- The target above the 2021 high is the 2011 peak

- Goldman Sachs says copper is the new oil

- Producers are looking for new supplies

- Nevada is a friendly state with lots of reserves

- The trend is your friend in markets- It is rising in copper and Nevada Copper shares- They still show increased value potential

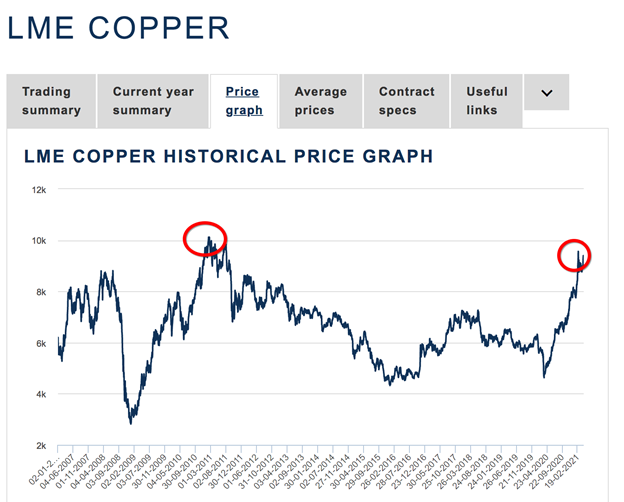

At the start of May, copper remained near a 10-year high of $4.50/lb. After correcting to $3.9435 in late March, copper bounced towards the high in a continuation of the bullish trend that has been in place since March 2020. Thirteen months ago, copper found a bottom at more than half the current price when it reached $2.0595 per pound on the nearby COMEX copper futures contract. LME three-month copper forwards fell to a low of $4,626.50 per ton.

Rising demand with supplies not keeping pace is fueling the copper bull. Producers are scouring the world for new reserves and production. One area that offers a friendly jurisdiction and exciting reserves is the state of Nevada and Nevada Copper has a substantial footprint in the state as it explores for copper, gold, and silver. Nevada copper holds a 100% interest in the Pumpkin Hollow property in Nevada, with the company’s headquarters nearby in Reno, Nevada.

Nevada Copper Corporation trades in the US on the over-the-counter market under the symbol- NEVDF. On the Toronto Stock Exchange (TSX), the company’s symbol is NCU.TO.

Exploration companies carry a high risk for investors. However, since the reward is a function of risk, payoffs can be massive for successful companies. Nevada Copper’s shares are worth a look as the red metal is moving higher in the most significant bull market in over a decade, and Nevada is a safe, growth area for copper production.

The target above the 2021 high is the 2011 peak

After reaching a high of $4.3755 per pound on the active month May COMEX futures contract on February 25, copper corrected to a low of $3.8490 on March 4. The over 12% decline was significant, but it did not negate the bullish trend since March 2020, when the continuous contract price reached a bottom at $2.0595 per pound.

Source: CQG

The chart shows that since the March 4 low, COMEX copper futures have made higher lows and higher highs and were back over the $4.50 per pound level at the end of April.

Source: CQG

The long-term quarterly chart illustrates the red metal has posted four consecutive quarterly gains. A close above $3.9830 on June 30 would mark the fifth straight quarter of higher prices. Open interest, the total number of open long and short positions in the COMEX copper futures market, is steady at the 248,000 level. Open interest has increased steadily over the past years. With rising open interest along with an increase in the copper spot price is a good indicator for a technical validation of a bullish trend in a futures market. Quarterly price momentum and relative strength indicators are rising in a bullish trend. Quarterly historical volatility at just below the 26% level is near the highest reading since 2013. The quarterly chart shows the next upside target stands at the 2011 peak at $4.6495 per pound, only 27.4 cents above the recent 2021 high.

Source: LME

The chart of three-month copper forwards on the London Metals Exchange shows that the red metal traded to a high of $9,562.50 in February, with the 2011 high at $10,123 per metric ton. LME forwards were at the $9,370 level recently.

Goldman Sachs says copper is the new oil

In a recent research report, Goldman Sachs analysts wrote, “The critical role copper will play in achieving the Paris climate goals cannot be overstated.” The report’s title is “Copper is the new oil,” a statement on the base metal’s rising profile in the world financial system.

Copper is a primary component in systems that create wind, solar, and geothermal energy. It is essential for electric vehicles and semiconductors, as well as having many other industrial applications. A US infrastructure rebuilding program and China’s massive and growing appetite for the red metal will only increase the base metal’s demand over the coming years.

According to Goldman Sachs’s report, it takes two to three years to extend an existing copper mine and as many as eight years to establish a new project. Goldman sees prices rising to the $15,000 per ton level by 2025, over 50% above the late February high and well above the 2011 peak.

Producers are looking for new supplies

The world’s leading copper producers are searching for new supplies. In 2020, the top five copper mining companies were:

- Codelco- 1.73 million tons

- BHP- 1.72 million tons

- Freeport-McMoRan- 1.45 million tons

- Glencore- 1.26 million tons

- Southern Copper- 1.0 million tons

As the demand rises, these leading mining companies and others worldwide will scourge the earth for new supplies. Exploration companies that locate proven and probable reserves in safe and friendly jurisdictions with minimal political risk will take advantage of the copper boom that began at the March 2020 lows and is likely to continue over the coming years. Nevada Copper Corporation could be a diamond in the rough in May 2021 as it has a foothold in a region rich in copper reserves in the safest area of the world.

