North Vancouver, British Columbia–(Newsfile Corp. – October 9, 2025) – Lion One Metals Limited (TSXV: LIO) (OTCQX: LOMLF) (“Lion One” or the “Company“) is pleased to report significant new high-grade gold results from 4,180.5 meters of underground infill and grade control drilling at its 100% owned Tuvatu Alkaline Gold Project in Fiji (“Tuvatu“). The drilling is focused on the Zone 5 area of the mine, down-dip of current mine levels.

All drilling was conducted from near surface underground workings. The Company intersected high-grade mineralized structures in 24 holes up to 100 m below current underground workings. The primary target for the drilling was the down-dip extension of the Zone 5 lodes below the current mine levels. Most of the high-grade drill intercepts are located within 60 m of current underground workings, and include multiple very high-grade gold assays, such as 267.95 g/t over 0.3 m, 168.25 g/t over 0.9 m, 179.52 g/t over 0.3 m, 126.49 g/t over 0.5 m, and 175.52 g/t over 0.4 m. Previous drilling in this part of the mine has returned similarly high-grade results, including the highest intercept ever recorded at Tuvatu – 2,749.86 g/t over 0.3 m (see press release dated January 23, 2025). Due to the proximity of these drill results to existing workings there is a strong probability that these intercepts can be incorporated into the mine plan in the next six to twelve months.

Highlights of New Drill Results:

- 175.43 g/t Au over 0.9 m (including 267.95 g/t Au over 0.3 m) (TGC-0451, from 89 m depth)

- 78.71 g/t Au over 2.0 m (including 168.25 g/t Au over 0.9 m) (TGC-0383, from 69.7 m depth)

- 29.70 g/t Au over 3.1 m (including 179.52 g/t Au over 0.3 m) (TGC-0406, from 83.2 m depth)

- 30.50 g/t Au over 2.7 m (including 45.78 g/t Au over 0.7 m) (TGC-0424, from 85.9 m depth)

- 51.35 g/t Au over 1.5 m (including 126.49 g/t Au over 0.5 m) (TGC-0379, from 89.5 m depth)

- 56.59 g/t Au over 1.3 m (including 62.39 g/t Au over 0.9 m) (TGC-0447, from 92 m depth)

- 175.52 g/t Au over 0.4 m (TGC-0387, from 67.1 m depth)

- 52.18 g/t Au over 1.1 m (including 86.25 g/t Au over 0.5 m) (TGC-0373, from 157.8 m depth)

- 16.19 g/t Au over 2.2 m (including 84.47 g/t Au over 0.3 m) (TGC-0414, from 74.9 m depth)

- 96.48 g/t Au over 0.4 m (TGC-0383, from 212.5 m depth)

- 12.83 g/t Au over 2.5 m (including 69.57 g/t Au over 0.3 m) (TGC-0451, from 99.0 m depth)

- 8.37 g/t Au over 3.6 m (including 17.91 g/t Au over 0.7 m) (TGC-0449, from 128.0 m depth)

*Drill intersects are downhole lengths, 3.0 g/t cutoff. True width not known. See Table 1 for additional data.

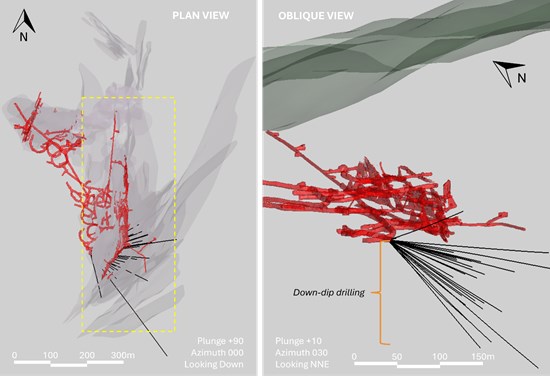

Figure 1. Location of the Zone 5 drilling reported in this news release. Left image: Plan view of the Zone 5 drilling in relation to the mineralized lodes shown in grey, with Tuvatu underground development shown in red. The yellow dashed square represents the area illustrated in the image on the right. Right image: Oblique view of the Zone 5 drilling looking NNE. The primary target for the Zone 5 drilling was the down-dip extension of the Zone 5 lodes up to 100 m below current underground workings.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/269758_8402144d5472b883_001full.jpg

Zone 5 Drilling

The Zone 5 area of Tuvatu is located on the east side of the deposit and includes the principal north-south and northeast-southwest oriented lode arrays. These lodes are steeply dipping structures that converge at approximately 500 m depth to form Zone 500, which is believed to be the highest-grade part of the deposit and is interpreted to be a feeder zone at Tuvatu. The system remains open at depth with the deepest high-grade (>10 g/t Au) intersects occurring below 1000 m depth.

