Author: admin

Burlington, Ontario–(Newsfile Corp. – June 15, 2023) – Silver Bullet Mines Corp. (TSXV: SBMI) (OTCQB: SBMCF) (‘SBMI’ or ‘the Company’) provides an operational update on its Arizona activities.

The mill in Globe, Arizona has been operating on a single shift of ten hours per day at its rated capacity with no major issues. It is running at optimal efficiency processing mineralized material from the lower grade stockpiles of vein material. Higher grade material from the mine should be introduced as it arrives at the mill. Videos of the mill can be seen at SBMI’s website www.silverbulletmines.com.

SBMI intends to increase the operating hours by adding another shift, which should happen as the mill crew becomes more familiar with the running of the mill and is able to onboard a second shift.

The mill has processed approximately 350 tons of vein material over the last seven days. The 350 tons of feed produced 418 pounds of both magnetic and non-magnetic concentrates from the concentrating table. As can be seen in the photograph below, there was a line of goldish coloured material on the right end of the shaker table when recent material was processed. Management believes this material could be gold, given its location on the table, gold’s specific gravity being higher than silver’s and copper’s, the history of the mineralized material from the Buckeye Mine, and management’s experience with processing. This material was not assayed for gold and readers are warned this material might not contain gold or such material may not be representative of other material from the Buckeye Mine.

Shaker table from SBMI’s mill in Arizona

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8464/170085_ef344bcd4423d80f_001full.jpg

From the 418 pounds of concentrate roughly 226 pounds of iron alloy were removed using a magnetic separation circuit, to remove the material which may host some silver, gold, and platinum group elements. This removed material is retained for future processing to recover any potential precious metals.

The 192 pounds of non-magnetic material was moved to the Company’s refinery where dore bars are poured. These dore bars contain silver and minor amounts of gold, copper, nickel and other metals. Based upon the report from SBMI’s customer, none of the material is deleterious in nature so it should not negatively impact the value of the bar. Slag material removed in the upgrading process will be retained for further processing and possible future sale.

The poured dore bars have been prepared for transportation.

Transportation of dore bars is handled by a specialized carrier permitted to transport precious metals to Europe requiring importation documentation. Working closely with the purchaser SBMI intends to make a smaller test run of product (proof of concept) to ensure the shipping process functions as expected. That proof of concept shipment should take place soon. The total number of paid ounces for silver and gold will be determined by assay after the bars’ arrival at the refinery.

At the Buckeye Silver Mine the mine team is carrying out screening and rock bolting as the team drifts along the vein. As noted in previous press releases, the goal of drifting along the vein is to intercept the historical higher mineralized zone behind the Treasure Room, which management believes should happen in the near future.

For further information, please contact:

John Carter

Silver Bullet Mines Corp., CEO

cartera@sympatico.ca

+1(905)302-3843

Peter M. Clausi

Silver Bullet Mines Corp., VP Capital Markets

pclausi@brantcapital.ca

+1 (416) 890-1232

Cautionary and Forward-Looking Statements

This news release contains certain statements that constitute forward-looking statements as they relate to SBMI and its subsidiaries. Forward-looking statements are not historical facts but represent management’s current expectation of future events, and can be identified by words such as “believe”, “expects”, “will”, “intends”, “plans”, “projects”, “anticipates”, “estimates”, “continues” and similar expressions. Although management believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that they will prove to be correct.

