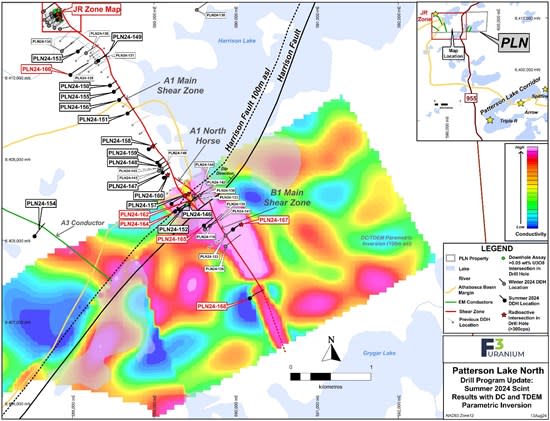

Kelowna, British Columbia–(Newsfile Corp. – September 10, 2024) – F3 Uranium Corp (TSV: FUU) (OTCQB: FUUFF) (“F3” or “the Company“) is pleased to announce scintillometer results from the current summer drill program, including PLN24-176 which was cored in the JR Zone and which returned mineralization over 11.0m, including 5.40m of high grade (>10,000 cps) containing 4.35m of composite off-scale mineralization (>65,535 cps).

Sam Hartmann, Vice President Exploration, commented:

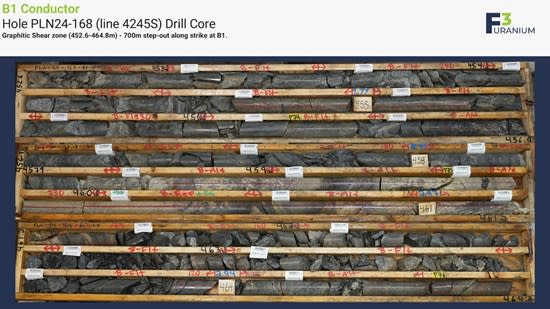

“PLN24-176 was planned to increase confidence and high-grade continuity in the heart of the JR Zone, approximately 15m in the up-dip direction of PLN24-137 (see NR April 1, 2024 and July 20, 2024). Based on total radioactivity and the intercepted width of high grade, we expect this hole to rank near the top of all drillholes at JR. Exploration remains the focus of the program; previously (see NR August 13, 2024) we announced PLN24-168, which stepped out 700m along strike and encountered the altered and strongly graphitic B1 shear well below the Athabasca Unconformity. PLN24-175 was a follow up, testing the same structure 110m up-dip targeting its intersection with the unconformity. This hole intersected strong alteration in the basement; coupled with intense silicification and brecciation observed in the lower Athabasca Sandstone and the lack of graphitic structure in the basement, indications are that the structure dips steeper than presumed. This reveals a new target down-dip from PLN24-175 and an additional hole is planned to test the structure in this area with these prospective signs for nearby mineralization.”

Summer 2024 JR Zone Handheld Spectrometer Highlights:

PLN24-176 (line 035S):

- 11.0m interval with mineralization between 186.0 and 206.5m, including

- 4.35m composite off-scale radioactivity (> 65,535 cps) between 197.40m and 202.15m

PLN24-177 (line 070S):

- 13.0 interval with mineralization between 199.0 and 214.5m, including

- 0.20m high-grade radioactivity (> 10,000 cps) between 211.0 and 211.2m

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8110/222573_7ebc035d04f7a8f9_002full.jpg

Table 1. Drill Hole Summary and Handheld Spectrometer Results

| Collar Information | * Hand-held Spectrometer Results On Mineralized Drillcore (>300 cps / >0.5m minimum) | Athabasca Unconformity Depth (m) | Total Drillhole Depth (m) | |||||||||

| Hole ID | Section Line | Easting | Northing | Elevation | Az | Dip | From (m) | To (m) | Interval (m) | Max CPS | ||

| PLN24-169 | 2820S | 589486.4 | 6408554.4 | 529.6 | 113.3 | -70.5 | B1 MSZ Exploration; no radioactivity >300 cps | 170.4, 256.3, 324.2 | 404 | |||

| PLN24-170 | 150S | 587940.0 | 6410725.8 | 546.3 | 58.4 | -84.6 | A1 Exploration; no radioactivity >300 cps | 172.3 | 263 | |||