The drilling reported in this news release targeted the down-dip extension of the Zone 5 lodes below current mine levels. All the drilling was conducted from one underground drill station and consisted of a fan of drillholes drilled on 15 m centers that was designed to infill a panel of the deposit approximately 130 m wide and 100 m tall. This area is targeted for mining within the next 6 to 12 months and represents an additional five levels of mining at Tuvatu.

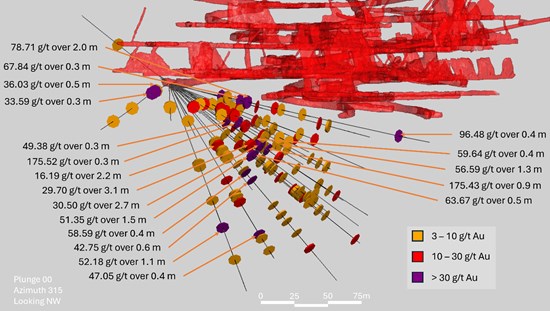

The drillholes reported in this news release include multiple very high-grade gold assays over narrow widths, such as 267.95 g/t over 0.3 m, 168.25 g/t over 0.9 m, 179.52 g/t over 0.3 m, 126.49 g/t over 0.5 m, and 175.52 g/t over 0.4 m. These types of intersects are typical at Tuvatu as the deposit consists of high-grade narrow vein structures. The drillholes reported here were designed to intersect the mineralized lodes in a perpendicular to sub-perpendicular orientation such that the mineralized intervals approximate the true width of the mineralization. The purpose of the Zone 5 drill program is to enhance the mine model and inform stope design in advance of mining the target areas. Highlights of the Zone 5 drilling reported here are shown in Figure 2.

Figure 2. Zone 5 drilling with high-grade intercepts highlighted, 3.0 g/t gold cutoff, section view. Section view looking northwest with select high-grade intercepts highlighted. The drill holes shown here primarily targeted the down dip extension of the Zone 5 lodes below current underground workings shown in red. This area is targeted for mining within the next 6 to 12 months.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/269758_8402144d5472b883_002full.jpg

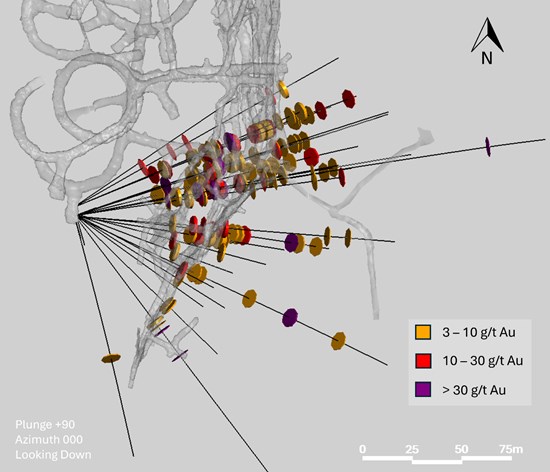

Figure 3. Zone 5 drilling with high-grade intercepts highlighted, 3.0 g/t gold cutoff, plan view. Plan view looking down with high-grade intercepts highlighted, underground workings shown in pale grey.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/269758_8402144d5472b883_003full.jpg

Note on Composite Grades

The drill holes reported in this news release are oriented approximately perpendicular to mineralization. The reported intercepts therefore approximate the true width of mineralization. The minimum mining width at Tuvatu is approximately 1.5 m. In reporting drillhole intercepts Lion One uses a grade composite cut-off of 3 g/t gold with <1 m internal dilution at <3 g/t. Drill hole intervals that are <3 g/t are below cutoff and are not included in Table 2.

Competent Person’s Statement

In accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43- 101”), Melvyn Levrel, MAIG, Senior Geologist for Lion One Metals, is the Qualified Person for the Company and has reviewed and approved the technical and scientific content of this news release.

Lion One Laboratories / QAQC

Lion One adheres to rigorous QAQC procedures above and beyond basic regulatory guidelines in conducting its drilling, sampling, testing, and analyses. The Company operates its own geochemical assay laboratory and its own fleet of diamond drill rigs using PQ, HQ and NQ sized drill rods. The Lion One geochemical laboratory is accredited under the IANZ ISO/IEC 17025:2017 Standard – the international standard for testing and calibration of laboratories.