By their nature, forward-looking statements include assumptions, and are subject to inherent risks and uncertainties that could cause actual future results, conditions, actions or events to differ materially from those in the forward-looking statements. If and when forward-looking statements are set out in this new release, SBMI will also set out the material risk factors or assumptions used to develop the forward-looking statements. Except as expressly required by applicable securities laws, SBMI assumes no obligation to update or revise any forward-looking statements. The future outcomes that relate to forward-looking statements may be influenced by many factors, including but not limited to: the impact of SARS CoV-2 or any other global virus; reliance on key personnel; the thoroughness of its QA/QA procedures; the continuity of the global supply chain for materials for SBMI to use in the production and processing of mineralized material; the presence or absence of mineable economic mineralized material; shareholder and regulatory approvals; activities and attitudes of communities local to the location of the SBMI’s properties; risks of future legal proceedings; income tax matters; fires, floods and other natural phenomena; the rate of inflation; availability and terms of financing; distribution of securities; commodities pricing; currency movements, especially as between the USD and CDN; effect of market interest rates on price of securities; and, potential dilution. SARS CoV-2 and other potential global pathogens create risks that at this time are immeasurable and impossible to define.

Vancouver, British Columbia–(Newsfile Corp. – June 15, 2023) – Stillwater Critical Minerals (TSXV: PGE), focused on critical minerals in the iconic Stillwater District of Montana, USA, is pleased to announce that it will be participating in THE Mining Investment Event of the North, June 19-21, 2023, (“THE Event”) at the Fairmont Chateau Frontenac and Voltigeurs de Quebec Armoury in Quebec City, Canada.

Michael Rowley, President & CEO, will be presenting at 8:50am ET on June 21st. Management from Stillwater Critical Minerals will also be holding one-on-one investor meetings throughout the three-day conference. Interested parties should contact Jennifer Choi at jchoi@vidconferences.com to inquire about registering to attend.

Information regarding THE Event including investor registration details, a list of participating companies, panelists and keynote speakers and a preliminary agenda can be found here: https://vidconferences.com/conferences-events/tier-1-mining-conference/

About Stillwater Critical Minerals

Stillwater Critical Minerals is focused on its flagship Stillwater West Ni-PGE-Cu-Co + Au project in the iconic and famously productive Stillwater mining district in Montana, USA. With the recent addition of two renowned Bushveld and Platreef geologists to the team, the Company is well positioned to advance the next phase of large-scale critical mineral supply from this world-class American district, building on past production of nickel, copper, and chromium, and the on-going production of platinum group and other metals by neighboring Sibanye-Stillwater. An expanded NI 43-101 mineral resource estimate, released January 2023, delineates a compelling suite of critical minerals contained within five Platreef-style nickel and copper sulphide deposits at Stillwater West which host a total of 1.6 billion pounds of nickel, copper and cobalt, and 3.8 million ounces of palladium, platinum, rhodium, and gold, and remain open for expansion along trend and at depth.Stillwater Critical Minerals also holds the high-grade Black Lake-Drayton Gold project adjacent to Treasury Metals’ development-stage Goliath Gold Complex in northwest Ontario, currently under an earn-in agreement with Heritage Mining, and the Kluane PGE-Ni-Cu-Co critical minerals project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory.

THE Mining Investment Event of the North is Canada’s only tier 1 Global Mining Investment Conference and hosted annually in Quebec City, Canada. THE Event is invitation only and is independently sponsored by the Government of Quebec, and financial and mining communities at large. THE Event is designed to specifically facilitate privately arranged meetings between mining companies, international investors, and various mining government authorities. THE Event is committed to promoting sustainability in the mining industry through education and innovation through unique Student Sponsorships, She-Co Initiatives, highlighting ESG and equality issues and by providing a platform for some of most influential thought leaders in the sector. The agenda, brochure, participating companies, speakers & panelists, initiatives and registration applications for issuers and investors may be found here: https://vidconferences.com/conferences-events/tier-1-mining-conference/

Interested parties please contact Jennifer Choi, jchoi@vidconferences.com

Joanne Jobin

Principal & Founder

IR.INC & VID Media Incorporated

jjobin@irinc.ca

Jennifer Choi

Vice President, Operations

IR.INC & VID Media Incorporated

jchoi@vidconferences.com

Brhett Booker

Associate

VID Media Incorporated

bbooker@vidconferences.com

Grade Control Drilling in URW1 and Zone 5 Areas Returns Grades over 100 g/t Au

North Vancouver, British Columbia–(Newsfile Corp. – June 14, 2023) – Lion One Metals Limited (TSXV: LIO) (OTCQX: LOMLF) (ASX: LLO) (“Lion One” or the “Company”) is pleased to report significant high-grade gold results from ongoing grade control drilling at its 100% owned Tuvatu Alkaline Gold Project in Fiji.