| PLN24-171 | 3345S | 589633.1 | 6408012.6 | 535.4 | 54.7 | -65.6 | B1 MSZ Exploration; no radioactivity >300 cps | 353.0 | 674 | |||

| PLN24-172 | 3780S | 590006.3 | 6407749.4 | 539.2 | 55.8 | -65.1 | B1 MSZ Exploration; no radioactivity >300 cps | 361.8 | 524 | |||

| PLN24-173 | 2850S | 589230.3 | 6408338.0 | 536.9 | 54.5 | -67.1 | A1 Exploration; no radioactivity >300 cps | 173.4 | 587 | |||

| PLN24-174 | 3075S | 589596.1 | 6408116.4 | 532.7 | 14.6 | -57.8 | B1 MSZ Exploration; no radioactivity >300 cps | 376.4 | 398 | |||

| PLN24-175 | 4245S | 590242.5 | 6407347.5 | 542.8 | 55.8 | -66.7 | B1 MSZ Exploration; no radioactivity >300 cps | 351.2 | 497 | |||

| PLN24-176 | 035S | 587813.4 | 6410772.8 | 545.9 | 55.8 | -80.8 | 186.00 | 186.50 | 0.50 | 300 | 181.8 | 296 |

| 193.50 | 194.00 | 0.50 | 300 | |||||||||

| 194.00 | 195.50 | 1.50 | <300 | |||||||||

| 195.50 | 196.00 | 0.50 | 320 | |||||||||

| 196.00 | 196.50 | 0.50 | 1100 | |||||||||

| 196.50 | 197.00 | 0.50 | 1200 | |||||||||

| 197.00 | 197.40 | 0.40 | 55500 | |||||||||

| 197.40 | 197.50 | 0.10 | >65535 | |||||||||

| 197.50 | 198.00 | 0.50 | >65535 | |||||||||

| 198.00 | 198.50 | 0.50 | >65535 | |||||||||

| 198.50 | 199.00 | 0.50 | >65535 | |||||||||

| 199.00 | 199.50 | 0.50 | >65535 | |||||||||

| 199.50 | 200.00 | 0.50 | >65535 | |||||||||

| 200.00 | 200.50 | 0.50 | >65535 | |||||||||

| 200.50 | 200.70 | 0.20 | >65535 | |||||||||

| 200.70 | 201.00 | 0.30 | 45500 | |||||||||

| 201.00 | 201.10 | 0.10 | 63600 | |||||||||

| 201.10 | 201.50 | 0.40 | >65535 | |||||||||

| 201.50 | 202.00 | 0.50 | >65535 | |||||||||

| 202.00 | 202.15 | 0.15 | >65535 | |||||||||

| 202.15 | 202.40 | 0.25 | 50200 | |||||||||

| 202.40 | 202.50 | 0.10 | 8700 | |||||||||

| 202.50 | 203.00 | 0.50 | 1600 | |||||||||

| 203.00 | 203.50 | 0.50 | 1900 | |||||||||

| 206.00 | 206.50 | 0.50 | 320 | |||||||||

| PLN24-177 | 70S | 587813.4 | 6410742.8 | 547.3 | 55.9 | -81.3 | 199.00 | 199.50 | 0.50 | 340 | 179.4 | 269 |

| 199.50 | 200.00 | 0.50 | 480 | |||||||||

| 200.00 | 200.50 | 0.50 | 400 | |||||||||

| 200.50 | 201.00 | 0.50 | 460 | |||||||||

| 201.00 | 201.50 | 0.50 | 670 | |||||||||

| 201.50 | 202.00 | 0.50 | 800 | |||||||||

| 202.00 | 202.50 | 0.50 | 1900 | |||||||||

| 202.50 | 203.00 | 0.50 | 1900 | |||||||||

| 203.00 | 203.50 | 0.50 | 1600 | |||||||||

| 203.50 | 204.00 | 0.50 | 900 | |||||||||

| 204.00 | 204.50 | 0.50 | <300 | |||||||||

| 204.50 | 205.00 | 0.50 | 2000 | |||||||||

| 205.00 | 205.50 | 0.50 | 410 | |||||||||

| 208.00 | 208.50 | 0.50 | 1300 | |||||||||

| 208.50 | 209.00 | 0.50 | 610 | |||||||||

| 209.00 | 209.50 | 0.50 | <300 | |||||||||

| 209.50 | 210.00 | 0.50 | 360 | |||||||||

| 210.00 | 210.50 | 0.50 | 780 | |||||||||

| 210.50 | 211.00 | 0.50 | 3800 | |||||||||

| 211.00 | 211.20 | 0.20 | 12500 | |||||||||

| 211.20 | 211.50 | 0.30 | 5100 | |||||||||

| 211.50 | 212.00 | 0.50 | 1600 | |||||||||

| 212.00 | 212.50 | 0.50 | 300 | |||||||||

| 212.50 | 214.00 | 1.50 | <300 | |||||||||

| 214.00 | 214.50 | 0.50 | 300 | |||||||||

Handheld spectrometer composite parameters:

1: Minimum Thickness of 0.5m

2: CPS Cut-Off of 300 counts per second

3: Maximum Internal Dilution of 2.0m

Natural gamma radiation in the drill core that is reported in this news release was measured in counts per second (cps) using a handheld Radiation Solutions RS-125 scintillometer. The Company considers greater than 300 cps on the handheld spectrometer as anomalous, >10,000 cps as high grade and greater than 65,535 cps as off-scale. The reader is cautioned that scintillometer readings are not directly or uniformly related to uranium grades of the rock sample measured and should be used only as a preliminary indication of the presence of radioactive materials. Samples from the drill core are split in half on site and are standardized at 0.5m lengths. One half of the split sample will be submitted to SRC Geoanalytical Laboratories (an SCC ISO/IEC 17025: 2005 Accredited Facility) in Saskatoon, SK. for lithogeochemical analysis using their “Uranium Package”.