Diamond drill core samples are logged by Lion One personnel on site. Exploration diamond drill core is split by Lion One personnel on site, with half core samples sent for analysis and the other half core remaining on site. Grade control diamond drill core is whole core assayed. Core samples are delivered to the Lion One Laboratory for preparation and analysis. All samples are pulverized at the Lion One lab to 85% passing through 75 microns and gold analysis is carried out using fire assay with an AA finish. Samples that return grades greater than 10.00 g/t Au are re-analyzed by gravimetric method, which is considered more accurate for very high-grade samples.

Duplicates of 5% of samples with grades above 0.5 g/t Au are delivered to ALS Global Laboratories in Australia for check assay determinations using the same methods (Au-AA26 and Au-GRA22 where applicable). ALS also analyses 33 pathfinder elements by HF-HNO3-HClO4 acid digestion, HCl leach and ICP-AES (method ME-ICP61). The Lion One lab can test a range of up to 71 elements through Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES), but currently focuses on a suite of 29 important pathfinder elements with an aqua regia digest and ICP-OES finish.

About Lion One Metals Limited

Lion One Metals is an emerging Canadian gold producer headquartered in North Vancouver BC, with new operations established in late 2023 at its 100% owned Tuvatu Alkaline Gold Project in Fiji. The Tuvatu project comprises the high-grade Tuvatu Alkaline Gold Deposit, the Underground Gold Mine, the Pilot Plant, and the Assay Lab. The Company also has an extensive exploration license covering the entire Navilawa Caldera, which is host to multiple mineralized zones and highly prospective exploration targets.

On behalf of the Board of Directors,

Walter Berukoff, Chairman & President

Contact Information

Email: info@liononemetals.com

Phone: 1-855-805-1250 (toll free North America)

Website: www.liononemetals.com

Neither the TSX-V nor its Regulation Service Provider accepts responsibility or the adequacy or accuracy of this release

This press release may contain statements that may be deemed to be “forward-looking statements” within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “proposed”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited’s current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance, or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labor or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Appendix 1: Full Drill Results and Collar Information

Table 1. Collar coordinates for drillholes reported in this release. Coordinates are in Fiji map grid.