Assay results are presented here for grade control drilling completed on both the URW1 lode system as well as the Zone 5 area of the deposit, which encompasses the upper portion of lodes UR1, UR2, UR3, UR4, URW2, URW3, URW1A, and UR2A (Figure 1). As reported on May 18, 2023, initial mining of the URW1 lode system has already commenced and grade control drilling is being completed in advance of mining. The Zone 5 area of the deposit is scheduled for mining in early 2024 and thus the grade control drilling in this area is being conducted in anticipation of future mining, as well as to increase the knowledge of the deposit in that area. Additional high-grade intersections peripheral to both the URW1 and the Zone 5 areas are also included in this release as part of the grade control program.

Highlights of new grade control drilling:

- 7.14 g/t Au over 21.6 m (including 18.61 g/t Au over 5.1 m) (TGC-0042, from 73.6 m depth)

- 52.05 g/t Au over 2.1 m (including 345.3 g/t Au over 0.3m) (TGC-0042, from 118.0 m depth)

- 23.11 g/t Au over 3.6 m (including 125.31 g/t Au over 0.3 m) (TGC-0040, from 65.4 m depth)

- 19.43 g/t Au over 3.3 m (including 80.87 g/t Au over 0.6 m) (TGC-0051, from 49.5 m depth)

- 21.15 g/t Au over 2.7 m (including 67.59 g/t Au over 0.6 m) (TGC-0047, from 123.3 m depth)

- 9.39 g/t Au over 4.2 m (including 67.30 g/t Au over 0.3 m) (TGC-0050, from 26.7 m depth)

- 10.13 g/t Au over 3.9 m (including 38.58 g/t Au over 0.6 m) (TGC-0043, from 66.3 m depth)

- 33.99 g/t Au over 0.9 m (including 100.89 g/t Au over 0.3 m) (TGC-0045, from 62.1 m depth)

- 78.03 g/t Au over 0.3 m (TGC-0052, from 40.2 m depth)

Grade control drilling is being conducted on 5-10 m centers and is designed to provide a much higher resolution of the lode arrays than compared to infill drilling, which is being conducted on approximately 20 m centers. This increased resolution provides a much better understanding of the geometry and mineralization of the lodes and helps to optimize mine development and extraction. The grade control drilling program is currently on schedule and the results to date confirm the local understanding of the URW1 and Zone 5 geological models.

Figure 1. Plan View of the Main Tuvatu Deposit with Reported Grade Control Drilling. Plan view image illustrating the location of the most recent grade control drillholes in relation to the Tuvatu lode system. Grade control holes are shown in black, currently modelled mineralized lodes are shown in light grey, the main decline is shown in red, and the historical exploration decline in blue. Previous grade control, infill and exploration drillholes are not shown.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/169899_3d3cc54d143c3b7b_001full.jpg

URW1 Grade Control Drilling

The URW1 lode system consists of narrow, high-grade to locally bonanza-grade vein arrays and vein swarms that strike approximately N-S and dip sub-vertically to steeply east. Current modelling suggests that there are multiple separate lodes within the URW1 lode system. The first two of these lodes, URW1a and URW1b, are currently being mined. The URW1 lode system has a current strike length of approximately 300 m in the N-S direction, and a vertical extent of approximately 300 m.

