Maurice Jackson: Joining us for a conversation today is Dr. Quinton Hennigh, the president and chairman of

Novo Resources Corp. (NVO:TSX.V; NSRPF:OTCQX), which is focused on “A New Paradigm in Gold Exploration and Investing.” Dr. Hennigh, welcome to the show.

Quinton Hennigh: Thank you, Maurice.

Maurice Jackson: Last time we spoke, Novo Resources accomplished a major milestone and that was the inclusion into the GDXJ. Since then Novo Resources has been extremely busy on a number of fronts from expanding the project portfolio, providing bulk sample results, mechanical rock sorting and DTC Eligibility, just to name a few. But before we go into greater detail, Dr. Hennigh, for someone new to the story, who is Novo Resources?

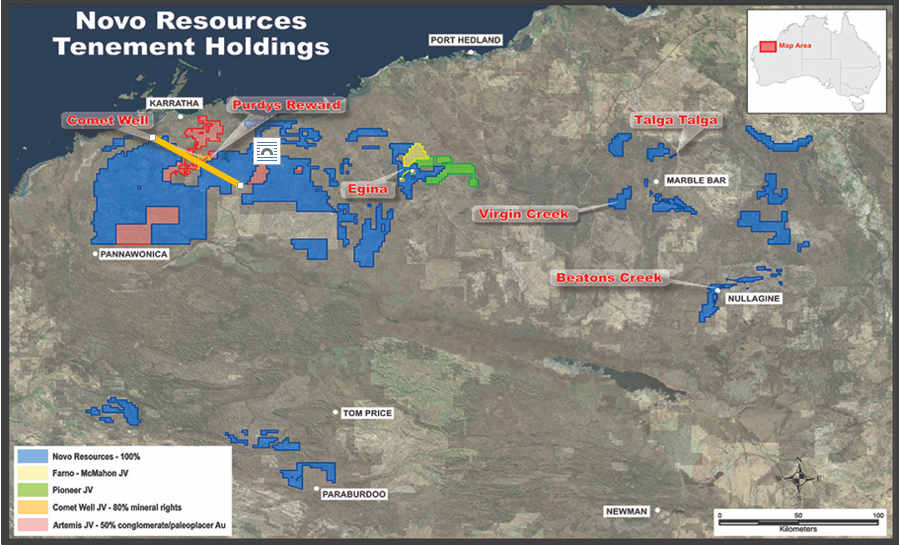

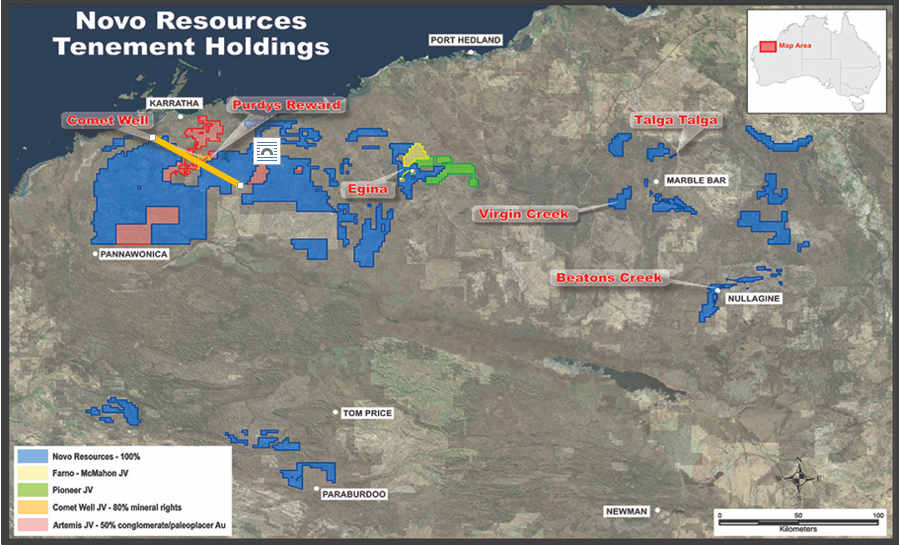

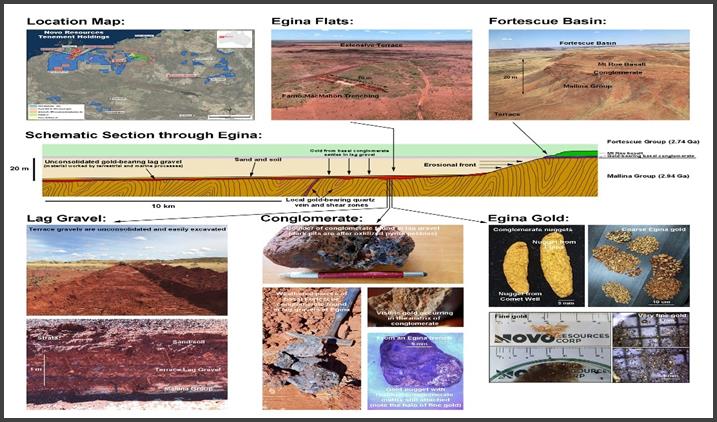

Quinton Hennigh: Novo Resources is Canada listed company that is focused on exploring in Australia. I founded the company roughly nine years ago, and it was explicitly to explore for a certain type of gold deposit in northwest Australia in a region called the Pilbara, which is just in from the Indian Ocean along the northern coast. Our projects are close to two cities, Port Hedland and Karratha.

They’re major cities that give access to the interior where there’s a lot of active iron ore mining in the region. The Pilbara has had a long-standing reputation, over 50 years, for their iron mines around Newman and Tom Price. Coincidently, within this same region Novo recognized the potential for gold early on in actually in the same strata, believe it or not, as the iron ore sequence.

Novo had a hypothesis that the Pilbara was once connected with the Kaapvaal Craton in South Africa. Both of those cratons are very old rocks, they’re over three billion years old, they share a lot of geologic similarities, including the strata that’s been deposited on each block. In addition, we identified the stratigraphy can be correlated from one side of the ocean to the other.

