|

|||||||||||||||||||

|

Category: Precious Metals

|

|

|

|

Michael Rowley of President and CEO of Group Ten Metals (TSX: PGE) sits down with Maurice Jackson of Proven and Probable to discuss the company’s latest press release regarding the High-Grade Palladium, Platinum, and Gold results from the Wild West and Boulder Target Areas, which are the beginning 2 out of 14 Target Area results. Shareholders will be extremely impressed with the company’s findings.

VIDEO

AUDIO

https://soundcloud.com/proven-and-probable/is-montana-home-to-a-platreef-style-deposit

TRANSCRIPT

Source: Maurice Jackson for Streetwise Reports (2/7/19)

Michael Rowley, president and CEO of Group Ten Metals, sits down with Maurice Jackson of Proven and Probable to discuss his company’s recent drill results at its Montana PGE project that is also showing significant gold mineralization.

Michael Rowley: Thank you, Maurice, glad to be back.

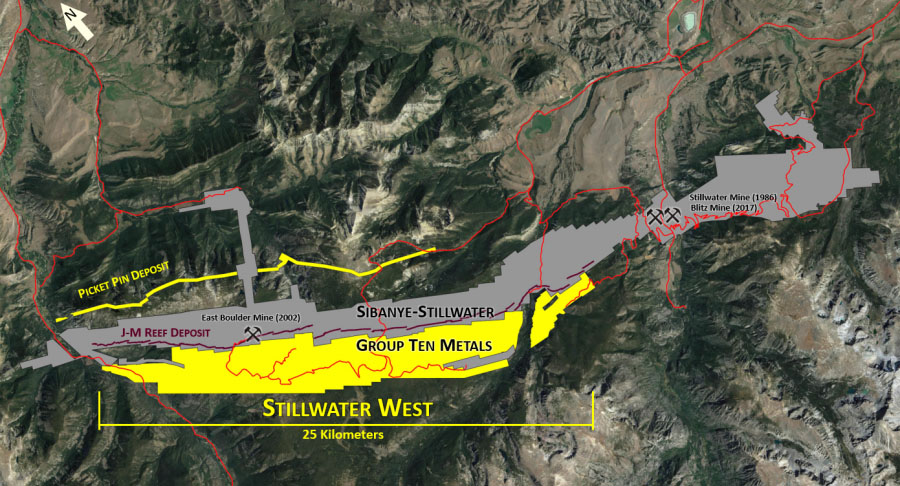

Maurice Jackson: Glad to have you back, sir. In 2018, Group Ten Metals began its first season on the ground and identified 14 target areas on its flagship project, Stillwater West. Today, we have the results from 2 of the 14 target areas, which are quite impressive. But before we begin, for someone new to the story, who is Group Ten Metals and what is the thesis you are attempting to prove?

Michael Rowley: At the very highest level, we are applying geologic models that were developed at the world’s biggest and most economic platinum, nickel and copper mines. These are the mines of the Northern Bushveld or Platreef District in South Africa. We’re applying those models to the Stillwater Complex in Montana, and this has not been done systematically before. The Bushveld and Stillwater Complexes are both large Igneous Complexes, they’re both magmatic systems, and there are many known parallels between the two. Despite those parallels, we are the first to bring together a large land position with a truly fantastic database and then bring in this Platreef expertise to enable a systematic exploration for these massive deposit types at Stillwater. In discussing that expertise, it’s worth noting that Ivanhoe’s Dr. David Broughton, who is one of the co-discoverers of its Platreef mine, which is now in development, joined our team late last year, which is a pretty good validation that we’re on the right track here in Stillwater.

Maurice Jackson: In our last interview, you shared the next unanswered question for Group Ten Metals would be assay results. On the 25th of January, Group Ten Metals issued a press release entitled “Group Ten reports high-grade palladium, platinum, and gold from the Wild West in Boulder target areas at the Stillwater West project, Montana.” Take us to the Wild West target area and provide us with some in-depth analysis on Group Ten Metals’ results there.

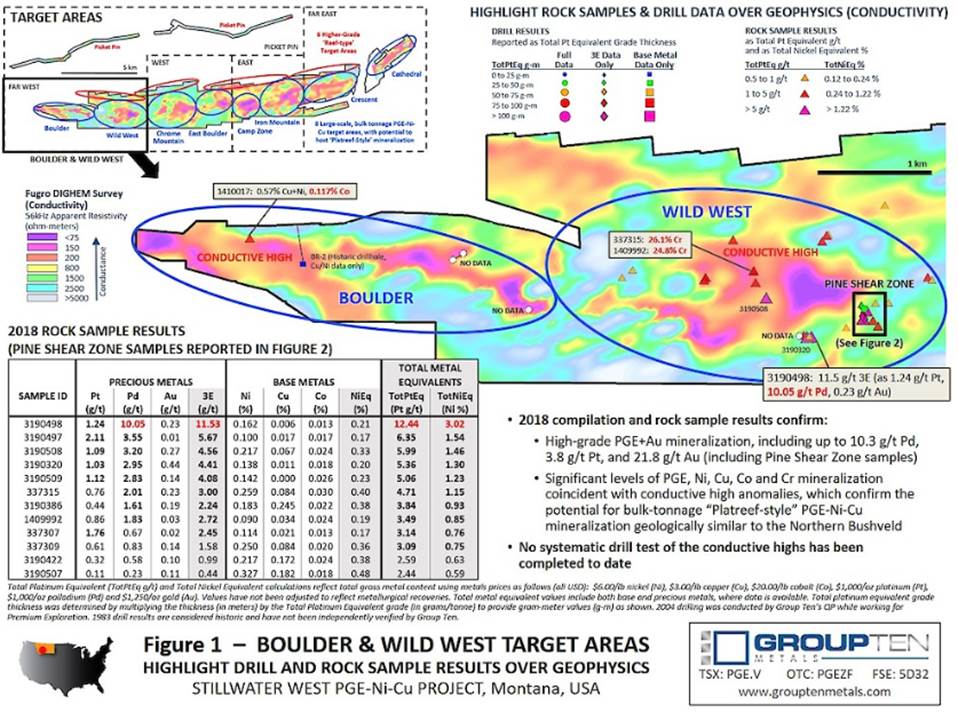

Michael Rowley: To begin, the press release issued on January 25, 2019, will be the first in a planned series and shareholders will see that the road map in the upper left corner of the image above. We’ve divided this 25-km-wide property into a series of target areas, and we’ll basically be releasing results west to east in the areas that you see. It’s the Chrome Mountain and Iron Mountain area that have the most drill results historically, that will be the subject of subsequent news releases here. In terms of the current news, it focused on the Boulder and Wild West, which are highlighted above, and the Wild West target area has the Platreef potential that we see property-wide is well-documented there historically. It also has the reef type, high-grade targets as shown in the red ellipses at the top of the claim block, and then it also has this high-grade gold occurrence, which is the Pine Shear zone, and that may be unexpected for some people, given that Stillwater camp is more generally known for palladium and platinum and nickel and copper, chrome. This is actually a significant area of gold mineralization and it’s got some spectacular hits.

