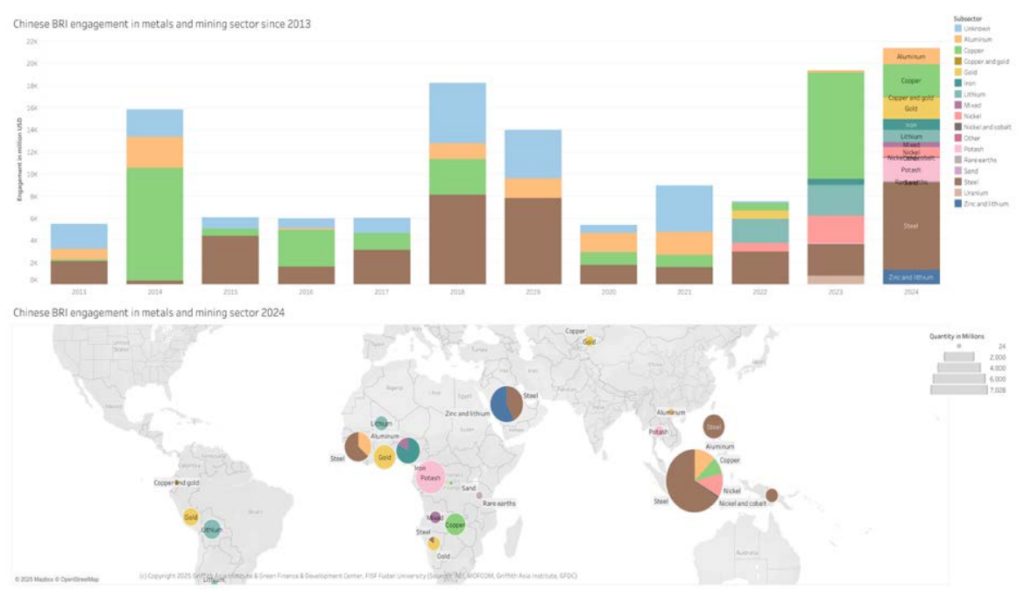

China’s overseas mining investment under its Belt and Road Initiative (BRI) hit another peak last year at $21.4 billion, as the government continues to place heavy emphasis on raw materials for the energy transition, according to a report published by Australia’s Griffith Asia Institute (GAI) in collaboration with the Green Finance & Development Center (GFDC) of China.

Launched in 2013, the BRI represents a massive global infrastructure development strategy adopted by the Chinese government to boost its trade, economic growth and regional influence. To date, China’s BRI spending has crossed $1.1 trillion, with the funds going towards key sectors such as mining, energy and transportation in partnership with 149 countries.

In 2024, mining maintained its status as a major area of focus under the initiative, accounting for 17.6% of last year’s total BRI-related investments, behind only energy’s 32.5%, GAI’s report shows. However, compared to the year before, when mining investment more than doubled to a then record of $19.4 billion, the sector’s share in 2024 is slightly down (from 21% in 2023).

Regionally, China’s engagement has been strong in various African countries, Bolivia and Chile in Latin America, and Indonesia, the report shows.

According to GAI, China already holds significant shares of global mining sources (over 80% of global graphite resources), and even more control in material processing (where across lithium, nickel, cobalt and graphite, China owns more than 50% of global capacity).

GAI’s report also notes that that Chinese firms are increasingly prioritizing equity investments in mining despite the high risks, while those in the energy sector mostly prefer to do construction deals, which are safer as they’re backed by financial institutions. Hence, construction deals have represented a larger share of BRI-related engagements, and in 2024, became much more abundant across every region except South Asia.

Like mining, China’s clean energy (solar, wind, hydropower) investments under the BRI also reached a record high of $11.8 billion. According to GAI’s estimates, this represents about 30% of last year’s total energy spend, which was the highest since 2017. The country also remained a large investor in fossil fuels (coal, oil and gas) abroad, led by a resurgence of coal mining, processing facilities and pipeline projects.

Looking ahead, GAI expects a further expansion of BRI investments and construction contracts in 2025, given the “clear need” to support the green energy transition in both China and in BRI countries. This, as it points out, provides continued opportunities for mining and minerals processing deals, technology deals and green energy — which China now refers to as the “New Three”.