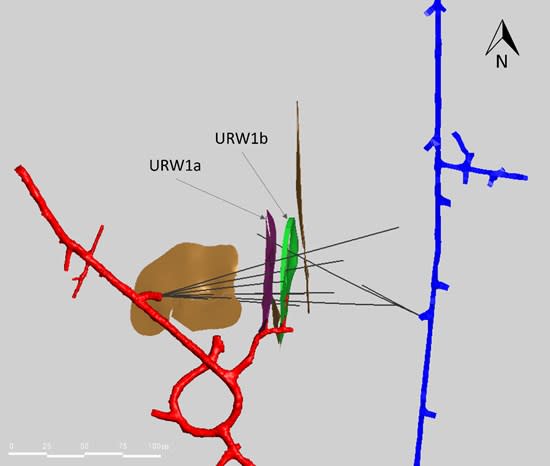

A total of 52 grade control holes have been completed to date in the grade control drill program. Results from the first 36 drillholes (TGC-0001 to TGC-0036) were reported on April 25, 2023, and the next 16 drillholes (TGC-0037 to TGC-0052) are reported here. Ten of the most recent grade control drillholes targeted the URW1 area. Figure 2 shows the location of the most recent drillholes in relation to the URW1a and URW1b lodes, as well as to the main Tuvatu decline. Grade control drilling on the URW1 lode system has been conducted from underground from both the main decline and the historical exploration decline, and has been designed to target an 80 m strike section within the overall 300 m strike length of the URW1 system.

Figure 2. Plan View of URW1 Lode System. Plan view image illustrating the location of the most recent grade control holes in relation to the URW1 lode system. The URW1 lode system consists of multiple separate lodes, two of which are highlighted here; URW1a in purple and URW1b in green. The remaining URW1 lodes are shown in brown. The main decline is shown in red, the historical exploration decline in blue, and the grade control drillholes in black.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/169899_3d3cc54d143c3b7b_002full.jpg

Figure 3. Long Section View of URW1 Lode System. Long section view showing recent high-grade drill intercepts of URW1 with URW1a highlighted in pink and URW1b highlighted in green. All other URW1 lodes are shown in brown. Composite intervals with grades between 3 and 10 g/t Au are shown in yellow, intervals with grades over 10 g/t Au are shown in red. Image is looking north.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/169899_3d3cc54d143c3b7b_003full.jpg

Figure 4. Example URW1 Drill Core. LEFT: TGC-0040 at 67.3 m depth. Monzonite-hosted stockwork-style veining with a narrow high-grade silica vein containing coarse grained visible gold. RIGHT: TGC-0042 at 91.60 m depth. Vuggy silica vein with narrow bleached alteration halo in monzonite. Width of core is 4.76 cm in each photo.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/169899_liononefigure4.jpg

