|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VANCOUVER, British Columbia, Jan. 25, 2019 (GLOBE NEWSWIRE) — Group Ten Metals Inc. (TSX.V: PGE; US OTC: PGEZF; FSE: 5D32) (the “Company” or “Group Ten”) announces results from the Wild West and Boulder target areas covering the far-western end of the Stillwater West Project in Montana, USA. This is the first in a series of planned news releases to report results of 2018 exploration programs and on-going compilation and modeling work at the Company’s flagship PGE-Ni-Cu project adjacent to Sibanye-Stillwater’s high-grade PGE mines in the Stillwater Igneous Complex. With more than 41 million ounces of past production and current M&I resources, plus another 49 million ounces of inferred resources at over 16 g/t palladium and platinum, the Stillwater Complex is recognized as one of the top regions in the world for PGE-Ni-Cu mineralization1,2.

Michael Rowley, President and CEO, commented, “We are pleased to report the results of our compilation and modelling efforts at Stillwater West alongside results of the 2018 exploration. This first release focuses on the Boulder and Wild West target areas, which cover the western-most 8 km of the 25 km long Stillwater West project, where work in 2018 confirmed the presence of significant PGE+gold along with nickel, copper and cobalt sulphide mineralization. Mineralization at these two target areas corresponds with two nearly untested electromagnetic geophysical conductors that are approximately 4 and 3.8 km in length, respectively. Surface sampling from these targets show values up to 10.3 grams-per-tonne (g/t) palladium, 3.8 g/t platinum and 21.8 g/t gold in rock samples, with 20 samples returning from 2 to 30 g/t platinum equivalent grade mineralization, including significant nickel, copper, and cobalt values.”

“Mineralization styles seen at these two target areas include high-grade PGE “Reef-type” and structurally controlled PGE+gold, along with bulk-tonnage “Platreef-style” PGE-Ni-Cu mineralization geologically similar to the Northern Bushveld, which hosts Anglo American’s world-leading Mogalakwena mines, as well as Ivanhoe’s Platreef project. These very encouraging sample results, along with the untested kilometer-scale electromagnetic conductor anomalies, highlight the potential for major new PGE-Ni-Cu discoveries at Stillwater West, within the prolific Stillwater Complex.”

Wild West Target Area

As shown in Figure 1, the Wild West target area is one of eight major target areas defined by the Company across the lower portion of the Stillwater Complex based on multi-kilometer-scale electromagnetic geophysical (conductive high) anomalies that are coincident with highly elevated metals in soils and surface rock sampling. The Wild West electromagnetic conductor target covers an area of approximately 3.8 km by 1.7 km in size with very encouraging but limited drilling completed on the southeastern edge of the conductor at the Pine Shear Zone.

Table 1 and Figure 2 present highlight intercepts from recent compilation work by the Company on 22 holes drilled at the Pine Shear Zone targeting high-grade gold+PGE mineralization along with nickel, copper and cobalt. Highlight results from drilling at the Pine Shear Zone include 31.02 g/t 3E (28.7 g/t Au, 1.06 g/t Pt, 1.27 g/t Pd) over 2.6 meters and 16.94 g/t 3E (16.19 g/t Au, 0.24 g/t Pt, 0.50 g/t Pd) over 7.98 meters in a gold+PGE-enriched, structurally-controlled shear zone hosted within the chromite-rich ultramafic stratigraphy. Mineralization remains open to expansion in all directions and is one of several priority targets for additional follow up exploration in the Wild West target area.

Rock sampling by Group Ten in 2018 at the Pine Shear Zone returned palladium grades of over 10 g/t while also confirming high-grade gold with the highest grab sample assaying 23.1 g/t 3E (21.8 g/t Au, 0.64 g/t Pt and 0.72 g/t Pd). Outside of the Pine Shear Zone in the broader Wild West target area, reconnaissance rock chip samples confirm the presence of significant PGE, nickel, copper and cobalt mineralization in the ultramafic series including up to 11.5 g/t 3E (10.5 g/t Pd, 1.2 g/t Pt and 0.23 g/t Au) with a total of 17 rock samples exceeding 2 g/t 3E see Figure 1 and Table 2).

TABLE 1 – Highlight mineralized drill intercepts from the Pine Shear Zone at the Wild West Target Area

| INTERVAL | PRECIOUS METALS | BASE METALS | TOTAL METAL EQUIVALENTS |

GRADE THICKNESS | ||||||||||

| HOLE ID | From | To | Width | Pt | Pd | Au | 3E | Ni | Cu | Co | NiEq | TotPtEq | TotNiEq | Grade x Width |

| (m) | (m) | (m) | (g/t) | (g/t) | (g/t) | (g/t) | (%) | (%) | (%) | (%) | (Pt g/t) | (Ni %) | (gram-meter) | |

| PC2004-04 | 0.00 | 20.73 | 20.73 | 0.21 | 0.34 | 0.08 | 0.64 | 0.12 | 0.06 | 0.009 | 0.18 | 1.38 | 0.34 | 29 |

| PC2004-07 | 19.20 | 46.63 | 27.43 | 0.25 | 0.76 | 0.09 | 1.10 | n/a | n/a | n/a | n/a | 1.13 | 0.27 | 31 |

| PC-2 | 11.09 | 22.46 | 11.37 | 0.17 | 0.35 | 11.77 | 12.30 | n/a | n/a | n/a | n/a | 15.24 | 3.70 | 173 |

| including | 14.48 | 22.46 | 7.98 | 0.24 | 0.50 | 16.19 | 16.94 | n/a | n/a | n/a | n/a | 20.99 | 5.10 | 167 |

| PC-3 | 0.15 | 9.72 | 9.57 | 0.16 | 0.16 | 3.77 | 4.09 | n/a | n/a | n/a | n/a | 5.04 | 1.22 | 48 |

| including | 5.70 | 9.72 | 4.02 | 0.38 | 0.39 | 7.27 | 8.04 | n/a | n/a | n/a | n/a | 9.86 | 2.40 | 40 |

| PC-5 | 3.05 | 6.28 | 3.23 | 0.89 | 1.04 | 23.49 | 25.43 | n/a | n/a | n/a | n/a | 31.30 | 7.61 | 101 |

| including | 3.05 | 5.67 | 2.62 | 1.06 | 1.27 | 28.69 | 31.02 | n/a | n/a | n/a | n/a | 38.19 | 9.28 | 100 |

| PC-6 | 29.87 | 39.84 | 9.97 | 0.12 | 0.12 | 4.36 | 4.60 | n/a | n/a | n/a | n/a | 5.69 | 1.38 | 57 |

| PC-9 | 4.39 | 5.76 | 1.37 | 0.34 | 0.34 | 15.87 | 16.56 | n/a | n/a | n/a | n/a | 20.53 | 4.99 | 28 |

Intercepts with grade thickness values over 25 gram-meter TotPtEq are presented above. Total Platinum Equivalent (TotPtEq g/t) and Total Nickel Equivalent calculations reflect total gross metal content using metals prices as follows (all USD): $6.00/lb nickel (Ni), $3.00/lb copper (Cu), $20.00/lb cobalt (Co), $1,000/oz platinum (Pt), $1,000/oz palladium (Pd) and $1,250/oz gold (Au). Values have not been adjusted to reflect metallurgical recoveries. Total metal equivalent values include both base and precious metals, where available. Results labelled ‘n/a’ were not assayed for that metal. Total platinum equivalent grade thickness was determined by multiplying the thickness (in meters) by the Total Platinum Equivalent grade (in grams/tonne) to provide gram-meter values (g-m) as shown. PC2004 series holes were conducted in 2004 by Group Ten’s QP while working for Premium Exploration. PC series holes were drilled in 1983 and the results are considered historic and have not been independently verified by Group Ten.

