- New all-time highs in copper in May- Bull markets rarely move in a straight line

- Inventories are trending lower- Analysts are bullish

- New production is a challenge- The case for a continuation of the bullish copper tend

- Nevada Copper’s production is ramping up- Timing is everything for the US producer

- An inexpensive stock with a compelling risk-reward profile

April and May 2020 were wild months in the markets. Bitcoin, the digital currency asset class leader, exploded to over $65,000 per token before halving in value. In 2010, a Bitcoin was worth only five cents. A $1 investment turned into over $1.3 million at the recent high.

Traders, investors, and speculators are looking for the next token or asset that will deliver Bitcoin-like returns. However, risk is always a function of potential rewards. Many of the over 10,000 cryptocurrencies floating around in cyberspace will wind up as dust collectors in computer wallets.

Meanwhile, hard asset prices continue to appreciate as central bank liquidity and government stimulus addressing the global pandemic’s fallout are stoking inflationary flames. In May, a host of commodity prices reached multi-year or all-time highs. Grains rose to the highest levels in eight years. Palladium and lumber reached all-time highs. Perhaps the most significant new record high came in the copper market.

The red metal with the nickname “Doctor Copper” diagnoses the overall health and well-being of the global economy. Rising copper prices point to expansion. A new record high in May tells us that the base metal expects an unprecedented boom. Producers can hardly keep pace with the rising demand for copper and other infrastructure building blocks. Addressing climate change will increase demand for the nonferrous metal, as will the shortage of semiconductors. The nearly perfect bullish storm pushed copper to almost $4.90 per pound on the nearby COMEX futures contract and over $10,700 per ton on the three-month LME forward market.

Digital currencies may be all the rage, but copper is likely to be a commodity set to deliver steady returns over the coming years without all the hype and wild price variance. Leveraging a copper investment requires identifying mining companies positioned to fill the widening supply-demand gap that continues to develop. Nevada Copper Corporation (NEVDF) shares trade on the over-the-counter market in the US and on the Toronto Stock Exchange or TSX, under the symbol NCU.TO.

While many market participants are busy looking for the next Bitcoin or Ethereum in the cryptocurrency asset class, Nevada Copper shares have the potential to deliver solid returns over the coming years. At 25 cents Canadian or 20.7 US cents on June 4, the shares are inexpensive. The copper price is in a bullish trend, and the company is working to cash in and establish itself as a mid-tier copper producer in a top mining jurisdiction worldwide.

Those who cashed in on the cryptocurrency craze and investors looking for a new value proposition, should consider following a company that could become a star in US copper production. Copper is a traditional industrial metal with growing applications as the technological age increases the demand dramatically.

New all-time highs in copper in May- Bull markets rarely move in a straight line On Friday, June 4, COMEX copper futures for July delivery settled at over the $4.52 per pound level. The price had moved to a new record peak in May before selling emerged. Despite the recent selloff from the highs, the trend remains higher.

Source: CQG

The quarterly chart highlights that COMEX copper futures never traded above $1.6065 before 2005. The price has been above that level since 2009. Meanwhile, the spike low at $1.2475 following the 2008 global financial crisis gave way to a record high of $4.6495 in 2011 as monetary and fiscal policies created inflationary pressures. After a correction that took copper to a higher low of $1.9355 in early 2016, the price recovered to over the $3.32 level in 2017. The worldwide pandemic caused selling in markets across all asset classes. Copper’s price fell, but it reached a higher low of $2.0595 in March 2020.

The levels of monetary and fiscal stimulus in 2020 and 2021 dwarf the levels in 2008. While it took three years for copper to reach a new all-time high following the global financial crisis, it only took a little over a year for the red metal to rise to a new high of $4.8985 per pound in May 2021. Bull markets rarely move in a straight line; the higher prices move during rallies; the odds of corrections increase. July COMEX copper futures pulled back to the settle at $4.5290 per pound on June 4.

