Category: Energy

Marks another major milestone in the redevelopment of the premium steelmaking coal mine

ST. LOUIS, Dec. 16, 2024 /PRNewswire/ — Peabody (NYSE: BTU) today announced that it has successfully shipped the first product from its Centurion Mine in Queensland’s Bowen Basin, marking another major milestone in the redevelopment of the premium hard coking coal mine.

The inaugural shipment was delivered to the Dalrymple Bay Coal Terminal and loaded for export to a customer in Asia last week. This achievement highlights Centurion’s ongoing ramp up toward higher-volume longwall production that is targeted to begin in March 2026.

“Two years ago, we announced the redevelopment of this mine with a plan to transform it into a world-class operation supplying premium hard coking coal to global markets, and this week we’re delivering on that plan,” Jim Grech, Peabody President and Chief Executive Officer, said. “This is the first strategic step in transforming Peabody into a primarily metallurgical coal producer, and we are proud of the strong progress being made.”

With a planned annual production averaging 4.7 million tons and approximately 140 million tons of reserves, the operation has a mine life of more than 25 years. The premium hard coking coal supplied from Centurion is essential to making original steel, a foundation material for hospitals, schools and bridges as well as renewable energy infrastructure like wind turbines. Centurion coal is sought after for its high coke strength and low impurities, qualities that enhance steel production efficiency and support decarbonisation in the steelmaking process.

Centurion is also advancing Peabody’s commitment to sustainability with predevelopment works underway for 5 megawatt (MW) power station at the mine supporting the project’s emission abatement goals by reusing waste gas from the coal seams.

In November, the company announced an agreement to acquire four Tier 1 steelmaking coal mines from Anglo American. The completion of that acquisition, intended for mid-2025, combined with the redevelopment of Centurion, accelerates Peabody’s strategy to reweight its global coal portfolio and cash flows to metallurgical coal.

Peabody is a leading coal producer, providing essential products for the production of affordable, reliable energy and steel. Our commitment to sustainability underpins everything we do and shapes our strategy for the future. For further information, visit PeabodyEnergy.com.

Please find interviews and background video here and photos here.

CONTACT:

Vic Svec

+1.314.342.7890

View original content to download multimedia:https://www.prnewswire.com/news-releases/peabody-announces-first-coal-shipment-from-centurion-mine-302332826.html

SOURCE Peabody

Key Takeaways

- Uranium Market Steadies: While the spot price declined in November, the overall price environment for the year has strengthened. Additionally, uranium miners gained for the month while remaining flat year-to-date.

- Nuclear Energy Continues to Gain Momentum: Global support continues to grow as more countries pledged to triple global nuclear capacity by 2050 at COP29.

- Implications After U.S. Election: The Trump presidency is likely to continue with a pro-nuclear stance, focusing on nuclear energy’s contributions to energy independence, national security and economic competitiveness.

- Energy Strategy Remains Critical: With Trump’s plan likely to prioritize domestic energy production, the stance on international uranium imports, mainly from Russia and China, will be a critical area to watch.

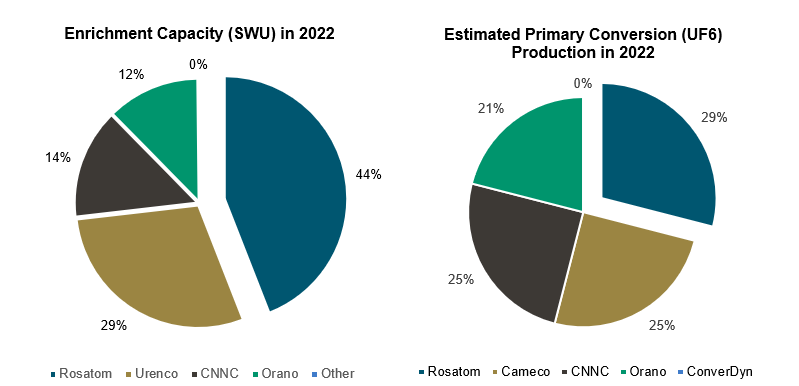

- Russian Ban Disrupts Supply Chain: Uranium supply faces pressure as Russia accounts for approximately 44% of global uranium enrichment capacity and 35% of U.S. enrichment imports. In sharp contrast, Russia only accounts for 5% of the global U3O8 supply.

Performance as of November 30, 2024

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR |

| U3O8 Uranium Spot Price 1 | -3.61% | -2.39% | -15.38% | -4.53% | 18.79% | 24.24% |

| Uranium Mining Equities (Northshore Global Uranium Mining Index) 2 | 1.18% | 15.38% | 0.13% | 2.89% | 9.15% | 34.74% |

| Uranium Junior Mining Equities (Nasdaq Sprott Junior Uranium Miners Index TR) 3 | 0.00% | 19.37% | 0.60% | -0.05% | 1.74% | 34.47% |

| Broad Commodities (BCOM Index) 4 | 0.05% | 2.14% | -0.51% | -3.60% | 0.81% | 4.94% |

| U.S. Equities (S&P 500 TR Index) 5 | 5.87% | 7.15% | 28.07% | 33.89% | 11.44% | 15.76% |

*Performance for periods under one year is not annualized.

Sources: Bloomberg and Sprott Asset Management LP. Data as of 11/30/2024. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Year-End Overhang on Uranium Spot Market

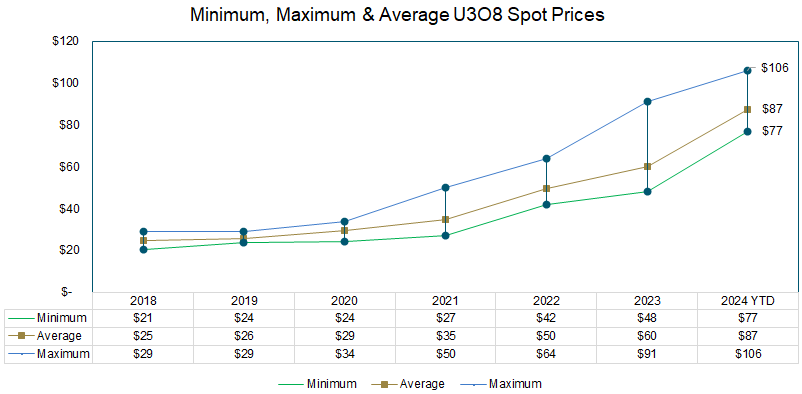

The uranium spot price retraced to support at $77.08 per pound at the end of November, which resulted in a 3.61% loss.1 The loss disguises a stronger price environment in the spot market for the year, with the minimum, average and maximum spot prices year-to-date at the highest levels compared to recent years (Figure 1). Given the growing sensitivity to geopolitical factors, we believe the uranium price will continue to behave in this staircase-like pattern over the intermediate term with short-term bouts of volatility. By contrast, uranium miners gained 1.18% in November and are flat year-to-date.