Zone 5 Grade Control Drilling

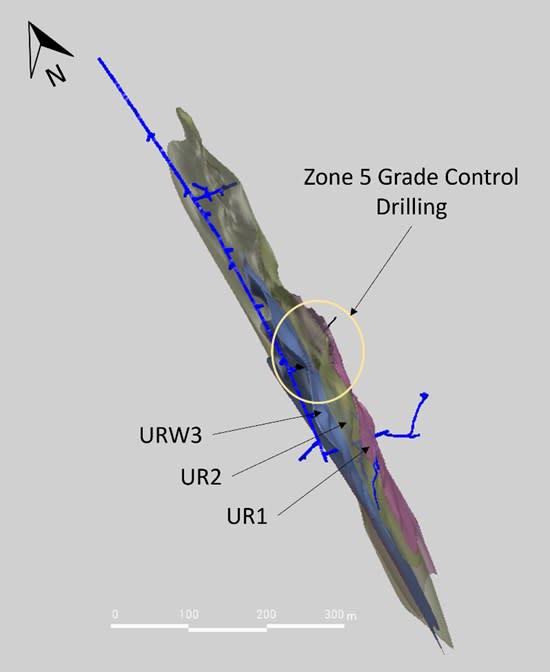

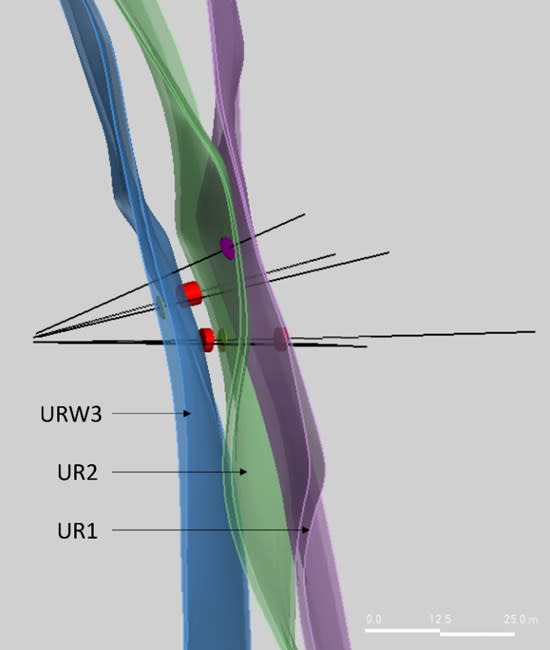

The Zone 5 area of the Tuvatu deposit consists of the upper portion of a series of closely spaced lode systems. The lode systems targeted by the most recent grade control drilling in Zone 5 are the UR1, UR2, and URW3 lodes. These three lodes are located just east of the historical exploration decline, strike approximately N-S, and dip sub-vertically to steeply east, similar to the URW1 lodes. As currently modelled, the UR1, UR2, and URW3 lodes have vertical extents ranging from approximately 700 m to approximately 900 m, and strike lengths ranging from 300 m to 600 m. All three of the lodes are open both along strike and at depth.

A total of six Zone 5 grade control drillholes are included in this report. These are the first six grade control drillholes to target the Zone 5 area and they follow upon the initial results from an ongoing infill drill program in the area. Figure 5 shows the location of these drillholes in relation to the UR1, UR2, and URW3 lodes, as well as to the historical exploration decline. Grade control drilling in the Zone 5 area has been conducted from the historical exploration decline and has been designed to target a 60 m strike section within the overall 300 m to 600 m strike length of these lodes.

Figure 5. Zone 5 Grade Control Drilling in Relation to Targeted Zone 5 Lodes. Image shows the Zone 5 grade control holes in relation to the targeted UR1, UR2, and URW3 lodes. These lodes are slightly concave with URW3 on the inside (left side on image), closest to the exploration decline, and UR1 on the outside. UR1 is shown in pink, UR2 in green, and URW3 in blue. The historical exploration decline is shown in bright blue, and the grade control drillholes are partially visible in black within the circle.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/169899_3d3cc54d143c3b7b_007full.jpg

Figure 6. Zone 5 Grade Control Intercepts. Section view facing north, showing a 60 m slice of lodes UR1, UR2, and URW3 within Zone 5. Composite intervals with grades between 3 and 10 g/t Au are shown in yellow, while intervals with grades over 10 g/t Au are shown in red and purple.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/169899_3d3cc54d143c3b7b_008full.jpg

Figure 7. Examples of Zone 5 Drill Core. LEFT: UR2 lode in TGC-0049 at 35.15 m depth. Coarse grained honey sphalerite and pyrite in variable light to dark grey quartz vein with narrow potassic alteration halo. RIGHT: URW3 lode in TGC-0050 at 29.6 m depth. Abundant coarse honey sphalerite rimmed by fine grained sooty pyrite +/- galena and narrow potassic alteration halo, within a larger zone of stockwork style mineralization. Width of core is 4.76 cm in each photo.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2178/169899_liononefigure7.jpg

Table 1. Highlights of composited drill results in the URW1 area. Only new grade control drilling results are included here. For previous results see news release from April 25, 2023. For full results see Table 3 in the appendix.

