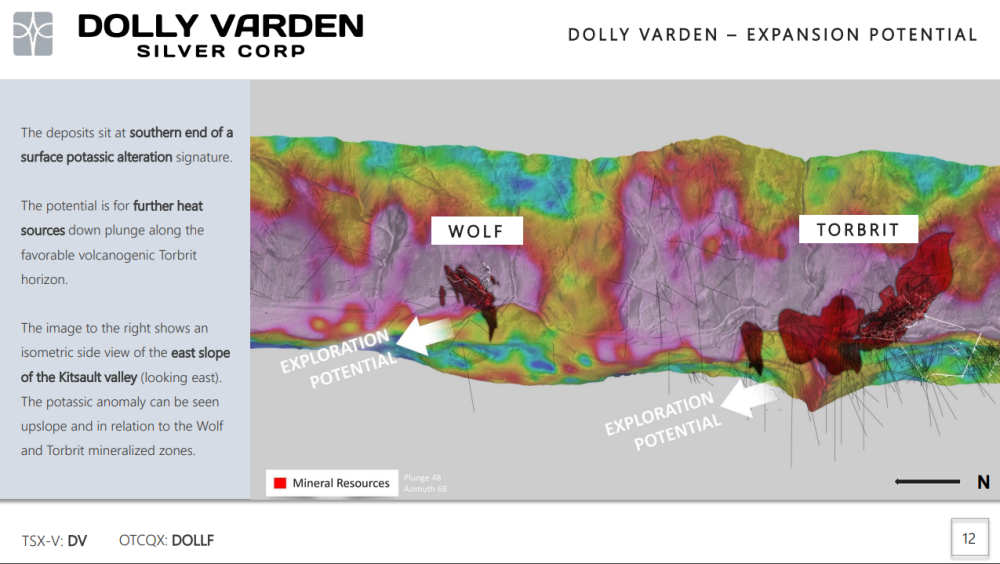

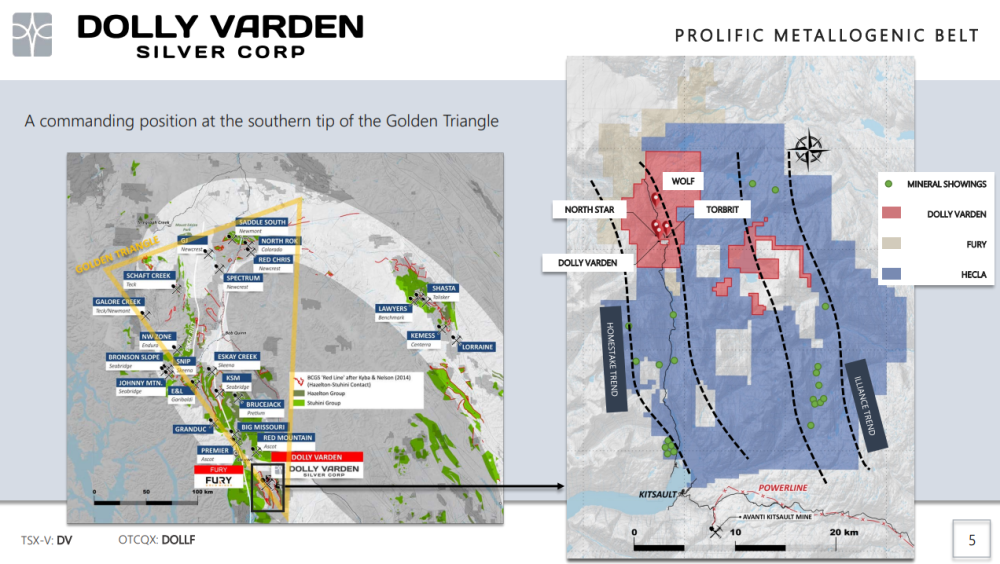

Figure 1

Laminated gray and white hot spring silica sinter overlain by dark gray silty mudstone in core. Dark coloration partially originates from fine sulfide mineralization. Down hole depth is 303.8 m.

