Vancouver, BC – Group Ten Metals Inc. (TSX.V: PGE; US OTC: PGEZF; FSE: 5D32) (the “Company” or “Group Ten”) announces results from the Camp Zone target area on the east side of the Stillwater West Project in Montana, USA. This is the third in a series of planned news releases to report results of 2018 exploration programs and on-going data synthesis and modeling work at the Company’s flagship platinum group element-nickel-copper (“PGE-Ni-Cu”) project adjacent to Sibanye-Stillwater’s high-grade PGE mines in the Stillwater Igneous Complex. Highlights include:

- Drilling by AMAX in the late 1960s and early 1970s includes nine holes which delineate a continuous zone of nickel-copper sulphide mineralization in the Basal Series ranging from 15 to 110 meters in thickness over approximately 1.5 kilometers strike with average grades of 0.42% nickel and 0.23% copper. Platinum and palladium assays, completed as composite samples over select intervals only, demonstrate thick intervals of enrichment, confirming the potential for Platreef-style deposits in the lower Stillwater Complex.

- Nickel and copper grades in these drill holes are comparable to those in the Platreef deposits. Limited data is available for platinum and palladium although select intervals were composited with intercepts of up to 1.4 g/t Pt+Pd. Additional drilling will be needed to better define PGE content.

- These drill holes confirm that the geophysical conductive high in this area is targeting high-sulphide mineralization which remains open along strike and to depth with untested parallel conductive anomalies.

- Initial bench-scale metallurgical results from the Camp Zone completed by AMAX are very encouraging and demonstrate that, though Stillwater West is still an exploration stage asset with a lot of room to grow, preliminary testing supports the potential for effective nickel and copper sulphide flotation along with recovery of a significant PGE component.