| Hole ID | From | To | Interval (m) | Au (g/t) | |

| TGC-0039 | 77.4 | 78.3 | 0.9 | 8.37 | |

| TGC-0039 | 101.7 | 102.9 | 1.2 | 7.18 | |

| including | 102.3 | 102.6 | 0.3 | 15.64 | |

| TGC-0040 | 30.3 | 31.5 | 1.2 | 4.7 | |

| TGC-0040 | 51.3 | 53.1 | 1.8 | 12.63 | |

| including | 51.9 | 52.5 | 0.6 | 27.05 | |

| TGC-0040 | 65.4 | 69 | 3.6 | 23.1 | |

| including | 66 | 66.3 | 0.3 | 85.87 | |

| and | 67.2 | 67.5 | 0.3 | 125.31 | |

| and | 68.4 | 68.7 | 0.3 | 13.93 | |

| and | 68.7 | 69 | 0.3 | 46.89 | |

| TGC-0040 | 82.5 | 82.8 | 0.3 | 64.65 | |

| TGC-0041 | 16.8 | 19.8 | 3 | 1.52 | |

| TGC-0042 | 47.4 | 51 | 3.6 | 3.96 | |

| including | 50.7 | 51 | 0.3 | 31.99 | |

| TGC-0042 | 52.8 | 54.6 | 1.8 | 11.82 | |

| including | 53.7 | 54 | 0.3 | 64.24 | |

| TGC-0042 | 60 | 63 | 3 | 5.52 | |

| including | 61.8 | 63 | 1.2 | 11.1 | |

| TGC-0042 | 64.5 | 66.6 | 2.1 | 7.19 | |

| including | 64.5 | 65.1 | 0.6 | 17.34 | |

| TGC-0042 | 68.5 | 72.4 | 3.9 | 4.46 | |

| including | 68.5 | 69.7 | 1.2 | 8.25 | |

| TGC-0042 | 73.6 | 95.2 | 21.6 | 7.14 | |

| including | 76.3 | 78.1 | 1.8 | 7.47 | |

| and | 82 | 92.5 | 10.5 | 12.06 | |

| which includes | 83.2 | 83.5 | 0.3 | 19.99 | |

| and | 85.9 | 86.2 | 0.3 | 11.88 | |

| and | 88.6 | 88.9 | 0.3 | 19.92 | |

| and | 89.5 | 90.1 | 0.6 | 15.26 | |

| and | 90.4 | 91.9 | 1.5 | 42.05 | |

| which includes | 90.4 | 91 | 0.6 | 19.98 | |

| and | 91 | 91.3 | 0.3 | 24.93 | |

| and | 91.3 | 91.9 | 0.6 | 72.68 | |

| TGC-0042 | 118 | 120.1 | 2.1 | 52.05 | |

| including | 118.6 | 119.2 | 0.6 | 177.66 | |

| which includes | 118.9 | 119.2 | 0.3 | 345.34 | |

| TGC-0043 | 33.3 | 34.5 | 1.2 | 5.72 | |

| including | 33.3 | 33.6 | 0.3 | 9.15 | |

| TGC-0043 | 66.3 | 70.2 | 3.9 | 10.13 | |

| including | 66.3 | 68.1 | 1.8 | 19.74 | |

| which includes | 66.3 | 66.9 | 0.6 | 38.58 | |

| and | 66.9 | 67.5 | 0.6 | 12.69 | |

| TGC-0044 | 36.6 | 39 | 2.4 | 8.87 | |

| including | 36.6 | 37.5 | 0.9 | 16.81 | |

| TGC-0045 | 62.1 | 63 | 0.9 | 33.99 | |

| including | 62.7 | 63 | 0.3 | 100.89 | |

| TGC-0045 | 75 | 75.6 | 0.6 | 5.94 | |

| including | 75 | 75.3 | 0.3 | 9.3 | |

| TGC-0047 | 100.5 | 101.4 | 0.9 | 23.16 | |

| TGC-0047 | 100.5 | 100.8 | 0.3 | 59.63 | |

| TGC-0047 | 102.6 | 107.7 | 5.1 | 1.54 | |

| TGC-0047 | 123.3 | 126 | 2.7 | 21.14 | |

| including | 124.5 | 126 | 1.5 | 37.08 | |

| which includes | 124.5 | 124.8 | 0.3 | 45.88 | |

| and | 124.8 | 125.4 | 0.6 | 67.59 | |

| TGC-0051 | 16.2 | 19.2 | 3 | 10.15 | |

| including | 16.8 | 17.4 | 0.6 | 19.15 | |

| and | 18 | 18.6 | 0.6 | 16.29 | |

| and | 18.6 | 19.2 | 0.6 | 9.57 | |

| TGC-0051 | 49.5 | 52.8 | 3.3 | 19.43 | |

| including | 49.5 | 50.1 | 0.6 | 8.35 | |

| and | 50.1 | 50.7 | 0.6 | 80.87 | |

| and | 51.9 | 52.8 | 0.9 | 8.69 |

Table 2. Highlights of composited drill results in the Zone 5 area. For full results see Table 4 in the appendix.

| Hole ID | From | To | Interval (m) | Au (g/t) | |

| TGC-0049 | 29.4 | 35.1 | 5.7 | 4.07 | |

