Video Transcript

As one of the lesser known but vital precious metals, Platinum has a long history of being used for jewelry and ornamentation, reaching back to the ancient Egyptian empire, having been discovered on a coffin unearthed in Thebes, estimated to be from the 7th century BC.

Platinum is a metal that represents power, prestige and a sense of great accomplishment. It has come to symbolize a high level of status in society, as evidenced by top-tier credit cards and membership programs using its name.

But Platinum has value beyond just being a status symbol. Modern-day uses of Platinum include being a key element in catalytic converters for vehicles, as it converts car exhaust gasses into less harmful substances, as a catalyst in the chemical industry and even in the creation of life-saving anti-cancer drugs.

Platinum was dubbed ‘platina’ or ‘little silver’ by the Spanish Conquistadors, and the truth is, it’s so much more than meets the eye.

But that’s just scratching the surface. On today’s episode, we explore this exclusive metal that befuddled miners and scientists alike when it was first discovered. Dubbed “platina” or “little silver” by the Spanish Conquistadors, the truth is, it’s so much more than meets the eye. Time to dig into Platinum on Commodity Culture.

What is Platinum?

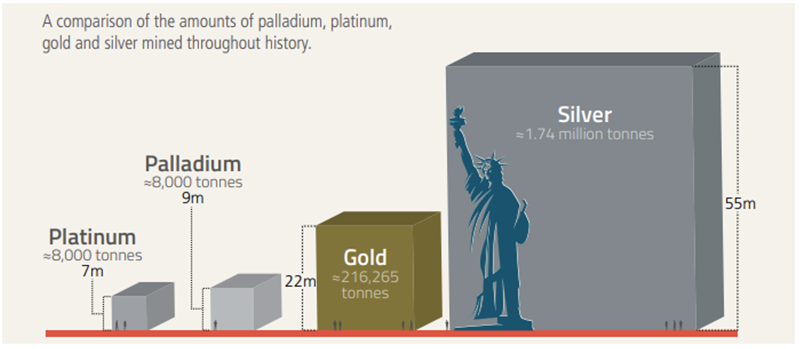

Platinum is a gray-white precious metal and one of a group of six elements known as the Platinum Group Metals (PGM). The other metals in the group are iridium, osmium, palladium, rhodium and ruthenium. Platinum is the most common of the group and sees the most use.

Platinum’s atomic number is 78; it has an atomic mass of 195 units, a melting point of 1768 Degrees Celsius, and is resistant to corrosion, stable at high temperatures and has stable electrical properties.

The name Platinum comes from the Spanish word “platina,” basically translating to “little silver.” This somewhat derogatory word was coined by Spanish Conquistadors in the 16th century, as they had no idea of Platinum’s uses or true value and considered it an annoyance that interfered with their attempts to mine gold.

In those times, it was widely believed that “platina” was young gold and that, given time, it would turn yellow as it matured, but until then, better to toss it aside and get back to mining for the real thing.

Platinum is rarely found on its own; it is often deposited alongside gold, copper, iron, nickel, and the other Platinum Group Metals. When discovered, Platinum can be quite inconspicuous at first glance, with nuggets having a dull gray or black hue. One thing that can help identify platinum is its incredible heft when held and if iron is also present in the alloy, it will be slightly magnetic.

First Known Platinum Jewelry

Some of the first known Platinum jewelry was crafted by the ancient indigenous peoples of Ecuador, with estimates placing their culture several centuries before the Spanish conquest of South America in 1492. It was particularly in the province of Esmeraldas where some of the most striking pieces were found, leading anthropologist William Farabee to declare:

“The native Indian workers of Esmeraldas were metallurgists of marked ability; they were the only people who manufactured Platinum jewelry.”

Considering Platinum is far more difficult to forge and manipulate than gold or silver, the method these ancient peoples used to work such a problematic metal was incredible and a testament to their dedication to their craft.

Platinum fragments were coated with gold dust, then heated by blowpipe on pieces of wood charcoal. The molten gold then caused the platinum to sinter, meaning it coalesced into a porous mass through heating, which allowed it to be forged.

Being the rarest of all the precious metals, along with its incredible strength as the hardest among them, has led Platinum to be one of the preferred forms of jewelry throughout the ages. In addition, it is highly resistant to scratches and other blemishes and does not wear away easily.

Platinum’s Unique Properties

Platinum, along with the other Platinum Group Metals, has strong catalytic properties – meaning it can accelerate or trigger a chemical process without becoming permanently changed or consumed.

