Is Novo about to snatch defeat from the jaws of victory?

Bob Moriarty

Archives

Nov 19, 2018

“It is not the critic who counts, not the man who points out how the strong man stumbled, or where the doer of deeds could have done better. The credit belongs to the man who is actually in the arena; whose face is marred by the dust and sweat and blood; who strives valiantly; who errs and comes short again and again, because there is no effort without error or shortcoming; who knows the great enthusiasms, the great devotions and spends himself in a worthy cause; who at the best, knows in the end the triumph of high achievement, and who, at worst, if he fails, at least fails while daring greatly; so that his place shall never be with those cold and timid souls who know neither victory or defeat.” Teddy Roosevelt

Novo Resource shares hit a high of $8.83 in October of 2017, up from $.75 a share on April 1, 2017 and have since declined to a recent low of $1.89. Disappointed shareholders who managed to buy at high prices are now screaming in anger looking to burn someone at the stake. Anyone would do.

After all, when share prices go up, it is always because of the brilliance of the investor and when share prices go down, it must be because of incompetence of management.

I’m writing this piece for the attention of existing Novo shareholders so I will skip a lot of the background information I usually insert to fill in the blanks. I am assuming present stockowners are familiar with the Karratha gold rush and the general Pilbara gold story that Novo has been part of for nine years.

I want to cover all of the major problems that have come to light and to try to explain why they happened and how they have been addressed.

The first giant problem literally goes back to the two high-grade gold samples announced on August 8th, 2017 that lit the fuse for the explosion in the price of Novo that took the value for shares to a record level in less than two months.

As discussed in Novo’s news release dated July 12, 2017, this sample originates from the uppermost horizon of an 11-meter thick sequence of mineralized conglomerate beds.

Results from this testwork are encouraging at several levels.

- The Steinert XSS T sorting machine proved highly efficient at sorting out coarse gold-bearing rock particles. Although the Sorted Concentrate represents only 2% of the overall sample weight, it contains about 82.6% of gold. Because this machine proved practical and efficient, Novo sees it as a means of assisting determination of grade of this very unusual mineralization. Given this machine can operate at about 48 tonnes per hour, Novo also considers it potentially viable for future processing applications.

- Although the vast majority of gold resides in the coarse fraction, a significant fine-grained gold component is evident. Although more work is needed to further quantify this fine-grained gold component and its distribution, it may prove meaningful when it comes time to demonstrate continuity and grade of this very unusual deposit.

- Novo considers the calculated head grade of subsamples #1 and #2, 87.76 and 46.14 gpt Au respectively, very encouraging. The weighted average grade of these two subsamples, 67.08 gpt Au, which equates to 2.16 oz per tonne.

By accident that press release made a whole series of assumptions many of which proved dead wrong over time. There was one sample taken from Purdy’s Reward that was split and sent to the lab for assay. One half of the split was 87.76 g/t gold, the other 46.14 g/t gold. Call them 3 ounce and 1.5-ounce gold for simplicity.

The release says the samples came from the uppermost horizon of an eleven-meter sequence of mineralized conglomerate and that there was a significant fine grain component of the gold.

When the local small-scale miners were using metal detectors to find gold, they would scrape off an area of conglomerate until they started getting results. Then they would pry out each nugget by use of hand tools.

Whoever took the samples probably did the same thing and used a metal detector to find a sweet spot to take the samples. While the press release says “mineralized conglomerate was collected from a 2×2 meter exposure of bedrock at the bottom of a half-meter deep trench.” That does not mean the sample was 2x2x.5. The samples were only about 270 kilos each so the original sample had to be more like .7 meters by .7 meters by 40 cm.

Because those samples were almost certainly by accident cherry picked they do demonstrate something vital. Many investors believed they were representative of the entire conglomerate sequence and obviously high grade. Even I believed the grade was representative and now we know it clearly was not. And while everyone wanted to believe the gold was at the top or throughout the conglomerate sequence, we now understand that it is at the very bottom of the gravel reef.