| including | 30 | 32.1 | 2.1 | 9.15 | |

| which includes | 30.3 | 30.9 | 0.6 | 16.71 | |

| and | 31.2 | 31.8 | 0.6 | 8.88 | |

| TGC-0049 | 43.3 | 45.1 | 1.8 | 7.59 | |

| including | 43.9 | 44.5 | 0.6 | 16.87 | |

| TGC-0050 | 26.7 | 30.9 | 4.2 | 9.39 | |

| including | 27.6 | 30.6 | 3 | 12.78 | |

| which includes | 27.9 | 29.7 | 1.8 | 18 | |

| which includes | 29.4 | 29.7 | 0.3 | 67.3 | |

| TGC-0052 | 40.2 | 40.5 | 0.3 | 78.03 |

About Tuvatu

The Tuvatu Alkaline Gold Project is located on the island of Viti Levu in Fiji. The January 2018 mineral resource for Tuvatu as disclosed in the technical report “Technical Report and Preliminary Economic Assessment for the Tuvatu Gold Project, Republic of Fiji”, dated September 25, 2020, and prepared by Mining Associates Pty Ltd of Brisbane Qld, comprises 1,007,000 tonnes indicated at 8.50 g/t Au (274,600 oz. Au) and 1,325,000 tonnes inferred at 9.0 g/t Au (384,000 oz. Au) at a cut-off grade of 3.0 g/t Au. The technical report is available on the Lion One website at www.liononemetals.com and on the SEDAR website at www.sedar.com.

Qualified Person

In accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), Sergio Cattalani, P.Geo, Senior Vice President Exploration, is the Qualified Person for the Company and has reviewed and is responsible for the technical and scientific content of this news release.

QAQC Procedures

Lion One adheres to rigorous QAQC procedures above and beyond basic regulatory guidelines in conducting its sampling, drilling, testing, and analyses. The Company utilizes its own fleet of diamond drill rigs, using PQ, HQ and NQ sized drill core rods. Drill core is logged and split by Lion One personnel on site. Samples are delivered to and analyzed at the Company’s geochemical and metallurgical laboratory in Fiji. Duplicates of all samples with grades above 0.5 g/t Au are both re-assayed at Lion One’s lab and delivered to ALS Global Laboratories in Australia (ALS) for check assay determinations. All samples for all high-grade intercepts are sent to ALS for check assays. All samples are pulverized to 85% passing through 75 microns. Gold analysis is carried out using fire assay with an AA finish. Samples that have returned grades greater than 10.00 g/t Au are then re-analyzed by gravimetric method. For samples that return greater than 0.50 g/t Au, repeat fire assay runs are carried out and repeated until a result is obtained that is within 10% of the original fire assay run. Lion One’s laboratory can also assay for a range of 71 other elements through Inductively Coupled Plasma Optical Emission Spectrometry (ICP-OES), but currently focuses on a suite of 9 important pathfinder elements. All duplicate anomalous samples are sent to ALS labs in Townsville QLD and are analyzed by the same methods (Au-AA26, and Au-GRA22 where applicable). ALS also analyses 33 pathfinder elements by HF-HNO3-HClO4 acid digestion, HCl leach and ICP-AES (method ME-ICP61).