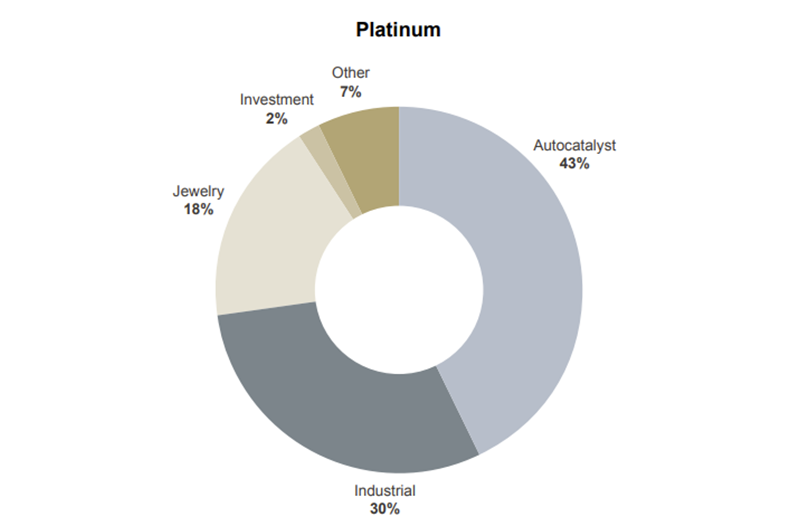

For this reason, Platinum is employed widely in the manufacturing of catalytic converters for use in exhaust systems in internal combustion vehicles. Platinum in exhaust systems helps curb vehicle pollution and contributes to enhanced air quality. Catalytic converters represent a whopping 50% of Platinum demand each year.

Due to its high melting point, Platinum is indispensable in chemical laboratories for electrodes and for crucibles and dishes in which materials can be heated to high temperatures.

In addition, Platinum is used in the chemicals industry as a catalyst to produce nitric acid, benzene and silicone. It is also used as a catalyst to improve the efficiency of fuel cells and for electrical contacts and sparking points, as it resists both the high temperatures and the chemical attack of electric arcs.

Platinum finds use in the electronics sector in the manufacturing of computer hard disks and thermocouples and is used to make optical fibers and LCD screens, turbine blades, spark plugs, pacemakers and, like other precious metals, is used widely in dentistry. Crowns, bridges, pins and other dental equipment, and fillings all employ Platinum as a key component.

Platinum is used as a catalyst in creating nitric acid, an essential ingredient in fertilizers, connecting Platinum to the creation of our food supply. But one of its more impactful uses to humanity is in the creation of chemotherapy drugs used to treat cancer, of which Platinum compounds are an important building block.

I’m willing to bet you didn’t think Platinum was such an essential element in our day-to-day lives, but the truth is, it’s a metal that is as practical as it is prestigious.

Next up, let’s explore the mining methods used to extract Platinum from the earth.

How is Platinum Mined?

Being one of the rarest metals on earth, Platinum is rarely found on its own but is generally found alongside Platinum Group Metals, nickel, iron, gold and other metals. Although pure Platinum deposits have been discovered, they are the exception rather than the rule.

One of the earliest Platinum mining methods is placer mining. Like gold, Platinum particles can accumulate in alluvial sands in rivers and streams. Placer deposits are minerals concentrated in streams and riverbeds from rock eroded from its source and further ground into pieces as it is washed away by the water.

Most of the world’s placer Platinum is found in Russia and back in the 19th century, alluvial deposits located in the Ural Mountains were heavily mined by both small-scale family operations and more official mining operations.

Placer mining for Platinum was also common in South America, especially in the Río de la Plata, or the River of Silver, located between Argentina and Uruguay.

Placer mining involves using dredges to scoop Platinum-bearing sand or gravel from riverbeds and washing it until Platinum grains or nuggets are captured and separated from the surrounding material.

In today’s world, most Platinum deposits are located underground and are mined very similarly to gold, silver and other underground metal deposits, namely with strategically placed explosives.

Miners drill holes into the mine walls and pack explosives into them before detonating the rock, blasting it into small pieces and hauling it up to the surface to be loaded onto trucks, which then take it to a facility to be processed.

Most platinum mining in the modern era is done in South Africa, which accounts for a whopping 80% of world platinum production.

The story of the man who first identified Platinum and began to make it known to the greater world is no less fantastic than the element itself, involving an adventure across continents, a capture and daring escape on the high seas, and a scientific discovery that would begin Platinum’s journey to becoming the dynamic metal we know it as today.

The History of Platinum’s Discovery

Antonio de Ulloa of Spain was only 19 years of age when he was promoted to the rank of frigate lieutenant and sent on what would be a life-altering expedition to Quito in Ecuador, led by French geographers Charles Marie de la Condamine and Pierre Bouguer.