Uranium’s stairstep rally continues: spot prices soften, but term prices surge to 16-year highs.

Uranium miners have played catchup to the physical commodity and outperformed in 2024, a reversal of last year’s trend. Notably, uranium miners predominantly contract in the term market instead of the spot market and are therefore supported by term prices hitting 16-year highs. These term contracts also contain floors and ceilings, which continue to rise and are reported to be increasing with floor prices in the $70s and ceilings in the $130s (before escalation), indicating a midpoint of a triple-digit uranium price. Similarly, conversion and enrichment prices are at all-time highs, underscoring the strength of uranium’s current market dynamics.

The spot market is dealing with an overhang of supply as some traders look to clear their positions before the year’s end. Further pressuring the spot market are rampant rumors the Kazakh ANU physical uranium fund may be liquidating its 2+ million-pound inventory. While Russia’s retaliatory export ban on enriched uranium to the U.S. pushes utilities’ focus to the nuclear fuel cycle’s conversion and enrichment segments, we believe this attention will eventually cascade down to uranium oxide (U3O8). This year’s muted term contracting activity, at 100.7 million pounds of U3O8e, was heavily skewed by Chinese contracts with Kazatomprom and increases the likelihood of future contracting, as deferred purchases will eventually need to be addressed. Delaying these purchases risks depleting existing stockpiles, which is an unsustainable scenario from a risk management perspective.

Figure 1. Historical Physical Uranium Spot Prices

Source: UxC LLC. As of 11/30/2024.

Global Support for Nuclear Energy Continues to Grow

Meanwhile, global support for nuclear energy continues to gain momentum. At COP29, six additional countries pledged to triple global nuclear capacity by 2050, bringing the total to 31 nations committed to this ambitious goal.6 COP conferences and global forums for climate action highlight nuclear energy’s role in achieving net-zero emissions and meeting growing electricity demand.

On a regional level, positive news flows further bolster the case for nuclear power. Taiwan’s premier recently announced consideration of nuclear power to address energy needs tied to AI-driven electricity demand.7 Taiwan’s significance in this context is amplified by its position as a global leader in semiconductor manufacturing, in which advanced chips are critical for AI development, making a reliable and scalable electricity supply essential to maintain its competitive edge in this high-demand industry. Vietnam, too, is signaling a nuclear pivot, revising its national power development plan to incorporate nuclear options alongside renewables.8 The goal is to expand power generation capacity by 12-15% annually and support annual economic growth of 7%. As global electricity demand intensifies, we believe nuclear power and, by extension, uranium stand poised to be key enablers of this next growth phase, particularly in emerging markets.

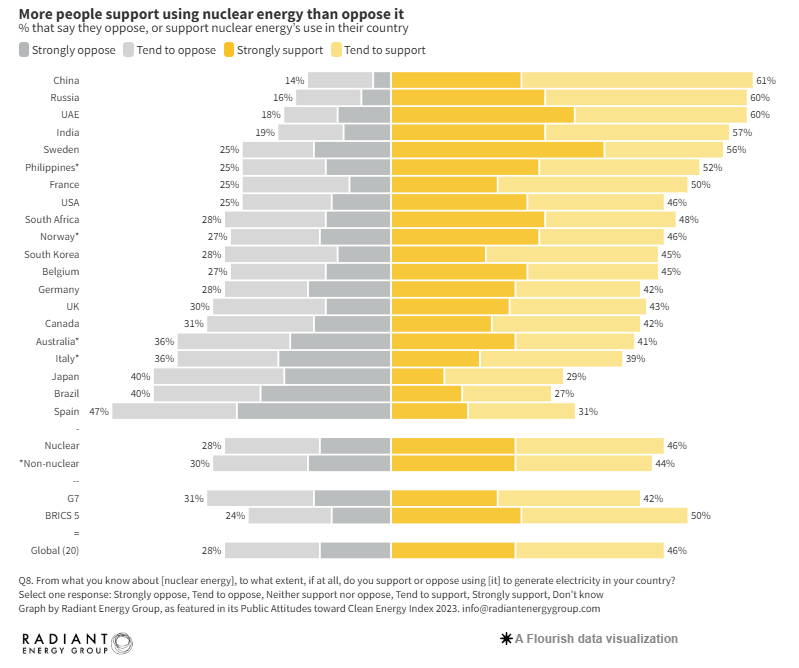

On an individual level, sentiment toward nuclear energy continues to improve, with a study finding that 1.5X more people support nuclear energy’s use than oppose it. Commissioned and analyzed by the Radiant Energy Group, the Public Attitudes Toward Clean Energy (PACE) index is the “world’s largest publicly released international study on what people think about nuclear energy.” Figure 2 shows that across the 20 countries surveyed, 28% of respondents oppose nuclear energy, while 46% support it, and 17 of the 20 countries had net support for nuclear energy. Further, the results found that nuclear energy was the second most preferred clean energy electricity source, after solar.

Figure 2. Public Attitudes Toward Nuclear Energy in 2023

Source: Radiant Energy Group https://www.radiantenergygroup.com/reports/public-attitudes-toward-clean-energy-2023-nuclear

U.S. Election and Potential Implications for the Nuclear Sector

The recent U.S. presidential election, which saw Donald Trump win the presidency along with Republican control of the Senate and the House of Representatives, will likely impact some elements of U.S. energy policy. It is important to note the Biden administration has been incredibly pro-nuclear for a Democratic government.

A second Trump administration is anticipated to maintain a pro-nuclear stance, though with motivations distinct from those of the Biden administration. While Democrats have emphasized nuclear energy as a cornerstone of their climate change strategy, Republicans are expected to champion it for its role in bolstering energy independence, enhancing national security, and driving economic competitiveness. Key industry initiatives that align with these priorities include expanding domestic uranium mining, simplifying nuclear permitting processes, and advancing innovative technologies like Small Modular Reactors (SMRs).

Bipartisan backing keeps U.S. nuclear strong, but policy shifts under Trump could reshape priorities.

