Capital Projects Construction Contract Awarded to Dumas Mining

YERINGTON, Nev., Feb. 13, 2023 (GLOBE NEWSWIRE) — Nevada Copper (TSX: NCU) (OTC: NEVDF) (FSE: ZYTA) (“Nevada Copper” or the “Company”) is pleased to provide an update on restart and operational activities for its Pumpkin Hollow underground copper mine (the “Underground Mine”).

Randy Buffington, President & CEO of Nevada Copper, stated, “Our Pumpkin Hollow team is focused on advancing the restart project quickly and safely. We are building on the momentum of the recent achievements by the underground crews as they have progressed through the dike structure and are advancing into the EN Zone in anticipation of the underground development contractor arriving on site and commencing development. The technical and leadership teams are in place and committed to executing this restart plan. We are targeting a mill restart in the third quarter with a quick ramp up to nameplate capacity by the end of 2023.”

Production Restart Highlights

- Clear line of site to full-scale production

- Simple and low-risk pathway to full-scale production established, comprising:

- Phase 1 Q4 2022 to Q1 2023: Finalize dike crossings to access EN Zone initial stoping area (complete), confirm all key technical hires for restart (complete), and award capital projects contract (complete).

- Phase 2 Q2 2023: Prioritized development of higher-grade EN Zone stope area.

- Phase 3 Q3 to Q4 2023: Restart of proven mill, with surface and underground ore feed developed and short ramp-up to nameplate capacity.

- Simple and low-risk pathway to full-scale production established, comprising:

- Phase 1 Restart Milestones Achieved

- Development into the EN Zone has demonstrated that rock quality is consistent with our geotechnical model, which predicted competent ground within the EN Zone, and development is progressing at full round lengths and standard ground support.

- Definition drilling and assaying of all initial EN Zone stopes planned for extraction in 2023 is complete representing approximately 210K tons of stope ore, providing significant visibility on quality and grade of ore feed.

- Contract awarded for completion of capital projects to debottleneck restart of development and underground operations.

- Development mining contract award well progressed.

- All key technical positions in place, with substantially strengthened operational leadership team on-site.

- Operations significantly de-risked

- Completion of both critical dike headings, securing the Underground Mine with full access to the primary EN Zone stope area. The third dike crossing is progressing well and, while it is not required to meet 2023 operating objectives, is expected to be completed in the first half of 2023.

- Building planned surface stockpile of approximately 150K tons of run-of-mine ore ahead of mill start-up provides substantial operating buffer for milling operations.

- Debottlenecking capital projects front-ended to provide additional operating flexibility.

Further Details on Production Restart

Underground Development Proceeding as Planned

The Nevada Copper operations team continues to make rapid progress on all underground activities including mine development, hoisting, stope preparation, and underground projects.

The historically reported dike crossings that provide initial stope top and bottom access into the EN Zone were fully established and completed in December 2022, and development is progressing toward stoping areas. Both key development drives that have crossed the dike have encountered ground conditions at or better than expectation, confirming the geotechnical model that predicted higher quality rock. Definition drilling of the initial stopes to feed the restart of milling operations in Q3 2023 have been completed and assayed, and confirm rock quality, grade and geometry represented by the geologic and reserve models.

Underground Development Contractor Update

The Company has completed the bid process for the development mining contractor and is in the final stages of negotiations for a unit rate contract with an internationally recognized major mining services contractor.

Key components of the development contract include:

- 72,000 feet of lateral capital development over a 24-month contract period;

- Delivery of full development stopes by Q3 2023 to provide sufficient faces and stopes to restart and maintain nameplate milling operations (approximately 5,000 tpd); and

- Nevada Copper’s operating team will perform all stope mining starting in Q3 2023.

Critical Construction Projects Progressing

The Company awarded Dumas Contracting USA, Inc. (“Dumas”) a $12 million construction contract to complete critical capital projects including the coarse ore bin and installation of an underground jaw crusher, permanent dewatering system, vent shaft stripping and surface fans. Dumas is a leading full-service underground mining contractor providing mine construction, development, production mining, mine services and engineering early-stage projects through well-established operating mines throughout the Americas.

Vent Shaft – Final stripping of the vent shaft commenced in January in preparation for connection of the surface fans, which are expected to be commissioned in early Q2 2023. The stripping is planned to be completed ahead of development contractor mobilization and the vent shaft is expected to provide the necessary ventilation for the life of the mine.

Ore Handling System – The additional ore handling system allows for increased ore throughput rates to the shaft hoisting system, enabling operations to ultimately exceed nameplate production. Engineering for ore handling system has been completed, and all long-lead items are on-site including the jaw crusher. Excavation is underway and planning for the installation of the system has already commenced.