In terms of the Platreef target, this conductive high that’s shown contains some very high level conductance in the rocks as evidenced by the purples and pinks. Historical drilling has shown that it does indeed contain copper and nickel, and that’s an excellent indication of a potential for this Platreef style mineralization. We also have some spectacular palladium hits, such as 10 gram per tonne palladium, very high grade, also with significant platinum that shows not only the level of mineralization in the system but also the potential for these high-grade reef-type deposits that, of course, the area is more known for. It’s worth noting that sitting just above the claim there is the 80 million ounce JM-Reef deposit, which averages a staggering 16 grams per tonne of palladium and platinum, so you know there’s a lot of metal in the system and this lower zone that we’re in continues that trend.

In addition to the high-grade samples summarized in this table, bottom left, we see some very good hits of palladium, platinum, and also some good indications of base metal mineralization, which again ties into that Platreef bulk mineable scenario. These are priorities for follow up in 2019 and we look forward to discussing that in further news releases.

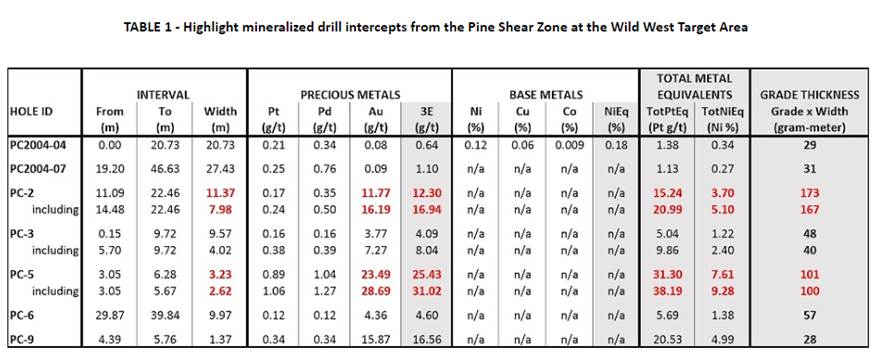

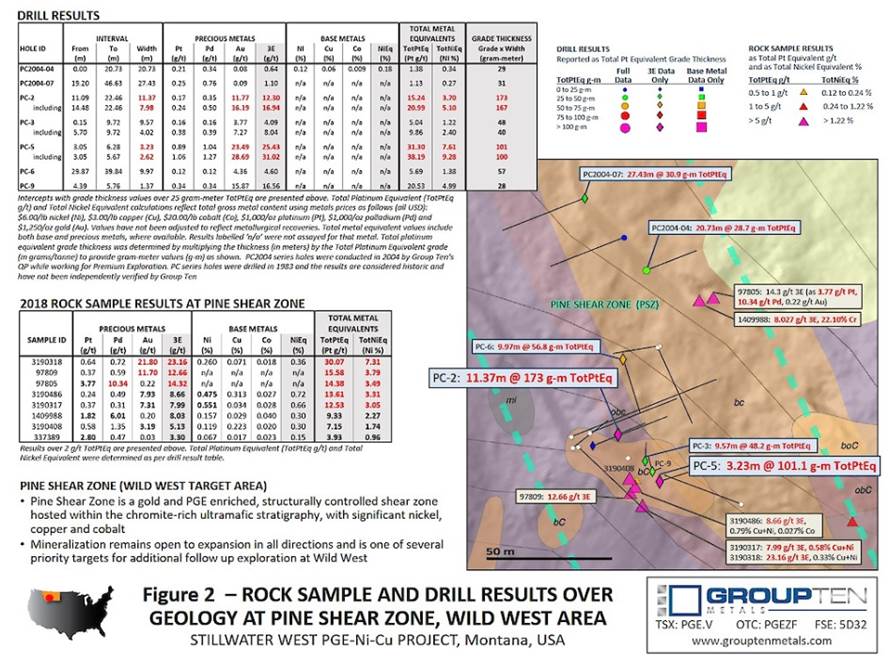

The Pine Shear, which is noted above, has shown to contain gold. These 2004 hits were actually drilled by our current qualified person; they’re not considered historical, and confirm the presence of significant copper and nickel in that system although the conductive highs have not been tested and that’s one of our key items for follow up. These PC series of holes from 1983 show the potential of this Pine Shear zone, which is a later geologic event within the Stillwater layered system. Something has introduced a lot of gold to the system as shown by these fantastic lengths and mineralization, gold mineralization. We see, for example, 11 meters at 12 grams per tonne gold, which is a very high-grade hit and good length within that 8 meters at 16 grams per tonne, and then the hole PC5, 3 meters at a staggering 23 grams per tonne, that’s 2/3 of an ounce, so it’s very high-grade and nice lengths of it. That’s definitely something for follow up in 2019.

In addition, we’ve got grab samples in that area, rock chip samples, and we see not only high-grade gold mineralization as shown in this first sample here, 22 grams per tonne gold, but in addition, we see some high-grade palladium, 10 grams per tonne gold and almost 4 platinum as well. So you’re seeing mineralization throughout this area. Not only the PGE-nickel-copper that you might expect from the district, but also high-grade gold, and that’s very compelling for follow-up in 2019.

Maurice Jackson: Michael, these numbers are quite impressive. But let me ask you this, you’re in the most prolific area with the highest grades, concentration grades of platinum and palladium. You strategically have your assets positioned there, so were you really surprised?

Michael Rowley: No, and we, of course, had seen this data as we got into the project in the early days, it’s nice to prove it up in the compellation effort and make it more formal and we can then discuss it publicly, but the Stillwater district is very well mineralized and you’re right, that is very well known. What’s pleasing now is to be able to reveal the results of the compellation effort and plan our programs for 2019 so we begin to reveal what we think we’ve got.