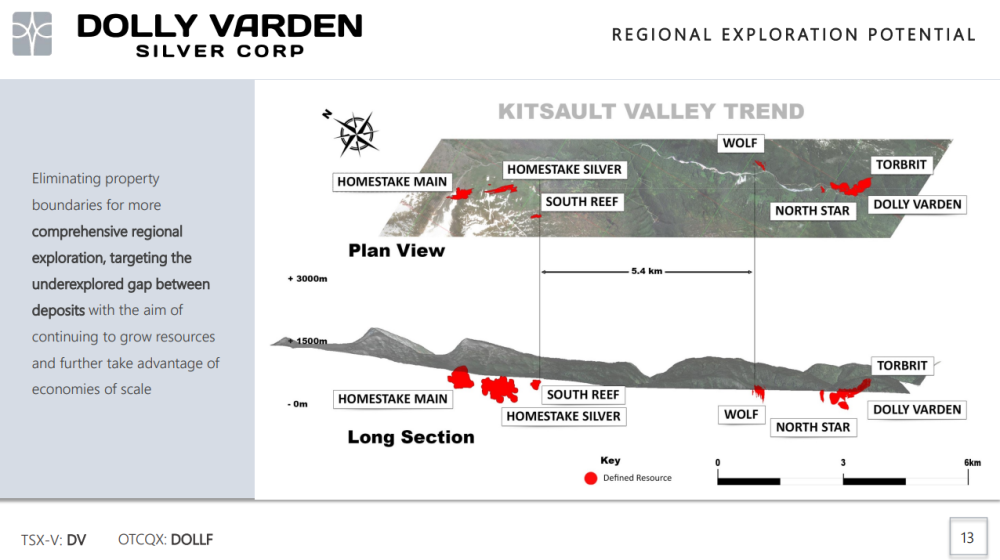

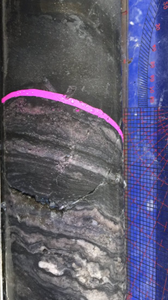

Figure 2

Fibrous columnar algal remains, now silicified, occurring within a bed of sinter in core. Down hole depth is 314 m.

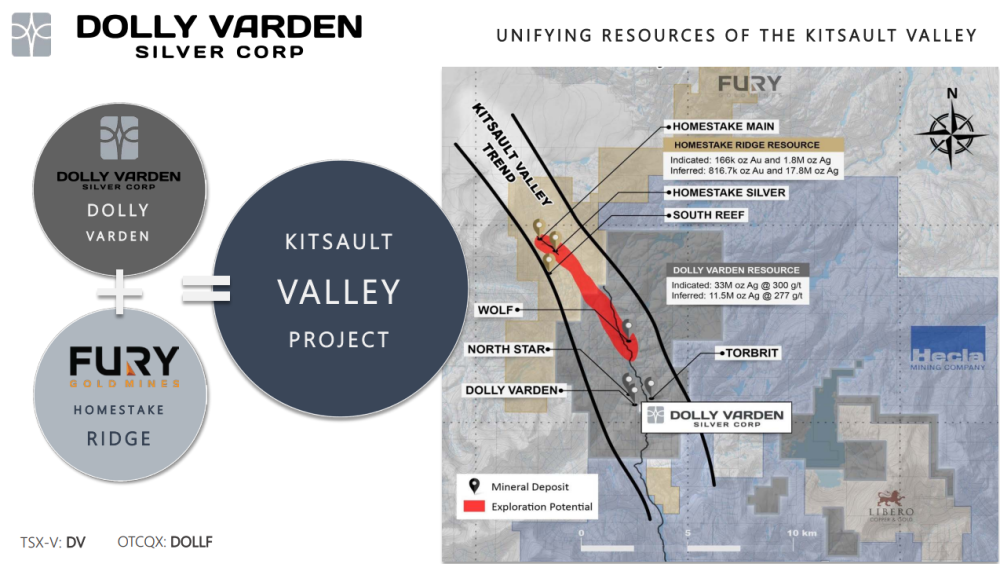

Figure 3

Examples of sulfide rich sinter from various intervals in hole 21OMI-002. Brassy and gray material is pyrite. Light gray, white and tan areas are silica.