On October 3, 2017, I said, “Where is the richest gold? Right! It’s at the very bottom of the gravel right on and in the bedrock.”

While the release was wrong, dead wrong, about where the gold was, the sample did show that if you could locate the 40-50 cm pay zone near the bottom of the conglomerate, you would find the richest gold. Keep that in mind because while Quinton Hennigh managed to solve a puzzle that no one else had in 130 years of small-scale mining not all the issues have been sorted just yet.

Another assumption that was made that proved to be a giant problem had to do with the issue of the small gold component. While it does exist in the samples taken from Purdy’s and Comet Well, it all seems to be associated with the nuggets. What it means is that when you have small gold, you can drill and get representative samples. The gold in the Carlin Trend is microscopic but easy to measure. As I have maintained all along, you cannot measure the nuggety gold, you can only mine it. And since the small gold all seems related to the nuggets, you can’t test this system by drilling.

The Steinert sorting machine seemed to work at first. Novo took the two samples and ran them through the machine. The sorted concentrate took the volume of the material down by 98% and captured 82.6% of the gold. That was a giant success and created a basis for profitably mining the deposit. If the machine was used correctly.

Someone made the decision to crush subsequent samples to 2 mm size and fed the material through the machine. The rock size was far too small and the fine rocks literally blanked out the ability of the machine to X-Ray. So instead of reducing the material by 98% it didn’t reduce it by much at all. The first machine belonged to another company and the tests after that were run through another machine. Everyone assumed the machine wasn’t calibrated correctly and that’s why it didn’t work but in fact months later someone realized the machine isn’t designed to work with small material.

It wasn’t the machine settings that were wrong; it was the crush size of the rock. Naturally by then all of the samples taken had been crushed to 2 mm making the samples worthless. It was 100% human error, it was corrected and Novo now knows better. It also happens anytime you start thinking outside the box.

But Novo had to determine not only the grade of the gold but where it was located in the sequence so they brought in the water well drill. It was a disaster because they needed to know exactly where in the conglomerate layers the gold was and the machine chewed everything up. They tried it, it didn’t work and they went to bulk samples.

SGS proved to be another problem area. There was miscommunication on both sides with lots of blame to assign if that is what rings your bell. It has been sorted and SGS now has the ability to process the bulk samples the way Novo needs them done. I would say the relationship was at times flawed but it has been repaired.

I just got back from a weeklong trip to Karratha and Egina. While I am a shareholder and no more happy than any other shareholder at the decline in share price, what I saw and what I learned totally changed my outlook.

Exploration is not mining. It is expense, not profit. Mining is mining. With a now massive 12,400 square kilometers land position Novo is poised to have one of the world’s largest gold deposits. I won’t even come up with a number, anything you say would be absurd but they have a giant land position containing a lot of gold. They added over 1,000 square km around Egina and that was really interesting.

In 130 years since the discovery of gold in the Pilbara, it never occurred to anyone that the whole place is mineralized. While Quinton focused on picking up as much of the conglomerate formations as possible, believing that the basal cover had preserved what had been nothing more that a giant placer deposit now morphed into hard rock, much of the conglomerate has eroded away. So where did that gold go?

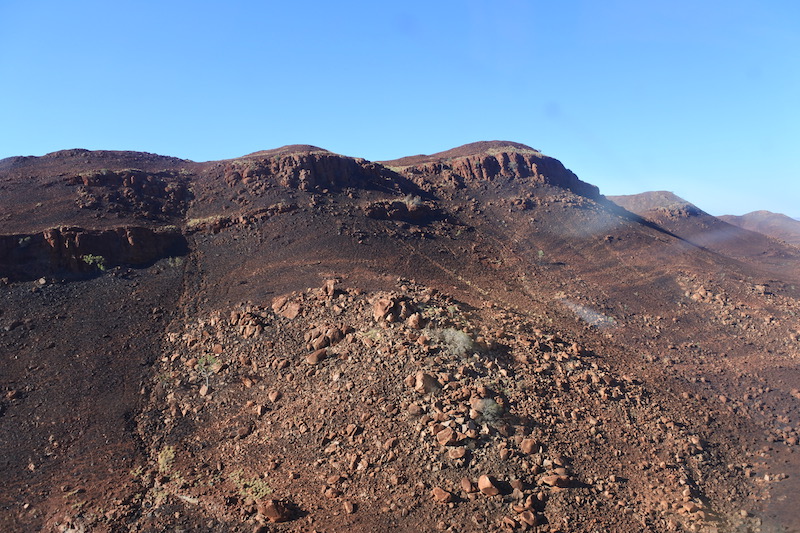

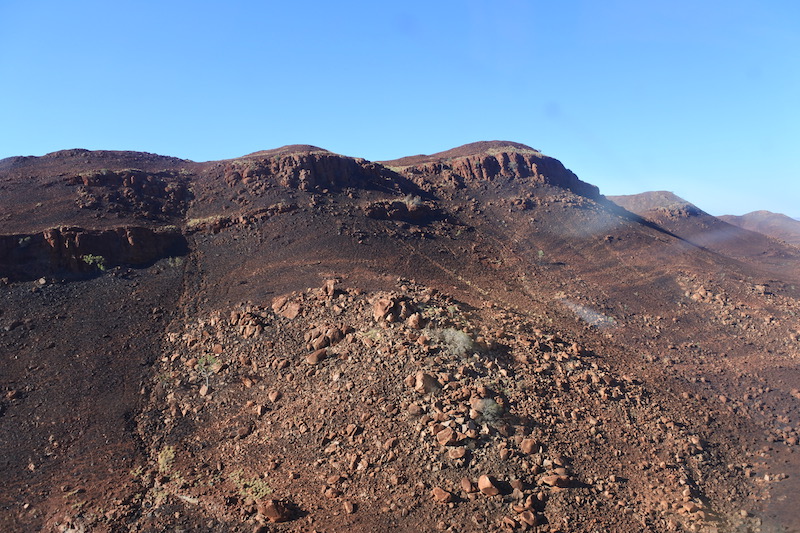

Eroded conglomerate sequence

Around Egina has a lot of it. And we panned tailings left over from the miner who has been working one of the two mining leases granted and permitted. We found a lot of small gold. Since it came from somewhere it infers that the surrounding conglomerate rocks could be drilled with conventional drilling. You wouldn’t be able to measure the nuggets but you could measure the small gold component.