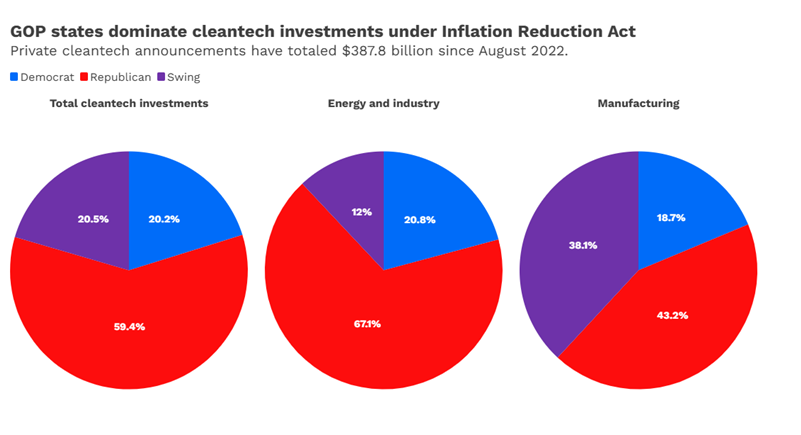

Significant legislation, such as the Bipartisan Infrastructure Law (BIL), the Inflation Reduction Act (IRA), and the Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy Act (ADVANCE Act), has provided substantial financial backing for nuclear projects, receiving broad bipartisan support. While some aspects of this legislation may undergo revision, we believe nuclear energy will continue to garner strong support. Notably, the fact that many IRA-driven projects are located in Republican-led states suggests that key components of these policies are likely to remain intact (Figure 3).

Trump’s energy strategy is expected to prioritize domestic energy production, including oil, gas and nuclear power, while potentially pulling back on climate-focused policies such as the Paris Agreement and offshore wind development. At the same time, the administration’s stance on international enriched uranium imports, mainly from Russia and China, will be a critical area to watch. Recent bipartisan legislation banning Russian enriched uranium imports, the Prohibiting Russian Uranium Imports Act (PRUIA), and calls for increased tariffs signal ongoing efforts to strengthen the U.S. domestic fuel cycle.

We believe the nuclear sector will continue to benefit from ongoing bipartisan support; however, potential shifts in policy priorities under a new Trump administration introduce uncertainty regarding the scale and direction of federal support. This uncertainty has contributed to the recent weakness in some clean energy sectors like renewables and electric vehicles.

Figure 3.

Source: https://www.ciphernews.com/articles/why-cleantech-is-booming-in-gop-led-states/. Clean Investment Monitor, Rhodium Group and MIT CEEPR. • Total announced investments range from Q3 2022 through Q2 2024. States are grouped as Republican, Democrat or Swing based on how they voted in the 2020 general election. Energy and Industry category includes the deployment of wind, solar, battery, geothermal, clean hydrogen, carbon management, sustainable aviation fuels and other electricity technologies. Manufacturing category refers to the production of these clean technologies.

Russia’s Retaliatory Restrictions on Enriched Uranium Exports

In November, Russia imposed restrictions on its enriched uranium exports to the U.S.9 The ban is seen as a “tit-for-tat” response to the U.S.’s Prohibiting Russian Uranium Imports Act, which came into effect in August. The PRUIA banned Russian-enriched uranium imports to the U.S. However, utilities may apply for waivers that authorize the importation of uranium to certain aggregate limits and up until the end of 2027 if the Secretary of Energy determines that there is no alternative viable source of uranium to sustain the continued operation of a U.S. nuclear reactor or if the importation of Russian-produced uranium is in the national interest.

Russia’s retaliation has imposed a more immediate threat to the industry as uncertainty on the timing and scale of escalatory actions grows. At the same time, the West is working on expanding enrichment capacity. Russia’s restrictions have already created ripple effects, with uranium stocks climbing given concerns about supply disruptions. Russia accounts for approximately 44% of global uranium enrichment capacity and 35% of U.S. enrichment imports. In sharp contrast, Russia only accounts for 5% of the global U3O8 supply (Figure 4).

The timing of Russia’s restrictions poses a critical challenge. Western countries are still in the process of expanding their enrichment capacities, and these facilities will not be fully operational for several years. This leaves the nuclear fuel supply chain vulnerable to further disruptions, as Russia’s decision to withhold enriched uranium could potentially outpace Western efforts to establish an alternative supply.

This urgency has also accelerated shifts in enrichment practices. Western utilities are moving from underfeeding to overfeeding, requiring more raw uranium to compensate for reduced enrichment capacity. We believe this shift is expected to support uranium prices and increase demand in the coming years. Whether these measures can bridge the gap before Russia’s actions exert broader impacts remains a pivotal question for the nuclear energy sector.

Figure 4. Russia’s (Rosatom) Market Shares in Enrichment and Conversion

Source: WNA Nuclear Fuel Report 2023.

Kazakhstan and Niger Add to Supply Uncertainty

Kazatomprom, the world’s largest uranium supplier, has finalized a major agreement with China’s CNNC and China National Uranium Corporation for the sale of uranium concentrates. Combined with previous transactions involving these entities, the deal represents over 50% of Kazatomprom’s total book value, highlighting Kazakhstan’s deepening ties with Eastern markets. This agreement builds on a similar large-scale transaction with a Chinese utility in late 2023 and aligns with broader regional developments, including the construction of a massive trading hub and storage facility (with a capacity of approximately 60 million pounds) near the Kazakh-China border.

For Western utilities, this shift raises significant concerns. With an increasing portion of Kazatomprom’s supply being directed to China and Russia, Western buyers are under growing pressure to secure alternative uranium sources. These challenges are further exacerbated by Kazatomprom’s ongoing production difficulties, including weaker-than-expected output reported in Q3 2024. The combination of production constraints and shifting supply priorities underscores the urgent need for Western utilities to diversify their supply chains and mitigate potential risks to their energy security.

Niger, previously the seventh largest producer of uranium, has seen its production capabilities and stability unravel following a military coup in July 2023. The military junta has distanced itself from traditional Western allies like France and the U.S., forging closer ties with Russia and China. The political upheaval has severely impacted uranium operations in Niger. Most recently, on December 4, the French nuclear firm Orano confirmed the loss of operational control of SOMAÏR in Niger.10 This follows the previous announcement on October 23 that Niger’s growing financial difficulties forced it to suspend operations at the mine.11

As a result of the coup, Orano has been unable to export uranium, and a total of 1,150 tonnes of uranium concentrate from 2023 and 2024 stocks haven’t been exported, according to Orano.12 This is worth about $210 million. Additionally, Niger has revoked mining licenses for key projects, such as Orano’s Imouraren and Canada-based GoviEx’s Madaouela, signaling a shift in the country’s resource management strategy.