Maurice Jackson: Well, the results are remarkable. We discussed the Wild West. Let’s move to the Boulder target area. What has Group Ten Metals excited here?

Michael Rowley: The Boulder area has less data than Wild West and then less data still than the Chrome Mountain and Iron Mountain target areas, however, it does have that lovely conductive high as shown in Figure 1. And, once again, the conductive highs have not been systematically tested. We do have the data from a historical drill hole, that’s BR2, shown more or less the middle of the Boulder target area. And that shows nice intercepts of copper-nickel mineralization. We have no PGE data on that, and that’s something that we’d like to remedy. In addition, we’ve got a very nice base metal hit up here including a very nice cobalt of 0.117, which speaks to the technology and battery metal potential of the system. The Bushveld is less known for cobalt, but we’re seeing very nice levels of cobalt here in the Stillwater Complex, which adds a nice co-product to a new potential operation here.

So in terms of 2019, Boulder won’t be a focus as we’ll discuss later, we’re going to have to focus on the more advanced target areas, however, we definitely will go back there and we’ll continue to move it along in our 2019 Program.

Maurice Jackson: Switching gears, we introduced the value proposition of Group Ten Metals on the 2nd of November. Since then, the company has successfully conducted a financing and the share price is up 29%. Please provide us with the company’s current capital structure.

Michael Rowley: We have 59 million shares outstanding at present and a market cap of about $12 million and that follows a raise of $1.2 million back in November, which we did at 15 cents in rather challenging market conditions, which speaks to the strength of this project in particular to attract investments, even in a rather challenging market.

Maurice Jackson: Sir, what is the next unanswered question for Group Ten Metals, when should we expect results and what determines success?

Michael Rowley: Well, I guess the unanswered question is, how is this possible, is there actually Stillwater in Montana? These districts have a lot of parallels and Stillwater is well known for these three very high-grade palladium-platinum mines. We’re looking forward to revealing why we think it’s there and how it’s been overlooked historically. This district has not been systematically explored for these target types and we’re the first to bring together the land position with the data with a team to do just that, and we’ll be launching a series of news releases to reveal what the past year of compellation work has shown us and what we, including David Boughton, see in the project and the potential.

Again, we’ll move from west to east across the project and the next news releases will detail the Chrome Mountain and Iron Mountain target areas, which include the most of the historical data including the 200 drill holes, and, of course, we have almost 12,000 meters of that core in our possession and have re-logged it now, so there’s some very exciting revelations to be revealed in the coming news releases.

Maurice Jackson: Mr. Rowley, what do you see as the biggest challenge for Group Ten Metals and how do you plan to mitigate that situation?

Michael Rowley: The biggest challenge facing us may just be the size of the project. It’s fantastic in the scale as you’ve seen from our figures, we may have as many as eight Platreef deposits across that, based on the coincidence geophysical anomalies, soil anomalies, and then just the geology and historical drill results. Thankfully, and the way to address that, is the quantity of data, the compilation effort that we’ve done, helps us focus our exploration efforts so prioritizing targets is very much the plan, we’ve done that and we look forward to revealing our 2019 plans. We’re going to focus basically on the Chrome Mountain and Iron Mountain areas where we have the greatest density of historical drilling and go out from there. And I think it will be a very exciting year for us as we reveal what we have and build it out with a 2019 exploration program. We had a terrific reception at the Core Shack at Roundup, we definitely attracted the attention of majors, and that’s the way forward that we see, if we do a couple of rounds here ourselves, and prove up what we think we have, and then look to engage bigger partners down the road as that becomes appropriate.

Maurice Jackson: Sir, we’ve covered the good. What keeps you up at night that we don’t know about?

Michael Rowley: The last time we talked, it was the share price and that has gotten a lot better as you mentioned, thanks to our campaign of news releases and I think also the Core Shack at Roundup did a lot for us. The good news in terms of share prices that we’ve only just begun to reveal what we have on the project, and we have a series of planned news releases and a major promotional push beginning here which will carry us right up through PDAC in March. We’ve had a number of very excellent meetings as well recently, and we’re excited to begin to reveal what we think we’re onto and what 2019 will hold for the company. I think it’ll be a pivotal year.

Maurice Jackson: Michael, today we’ve covered the value proposition of Group Ten Metals but Group Ten Metals is actually one of three companies comprising the Metallic Group of Companies. Please introduce them to us and share their value propositions with us.

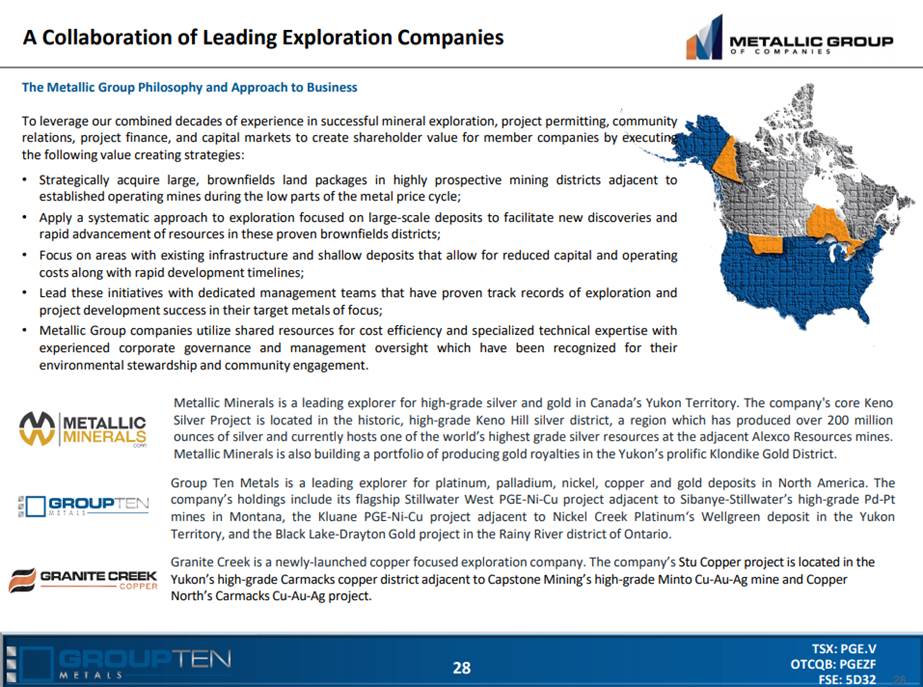

Michael Rowley: The Metallic Group is a collaboration of three independent public exploration companies, growth-stage companies. We’ve essentially launched one company each year, Metallic Minerals in 2016, Group Ten in 2017, and then most recently Granite Creek Copper just a few weeks ago. Each one has been put together with the same method that you see at Group Ten, which is to acquire high-quality brownfields assets in a known mining district beside an existing mine, and then make that acquisition strategically in a depressed market at a price that would not otherwise be possible in a more normal market. And then add a substantial database to that and a world-class technical team, a world-class corporate team as well, and bring in geologic models from outside that district. Shareholders have seen us do that at Group Ten, we’re applying this Platreef thinking for the Bushveld, South Africa, to the Stillwater District.