Antonio departed Spain in May of 1735, not knowing he wouldn’t see his motherland again for more than a decade. The mission was a monumental one: To help determine whether the earth was flat, as was popularly believed throughout most of human history up until that point, or whether it was a sphere, as suggested by Sir Isaac Newton.

To this end, it was necessary to measure the length of a degree of latitude at the equator, of which Quito was the closest city, and again at somewhere as near as possible to one of the poles. An expedition to the far north of Sweden was also dispatched for this purpose, but our story shall leave that journey to the pages of history.

As Antonio accompanied the geographers in Ecuador, their task proved epic indeed and with great struggle, they finally completed their work around 1745. Over the course of this decade, Antonio had plenty of time to explore the territory and the people there, recording his more interesting observations in various papers he carried with him.

As the expedition finally departed back to Spain, their mission accomplished, Antonio must have been filled with strong emotions as he was, at long last, headed home. Fate, however, had other plans in store for him.

As they made their way, sailing around Cape Horn, they were chased down north of the Azores by an English privateer and their ship was captured. However, they managed an escape and as luck seemed to be on their side, they evaded their captors and seemed to leave danger behind.

However, higher powers seemed intent on testing their wills and as they reached Louisbourg in Nova Scotia, their vessel was once again captured, this time by a British naval vessel and escape was out of the question. Antonio and his companions were taken to London and imprisoned, while the Admiralty confiscated nearly a decade’s worth of notes from Antonio’s time spent in Ecuador. Things looked grim for our frigate lieutenant as he sat in a cell awaiting his fate.

But this opened a window and good fortune came in the form of the President of the Royal Society, Martin Folkes, who came to know Antonio and his story and befriended him. The Royal Society was a group of natural philosophers and physicians, and not only did Martin free Antonio from his chains, but he also got all his papers returned to him and even made him a Fellow of the Royal Society in 1746. He was then allowed to return to Spain.

Finally, after his long mission, Antonio set to work compiling an account of his adventures, which he published in 1748, first in Spanish and then translated into several other languages.

For our subject today, one passage, in particular, stands out:

“In the district of Choco are many mines of lavadero or wash gold. Several of the mines have been abandoned on account of the Platina, a substance of such resistance, that when struck on an anvil of steel, it is not easy to be separated; nor is it calcinable, so that the metal enclosed within this obdurate body could only be extracted with infinite labor and charge.”

Shortly after releasing his book, Antonio was tasked with a new mission by the King of Spain, King Ferdinand VI, to travel throughout Europe and study scientific developments across the continent.

Antonio’s travels brought him to Sweden in the autumn of 1751 and he was welcomed with open arms by Swedish scientists. Shortly after his arrival, he was duly elected to the Royal Swedish Academy of Sciences in October of the same year. During his time there, he met with mathematician and chemist H.T. Scheffer. Scheffer was a former mine and metal works manager and an assayer at the mint and so had a vested interest in metals.

There is no official record of what exactly was said in that meeting, but shortly after that in November of 1751, Scheffer produced a paper titled, “The White Gold, or 7th Metal, called in Spain’ Platina del pinto’ Little Silver of Pinto, its Nature Described,” and submitted it to the Academy.

Scheffer was already familiar with Platinum before encountering Antonio, as he had received samples of it just a year earlier in 1750 from the West Indies, but his time with Antonio undoubtedly influenced his writing. In his paper, he came to the following conclusions about Platinum:

“That this is a metal hard but malleable, but of the hardness of malleable iron.

“That it is a precious metal of durability, like gold and silver.

“That it is not any of the six old metals, since first it is wholly and entirely a precious metal, containing nothing of copper, tin, lead, or iron, because it allows nothing to be taken from it. It is not silver, nor is it gold; but it is a seventh metal among those which are known up till now in all lands.”

In addition, he recommended a potential practical application for Platinum when he wrote:

“This metal is the most suitable of all to make telescope mirrors because it resists as well as gold the vapors of the air, it is very heavy, very dense, colorless and much heavier than ordinary gold, which is rendered unsuitable for this particular use by lacking these two latter properties.”

Although attempts were made in the years that followed, Platinum never found its place in the telescopes of the era, although Scheffer would be delighted to know the metal did eventually find use in the construction of x-ray telescopes centuries later. Nonetheless, Scheffer’s paper sparked the imaginations of scientists around the world, and a flurry of research into Platinum began, leading it to establish itself as the multifaceted metal that we know in the modern era.