Despite these setbacks, some projects remain. Two uranium projects, the SOMINA Azelik project and Global Atomic’s Dasa project, are slated to commence production in the coming years. However, the nationalization of key assets and closer ties with Russia suggest that future uranium output may be increasingly directed away from Western markets.

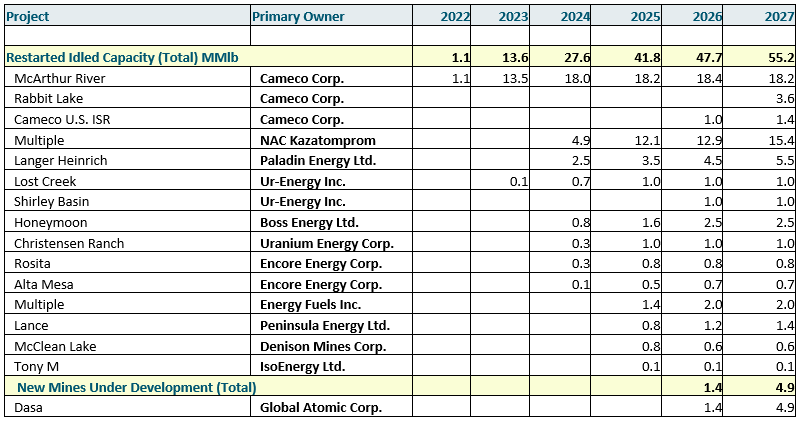

Junior Uranium Miners Helping to Address Supply Shortfalls

The shifting and uncertain dynamics of the global uranium supply underscore the urgent need to boost production through mine restarts and new developments. Junior uranium miners are playing a pivotal role in addressing this supply gap, with many resuming operations at previously idled mines to bring production back online (Figure 5). These projects are crucial for maintaining a stable uranium supply to Western utilities amid escalating geopolitical risks and dwindling access to traditional sources. By leveraging existing infrastructure, mine restarts can deliver uranium more quickly and cost-effectively than greenfield developments. Their success is essential to mitigating supply chain vulnerabilities and ensuring the long-term sustainability of the nuclear fuel cycle.

Junior uranium miners drive supply security, with quick restarts and new landmark projects like NexGen’s Rook I.

New uranium mines are poised to be vital in ensuring longer-term supply security. NexGen Energy Ltd. (NexGen) is a prominent junior uranium mining company developing the world’s largest single-source deposit of high-grade, low-cost uranium. Its renowned Rook 1 Project is situated in the Athabasca Basin in Saskatchewan, Canada. This location places it within one of the world’s top mining jurisdictions, known for its prolific uranium resources. The company boasts substantial uranium resources, totaling 337 million pounds. When NexGen had previously achieved provincial environmental approval, it marked the first uranium mine in Saskatchewan to reach this stage in over 20 years. The company projects a potential production output of up to 28.8 million pounds by 2030 and beyond.

NexGen’s recent progress with its flagship Rook I Project in Saskatchewan highlights the potential of junior uranium miners. The company recently reached a significant Rook I milestone, with the successful completion of the final federal technical review.13 This paves the way for the final steps of the approval process, including a Commission Hearing that could lead to a project approval decision.

NexGen has also taken significant strides toward commercializing its project by securing its first uranium sales contracts with leading U.S. utilities. These agreements cover the delivery of 5 million pounds of U3O8 over five years (2029–2033), with pricing mechanisms tied to market conditions. Notably, the contracts feature floor and ceiling prices of approximately $79 and $150 per pound, respectively, reflecting robust demand and favorable market conditions.14 It is important to highlight the contract ceiling price is notably higher than levels recently quoted by Cameco, which we believe reflects the strong market appetite for new sources of Western supply.

Figure 5. Uranium Supply Pipeline

Source: Mike Kozak, Uranium Analyst, Cantor Fitzgerald, September 2024. Company websites and UxC LLC. Assumes certain mines will be restarted that have yet to be announced. 2024-2027 is forecasted information from Cantor Fitzgerald’s report.

What to Make of Market Signals?

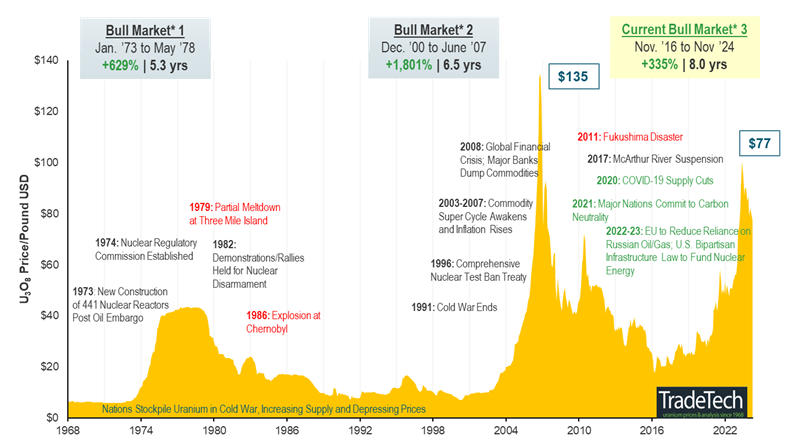

We believe the recent correction in the spot uranium price and the miners may represent an attractive entry point in the ongoing bull market. While the softness in the spot market over the past few months has been frustrating and confusing to watch, we believe it is sending a false signal given that the long-term fundamentals have only improved. Operational challenges appear to be getting worse, which will keep supply conditions tight, while the nuclear fuel supply chain remains highly susceptible to disruptions. Key producers remain steadfast in their supply discipline strategy and there appears to be a market standoff. Utilities are balking at the significant move in uranium prices over the past year, which will impact their future operating budgets, while producers are capitalizing on their long-awaited market leverage over utilities. As Cameco often repeats, utilities can “delay and defer,” but they will eventually be forced to buy.

Uranium supply deficits, tight market conditions and rising demand signal long-term strength.

A longstanding primary supply deficit and renewed interest in nuclear energy highlight the real challenges to bring the market back into balance. We believe this bull market has further room to run with no meaningful new supply on the horizon for three to five years. While last year’s multi-year record in long-term uranium contracting was celebrated, the overall numbers disguise a bifurcated market. Some utilities are well covered, while others have ignored the powerful market signals and failed to adapt their procurement strategies to the new market realities.

With global uranium mine production well short of the world’s uranium reactor requirements, the supply deficit building over the next decade, and near-term supply inhibited by long lead times and capital intensity, we believe that restarts and new mines in development are critical. The uranium price target as an incentive level for further restarts and greenfield development is a moving target, and we believe that we will need higher uranium prices to incentivize enough production to meet forecasted deficits. Over the long term, increased demand in the face of an uncertain uranium supply may continue supporting a sustained bull market (Figure 6).