In South Africa, as many people know, there are vast deposits of gold in conglomerates in a basin called the Witwatersrand Basin. These gold deposits have been mined since around 1886 when they were first discovered; they produced something like 35% of all the gold produced on earth, around 1.7 billion ounces. The Witwatersrand Basin is a remarkable deposit; it’s basically the Saudi Arabia of gold.

The logical conclusion for us was, if deposits like that are present in South Africa, maybe over here in the Pilbara Craton there are similar deposits in conglomerates and of similar age, that have yet been discovered. Therefore, we came to Australia on that premise. We first structured deals with a gentleman named Mark Creasy, a well-known prospector in Australia, and those deals were largely centered over in the eastern part of the Pilbara region.

The Pilbara region is quite vast from one side to the other, covering over six hundred kilometers, and from the coast up here down to Paraburdoo is something like 250 or 300 kilometers. This is an enormous target area. Our first exploration ever was at

Beatons Creek.

In 2011, drilled up a

small resource at Beatons Creek, but what we learned is that the conglomerate units were quite continuous, and the gold is indeed there. The gold is a coarser grain than the Witwatersrand, but it is indeed present and appears to be economic. During our time at Beatons Creek we also conducted a bit of exploration at

Marble Bar.

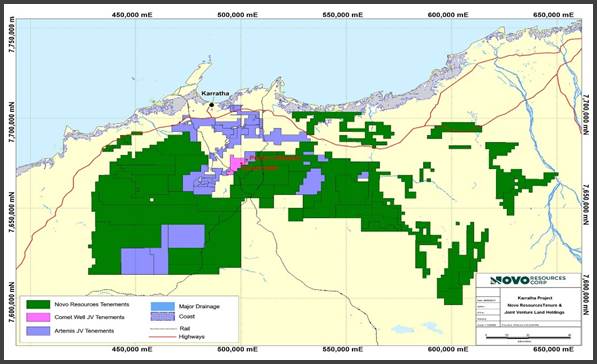

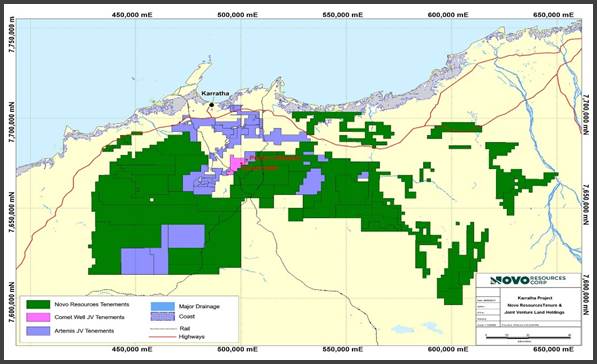

Since that time, we have focused efforts more to the northwest and acquired this vast land package by Karratha. This was based on a discovery roughly two-and-a-half years ago of gold being found by prospectors in areas like

Comet Well and Purdy’s Reward, as well as others around the marsh and the basin, including Egina and some other select locals.

The gold occurrences had been known by the locals for many years. When the news got out in late 2016, we strategically assembled a land package, including Comet Well and Egina. Novo staked a tremendous amount of ground, which is 100% owned by us. In addition, we also conducted a joint-venture agreement with

Artemis Resource.