The quarterly chart remains bullish after the recent correction. Quarterly price momentum and relative strength indicators are trending higher, well above neutral readings. The total number of open long and short positions in the COMEX futures market has been moving higher with the price, typically a technical validation of a bullish trend in a futures market. Quarterly historical volatility at 26.35% is trending higher, reflecting the copper market’s higher quarterly trading ranges. Three-month copper forwards on the London Metals Exchange rose to $10,747 per ton in May, a record high.

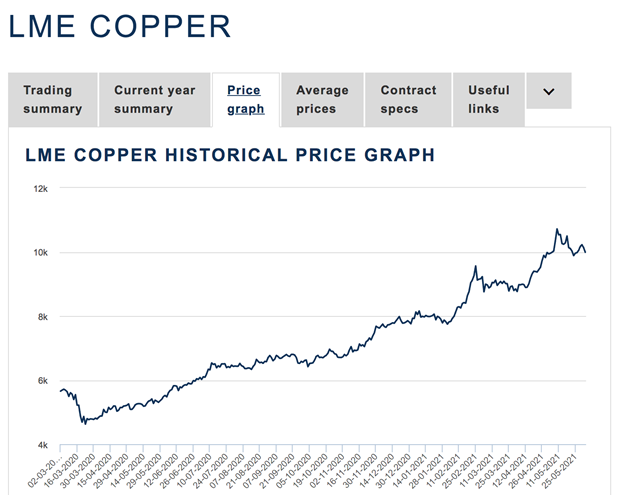

Source: LME

The chart shows the move from the March 2020 low at below $4,630 to over $10,700 per ton. Three-month copper forwards were trading at just below the $10,000 per ton level on June 4 after the most recent selloff.

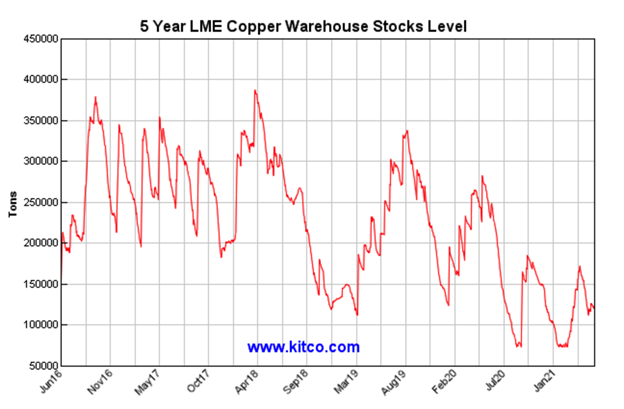

Inventories are trending lower- Analysts are bullish One of the metrics market participants closely watch is inventories of copper in London Metal Exchange and COMEX warehouses. Falling stockpiles are a sign of increasing demand for the metal.

Source: Kitco/LME The five-year chart of LME copper stocks highlights lower highs and lower lows. Stocks stood at the 124,675-ton level on June 4.

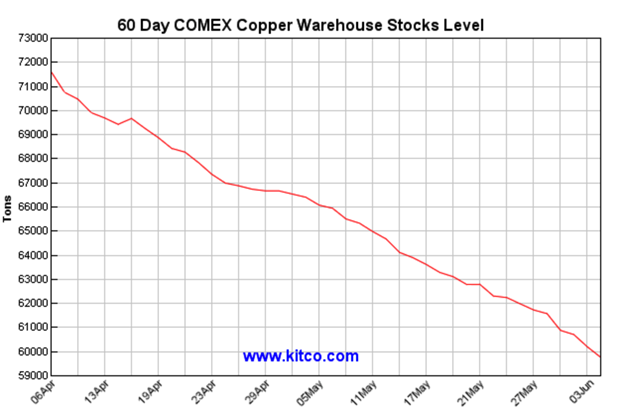

Source: Kitco/COMEX

Over the past two months, COMEX inventories have declined steadily from over 72,000 tons to 59.765 metric tons on June 4.

Dominant market participants have a long history of manipulating stockpiled data to support risk positions. Since a Chinese company owns the LME and China is the world’s leading consumer of the red metal, the potential for manipulative activity to influence prices on a short-term basis is always high. However, the trend over the past half-decade tells us that demand is rising, and production is struggling to keep pace with the growing requirements.