Figure 6. Uranium Bull Market Continues (1968-2024)

Click here to enlarge this chart.

Note: A “bull market” refers to a condition of financial markets in which prices are generally rising. A “bear market” refers to a condition of financial markets in which prices are generally falling.

Source: TradeTech Data as of 11/30/2024. TradeTech is the leading independent provider of uranium prices and nuclear fuel market information. The uranium prices in this chart dating back to 1968 is sourced exclusively from TradeTech; visit https://www.uranium.info/.

Footnotes

| 1 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 2 | The North Shore Global Uranium Mining Index (URNMX) was created by North Shore Indices, Inc. (the “Index Provider”). The Index Provider developed the methodology for determining the securities to be included in the Index and is responsible for the ongoing maintenance of the Index. The Index is calculated by Indxx, LLC, which is not affiliated with the North Shore Global Uranium Miners Fund (“Existing Fund”), ALPS Advisors, Inc. (the “Sub-Adviser”) or Sprott Asset Management LP (the “Adviser”). |

| 3 | The Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) was co-developed by Nasdaq® (the “Index Provider”) and Sprott Asset Management LP (the “Adviser”). The Index Provider and Adviser co-developed the methodology for determining the securities to be included in the Index and the Index Provider is responsible for the ongoing maintenance of the Index. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 5 | The S&P 500 or Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 6 | Source: World Nuclear Association. Six More Countries Endorse the Declaration to Triple Nuclear Energy by 2050 at COP29. |

| 7 | Source: BNN Bloomberg. Taiwan Signals Openness to Nuclear Power Amid Surging AI Demand. |

| 8 | Source: Reuters. Vietnam to amend national power plan to include nuclear energy. |

| 9 | Source: World Nuclear News. Russia places ‘tit-for-tat’ ban on US uranium exports. |

| 10 | Source: Orano. Orano confirms the loss of operational control of SOMAÏR in Niger. |

| 11 | Source: Orano. Niger: growing financial difficulties will force SOMAÏR to suspend operations. |

| 12 | Source: BBC. Niger junta takes control of French uranium mine. |

| 13 | Source: Mining.com. NexGen Energy nears Rook I uranium project approval following final federal review. |

| 14 | Source: NexGen Energy Ltd. NexGen Announces First Uranium Sales Contracts for 5 Million Pounds with Major US Utilities. |

Toronto, Ontario–(Newsfile Corp. – December 13, 2024) – Gary Thompson, Chief Executive Officer, Silver47 Exploration Corp. (“Silver47” or the “Company”) (TSXV: AGA), and his team, joined Dean McPherson, Head, Business Development, Global Mining, Toronto Stock Exchange (TSX), to open the market to celebrate the Company’s new listing on the TSX Venture Exchange.

Silver47 Exploration Corp. is focused on rapidly expanding its resource base of silver, gold, copper, zinc and lead, with the aim of reaching a milestone development decision in the next 3-5 years, while also driving new discoveries.

Backed by industry leaders, the Company is advancing its flagship Red Mountain project in Alaska, which currently hosts 168.6 million ounces of silver at 336 g/t AgEq, equivalent to 1 million tonnes of zinc at 7% ZnEq or 2 million ounces of gold at 4 g/t AuEq.

Silver47’s initial focus is on increasing the silver-gold rich Dry Creek and West Tundra Flats resources at the eastern end of this district-scale land package, with an exploration target of 50Mt in the 300-400 g/t AgEq grade range for 480Moz Eq. The company’s extensive land holdings of 942 state mining claims and one mining lease cover a 60km trend of polymetallic mineralization.

MEDIA CONTACT:

Gary Thompson

President & CEO

info@silver47.ca

403-870-1166

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/233679

North Vancouver, British Columbia–(Newsfile Corp. – December 12, 2024) – Lion One Metals Limited (TSXV: LIO) (OTCQX: LOMLF) (“Lion One” or the “Company”) is pleased to announce the results of the Company’s annual and special general meeting of shareholders (the “Meeting”) held on December 12, 2024.

At the Meeting, the number of directors of the Company was set at three (3) with the following directors re-elected at the Meeting: Walter Berukoff, Richard Meli, and Kevin Puil. In addition, shareholders of the Company approved the Company’s Omnibus Equity Incentive Compensation Plan as described in the management information circular dated October 29, 2024 (the “Circular”) as well as the re-appointment of Davidson & Company LLP, Chartered Professional Accountants as the auditor of the Company for the ensuing fiscal year.

About Lion One Metals Limited

Lion One Metals is an emerging Canadian gold producer headquartered in North Vancouver BC, with new operations established in late 2023 at its 100% owned Tuvatu Alkaline Gold Project in Fiji. The Tuvatu project comprises the high-grade Tuvatu Alkaline Gold Deposit, the Underground Gold Mine, the Pilot Plant, and the Assay Lab. The Company also has an extensive exploration license covering the entire Navilawa Caldera, which is host to multiple mineralized zones and highly prospective exploration targets.

On behalf of the Board of Directors,

Walter Berukoff, Chairman & CEO

Contact Information

Email: info@liononemetals.com

Phone: 1-855-805-1250 (toll free North America)

Website: www.liononemetals.com

Neither the TSX-V nor its Regulation Service Provider accepts responsibility or the adequacy or accuracy of this release

This press release may contain statements that may be deemed to be “forward-looking statements” within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “proposed”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited’s current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance, or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labor or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/233639

By David Lawder

WASHINGTON (Reuters) -The U.S. government posted a $367 billion budget deficit for November, up 17% from a year earlier, as calendar adjustments for benefit payments boosted outlays by some $80 billion compared to the same month in 2023, the Treasury Department said on Wednesday.

The Treasury Department said that without the acceleration of December payments for the Medicare and Social Security programs into November, the deficit last month would have been about $29 billion, or 9% lower than last year.

The health care and pension programs for seniors are two of the government’s largest expenditure items.

But as reported, the November deficit was a record high for that month. Receipts and outlays also were record highs for the month of November, with receipts up 10% to $302 billion, and outlays up 14% to $669 billion.

The deficit for the first two months of the 2025 fiscal year also was a record high for that period – higher than the deficits of the COVID-19 era – reaching $624 billion, up $244 billion, or 64%, from the same period a year earlier. The government’s fiscal year starts on Oct. 1.

Those deficits were also inflated by calendar-related benefit shifts as well as higher receipts in October and November of 2023 due to the expiration of tax payment deferrals tied to California wildfires and other weather-related disasters that year.