Metallic Minerals, ticker is MMG, is applying geologic models from the multi-billion ounce Coeur d’Alene silver district in Idaho to the Yukon’s Keno High-Grade Silver district. And the parallels are there, there are very good indications of success in that one.

And then similarly at Granite Creek Copper, GCX is the ticker. We’re applying geologic models that are new in the district, this is a billion pound copper district in the Yukon. Models that were developed in the neighboring Minto mine, we’re applying to the Stu high-grade copper project, and that one is shaping up very nicely as well. It’s only been trading for about 10 days at this point and there’s a lot to be released on that one in the coming months.

In all three cases, we expect to add value by de-risking the projects and fast-tracking them to resource to delineation stage.

Maurice Jackson: Michael, for someone listening that wants to get more information on Group Ten Metals, please share the website address with us.

Michael Rowley: The website is http://www.grouptenmetals.com.

Maurice Jackson: And as a reminder, Group Ten Metals trades on the TXS.V:PGE, and on the OTCQB:PGEZF; for direct inquiries please contact Chris Ackerman at 604-357-4790 extension 1, or email info@grouptenmetals.com, as reminder Group Ten Metals is a sponsor of Proven and Probable, and we are proud shareholders for the virtues conveyed into today’s interview.

Last but not least, please visit our website www.provenandprobable.com where we interview the most respected names in the natural resource space. You may reach us at contact@provenandprobable.com.

Michael Rowley of Group Ten Metals, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Group Ten Metals and Metallic Minerals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Group Ten Metals and Metallic Minerals are sponsors of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click herefor important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kevin Vecmains the founder of VanAurum Financial Technologies sits down with Maurice Jackson of Proven and Probable to discuss: What Happens When Central Banks Unwind Balance Sheets.

VIDEO

AUDIO

TRANSCRIPTS

Contributed Opinion

Source: Maurice Jackson for Streetwise Reports (1/30/19)

Kevin Vecmanis, founder of VanAurum Financial Technologies, sits down with Maurice Jackson of Proven and Probable to discuss what the unwinding of central bank balance sheets may mean for investors.

Kevin Vecmanis, founder of VanAurum Financial Technologies, sits down with Maurice Jackson of Proven and Probable to discuss what the unwinding of central bank balance sheets may mean for investors.

Kevin V.: Hello, Maurice. It’s great to be here. Thanks a lot.

Maurice J.: Glad to have you back on the program. In our last interview, we addressed the value proposition for the next capital vortex. Today, we will address central banks unwinding their balance sheets, and the duplicitous effects that may occur. And what actions you, the investor, may take to prepare yourself.

But before we begin, Kevin, your company uses a unique skill set that I find intriguing, which is artificial intelligence for investing. For our first time listeners, please introduce us to VanAurum Financial Technologies.

Kevin V.: VanAurum is an intelligent lead generator for trading opportunities. That’s probably the best way to summarize it. We use machine learning techniques to detect anomalies, and unusual market behavior and then we report on it to members on a daily basis.

Our platform attracts a global cross-section of sectors, ratios and economic data points. And then when something occurs that has some kind of historical precedent for being either positive or negative for forward returns, VanAurum will report on it to members.

We believe that by having an intelligent filter that’s hand-picking market events to look at, it frees up our members’ time to focus their efforts on more productive means, such as, constructing trading strategies and or analysis on their own. So if someone uses a charting service, or trades on technical analysis, VanAurum’s definitely worthy of membership consideration.

Maurice J.: Kevin, your research has noted a mega trend occurring that is related to central banks unwinding their balance sheets. Beginning at the 10,000-foot level, can you share with us why central banks are unwinding their balance sheets, and what this means for investors?

Kevin V.: Stepping back for a moment, in 2009, the Federal Reserve came up with an explicit program called Quantitative Easing, to buy mortgage-backed securities and other debt-related securities from the balance sheets of different institutions, and most central banks globally eventually caught on to this well, to bail out financial institutions in the sector that were carrying this “toxic debt” on their balance sheets.

The Fed conversely grew its balance sheet from about $800 billion to almost $4.5 trillion. And it was maintaining it at that level for a while. When the Fed is maintaining the size of its balance sheet with these debt-related securities what its intentions are as follows: as the securities mature on its balance sheet, it is actively seeking out other similar securities to buy to replace them, so that the Fed can keep the size of its balance sheet at a constant level.

So, the process of expanding the balance sheet, as well as maintaining it at a certain level, there was an implicit assumption in the market that the central bank was going to be there, and be a significant source of debt demand for a lot of these securities, which would be the primary driver behind interest rates ultimately hitting rock-bottom yields. The Fed was such a heavy influence on interest rates that, in January of 2018, the yield on the S&P 500 was about 1.73%. And the yield on the three-month Treasuries, which is considered to be the United States’ riskless asset, was higher than that.

The end result is that the S&P equity yields, which are considered to be risky assets on somebody’s balance sheet, or within their portfolio, these yields are essentially risk-free. Which is a really amazing thing if you think about it. A situation that is really unsustainable.

Going forward, the Fed has now communicated that it is going to shrink the size of its balance sheet. So in effect what that’s actually doing is removing a major source of demand out the market, for not only U.S. Treasuries, but other mortgage-backed securities as well. This is a simple supply and demand factor. The likelihood of supply and demand to equalize will not be accomplished until rates are much higher.

Maurice J.: I always find it disingenuous that the U.S. Treasury references the nominal rate of return and omits the real rate of return on Treasuries.

