Tag: Gregory Beischer

Figure 1

Plan View Map showing the location of the project within the Tintina Gold Province.

Figure 2

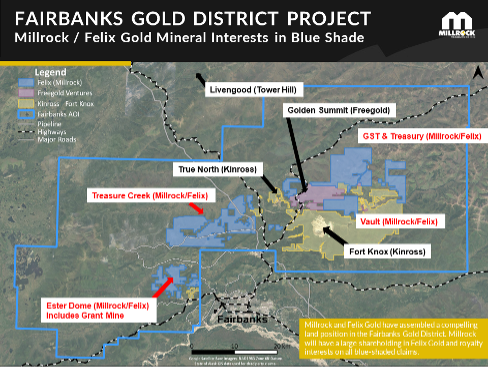

Plan View Map of Felix Gold land holdings in relation to the City of Fairbanks, Kinross’ Fort Knox Mine and Gil satellite mine, and Freegold Ventures Golden Summit / Cleary Hill gold deposit.

VANCOUVER, British Columbia, Nov. 30, 2021 (GLOBE NEWSWIRE) — Millrock Resources Inc. (TSX-V: MRO, OTCQB: MLRKF) (“Millrock” or the “Company”) is pleased to have received notice from Felix Gold that it has lodged a prospectus with the Australian Securities and Investments Commission. The filing initiates the process by which Felix Gold may become a publicly-traded company on the Australian Securities Exchange (“ASX”). If successful under the proposed schedule the company shares would begin trading in January 2022. Depending on the concurrent capital raise, Felix Gold would have between AUD$10 million and AUD$13 million in their treasury, with much of that funding to be directed to exploration of the mineral claims that have been contributed by Millrock and/or staked or acquired by Felix Gold in the Fairbanks Mining District. Upon successful IPO and capital raise, Millrock will be entitled to a payment of Felix Gold shares. It is anticipated that the ASX will impose a mandatory restriction on the disposal of these shares of up to two years. Readers are cautioned that the share payment will only be made if the IPO is successfully completed.

Millrock President and CEO Gregory Beischer commented: “This is great news for Millrock and its shareholders. Depending on the amount of money raised in the IPO, Millrock will receive Felix Gold shares with an initial value ranging between approximately US$1.7 million and US$1.9 million. Additionally, Millrock will be entitled to production royalties on all of the claims comprising the current extensive property position and on future claims that may be acquired within a large Area of Interest surrounding the Fairbanks Mining District. Millrock will be entitled to Advanced Minimum Royalty payments that begin January 2022. Some excellent targets have been developed over the past year, while Felix Gold was an unlisted company. With a strong treasury and a robust 2022 budget, Felix Gold will have a great chance to make new gold discoveries and expand the gold resource at the Grant Mine. Any exploration success should result in strong appreciation of the Felix Gold shares that Millrock will hold, and also should support Millrock’s share price.”

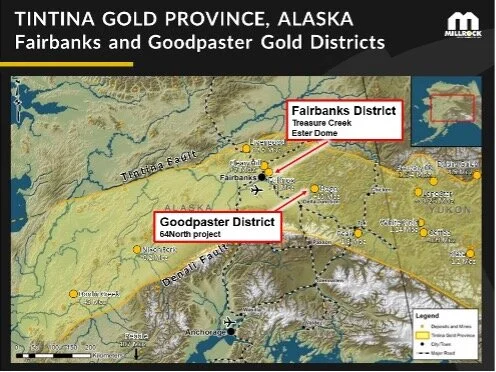

As reported in a January 12, 2021 press release, Millrock assigned Felix all of its rights in the Fairbanks area Ester Dome and Treasure Creek properties. It had held these rights for several years under agreements with prospectors. The Fairbanks Mining District is located within the prolific Tintina Gold Province, which spans Alaska and Yukon.

The Felix Gold prospectus indicates that (assuming the IPO and capital raise is successful) Millrock will be issued a minimum of 9,957,157 and a maximum of 11,442,384 Felix Gold shares at an IPO price of AUD$0.25 with an indicative initial value ranging between AUD$2,249,289 (CDN$2,047,389) and AUD$2,860,596 (CDN$2,603,491). The number of shares to be issued is dependent on the amount of capital raised. The shares will only be issued to Millrock if the IPO and capital raise is successfully completed.

Since signing the initial agreements in January 2021, the Felix Gold team, working in collaboration with Millrock, significantly expanded the claim package, targeting areas that appeared to have high potential based on a systematic evaluation of public data and Millrock’s proprietary database. A large soil sampling effort was carried out in 2021. More than 3,000 soil samples were collected using power augers which allow for the collection of soil at the bedrock – overburden interface. Overlying overburden in the Fairbanks area often consists of very fine grained windblown sediments with or without permafrost making traditional soil geochemical surveys less effective. This work has served to identify strongly anomalous areas on the Treasure Creek project with three main prospects: NW Array, Scrafford, and Eastgate. The survey also identified strong anomalies at the Northeast Fairbanks portion of the project, which is proximal to Kinross’ Fort Knox gold mine, the satellite Gil deposit recently put into production by Kinross, and the Golden Summit / Cleary Hill deposit, which is being actively explored by Freegold Ventures Limited with strong success.

Felix Gold has examined data from the former-producing Grant Mine upon which they have an option to purchase a 100% interest. As a result of the data analysis, Felix Gold has been able to calculate a gold resource that is compliant with the Australia Joint Ore Reserves Committee (“JORC”) standards that govern such calculations in Australia (source: INDEPENDENT GEOLOGIST’S REPORTS ON FELIX GOLD LIMITED’S MINERAL EXPLORATION PROJECTS IN ALASKA, Prepared by Independent Geologist Mr. Ian Taylor of Mining Associates Pty Ltd., October 15, 2021).

The independent geologist’s report is appended to the Felix Gold prospectus and reports the following:

- Inferred Mineral Resource estimate (JORC 2012) for Grant Mine of 5.8 million tonnes @ 1.95 grams per tonne gold for 364,000 ounces of contained gold including an underground resource of 136,000 ounces of gold grading 6.2 grams of gold per tonne.

- And also: Grant Mine Exploration Target (JORC 2012) of 5.6 million tonnes to 6.6 million tonnes at a grade of 1.9 grams per tonne gold to 2.1 grams per tonne gold for 338,000 to 545,000 ounces of gold (exclusive of the Mineral Resource).

Note: The NI43-101 standards are the standards to which Millrock must adhere as a TSX Venture Exchange issuer, and the Australia JORC standards are those to which Felix Gold must comply as an Australian issuer. The JORC standards are robust, similar and parallel to the NI43-101 standards. JORC (2012) is defined as an ‘acceptable foreign code’ under NI43-101 reporting standards and the definition and classification of Mineral Resources are essentially the same as the NI43-101 Canadian Institute of Mining Definition standards. The Millrock qualified person has not independently verified the drill hole data, drill core, and estimation methodology as reported by Felix.

Figure 1. Plan View Map showing the location of the project within the Tintina Gold Province.

https://www.globenewswire.com/NewsRoom/AttachmentNg/71c71907-ec2d-4791-a632-b1e2fbbd4fca

Figure 2. Plan View Map of Felix Gold land holdings in relation to the City of Fairbanks, Kinross’ Fort Knox Mine and Gil satellite mine, and Freegold Ventures Golden Summit / Cleary Hill gold deposit.

https://www.globenewswire.com/NewsRoom/AttachmentNg/d99e5cc4-19be-44d7-964d-0ca5df2fe96f

Qualified Person

The scientific and technical information disclosed within this document has been prepared, reviewed, and approved by Gregory A. Beischer, President, CEO, and a director of Millrock Resources. Mr. Beischer is a qualified person as defined in NI 43-101.

About Millrock Resources Inc.

Millrock Resources Inc. is a premier project generator to the mining industry. Millrock identifies, packages, and operates large-scale projects for joint venture, thereby exposing its shareholders to the benefits of mineral discovery without the usual financial risk taken on by most exploration companies. The company is recognized as the premier generative explorer in Alaska, holds royalty interests in British Columbia, Canada, and Sonora State, Mexico, is a significant shareholder of junior explorer ArcWest Exploration Inc. and owns a large shareholding in Resolution Minerals Limited. Funding for drilling at Millrock’s exploration projects is primarily provided by its joint venture partners. Business partners of Millrock have included some of the leading names in the mining industry: EMX Royalty, Centerra Gold, First Quantum, Teck, Kinross, Vale, Inmet and, Altius as well as junior explorers Resolution, Riverside, PolarX, Felix Gold and Tocvan.

ON BEHALF OF THE BOARD

“Gregory Beischer”

Gregory Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:

Melanee Henderson, Investor Relations

Toll-Free: 877-217-8978 | Local: 604-638-3164

Twitter | Facebook | LinkedIn

Some statements in this news release may contain forward-looking information (within the meaning of Canadian securities legislation) including without limitation the successful completion of an IPO and capital raise by Felix Gold and the intention to mount further exploration including drilling in 2022. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements.

Figure 1. Project location map.

Figure 1. Project location map.

Figure 2. Prospect Location Map

Figure 2. Prospect Location Map

VANCOUVER, British Columbia, Nov. 08, 2021 (GLOBE NEWSWIRE) — Millrock Resources Inc. (TSX-V: MRO, OTCQB: MLRKF) (“Millrock” or the “Company”) is pleased to announce it has signed a binding letter agreement (“Letter Agreement”) with Mine Discovery Fund Pty. Ltd. (“MDF”) concerning its El Batamote porphyry copper exploration project in Mexico. MDF is a private Australian company. In good faith, MDF has made an initial US$50,000 cash payment upon signing the Letter Agreement. A definitive agreement (“Definitive Agreement”) has been prepared will be signed immediately following the formation of a Mexico subsidiary company by MDF. MDF has placed Batamote into a wholly-owned subsidiary company called Latin America Copper Limited(“LatCopper”) along with other assets in Chile. MDF indicates it has commenced compliance documentation for a potential ASX or TSX listing in the first half of 2022.

Millrock President and CEO Gregory Beischer commented: “Batamote has excellent potential to discover a porphyry copper deposit. We know already that breccia-style and porphyry copper mineralization is present. We are particularly excited to drill-test beneath what appears to be a leach cap alteration zone at a prospect called El Choclo NW. The project is situated within a belt that has produced very large porphyry copper deposits being mined by others as evidenced by the Cananea and La Caridad mines.”

Latin American Copper Director Joseph Webb commented: “With the addition of El Batamote, LatCopper has three exceptional cornerstone exploration assets with evidence of Tier 1 scale potential in the globally significant copper belts of Latin America. El Batamote is 25 kilometers northwest of Grupo Mexico’s La Caridad copper mine (5.98 billion tonnes at 0.34% copper equivalent) with an untested leach cap identified along strike from known mineralisation. This indicates potential for supergene mineralisation at Choclo. The Bata Sur definitive mineralised porphyry system intersected by historic drilling remains open along strike.”

Under the terms of the Definitive Agreement, LatCopper will have the option to purchase a 100% interest in the concessions that underlie the Batamote copper project. To earn the interest, LatCopper will have to make cash payments totalling US$1,000,000 over five years, execute US$6,000,000 dollars in exploration work, and pay Millrock US$250,000 in shares when LatCopper becomes a publicly listed company. In the event that LatCopper exercises the option to purchase the Batamote project, annual advanced minimum royalty (“AMR”) payments will be triggered. The first payment will be US$50,000 and the payment will increase by US$50,000 each year until a cap of US$500,000 is reached. Annual payments will then remain at the capped level until a mine reaches commercial production. At that point, a Net Smelter Return production royalty of 1.0% will be triggered. Any AMR payments made by LatCopper can be credited against production royalty payments.

About the El Batamote Project

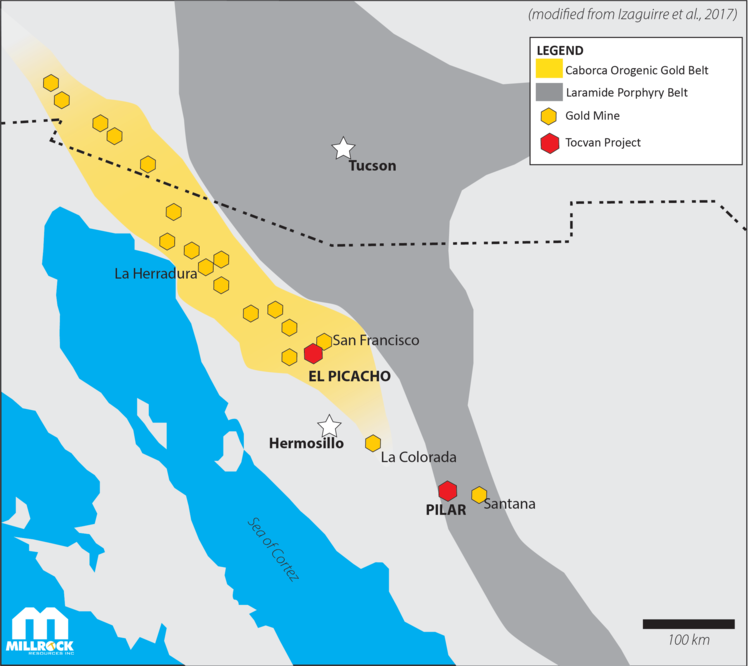

The project is located 100 kilometers south of the Sonora – Arizona border and 140 kilometers north of the mining hub of Hermosillo in northeastern Sonora State, Mexico. The project is fully accessible by road and covers nearly 4,000 hectares. Millrock previously purchased the concessions and historical exploration data from a subsidiary of Teck Resources Ltd., as announced by Millrock in a November 2015 press release. The project is situated within the Cananea-La Caridad Copper Porphyry belt (Figure 1). This district-scale structural trend is situated within the larger North American porphyry copper province containing over 20 copper-molybdenum deposits and mines in Arizona, New Mexico, and Sonora.

Figure 1. Project location map is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/639437fc-1d2c-4f6a-9a1c-b6e6ac47e702.

El Batamote contains alteration and geochemistry characteristics of a Cu-Mo porphyry system. Important historical work has been conducted on the property by large companies such as Phelps Dodge, BHP, Noranda, Peñoles, and Teck. Abundant information was generated by prior workings in the south and central part of the claim block and includes regional and semi-detail mapping, geochemistry, petrography, spectrometry, geophysics and drilling with more than 10,000 meters of diamond core having been drilled.

The exploration led to the discovery of several key prospects: Bata Sur, El Choclo NW and El Choclo West (Figure 2). Review of the historic data has led Millrock geologists to make new exploration observations, conclusions, and recommendations. Preliminary plans include geophysical surveys at El Choclo NW, where a possible leach cap is situated adjacent to known porphyry mineralization. No drilling has been done beneath the alteration zone. At the Bata Sur prospect, breccia pipe style mineralization has been intersected by prior drilling. Drilling is recommended to test for higher grade and to test previously untested geochemical anomalies. Millrock has drilling permits in hand.

Figure 2. Prospect Location Map is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b48bb9da-f767-4ecf-af5b-4b76c395f052.

The lithology and alteration at Batamote are similar to that found at the La Caridad and Cananea mines. The mining concession covers Late Cretaceous Laramide age intermediate composition volcanic sequences which are intruded by a large, multi-phase batholith with multiple, mineralized porphyry pulses along a northwest-trending structural corridor. Porphyry dikes cut the system and are followed by later, mid-Tertiary post-mineral tuffaceous rocks, all of which are cut by long-lived northeast-trending and north-south fault structures. Intermediate volcanic rocks are the main host to copper mineralization. These rocks contain strong hydrothermal alteration related to porphyry-type systems in a three-kilometer by six-kilometer area that on the west side, is truncated by north-west to north-south trending post-mineral faults. Quaternary gravels cover bedrock west of these faults, but porphyry mineralization may be concealed below as potentially indicated by geophysical surveys at Choclo W.

Qualified Person

The scientific and technical information disclosed within this document has been prepared, reviewed, and approved by Gregory A. Beischer, President, CEO, and a director of Millrock Resources. Mr. Beischer is a qualified person as defined in NI 43-101.

About Millrock Resources Inc.

Millrock Resources Inc. is a premier project generator to the mining industry. Millrock identifies, packages, and operates large-scale projects for joint venture, thereby exposing its shareholders to the benefits of mineral discovery without the usual financial risk taken on by most exploration companies. The company is recognized as the premier generative explorer in Alaska, holds royalty interests in British Columbia, Canada, and Sonora State, Mexico, is a significant shareholder of junior explorer ArcWest Exploration Inc. and owns a large shareholding in Resolution Minerals Limited. Funding for drilling at Millrock’s exploration projects is primarily provided by its joint venture partners. Business partners of Millrock have included some of the leading names in the mining industry: EMX Royalty, Coeur Explorations, Centerra Gold, First Quantum, Teck, Kinross, Vale, Inmet and, Altius as well as junior explorers Resolution, Riverside, PolarX, Felix Gold, Tocvan, and now Mine Discovery Fund.

About Mine Discovery Fund

Mine Discovery Fund (MDF) is a private investment vehicle backed by some of the industry’s leading technical advisors and professional mining investors. MDF focus is on Tier 1 orebody discovery in the jurisdictions that provide the highest probability of exploration success (in the most fertile Tier 1 Belts and in areas with clear pathways for development potential.

ON BEHALF OF THE BOARD

“Gregory Beischer”

Gregory Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:

Melanee Henderson, Investor Relations

Toll-Free: 877-217-8978 | Local: 604-638-3164

Twitter | Facebook | LinkedIn

Some statements in this news release may contain forward-looking information (within the meaning of Canadian securities legislation) including without limitation the intention to mount further exploration including drilling in 2021 and 2022, and the intention to enter a definitive agreement with Mine Discovery Fund. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements.

| Recently, CEO Greg Beischer presented at the Denver Gold Group Explorer and Developer Forumin Colorado Springs and we were lucky enough to get our hands on his presentation to share with all of you. In the presentation, Greg provides an update on the current state of our company and covers numerous projects including Treasure Creek, Ester Dome, and 64North projects in Alaska. To make it easy to digest, I’ve pulled out the key highlights below. Key Highlights: 0:39 – Greg provides context on how the Apex Gold project came about and how Millrock attracted the interest of a mid-tier mining company to partner with. 0:31 – An explanation of the Project Generator model and shows how reduces investor risk. 2:16 – An overview of Millrock’s partners which include both major mining companies and smaller miners. 5:10 – Greg explains why Millrock has chosen Alaska as our home base to explore. 5:52 – Overview of our current active projects in Alaska including an overview of the Tintina Gold Province. 7:28 – Greg provides a history of the Fairbanks Gold District and explains Millrock’s current projects in the district including Treasure Creek, Ester Dome, and 64North. 13:50 – Greg provides a high-level overview of all the upcoming catalysts Milrock has including work in Sonora state, Mexico. 15:10 – Greg answers questions from the audience. It’s a great presentation, so please take a listen below. |

Take care and enjoy the day. Best regards, Melanee Henderson, Manager of Investor Relations Millrock Resources Inc. | MRO.V | MLRKF.OTCQB Toll-Free: 877-217-8978 | Local: 604-638-3164 |

Highlights

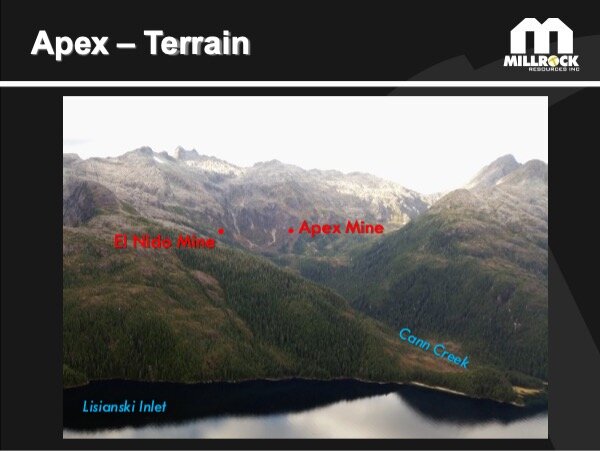

- Millrock has executed an agreement with Coeur Explorations, Inc., a wholly-owned subsidiary of Coeur Mining, Inc. concerning claims controlled by Millrock at the Apex gold project, located approximately 70 kilometers from Juneau in Southeast Alaska.

- Coeur Explorations may exercise an option to earn a 100% interest in the claims through staged payments and exploration expenditures.

- Upon earning 100% interest, a Net Smelter Returns royalty with an advanced minimum royalty provision and buyback option will be granted to Millrock.

- Initial exploration is underway; drill permits have been approved.

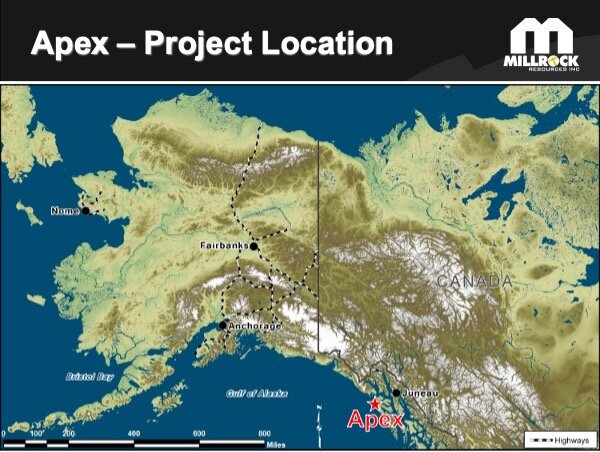

VANCOUVER, BRITISH COLUMBIA, August 12, 2021 – Millrock Resources Inc. (TSX-V: MRO, OTCQB: MLRKF) (“Millrock” or the “Company”) is pleased to announce that it has entered into an agreement with Coeur Explorations, Inc., a wholly-owned subsidiary of Coeur Mining, Inc. (“Coeur”), concerning the Apex gold project in Southeast Alaska. The project is located on Chichagoff Island, three kilometers north of the village of Pelican and 70 kilometers southwest of Juneau, Alaska.

Millrock President & CEO Gregory Beischer commented: “We are pleased to enter into this agreement with Coeur Explorations and will work diligently with their exploration team to explore the claims. From historic documents, we know that high-grade gold ore was previously mined, but there has never been a single exploratory hole drilled. It seems likely that the known high-grade gold-bearing quartz veins will continue along strike and in the down-dip direction. The claims have been completely dormant since the 1980s. We’ll start with surface geochemical sampling and detailed structural mapping this year and look to drill in 2022.”

The Apex project targets high-grade, mesothermal, gold-bearing quartz vein deposits. The claims cover the former-producing Apex and El Nido gold mines which operated intermittently from the 1920s through to the 1940s and reportedly produced approximately 34,000 ounces of gold by underground mining methods. Nearly 1,200 meters of workings on four levels were used to extract ore (United States Geological Survey Alaska Resource Data File). Ore was hand-cobbed and milled on site. Surface exploration was done by WGM Inc. in the 1980s, but no drilling was done and the property has been dormant since. Millrock secured an option on the core claim group in 2016 from Apex El Nido Gold Mines Inc. Subsequently, Millrock staked surrounding lands, compiled information, and secured drilling permits. At surface, above the caved portal to the Apex Mine, a swarm of quartz veins can be observed over a width of more than 200 meters. Within the swarm, four thicker veins were the subject of the historic mining efforts. Geological and geochemical features suggest the vein system has continuity along strike to the northeast beneath Cann Creek, toward the tidewater of Lisianski Inlet, two kilometers away. The gold-bearing vein system has never been drill tested along strike or below the historic workings.

Under the agreement, Millrock will assign its rights under the existing option agreement with Apex El Nido Gold Mines to Coeur Explorations. Coeur Explorations will be responsible for making cash payments and funding exploration expenditures to keep the option agreement with Apex El Nido Gold Mines in good standing. Millrock will execute exploration under a services agreement on behalf of Coeur. Coeur Explorations may determine not to proceed to exercise the option at any time, but if it makes all the payments and expenditures, it will vest with a 100% interest in the underlying claims. Upon exercising the option to purchase the Apex El Nido Gold Mine claims, Millrock will also transfer the claims it owns outright to Coeur Explorations, and the entire project will become subject to a net smelter returns (“NSR”) royalty in favour of Millrock. The royalty payable is a 2.5% NSR with an advanced minimum royalty (“AMR”) provision. Coeur Explorations may reduce the NSR to 1.0% by paying Millrock US$3.0 million. The initial AMR payment will be US$50,000 and will increase by US$50,000 annually until production occurs. AMR payments are deductible from NSR payments. The property will revert to Millrock in the event that Coeur elects to discontinue AMR payments.

Typical of Southeast Alaska, the terrain is steep and challenging, as pictured in Figure 2. The former producing Apex and El Nido mine entries are at tree level, approximately 360 meters above sea level. A soil sampling crew has been mobilized to the project and is presently working out of accommodations in Pelican, using boat access. The goal of the program is to trace the mineralized structure and refine vein locations in anticipation of a 2022 drilling program.

Qualified Person

The scientific and technical information disclosed within this document has been prepared, reviewed, and approved by Gregory A. Beischer, President, CEO, and a director of Millrock Resources. Mr. Beischer is a qualified person as defined in NI 43-101.

About Millrock Resources Inc.

Millrock Resources Inc. is a premier project generator to the mining industry. Millrock identifies, packages, and operates large-scale projects for joint venture, thereby exposing its shareholders to the benefits of mineral discovery without the usual financial risk taken on by most exploration companies. The company is recognized as the premier generative explorer in Alaska, holds royalty interests in British Columbia, Canada, and Sonora State, Mexico, is a significant shareholder of junior explorer ArcWest Exploration Inc. and owns a large shareholding in Resolution Minerals Limited. Funding for drilling at Millrock’s exploration projects is primarily provided by its joint venture partners. Business partners of Millrock have included some of the leading names in the mining industry: Coeur Explorations, EMX Royalty, Centerra Gold, First Quantum, Teck, Kinross, Vale, Inmet and, Altius as well as junior explorers Resolution, Riverside, PolarX, and Felix Gold.

ON BEHALF OF THE BOARD

“Gregory Beischer”

Gregory Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:

Melanee Henderson, Investor Relations

Toll-Free: 877-217-8978 | Local: 604-638-3164

Twitter | Facebook | LinkedIn

Some statements in this news release may contain forward-looking information (within the meaning of Canadian securities legislation) including without limitation the intention to mount further exploration including drilling in 2022. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements.

Highlights

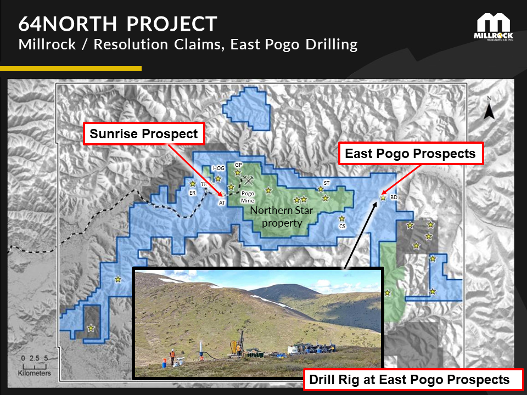

Resolution Minerals Partnership – 64North Gold Project.

- Resolution Minerals reported that it had received assay results from a recently completed, shallow, reverse circulation drilling program conducted at prospects within the East Pogo block of the 64North Gold Project near Pogo Mine.

- No significant gold intersections were realized, but Resolution Minerals reports strong gold pathfinder element signatures in a target area measuring 1,600 meters by 2000 meters.

- Resolution states that pathfinder results from drill hole 21EP008 indicate potential for gold at depth and that a follow-up deeper drilling program is warranted.

Felix Gold Partnership

- Major soil sampling program continues: 2,000 samples collected to date.

- Drill plans are being formulated.

VANCOUVER, BRITISH COLUMBIA, August 5, 2021 – Millrock Resources Inc. (TSX-V: MRO, OTCQB: MLRKF) (“Millrock” or the “Company”) is pleased to provide an update on its exploration activities at its Goodpaster and Fairbanks gold district projects (Figure 1).

Goodpaster District Projects

Millrock owns a 70% interest in a very large claim block surrounding the Pogo Mine in Alaska. Pogo is a high-grade gold mine operated by Northern Star Resources Ltd. The 64North claims, which are subdivided into eight different blocks, are the subject of an option agreement with Resolution Minerals Ltd (ASX: RML, “Resolution”). Recently, a 30% interest was earned by Resolution by virtue of exploration expenditures plus cash and share payments made to Millrock in the first year of the project.

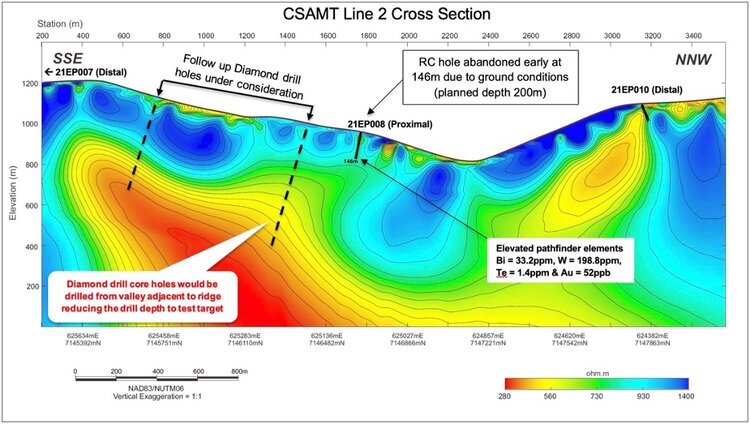

64North Gold Project – East Pogo block: Millrock partner Resolution has recently completed a drilling program at gold prospects located on the East Pogo block (Figure 2). A reverse circulation drill was used to test shallow, gently-dipping conductive zones detected in 2020 by ZTEM and CSAMT geophysical surveys. A total of 1,663 meters was drilled over 12 holes. Gently-dipping altered, graphitic zones with quartz and sulfides were reported in several holes. Assay results indicate only anomalous gold values. However, gold pathfinder elements detected indicate possible proximity to a gold-bearing vein system. At the nearby Pogo Mine, rocks close to the gold-bearing veins are enriched in the pathfinder elements bismuth, tellurium, sulfur, and arsenic. From the recent drilling at East Pogo, Resolution has identified a target area measuring 1,600 meters by 2,000 meters for follow-up, with a CSAMT conductive zone beneath. Drill hole 21EP008 intersected sericite and biotite alteration including minor quartz veining with strongly elevated geochemical pathfinder elements. The hole had a trend of increasing gold and alteration intensity over the last 50 meters drilled with sericite alteration present in the last few meters. This signifies potential for gold mineralization at greater depth, perhaps at the level of the CSAMT conductor. The hole unfortunately had to be terminated prior to reaching target depth. Resolution indicates it is considering drilling deeper with a core rig to test the CSAMT target below the geochemical anomaly detected through the shallow reverse circulation drilling program (Figure 3).

Fairbanks Gold District Projects

Millrock is in a strategic alliance agreement with Felix Gold Ltd. (“Felix Gold”), a private Australian company that intends to become a public company listed on the Australia Stock Exchange (“ASX”). Millrock is assigning its existing mineral rights in return for Felix Gold shares and royalty interests. Felix Gold is funding exploration work and paying the costs of acquiring claims by staking and by agreements with claim holders. All new properties within the strategic alliance Area of Interest become subject to royalties in favor of Millrock (Figure 4).

A major soil sampling program is well underway. To date, 2,000 soil samples have been collected across the claim holdings. The planned work will be completed at the end of August. Samples are being collected using a small auger Figure 5). The goal is to get uniform, modern soil sample coverage across the claims. Once the soil data is merged with all historic data which has been compiled in a database, drill targeting will be done.

Qualified Person

The scientific and technical information disclosed within this document has been prepared, reviewed, and approved by Gregory A. Beischer, President, CEO, and a director of Millrock Resources. Mr. Beischer is a qualified person as defined in NI 43-101.

About Millrock Resources Inc.

Millrock Resources Inc. is a premier project generator to the mining industry. Millrock identifies, packages, and operates large-scale projects for joint venture, thereby exposing its shareholders to the benefits of mineral discovery without the usual financial risk taken on by most exploration companies. The company is recognized as the premier generative explorer in Alaska, holds royalty interests in British Columbia, Canada, and Sonora State, Mexico, is a significant shareholder of junior explorer ArcWest Exploration Inc. and owns a large shareholding in Resolution Minerals Limited. Funding for drilling at Millrock’s exploration projects is primarily provided by its joint venture partners. Business partners of Millrock have included some of the leading names in the mining industry: EMX Royalty, Centerra Gold, First Quantum, Teck, Kinross, Vale, Inmet and, Altius as well as junior explorers Resolution, Riverside, PolarX, and Felix Gold.

ON BEHALF OF THE BOARD

“Gregory Beischer”

Gregory Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:

Melanee Henderson, Investor Relations

Toll-Free: 877-217-8978 | Local: 604-638-3164

Twitter | Facebook | LinkedIn

Some statements in this news release may contain forward-looking information (within the meaning of Canadian securities legislation) including without limitation the intention to mount further exploration including drilling in 2021. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements.

Press Release

Corporate Presentation

https://youtu.be/vqnPhZr14Gg

Millrock President and CEO Gregory Beischer commented: “El Picacho has great exploration potential for large-tonnage, bulk minable gold deposits, and higher-grade, vein-hosted deposits. We had previously dropped our option on the project, but it was readily reinstated. In turn, we are very pleased to assign our rights to Tocvan in exchange for royalty interests that may begin cash flowing in a relatively short time period. Further, in the event that Tocvan does not complete the underlying option with the concession owners, the option rights will be returned to Millrock.”

FOR FURTHER INFORMATION, PLEASE CONTACT:

Melanee Henderson, Investor Relations

Toll-Free: 877-217-8978 | Local: 604-638-3164

Twitter | Facebook | LinkedIn

Transcript

https://youtu.be/HwXHWNC3-nc

Today we revisit the value proposition of a Millrock Resources, a Premier Prospect Generator, that has a brownfields, district-scale land package located in the prolific Tintina Gold Province of Alaska, surrounding 10 million ounces of gold in resources at Pogo Mine operated by their neighbor Northern Star Resources. In this interview, we will be joined by CEO Gregory Beischer and Gabriel Graf, who is a consultant for MRO and is credited with the discovery of Northern Star’s Goodpaster deposit. Mr. Beischer will walk us through the latest drill results as Mr. Graf will convey the similarities between the 64 North Project and the Goodpaster Deposit. Millrock Resources has a strategic partner in EMX Royalty and Resolution Minerals. Millrock will apply up to $5 Million in the capital in an effort to delineate the 64 North Project to increase shareholder value. If you like the Golden Triangle, you should consider the Tinatina Gold Province. The stock price for Millrock Resouces has nearly tripled since September with the potential to go much higher! Legendary commodities investor Rick Rule is investing in Millrock Resources. Find out why in this exclusive interview with Gregory Beischer the CEO of Millrock Resources.

INVESTOR INQUIRIES

Melanee Henderson

Investor Relations Direct: 604-638-3164 mhenderson@millrockresources.com