TABLE 2 – Highlight 2018 rock sample results from the Wild West target area

| PRECIOUS METALS | BASE METALS | TOTAL METAL EQUIVALENTS |

|||||||||

| SAMPLE ID | LOCATION | Pt | Pd | Au | 3E | Ni | Cu | Co | NiEq | TotPtEq | TotNiEq |

| (g/t) | (g/t) | (g/t) | (g/t) | (%) | (%) | (%) | (%) | (Pt g/t) | (Ni %) | ||

| 3190318 | Wild West (PSZ) | 0.64 | 0.72 | 21.80 | 23.16 | 0.260 | 0.071 | 0.018 | 0.36 | 30.07 | 7.31 |

| 97809 | Wild West (PSZ) | 0.37 | 0.59 | 11.70 | 12.66 | n/a | n/a | n/a | n/a | 15.58 | 3.79 |

| 97805 | Wild West (PSZ) | 3.77 | 10.34 | 0.22 | 14.32 | n/a | n/a | n/a | n/a | 14.38 | 3.49 |

| 3190486 | Wild West (PSZ) | 0.24 | 0.49 | 7.93 | 8.66 | 0.475 | 0.313 | 0.027 | 0.72 | 13.61 | 3.31 |

| 3190317 | Wild West (PSZ) | 0.37 | 0.31 | 7.31 | 7.99 | 0.551 | 0.034 | 0.028 | 0.66 | 12.53 | 3.05 |

| 3190498 | Wild West | 1.24 | 10.05 | 0.23 | 11.53 | 0.162 | 0.006 | 0.013 | 0.21 | 12.44 | 3.02 |

| 1409988 | Wild West (PSZ) | 1.82 | 6.01 | 0.20 | 8.03 | 0.157 | 0.029 | 0.040 | 0.30 | 9.33 | 2.27 |

| 3190408 | Wild West (PSZ) | 0.58 | 1.35 | 3.19 | 5.13 | 0.119 | 0.223 | 0.020 | 0.30 | 7.15 | 1.74 |

| 3190497 | Wild West | 2.11 | 3.55 | 0.01 | 5.67 | 0.100 | 0.017 | 0.017 | 0.17 | 6.35 | 1.54 |

| 3190508 | Wild West | 1.09 | 3.20 | 0.27 | 4.56 | 0.217 | 0.067 | 0.024 | 0.33 | 5.99 | 1.46 |

| 3190320 | Wild West | 1.03 | 2.95 | 0.44 | 4.41 | 0.138 | 0.011 | 0.018 | 0.20 | 5.36 | 1.30 |

| 3190509 | Wild West | 1.12 | 2.83 | 0.14 | 4.08 | 0.142 | 0.000 | 0.026 | 0.23 | 5.06 | 1.23 |

| 337315 | Wild West | 0.76 | 2.01 | 0.23 | 3.00 | 0.259 | 0.084 | 0.030 | 0.40 | 4.71 | 1.15 |

| 337389 | Wild West (PSZ) | 2.80 | 0.47 | 0.03 | 3.30 | 0.067 | 0.017 | 0.023 | 0.15 | 3.93 | 0.96 |

| 3190386 | Wild West | 0.44 | 1.61 | 0.19 | 2.24 | 0.183 | 0.245 | 0.022 | 0.38 | 3.84 | 0.93 |

| 1409992 | Wild West | 0.86 | 1.83 | 0.03 | 2.72 | 0.090 | 0.034 | 0.024 | 0.19 | 3.49 | 0.85 |

| 337307 | Wild West | 1.76 | 0.67 | 0.02 | 2.45 | 0.114 | 0.021 | 0.013 | 0.17 | 3.14 | 0.76 |

| 337309 | Wild West | 0.61 | 0.83 | 0.14 | 1.58 | 0.250 | 0.084 | 0.020 | 0.36 | 3.09 | 0.75 |

| 3190422 | Wild West | 0.32 | 0.58 | 0.10 | 0.99 | 0.217 | 0.172 | 0.024 | 0.38 | 2.59 | 0.63 |

| 3190507 | Wild West | 0.11 | 0.23 | 0.11 | 0.44 | 0.327 | 0.182 | 0.018 | 0.48 | 2.44 | 0.59 |

Results over 2 g/t TotPtEq are presented above. Total Platinum Equivalent (TotPtEq g/t) and Total Nickel Equivalent were determined as per Table 1.

Boulder Target Area

The Boulder EM conductor target covers an area approximately 4 km long by 1 km wide with a highly conductive electromagnetic response over the Ultramafic and Basal Series of the Stillwater Complex. While the area is among the least explored at Stillwater West, Group Ten’s work in 2018, together with the available historic data, confirms the presence of significant levels of PGE, Ni, Cu, Co and Cr mineralization coincident with the conductive high anomaly, confirming the potential for large bodies of strongly disseminated sulphides.

Mineralization at the Boulder target area is further confirmed by historic drilling by Anaconda in the 1970s which targeted nickel and copper sulphides and chromites in the Basal and Ultramafic Series. Historic data from drill hole BR-2 at the Boulder Target Area reported three intervals grading between 0.42% to 1.5% combined nickel plus copper but were not assayed for PGE or gold values. Future work at the Boulder Target Area will include detailed mapping and soil and rock sampling to develop and refine drill targets.

Upcoming News and Events, Including Core Display at AMEBC Roundup

Group Ten will be participating in the 2019 AMEBC Mineral Roundup Event in Vancouver. Investors are invited to view core from Stillwater West at display #1018 in the Core Shack area during the AME Round Up tradeshow on January 28 and 29, 2019. Group Ten will also be at booth #1009 in the Exhibit Hall for the duration of the show, and will be at the PDAC convention in March in Toronto, among other upcoming shows.

The Company looks forward to releasing further results from the adjacent and more advanced Chrome Mountain and Iron Mountain target areas in the coming weeks.

About Stillwater West

The Stillwater West PGE-Ni-Cu project positions Group Ten as the second largest landholder in the Stillwater Complex, adjoining and adjacent to Sibanye-Stillwater’s world-leading Stillwater, East Boulder, and Blitz platinum group elements (PGE) mines in south central Montana, USA. With more than 41 million ounces of past production and current M&I resources, plus another 49 million ounces of Inferred resources1,2, the Stillwater Complex is recognized as one of the top regions in the world for PGE-Ni-Cu mineralization, alongside the Bushveld Complex and Great Dyke in southern Africa, which are similar layered intrusions. The J-M Reef, and other PGE-enriched sulphide horizons in the Stillwater Complex, share many similarities with the highly prolific Merensky and UG2 Reefs in the Bushveld Complex, while the lower part of the Stillwater Complex also shows the potential for much larger scale disseminated and high-sulphide PGE-nickel-copper type deposits, possibly similar to Platreef in the Bushveld Complex3. Group Ten’s Stillwater West property covers the lower part of the Stillwater Complex along with the Picket Pin PGE Reef-type deposit in the upper portion, and includes extensive historic data, including soil and rock geochemistry, geophysical surveys, geologic mapping, and historic drilling.

| Note 1: | Report on Montana Platinum Group Metal Mineral Assets of Sibanye-Stillwater, November 2017, Measured and Indicated Resources of 57.2 million tonnes grading 17.0 g/t Pt+Pd containing 31.3 million ounces and 92.5 million tonnes grading 16.6 g/t containing 49.4 million ounces. |

| Note 2: | Public production records from Stillwater Mining Company from 1992 to present. |

| Note 3: | Magmatic Ore Deposits in Layered Intrusions—Descriptive Model for Reef-Type PGE and Contact-Type Cu-Ni-PGE Deposits, Michael Zientek, USGS Open-File Report 2012–1010. |

About Group Ten Metals Inc.