Maurice Jackson: Dr. Hennigh, you’ve already introduced us to the project portfolio, but introduce us in particular to the value proposition we have before us.

Quinton Hennigh: The conglomerate gold systems in our project portfolio are different gold deposits than most people are used to seeing. Our conglomerates are flat-sheet-like, and continuous over large areas. We’ve latched onto three systems in particular that we’re focused on right now, which are

Beatons Creek,

Comet Well and Purdy’s Reward, where we are actively exploring now.

In 2018, we assembled the land package at Egina, and we’re conducting advanced exploration there now including bulk sampling.

For current and prospective shareholders I believe it best to become familiar with our trajectory for each project, as they are separate and unique. At Beatons Creek we’ve now undertaken a couple rounds of drilling over the past few years and also large-scale sampling, so this would be trench sampling as well as bulk sampling, and our

current resource stands at somewhere around 670,000 ounces Measured, Indicated and Inferred. We are looking to grow that and are working to get a resource put together at Beatons Creek north of 1 million ounces in the near future.

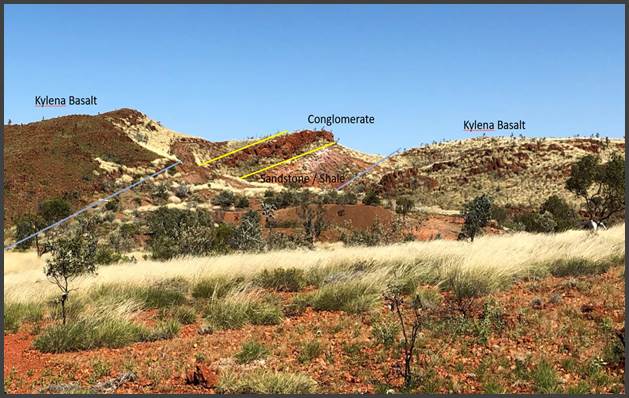

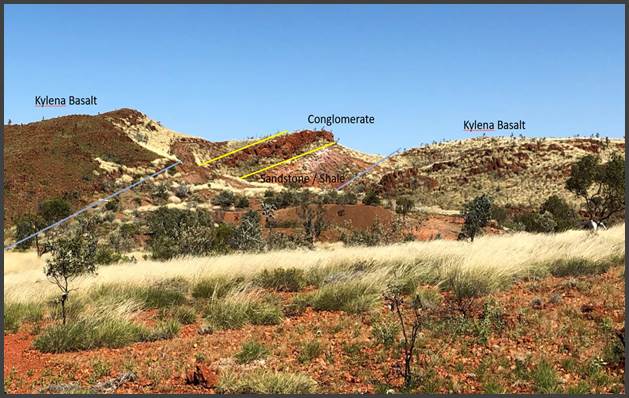

Not only that, we’ve done a lot of work like test mining and other things to demonstrate the economics and continuity of this system. We are looking to advance our Beatons Creek project towards monetization over the coming year. Beatons Creek is our most advanced, it’s certainly a robust project. What you see there at Beatons Creek, you see conglomerate horizons, in some places it’s stacked six high, so we have a conglomerate bed with a bit of intervening material, another conglomerate bed, and so forth.

At Beatons Creek we have a robust deposit, easily accessible form surface. Those familiar with coal mines in West Virginia would identify these as tabletop mines. That’s the kind of setting we have at Beatons Creek, so it’s a really interesting deposit from that aspect, and the most exiting aspect is that Beatons Creek may be very inexpensive from a production standpoint. The gold is coarse and is easily recoverable; gravity recovery captures a lot but you know cyanide captures the rest so we expect very, very good recoveries out of that deposit in particular.

At Comet Well and Purdy’s Reward, we first evaluated the system, because it is a very coarse gold system, this is not your average gold deposit.

The gold particles are often tenths of a gram up to multi-gram even tens of grams, and they’re distributed through the conglomerate somewhat randomly. Therefore, one can’t just walk up, grab a rock chip sample and expect to know through fire assay what’s in this rock. We’ve had to do some very hard yards in terms of bulk sampling and other means to begin to evaluate the grain here.

What we’ve shown at Comet Well and the Purdy’s Reward joint venture with Artemis is that the continuity appears to be good over several kilometers. We’ve done a lot of core drilling for geology and stepped out into the basin. Presently, we have enough data between the core drilling, three-dimensional modeling, as well as the grade data that we have from the bulk samples, to put together a mineralization report.