Dewatering System – The pumps for the permanent dewatering system are on site and ready for installation. Once installed, the additional pumps are expected to provide all dewatering requirements for the life of the mine.

Regional Exploration Opportunities

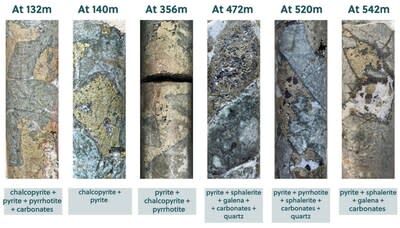

The Company has completed a thorough review of regional mapping for its Pumpkin Hollow land position and several high-quality targets of interest have been identified. Surface sampling results from the Copper Ridge area have indicated the high-grade potential, highlighted by grades including 5.03% and 5.43% copper (see table below for additional assay information) that warrant additional investigation. In 2023, detailed mapping, interpretation of recent geophysical analysis and surface sampling are planned to follow-up on other identified high-potential targets on the Nevada Copper land position. The grades identified are conceptual in nature as there has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the delineation of a mineral resource. Grades were determined through third-party labs, as detailed below under “Quality Assurance and Quality Control”.

| Table of Assays (samples greater than 1%) | ||||||

| Sample ID | Easting (m) | Northing (m) | Elevation (m) | Cu (%) | Au (ppm) | Ag (ppm) |

| 533857 | 318720 | 4316510 | 1451 | 2.31 | 0.036 | 0.5 |

| 533861 | 318751 | 4316512 | 1458 | 2.36 | 0.008 | <0.2 |

| 533862 | 318766 | 4316512 | 1459 | 1.54 | 0.130 | 0.2 |

| 1615147 | 319706 | 4317023 | 1443 | 3.35 | 0.030 | 4.8 |

| 1615150 | 319603 | 4317072 | 1444 | 3.65 | 0.011 | 0.4 |

| 1615178 | 319087 | 4316782 | 1517 | 2.02 | 0.119 | 5.4 |

| 1669223 | 319621 | 4317082 | 1442 | 2.65 | 0.045 | 2.7 |

| 1669224 | 319678 | 4317033 | 1444 | 3.10 | 0.056 | 4.4 |

| 1669225 | 318483 | 4316515 | 1413 | 1.60 | 1.430 | 2.7 |

| 1669229 | 318639 | 4316481 | 1437 | 1.19 | 0.180 | 0.8 |

| 1669232 | 318607 | 4316637 | 1440 | 1.03 | 0.104 | 1.1 |

| M59971* | 319729 | 4317020 | 1440 | 5.03 | 0.150 | 10.0 |

| M59982* | 318739 | 4316527 | 1446 | 5.43 | 0.075 | 16.0 |

| M59984* | 318789 | 4316601 | 1470 | 4.10 | 0.055 | 8.0 |

| M59994* | 318438 | 4316507 | 1405 | 2.87 | 1.490 | 6.0 |

* Historic sample

Board Changes

Ms. Kate Southwell will be stepping down as a member of the Board of Directors effective February 28, 2023 to pursue other career opportunities. Stephen Gill, Chairman of the Board stated, “The Board and management team appreciate Kate’s valuable input during her tenure, particularly with regard to financing and commercial matters and as Chair of the Sustainability Committee and wish her well in her future endeavors”. The Nominating Committee of the Board is in the process of identifying qualified candidates to fill the vacant role at or prior to this year’s annual shareholder meeting.

Qualified Person

The technical information and data in this news release has been reviewed by Steven Newman, Registered Member – SME, Vice President, Technical Services for Nevada Copper, and Greg French, C.P.G., VP Exploration of Nevada Copper, who are non-independent Qualified Persons within the meaning of NI 43-101.

Quality Assurance and Quality Control

The analytical work was performed by American Assay Labs (AAL) located in Sparks, Nevada. AAL is an ISO/IEC 17025 accredited laboratory. The Samples were crushed so that >80% passes 10 mesh, followed by pulverizing to >90% passes 75 < 150 mesh. Prepared samples were run using a three-acid digestion process and conventional ICP-AES analysis. Gold determination was via standard atomic absorption (AA) finish 30-gram fire-assay (FA) analysis. Blank, standard and duplicate samples were routinely inserted and monitored for quality assurance and quality control.

The historic analytical work was performed by Chemex Labs Inc., currently ALS Geochemistry (ALS) located in, Nevada. ALS is an ISO/IEC 17025 accredited laboratory. The samples were crushed so that >80% passes 10 mesh, followed by pulverizing split to < 150 mesh. Prepared samples were run using an acid digestion process and conventional ICP-AES analysis. Gold determination was via standard atomic absorption (AA) finish 30-gram fire-assay (FA) analysis.