Group Ten Metals Inc. is a TSX-V-listed Canadian mineral exploration company focused on the development of high-quality platinum, palladium, nickel, copper, cobalt and gold exploration assets in top North American mining jurisdictions. The Company’s core asset is the Stillwater West PGE-Ni-Cu project adjacent to Sibanye-Stillwater’s high-grade PGE mines in Montana, USA. Group Ten also holds the highly prospective Kluane PGE-Ni-Cu project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory, and the high-grade Black Lake-Drayton Gold project in the Rainy River district of northwest Ontario.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large brownfields assets in established mining districts adjacent to some of the industry’s highest-grade producers of platinum & palladium, silver and copper. Member companies include Group Ten Metals (PGE.V) in the Stillwater PGM-Ni-Cu district of Montana, Metallic Minerals (MMG.V) in the Yukon’s Keno Hill silver district, and Granite Creek Copper (GCX-H.V) in the Yukon’s Carmacks copper district. Highly experienced management and technical teams at the Metallic Group have expertise across the spectrum of resource exploration and project development from initial discoveries to advanced development, including strong project finance and capital markets experience and have demonstrated a commitment to community engagement and environmental best practices. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorer/developers and major producers and are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven historic mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges.

FOR FURTHER INFORMATION, PLEASE CONTACT:

| Michael Rowley, President, CEO & Director | |

| Email: info@grouptenmetals.com | Phone: (604) 357 4790 |

| Web: http://grouptenmetals.com | Toll Free: (888) 432 0075 |

Quality Control and Quality Assurance

2018 rock chip samples were analyzed by Bureau Veritas Mineral Laboratories in Vancouver, B.C. Samples were crushed and split, and a 250 g split pulverized with 85% passing 200 mesh. Gold, platinum, and palladium were analyzed by fire assay (FA350) with ICP finish. Selected major and trace elements were analyzed by peroxide fusion with ICP-EB finish to insure complete dissolution of resistate minerals. Following industry QA/QC standards, blanks, duplicate samples, and certified standards were also assayed. Due to a Pd over-limit of 10 ppm, there is only qualitative Pd data for sample 3190498 from FA350 analysis.

2004 drilling was conducted by Group Ten’s QP while working for Premium Exploration. 1983 drill results are considered historic and have not been independently verified by Group Ten.

1980s assay data was obtained from a 1986 report by geologist R.J. Warchola titled “A Hydrothermal Gold Occurrence on Chrome Mountain, Stillwater Complex, Montana” published in the Montana Geologic Society and Yellowstone Bighorn Research Association Joint Field Conference and Symposium: Geology of the Beartooth Uplift and Adjacent Basin: YBRA 50th Anniversary Edition, 1986; and a 1984 internal report by R.J. Warchola titled “Geologic Report on the Pine Claim, Sweetgrass County, Montana February 1984”

Assay data for drillhole BR-2 was obtained graphically from a 1979 Anaconda Copper Company map by G.F. Willis and J. Bielak.

Mr. Mike Ostenson, P.Geo., is the qualified person for the purposes of National Instrument 43-101, and he has reviewed and approved the technical disclosure contained in this news release.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Group Ten believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at:

http://www.globenewswire.com/NewsRoom/AttachmentNg/4892ef65-f505-4efc-92a5-e8e4a2e89b03

http://www.globenewswire.com/NewsRoom/AttachmentNg/67397f95-bf6a-4232-aec3-d0827a765b95

TORONTO , Jan. 24, 2019 /CNW/ – Anaconda Mining Inc. (“Anaconda” or the “Company”) (ANX.TO) (ANXGF) is pleased to announce it has completed an updated Mineral Resource Estimate for the Rattling Brook Deposit (“Rattling Brook”) of the Great Northern Project (“Great Northern”) in Newfoundland and an initial Mineral Resource Estimate for the Cape Spencer Gold Project (“Cape Spencer”) in New Brunswick . The Mineral Resource Estimates are presented below in Tables 1 and 3.

The Great Northern and Cape Spencer Gold Projects are held in a wholly-owned subsidiary of Anaconda (“ExploreCo”), with a mandate to identify strategic options to unlock the value of these assets for shareholders through a separate vehicle, allowing Anaconda to focus on its core mining and development operations.

Mineral Resource Estimate Highlights:

Great Northern Project

Cape Spencer Project

“In 2018, Anaconda created a wholly-owned subsidiary to house these highly-prospective, Atlantic Canadian exploration projects, with the aim of developing strategic alternatives to realize value from them. To that end, we proceeded to update the Rattling Brook Mineral Resource Estimate and generate a maiden Mineral Resource Estimate for Cape Spencer. As a result, ExploreCo currently has 83,000 ounces of Indicated Mineral Resources in the Thor Deposit, 151,000 ounces of Inferred Mineral Resources at the Cape Spencer Project and 286,000 ounces of Inferred Mineral Resources in the Thor and Rattling Brook Deposits. We have established these gold resources in highly prospective areas with sizeable land packages that provide the platform to build significant district-scale mineral resources in Atlantic Canada in the long term. We have continued to create value at these projects with low expenditures and are well positioned to pursue strategic options to realize that value for our shareholders, while remaining focused on our core assets at Goldboro and on the Baie Verte Peninsula .”

~ Dustin Angelo , President and CEO, Anaconda Mining Inc.

ExploreCo Table of Mineral Resources*

|

Deposit |

Cut-Off (Au g/t) |

Category |

Rounded Tonnes |

Au (g/t) |

Rounded Ounces |

|

Thor Deposit** |

0.5 |

Indicated |

1,817,000 |

1.42 |

83,000 |

|

0.5 |

Inferred |

847,000 |

1.15 |

31,000 |

|

|

Rattling Brook |

1.0 |

Inferred |

5,460,000 |

1.45 |

255,000 |

|

Cape Spencer Pit Zone |

0.5 |

Inferred |

990,000 |

1.71 |

54,000 |

|

Cape Spencer Northeast Zone |

2.5 |

Inferred |

740,000 |

4.07 |

96,000 |

Rattling Brook Deposit Mineral Resource Estimate – Great Northern Project

The updated Mineral Resource Estimate for the Rattling Brook Deposit is 5,460,000 tonnes at an average grade of 1.45 g/t gold for 255,000 contained ounces at a cut-off grade of 1.0 g/t gold in 3 mineralized zones; the Road, Apsy and Beaver Dam zones with an effective date of January 23, 2019 (Table 1). This represents a 25% increase in tonnes, a 13% increase in grade and a 42% increase in contained ounces at the 1.0 g/t cut-off value compared to the 2008 Historic Mineral Resource Estimate*** that is based on a 0.5 g/t gold cut-off (see Table 2 below for full comparison). This increase in Mineral Resources at the higher cut-off value was obtained by refining the geological model for the deposit, primarily through reducing the volume of marginal grade mineralization that is incorporated in the model. A sensitivity report for the Rattling Brook Deposit and comparison with the 2008 Historic Mineral Resource Estimate is presented in Table 2.