This is a big step for Novo. All of our tenements are currently exploration licenses. In order to advance a project towards a mining stage, we have to convert exploration licenses to mining licenses in Australia, and to do that we need a couple of things. One, we need a mineralization report, in this case we’re not necessarily going to produce a resource per se, we’ll demonstrate that we have a potentially economic body of rock here, through the data that we’ve collected that I just mentioned.

Novo Resources will submit a mineralization report within the next few weeks. The other aspect that’s needed is an agreement with the Aboriginal community, this would be the Ngarluma Community. The Ngarluma Community basically covers most of this project area here. We’ve been in negotiations with them, and developed a good relationship with the Ngarlumas, over the past year and a half.

We need to strike what’s called a “Native Title Agreement” that allows us rights to go mining, as well the Ngarlumas have commercial rights, such as royalty, as part of this project. But these are things that also have to be worked out for granting a mining lease.

We anticipate taking Comet Well and Purdy’s Reward through a development trajectory, probably first through trial mining. In fact, we might do a certain amount of trial mining this year. That will provide us more supporting data for developing a larger scale mine. But we are definitely moving Comet Well and Purdy’s Reward forward in a trajectory towards making a producing asset.

Revisiting the map, one can see that Comet Well and Purdy’s Reward are really just a small component of a much larger land package. As I alluded to earlier, within the conglomerate horizons, people have found nuggets weathering out of these conglomerates over many kilometers through this region. We have a lot of greenfields work to do along strike (gold line).

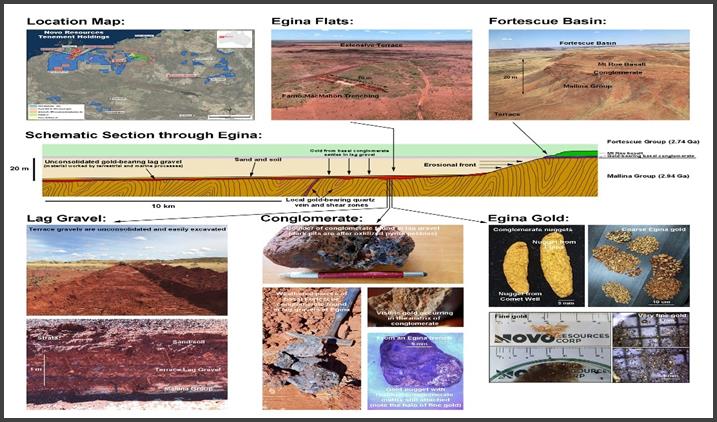

We also have some very interesting new ground at Egina that we’ve recently assembled. At

Egina the conglomerates have weathered away over time. They used to cover a significant portion in the Pilbara. But as they have weathered away and receded back, they’ve left the gold that was in them behind across a terrace, or flat country through here in the Pilbara. If one drives across this country, it is absolutely flat as a pancake, very similar to West Texas.

If one were to look in either direction, it’s like a pool table. But the flat surface throughout this region has what is called a lag gravel horizon on it. The lag gravel horizon is about one to two meters thick. Novo was able to demonstrate last year through our trial bulk sampling at Egina that it contains gold and it’s fairly coarse-grain gold; we recovered something like 108 grams of gold out of a hundred cubic meters of bulk sample that we collected.

That’s pretty remarkable! A lot of alluvial deposits are less than 0.3 grams, and the grades we’re seeing at Egina are very enticing. Our hypothesis is that this terrace, of which we own about 400 sq km, could be a sizeable gold project in its own right.

Egina is basically another very large target we have. It is earlier stage, but the nice thing about Egina is that it’s soft rock, gravels at surface. Novo can advance this in a fairly orderly fashion.

We control 100% (of the blue on the map) at Egina. Thus, we are able to get out there and do a lot of test mining and stuff like that that we can’t quite undertake presently at Comet Well at the moment. So Egina is definitely going to be a focus for us this year. We’re going to tackle that terrace gravel, see what kind of economics that might have, including the size and potential that we might have.

Therefore, we are going to do sampling not only in the mining lease but hopefully in some more extensive areas to demonstrate the hypothesis that this region could hold a vast gold deposit could be true.

Maurice Jackson: Dr. Hennigh, allow be to interject here. This land package you have here, it looks quite massive, how many square kilometers are we looking at here?

Quinton Hennigh: Our land package is around 12,000 square kilometers at present.

Maurice Jackson: Let me ask you this, sir. I know Novo Resources has undergone a tedious and methodical process in attempting to figure out grade and tonnage. In the spring of 2018 the company released the first bulk-sample results from Comet Well, how have those been coming along?

Quinton Hennigh: The

bulk samples from Comet Well that we released in May were the first two that we completed. To get these samples through the lab was a big exercise. It required several renditions of crushing and experimenting and assaying different streams. We also were battling a bit of wet weather down in Perth last year; it took a long time but we did get a pretty comprehensive set of

assays out in late October that demonstrated the grade of these conglomerate horizons.

What we’ve identified are two conglomerate horizons at Comet Well and Purdy’s Reward. The lower one of which is say 2or 3 meters thick, the grades range from about a 1 to 6 grams, and it sits right on the basement, so it’s basically the lowermost bed of rock in this bigger sequence.

Twelve to fifteen meters above first horizon is a second horizon. We call it the Upper Cannonball conglomerate, the Upper Cannonball conglomerate is about 1 to 2 meters thick, and again the grades in that bed are in a range of 1 to 3, 4 grams, somewhere in that range. And it’s very continuous along strike; we can see good continuity from one trench to the other over three-and-a-half, four kilometers right now. We feel very compelled that it’s demonstrating similar continuity to the beds we see at Beatons Creek.

For those who have followed Novo Resources for the year are familiar with the challenges we had at Beatons Creek. Specifically, we had to develop sampling protocols to deal with the coarse grade, assay protocols that were unusual; it took some time to develop. But now, Beatons Creek is basically getting close to mine.

Comet Well and Purdy’s Reward area are going along the same trajectory as Beatons Creek. We’ve had to cut our teeth with different styles of bulk sampling and assaying but we’ve now got things under control. We are also experimenting with somewhat unconventional techniques of recovering the gold.

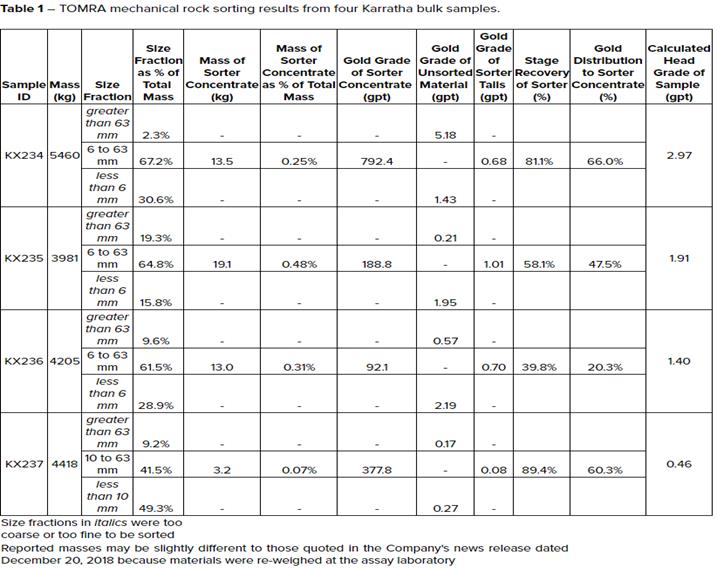

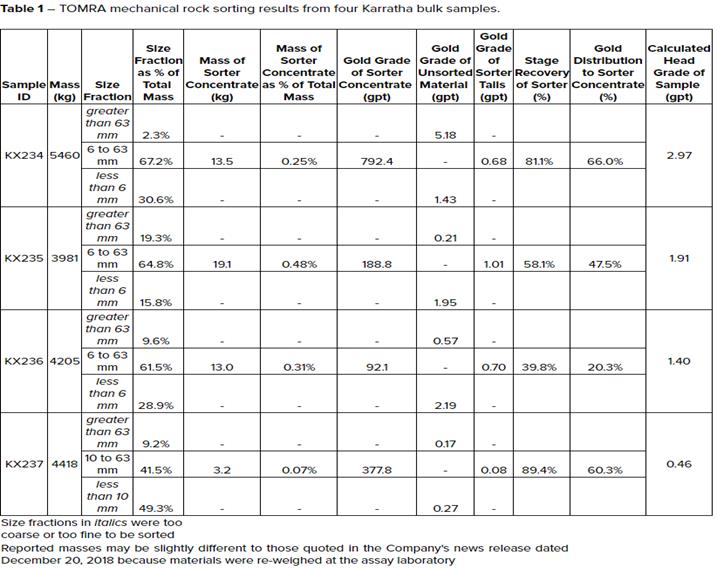

Novo has done test work with TOMRA, for example; this was starting in late last year in November. The results that came out are fantastic! We think there is potential to crush up the conglomerate, screen it, of course, but put it through an ore sorting machine, and actually let the ore sorter pick rock with the gold particles.

You know the downside of coarse gold is assaying. It’s a real challenge, but the upside is that the metallurgy might be very favorable for us. Novo is very excited about that ore sorter possibility.

Maurice Jackson: Dr. Hennigh, the following may be a bit premature to address at the moment but the two most frequent questions I receive from prospective shareholders are, “Is this a place for deposit?” and, “How do you intend to extract the gold?” What do you have to say to those two questions?

Quinton Hennigh: Sure, the first question is a very good one. I came to this region on the basis that there might be deposits like those in South Africa. Now let me give a little background there, in South Africa there are really two types of ore, there’s the conglomeratic ore and in that the gold occurs as particles distributed in the matrix of the conglomerate.

In effect those are alluvial deposits in the Witwatersrand Basin. There is also what they call “carbon leader ore.” Carbon leader ore is a very, very thin seam of carbon, almost like coal, and I’ve written several papers (

click here to view paper) on this with other authors. We believe that that seam of carbon is basically the fossil remains of early cyanobacterial mats that formed or evolved in a time when Earth’s atmosphere was largely reduced. The idea is the sea water back at that time, under reduced conditions, would have been able to dissolve a fair bit of gold. Gold dissolves in reduced atmospheric conditions.

The cyanobacteria was the first photosynthetic life. During this time period the cyanobacteria starting to kick off oxygen. What we believe is that that oxygen, which causes gold to precipitate, actually pulled, or started pulling the gold out of sea water and created that little carbon seam type ore, that is very, very rich in gold. This is a very, very unusual style of gold mineralization. It’s a thin and very continuous and covers many square kilometers. A seam of carbonaceous gold ore.

I came here looking for similar carbonaceous ores. What have we found? Well, at Beatons Creek, in fact we’ve talked about this in the past, we’ve actually found particles, pieces of carbonaceous material in the conglomerates here. So to answer your question, at Beatons Creek, we see two types of gold, we see bonafide alluvial gold. These would be loose, somewhat rounded particles in the matrix of the conglomerate, but we also see a component of carbonaceous material at Beatons Creek that tells us that that same process that you see in the Witwatersrand was active over in this area.

At Comet Well and Purdy’s Reward, what we see in the conglomerates here are large, rounded; they appear to be water-worn nuggets of gold. The origin of that gold we still haven’t put our finger on, but it’s possible that that gold has been recycled from weathering of previously existing conglomerates or carbonaceous beds that no longer exist.

In their present form it’s alluvial gold, but it’s ultimate origin is still in question. In addition, we have gold that appears to have grown in the matrix around the nuggets. This is what we call “halo gold,” it’s a thin halo about two or three millimeters wide around the gold nuggets, the coarse nuggets, and we believe that gold is actually a precipitated type gold, probably in response to biogenic activity.

So once again I would say it’s a mixture of two types of gold that have brought the system together. We have alluvial particles for sure, we have secondary gold that appears to be perhaps biogenic in nature.

Maurice Jackson: Alright and the second question: “How do you intend to extract the gold?”

Quinton Hennigh: Like the coarse gold is a problem from the sense of assaying but in terms of recovery, it is quite favorable. Gold is dense. One of the easiest ways to treat coarse gold is, of course, gravity recovery, and that’s certainly a possibility, but one of the things we wanted to look at was a call it a somewhat portable style of processing, by using ore sorting machines.

These ore sorting devices are skid mounted or they’re mounted on a transportable platform. They can be moved from one location to the other. Now why is that important? Well, this is a flat deposit, so if you have something that’s long, you know rather than trucking ore from one place to another over kilometers, why not mine process, right on the spot, and then move as you mine the material.

We looked at TOMRA ore sorters starting late last year (

click here). We tried ore sorting early in 2017, had mixed results with the Steinert, first looked like it worked great, second rendition didn’t work so well. When we went to TOMRA they showed us some reasons why they thought they could improve things dramatically and just recently we published the final data from that.

In fact, the two samples that were good coherent conglomerate material that we put through saw recoveries over 80% just by sorting. This is using a scanner device, X-ray transmission that literally picks out particles of rock off a conveyor belt that have gold embedded in them. It’s just remarkable! We essentially took gravel, put it on a conveyor belt, sent it across this machine, and it picks out the little particles of rock with gold. What you end up with is a concentrate that’s a very, very small fraction of the overall mass you put in that machine, and it has most of the gold in it.

There are a few additional steps we have got to take to test this further. One question is “What do we do with the fines?” At the present, we are considering to conglomerate them, and then put them through the ore sorter as they are. In other words, turn them back into little pellets or something, let the ore sorter pick them out. Or another option we could do is just put the fines through a gravity circuit on their own. These are options we are considering, which are essentially unconventional means of processing for this very unconventional deposit.

Maurice Jackson: Looking forward, what are the company’s goals and objectives for 2019?

Quinton Hennigh: First, at Beatons Creek, which I talked about as being the most advanced project. We have a resource remodel underway right now, this is work that’s ongoing and we are expecting some bulk samples back from the project. These are ones we collected late last year. Once we have all that data, which should be available by the end of the first quarter, we anticipate publishing a new, updated resource for Beatons Creek. We are targeting over a million ounces, we’ll see if we can get there, I feel pretty confident. Beatons Creek should be a robust deposit. This puts the project in a good path for monetization. Then we will take the next steps of looking at how we potentially develop that project.

Second, at Comet Well and Purdy’s Reward, we anticipate doing a level of trial mining this year. We are continuing to evaluate some of the test work around the TOMRA, for example, as a means of processing at Comet Well. I think once we get a full evaluation, and we do have a bit more data we got to get back on that, but once we have a full evaluation of that processing, we’ll look at that trajectory. Bear in mind, we also are shooting for that mineralization report and working on a Native Title agreement so that we can convert a lot of that country into mining leases. That’s the trajectory for Comet Well and Purdy’s Reward.

Third, at Egina, once the rainy season’s over in a few weeks, we anticipate getting out there and hitting the mining lease very hard. This is the mining lease where we took our bulk sample last year. We anticipate putting together on a test basis, a grid of samples across a target area, where we can see if we can put together a resource on the terrace gravels.

We also anticipate, because it’s a mining lease and we have permit to go up to 50,000 tons extractable, doing some small-scale test mining. We are seeking to help build our confidence around that project. The other aspect to Egina, very important, we anticipate taking some samples further afield in some more distant areas, and trying to get an idea how extensive that deposit may be. If Novo proves that that deposit covers a vast area, encompassing many tens of square kilometers, in that country, I think people will sit up and take note. I think that’s really a big add to the story we have in the Pilbara right now.

Maurice Jackson: Near term, what is the next unanswered question, when should we expect results, and what determines success?

Quinton Hennigh: Per each project, the factors that determine success are a bit different. We have data coming back from bulk samples from Beatons Creek that will help support a new resource model, again that’s going to be over the next few weeks. We anticipate getting that resource put together by the end of this quarter.

If we see a resource above a million ounces I think we now have critical mass that allows us to look at that project a bit differently and more aggressively in terms of advancing it.

As far as Comet Well goes, I think right now we feel comfortable with the grades and the continuities we’re seeing. I think we have a fairly decent understanding of what this deposit is. What we really need to do there is to go test mine it on a scale, maybe a few tens of thousands of tonnes, and from multiple locations alone the strike of the conglomerate.

We also have to do some ore sorting tests to see if we can use that as a means of processing. Those are the two factors if we can successfully process this material using ore sorter, and that includes capturing the gold that’s in the finer material, I think we have an exceptional means of treating this unusual mineralization.

Ore sorting and test mining at Comet Well are absolutely critical paths for us. At Egina, because it’s free-dig gravel at surface, we have the luxury, and because we have a mining lease, too, of going out there and being pretty aggressive. Right so we can go out and start digging some hundred cubic meter samples like we did late in 2018, and we can advance that project quickly.

Basically, it’s almost like doing an exploration program in parallel with test mining and test processing. So I really think even though the metrics are not fully defined yet, I think Egina is one where it’s an easier project that can be advanced much more quickly. Therefore, we believe going forward Egina is going to become more and more important to the company.

Maurice Jackson: Sir, what do you see as the biggest challenge for Novo Resources, and how would you mitigate that situation?

Quinton Hennigh: This is a good question. Australia’s a very good place to work and in particular in Western Australia. Every single project that’s been put up for permitting and advancement has become a mine. There are virtually no examples where a deposit wasn’t mined, but it takes time. That’s our determining factor.

We have to do things like permit, we have to get mining leases from exploration licenses. We have to do the proper steps. We have to work with social license, we can’t just go in and start mining. I think a lot of people, they look at our projects and they’re very exciting, it’s easy to see that these things could be developed, we literally go out and start mining some tomorrow if you had that luxury, but we have to do things right here.

We have to do things right, both in terms of permitting, social license and all of those aspects, but we also have to do the right technical work to make sure that we take the right steps. We don’t want to go and fall on our sword. I guess my comment to that question would be, time and patience is what we need.

Maurice Jackson: Switching gears, sir can you please share with us the current capital structure for Novo Resources?

Quinton Hennigh:

Quinton Hennigh: We have a little over 163 million shares out. We have a few options in warrants out there bringing us to 204 million shares. Right now we have a little less cash than shown above, we’re around CA$45 million at the end of the year. We have a good treasury, which is great! Because these projects, as I just said, need time and patience to advance.

What we really are appreciative of is the shareholder base. We’ve got good shareholders, we have Kirkland Lake, we have Newmont Mining, Mark Creasy who I mentioned earlier, we have a lot of long-term shareholders who really understand the geology, and they understand the steps that we need to take to get these projects through to fruition.

Maurice Jackson: And at the recording of today’s interview, right now the share price is at CA$2.32. Sir, for our U.S. investors, what can you share with us regarding DTC Eligibility?

Quinton Hennigh: Novo Resources

filed DTC Eligibility in October 2018. This will enable U.S. citizens’ shares to be traded electronically in much more user-friendly way to facilitate electronic trading. It allows U.S. shareholders to put those share certificates into a U.S. brokerage accounts and trade them. So we did that for the benefit of our shareholders and I haven’t heard any complaints since.

Maurice Jackson: Last question. What did I forget to ask?

Quinton Hennigh: What does Novo Resources want to become? People who really know us know the story. They know we want to become a gold producer. Novo has tackled a very unusual style of mineralization but we want to prove that these deposits are going to make good economic mines, and we have three very promising projects, each of which has huge potential! Beatons Creek, Karratha, as well as Egina, all have extremely good potential to be very large, and hopefully very high margin, deposits.

I think if I had one comment to say, that’s the path we’re going to take: “Novo would like to become an established Western Australian gold producer.”

Maurice Jackson: Dr. Hennigh, for someone who wants to get more information on Novo Resources, please share the contact details.

Quinton Hennigh: Please contact our Head of Investor Relations Leo Karabelas in Toronto. His telephone number 416.543.3120 or email

leo@novoresources.com.

Maurice Jackson: And as a reminder, Novo Resources trades on the TSX.V symbol

NVO and on the OTCQX symbol

NSRPF. Novo Resources is a sponsor of Proven and Probable and we are proud shareholders of Novo Resources for the virtues conveyed in today’s message. And last but not least, please visit our website,

provenandprobable.com, where we deliver mining insights and bullion sales. You may reach us at

contact@provenandprobable.com.

Dr. Quentin Hennigh of Novo Resources, thank you for joining us today, on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Novo Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Novo Resources is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click herefor important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

Since that time, we have focused efforts more to the northwest and acquired this vast land package by Karratha. This was based on a discovery roughly two-and-a-half years ago of gold being found by prospectors in areas like

Since that time, we have focused efforts more to the northwest and acquired this vast land package by Karratha. This was based on a discovery roughly two-and-a-half years ago of gold being found by prospectors in areas like

James Rickards – Editor, Strategic Intelligence and a world famous consultant to the Pentagon and CIA. He helped the Federal Reserve avoid a complete financial meltdown, and even investigated market activity which predicted 9/11. He’ll combine his exceptional background as a government insider with his economic expertise and show you how to navigate today’s volatile markets.

James Rickards – Editor, Strategic Intelligence and a world famous consultant to the Pentagon and CIA. He helped the Federal Reserve avoid a complete financial meltdown, and even investigated market activity which predicted 9/11. He’ll combine his exceptional background as a government insider with his economic expertise and show you how to navigate today’s volatile markets. Nomi Prins – Distinguished political-financial expert, journalist and best-selling author, she’s also a former member of Senator Bernie Sanders’ Federal Reserve Reform Advisory Council. On Wall Street, Nomi was a managing director at Goldman Sachs, she ran the international analytics group as a senior managing director at Bear Stearns in London, and worked as a strategist at Lehman Brothers and Chase Manhattan Bank.

Nomi Prins – Distinguished political-financial expert, journalist and best-selling author, she’s also a former member of Senator Bernie Sanders’ Federal Reserve Reform Advisory Council. On Wall Street, Nomi was a managing director at Goldman Sachs, she ran the international analytics group as a senior managing director at Bear Stearns in London, and worked as a strategist at Lehman Brothers and Chase Manhattan Bank. Danielle DiMartino Booth – Author and former top adviser at the Federal Reserve Bank of Dallas, she utilizes her years of experience in central banking and Wall Street to help investors understand macroeconomics – how the movements of world markets and actions of regulators may affect their businesses in an ever-changing world economy.

Danielle DiMartino Booth – Author and former top adviser at the Federal Reserve Bank of Dallas, she utilizes her years of experience in central banking and Wall Street to help investors understand macroeconomics – how the movements of world markets and actions of regulators may affect their businesses in an ever-changing world economy.