Twofold question here for you. How will this impact currencies and capital markets?

Kevin V.: We have witnessed the Fed go through hiking cycles in the past, typically any kind of economic turmoil that led to a flight to safe haven assets increased the demand for Treasuries and the U.S. dollar.

I am of the opinion that the Federal Reserve is in a bit of a tricky situation right now. And over time, more and more investors are going to actually start picking up on this. In a historical context, the level to which they’ve actually raised interest rates is not really that high. What is unprecedented is the extended period of time that the Fed has pinned along interest rates to zero. The Fed recognizes that it needs to raise rates because it has artificially suppressed interest rates, which were driving the yields on the S&P and of bonds respectively to disproportionate levels.

Should the market witness again that the Federal Reserve is willing to reverse course, by printing currency (inflation) to buy up a lot of assets and thus further expand its balance sheet again, I believe the market will react violently to the Fed’s attempts. I think this time around, the impact could actually be very negative on the U.S. dollar and Western currencies as investors will begin to realize maybe how unsustainable some of the debt trajectories actually are.

Maurice J.: If currencies and equities will be negatively impacted, what is the prudent investment decision that one should make now?

Kevin V.: In this situation, I like to look at what were the major beneficiaries within the broad markets when the Federal Reserve decided to embark down this path of explicit balance sheet expansion. And I guess the answer to that is bonds, equities, and to a large extent, real estate within major urban centers. So we’ve seen significant inflation in a lot of these markets. They were the major beneficiaries of what I call the risk premium compression that resulted from the Fed artificially lowering interest rates.

After the crisis everybody thought that commodities and other markets like that were going to go hyperbolic. But we actually didn’t see that. And, in my opinion, a lot of the reason why we didn’t see that was because the market was front running all these explicit purchases from the central bank. Why wouldn’t you buy bonds if you knew that the Federal Reserve was going to be buying, $30, $40 billion of them a month, on an open-ended basis.

So I think that drew a lot of capital away from resource sector stocks, from commodities. Any commodity, really. And so I think this time around, when we see this whole process unwinding, to me it only seems logical that the markets that were previous beneficiaries might suffer. Conversely, the markets that didn’t benefit we will start to see a lot of those begin to mean revert. I foresee big potential in platinum, gold, resource sector stocks and energy stocks, which have been punished to a significant degree, especially within the explorers and the producers, which experienced some of the sharpest declines in record.

So, I think it all depends on how the market decides to react with the U.S. dollar. Whatever it is, we get the next major trajectory change from the Federal Reserve. But my inkling, my instincts right now, and all the data that I look at with VanAurum and our research, suggests that the U.S. dollar will probably be negatively impacted the next time around.

Maurice J.: So then the answer will be, if I’m correct here, would physical gold be the first prudent investment decision?

Kevin V.: Yes, definitely at this point. I always advocate having some allocation to gold in your portfolio, especially right now with the debt-based currencies in the West really starting to balloon out of control. But there’s lots of fear in the market right now. We’ve experienced a significant correction on the S&P 500 and the broad equities. A lot of the valuation extremes that we saw leading up to this point was causing everybody to warn of bubbles. We’ve actually seen a fair amount of that lead off. And it’s come back into nominal territories.

I sent a message out to my members earlier this week saying that at this juncture, if the correction in the S&P 500 extends into bear market territory, closer to it being down 20%, which at that point, going back to 1980 within our data that VanAurum analyzes, most of the precedence, if not all of them, are actually positive for one-year returns going forward once the market has experienced a selloff greater than 20%.

So there could be draw downs in the broad equity market from here. In September 2008, the market ultimately fell 40% before hitting its ultimate bottom. And then exactly one year later, from September 2008, the market was almost unchanged again. So, could the market accelerate to the downside again, and resume a bear market? It’s likely. But at this point, I think prudent investors will start trying to anticipate some type of accumulation program for broad equities.

I have my attention on what I would term as the kind of the forgotten markets right now, like gold, which is carving out a multi-year base; platinum, which has been absolutely crushed recently; and silver are going to do extremely well in the environment that we’re about to move into.

Maurice J.: Regarding physical precious metals, would precious metal equities be the right place to be as well, once someone has secured a position first in the physical metals?

Kevin V.: Yes, full disclosure, I have long positions in GDX and GDXJ. With VanAurum, and my research, I study sectors. There are lots of people who are really good at picking individual issues. But when we’re working with our machine learning system, for reasons that maybe are beyond the subject of this interview, we try to stick with a sector. So, I do have exposure to the gold mining equities, through GDX and GDXJ.

Depending on what the investors are looking for, royalty companies and the gold streaming companies really tend to do well during downside turmoil in gold and equity markets. We saw companies like Franco-Nevada, whose stock performed incredibly well during the gold bear market from 2011 to 2015. Where you really get your upside leverage, in the gold mining and the resource space, is when you’re dealing with an issuer whose cost of production is really close to the prevailing gold price.

What happens there is you get profit leverage. So, if you have a gold mining company that’s selling gold for $1,200 an ounce, and say its all-in cost to produce that ounce of gold are $1,199. So it’s making $1 of profit. If the price of gold increases by a dollar, then the earnings for that particular company increased by 100%. So you go from $1 to $2, you double your earnings. And so that’s what we mean by profit leverage.

You start to see a lot of the high-cost companies really start to accelerate when you see gold moving into a particularly strong bull market. I think what’s happening right now is you’re seeing a lot of the accumulation, and a lot of the higher quality issuers, and they’ve been doing well for quite some time.

But the sectors like GDX and GDXJ, I think have been languishing partly because they’re full of lots of producers that a lot of them haven’t been particularly well in this environment. But I think that will change if gold can stage a major breakout. I think you’ll see a bid under, pretty much any company that’s producing gold. And stage a breakout, and sustain it above $1,400 US.

Maurice J.: Switching gears, Mr. Vecmanis, what is the next unanswered question that VanAurum Technologies is researching? And when do you believe we will have an answer?

Kevin V.: Right now, to me the elephant in the room are interest rates, and how the market is fully going to react to the Federal Reserve removing itself as a major demand source in the debt markets. So, it seems to me like there’s a little bit of disbelief. You’re starting to see two-year Treasury yields, which is a fairly close proxy for interest rate hike expectations, you’ve seen a lot of those rates come down recently. Some of that might have been because the yields were overbought. And the bonds were due for a rally.