Aerial of existing mining

Egina Mining

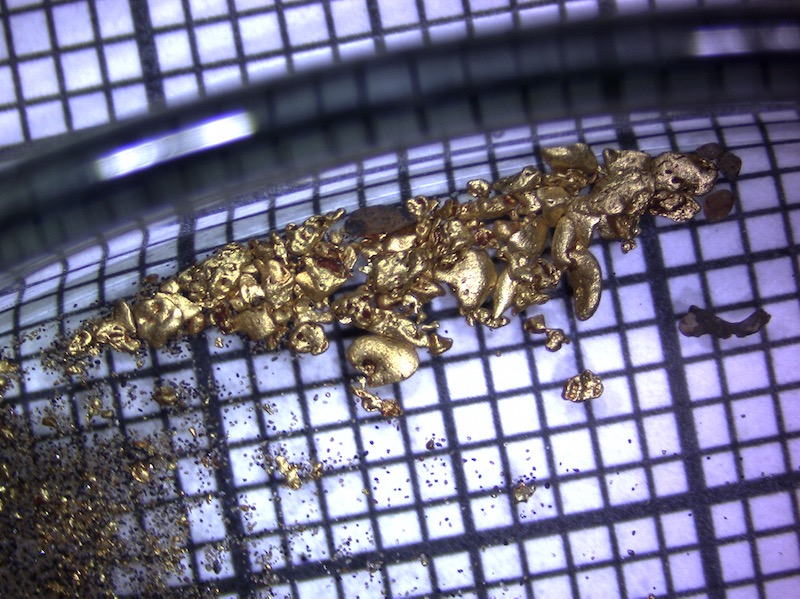

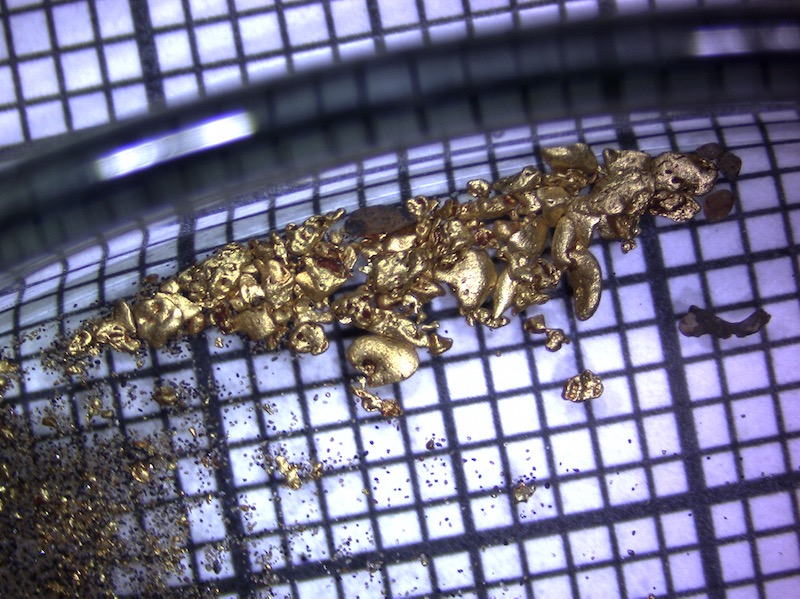

Bob panning Egina gold

Panned gold from Egina

Small gold component from Egina

And in a giant leap forward for the company, Novo tested a sorting machine from Tomralate last week. Initial tests show a reduction of mass of 99%. It appears to work with both the hard rock from Karratha and the alluvial material similar to around Egina. The machines have a high capacity potential of up to 1000 tons per hour.

Let me explain why that is so important, in fact, game changing for the entire mining business not just for Novo.

The best information we have so far is that there is a 40 cm reef of nuggety gold located near or on the contact with the lower unit and the grade of that reef is about 25 g/t.

40 cm would be similar in nature to a high-grade narrow vein system. Those aren’t popular with mining companies. Mining companies want bulk processing. But if you could take 4 meters of material now averaging 2.5 g/t gold you would have a simple solution to mining. But every ton of rock processed through a plant costs the same no matter what the grade. So plant engineers prefer 25 g/t gold to 2.5 g/t gold, all else being equal.

If Novo can reduce the bulk of the material by 99% they turn 4 meters of 2.5-g/t material into 250 g/t gold material with only 1% of the volume. That’s direct shipping ore and reduces the very real risk of gold flying away into the pockets of those who spot it.

To crack the code of the Karratha and Egina gold mystery requires two things. 1. You have to think far enough outside the box to come up with a viable concept and 2. You have to think outside the box far enough to come up with a way to mine and mill the gold at a profit while maintaining security.

In 130 years since the discovery of gold in the Pilbara conglomerates and also in alluvial material only one person has managed to do that. That would be Quinton Hennigh. He will go down in history as the John Mackay of the Comstock Lode and the Cecil Rhodes who managed to consolidate the Kimberly diamond pipe small claims into one and formed De Beers to control both the supply and the price of diamonds.

As someone has repeated again and again, this is not a conventional deposit and cannot be approached in a conventional manner. If it were conventional it would have been mined as one of the two biggest gold discoveries in history similar in both grade and tonnage to the Witwatersrand in South Africa. However it has taken 130 years for someone to put it together.

George Mehri of Kairos took Quinton and I to see their ground just south of Egina where he is heading the exploration program last week. We saw a 40×50 meter patch of ground that he went over with a metal detector and found over 10 ounces of gold right at surface. No one has any idea of what that means or where the gold came from or why it’s there. We are all just scratching our heads.

George’s nugget patch

What people need to think about is that there is a lot of gold in Karratha and Egina and within the Pilbara. Much of it we have no clue as to how it got there or even why it’s there. This project is a work in progress and many questions may never be answered. But there is a lot of gold there and Quinton is figuring out how to extract it at a profit.

The chorus of observers screeching for the blood of the combatants has gotten shrill. But while picking nits they are ignoring what is right in front of them. Let’s look at the minimum value of just Beaton’s Creek. Novo has defined about 700,000 economic ounces of oxide gold near surface. It wouldn’t take much of a leap to figure out there is an easy million ounces there. But let’s stay with the 700,000 ounces we can measure. At a market cap of $283 million USD today, that would be a value of $400 an ounce. Deals are done all the time for more than that.

In other words, Beaton’s Creek all by itself is a floor under the value of Novo shares.

But let’s look at potential upside. Pretend this is a conventional deposit with easy to drill and measure gold.

Novo has drilled 210 core holes at Purdy’s and Comet Well. They were short holes. All of the 210 holes intersected conglomerate. What would be the value of Novo shares if every one of those 210 holes assayed 2.5 g/t gold over four meters? It would be recognized as one of the great gold finds of history and the value would be in the billions because the market would recognize there are another ten thousand square km with exactly the same potential.

But it’s the same grade and quantity of gold no matter if you can easily measure it or not.

Mackay and Rhodes thought outside the box. You may safely assume a lot of people were green with jealousy and sought to undermine them at every turn. Not because of their failures which were legion but because of their successes.

Novo shareholders are being called on to vote in the AGM scheduled for the 5th of December. It’s the standard stuff with nothing exciting except the possible reelection of the six directors.

There are six directors at present, Quinton Hennigh, Chairman, Rob Humphryson, CEO, Michael Barrett, Akiko Levinson, Greg Gibson and Eric Sprott. The first four are friendly to Quinton Hennigh and Greg Gibson works for Eric Sprott.

At present Eric Sprott controls about 28% of the vote directly and through Kirkland Lake.

I want to make one thing perfectly clear. Eric Sprott is a businessman who makes money or loses money by investing his money in companies. He is totally a good guy and I have never heard anything bad about him. I have zero conflict with him on any basis, other than me trying to figure out just how gold was suppressed from $252 to $1923.

What I’m about to write is not based on inside information or anything I’ve heard or even anything I suspect. It is only what I fear.

Eric Sprott has to belong to the herd of shareholders who are pissed. On the chat boards it’s clear that Rob and Quinton are blithering idiots. Drawing and quartering are too good for them because they made the shares go down all by themselves.

Give me a break. We are in a bear phase of the gold market and everything is down.

If you like to use the Sprott PSLV as a contrary indicator for the market, recently it hit an all time low with a discount over 5%. I used the same indicator to say we were at a top in April of 2011 where I correctly called the top in silver to the day. Now it’s saying we are very near or just past a bottom.

I managed to pick up a little silver at $14.02 and I really wish someone would suppress it down just a little more so I can load up the boat.

This is an unconventional deposit. It has to be approached in an unconventional way. Quinton is trying to herd cats, juggle eggs and tap dance all at the same time. I’m not convinced that throwing rocks at him is really going to help things.

Eric Sprott has all the right in the world to vote his 28% of shares in Novo any way he wishes. But what I fear is that he might want to treat this as a conventional deposit and all he needs to do is tinker a little bit in his best interest and make things right.

This is not a conventional deposit. For all the screw-ups and miscommunication, Quinton and his brilliant crew have made amazing progress. Egina is a game changer beyond belief. I won’t even suggest what I think the grades are going to be but he has two of the smartest and most experienced alluvial experts in the world testing the resource today and designing a processing plant that could be actually mining in the Australian fall, our spring. We will be seeing grades before the end of the year and once I have numbers I can take to the bank, I will comment on what they mean.

Nobody knows this but Quinton and me but when we went to Perth and then into the field in June of 2009 before Novo was even born, Quinton had three kids in college and didn’t have a pot to piss in. He paid his airfare but I contributed to the expenses in both New Zealand and the Pilbara basin work. I know this project, the problems and the potential better than anyone outside the company.

By reasonable terms Quinton is rich today from his investments in both Novo and Irving Resources. Normally when Eric Sprott wants changes in a company everyone is quaking in their boots in fear of losing that paycheck.

Quinton doesn’t need the paycheck and at some point he will conclude he doesn’t need the aggravation. If he leaves, Rob Humphryson leaves. And if for any reason Rob Humphryson leaves, Quinton leaves. And if they both leave, Eric Sprott will learn the meaning of Jingle mail because when the last person leaves the office after shutting off the lights, they will mail him the keys to the door so he can run Novo any way he wants. People work for Novo because they love working with Quinton and know the challenge of developing another Witwatersrand deposit.

I’d just hate to see that happen. There are lots of people in the industry and on the chat boards that all believe they are smarter than Quinton Hennigh but I can assure you it just isn’t so.

What I fear is that Eric Sprott will crap in his own lunch bucket by voting his shares to WITHOLD the three Quinton friendly. Then there are two people voting the way Eric wants and one voting the way Quinton wants.

While Eric Sprott owns and controls 28% of the shares, he does not own and control 72% of the shares. If he takes total control of the board he is going to do what is in what he sees as his best interests. Quinton on the other hand is responsible for acting in what he sees as the best interests of 100% of the Novo shareholders. And as bright as Eric Sprott and his people are, Quinton unlocked a mystery that was 130 years old that no one else figured out.

For the next year or so he alone can run the ship. When I was in the service, we had a saying, “no matter how big or how small a ship is, there is only room for one captain.” Before taking action I suggest Eric ponder the ramifications of whatever he does.

So when I get my proxy form, I am going to vote for all of the current members of the Board except for Greg Gibson. I have nothing against Greg but I think that Eric Sprott needs to understand that there are a lot of shareholders who don’t think they are smarter than Rob Humphryson and Quinton Hennigh and they would like them to stick around as the fat lady warms up in the wings.

I don’t think for a minute my vote will change anything but if a lot of other shareholders vote as I do, it will send a clear message to Eric about what people think of the value of Quinton and his team.

For all the people who believe Quinton and team have fucked up, you haven’t seen anything yet. Bring in a bunch of conventional mining guys. Once they figure out where the light switch is in the office it will take them 18 months just to determine where the projects stand today. It will be the biggest Chinese fire drill you have ever seen with conventional thinking on an unconventional deposit. I’ll be quite content to dump my shares at a nice profit and sit on the sidelines throwing rocks at every error they make.

It might be a good idea for Eric to think about the difference between being involved and being committed. It’s a lot like the difference between ham and eggs. The chicken, she’s involved but the pig, he’s committed.

If Eric takes control of the board, he will set the 2nd Pilbara gold rush back five years. All the good will Quinton has built within the Australian mining community and with the native corporations will evaporate before the light has left the room after the switch is turned off.

I like Eric a lot and I’d hate to see him tinker with something actually working quite well. Anyone not making mistakes is not making enough decisions. It’s only a sin when you keep making the same mistake again and again. Quinton doesn’t do that.

Novo Resources

NVO-V $2.28 (Nov 16, 2018)

NSRPF $1.73 OTCQX 162.3 million shares

Novo Resources website

###

Bob Moriarty

President: 321gold

Archives

321gold Ltd

|

![]()