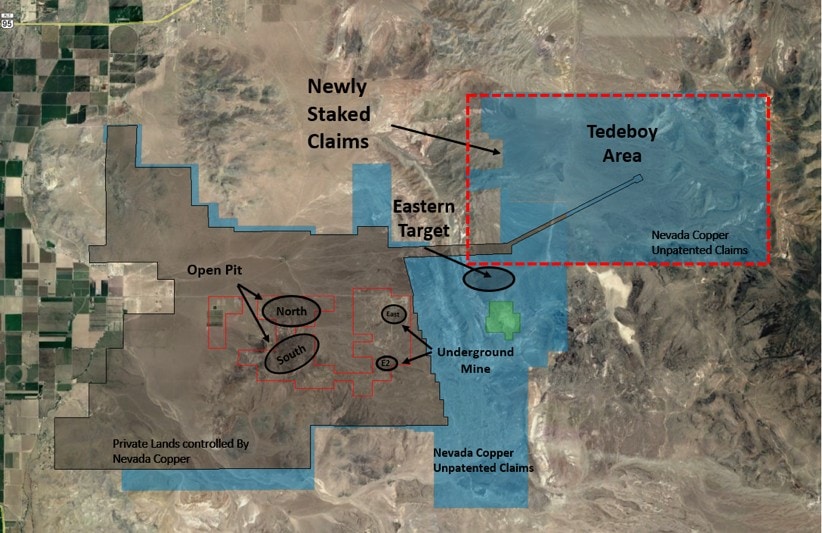

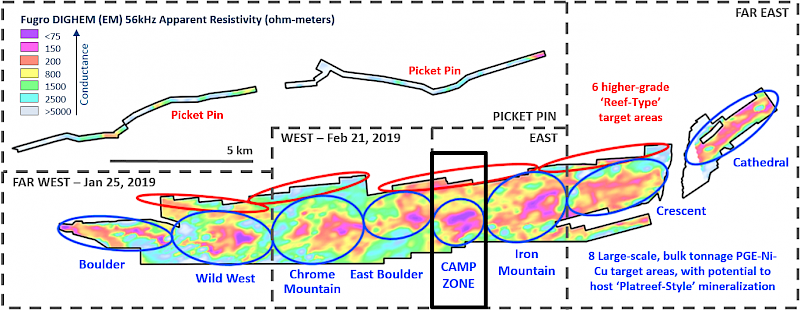

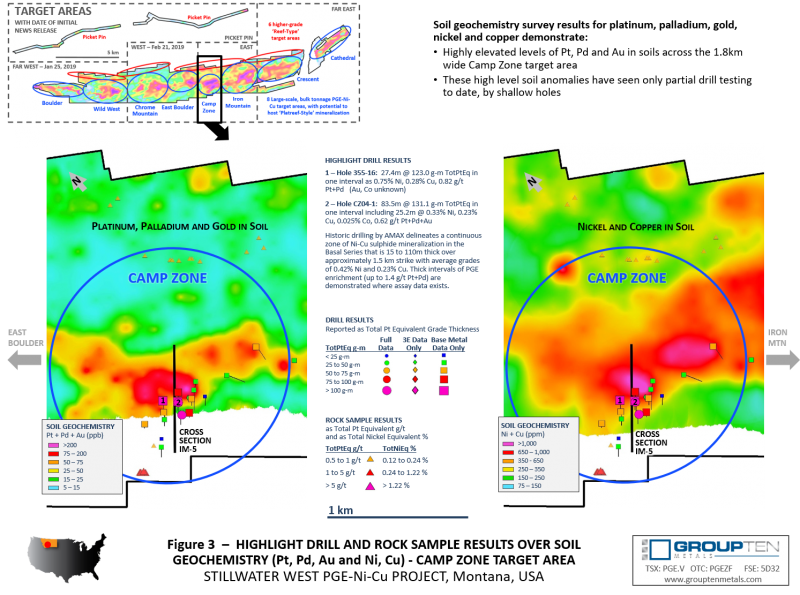

Michael Rowley, President and CEO, commented, “We are pleased to report results of our work to date in the Camp Zone target area of the 25-km-long Stillwater West Project (see Figure 1) which, like the four target areas announced previously, displays widespread platinum, palladium, gold, nickel, copper and cobalt mineralization in drill and rock sample results across highly conductive kilometer-scale geophysical anomalies with coincident highly elevated levels of metals in soils. The Camp Zone target area is among the most developed at Stillwater West Project and is, along with the Chrome and Iron Mountain target areas, a priority for work in 2019. We see the potential to rapidly expand on previous work in terms of both size and grade through the application of the geological model we have developed. The scale of these targets, and the geological similarities to the Bushveld Complex of South Africa, demonstrate the potential for discovery of a major new bulk-tonnage “Platreef-style” PGE-Ni-Cu deposit in the famously metal-rich Stillwater Complex.”

Figure 1 – 14 Target Areas Across the 25-Kilometer Width of the Stillwater West Project