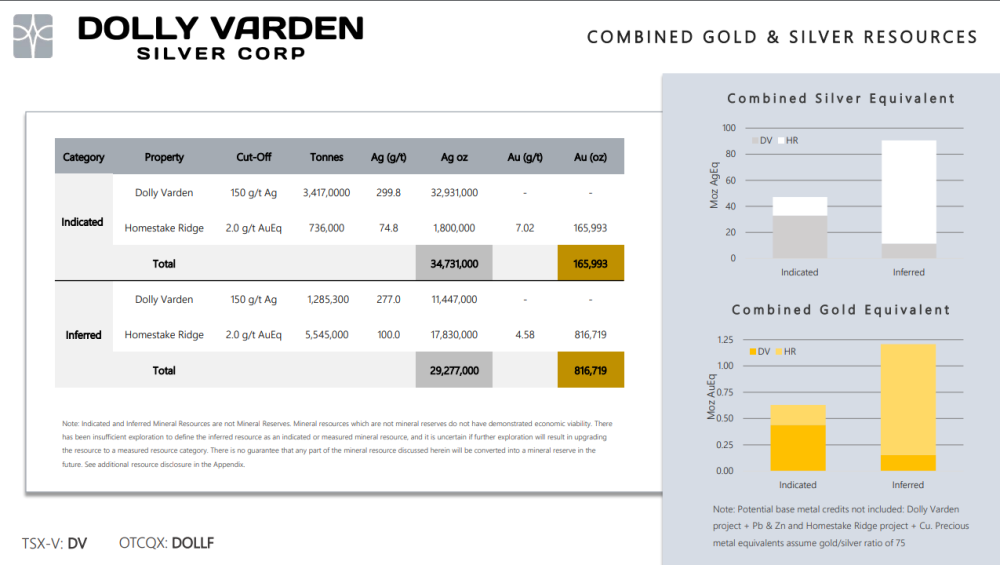

Figure 4

Model illustrating the geologic evolution of Honpi looking ESE. Top shows the initial epithermal system with a feeder and sinter. Second shows this system buried by the Omu Sequence and re-establishment of the epithermal system. It was this phase that produced the veins that come to surface around Honpi. Bottom shows Honpi in its current state, somewhat tilted and eroded. Irving drilled shallow holes to test for near-surface veins. Hole 21OMI-002 tested these same veins but encountered a sinter-rich sequence from approximately 240-340m down hole ending in volcanic and sedimentary rocks, the Kamiomu Formation. Sinter was found down slope from Honpi where it comes to surface. Irving believes the feeder for the sinter to be below the main vein, Honpi. Deep Au-Ag-rich veins encountered in hole 19OMI-010, a deep hole drilled off section from this image, may be part of this lower feeder. Irving rates this target with highest priority for follow up drilling in early 2022.

VANCOUVER, British Columbia, Dec. 13, 2021 (GLOBE NEWSWIRE) — Irving Resources Inc. (CSE:IRV; OTCQX: IRVRF) (“Irving” or the “Company”) is pleased to announce it has discovered a new, buried hot spring system immediately beneath areas previously targeted with shallow drilling at the Omui Mine Site, part of Irving’s 100% controlled Omu Au-Ag Vein Project, Hokkaido, Japan. Also, the Company completed one diamond drill hole at Hokuryu, also part of the Omu Au-Ag Vein Project with at least one notable vein intercept.

Summary of New Discovery at Omui Mine Site and Implications for Exploration Potential

- Hole 21OMI-002, the second diamond drill hole of a two-hole follow up drill program recently completed by Irving has encountered an approximately 100 m long intercept of beds of siliceous hot spring sinter interbedded with various clastic rocks (Figure 1) at a depth of approximately 200 vertical meters beneath the historic Honpi mine area.

- Textures of silica sinter include fossil algae, a common occurrence in terrestrial hot spring sinter deposits (Figure 2). Sulfide mineralization is abundant in select bands of sinter (Figure 3) suggesting this older system has potential to be associated with precious metal mineralization.