Nevada is a friendly state with lots of reserves

In the United States, scarcity in the copper market could become a national security issue over the coming years. Competing with China could be a challenge as the Chinese have spent decades securing relationships and supplies worldwide via copper producers and infrastructure investments in copper-producing countries. Therefore, the importance of US domestic output is rising.

When most people think of Las Vegas and its gambling, shows, and fine dining when it comes to Nevada, mining shaped the state’s economy for many years. Mark Twain, the American writer, humorist, entrepreneur, publisher, and lecturer, lived in Nevada when he wrote Roughing It in the early 1870s. Nevada is officially known as the “Silver State” because of the role of silver in the state’s history and economy. In the 2020s, Nevada looks set to become the “Copper State” as Nevada Copper is extracting substantial supplies of the red metal from mineral-rich areas within the state’s borders.

Pumpkin Hollow is Nevada Copper’s crown jewel property, hosting an underground project currently in production and an open pit development. The Fraser Institute rates the location in Nevada as the World’s #1 mining jurisdiction. Moreover, the local district of Yerington is a former copper-producing region with world-class infrastructure and a skilled workforce. Pumpkin Hollow’s substantial reserves and resources include copper, gold, and silver, with lots of potential for deposit expansion and greenfield exploration. Production is ongoing at Pumpkin Hollow; the open pit project is advancing to the feasibility stage, and greenfield exploration activity has started.

Nevada Congressman Mark Amodei was the Master of Ceremonies at Pumpkin Hollow’s groundbreaking ceremony eight years ago. He recently visited the site to survey progress. Congressman Amodei sponsored the successful Yerington Land Conveyance and introduced the bill in the US House of Representatives in February 2012. The legislation was Section 3009 in the National Defense Authorization Act of 2014 that privatized all 10,000+ acres of land where Pumpkin Hollow resides. Nevada Copper has the only mining permits in the area.

The trend is your friend in markets- It is rising in copper and Nevada Copper shares- They still show increased value potential

You can learn more about Nevada Copper and the company’s plans and projects on its website. In markets, the trend is always your best friend, and in copper, it is higher. The rising price and increasing US copper requirements put Nevada Copper in a perfect position to grow and profit over the coming years. As a company closing in on commercial production with their underground mine, and an additional fully permitted open-pit mine n development, and with a property of multiple exploration targets, they are creating a franchise in the region. The value proposition has not been fully realized. Nevada is a location that offers political and economic stability compared to most other mineral-rich sites.

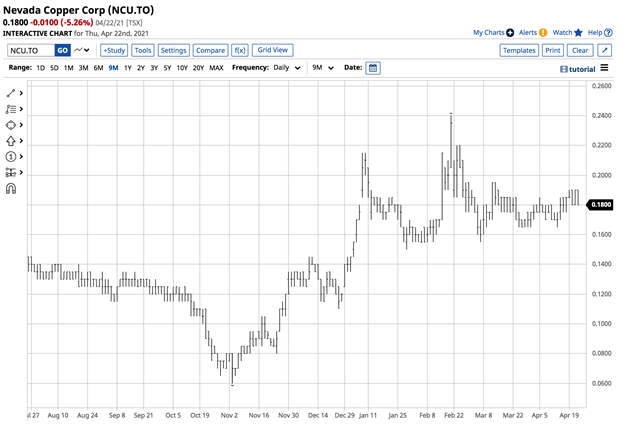

Source: Barchart

The chart of Nevada Copper Corp shares (NCU.TO) that trade on the Toronto Stock Exchange highlights the move from C$0.06 on November 3, 2020, to a high of C$0.24 on February 19. On April 22, the shares pulled back to the C$0.18 level.

At the C$0.18 level, Nevada Copper has a market cap of C$323.633 million. NCU.TO trades an average of over 3.3 million shares each day, making the company liquid for trading or investing. In the US, Nevada Copper Corporation trades under the symbol NEVDF. The stock closed at USD $0.1531 on April 22, with a market cap of USD $278.801 million and an average of over 1.35 million shares changing hands each day. The stock has been climbing since and on April 30 reached C$0.23 in Canada and USD $0.18 in the US.

Nevada Copper offers investors three compelling reasons to consider the company for portfolios:

- The trend in copper is rising, and some of the most respected analysts on Wall Street see the price moving over 50% higher than the current level.

- Nevada Copper has an exploration and production franchise in a prime location in Nevada, a state that offers political and economic stability.

- The US needs to secure copper supplies for the coming years and is likely to favor domestic exploration companies and producers as it competes for metal with China

Nevada Copper offers lots of upside potential at the current share price. The company’s success is a strategic imperative for the United States as it competes with China and other countries for scarce copper supplies. There are few places better than in the US’s backyard in the “Silver State” of Nevada, with a long history of success in the mining business, to secure copper supplies for the coming years.

If you’re interested in following Nevada Copper’s progress, visit https://investors.nevadacopper.com/alerts.

Written By: Andrew Hecht, on behalf of Maurice Jackson of Proven and Probable.

Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.