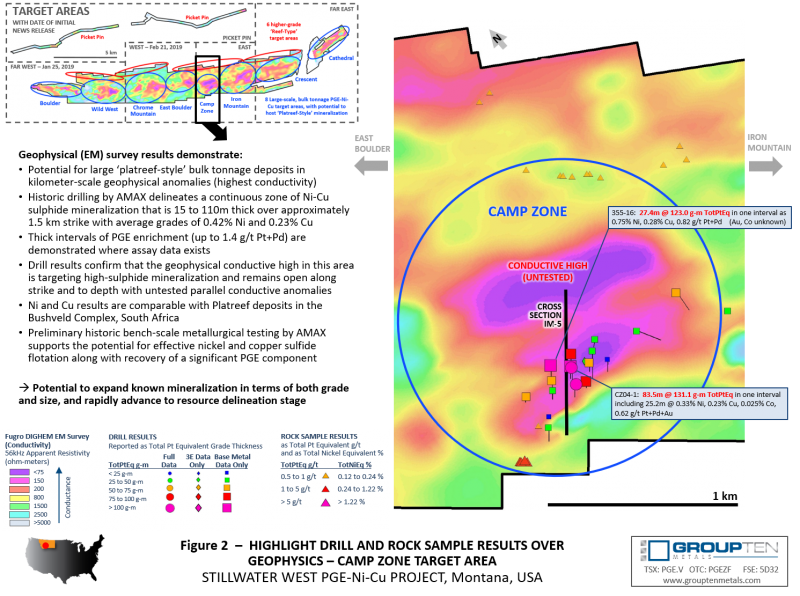

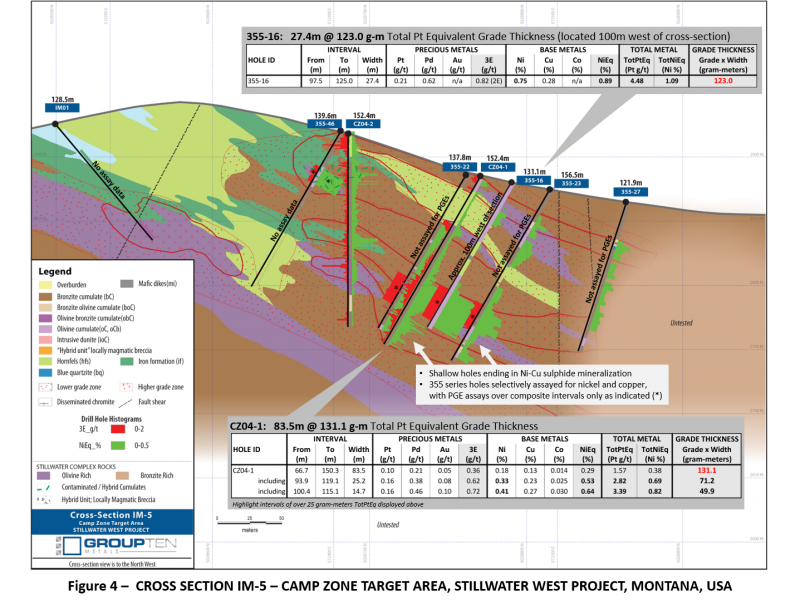

As shown in Figure 1, the Camp Zone target area covers 1.8 km of strike length and represents one of eight major electromagnetic geophysical conductors defined across the 25-kilometer length of the Stillwater West project. Most of the work to date at Camp Zone has focused on disseminated to net-textured sulphide mineralization within cumulates of the Basal Series and adjacent country rocks. Drilling by Amax in the late 1960s through mid-1970s focused on exploration for nickel and copper. Platinum and palladium analyses were completed on some intervals on a composite basis with assays up to 1.4 g/t Pt+Pd, and select holes report PGE assay results composited over long intervals including hole 355-16 which returned 27.4m at 123.0 gram-meters Total Platinum Equivalent (TotPtEq) grade thickness (0.75% Ni, 0.28% Cu, 0.21 g/t Pt and 0.62 g/t Pd, equivalent to 4.48 g/t TotPtEq, or 1.09% Total Nickel Equivalent).

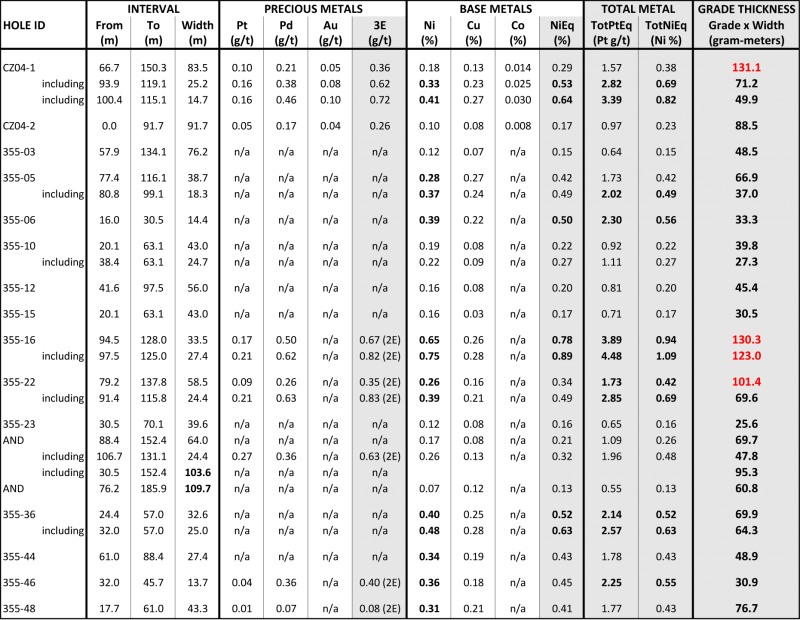

Table 1 – Highlight Mineralized Drill Intercepts from the Camp Zone Target Area

Intercepts with grade thickness values over 25 gram-meter TotPtEq are presented above. Intervals with 2E data have composite platinum and palladium assays only. Total Platinum Equivalent (TotPtEq g/t) and Total Nickel Equivalent calculations reflect total gross metal content using metals prices as follows (all USD): $6.00/lb nickel (Ni), $3.00/lb copper (Cu), $20.00/lb cobalt (Co), $1,000/oz platinum (Pt), $1,000/oz palladium (Pd) and $1,250/oz gold (Au). Values have not been adjusted to reflect metallurgical recoveries. Total metal equivalent values include both base and precious metals, where available. Results labelled ‘n/a’ were not assayed for that metal. Total platinum equivalent grade thickness was determined by multiplying the thickness (in meters) by the Total Platinum Equivalent grade (in grams/tonne) to provide gram-meter values (g-m) as shown. CZ04 series drill holes were conducted by Group Ten’s QP and are not considered historic. 355 series drill are considered historic and have not been independently verified by Group Ten.

Subsequent drilling in 2004 within the footprint of the historic Camp Zone holes confirms the presence of broad zones of nickel and copper sulphides and also identified significant associated precious metal and cobalt mineralization with hole CZ04-1 returning 83.5 meters at 131.1 g-m TotPtEq including 25.2 meters at 2.82 g/t TotPtEq (or 0.69% TotNiEq). This hole comprised 0.33% Ni, 0.23% Cu, 0.025% Co, and 0.62 g/t 3E (as 0.16 g/t Pt, 0.38 g/t Pd, 0.08 g/t Au).

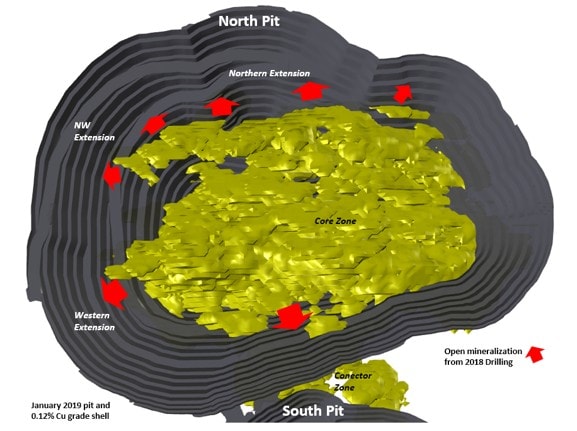

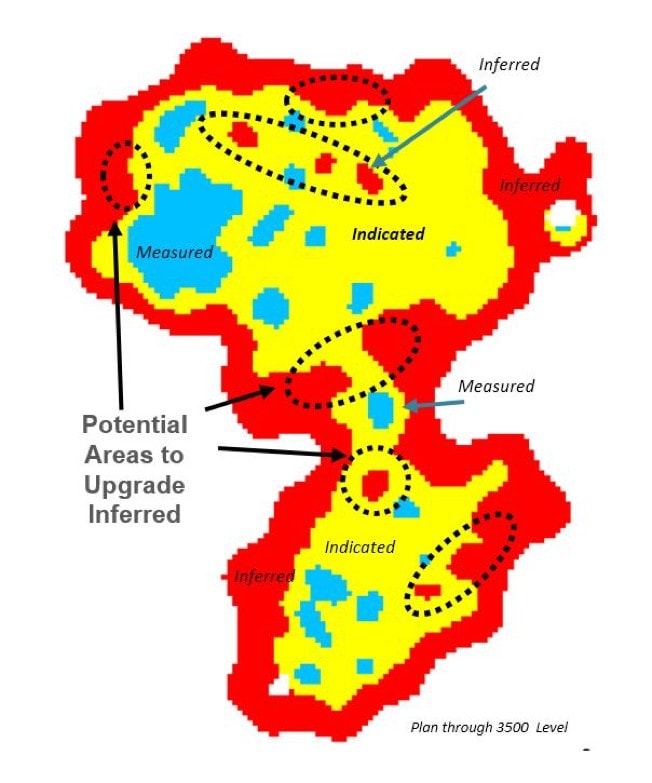

Like the Hybrid Zone target area at Chrome Mountain (announced February 21, 2019), past work in the Camp Zone target area provides the Company with drill-defined wide intervals of mineralization that have typically only been tested to less than 150 meters of depth. These zones remain open in all directions and the adjacent soil and geophysical anomalies remain untested (see Figure 2).

The Company is targeting a Platreef-type setting at the Camp Zone where bulk-tonnage sulphide mineralization in the Basal Series of the complex may be associated with interaction between the layered basal magmatic system and the basement country rocks. Interaction and assimilation of basement country rocks is an important component of the Platreef deposits in the Bushveld Complex, where the country rocks may be in place as the footwall or occur as large rafts within the layered magmatic stratigraphy. The potential for this setting at the Camp Zone is supported by deep conductive geophysical targets along with historic drilling just south of the Camp Zone, where hole IM01 drilled through iron formation starting at surface, in what had been interpreted as basement country rocks, before returning to mineralized layered ultramafic rocks below (see Figure 4).

The multi-kilometer geophysical, geochemical and geological signatures present compelling bulk-tonnage targets in this type of setting for PGE-enriched Ni-Cu sulphides in the lower Stillwater Complex stratigraphy. The Camp Zone target area is a priority for follow-up work in 2019 based on the potential for large-scale disseminated and massive nickel and copper sulphide mineralization enriched in PGE, gold and cobalt. Group Ten sees the potential to expand known mineralization in terms of both scale and grade and rapidly advance these areas to resource delineation stage through the application of a systematic approach and the predictive geologic model developed to date.

About the Stillwater West Project

The Stillwater West PGE-Ni-Cu project positions Group Ten as the second largest landholder in the Stillwater Complex, adjoining and adjacent to Sibanye-Stillwater’s world-leading Stillwater, East Boulder, and Blitz platinum group elements (PGE) mines in south central Montana, USA. With more than 41 million ounces of past production and current M&I resources, plus another 49 million ounces of Inferred resources1,2, the Stillwater Complex is recognized as one of the top regions in the world for PGE-Ni-Cu mineralization, alongside the Bushveld Complex and Great Dyke in southern Africa, which are similar layered intrusions. The J-M Reef, and other PGE-enriched sulphide horizons in the Stillwater Complex, share many similarities with the highly prolific Merensky and UG2 Reefs in the Bushveld Complex, while the lower part of the Stillwater Complex also shows the potential for much larger scale disseminated and high-sulphide PGE-nickel-copper type deposits, possibly similar to Platreef in the Bushveld Complex3. Group Ten’s Stillwater West property covers the lower part of the Stillwater Complex along with the Picket Pin PGE Reef-type deposit in the upper portion, and includes extensive historic data, including soil and rock geochemistry, geophysical surveys, geologic mapping, and historic drilling.

Note 1: Report on Montana Platinum Group Metal Mineral Assets of Sibanye-Stillwater, November 2017, Measured and Indicated Resources of 57.2 million tonnes grading 17.0 g/t Pt+Pd containing 31.3 million ounces and 92.5 million tonnes grading 16.6 g/t containing 49.4 million ounces. Grade thickness was determined by applying the reported minimum mining width of 2.0 meters to the M&I grade of 17 g/t Pt+Pd for an average grade thickness of approximately 34 gram-meter (g-m).

Note 2: Public production records from Stillwater Mining Company from 1992 to present.

Note 3: Magmatic Ore Deposits in Layered Intrusions—Descriptive Model for Reef-Type PGE and Contact-Type Cu-Ni-PGE Deposits, Michael Zientek, USGS Open-File Report 2012–1010.

About Group Ten Metals Inc.

Group Ten Metals Inc. is a TSX-V-listed Canadian mineral exploration company focused on the development of high-quality platinum, palladium, nickel, copper, cobalt and gold exploration assets in top North American mining jurisdictions. The Company’s core asset is the Stillwater West PGE-Ni-Cu project adjacent to Sibanye-Stillwater’s high-grade PGE mines in Montana, USA. Group Ten also holds the high-grade Black Lake-Drayton Gold project in the Rainy River district of northwest Ontario and the highly prospective Kluane PGE-Ni-Cu project on trend with Nickel Creek Platinum’s Wellgreen deposit in Canada‘s Yukon Territory.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry’s highest-grade producers of platinum, palladium, silver and copper. Member companies include Group Ten Metals (TSX-V: PGE) in the Stillwater PGM-Ni-Cu district of Montana, Metallic Minerals (TSX-V: MMG) in the Yukon’s Keno Hill silver district, and Granite Creek Copper (TSX-V: GCX) in the Yukon’s Carmacks copper district. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorer/developers and major producers and are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven historic mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director

Email: info@grouptenmetals.com Phone: (604) 357 4790

Web: http://grouptenmetals.com Toll Free: (888) 432 0075

Quality Control and Quality Assurance

2018 rock chip samples were analyzed by Bureau Veritas Mineral Laboratories in Vancouver, B.C. Samples were crushed and split, and a 250 g split pulverized with 85% passing 200 mesh. Gold, platinum, and palladium were analyzed by fire assay (FA350) with ICP finish. Selected major and trace elements were analyzed by peroxide fusion with ICP-EB finish to insure complete dissolution of resistate minerals. Following industry QA/QC standards, blanks, duplicate samples, and certified standards were also assayed.

2004 drilling was conducted by Group Ten’s QP while working for Beartooth Platinum. Pre-2001 drill results are considered historic and have not been independently verified by Group Ten. Mr. Mike Ostenson, P.Geo., is the qualified person for the purposes of National Instrument 43-101, and he has reviewed and approved the technical disclosure contained in this news release.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Group Ten believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.