Ottawa, Ontario–(Newsfile Corp. – January 22, 2024) – Gold79 Mines Ltd. (TSXV: AUU) (OTCQB: AUSVF) (“Gold79” or the “Company”) is pleased to announce that it has defined an exploration target at the Tyro Main Zone, the first potential resource area, on the Gold Chain Project in Arizona (the “Exploration Target”).

Gold79 believes that the Tyro Main Zone has the potential for 15.6 to 31.2 Mt grading 1.5 to 2.5 g/t Au. This is based on previous exploration on the property, including 685.7 metres of drilling along with surface sampling (95 samples), sampling of historical underground workings (56 samples) and detailed mapping. The Exploration Target was derived by modeling the Tyro Vein System within the Tyro Main Zone. The volume of the modeled areas determines the potential tonnage statement in the Exploration Target. The grade range given in the Exploration Target is determined with consideration to the drill results within the modeled Exploration Target area and consideration of the geological setting in an established gold camp where mineralization typically extends to a depth of at least 300 metres. See the heading below “Tyro Main Zone Exploration Target” for additional details. The potential quantity and grades are conceptual in nature. There has been insufficient exploration drilling to define a mineral resource and it is uncertain if further exploration will result in the Exploration Target being delineated as a mineral resource.

The highlights in this update include:

- To generate a potential maiden resource at the Tyro Main Zone, additional core and reverse circulation (RC) drilling is proposed along with mechanized sampling of surface vein exposures.

- The Tyro Main Zone Exploration Target is limited to only 1 kilometre of the 3.4 kilometre strike length of the full Tyro vein system (Figure 4).

- The initial target at the Tyro Main Zone excludes the adjacent targets identified at the historic Banner and Sheep Trail Mines (previous drilling at Banner by Gold79 returned 10.7 grams per tonne Au over 3.1 metres in drill hole GC21-08, see press release dated November 2, 2021).

- The Tyro Main Zone Exploration Target also excludes the Frisco Graben to the northeast, where continuing work indicates the upper levels of a potential low sulfidation epithermal gold system over an extent of 4 kilometres.

Derek Macpherson, President and CEO stated, “In the second half of 2023, Gold79 undertook a review of all the data collected from the Company’s work at the Gold Chain project over the last 3 years. Our conclusion continues to be that the Gold Chain project has the potential to host multiple, plus million-ounce gold targets. The Tyro Main Zone represents a portion of the potential we see at the project and has become a priority for the Company given the potential to define a higher-grade open-pittable resource that would start from surface with a relatively small amount of additional exploration work.”

Mr. Macpherson continued, “This Exploration Target, if converted to a resource, would have the potential to be one of the higher-grade open-pit deposits in the camp, and has the potential to be moved into production quickly given that it is on patented claims and given the existing underutilized infrastructure in the surrounding district.”

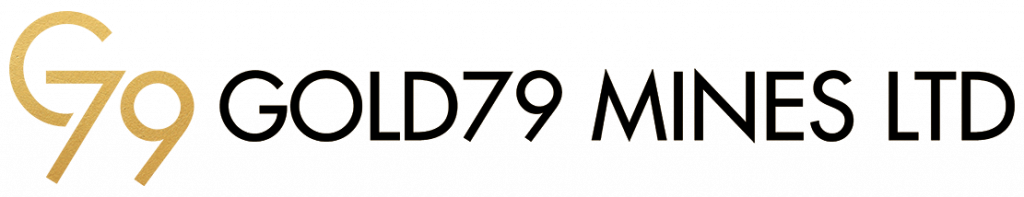

Figure 1. Geologic map of the Katherine district and the Gold Chain project.

To view an enhanced version of Figure 1, please visit:

https://images.newsfilecorp.com/files/5717/194934_f7cdbb6454a278e2_001full.jpg

Tyro Main Zone Exploration Target

The Tyro Main Zone consists of the historic Tyro Mine (with production from two-levels of underground workings and a small slot pit) and the Decimal Hill area. The 1,000-metre extent considered in this Exploration Target is contained within 15.6 to 31.2 Mt grading 1.5 to 2.5 g/t Au and is located entirely on 3 patented claims controlled by Gold79.