But to me that really is the biggest question, because the Federal Reserve was such a huge component of this equity rally that we had from 2009 until now. And I think whatever its action will be is going to be a major component of how the market plays out going forward. You can see the market starting to begin to call its bluff. But what I’m really interested in finding out is what the Federal Reserve actually intends to do. If the markets truly start to react violently to the rate hike cycle, it is going to end it? And is the Fed going to start to ease again, meaning increasing the size of its balance sheet. Or is it going to start cutting rates?

I think if the Fed starts cutting rates, having only reached the levels that they’re at, I think that’s going to be a really, really scary warning sign to market participants everywhere that the U.S. economy just can’t handle higher rates and has become almost addicted to Federal Reserve accommodation. And I think at that point, how the market reacts to that is going to be the primary determinant of which people are going to make a lot of money, and which people are going to lose a lot of money. And I think we’ll have the answer to that probably by the summertime.

Maurice J.: Truly interesting times, and unprecedented times. And I’m tickled to death to be here just to watch it all, and actually participate. Sir, last question. What did I forget to ask?

Kevin V.: I think we covered a lot, Maurice. But, I’d like to discuss a little bit about VanAurum’s AI curated newsletter that we put out daily. The core of our research service that we offer right now is our daily AI curated report, which is a combination of human and machine learning and behavior. So, I’m a big believer fundamentally in the convergence of machine learning-based systems and human-based systems. I believe the people and machines are really good at particular things. And what I try to do at VanAurum is to create workflows that combine the best of those worlds.

The AI curated report analyzes a global cross-section of assets, whether it’s Chinese stocks, Israeli stocks, resource sector stocks, yield curves and economic data points. And it figures out when something is behaving unusual in the market. It performs some hypothesis testing on it, to see if there’s any historical precedent for meaningful positive or negative returns. And then it presents that in a report to our members. And that’s kind of the launch point for the analysis that we do.

So, we’re getting this pipeline of trading and investment suggestions coming from VanAurum daily, which are really high quality. Our members love it. The feedback I get from the members is that it’s exposing them to things in markets that they wouldn’t have thought to look at before, which is really what it’s all about.

Maurice J.: For readers that want to get more information about VanAurum Financial Technologies report, please share the contact details with us.

Kevin V.: Sure. Readers and listeners can visit vanaurum.ai. And we have a public version of the report, which is delayed a certain number of days, to keep our best information fresh for our members. But if they’re interested in how that report works, there’s a link on our homepage to the public report. And they can also take a look at the other services that we offer as well.

Maurice J.: And we would like to take this opportunity to remind our listeners, if you’re interested in buying or selling physical precious metals, please call us at 855-505-1900. Or visit our website, provenandprobable.com, where we interview the most respected names in the natural resource space. You may reach us at contact@provenandprobable.com.

Kevin Vecmanis of VanAurum Financial Technologies, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click herefor important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Franco-Nevada, a company mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

|

|||||||||||||||||||||

|

VANCOUVER, BRITISH COLUMBIA, January 29, 2019 – Millrock Resources Inc. (TSX-V: MRO, OTCQX: MLRKF) (“Millrock” or the “Company”) reports that results from a drilling program completed at the La Navidad gold project in Sonora State, Mexico have been received. The program focused on the northwestern portion of the project. Four holes were drilled at El Tigre prospect, where gold had been detected by soil sampling in the vicinity of historic mine workings. The drill holes tested induced polarization geophysical anomalies and northwest-trending high-angle structures that appear to control mineralization observed at surface. Four further holes tested El Chupadero prospect where alteration (decalcification and jasperoid replacement of limestone) pointed to the possibility of an intrusion-related gold deposit. In total, eight holes totaling 1,844 meters were drilled in the program. The exploration work was funded under an option to joint venture agreement by Centerra Gold Inc. (“Centerra”).

The drilling results were generally disappointing. Only a few weakly anomalous gold values were returned. The alteration and mineralization observed at surface appear to weaken in the subsurface. It does not appear that further exploration work on these prospects is warranted.

Millrock has received notification from Centerra that it is terminating the option to joint venture agreements on both La Navidad and El Picacho gold projects.

Millrock President & CEO Gregory Beischer stated “Millrock thanks Centerra for the investment they made in advancing these projects. While Centerra has elected to leave, we strongly believe the projects have excellent technical merit. We think they will be attractive to mid-tier or smaller mining companies. Our intention is to seek out new funding partners, but at the same time we will have to balance the cost to hold to La Navidad and El Picacho concessions in the face of Millrock’s currently limited cash position.”

Corporate Developments:

PolarX Shares and Cash Position

Millrock recently sold 10 million PolarX shares for A$475,000. While Millrock continues to be a strong believer in the Alaska Range Project, given Millrock’s relatively weak cash position it made sense to sell the shares. Millrock continues to be entitled to a production royalty, an advanced minimum royalty, and certain milestone payments.

Gregory Beischer, Millrock President and CEO stated, “Equity markets continue to be very tight. Millrock has to be extremely careful with its remaining funds. Management is cutting costs in all ways possible while the technical team works diligently to secure new funding partners. It is management’s view that securing new partnerships will be the best way for the Company to reduce overhead costs. The Company has an excellent portfolio of gold and copper projects but there is a cost to hold un-partnered projects until new partners are secured. Given the continued weakness of Millrock’s cash position (approximately C$790,000, as of today’s date, net of near-term accounts receivable and payable), the Company is considering all possible alternatives to move forward, including divestiture of Mexico projects and other assets.”

Quality Control – Quality Assurance

Millrock adheres to stringent Quality Assurance – Quality Control (“QA/QC”) standards. For the La Navidad drill program drill core samples were kept in a secure location at all times. Rock samples were assayed at the Bureau Veritas laboratory in Hermosillo, Mexico. Preparation and analysis methods are described in further detail here. The sample preparation method code being utilized for the current rock sampling program was PRP70-250. Analysis methods used include FA430 (30 gr/Fire Assay/ICP) and AQ-200 (Aqua Regia – ICP/MS). For every 20 rock samples a blank sample known to contain less than 3 parts per billion gold or a standard sample (Certified Reference Materials) of known gold concentration, or a duplicate sample was also analyzed. The qualified person is of the opinion that the results received from the laboratory for the samples in collected in this drill program are reliable.