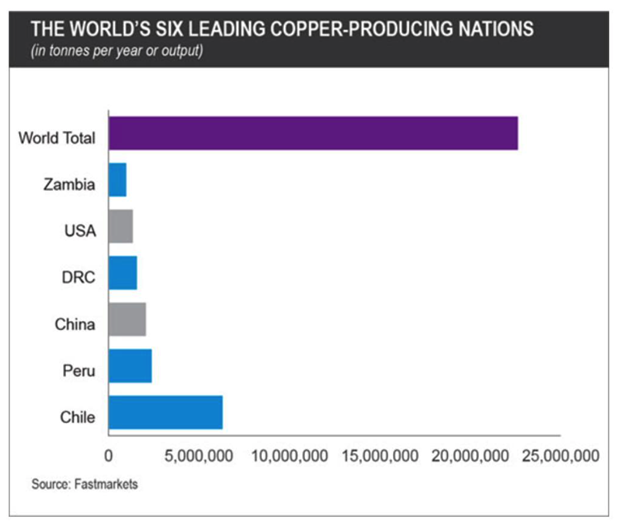

New production is a challenge- The case for a continuation of the bullish copper tend Bringing a new copper mine into production is a multi-year process that can take up to a decade. In 2020, Chile, Peru, Zambia, and the Democratic Republic of Congo (DRC) produced 10.14 million tons of copper, accounting for 49% of worldwide output. Chile, Peru, and DRC will produce 27% of the 15 million tons of copper mining projects coming to market by 2030.

Source: Fastmarkets

The chart shows that the countries listed produce 45% of the world’s annual copper supplies. The worldwide pandemic has wreaked havoc with economies. Many governments are looking for new revenue sources to offset COVID-19’s enormous costs. Chile, the leading producing nation, is considering increasing royalties on copper mining.

Source: Chilean Lower House of Congress, Sonami

The chart highlights at over $4.50 per pound, the current price, the total effective tax rate could climb to nearly 27.5%, with the marginal rate above $4.50 at 75%. Other governments are considering increasing royalties and taxes. Meanwhile, production costs are skyrocketing as energy, equipment, labor, and other expenses rise. As tax rates soar and politicians look to increasingly wet their beaks, investment capital for new projects could dry up.

Sonami, the Chilean association of private mining companies, calculates that the royalty proposal would put about half of the country’s copper mines and a quarter of output at risk.

Peru is the second-leading copper-producing nation. The June 6 election between Keiko Fujimori and Pedro Castillo, who has emerged as the favorite, could cause royalty levels to soar. Castillo supports royalties and increased income taxes. The virus is raging in Peru, and workers have clashed with management at the Las Bambas copper mine, increasing the odds of an election victory for Mr. Castillo.

Meanwhile, the DRC and Zambia are likely to “adjust” taxes and royalties, and they will not be moving lower. China, a leading producer and the world’s top consumer of the red metal is experiencing economic growth. With global interest rates at historically low levels, consumers and speculators are likely to continue to buy copper, and other raw materials for immediate or future consumption as the price trend remains highly bullish.

The Biden administration is working with Congress on a massive infrastructure rebuilding package in the US, adding to the copper market’s demand. Addressing climate change will require even more of the base metal, which is a critical component in EV production. A worldwide semiconductor shortage only adds to requirements.

The bottom line is that the fundamental landscape for copper could be in the most bullish position of our lifetime. The technical trend and fundamental support are causing analysts to project much higher prices over the coming years. Goldman Sachs recently called copper “the new oil.” In its report, Goldman sees the price rising to the $13,000 per ton level by 2025. Other analysts believe that price could move to the $20,000 per ton level. Bull markets tend to take prices to illogical, irrational, and unreasonable levels on the upside. With the copper bull charging, the sky appears to be the limit for the red metal over the coming years with solid fundamental support.

Meanwhile, Goldman is also calling for $80 per barrel crude oil in 2021, and other analysts project a move back to the $100 level. Rising energy prices only increase the chances of higher copper prices as energy is a critical production component.

Greedy governments, increasing demand set to outstrip supplies, rising production costs, and falling stockpiles, create an almost perfect bullish storm for copper and other base metal prices.