Table 1: Rattling Brook Deposit Mineral Resource Estimate – Effective Date: January 23, 2018

|

Zone |

Cut-Off (Au g/t) |

Category |

Rounded Tonnes |

Au (g/t) |

Rounded Ounces |

|

Apsy |

1.0 |

Inferred |

2,850,000 |

1.52 |

139,000 |

|

Road |

1.0 |

Inferred |

2,120,000 |

1.28 |

87,000 |

|

Beaverdam |

1.0 |

Inferred |

480,000 |

1.81 |

28,000 |

|

Total |

1.0 |

Inferred |

5,460,000 |

1.45 |

255,000 |

|

1. |

This Mineral Resource Estimate was prepared in accordance with NI 43-101 and the CIM Standards (2014) |

|

2. |

Mineral Resource Estimate tonnages have been rounded to the nearest 10,000 and ounces have been rounded to the nearest 1,000. Totals may not sum due to rounding. |

|

3. |

A cut-off of 1.00 g/t gold was used to estimate Mineral Resources. |

|

4. |

Mineral Resources were interpolated using Ordinary Kriging from 1.5 metre downhole assay composites. |

|

5. |

An average bulk density of 2.70 g/cm3 has been applied. |

|

6. |

Over 90% of Mineral Resources occur above a depth of 150m below surface, the current maximum depth of the Anaconda Mining operated Pine Cove Mine. Mineral Resources were reported within an additional 50m of the 150m bench mark, to a maximum depth of 200m, and are considered to reflect reasonable prospects for economic extraction in the foreseeable future using conventional open-pit mining methods at a gold price of CAD $1,550 per ounce. |

|

7. |

Mineral Resources do not have demonstrated economic viability. |

|

8. |

This estimate of Mineral Resources may be materially affected by environmental, permitting, legal title, taxation, sociopolitical, marketing, or other relevant issues. |

Table 2: Rattling Brook Deposit Sensitivity Report and Comparison with 2008 Historic Mineral Estimate

|

Zone |

Cut-Off (Au g/t) |

January 23, 2018 Inferred Mineral Resource Estimate |

2008 Historic Inferred Mineral Resource Estimate*** |

Percent Change |

||||||

|

Rounded Tonnes |

Au g/t |

Rounded Ounces |

Rounded Tonnes |

Au g/t |

Rounded Ounces |

Tonnes |

Grade (Au g/t) |

Ounces |

||

|

Road Zone |

0.5 |

8,960,000 |

0.86 |

248,000 |

9,880,000 |

0.76 |

241,000 |

-9% |

13% |

3% |

|

1.0 |

2,120,000 |

1.28 |

87,000 |

1,400,000 |

1.22 |

55,000 |

51% |

5% |

58% |

|

|

Apsy Zone |

0.5 |

6,010,000 |

1.12 |

217,000 |

7,410,000 |

0.95 |

226000 |

-19% |

18% |

-4% |

|

1.0 |

2,850,000 |

1.52 |

139,000 |

2,760,000 |

1.30 |

115,000 |

3% |

17% |

21% |

|

|

Beaver Dam |

0.5 |

1,220,000 |

1.16 |

45,000 |

1,020,000 |

0.85 |

28,000 |

20% |

36% |

61% |

|

1.0 |

480,000 |

1.81 |

28,000 |

200,000 |

1.52 |

10,000 |

140% |

19% |

180% |

|

|

Total |

0.5 |

16,190,000 |

0.98 |

510,000 |

18,310,000 |

0.84 |

495,000 |

-12% |

17% |

3% |

|

1.0 |

5,460,000 |

1.45 |

255,000 |

4,360,000 |

1.28 |

179,000 |

25% |

13% |

42% |

|

Cape Spencer Project Mineral Resource Estimate

The Inferred Mineral Resource Estimate for the Cape Spencer Deposit is 1,720,000 tonnes at an average grade of 2.72 g/t gold for 151,000 contained ounces at cut-off grade of 0.5 g/t gold and 2.5 g/t gold in two mineralized zones; the Pit Zone and the Northeast Zone with an effective date of January 23, 2019 (Table 3). The Northeast Zone contains a conceptual underground inferred mineral resource estimate of 740,000 tonnes at an average grade of 4.07 g/t gold for 96,000 contained ounces at a cut-off grade of 2.5 g/t gold and the Pit Zone contains a conceptual open-pit inferred mineral resource estimate of 990,000 tonnes at an average grade of 1.71 g/t gold for 54,000 contained ounces at a cut-off grade of 0.5 g/t gold. A sensitivity report for the Cape Spencer Project Northeast Zone and Pit Zone is presented in Table 4.

Table 3: Cape Spencer Project Mineral Resource Estimate – Effective Date: January 23, 2018

|

Zone |

Cut-Off (Au g/t) |

Category |

Rounded Tonnes |

Au (g/t) |

Rounded Ounces |

|

Northeast |

2.5 |

Inferred |

740,000 |

4.07 |

96,000 |

|

Pit |

0.5 |

Inferred |

990,000 |

1.71 |

54,000 |

|

Total |

0.5 and 2.5 |

Inferred |

1,720,000 |

2.72 |

151,000 |

|

1. |

This Mineral Resources Estimate was prepared in accordance with NI 43-101 and the CIM Standards (2014) |

|

2. |

Mineral Resource tonnages have been rounded to the nearest 10,000 and ounces have been rounded to the nearest 1,000. Total may not sum due to rounding. |

|

3. |

A cut-off of 2.50 g/t gold was used to estimate Mineral Resources for the Northeast Zone. |

|

4. |

A cut-off of 0.50 g/t gold was used to estimate Mineral Resources for the Pit Zone. |

|

5. |

Mineral Resources were interpolated using Ordinary Kriging from 1.5 metre assay composites capped at 15 g/t gold. |

|

6. |

An average bulk density of 2.74 g/cm3 has been applied. |

|

7. |

Northeast Zone Mineral Resources extend to a maximum depth of 225m below surface and are considered to reflect reasonable prospects for economic extraction in the foreseeable future using conventional underground mining methods at a gold price of CAD $1,550 per ounce. |

|

8. |

Pit Zone Mineral Resources extend to a maximum depth of 100m below surface and are considered to reflect reasonable prospects for economic extraction in the foreseeable future using conventional open-pit mining methods at a gold price of CAD $1,550 per ounce. |

|

9. |

Mineral Resources do not have demonstrated economic viability. |

|

10. |

This estimate of Mineral Resources may be materially affected by environmental, permitting, legal title, taxation, sociopolitical, marketing, or other relevant issues. |

Table 4: Cape Spencer Project Sensitivity Report

|

Zone |

Cut-Off (Au g/t) |

Category |

Rounded Tonnes |

Au (g/t) |

Rounded Ounces |

|

Northeast |

1.5 |

Inferred |

1,480,000 |

2.98 |

142,000 |

|

2.5 |

Inferred |

740,000 |

4.07 |

96,000 |

|

|

3.5 |

Inferred |

400,000 |

5.04 |

64,000 |

|

|

Pit |

0.5 |

Inferred |

990,000 |

1.71 |

54,000 |

|

1.0 |

Inferred |

830,000 |

1.88 |

50,000 |

Press Release Notes:

*Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. All Mineral Resource Estimates were prepared in accordance with NI 43-101 and the CIM Standards (2014).

** The Thor Deposit forms part of the project formerly referred to as the Viking Project. The resources quoted in this press release refer to the technical report: “NI 43-101 Technical Report and Mineral Resource Estimate on the Thor Deposit, Viking Project, White Bay Area, Newfoundland and Labrador, Canada ” with an effective date of August 29, 2016 and authored by independent qualified persons David A. Copeland , M.Sc., P.Geo., Shane Ebert , Ph.D., P.Geo. (an independent consultant) and Gary Giroux , MASc, P.Eng. (Giroux Consultants Ltd.).

*** The Rattling Brook Deposit, including the Apsy, Road and Beaver Dam zones, form part of the project formerly referred to as the Jacksons Arm Gold Project. The Historic Resources quoted in this press release refer to the technical report: “Technical Report On Mineral Resource Estimate, Jacksons Arm Gold Project, White Bay, Newfoundland And Labrador, Latitude 49o 53′ 2.65”North Longitude 56o 50’7.09” West. With an effective date of April 20th, 2009 , and authored by Michael P. Cullen , M.Sc., P.Geo., Chrystal Kennedy , B.Sc., P.Geo., Matthew Harrington , B.Sc. (Hons.), and Andrew Hilchey , B.Sc. (Hons.) of Mercator Geological Services.

This news release has been reviewed and approved by David A. Copeland, P.Geo., Chief Geologist with Anaconda Mining Inc., “Qualified Persons” and Matthew Harrington, P.Geo. and Michael Cullen , P.Geo. of Mercator Geological Services Ltd., “Independent Qualified Persons” under NI 43-101. A Technical Report prepared in accordance with NI43-101 for the Great Northern and Cape Spencer Projects will be filed on SEDAR (www.sedar.com) within 45 days of this news release.

A version of this press release will be available in French on Anaconda’s website (www.anacondamining.com) in two to three business days.

ABOUT ANACONDA MINING INC.

Anaconda Mining is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in the prospective Atlantic Canadian jurisdictions of Newfoundland and Nova Scotia . The Company operates the Point Rousse Project located in the Baie Verte Mining District in Newfoundland , comprised of the Stog’er Tight Mine, the Pine Cove open pit mine, the Argyle Mineral Resource, the fully-permitted Pine Cove Mill and tailings facility, and approximately 9,150 hectares of prospective gold-bearing property. Anaconda is also developing the Goldboro Gold Project in Nova Scotia , a high-grade Mineral Resource, subject to a 2018 a preliminary economic assessment which demonstrates a strong project economics. The Company also has a wholly owned exploration company that is solely focused on early stage exploration in Newfoundland and New Brunswick .

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking information” within the meaning of applicable Canadian and United States securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects”, or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “does not anticipate”, or “believes” or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, or “will be taken”, “occur”, or “be achieved”. Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in the annual information form for the fiscal year ended December 31, 2017 , available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Anaconda does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE Anaconda Mining Inc.

View original content: http://www.newswire.ca/en/releases/archive/January2019/24/c3014.html

By Ernest Scheyder

YERINGTON, Nev. (Reuters) – Once seen as a laggard in the global mining industry, U.S. copper deposits have quietly drawn more than $1.1 billion in investments from small and large miners alike as Tesla and other electric carmakers scramble for more of the red metal.

Four U.S. copper projects are set to open by next year – the first to come online in more than a decade – with several mine expansions also underway across the country, home to the world’s fifth-largest copper reserves, according to the U.S. Geological Survey.

The rising popularity of electric vehicles – which use twice as much copper as internal combustion engines – and increasingly pro-mining policies in the U.S. while other nations exert greater control over their mineral deposits are fueling the spending, according to mining executives and investors.”Fifteen years ago, U.S. mining was thought to be a dead industry, but now it’s a profitable area for us,” said Richard Adkerson, chief executive of Freeport-McMoran Inc.

The Phoenix-based miner, which last month relinquished majority control of the world’s second-largest copper mine under pressure from the Indonesian government even though it will remain the project’s operator, is set to open a $850 million expansion of one of its Arizona copper mines next year.

“The U.S. is really the core for our future growth,” Adkerson said. The U.S. is home to half of Freeport’s reserves.

The buildouts are expected to boost U.S. copper production by at least 8 percent in the next four years, according to data from the International Copper Study Group and DBS, with Nevada Copper Corp, Taseko Mines Ltd, THEMAC Resources Group Ltd and Excelsior Mining Corp aiming to open copper mines by the end of 2020.

The development trend has gone largely under the radar, with copper industry customers like Tesla Inc – rather than miners themselves – grabbing the headlines. But that is slowly changing.

The prospect of a copper boom in the U.S., where the Trump administration is pushing for mining permit approvals to be approved five times faster and where resource nationalism fears are largely absent, is starting to draw major institutional investors.

Industry analysts recommend investors buy shares of companies building new U.S. copper mines, a marked change from just 12 months ago when most recommendations were to hold. Four analysts, for instance, advise buying Taseko shares; none did a year ago. These analysts also have set price targets for the miners at more than double current trading levels, according to Refinitiv data.

“The copper industry needs areas of good supply with low political risk, and that’s what we get in the United States,” said Stephen Gill of Switzerland-based Pala Investments, Nevada Copper’s largest shareholder.

‘COPPER IS KING’

Nevada Copper’s Pumpkin Hollow copper project in Yerington, Nevada is less than 60 miles (100 km) from Tesla’s massive Gigafactory, a proximity that Gill said was a key factor in Pala’s investment.

Surrounded by onion farms and backed by the Sierra Nevada mountains, the Pumpkin Hollow mine will produce more than 100,000 tonnes of copper each year once its underground and open-pit portions fully open, which is slated to happen in phases.”Copper is king for this electrification trend taking over the global economy,” said Matt Gili, Nevada Copper’s chief executive.

“We see demand increasing steadily in the years ahead and, so far, supply is not keeping up.”

Majors Freeport, Rio Tinto and BHP Group Ltd also have U.S. copper projects of their own under development. These come just as copper prices are forecast to rise more than 10 percent in the next two years, according to Canaccord Genuity.

Nevada Copper’s project has been largely supported by local residents in a state whose economy is linked to mining. But elsewhere, there has been opposition due to concerns about water rights and native lands.

“Green technologies can have a dark side,” said John Hadder of Great Basin Resource Watch, a Nevada-based environmental group.

SMALL VERSUS BIG

Nevada Copper and other junior miners have an advantage over larger peers. Their smaller balance sheets force them to plan small copper mines, making permitting and negotiations with local residents easier.

Rio and BHP, for instance, have been trying since 2001 to open Arizona’s Resolution Copper mine, one of the world’s largest projects of its type.

The two are still waiting for regulatory clearance, having spent more than $1.3 billion since 2001, in a delay brought on partly by a dispute involving local American Indian tribes.

The mine is not slated to open until at least 2030. The U.S. Forest Service is expected to post a draft environmental study on the project by this summer, after which American Indian groups and others will be able to give feedback.

Rio is also studying ways to open the mine sooner – perhaps a year or two – by making engineering changes, but nothing has been finalized, said Arnaud Soirat, head of Rio Tinto’s copper and diamond businesses.

Resolution is on U.S. federal land, complicating the development. Many of the projects that are set to open in the next two years, though, are on private land, fueling an easier path to bring copper to a hungry market.

“I’m convinced over time there will be a global movement toward renewable energy generation and electric vehicles … that means the world will need our U.S. copper,” said Freeport CEO Adkerson.

(Reporting by Ernest Scheyder; Editing by Amran Abocar and Chris Reese)

![]()

VANCOUVER , Jan. 24, 2019 /CNW/ – Pacton Gold Inc. (TSXV: PAC, OTC: PACXF) (the “Company” or “Pacton“) is pleased to announce that it has finalized initial 2019 exploration plans for three of its Pilbara orogenic and conglomerate gold projects in Western Australia .

Highlights:

Geological data and target inventories are being compiled for Pacton’s projects in Western Australia’s Pilbara craton. (Figure 1). Numerous targets types have been identified, most with surface gold occurrences, including Paleoarchean and Mesoarchean orogenic shear hosted occurrences and intrusion related environments. Most of tenements also contain the unconformably overlying, horizontal Fortescue Group gold-bearing Mount Roe and Hardey conglomerates. Pacton is currently planning the remainder of its 2019 exploration program, which shall include field work on all of its Pilbara tenements.

Boodalyerrie Project

Boodalyerrie, Pacton’s most easterly Pilbara tenement, (Figure 1), hosts a prominent swarm of up to 10 m thick gold-bearing veins and stockworks hosted in a granitic tonalite host rock. Superficial reconnaissance prospecting and surface sampling conducted in 2013 returned encouraging grades. Pacton has prioritized exploration of the Boodalyerrie based on image analysis, including satellite hyperspectral data, which indicates large areas of alteration between the most massive quartz veins. This is interpreted as representing a stockwork of smaller, nested vein systems that present excellent, large, pervasive gold-bearing targets.

The Boodalyerrie tenement also contains over 20 km of strike length along the contact of Fortescue Group rocks that unconformably overlie the tonalite pluton. The Fortescue Group Mount Roe formation and the directly overlying Kylena basalt are present. Geological relationships indicate that the emplacement of the quartz veins precedes the deposition of the Mount Roe formation. Consequently, the vein system is interpreted to extend under the Mount Roe formation.

The initial 2019 Boodalyerrie exploration program will include detailed sampling over the entire tonalite pluton, with emphasis on the large alteration patches. Preliminary planning for a targeted drill program is underway for currently identified targets and will include expansion for additional targets identified by the sampling program.

Egina Projects (Friendly Creek, Golden Palms , Hong Kong and Arrow South tenements)

Pacton’s Egina properties, (Figure 3), are contiguous with Novo Resources Corp.’s extensive Egina tenements which contain gold-bearing lag gravels that overlie Mesoarchean age orogenic gold occurrences, and locally, formations of the basal Fortescue Group. To the southeast of the Novo tenements, Pacton’s Friendly Creek, Hong Kong and Golden Palms tenements contain gold showings, including gold nuggets, in areas of Mesoarchean basalts, and in lag gravels mapped as alluvial deposits. To the west and northwest of the Novo project, Pacton’s Arrow South and Arrow North projects contain Archean orogenic gold prospects that are partially covered with extensive layers of alluvial gravels and conglomerates.

Pacton’s initial 2019 Egina exploration will consist of spot sampling of gravels with subsequent follow-up samples based on initial results. Pacton is able to undertake bulk sampling operations as a result of its 2018 strategic alliance with Artemis Resources, which includes access to the Artemis Radio Hill processing plant, now nearing completion.

The initial 2019 Egina exploration program will also include more detailed mapping and sampling of the gold-bearing Mesoarchean basaltic rocks, and their associated erosional gravels.

Nullagine -Beatons Creek (Impact 5 tenement)

The Beatons Creek gold project, (Figure 4), consists of extensive gold-bearing Hardey formation conglomerates that outcrop on the eastern edge of a Fortescue Group plateau that accumulated in the Nullagine sub-basin. Novo Resources Corp’s gold project is located immediately west of the town of Nullagine. Immediately east of Nullagine lies the historic Mosquito Creek gold district represented by orogenic gold deposits in older Archean rocks.

Novo has been prospecting, sampling and drilling its Beaton’s Creek project for several years, including a 1,000 m deep reconnaissance hole collared in the Kylena basalt which overlies the Hardey formation and the basal Fortescue Mount Roe basalt. Novo’s sampling and drilling programs have established that gold-bearing units show a substantial increase in gold grade in proximity to faults that cut the Hardey formation.

Pacton’s Impact 5 tenement is located approximately 17 km northwest of Novo’s Beatons Creek project and lies on the western edge of the Hardey formation plateau. Pacton has established a stratigraphic equivalency between the exposed Impact 5 western plateau edge and the productive stratigraphy at Beatons Creek. (Figure 5). Moreover, the Hardey formation within the Impact 5 tenement is intensely fractured with steep dipping faults and multiple networks of low displacement shears that collectively form a pervasive fracture network.

The initial 2019 Impact 5 exploration program will consist of surface prospecting along the Hardey plateau’s western edge and along dissected drainages. A specific 70 m thick stratigraphic interval will be investigated on the basis that it is interpreted to correlate with the Beatons Creek gold-bearing stratigraphy. Additionally, the intense fracture network will be sampled on surface, in drainages and along the western Hardey plateau edge.

About Pacton Gold

Pacton Gold (PAC: TSXV; PACXF: US) is a well-financed Canadian junior with key strategic partners focused on the exploration and development of conglomerate-hosted gold properties located in the district-scale Pilbara gold rush in Western Australia. The Company currently controls the third largest conglomerate-hosted gold property portfolio totaling in excess of 2,500 km2 and continues to aggressively review additional accretive acquisitions.

The technical content of this news release has been reviewed and approved by Peter Caldbick , P.Geo., a director of the Company and a Qualified Person pursuant to National Instrument 43-101. The qualified person has not yet verified the data disclosed, including sampling, analytical, and test data underlying the information or opinions contained in the written disclosure.

On Behalf of the Board of Pacton Gold Inc.

Alec Pismiris

Interim President and CEO

This news release may contain or refer to forward-looking information based on current expectations, including, but not limited to the Company achieving success in exploring its properties and the impact on the Company of these events, including the effect on its share price. Forward-looking information is subject to significant risks and uncertainties, as actual results may differ materially from forecasted results. Forward-looking information is provided as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances. References to other issuers with nearby projects is for information purposes only and there are no assurances the Company will achieve similar results.

Neither TSX Venture Exchange, the Toronto Stock Exchange nor their Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

View original content to download multimedia:http://www.prnewswire.com/news-releases/pacton-finalizes-initial-2019-pilbara-exploration-plan-300783753.html

SOURCE Pacton Gold Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2019/24/c6993.html

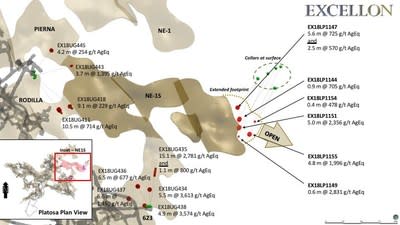

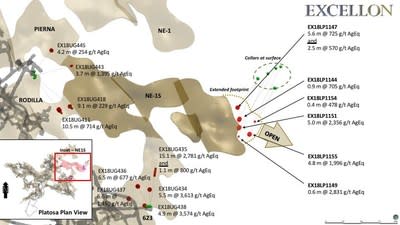

TORONTO , Jan. 24, 2019 /CNW/ – Excellon Resources Inc. (TSX:EXN; OTC:EXLLF) (“Excellon” or the “Company”) is pleased to announce high-grade results from the ongoing surface exploration program at the Platosa Property in Durango, Mexico , where diamond drilling has expanded the NE-1S Manto eastward and identified an open zone of mineralization, with drilling ongoing.

Highlights:

“We have encountered significantly higher than anticipated grades and widths at NE-1S from surface,” stated Ben Pullinger , Senior Vice President Geology. “More importantly, we have identified an open zone to continue expanding the mineralized footprint to the east with our ongoing drilling program during 2019.”

Exploration Results

The following table shows highlighted intervals from the current surface drilling program currently targeting the NE-1S Manto.

|

Hole ID |

Interval(1) |

Interval(2) |

Au |

Ag |

Pb |

Zn |

AgEq (3) |

|

|

From |

To |

metres |

g/t |

g/t |

% |

% |

g/t |

|

|

EX18LP1144 |

344.0 |

344.8 |

0.9 |

0.02 |

283 |

9.8 |

0.3 |

705 |

|

EX18LP1147 |

343.5 |

349.1 |

5.6 |

0.03 |

383 |

8.0 |

0.2 |

725 |

|

including |

343.5 |

344.2 |

0.7 |

0.07 |

1,394 |

12.5 |

0.1 |

1,917 |

|

and |

350.4 |

352.9 |

2.5 |

0.01 |

406 |

3.7 |

0.2 |

570 |

|

including |

351.0 |

351.8 |

0.8 |

0.01 |

1,015 |

8.2 |

0.2 |

1,362 |

|

EX18LP1149 |

347.3 |

347.9 |

0.6 |

0.01 |

2,060 |

7.8 |

9.1 |

2,831 |

|

EX18LP1151 |

352.0 |

357.0 |

5.0 |

0.28 |

968 |

9.4 |

20.2 |

2,356 |

|

including |

352.0 |

353.2 |

1.2 |

0.38 |

1,312 |

17.2 |

24.7 |

3,252 |

|

EX18LP1154 |

350.3 |

350.2 |

0.4 |

– |

391 |

1.5 |

0.5 |

478 |

|

EX18LP1155 |

349.5 |

354.5 |

4.8 |

0.02 |

1,127 |

8.4 |

10.5 |

1,996 |

|

including |

349.9 |

350.6 |

0.7 |

0.01 |

4,284 |

24.9 |

8.1 |

5,720 |

|

(1) |

From-to intervals are measured from the drill collar. |

|

(2) |

All intervals are reported as core length, true width is estimated to be 85-95% of reported intervals. |

|

(3) |

AgEq in drill results assumes $17.00 Ag, $1.03 Pb and $1.23 Zn with 100% metallurgical recovery, consistent with earlier results from the ongoing drilling program. |

Today’s results are from systematic step out drilling to the east of the NE-1S Manto. These holes define an additional approximately 35 metres of eastward extension, where mineralization remains open and is the target of ongoing surface drilling. These holes are also located along a gold-bearing northeast structural trend that continues from the 623 Manto.

Surface drilling continues with a drill rig testing targets in the same target horizon that hosts the Platosa Mine within the north-south trending Platosa corridor. The Company is also in the process of defining new targets at Jaboncillo , PDN, Saltillera North and South and San Gilberto through its ongoing fieldwork program.

Platosa drill core samples are prepared and assayed by SGS Minerals Services in Durango, Mexico . The lab is accredited to ISO/IEC 17025. The Company has a comprehensive QA/QC program, supervised by an independent Qualified Person.

Qualified Person

Mr. Ben Pullinger , P. Geo, Senior Vice-President Geology, has acted as the Qualified Person, as defined in NI 43-101, with respect to the disclosure of the scientific and technical information relating to exploration results contained in this press release.

About Excellon

Excellon’s 100%-owned Platosa Mine has been Mexico’s highest-grade silver mine since production commenced in 2005. The Company is focused on optimizing Platosa’s cost and production profile, discovering further high-grade silver and carbonate replacement deposit (CRD) mineralization on the 21,000 hectare Platosa Project and epithermal silver mineralization on the 100%-owned 45,000 hectare Evolución Property, and capitalizing on current market conditions by acquiring undervalued projects in the Americas.

Additional details on the La Platosa Mine and the rest of Excellon’s exploration properties are available at www.excellonresources.com.

Forward-Looking Statements

The Toronto Stock Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of the content of this Press Release, which has been prepared by management. This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 27E of the Exchange Act. Such statements include, without limitation, statements regarding the future results of operations, performance and achievements of the Company, including potential property acquisitions, the timing, content, cost and results of proposed work programs, the discovery and delineation of mineral deposits/resources/reserves, geological interpretations, proposed production rates, potential mineral recovery processes and rates, business and financing plans, business trends and future operating revenues. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward looking statements as a result of various factors, including, but not limited to, variations in the nature, quality and quantity of any mineral deposits that may be located, significant downward variations in the market price of any minerals produced, the Company’s inability to obtain any necessary permits, consents or authorizations required for its activities, to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies. All of the Company’s public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including the technical reports filed with respect to the Company’s mineral properties, and particularly the September 7, 2018 NI 43-101 technical report prepared by SRK Consulting ( Canada ) Inc. with respect to the Platosa Property. This press release is not, and is not to be construed in any way as, an offer to buy or sell securities in the United States.

SOURCE Excellon Resources Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2019/24/c7446.html

Calibre Acquires a 100% Interest in the Siuna Gold-Silver-Copper Property in Nicaragua from Centerra GoldJanuary 24, 2019

Property Highlights

On closing of the Transaction, Calibre will own 2.44 million AuEq ounces of Inferred Resources in four deposits on the Borosi gold-silver projects – see web site for details.

Recent diamond drilling at the Cerro Aeropuerto gold-silver deposit completed subsequent to the resource estimate, has returned positive results including both wide mineralized zones and narrower high-grade intercepts including: 2.07 m grading 157.20 g/t Au and 117.7 g/t Ag and 8.12 m grading 22.47 g/t Au and 10.9 g/t Ag in drill hole CA16-022 and 26.03 m grading 6.39 g/t Au and 9.1 g/t Ag in drill hole CA16-020 (see Calibre News Release dated March 22, 2016) and 77.78 m grading 1.09 g/t Au and 13.7 g/t Ag in drill hole CA17-045 (see Calibre News Release dated January 11, 2018). |

VANCOUVER, British Columbia, Jan. 21, 2019 (GLOBE NEWSWIRE) — Granite Creek Copper Ltd. (GCX.V) (“Granite Creek” or the “Company”) announces the appointment of Ms. Alicia Milne as Corporate Secretary, effective immediately.

Ms. Milne has over 20 years’ experience providing corporate secretary, securities compliance and corporate paralegal services to companies listed on the NYSE, TSX and TSX Venture Exchanges, with a focus on the resource sector. She is a member of the Governance Professionals of Canada and is on the Board of Directors of Women in Mining British Columbia.

Mr. Timothy Johnson, President & CEO, stated, “We are very pleased to have Ms. Milne join Granite Creek as we continue to develop our corporate infrastructure. The Company expects to announce further additions to the team over the coming weeks, as well as updates with respect to the Stu project and our 2019 exploration plans.”

About Granite Creek Copper

Granite Creek is a newly-launched copper-focused exploration company. The Company’s flagship project is the 111 square kilometer Stu Copper property located in the Yukon’s Carmacks copper district, adjacent to Capstone Mining’s high-grade Minto Cu-Au-Ag mine and Copper North’s Carmacks Cu-Au-Ag project. More information about the Company and the Stu Copper property can be viewed on the company website at www.gcxcopper.com.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry’s highest-grade platinum and palladium, silver and copper producers. Member companies include Group Ten Metals (PGE.V) in the Stillwater PGM-Ni-Cu district of Montana, Metallic Minerals (MMG.V) in the Yukon’s Keno Hill Silver District, and Granite Creek Copper (GCX-H.V) in the Yukon’s Carmacks copper district.

FOR FURTHER INFORMATION PLEASE CONTACT:

Timothy Johnson, President

Telephone: 1 (604) 235-1982

Toll Free: 1 (888) 361-3494

E-mail: info@gcxcopper.com

Website: www.gcxcopper.com

Metallic Group: www.metallicgroup.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

VANCOUVER, British Columbia, Jan. 22, 2019 (GLOBE NEWSWIRE) — Allegiant Gold Ltd. (“ALLEGIANT”) (AUAU:TSX-V) (AUXXF:OTCQX) is pleased to announce that it has optioned-out three projects. Two projects, Bolo and Mogollon, have been optioned to Barrian Mining Corp. (“Barrian”) and one project, Four Metals, has been optioned to Barksdale Capital Corp. (“Barksdale”) (BRO:TSX-V).

“With our focus in the foreseeable future clearly dedicated to our high-impact 6 project discovery drilling campaign, optioning-out certain projects will ensure they are advanced with exploration spending”, said Robert Giustra, Chairman & CEO of ALLEGIANT. “In addition, ALLEGIANT’s annual property holding costs may be reduced by up to $600,000 during the option periods, and the deals could generate up to approximately $3 million in option payments to ALLEGIANT.”

BOLO OPTION AGREEMENT

ALLEGIANT has granted Barrian, a private gold exploration company in the process of completing an IPO, the option to acquire up to a 75% interest in the Bolo gold project, located in Nevada. Barrian can earn an initial 50.01% interest in Bolo by issuing common shares valued at US$1.0 million to ALLEGIANT over a 3-year period, and by incurring exploration expenditures of at least US$4.0 million by December 31, 2022. Barrian can earn an additional 24.99% interest in Bolo, for a total of 75%, by incurring an additional US$4.0 million in exploration expenditures within 2 years of earning the initial 50.01% interest. If Barrian does not earn an additional 24.99% interest in Bolo, it will transfer 0.02% back to ALLEGIANT such that ALLEGIANT will hold a 50.01% interest in Bolo.

Gold mineralization at Bolo is Carlin-type, similar to Pinson, Lone Tree/Stonehouse, and Turquoise Ridge/Getchell, all multi-million-ounce producers, where gold spreads into wall rocks along high-angle structures. Surface sampling at Bolo has defined widespread gold mineralization, associated with jasperoids and iron-stained structures, along two parallel north-south trending faults known as the Mine Fault and the East Fault. Alteration along the Mine Fault has been traced for 2,750 metres, with outcrop sampling returning gold values up to 8.6 g/t gold. The East Fault has been mapped for 2,200 metres and has returned gold values up to 4.7 g/t gold.

The Mine Fault and the East Fault and dozens of altered outcropping and buried cross-faults at Bolo have had very limited drilling and represent excellent exploration targets. An exploration target map can be found at the following link:

www.allegiantgold.com/nr/2019-01-22-targets.pdf

Bolo has the potential to host good grade pods of Carlin-type gold mineralization. At least two such pods have been identified with drilling so far, and as more pods are uncovered, the focus will eventually shift to definition drilling to establish potential for resources.

MOGOLLON OPTION AGREEMENT

ALLEGIANT has also granted Barrian an option to acquire a 100% interest in the Mogollon gold project, located in New Mexico. Barrian can earn a 100% interest in Mogollon by issuing common shares valued at US$1.0 million to ALLEGIANT over a 3-year period.

Mogollon covers an extensive, silver-gold bearing epithermal vein field on a caldera margin of the Tertiary Bursum volcanic center. A number of historical silver-gold deposits are hosted at Mogollon in classic epithermal veins, which demonstrate good continuity of grade and thickness for strike lengths of up to 4,000 ft (1,219 m) in the Little Fanny and Last Chance mines, and through a remarkably consistent, elevation-controlled vertical range of about 1,000 ft (305 m). There are two sets of veins at Mogollon, an east-west set represented by the productive Little Fanny and Last Chance veins, and a north-south set represented by the Queen vein developed in the Consolidated Mine.

Significant intercepts of gold and silver have been encountered in past drilling at Mogollon. Excellent resource expansion potential exists at Mogollon as only 4.8 km of the total 72 km epithermal vein system has been developed.

FOUR METALS OPTION AGREEMENT

In April, 2018 ALLEGIANT granted Barksdale the option to acquire 100% of its interest in the Four Metals project, located in Arizona. To earn the interest, Barksdale must make cash and share payments totaling US$450,000 to ALLEGIANT and its partner MinQuest Ltd., on a 50/50 basis, over a five-year period.

The Four Metals project is located in the Patagonia District 16 km (10 miles) north of Nogales, Santa Cruz County. The Patagonia Range contains a number of undeveloped porphyry copper, breccia copper, and polymetallic vein and replacement deposits within the famous Arizona Porphyry Copper Ore Province.

The Four Metals claims cover the historical Four Metals copper mine which has been intermittently investigated since the 1960’s. Past programs have included underground development, surface and underground core drilling, resource estimates, metallurgical test work, and various investigations of a leach copper mining operation at the site.

The Four Metals copper deposit is hosted within a crudely circular breccia pipe, about 305 m (1,000 ft) in diameter, intruding batholitic granite rocks. Mineralization consists of a shallow zone of supergene enriched chalcocite mineralization underlain by a larger body of primary mineralization containing chalcopyrite, pyrite, and molybdenite.

Various resource estimates have been carried out at Four Metals. The project has the potential for near term development of a small, low capital, copper mine in an area of favorable infrastructure and markets.

Qualified Person

Andy Wallace is a Certified Professional Geologist (CPG) with the American Institute of Professional Geologists and is a Qualified Person as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Wallace has reviewed and approved the technical content of this press release.

ABOUT ALLEGIANT

ALLEGIANT owns 100% of 12 highly-prospective drill-ready gold projects in the United States, 9 of which are located in the mining-friendly jurisdiction of Nevada. ALLEGIANT’s flagship Eastside project hosts a large and expanding gold resource, is district scale, and is located in an area of excellent infrastructure. Preliminary metallurgical testing indicates that both oxide and sulphide gold mineralization at Eastside is amenable to heap leaching.

ABOUT BARRIAN

Barrian Mining Corp is a private junior exploration company focused on acquiring proven gold assets in the United States. Barrian is composed of successful public market entrepreneurs whose goal is to create value for shareholders through the drill bit. Barrian has entered into an earn in agreement with ALLEGIANT to acquire up to a 75% interest in the proven and highly prospective Carlin type Bolo asset located about 90 km north of Tonopah Nevada and a 100% interest in a second asset located in New Mexico. Barrian will trade under the symbol BARI upon completion of its IPO.

Further information regarding ALLEGIANT can be found at www.allegiantgold.com

ON BEHALF OF THE BOARD,

Robert F. Giustra

Chairman & CEO

For more information contact:

Investor Relations

(604) 634-0970 or

1-888-818-1364

ir@allegiantgold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

Certain statements and information contained in this press release constitute “forward-looking statements” within the meaning of applicable U.S. securities laws and “forward-looking information” within the meaning of applicable Canadian securities laws, which are referred to collectively as “forward-looking statements”. The United States Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for certain forward-looking statements. Forward-looking statements are statements and information regarding possible events, conditions or results of operations that are based upon assumptions about future economic conditions and courses of action. All statements and information other than statements of historical fact may be forward-looking statements. In some cases, forward-looking statements can be identified by the use of words such as “seek”, “expect”, “anticipate”, “budget”, “plan”, “estimate”, “continue”, “forecast”, “intend”, “believe”, “predict”, “potential”, “target”, “may”, “could”, “would”, “might”, “will” and similar words or phrases (including negative variations) suggesting future outcomes or statements regarding an outlook. Forward-looking statements in this and other press releases include, but are not limited to statements and information regarding: Allegiant Gold Ltd.’s (“Allegiant”) property holding costs savings or income generated from optioning out certain properties; Allegiant’s drilling and exploration plans for its properties, including anticipated costs and timing thereof; the potential of hosting good grade gold mineralization or expansion; Allegiant’s plans for growth through exploration activities, acquisitions or otherwise; and expectations regarding future maintenance and capital expenditures, working capital requirements; and Barrian’s plan to complete an initial public offering and its acquisition of certain properties. Such forward-looking statements are based on a number of material factors and assumptions and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to differ materially from those anticipated in such forward-looking information. You are cautioned not to place undue reliance on forward-looking statements contained in this press release. Some of the known risks and other factors which could cause actual results to differ materially from those expressed in the forward-looking statements are described in the sections entitled “Risk Factors” in Allegiant’s Listing Application, dated January 24, 2018, as filed with the TSX Venture Exchange and available on SEDAR under Allegiant’s profile at www.sedar.com. Actual results and future events could differ materially from those anticipated in such statements. Allegiant undertakes no obligation to update or revise any forward-looking statements included in this press release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

Bank of England blocks Maduro’s $1.2B gold withdrawal – report

By Rob Picheta, CNN

Updated at 12:32 PM ET, Sat January 26, 2019