| Hole ID | Easting | Northing | Elevation | Azimuth | Dip | Depth |

| TGC-0346 | 1876384 | 3920429 | 94 | 104.8 | -16.9 | 102.2 |

| TGC-0349 | 1876384 | 3920429 | 94 | 110.9 | -15.3 | 86.9 |

| TGC-0352 | 1876384 | 3920428 | 94 | 117.7 | -15.6 | 80.5 |

| TGC-0354 | 1876384 | 3920428 | 94 | 126.1 | -15.0 | 80.5 |

| TGC-0356 | 1876384 | 3920427 | 94 | 134.4 | -14.3 | 101.4 |

| TGC-0358 | 1876384 | 3920428 | 94 | 122.1 | -23.9 | 95.5 |

| TGC-0361 | 1876385 | 3920426 | 94 | 142.9 | -4.5 | 350.1 |

| TGC-0373 | 1876384 | 3920427 | 93 | 114.6 | -42.0 | 230.5 |

| TGC-0375 | 1876384 | 3920428 | 93 | 95.3 | -42.8 | 181.3 |

| TGC-0377 | 1876384 | 3920429 | 94 | 80.7 | -17.5 | 140.4 |

| TGC-0379 | 1876384 | 3920429 | 93 | 79.2 | -37.7 | 170.8 |

| TGC-0383 | 1876384 | 3920428 | 94 | 78.9 | -11.3 | 242.1 |

| TGC-0387 | 1876384 | 3920429 | 94 | 78.5 | -25.1 | 146.7 |

| TGC-0406 | 1876384 | 3920429 | 94 | 78.6 | -32.6 | 200.2 |

| TGC-0409 | 1876384 | 3920429 | 94 | 71.8 | -21.0 | 175.8 |

| TGC-0414 | 1876384 | 3920428 | 94 | 99.0 | -36.2 | 131.2 |

| TGC-0416 | 1876384 | 3920428 | 94 | 95.1 | -17.0 | 167.5 |

| TGC-0419 | 1876384 | 3920429 | 93 | 75.8 | -45.1 | 205.5 |

| TGC-0421 | 1876384 | 3920429 | 93 | 71.3 | -32.0 | 11.3 |

| TGC-0423 | 1876384 | 3920429 | 94 | 69.4 | -32.0 | 11.5 |

| TGC-0424 | 1876384 | 3920429 | 94 | 71.0 | -32.1 | 191.3 |

| TGC-0434 | 1876384 | 3920429 | 93 | 70.5 | -38.0 | 161.5 |

| TGC-0438 | 1876383 | 3920425 | 96 | 164.3 | 16.5 | 9.0 |

| TGC-0440 | 1876384 | 3920425 | 97 | 164.4 | 22.0 | 12.6 |

| TGC-0441 | 1876383 | 3920425 | 96 | 165.3 | 22.7 | 131.1 |

| TGC-0445 | 1876384 | 3920434 | 94 | 60.3 | -14.7 | 155.6 |

| TGC-0447 | 1876384 | 3920433 | 94 | 67.2 | -26.8 | 140.0 |

| TGC-0449 | 1876384 | 3920433 | 93 | 67.7 | -40.7 | 191.1 |

| TGC-0451 | 1876384 | 3920433 | 94 | 67.9 | -32.3 | 162.0 |

| TGC-0456 | 1876384 | 3920434 | 93 | 55.9 | -30.9 | 114.4 |

Table 2. Composite intervals from drillholes reported in this news release (composite grade >3.0 g/t Au, with <1 m internal dilution at <3.0 g/t Au).

| Hole ID | From (m) | To (m) | Width (m) | Au (g/t) | |

| TGC-0346 | 51.2 | 51.8 | 0.6 | 14.79 | |

| 77.4 | 78.4 | 1.1 | 5.25 | ||

| TGC-0349 | 53.7 | 55.3 | 1.6 | 5.28 | |

| including | 53.0 | 53.7 | 0.7 | 0.03 | |

| and | 53.7 | 54.1 | 0.4 | 7.99 | |

| and | 54.1 | 54.5 | 0.4 | 10.25 | |

| and | 54.5 | 55.0 | 0.5 | 0.06 | |

| and | 55.0 | 55.3 | 0.3 | 3.76 | |

| TGC-0352 | 60.8 | 62.5 | 1.7 | 10.80 | |

| including | 60.8 | 61.1 | 0.3 | 25.27 | |

| and | 61.1 | 61.4 | 0.3 | 1.54 | |

| and | 61.4 | 61.7 | 0.3 | 17.89 | |

| and | 61.7 | 62.5 | 0.8 | 6.18 | |

| TGC-0356 | 63.8 | 64.3 | 0.5 | 3.40 | |

| 65.7 | 66.5 | 0.8 | 7.13 | ||

| including | 65.7 | 66.2 | 0.5 | 5.25 | |

| and | 66.2 | 66.5 | 0.3 | 10.25 | |

| TGC-0358 | 65.4 | 65.7 | 0.3 | 5.78 | |

| TGC-0361 | 63.2 | 64.8 | 1.6 | 7.22 | |

| including | 63.2 | 64.2 | 1.0 | 5.02 | |

| and | 64.2 | 64.5 | 0.3 | 1.86 | |

| and | 64.5 | 64.8 | 0.3 | 19.89 | |

| 66.4 | 66.7 | 0.3 | 4.60 | ||

| 69.4 | 69.9 | 0.5 | 36.03 | ||

| 84.9 | 85.2 | 0.3 | 33.59 | ||

| 192.6 | 193.2 | 0.6 | 3.40 | ||

| 287.4 | 287.8 | 0.4 | 3.28 | ||

| TGC-0373 | 86.5 | 87.4 | 0.9 | 6.39 | |

| including | 86.5 | 87.0 | 0.5 | 6.40 | |

| and | 87.0 | 87.4 | 0.4 | 6.38 | |

| 90.9 | 91.2 | 0.3 | 4.66 | ||

| 127.9 | 128.3 | 0.4 | 5.64 | ||

| 157.8 | 158.9 | 1.1 | 52.18 | ||

| including | 157.8 | 158.4 | 0.6 | 23.79 | |

| and | 158.4 | 158.9 | 0.5 | 86.25 | |

| 194.2 | 194.7 | 0.5 | 6.61 | ||

| TGC-0375 | 97.7 | 98.1 | 0.4 | 24.36 | |

| 111.5 | 112.9 | 1.4 | 6.33 | ||

| including | 111.5 | 111.9 | 0.4 | 3.12 | |

| and | 111.9 | 112.4 | 0.5 | 0.04 | |

| and | 112.4 | 112.9 | 0.5 | 15.20 | |

| 115.3 | 116.8 | 1.5 | 9.13 | ||

| including | 115.3 | 115.7 | 0.4 | 29.58 | |

| and | 115.7 | 116.5 | 0.8 | 0.99 | |

| and | 116.5 | 116.8 | 0.3 | 3.55 | |

| 120.4 | 121.5 | 1.1 | 13.22 | ||

| including | 120.4 | 121.1 | 0.7 | 3.39 | |

| and | 121.1 | 121.5 | 0.4 | 30.43 | |

| 154.8 | 155.2 | 0.4 | 47.05 | ||

| 159.1 | 159.9 | 0.8 | 5.54 | ||

| including | 159.1 | 159.6 | 0.5 | 3.38 | |

| and | 159.6 | 159.9 | 0.3 | 9.14 | |

| 172.2 | 172.5 | 0.3 | 4.44 | ||

| TGC-0377 | 47.7 | 48.0 | 0.3 | 6.82 | |

| 57.7 | 59.9 | 2.2 | 3.25 | ||

| including | 57.7 | 58.0 | 0.3 | 5.56 | |

| and | 58.0 | 58.5 | 0.5 | 3.00 | |

| and | 58.5 | 58.8 | 0.4 | 3.50 | |

| and | 58.8 | 59.2 | 0.4 | 2.13 | |

| and | 59.2 | 59.5 | 0.3 | 1.91 | |

| and | 59.5 | 59.9 | 0.4 | 3.62 | |

| 65.1 | 65.4 | 0.3 | 13.36 | ||

| 66.4 | 67.2 | 0.8 | 5.70 | ||

| including | 66.4 | 66.9 | 0.5 | 7.12 | |

| and | 66.9 | 67.2 | 0.3 | 3.57 | |

| 92.7 | 93.1 | 0.4 | 5.03 | ||

| 125.5 | 125.8 | 0.3 | 7.28 | ||

| 140.1 | 140.4 | 0.3 | 14.59 | ||

| TGC-0379 | 61.3 | 62.0 | 0.7 | 4.13 | |

| 76.0 | 76.4 | 0.4 | 16.87 | ||

| 89.5 | 91.0 | 1.5 | 51.35 | ||

| including | 89.5 | 90.0 | 0.5 | 126.49 | |

| and | 90.0 | 90.6 | 0.6 | 8.59 | |

| and | 90.6 | 91.0 | 0.4 | 21.55 | |

| 153.2 | 153.6 | 0.4 | 5.63 | ||

| TGC-0383 | 46.3 | 46.7 | 0.4 | 31.47 | |

| 51.6 | 53.1 | 1.5 | 3.39 | ||

| including | 51.6 | 51.9 | 0.3 | 4.24 | |

| and | 51.9 | 53.1 | 1.2 | 3.15 | |

| 63.7 | 64.0 | 0.3 | 67.84 | ||

| 69.7 | 71.7 | 2.0 | 78.71 | ||

| including | 69.7 | 70.6 | 0.9 | 168.25 | |

| and | 70.6 | 71.1 | 0.5 | 0.67 | |

| and | 71.1 | 71.4 | 0.3 | 18.46 | |

| and | 71.4 | 71.7 | 0.3 | 9.77 | |

| 96.3 | 96.6 | 0.3 | 20.28 | ||

| 102.2 | 102.5 | 0.3 | 3.41 | ||

| 122.0 | 122.3 | 0.3 | 3.75 | ||

| 212.5 | 212.9 | 0.4 | 96.48 | ||

| TGC-0387 | 67.1 | 67.5 | 0.4 | 175.52 | |

| 72.7 | 75.2 | 2.6 | 10.72 | ||

| including | 72.7 | 73.1 | 0.5 | 3.08 | |

| and | 73.1 | 73.7 | 0.6 | 18.37 | |

| and | 73.7 | 74.1 | 0.4 | 1.18 | |

| and | 74.1 | 74.4 | 0.3 | 12.42 | |

| and | 74.4 | 74.9 | 0.5 | 4.05 | |

| and | 74.9 | 75.2 | 0.3 | 28.97 | |

| 89.9 | 90.6 | 0.7 | 14.95 | ||

| including | 89.9 | 90.3 | 0.4 | 13.42 | |

| and | 90.3 | 90.6 | 0.3 | 16.99 | |

| 92.3 | 93.3 | 1.0 | 7.22 | ||

| including | 92.3 | 92.7 | 0.4 | 10.78 | |

| and | 92.7 | 93.3 | 0.6 | 4.84 | |

| 104.5 | 105.0 | 0.5 | 9.01 | ||

| 107.8 | 108.4 | 0.6 | 4.69 | ||

| 115.0 | 115.7 | 0.7 | 8.68 | ||

| TGC-0406 | 72.3 | 72.6 | 0.3 | 5.90 | |

| 83.2 | 86.3 | 3.1 | 29.70 | ||

| including | 83.2 | 83.6 | 0.4 | 34.63 | |

| and | 83.6 | 83.9 | 0.3 | 23.01 | |

| and | 83.9 | 84.2 | 0.3 | 21.97 | |

| and | 84.2 | 84.9 | 0.7 | 2.95 | |

| and | 84.9 | 85.2 | 0.3 | 4.29 | |

| and | 85.2 | 85.5 | 0.3 | 8.32 | |

| and | 85.5 | 85.8 | 0.3 | 179.52 | |

| and | 85.8 | 86.3 | 0.5 | 9.99 | |

| 153.5 | 153.8 | 0.3 | 3.61 | ||

| TGC-0409 | 74.9 | 75.5 | 0.6 | 12.37 | |

| 78.3 | 78.8 | 0.5 | 4.00 | ||

| 90.8 | 92.6 | 1.8 | 6.22 | ||

| including | 90.8 | 91.4 | 0.6 | 9.23 | |

| and | 91.4 | 92.0 | 0.6 | 0.46 | |

| and | 92.0 | 92.6 | 0.6 | 8.97 | |

| 112.0 | 112.7 | 0.7 | 14.28 | ||

| TGC-0414 | 70.4 | 71.9 | 1.5 | 9.76 | |

| including | 70.4 | 71.0 | 0.6 | 18.87 | |

| and | 71.0 | 71.5 | 0.5 | 2.46 | |

| and | 71.5 | 71.9 | 0.4 | 5.22 | |

| 74.9 | 77.0 | 2.2 | 16.19 | ||

| including | 74.9 | 75.3 | 0.4 | 4.60 | |

| and | 75.3 | 75.6 | 0.3 | 84.47 | |

| and | 75.6 | 75.9 | 0.3 | 3.14 | |

| and | 75.9 | 76.4 | 0.5 | 4.23 | |

| and | 76.4 | 77.0 | 0.7 | 7.03 | |

| 81.4 | 84.0 | 2.6 | 4.65 | ||

| including | 81.4 | 81.7 | 0.3 | 3.35 | |

| and | 81.7 | 82.7 | 1.0 | 0.08 | |

| and | 82.7 | 83.0 | 0.4 | 4.78 | |

| and | 83.0 | 83.3 | 0.3 | 8.05 | |

| and | 83.3 | 83.7 | 0.4 | 11.02 | |

| and | 83.7 | 84.0 | 0.3 | 8.40 | |

| 88.3 | 91.0 | 2.8 | 8.42 | ||

| including | 88.3 | 88.6 | 0.4 | 5.77 | |

| and | 88.6 | 89.1 | 0.5 | 0.68 | |

| and | 89.1 | 89.4 | 0.3 | 21.06 | |

| and | 89.4 | 89.9 | 0.5 | 4.20 | |

| and | 89.9 | 90.4 | 0.5 | 4.85 | |

| and | 90.4 | 91.0 | 0.6 | 16.58 | |

| 92.2 | 92.5 | 0.3 | 4.29 | ||

| TGC-0416 | 49.4 | 50.4 | 1.0 | 4.51 | |

| including | 49.4 | 50.0 | 0.6 | 5.56 | |

| and | 50.0 | 50.4 | 0.5 | 3.19 | |

| 60.0 | 61.5 | 1.5 | 12.23 | ||

| including | 60.0 | 60.9 | 0.9 | 13.36 | |

| and | 60.9 | 61.2 | 0.3 | 14.03 | |

| and | 61.2 | 61.5 | 0.3 | 7.02 | |

| 66.0 | 66.3 | 0.4 | 14.89 | ||

| 74.6 | 75.0 | 0.5 | 27.00 | ||

| 76.5 | 78.1 | 1.6 | 10.27 | ||

| including | 76.5 | 76.9 | 0.4 | 9.24 | |

| and | 76.9 | 77.4 | 0.6 | 0.29 | |

| and | 77.4 | 78.1 | 0.7 | 18.39 | |

| 131.6 | 132.0 | 0.4 | 3.99 | ||

| 142.6 | 142.9 | 0.3 | 3.58 | ||

| TGC-0419 | 58.0 | 59.6 | 1.6 | 4.23 | |

| including | 58.0 | 58.4 | 0.4 | 7.79 | |

| and | 58.4 | 59.6 | 1.2 | 3.04 | |

| 82.4 | 83.1 | 0.7 | 3.23 | ||

| 89.4 | 90.0 | 0.6 | 6.64 | ||

| 92.3 | 92.6 | 0.4 | 58.59 | ||

| 99.8 | 100.3 | 0.6 | 42.75 | ||

| 126.2 | 126.7 | 0.5 | 4.91 | ||

| 135.8 | 136.9 | 1.1 | 5.11 | ||

| including | 135.8 | 136.4 | 0.6 | 6.10 | |

| and | 136.4 | 136.9 | 0.5 | 3.92 | |

| 143.0 | 143.6 | 0.6 | 3.98 | ||

| 155.3 | 155.6 | 0.3 | 5.48 | ||

| 170.9 | 172.1 | 1.2 | 19.73 | ||

| TGC-0424 | 54.7 | 55.0 | 0.3 | 49.38 | |

| 81.3 | 81.6 | 0.3 | 3.38 | ||

| 83.2 | 83.6 | 0.4 | 59.64 | ||

| 85.9 | 88.6 | 2.7 | 30.50 | ||

| including | 85.9 | 86.3 | 0.4 | 22.59 | |

| and | 86.3 | 87.0 | 0.7 | 45.78 | |

| and | 87.0 | 87.6 | 0.6 | 41.09 | |

| and | 87.6 | 88.0 | 0.4 | 1.68 | |

| and | 88.0 | 88.6 | 0.6 | 26.23 | |

| 121.5 | 122.3 | 0.8 | 3.06 | ||

| TGC-0434 | 75.0 | 76.2 | 1.2 | 3.44 | |

| 77.5 | 77.8 | 0.3 | 4.00 | ||

| 86.8 | 87.3 | 0.5 | 63.67 | ||

| 92.6 | 93.1 | 0.5 | 4.34 | ||

| 99.8 | 103.2 | 3.5 | 7.47 | ||

| including | 99.8 | 100.2 | 0.4 | 4.76 | |

| and | 100.2 | 100.7 | 0.5 | 25.88 | |

| and | 100.7 | 101.1 | 0.4 | 5.13 | |

| and | 101.1 | 101.7 | 0.7 | 0.11 | |

| and | 101.7 | 102.1 | 0.4 | 6.07 | |

| and | 102.1 | 102.6 | 0.5 | 10.49 | |

| and | 102.6 | 103.2 | 0.7 | 4.26 | |

| 106.0 | 106.7 | 0.8 | 3.21 | ||

| 116.2 | 116.6 | 0.4 | 5.69 | ||

| 133.9 | 134.4 | 0.5 | 9.78 | ||

| 140.5 | 141.1 | 0.6 | 3.98 | ||

| 143.1 | 143.5 | 0.4 | 5.48 | ||

| 147.8 | 148.2 | 0.4 | 7.94 | ||

| TGC-0441 | 75.6 | 76.2 | 0.6 | 4.25 | |

| TGC-0445 | 38.8 | 39.5 | 0.7 | 13.54 | |

| 55.8 | 56.1 | 0.3 | 26.89 | ||

| 65.0 | 65.4 | 0.4 | 13.64 | ||

| 114.6 | 115.5 | 0.9 | 22.99 | ||

| 121.4 | 123.2 | 1.8 | 7.64 | ||

| including | 121.4 | 122.0 | 0.6 | 3.79 | |

| and | 122.0 | 122.4 | 0.4 | 0.17 | |

| and | 122.4 | 122.9 | 0.5 | 0.37 | |

| and | 122.9 | 123.2 | 0.4 | 32.08 | |

| TGC-0447 | 51.8 | 52.3 | 0.5 | 3.58 | |

| 80.5 | 80.9 | 0.4 | 4.51 | ||

| 83.7 | 84.2 | 0.5 | 8.13 | ||

| 92.0 | 93.3 | 1.3 | 56.59 | ||

| including | 92.0 | 92.4 | 0.4 | 43.54 | |

| and | 92.4 | 93.3 | 0.9 | 62.39 | |

| 122.1 | 122.4 | 0.3 | 3.31 | ||

| 129.3 | 129.9 | 0.6 | 4.58 | ||

| 135.5 | 137.0 | 1.5 | 4.41 | ||

| including | 135.5 | 136.1 | 0.6 | 8.79 | |

| and | 136.1 | 136.7 | 0.6 | -0.01 | |

| and | 136.7 | 137.0 | 0.3 | 4.48 | |

| TGC-0449 | 80.5 | 81.0 | 0.5 | 4.23 | |

| 81.9 | 82.5 | 0.6 | 3.08 | ||

| 89.0 | 90.3 | 1.3 | 7.47 | ||

| including | 89.0 | 89.5 | 0.5 | 14.87 | |

| and | 89.5 | 90.3 | 0.8 | 3.07 | |

| 97.5 | 97.8 | 0.3 | 23.14 | ||

| 108.0 | 108.6 | 0.6 | 14.23 | ||

| 122.1 | 122.7 | 0.6 | 13.02 | ||

| 123.8 | 126.5 | 2.7 | 6.17 | ||

| including | 123.8 | 124.2 | 0.4 | 3.60 | |

| and | 124.2 | 124.5 | 0.3 | 9.01 | |

| and | 124.5 | 125.4 | 1.0 | 2.60 | |

| and | 125.4 | 126.0 | 0.6 | 10.99 | |

| and | 126.0 | 126.5 | 0.5 | 8.01 | |

| 128.0 | 131.6 | 3.6 | 8.37 | ||

| including | 128.0 | 128.4 | 0.4 | 8.12 | |

| and | 128.4 | 128.9 | 0.6 | 6.37 | |

| and | 128.9 | 129.7 | 0.7 | 17.91 | |

| and | 129.7 | 130.2 | 0.5 | 8.47 | |

| and | 130.2 | 131.0 | 0.8 | 0.02 | |

| and | 131.0 | 131.3 | 0.4 | 12.82 | |

| and | 131.3 | 131.6 | 0.3 | 4.31 | |

| 133.3 | 133.6 | 0.3 | 16.07 | ||

| 148.1 | 149.5 | 1.4 | 5.91 | ||

| including | 148.1 | 148.8 | 0.7 | 4.74 | |

| and | 148.8 | 149.5 | 0.7 | 7.02 | |

| 155.8 | 156.1 | 0.3 | 6.83 | ||

| 185.7 | 186.2 | 0.4 | 17.36 | ||

| TGC-0451 | 49.2 | 49.5 | 0.3 | 19.74 | |

| 57.5 | 57.8 | 0.3 | 12.69 | ||

| 83.3 | 83.9 | 0.6 | 10.56 | ||

| including | 83.3 | 83.6 | 0.3 | 13.76 | |

| and | 83.6 | 83.9 | 0.3 | 7.36 | |

| 85.6 | 86.7 | 1.1 | 5.09 | ||

| including | 85.6 | 85.9 | 0.3 | 3.54 | |

| and | 85.9 | 86.4 | 0.5 | 0.14 | |

| and | 86.4 | 86.7 | 0.3 | 14.89 | |

| 89.0 | 89.9 | 0.9 | 175.43 | ||

| including | 89.0 | 89.3 | 0.3 | 267.95 | |

| and | 89.3 | 89.6 | 0.3 | 249.00 | |

| and | 89.6 | 89.9 | 0.3 | 9.33 | |

| 99.0 | 101.5 | 2.5 | 12.83 | ||

| including | 99.0 | 99.7 | 0.7 | 9.33 | |

| and | 99.7 | 100.0 | 0.3 | 69.57 | |

| and | 100.0 | 100.3 | 0.3 | 2.60 | |

| and | 100.3 | 100.6 | 0.3 | 1.30 | |

| and | 100.6 | 100.9 | 0.3 | 1.13 | |

| and | 100.9 | 101.2 | 0.3 | 6.92 | |

| and | 101.2 | 101.5 | 0.3 | 3.64 | |

| 138.0 | 138.3 | 0.3 | 3.32 | ||

| 139.2 | 139.5 | 0.3 | 6.60 | ||

| 147.8 | 148.1 | 0.3 | 6.19 | ||

| 155.2 | 155.5 | 0.3 | 13.25 |

SOURCE: Lion One Metals Limited