Nevada Copper detected no significant QA/QC issues during review of the data and is not aware of any sampling or other factors that could materially affect the accuracy or reliability of the data referred to herein.

About Nevada Copper

Nevada Copper (TSX: NCU) is a copper producer and owner of the Pumpkin Hollow copper project. Located in Nevada, USA, Pumpkin Hollow has substantial reserves and resources including copper, gold and silver. Its two fully permitted projects include the high-grade Underground Mine and processing facility, which is now in the production stage, and a large-scale open pit PFS stage project.

Randy Buffington

President & CEO

For additional information, please see the Company’s website at www.nevadacopper.com, or contact:

Tracey Thom | Vice President, IR and Community Relations

tthom@nevadacopper.com

+1 775 391 9029

Cautionary Language on Forward Looking Statements

This news release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts, are forward-looking statements. Such forward-looking information and forward-looking statements specifically include, but are not limited to, statements that relate to development and ramp-up plans and activities at the Underground Mine and the timing in respect thereof.

Forward-looking statements and information include statements regarding the expectations and beliefs of management. Often, but not always, forward-looking statements and forward-looking information can be identified by the use of words such as “plans”, “expects”, “potential”, “is expected”, “anticipated”, “is targeted”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements or information should not be read as guarantees of future performance and results. They are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and events to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information.

Such risks and uncertainties include, without limitation, those relating to: requirements for additional capital and no assurance can be given regarding the availability thereof; the outcome of discussions with vendors; the ability of the Company to complete the ramp-up of the Underground Mine within the expected cost estimates and timeframe; the impact of COVID-19 on the business and operations of the Company; the state of financial markets; history of losses; dilution; adverse events relating to milling operations, construction, development and ramp-up, including the ability of the Company to address underground development and process plant issues; ground conditions; cost overruns relating to development, construction and ramp-up of the Underground Mine; loss of material properties; interest rate increases; global economy; limited history of production; future metals price fluctuations; speculative nature of exploration activities; periodic interruptions to exploration, development and mining activities; environmental hazards and liability; industrial accidents; failure of processing and mining equipment to perform as expected; labour disputes; supply problems; uncertainty of production and cost estimates; the interpretation of drill results and the estimation of mineral resources and reserves; changes in project parameters as plans continue to be refined; possible variations in ore reserves, grade of mineralization or recovery rates from management’s expectations and the difference may be material; legal and regulatory proceedings and community actions; accidents; title matters; regulatory approvals and restrictions; increased costs and physical risks relating to climate change, including extreme weather events, and new or revised regulations relating to climate change; permitting and licensing; dependence on management information systems and cyber security risks; volatility of the market price of the Company’s securities; insurance; competition; hedging activities; currency fluctuations; loss of key employees; other risks of the mining industry as well as those risks discussed in the Company’s Management’s Discussion and Analysis in respect of the year ended December 31, 2021 and the quarter ended September 30, 2022 and in the section entitled “Risk Factors” in the Company’s Annual Information Form dated March 31, 2022. The forward-looking statements and information contained in this news release are based upon assumptions management believes to be reasonable, including, without limitation: no adverse developments in respect of the property or operations at the project; no material changes to applicable laws; the ramp-up of operations at the Underground Mine in accordance with management’s plans and expectations; no worsening of the current COVID-19 related work restrictions; reduced impacts of COVID-19 going forward; the Company will be able to obtain sufficient additional funding to complete the ramp-up, no material adverse change to the price of copper from current levels; and the absence of any other factors that could cause actions, events or results to differ from those anticipated, estimated or intended.

The forward-looking information and statements are stated as of the date hereof. The Company disclaims any intent or obligation to update forward-looking statements or information except as required by law. Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking information and statements, there may be other factors that could cause actions, events or results not to be as anticipated, estimated or intended. Specific reference is made to “Risk Factors” in the Company’s Management’s Discussion and Analysis in respect of the year ended December 31, 2021 and the quarter ended September 30, 2022 and “Risk Factors” in the Company’s Annual Information Form dated March 31, 2022, for a discussion of factors that may affect forward-looking statements and information. Should one or more of these risks or uncertainties materialize, should other risks or uncertainties materialize or should underlying assumptions prove incorrect, actual results and events may vary materially from those described in forward-looking statements and information. For more information on the Company and the risks and challenges of its business, investors should review the Company’s filings that are available at www.sedar.com.

The Company provides no assurance that forward-looking statements and information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information.