- The presence of this new sinter horizon suggests the presence of an older, extensive hot spring system buried underneath Honpi (Figure 4). This raises the exciting possibility that the feeder for this sinter may lie at deeper levels below Honpi. Hole 19OMI-010, a deep hole drilled by Irving in 2019, encountered numerous deep high-grade vein intercepts that might be part of the feeder system for this lower hot spring deposit.

- Further evidence for potential high-grade mineralization at depth comes from fragments of dark banded silica found in some Honpi vein samples. Such dark silica fragments sometimes bear abundant fine particles of electrum, a natural Au-Ag alloy, and silver sulfosalt minerals. The source of these fragments is believed to be somewhere below Honpi, but until now, a viable source could not be rationalized. It is possible that these fragments were ripped up from the lower hot spring system by hydrothermal activity and carried upward into Honpi vein where they were incorporated into later quartz veining.

- Other notable epithermal deposits are buried, or “blind,” including the Fruta del Norte (“FDN”) deposit in Ecuador. The sinter cap of the FDN system was discovered under approximately 200m of post mineral cover and the deposit occurs immediately beneath the sinter.

Because of the very important nature of this discovery, Irving is currently working on plans to conduct follow up drilling around Honpi at Omui beginning in February 2022.

“The discovery of a new, older hot spring system beneath Honpi raises exciting possibilities,” commented Quinton Hennigh, technical advisor and director of Irving. “We appear to have an entirely new level to test. Hole 19OMI-010 encountered multiple high-grade veins at depth, ones that are somewhat distinct from those encountered at shallow levels around Honpi. Until now, we have been challenged to understand this dichotomy. We have also been challenged to point to the source of Au- and Ag-rich fragments of silica found trapped in Honpi vein material. It could be the answer is right below our feet. Because this is an exceptionally important target, we are making plans for follow up drilling at Omui beginning in February of next year. We are very excited what might be discovered.”

Summary of Diamond Drilling at Hokuryu

- One diamond drill hole, 21HKR-001, was completed to a depth of 294.7m at Irving’s Hokuryu vein target during October. Drilling of additional holes was postponed due to inclement weather.

- In a position approximately 50m west of historic Hokuryu mine workings, hole 21HKR-001 encountered a narrow intercept of banded epithermal vein displaying giguro bands. Veins mined at Hokuryu were reportedly narrow, but very high-grade. Assays from 21HKR-001 will be announced upon receipt.

- Depending on results, Irving may elect to extend hole 21HKR-001. The remaining two holes of the Hokuryu Phase One drill program will be completed in 2022.

Quinton Hennigh (Ph.D., P.Geo.) is the qualified person pursuant to National Instrument 43-101 responsible for, and having reviewed and approved, the technical information contained in this news release. Dr. Hennigh is a technical advisor and director of Irving Resources Inc.

About Irving Resources Inc.:

Irving is a junior exploration company with a focus on gold in Japan. Irving also holds, through a subsidiary, a Joint Exploration Agreement with Japan Oil, Gas and Metals National Corporation (JOGMEC). JOGMEC is a government organization established under the law of Japan, administrated by the Ministry of Economy, Trade and Industry of Japan, and is responsible for stable supply of various resources to Japan through the discovery of sizable economic deposits of base, precious and rare metals.

Additional information can be found on the Company’s website: www.IRVresources.com.

Akiko Levinson,

President, CEO & Director

Forward-looking information

Some statements in this news release may contain forward-looking information within the meaning of Canadian securities legislation including, without limitation, statements as to the potential for high-grade mineralization at the Omui Mine site and as to planned exploration activities. Forward-looking statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, customary risks of the mineral resource exploration industry, the availability to Irving of sufficient cash to fund any planned drilling and other exploration activities, as well as the performance of services by third parties.

THE CSE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ACCURACY OR ADEQUACY OF THIS RELEASE.

Photos accompanying this announcement are available at

CONTACT: For further information, please contact: Tel: (604) 682-3234 Toll free: 1 (888) 242-3234 Fax: (604) 971-0209 info@IRVresources.com

Shawn Khunkhun:

Shawn Khunkhun: Shawn Khunkhun:

Shawn Khunkhun: