Bob Moriarty

Archives

Jul 29, 2024

I think we are in a perfectly normal correction after a shot higher to a new record high for gold a week ago. Gold has come down about four percent while silver dropped about ten percent. Markets go up. Markets go down. We are still in the most favorable time of the year for resource stocks into September.

That makes this an appropriate time to be looking around for the next good cheap stock. Someone contacted me about a company a few weeks ago and I think I have found what looks like a potential winner.

The company named Barton Gold (BGD-ASX and BGDFF-OTCQB) calls South Australia home. I’ve visited Australia a number of times and often the Aussies grouse about how little their fellow countrymen are willing to spring for gold in the ground.

Barton Gold is a perfect example. The company shows an existing 1.6-million-ounce gold JORC resource with a market cap of $52 million in Australian pesos. Given the approximately $10 million in cash it means local punters are only willing to pay about $21 an ounce for gold in the ground from a company with permits and an existing mill. If you multiply the $21 Aussie by a conversion of .66 for USD you come up with $14 an ounce in USD. That’s absurdly cheap and if Barton Gold was in Nevada or Quebec at this stage they would probably be getting more like $50-$60 an ounce at a minimum.

Barton’s solution proved to be simple. Get an OTCQB listing and sell those cheap ounces to American and Canadian investors. But even there is a problem that I am going to be 100% up front about.

WHEN BUYING OR SELLING OTC LISTED STOCKS, DO NOT EVER, EVER, EVER PUT IN A MARKET ORDER.

SHOULD YOU DO THAT, THE BROKER WILL BEND YOU OVER A BARREL AND DO TERRIBLE THINGS TO YOU THAT YOU WILL NOT ENJOY. IT WILL BE THE MOST EXPENSIVE SEX YOU HAVE EVER SUFFERED.

(Click on images to enlarge)

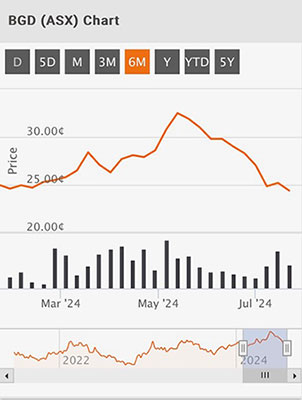

That’s a six-month chart taken from HotCopper showing the price in Australian dollars. It shows shares trading at about $.25 six months ago rising to $.35 and dropping gradually and steadily to $.24 today.

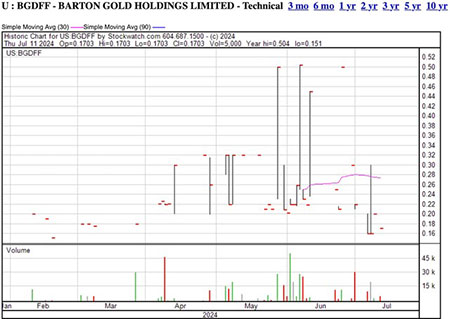

That’s what happens when investors put in market orders. Those buying through the OTCQB were paying up to $.50 in USD for shares that were only worth a tiny fraction of that. The brokers screwed them.

But the chart of BGD does indicate what I have said, at current prices Barton Gold seems pretty cheap. Let’s go into the particulars.

Barton Gold indicates over 5,000 square km of tenements in the center of South Australia with various properties containing 1.6 million ounces of gold in a JORC report.

A recent scoping study released only two weeks ago shows a 6.4 year mine life for the existing 1.5 million ounce resource at the Tunkillia project producing 130,000 ounces of gold yearly and 311,000 ounces of silver. The Tunkillia mine would require $374 million initial capex with a NPV at 7.5% of $512 million and a 40% IRR with a 1.9-year payback of initial capital. The average LOM AISC would be $1,917 and compares favorably with the current price for gold of $3615.

At the nearby Tarcoola Gold mine and mill, Barton recently completed a 9,000-meter RC drill program with a nine-hole 900 meters drill program just finished in the Perseverance open pit. Tarcoola has the advantage of being within trucking distance of the Challenger 650 TPD CIL plant. Results from the almost 10,000-meter program will be released soon.

Managing Director and CEO Alex Scanlon takes a very aggressive approach to building the next mid-tier gold company in Australia. He is young, frankly that is a good thing, we need new young thinking in the industry. He has a plan and is busy executing it.

In June of 2021 he came up with a plan for asset monetization that has generated A$ 10 million sufficient non-dilutive cash to pay 100% of the corporate overhead. One brilliant move was in December of 2022 to do a thorough mill cleanup that generated 1,400 ounces of gold. That was sold in June of 2024 near the all-time high for gold to generate a payment of $4.25 million AUD.

Alex is an excellent communicator and a glance at the timing of recent ASX announcements show a constant flow of valuable information. I highly recommend all potential investors go over their excellent presentation and work out the numbers. For a company with 1.6 million ounces of gold with a 650 TPD and is permitted, this is some of the cheapest gold you will ever find.

Barton Gold is an advertiser so that makes me biased. Do your own due diligence.

Barton Gold Holdings Limited

BGD-ASX $.24 Aussie (Jul 26, 2024)

BGDFF-OTCQB $.17 USD

219 million shares

Barton Gold website

###

Bob Moriarty

President: 321gold

Archives

321gold Ltd