Nevada Copper’s production is ramping up- Timing is everything for the US producer

Nevada Copper Corporation controls one of the only production-ready new sources of copper supply in North America today. The company’s website outlines its unique source of US copper supply growth and straightforward route to a new copper district in Nevada.

The company’s latest highlights include:

- Ramping-up production to the 3,000 ton per day level by the end of June 2021.

- Fully permitted for 70,000 tons per day of output

- Profitable production forecast at a long-term average copper price of $3.20 per pound.

- Economics for Nevada Copper’s underground mine become more attractive as the company expands its reach.

The original open-pit economics was profitable at $2.48 per pound. At $3.20, EBITA increases by 40%, and copper is currently trading at over $4.50 per pound.

- Source: Nevada Copper

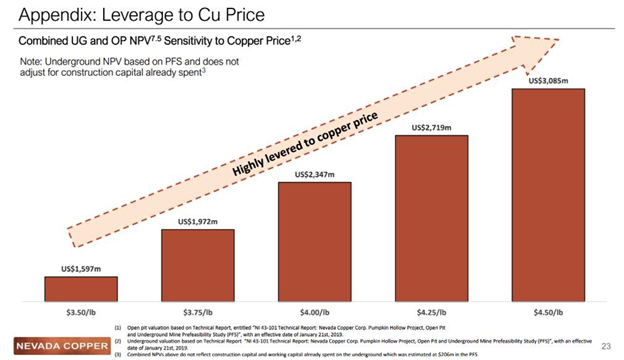

The chart illustrates that Nevada Copper is highly levered to copper’s price

- Mike Ciricillo, the former chief of Glencore’s global copper assets, is Nevada Copper’s CEO. Mr. Ciricillo joined to build the company into a mid-tier producer in a top mining jurisdiction in the world.

Timing is everything in life and business. The late Yogi Berra, the Hall-of-Fame Yankee catcher, and manager, and armchair philosopher, once said, “When you come to a fork in the road…take it!” Nevada Copper’s management came to that fork long before the copper bull market began. The production is well on its way at a time when the price is skyrocketing. Yogi would tell investors that Nevada Copper went in the right direction when it reached the fork in the mining road. The company’s management took a conservative view on the copper price and has been rewarded with new record highs and the prospects for far higher prices over the coming years as it extracts the red metal from the earth’s crust.

An inexpensive stock with a compelling risk-reward profile

There are lots of choices in the investment world. Inflationary pressures are causing all asset prices to rise as money’s purchasing declines. The tidal wave of central bank liquidity, government stimulus, infrastructure building, and rebuilding programs in the world’s two wealthiest nations, China and the US create an almost perfect bullish storm for copper.

Many investors are chasing their dreams in the cryptocurrency markets. I favor investments that rely on hard assets. Copper is a leading bellwether commodity, a construction requirement, a critical input for cleaner energy choices, among its many other applications. Besides, a pound of copper is a physical asset that does not require a computer wallet or custody in cyberspace. The recent trend in Nevada Copper shares on the US OTC and TSX markets has been bullish, as the stock has made higher lows and higher highs over the past months with the rising copper price.

Source: Barchart In early March 2021, NEVDF shares were trading at a low of 12 cents. The stock rose to a high of 27.1 cents on May 10; the day copper hit its most recent record high. At 20.7 cents on June 4, NEVDF was just above the middle of its trading range.

Source: Barchart

Over the same period, NCU.TO shares rose from C$0.155 to C$0.315 and were at C$0.25 on June 4.

Nevada Copper is well on its way to establishing a significant source of copper in Nevada, a mining-friendly state. I would rather own this stock than any cryptocurrency as the potential for success and profits have increased dramatically with copper’s price. Yogi also said, “You can observe a lot by watching.” With copper producers scouring the world for new supplies and watching new mining projects, Nevada Copper is in an enviable position with its’ new mine and future production profile.

If you’re interested in following Nevada Copper’s progress, visit https://investors.nevadacopper.com/alerts.

Written By: Andrew Hecht, on behalf of Maurice Jackson of Proven and Probable.

Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.