

(TSX.V: SYH | OTCQB: SYHBF)

Azincourt’s President and CEO, Alex Klenman stated: “East Preston is a large and highly prospective uranium exploration project with a comprehensive inventory of compelling drill targets, and we’re eager to begin testing the target zones.” “Earlier this year a number of factors prevented us from drilling as much as we had planned. The timing of funding, a late start, and the early onset of warmer weather cut short our efforts. However, this upcoming campaign has the benefit of not only adequate funding already in place, but also, we’re significantly ahead of the permitting and preparation process than we were last time. We will test a number of priority targets this time, so we’re excited to get going,” continued Mr. Klenman.

For more details on SHY contact:

Jordan Trimble | CEO

jtrimble@skyharbourltd.com |Telephone: 604-639-3856

Or:

Simon Dyakowski |Corporate Development and Communications

Telephone: 604-639-3850 | Email: info@skyharbourltd.com

Riverside Resources

(TSX.V: RRI | OTCQB: RVSDF)

In this exclusive interview Freeman Smith of Riverside Resources sit down with Maurice Jackson of Proven and Probable to introduce the newest Project in the Riverside Property Bank the Pichette, located in the Geraldton Beardmore Gold Belt of Ontario, Canada. Mr. Freeman will highlight the value proposition of the Pichette and potential catalysts.

For investor questions please call or email:

Communications Team 778-327-6671 Email info@rivres.com

Riverside Resources

(TSX.V: RRI | OTCQB: RVSDF)

Riverside’s President and CEO, John-Mark Staude, stated: “We are very pleased to continue growing Riverside’s Canadian portfolio with an additional gold project with great potential in the Beardmore Geraldton Gold Belt. Riverside has now built a quality, easily accessible, readily drillable portfolio of three projects in Ontario adjacent to large higher-grade gold mines. The Company will explore partnerships to begin drill testing these prospects during 2020.”

Contact Riverside Resources:

Communications Team 778-327-6671

Email info@rivres.com

Skyharbour Resources

(TSX.V: SYH | OTCQB: SYHBF)

Jordan Trimble the President, Director, and CEO of Skyharbour Resources sits down with Maurice Jackson of Proven and Probable to discuss some important topics for shareholders. The first, the uranium spot price and a number of catalysts that should make the near price go higher. Then, we will address project newsflow that will be anticipated throughout the Property Bank, more specifically on the upcoming drill program set to begin in 2020. For more details on SHY contact:

Jordan Trimble | CEO

jtrimble@skyharbourltd.com |Telephone: 604-639-3856

Simon Dyakowski | Investor Relations

info@skyharbourltd.com | Telephone: 604-639-3850

EMX Royalty

(TSX.V: EMX | NYSE: EMX)

David Cole the CEO of EMX Royalty has been demonstrating to the Market the full confidence he has in the value proposition of The Royalty Generator. Mr.Cole has purchased 646,325 shares within the past 1 year period!

We are of the opinion that EMX Royalty has the potential of witnessing a MELT UP in the share price. There are a number of catalysts that are advancing to see this come to fruition. We encourage you to contact Scott Close of Investor Relations to find out why we have matched our bullion purchases this year in shares of EMX Royatly. . . The Royalty Generator.

Investor Relations

Mr. Scott S. Close

Email: sclose@emxroyalty.comPhone: +1 (303) 973-8585https://youtu.be/ePTxDlAw2tk

EMX Royalty

(TSX.V: EMX | NYSE: EMX)

David Cole the CEO of EMX Royalty has been demonstrating to the Market the full confidence he has in the value proposition of The Royalty Generator. Mr.Cole has purchased 646,325 shares within the past 1 year period!

We are of the opinion that EMX Royalty has the potential of witnessing a MELT UP in the share price. There are a number of catalysts that are advancing to see this come to fruition. We encourage you to contact Scott Close of Investor Relations to find out why we have matched our bullion purchases this year in shares of EMX Royatly. . . The Royalty Generator.

Investor Relations

Mr. Scott S. Close

Email: sclose@emxroyalty.com

Phone: +1 (303) 973-8585

SEDI.CA