The Future of Platinum

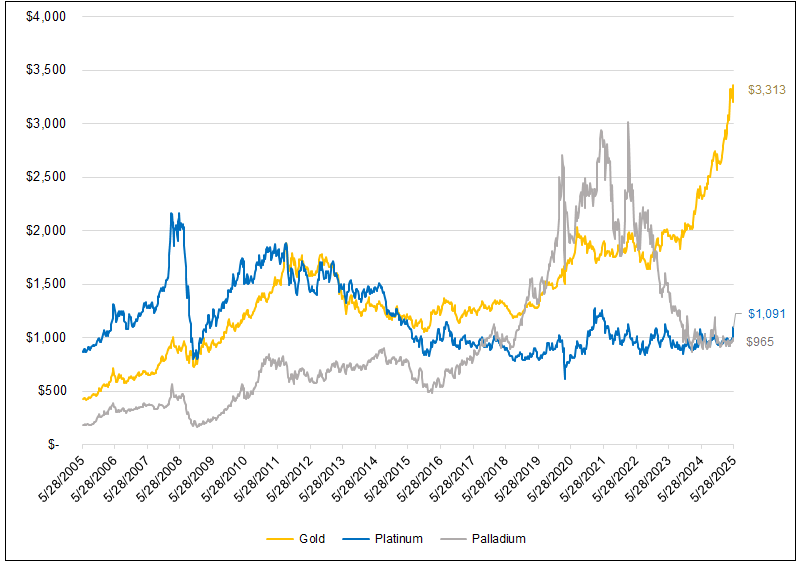

Although the recent trend toward electrifying vehicles seemingly puts Platinum’s use in traditional gasoline-powered catalytic converters at risk, we need to step back and look at the bigger picture.

In the coming years, autocatalyst demand for Platinum is likely to rise as recent legislation to curb pollution from gasoline and diesel engines is boosting the demand for cleaner emissions, which is Platinum’s forte.

Either way, Platinum will have a role to play in a carbon-neutral future, as it is needed for hydrogen-powered fuel cell electric vehicles. These use a propulsion system similar to that of electric vehicles, where energy stored as hydrogen is converted to electricity by the fuel cell, and these vehicles are already becoming available in California and a few other places.

Platinum is also playing a role in the greater energy economy, as Platinum-based fuel cells are a cost-effective, clean and reliable off-grid power source that is currently seeing use in some remote areas, such as rural South Africa.

These fuel cells can help provide greater energy access to communities that might not normally be able to get a steady source of electricity. This includes electricity for schools, improving the quality of education and providing the ability to pump water for irrigation, facilitating agriculture.

Platinum’s other myriad uses also aren’t going away, and for this reason, Platinum will remain an essential metal to our modern civilization for as long as we can extract it from the earth.

Jesse Day is not an employee or an affiliate of Sprott Asset Management LP. The opinions, estimates and projections (“information”) contained within this content are solely those of the presenter and are subject to change without notice. Sprott Asset Management LP makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Sprott Asset Management LP assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Sprott Asset Management LP is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Please contact your own personal advisor on your particular circumstances. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Sprott Asset Management LP. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell.

Important Disclosure

Sprott Physical Platinum and Palladium Trust (the “Trust”) is a closed-end fund established under the laws of the Province of Ontario in Canada. The Trust is available to U.S. investors by way of a listing on the NYSE Arca pursuant to the U.S. Securities Exchange Act of 1934. The Trust is not registered as an investment company under the U.S. Investment Company Act of 1940.

The Trust is generally exposed to the multiple risks that have been identified and described in the prospectus. Please refer to the prospectus for a description of these risks. Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like store of value, safe haven, and safe asset. These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds, and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

All data is in U.S. dollars unless otherwise noted.

Past performance is not an indication of future results. The information provided is general in nature and is provided with the understanding that it may not be relied upon as, nor considered to be tax, legal, accounting or professional advice. Readers should consult with their own accountants and/or lawyers for advice on their specific circumstances before taking any action. Sprott Asset Management LP is the investment manager to the Trust. Important information about the Trust, including the investment objectives and strategies, applicable management fees, and expenses, is contained in the prospectus. Please read the prospectus carefully before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or operational charges or income taxes payable by any unitholder that would have reduced returns. You will usually pay brokerage fees to your dealer if you purchase or sell units of the Trusts on the Toronto Stock Exchange (“TSX”) or the New York Stock Exchange (“NYSE”). If the units are purchased or sold on the TSX or the NYSE, investors may pay more than the current net asset value when buying units or shares of the Trusts and may receive less than the current net asset value when selling them. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. The information contained herein does not constitute an offer or solicitation to anyone in the United States or in any other jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds managed by Sprott Asset Management LP. These views are not to be considered as investment advice nor should they be considered a recommendation to buy or sell.