Year-to-date receipts as reported were down 7% from a year earlier to $629 billion, while year-to-date outlays were up 18% to $1.253 trillion.

The outlays for the first two months of the fiscal year included a $4 billion, or 30%, increase in Department of Homeland Security spending to $19 billion, largely reflecting Federal Emergency Management Agency spending related to recent hurricanes.

But the Treasury’s interest cost on public debt for the fiscal year’s first two months was flat at $169 billion, despite a $7 billion increase for November.

(Reporting by David Lawder; Editing by Paul Simao)

Original Source: https://finance.yahoo.com/news/buy-dogecoin-while-under-1-092700666.html

VANCOUVER, BC / ACCESSWIRE / December 10, 2024 / Granite Creek Copper Ltd. (TSXV:GCX)(OTCQB:GCXXF) (“Granite Creek” or the “Company”) is pleased to announce drill results from the 2024 drill campaign on at its wholly owned Carmacks copper-gold-silver project located in central Yukon, Canada. As previously mentioned, the Company identified a new zone within the Carmacks project called the Gap Zone (see news release dated October 3, 2024), located between existing high-grade, pit-constrained resources. The exploratory drill program intercepted copper mineralization in all four drill holes, laying the foundation for a follow-up resource definition and expansion drilling campaign. See below for selected drill results.

Table 1 – Selected Assay Results

| Drillhole | From(m) | To(m) | Length*(m) | Cu(%) | Au(g/t) | Ag(g/t) |

|---|---|---|---|---|---|---|

| CRM24-026 | 172.21 | 180.15 | 7.94 | 0.13 | 0.017 | 0.7 |

| CRM24-027 | 250.00 | 253.70 | 3.70 | 0.94 | 0.124 | 5.8 |

| and | 258.50 | 279.75 | 21.25 | 0.53 | 0.072 | 3.3 |

| Including | 261.30 | 270.30 | 9.00 | 0.70 | 0.090 | 4.4 |

| CRM24-028 | 255.04 | 269.99 | 14.95 | 0.40 | 0.037 | 2.7 |

| CRM24-029 | 247.00 | 261.85 | 14.85 | 0.51 | 0.059 | 3.4 |

| Including | 254.60 | 259.00 | 4.40 | 0.77 | 0.093 | 6.5 |

Figure 1 – Gap Zone plan view showing drill locations and traces

The Gap Zone lies between the proposed 147 and 2000S pits and was first identified by a 2022 geophysical IP survey (see news release dated November 21, 2022). Likely representing a fault offset from the main 147 Zone, the Gap Zone has the potential to add significant tonnage and extend the mine life envisioned by the 2023 Preliminary Economic Assessment (see news release dated January 19, 2023)

Granite Creek President and CEO, Timothy Johnson, stated, “The success of this drill program highlights the continued prospectivity of the Carmacks project. There remain multiple untested drill targets on the project, both proximal to the proposed pits as outlined int the 2023 PEA, as well as distal areas and across the northern sector which has seen only modest exploration. The project hosts significant copper-gold-silver resources and has the potential for major expansion across the 177 square kilometre land package in this top mining jurisdiction.”

Carmacks Deposit

The 177 sq km, Carmacks project contains over 824 Mlbs Measured and Indicated and 29 Mlbs Inferred copper equivalent (“CuEq”) metal within a National Instrument 43-101-compliant, high-grade resource of 36.2 million tonnes grading 1.07 % CuEq (0.81% Cu, 0.31 g/t Au, 3.41 Ag)1. The road accessible project is located along the Freegold Road, a Resource Gateway Road currently being upgraded by the Yukon government and is within 20 km of the Yukon electrical grid. The project is also situated within the Minto Copper Belt, a roughly 80 km long belt of rocks known for high grade occurrences of copper-gold-silver mineralisation.

The 2023 Carmacks Preliminary Economic Assessment (“PEA”), completed by SGS Canada, identified increased resources along with improved recovery as prime means of increasing the Net Present Value (“NPV”) of the project. Work completed this year by Kemetco Research (see news release dated January 17, 2024) demonstrated that recoveries exceeding the target outlined in the PEA can be achieved. The just completed drill program was designed to show that significant resource expansion is possible and specifically targeted areas that could lead to an expanded mine life as envisioned by the PEA.

About Granite Creek Copper

Granite Creek Copper is a focused on the exploration and development of critical minerals projects in North America and more recently on geologic hydrogen. The Company’s projects consist of its flagship 177 square kilometer Carmacks project in the Minto copper district of Canada’s Yukon Territory on trend with the formerly operating, high-grade Minto copper-gold mine and the advanced stage LS molybdenum project and the Star copper-nickel-PGM project, both located in central British Columbia. Recent acquisitions include the Union Bay geologic hydrogen project as well as entering into a letter of intent to acquire the Duke Island ultramafic project for it’s geologic hydrogen potential, both projects located in the state of Alaska. More information about Granite Creek Copper can be viewed on the Company’s website at www.gcxcopper.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Timothy Johnson, President & CEO

Telephone: 1 (604) 235-1982

Toll Free: 1 (888) 361-3494

E-mail: info@gcxcopper.com

Website: www.gcxcopper.com

Qualified Person

Debbie James P.Geo, has reviewed and approved the technical information contained in this news release. Ms. James is a Qualified Person as defined in NI 43-101 and supervised the 2024 drilling program. She is not independent of the Company because she has received employment income from the Company and holds stock in the Company.

1Mineral Resources are reported within a conceptual constraining pit shell that includes the following input parameters: Metal prices of $3.60/lb Cu, $1,750/Au, $22/oz Ag, $14/lb Mo and pit slope angles that vary from 35° for overburden to 55°for granodiorite host, metal prices are in US$. Metallurgical recoveries reflective of prior test work that averages: 85% Cu, 85% Au, 65% Ag in the oxide domain and 90% Cu, 76% Au, 65% Ag in the sulphide domain. Mo recovery is assumed to be 70% in both oxide and sulphide domain. Totals and Metal content may not sum due to rounding and significant digits used in calculations. Cu Eq calculation is based on 100% recovery of all metals using the same metal prices used in the resource calculation: $3.60/lb Cu, $1,750/Au, $22/oz Ag, $14/lb Mo.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed “forward-looking statements” or “forward-looking information”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding expected use of proceeds from the private placement and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Granite Creek Copper believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Granite Creek Copper and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedarplus.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Granite Creek Copper Ltd.