Qualified Person

The scientific and technical information disclosed within this document has been prepared, reviewed and approved by Gregory A. Beischer, President, CEO and a director of Millrock Resources. Mr. Beischer is a qualified person as defined in NI 43-101.

About Millrock Resources Inc.

Millrock Resources Inc. is a premier project generator to the mining industry. Millrock identifies, packages and operates large-scale projects for joint venture, thereby exposing its shareholders to the benefits of mineral discovery without the usual financial risk taken on by most exploration companies. The company is active in Alaska, the southwest USA and Sonora State, Mexico. Funding for drilling at Millrock’s exploration projects is primarily provided by its joint venture partners. Business partners of Millrock have included some of the leading names in the mining industry: Centerra Gold, First Quantum, Teck, Kinross, Vale, Inmet, Altius, and Riverside. Millrock is a major shareholder of junior explorer Sojourn Exploration Inc.

ON BEHALF OF THE BOARD

“Gregory Beischer”

Gregory Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:

Melanee Henderson, Investor Relations

(604) 638-3164

(877) 217-8978 (toll-free)

Some statements in this news release contain forward-looking information (within the meaning of Canadian securities legislation) including, without limitation, the statement thatis management’s view that securing new partnerships will be the best way for the Company to reduce overhead costs. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, the ability of Millrock to negotiate agreements with third parties to fund exploration programs on terms beneficial to the Company.

Copyright © 2019 Millrock Resources, All rights reserved.

You are receiving this email because you opted in to our mailing list.

Our mailing address is:

Vancouver, Bc V6E2K3

|

|||||||||||||||||

|

Vancouver, British Columbia–(Newsfile Corp. – January 28, 2019) – EMX Royalty Corporation (TSXV: EMX) (NYSE American: EMX) (the “Company” or “EMX”) is pleased to announce Boreal Metals Corp.’s (“Boreal”) recent diamond drill results and the discovery of a high grade zone of zinc-silver-lead-gold mineralization at EMX’s Gumsberg royalty property. EMX is a royalty holder on the Gumsberg project, and currently owns a 9.4% equity interest in Boreal. Gumsberg is located in the Bergslagen mining district of southern Sweden. The drill results include 11.00 meters averaging 5.90% zinc, 239.0 g/t silver, 2.51% lead, and 0.96 g/t gold in hole GUM-18-003, and 11.01 meters averaging 7.45% zinc, 275.1 g/t silver, 2.65% lead, and 0.77 g/t gold in hole GUM-18-004 (true widths estimated at 50% of reported interval lengths). EMX congratulates Boreal on its new high grade discovery, termed the South Zone, and looks forward to further advancement of the Company’s Gumsberg royalty interests.

Boreal reported results from the first four holes of its recently completed nine hole, 1,620.8 meter winter drill program, including GUM-18-003 and GUM-18-004, which intersected South Zone massive sulfide mineralization east and west of previously reported hole BM-17-005 (10.94 meters averaging 16.97% zinc, 656.7 g/t silver, 8.52% lead, and 0.76 g/t gold; true width estimated at 20-50% of reported interval length). The South Zone occurs near the historic Östra Silvberg mine, and is currently delineated as 130 meters of eastward plunging mineralization that remains open for expansion to the east and at depth. Holes GUM-18-001 and GUM-18-002, drilled west of the South Zone, did not return significant intercepts. GUM-18-001 terminated when it drilled into an unmapped mine working, and GUM-18-002 deviated from plan and failed to intersect the target horizon.

Boreal reported that additional assays pending from the remaining holes of the winter campaign are expected in the coming weeks. Please see Boreal’s news release dated January 28, 2019 for further details, and Appendix 1 of this news release for a table of drill results reported by Boreal.

EMX has a significant equity interest in Boreal, as well as its subsidiary company Boreal Energy Metals Corp. (“BEMC”), that resulted from the sale of Gumsberg and other royalty generation properties in Sweden and Norway[1]. EMX retains uncapped 3% net smelter return (NSR) royalty interests on each of the properties sold to Boreal and BEMC[2], including the Gumsberg project, and will receive annual advance royalty (AAR) payments and other considerations from the sale of the projects.

The Boreal agreements are an excellent example of EMX’s execution of the royalty generation aspect of the Company’s business model. EMX leveraged in-country geologic and business development expertise to acquire prospective properties on open ground, built value through low cost work programs and targeting, and partnered the projects for retained royalty interests, equity interests, and AAR payments. This business strategy has provided EMX with substantial share equity in Boreal and BEMC, exposure to exploration and discovery upside at no additional cost, and the potential for future royalty payments upon the commencement of production.

EMX continues to build its portfolio of precious metal, base metal, and cobalt properties in Scandinavia. Many new properties are available for partnership. Please see www.EMXroyalty.com for more information.

Dr. Eric P. Jensen, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX leverages asset ownership and exploration insight into partnerships that advance our mineral properties, with EMX receiving pre-production payments and retaining royalty interests. EMX complements its royalty generation initiatives with royalty acquisitions and strategic investments.

-30-

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 979-6666

Email: Dave@EMXroyalty.com

Scott Close

Director of Investor Relations

Phone: (303) 973-8585

Email: SClose@EMXroyalty.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release may contain “forward looking statements” that reflect the Company’s current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merits of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as “estimate,” “intend,” “expect,” “anticipate,” “will”, “believe”, “potential” and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company’s future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company’s actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to: unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company’s MD&A for the nine month period that ended on September 30, 2018 (the “MD&A”), and the most recently filed Form 20-F for the year that ended on December 31, 2017, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the 20-F and financial statements of the Company, is available on SEDAR at www.sedar.com and on the SEC’s EDGAR website at www.sec.gov.