The work completed to date by Gold79 at the Tyro Main Zone includes:

- 685.7 metres of RC drilling (Table 1).

- 95 surface rock chip samples (Figure 2).

- 56 chip channel samples from the underground workings (Table 2).

- Detailed geologic mapping of the mine workings, patented claims and surrounding BLM claims.

Using this data, Gold79 has defined the Exploration Target over the 1,000-metre strike length of the Tyro Main Zone and down to a depth of 300 metres. The Exploration Target effectively excludes the potential high-grade zone intersected with drill hole GC23-28 (which included 9.1 metres at 51.09 grams per tonne gold, see press release dated February 28, 2023). This potential high-grade zone was excluded since it has only been intersected in one drill hole to date and would materially skew the potential grade range higher. It should be noted that similar grades in line with GC23-28 were documented to have been mined historically (pre-1940) at the Tyro underground mine.

The dimensions of the Exploration Target are based on surface sampling, detailed mapping, and drilling for strike length and width. The 300-metre depth is consistent with the depth of mineralization encountered in neighboring veins (i.e. Katherine, Arabian and the Oatman district) shown in Figure 1.

The potential quantity and grades estimated for the Tyro Main Zone Exploration Target are conceptual in nature, and there has been insufficient exploration completed to date to define a mineral resource. It is uncertain if further exploration will result in the Tyro Main Zone Exploration Target being delineated as a mineral resource.

Figure 2. Tyro Mine area geologic map showing sections, drill holes and sampling results.

To view an enhanced version of Figure 2, please visit:

https://images.newsfilecorp.com/files/5717/194934_figure2.jpg

Figure 3. Three-dimensional view looking north across the mineralized domain (red) of the Tyro vein system. Historical holes (black dots) and holes proposed for 2024 (blue poles).

To view an enhanced version of Figure 3, please visit:

https://images.newsfilecorp.com/files/5717/194934_figure3.jpg

Path to a Resource at the Tyro Main Zone

Gold79 believes it has a unique opportunity to define a gold resource with minimal additional investment over a short period of time. Modelling of the existing database (Figure 3) has identified areas where additional exploration is needed to support a maiden inferred resource estimate. Gold79 believes that to define a maiden resource at the Tyro Main Zone to a depth of approximately 150m the following work is required.

- Trenching – 24 trenches (~1,100 metres)

- Core Drilling – 750 to 1,250 metres

- RC Drilling – 1,500 to 2,500 metres

The planned trenching program is expected to help define widths and gold grade in mine and surface exposures. The accessible mine workings have already been sampled (Table 2). Many of the roads required for this work were constructed in the 1980s and surface access/disturbance should not require a permit. It is important to note that each step in the exploration process will define the scale required at the subsequent step.

The potential quantity and grade estimated for the Tyro Main Zone Exploration Target is conceptual in nature, and there has been insufficient exploration completed to date to define a mineral resource. It is uncertain if further exploration will result in the Tyro Main Zone Exploration Target being delineated as a mineral resource.

Table 1. Selected Intercepts from Tyro Main Zone Drilling.

To view an enhanced version of Table 1, please visit:

https://images.newsfilecorp.com/files/5717/194934_table1.jpg

Table 2. Summary of underground chip-channel sampling on the

Tyro Mine 200 Level.

To view an enhanced version of Table 2, please visit:

https://images.newsfilecorp.com/files/5717/194934_table2.jpg

Figure 4. Schematic diagram of the Tyro vein system showing the vein segments defined by WNW- to NW-trending intra- to post-mineral faults and veins.

To view an enhanced version of Figure 4, please visit:

https://images.newsfilecorp.com/files/5717/194934_figure4.jpg

Figure 5. Exploration model for low-sulfidation epithermal gold-silver vein systems illustrating vertical variations in quartz textures, structure, alteration and geochemistry along with the estimated vertical positions of the several structural segments of the Tyro vein system. Diagram adapted from: Buchanan (1980), Hollister (1985), Berger & Eimon (1983), Anaconda Corp. (1983), Guoyi (1992) and Corbett & Leach (1996).

To view an enhanced version of Figure 5, please visit:

https://images.newsfilecorp.com/files/5717/194934_figure5.jpg

Further Updates Planned on the Frisco Graben and North Oatman Trend

Gold79 has completed a review of the exploration data collected over the last three years at Gold Chain. Given that the upper extent of the “boiling zone” of this low sulphidation epithermal gold system is effectively at surface for the Tyro Main Zone (Figure 5), this has become Gold79’s priority exploration target at Gold Chain. However, based on this review of exploration data, Gold79 also believes that other targets at the Gold Chain project have the potential to yield large gold deposits. Besides the Tyro Vein system, discussed in our May 9, 2023 press release, the North Oatman Trend and Frisco Graben represent large scale targets, with the “bonanza zones” partially exposed or blind to the surface (Figure 5). The Company plans to provide future updates on these other large-scale targets at its Gold Chain project in northwest Arizona.

Qualified Person / Quality Control and Quality Assurance

Robert Johansing, M.Sc. Econ. Geol., P. Geo., the Company’s Vice President, Exploration is a qualified person (“QP”) as defined by NI 43-101 and has reviewed and approved the technical content of this press release. Mr. Johansing has also been responsible for all phases of drilling programs including sample collection, labelling, bagging and transport from the project to American Assay Laboratories of Sparks, Nevada. Samples were then dried, crushed and split, and pulp samples were prepared for analysis. Gold was determined by fire assay with an ICP finish, over limit samples were determined by fire assay and gravimetric finish. Silver plus 34 other elements were determined by Aqua Regia ICP-AES, over limit samples were determined by fire assay and gravimetric finish. Standard sample chain of custody procedures were employed during field work and the drilling campaigns until delivery to the analytical facility.

About Gold79 Mines Ltd.

Gold79 Mines Ltd. is a TSX Venture listed company focused on building ounces in the Southwest USA. Gold79 holds 100% earn-in option to purchase agreements on three gold projects: the Jefferson Canyon Gold Project and the Tip Top Gold Project both located in Nevada, USA, and, the Gold Chain Project located in Arizona, USA. In addition, Gold79 holds a 32.3% interest in the Greyhound Project, Nunavut, Canada under JV by Agnico Eagle Mines Limited.

For further information regarding this press release contact:

Derek Macpherson, President & CEO

Phone: 416-294-6713

Email: dm@gold79mines.com

Website: www.gold79mines.com.

Book a 30-minute meeting with our CEO here.

FORWARD-LOOKING STATEMENTS:

This press release may contain forward-looking statements that are made as of the date hereof and are based on current expectations, forecasts and assumptions which involve risks and uncertainties associated with our business including any future private placement financing, the uncertainty as to whether further exploration will result in the target(s) being delineated as a mineral resource, capital expenditures, operating costs, mineral resources, recovery rates, grades and prices, estimated goals, expansion and growth of the business and operations, plans and references to the Company’s future successes with its business and the economic environment in which the business operates. All such statements are made pursuant to the ‘safe harbour’ provisions of, and are intended to be forward-looking statements under, applicable Canadian securities legislation. Any statements contained herein that are statements of historical facts may be deemed to be forward-looking statements. By their nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties. We caution readers of this news release not to place undue reliance on our forward-looking statements as a number of factors could cause actual results or conditions to differ materially from current expectations. Please refer to the risks set forth in the Company’s most recent annual MD&A and the Company’s continuous disclosure documents that can be found on SEDAR at www.sedar.com. Gold79 does not intend, and disclaims any obligation, except as required by law, to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/194934