View the original press release on accesswire.com

Vancouver, British Columbia–(Newsfile Corp. – December 9, 2024) – Riverside Resources Inc. (TSXV: RRI) (OTCQB: RVSDF) (FSE: 5YY) (“Riverside” or the “Company”), is pleased to announce it has signed an option agreement to acquire a 100% interest in the Taft Project (“Project”). The Project covers a total area of 3,000 hectares (30 km2) and is located in the highly prospective Revelstoke Carbonatite Belt region of British Columbia for Rare Earth Elements (REE) and gold mineralization. This transaction aligns with Riverside’s strategy of targeting high-value mineral assets in favorable jurisdictions and taking advantage of government support led by technical quality as a focus. Critical metals, such as rare earth elements (REE), are essential for national security and economic prosperity and Riverside is actively strengthening its position by acquiring and staking high-potential critical metals projects. The Company plans to begin a field program on the Project immediately.

“Riverside Resources has a long history of identifying and acquiring high-potential mineral assets in stable jurisdictions, and the Taft Project is another excellent example of this approach,” stated John-Mark Staude, President and CEO of Riverside Resources. “As the demand for critical minerals continues to grow, particularly in the fields of renewable energy, electric vehicles, and advanced technologies, projects like Taft play an essential role in securing North America’s access to these vital resources.”

“With governments increasingly emphasizing the importance of developing domestic supply chains for critical minerals, including recent initiatives by the United States and Canada to support exploration and production, Riverside is proud to contribute to this strategic imperative. By acquiring and investing in projects like Taft, we are not only enhancing our portfolio but also progressing the global transition to cleaner energy and more resilient supply networks.”

Project Option Terms:

As per the Agreement, Riverside can earn a 100% interest in the Taft Project by making staged cash payments totaling CAD $125,000 over five years, as detailed below:

a) $15,000 upon signing of the Agreement; (paid)

b) $15,000 on or before the 1st anniversary of the Effective Date;

c) $20,000 on or before the 2nd anniversary of the Effective Date;

d) $20,000 on or before the 3rd anniversary of the Effective Date;

e) $25,000 on or before the 4th anniversary of the Effective Date; and

f) $30,000 on or before the final anniversary of the Effective Date.

Additionally, Riverside will commit to a minimum of $320,000 in exploration expenditures over the same period, as detailed below:

a) $ 60,000.00 on or before the 1st anniversary of the Effective Date;

b) $ 60,000.00 on or before the 2nd anniversary of the Effective Date;

c) $ 60,000.00 on or before the 3rd anniversary of the Effective Date;

d) $ 60,000.00 on or before the 4th anniversary of the Effective Date; and

e) $ 80,000.00 on or before the final anniversary of the Effective Date.

This transaction involves no royalties, aligning with Riverside’s ongoing commitment to maintaining royalty-free projects. Consistent with its business model over the past 15+ years, Riverside creates royalties only when optioning or selling projects to third parties in future business transactions.

Exploration Plans

The exploration program will begin with stream geochemistry studies initiated this summer, followed by soil and rock geochemical prospecting. Fieldwork will include geological mapping and reconnaissance traverses, building on earlier government studies and prior prospector reports. The focus is to delineate the Rare Earth Element potential associated with carbonatite intrusions, which are key mineralization targets for both the property and the company within this belt. Additionally, the program will investigate gold anomalies identified in initial surveys, building on previous exploration efforts in the area. Riverside’s planned investments include geological mapping, sampling, and targeted drilling to further define the resource potential of the project.

About the Taft Project

The Taft Project presents a high-potential opportunity to discover critical mineral resources essential to the increasing demand for renewable energy, technology, and advanced materials. Its favorable geological setting and strategic location within a supportive jurisdiction highlight its importance in Riverside’s portfolio. Geological mapping of the REE-rich terrane has identified promising areas along the belt, supported by favorable geochemistry and indicator minerals. Current sampling and exploration efforts, in collaboration with local prospectors, aim to refine targets through access, sampling, and mapping. These activities are paving the way for a focused exploration program in 2025, targeting both REE and gold zones.

Figure 1: Location map and mineral concession map with tenure under option in red and Riverside 100% owned tenure in yellow.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6101/232849_36c44faa64bf49eb_003full.jpg

Qualified Person & QA/QC:

The scientific and technical data contained in this news release was reviewed and approved by Freeman Smith, P.Geo, a non-independent qualified person to Riverside Resources who is responsible for ensuring that the information provided in this news release is accurate and who acts as a “qualified person” under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About Riverside Resources Inc.:

Riverside is a well-funded exploration company driven by value generation and discovery. The Company has over $5M in cash, no debt and less than 75M shares outstanding with a strong portfolio of gold-silver and copper assets and royalties in North America. Riverside has extensive experience and knowledge operating in Mexico and Canada and leverages its large database to generate a portfolio of prospective mineral properties. In addition to Riverside’s own exploration spending, the Company also strives to diversify risk by securing joint-venture and spin-out partnerships to advance multiple assets simultaneously and create more chances for discovery. Riverside has properties available for option, with information available on the Company’s website at www.rivres.com.

ON BEHALF OF RIVERSIDE RESOURCES INC.

“John-Mark Staude”

Dr. John-Mark Staude, President & CEO

For additional information contact:

John-Mark Staude

President, CEO

Riverside Resources Inc.

info@rivres.com

Phone: (778) 327-6671

Fax: (778) 327-6675

Web: www.rivres.com

Eric Negraeff

Investor Relations

Riverside Resources Inc.

Phone: (778) 327-6671

TF: (877) RIV-RES1

Web: www.rivres.com

Certain statements in this press release may be considered forward-looking information. These statements can be identified by the use of forward-looking terminology (e.g., “expect”,” estimates”, “intends”, “anticipates”, “believes”, “plans”). Such information involves known and unknown risks — including the availability of funds, the results of financing and exploration activities, the interpretation of exploration results and other geological data, or unanticipated costs and expenses and other risks identified by Riverside in its public securities filings that may cause actual events to differ materially from current expectations. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/232849

Kelowna, British Columbia–(Newsfile Corp. – December 3, 2024) – Strathmore Plus Uranium Corporation (TSXV: SUU) (OTCQB: SUUFF) (FSE: TO3) (“Strathmore” or “the Company“) is pleased to announce that the Company drilled two newly identified uranium roll fronts on the Beaver Rim project. Four drill holes were completed, including the discovery of the two mineralized zones on the South Sage claim group. The intercepts included 7.5 feet grading 0.042% eU3O8 from 1,119-1,126.5 feet (hole BR-03-24) and 4.5 feet grading 0.024% eU3O8 from 1,090-1,094.5 feet (hole BR-01-24).