All depth measurements reported are down-hole and true thickness are yet to be determined.

About Patterson Lake North:

The Company’s 4,078-hectare 100% owned Patterson Lake North property (PLN) is located just within the south-western edge of the Athabasca Basin in proximity to Fission Uranium’s Triple R and NexGen Energy’s Arrow high-grade world class uranium deposits which is poised to become the next major area of development for new uranium operations in northern Saskatchewan. PLN is accessed by Provincial Highway 955, which transects the property, and the new JR Zone uranium discovery is located 23km northwest of Fission Uranium’s Triple R deposit.

Qualified Person:

The technical information in this news release has been prepare in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and approved on behalf of the company by Raymond Ashley, P.Geo., President & COO of F3 Uranium Corp, a Qualified Person. Mr. Ashley has verified the data disclosed.

About F3 Uranium Corp.:

F3 Uranium is a uranium exploration company advancing its newly discovered high-grade JR Zone and exploring for additional mineralized zones on its 100%-owned Patterson Lake North (PLN) Project in the southwest Athabasca Basin. PLN is accessed by Provincial Highway 955, which transects the property, and the new JR Zone discovery is located ~25km northwest of Fission Uranium’s Triple R and NexGen Energy’s Arrow high-grade uranium deposits. This area is poised to become the next major area of development for new uranium operations in northern Saskatchewan. The PLN project is comprised of the PLN, Minto and Broach properties. The Broach property incorporates the former PW property which was obtained from CanAlaska as a result of a property swap.

Forward Looking Statements

This news release contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, including statements regarding the suitability of the Properties for mining exploration, future payments, issuance of shares and work commitment funds, entry into of a definitive option agreement respecting the Properties, are “forward-looking statements.” These forward-looking statements reflect the expectations or beliefs of management of the Company based on information currently available to it. Forward-looking statements are subject to a number of risks and uncertainties, including those detailed from time to time in filings made by the Company with securities regulatory authorities, which may cause actual outcomes to differ materially from those discussed in the forward-looking statements. These factors should be considered carefully and readers are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements and information contained in this news release are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

The TSX Venture Exchange and the Canadian Securities Exchange have not reviewed, approved or disapproved the contents of this press release, and do not accept responsibility for the adequacy or accuracy of this release.

F3 Uranium Corp.

750-1620 Dickson Avenue

Kelowna, BC V1Y9Y2

Contact Information

Investor Relations

Telephone: 778 484 8030

Email: ir@f3uranium.com

ON BEHALF OF THE BOARD

“Dev Randhawa”

Dev Randhawa, CEO

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/222573