Appendix 1

Drill results reported in Boreal’s January 28, 2019 news release.

| Hole ID |

From Meters |

To Meters |

Length Meters |

Zn % |

Ag g/t |

Pb % |

Au g/t |

| GUM-18-001 | No significant intercepts; intersected previously unidentified mine stope. | ||||||

| GUM-18-002 | No significant intercepts; geological interpretations suggest hole failed to reach the targeted horizon. | ||||||

| GUM-18-003 | 105.00 | 116.00 | 11.00 | 5.90 | 239.00 | 2.51 | 0.96 |

| Including | 105.00 | 108.00 | 3.00 | 5.71 | 386.00 | 2.30 | 2.33 |

| and | 109.65 | 111.10 | 1.45 | 23.78 | 666.48 | 9.37 | 1.72 |

| and | 113.00 | 114.00 | 1.00 | 4.73 | 222.00 | 2.83 | 0.70 |

| and | 114.80 | 116.00 | 1.20 | 6.96 | 227.00 | 3.49 | 0.31 |

| GUM-18-004 | 162.16 | 173.17 | 11.01 | 7.45 | 275.12 | 2.65 | 0.77 |

| Including | 162.16 | 164.18 | 2.02 | 11.09 | 313.00 | 3.61 | 0.76 |

| and | 165.28 | 166.18 | 0.90 | 8.93 | 403.00 | 3.62 | 1.17 |

| and | 165.28 | 168.50 | 3.22 | 8.57 | 343.39 | 3.68 | 1.52 |

| and | 169.45 | 172.25 | 2.80 | 11.05 | 429.14 | 3.25 | 0.70 |

True widths are estimated to be 50% of reported interval lengths.

Statement of Quality Control, Quality Assurance and Core Handling Protocols reported in Boreal’s January 28, 2019 news release.

Drill core is logged and prepped for sampling before submittal to ALS in Malå, Sweden where it is cut, bagged and prepped for analysis. Accredited control samples (blanks and accredited standards) are inserted into the sample intervals regularly. Samples are dried (if necessary), weighed, crushed (70% < 2mm), and riffle split into two fractions. One is retained (coarse reject) and the other is pulverized to 85% < 75µm. Pulps are analyzed by ultra-trace ICP-MS (ME-MS41) and ICP-AES Au-Pt-Pd (PGM-ICP23). Over detection limit samples are reanalyzed using ore grade ICP-AES by aqua regia (ME-OG46) or by AAS in the case of high grade zinc (Zn-AAORE).

[1] See EMX news releases dated November 22, 2016, January 16, 2018, February 9, 2018 and April 11, 2018.

[2] Boreal and BEMC retain a right to purchase 1% of the NSR royalty on individual projects by paying EMX CDN $2,500,000 in cash and shares within five years of the closing date.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/42487

Major Opportunity Developing in Platinum

By Kevin Vecmanis

Once in a while an opportunity comes along in the markets where the dislocations are so extreme and compelling that it commands one to take a calculated risk. Anytime you can say, “This is among the cheapest this asset has been in history”, there is typically a fantastic contrarian play at hand.

In February of 2016 the price of WTI Crude Oil hit ~ $25/barrel. On an inflation adjusted basis, this was among the cheapest oil had been in recorded history. I was working in the Oil Industry at the time doing engineering management, and during a lunch with the President of our company I told him I was going to buy a lot of energy equities on that fact alone. Considering the sentiment at the time (atrocious), he was skeptical. Six weeks later I had doubled my money.

Click here now. The same situation is developing in the Platinum market. This plot shows the $USD close of Platinum, with the Platinum/Copper and Platinum/Gold ratio. Platinum is at $805 as of this writing, and on an inflation-adjusted basis is among the cheapest Platinum has been in history. Priced in Gold, this the cheapest platinum has ever been. Priced in Copper, Platinum hasn’t been this cheap since 1977. The same is true of the Platinum/Silver ratio which is languising near lows last seen in 2012, and then the 1980’s before that. The Platinum/Palladium ratio is as extreme as the Platinum/Gold ratio, which is almost tied for all-time lows for the entire price history dating back to the 70’s. Priced in units of the S&P 500 it’s also languishing at the cheapest in history.

So what’s happening here? Some make the (valid) argument that shifting auto demand from combustion vehicles to electric vehicles is forcing the market to reprice the value of Platinum relative to other assets. This is fine, and I tend to agree with this assessment. However, the adaptive and non-stationary aspect of markets needs to be respected. Platinum has inalienable properties that make it a fantastic input to a lot of products and processes. The simple fact that Platinum (and Gold) are immune to oxydative damage means that if they were cheap enough we would use them in everything where a certain degree of robustness and longevity is required. In other words, at some point new use cases for Platinum will emerge that are economically viable at these price levels. This will drive a mean-reversion relative to other assets over the long-term.

Technically, Platinum is sitting right at major support that held during the 2008 crash and the 2015 low. It remains to be seen if a double-bottom will form here, or if the market will break support and jolt lower. The essence of speculation is buying what nobody wants, and selling what everybody wants. I think investors or speculators with the luxury of time would do well to accumulate platinum-based assets at this juncture.

As a matter of disclosure, we currently do not own any positions in Platinum or Platinum miners directly. We do plan to take long-positions in PPLT within the next 1-3 months.

About VanAurum

VanAurum is an intelligent lead generator for trading and investing opportunities. It analyzes over 140 asset classes everyday that cover a global cross-section of the market. When something happens that historically has been positive or negative for returns, it reports on it to members. It’s an AI-based market historian. VanAurum alerted me to the situation in Platinum through action it was seeing in the Platinum/Gold ratio.

Staying in tune with notable price action for the world’s largest asset classes is time-consuming, and perfectly suited for a machine-learning systems to handle. That’s why I built VanAurum – to sift through the market noise and increase the quantity and quality of trading leads for members. If you use technical analysis to trade the markets, VanAurum is a must-have membership because it can quantify exactly what technical events have meant for asset returns in the past.

Due to the popularity of our AI platform, we will be increasing membership prices for new members in February. 321Gold readers can sign-up and lock in current prices by following the steps below. All memberships come with a 14-day, no obligation free-trial.

To sign up:

- Click on the button below.

- Enter a valid credit card to get past our authentication wall (Your card won’t be charged until the 14-day trial has ended).

- Once through, Complete the sign-up form and you’re good to go.

- If you have any questions at all, please e-mail me directly at kevin@vanaurum.ai

Happy and prosperous investing!

Kevin

Founder, VanAurum

VanAurum’s three business activities are research, trading, and consulting. We are not an investment advisor. Machine learning systems are subject to biases that that may be inherent to the data studied by the system. These biases may be a benefit or a detriment to the quality of the output from the machine learning system. Trading contains substantial risk and is not for every investor. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. You should always perform your own due diligence before making any investment decisions. The content of this website is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers are expressly advised to seek the advice of registered investment advisors and other professional advisors, as required, before investing in any securities or acting upon investment strategies, including those discussed on this website. Strategies and securities discussed on this website might carry substantial risk and may not be suitable to all investors.