The Beaver Rim areas drilled lie 1 to 3 miles south of Cameco’s fully permitted in-situ recovery Gas Hills project. The goals of the drilling program were to determine the validity of our geologic model for Beaver Rim and that it’s a legitimate uranium exploration target. This included:

- Finding out if the arkosic-rich sediments beneath Beaver Rim correlate to the uranium bearing sediments to the north in the adjacent Gas Hills mining district?

- Did these sediments act as the geologic passageway for uranium transport from the south through the project area towards Gas Hills?

- Are these sediments suitable for uranium deposition and was there any uranium mineralization discovered in the Beaver Rim sediments?

With completion of the initial phase of drilling, Strathmore believes we have answered “Yes” to each of the questions regarding the geologic model, by having encountered uranium mineralization on the Beaver Rim project. The targeted host sandstone, the Puddle Springs Arkose member of the Eocene Wind River Formation was tested with the drilling. Results of the drilling show that the Puddle Springs is a very clean quartzite and feldspar-rich coarse sandstone and lesser mudstones. The member varied in thickness from 130-170 feet. Mineralization above grade cutoff (0.015% eU3O8) was encountered in two holes (BR-01-24, BR-03-24) in two separate sandstone intervals. A third hole, BR-02-24, showed above background gamma levels in three distinct sand intervals with notable alteration of the granitic sandstones in all holes drilled.

Based on these results, Strathmore believes the Beaver Rim area is a viable uranium exploration target. The Company plans to continue exploration of the project in 2025, including on the Diamond claim group to the west where previous drilling by Strathmore Minerals in 2012 encountered stacked roll front mineralization.

| Hole ID | Latitude | Longitude | Collar (Ft) | From (Ft) | To (Ft) | Thickness (Ft) | Grade % |

| BR-01-24 | 42.72470 | -107.51230 | 7,118 | 1,090.0 | 1,094.5 | 4.5 | 0.028 |

| BR-02-24 | 42.72918 | -107.51454 | 7,178 | Below cutoff | |||

| BR-03-24 | 42.72495 | -107.51283 | 7,126 | 1,119.0 | 1,126.5 | 7.5 | 0.042 |

| 1,137.0 | 1,139.5 | 2.5 | 0.028 | ||||

| BR-04-24 | 42.76613 | -107.50053 | 7,403 | Below cutoff |

Note: The tabled geophysical results are based on equivalent uranium (eU3O8) of the gamma-ray probes calibrated at the Department of Energy’s Test Facility in Casper, Wyoming. A series E Century Geophysical logging tool with gamma-ray, spontaneous potential, resistivity, and drift detectors was utilized in the logging. The reader is cautioned that the reported uranium grades may not reflect actual uranium concentrations due to the potential for disequilibrium between uranium and its gamma emitting daughter products. Further analysis on radiometric equilibrium will be conducted by Strathmore in the future.

Beaver Rim Technical Report

The Company has refiled to Sedar a technical report for the Beaver Rim project titled Technical Report on the Gas Hills-Beaver Rim Uranium Exploration Project, Fremont and Natrona Counties, Wyoming, USA. The report was authored by Mark B. Mathisen, C.P.G., of SLR International Corporation, and dated May 31, 2022. The report was required for Company regulatory purposes and inadvertently misfiled at the time in 2022. The report is available at www.sedarplus.ca. An updated report is planned upon completion of the autumn exploration program at the Beaver Rim project.

About the Beaver Rim Project

The Gas Hills uranium district is the largest uranium district in the State of Wyoming; with more than 100 million pounds of uranium being mined between 1954 to1988 when production ceased due to declining prices. Historical and recent reports suggest 50 to100 million pounds of uranium may exist in the Gas Hills district. The Beaver Rim project consists of 265 wholly owned mining claims totaling 5,475 acres. The project area was previously explored by American Nuclear in the 1970s, Cameco between1990 to early 2000’s, and most recently by Strathmore Minerals in 2012, where uranium mineralization was encountered at depths of 700-1,000 feet, contained in stacked, Wyoming-type roll front deposits within arkosic-rich sandstones of the Eocene-age Wind River Formation.

The Beaver Rim project lies immediately south and adjacent to Cameco’s fully permitted Gas Hills in-situ recovery project. Cameco reported for their Gas Hills project indicated and inferred mineral resources of 13.3 million and 6 million pounds of uranium, at 0.14% and 0.08% eU3O8 respectively (reported Dec. 31, 2023). Additional, historically defined resources controlled by Cameco are noted to trend from their Property south beneath the Beaver Rim claims including the West Diamond, East Diamond, North Sage, and South Sage properties. Strathmore is reviewing the greater Beaver Rim area and past exploration as part of its intent to acquire additional properties with the potential to contain uranium mineralization.

About Strathmore Plus Uranium Corp.

Strathmore has three permitted uranium projects in Wyoming: Agate, Beaver Rim, and Night Owl. The Agate and Beaver Rim properties contain uranium mineralization in typical Wyoming-type roll front deposits based on historical and recent drilling data. The Night Owl property is a former producing surface mine that was in production in the early 1960s.

Cautionary Statement: “Neither the TSX Venture Exchange nor its Regulation Services Provider (as the term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.”

Certain information contained in this press release constitutes “forward-looking information,” within the meaning of Canadian legislation. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur”, “be achieved” or “has the potential to”. Forward-looking statements contained in this press release may include statements regarding the future operating or financial performance of Strathmore Plus Uranium Corp. which involve known and unknown risks and uncertainties which may not prove to be accurate. Actual results and outcomes may differ materially from what is expressed or forecasted in these forward-looking statements. Such statements are qualified in their entirety by the inherent risks and uncertainties surrounding future expectations. Among those factors which could cause actual results to differ materially are the following: market conditions and other risk factors listed from time to time in our reports filed with Canadian securities regulators on SEDAR at www.sedarplus.ca. The forward-looking statements included in this press release are made as of the date of this press release and Strathmore Plus Uranium Corp. disclaim any intention or obligation to update or revise any forward-looking statements, whether a result of new information, future events or otherwise, except as expressly required by applicable securities legislation.

Qualified Person

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and reviewed on behalf of the company by Terrence Osier, P.Geo., Vice President, Exploration of Strathmore Plus Uranium Corp., a Qualified Person.

Strathmore Plus Uranium Corp.

Contact Information:

Investor Relations

Telephone: 1 888 882 8177

Email: info@strathmoreplus.com

ON BEHALF OF THE BOARD

“Dev Randhawa”

Dev Randhawa, CEO

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/232148