About Lion One Metals Limited

Lion One’s flagship asset is 100% owned, fully permitted high grade Tuvatu Alkaline Gold Project, located on the island of Viti Levu in Fiji. Lion One envisions a low-cost high-grade underground gold mining operation at Tuvatu coupled with exciting exploration upside inside its tenements covering the entire Navilawa Caldera, an underexplored yet highly prospective 7km diameter alkaline gold system. Lion One’s CEO Walter Berukoff leads an experienced team of explorers and mine builders and has owned or operated over 20 mines in 7 countries. As the founder and former CEO of Miramar Mines, Northern Orion, and La Mancha Resources, Walter is credited with building over $3 billion of value for shareholders.

On behalf of the Board of Directors of Lion One Metals Limited

“Walter Berukoff“, Chairman and CEO

Contact Investor Relations

Toll Free (North America) Tel: 1-855-805-1250

Email: info@liononemetals.com

Website: www.liononemetals.com

Neither the TSX Venture Exchange nor its Regulation Service Provider accepts responsibility for the adequacy or accuracy of this release

This press release may contain statements that may be deemed to be “forward-looking statements” within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “proposed”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Lion One Metals Limited’s current beliefs and is based on information currently available to Lion One Metals Limited and on assumptions Lion One Metals Limited believes are reasonable. These assumptions include, but are not limited to, the actual results of exploration projects being equivalent to or better than estimated results in technical reports, assessment reports, and other geological reports or prior exploration results. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Lion One Metals Limited or its subsidiaries to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the stage development of Lion One Metals Limited, general business, economic, competitive, political and social uncertainties; the actual results of current research and development or operational activities; competition; uncertainty as to patent applications and intellectual property rights; product liability and lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting mining, timing and availability of external financing on acceptable terms; not realizing on the potential benefits of technology; conclusions of economic evaluations; and lack of qualified, skilled labour or loss of key individuals. Although Lion One Metals Limited has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. Lion One Metals Limited does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Appendix 1: Full Drill Results and Collar Information

Table 3. Composited results from grade control drillholes in the URW1 area (grade >0.5 g/t Au)

| Hole ID | From | To | Interval (m) | Au (g/t) | |

| TGC-0039 | 77.4 | 78.3 | 0.9 | 8.37 | |

| TGC-0039 | 86.1 | 87 | 0.9 | 1.1 | |

| TGC-0039 | 101.7 | 102.9 | 1.2 | 7.18 | |

| TGC-0039 | including | 102.3 | 102.6 | 0.3 | 15.64 |

| TGC-0039 | 106.5 | 107.1 | 0.6 | 0.99 | |

| TGC-0039 | 112.5 | 113.1 | 0.6 | 1.09 | |

| TGC-0039 | 117.3 | 117.6 | 0.3 | 5.86 | |

| TGC-0040 | 10.8 | 12.3 | 1.5 | 2.05 | |

| TGC-0040 | 30.3 | 31.5 | 1.2 | 4.7 | |

| TGC-0040 | 49.8 | 50.1 | 0.3 | 0.85 | |

| TGC-0040 | 51.3 | 53.1 | 1.8 | 12.63 | |

| TGC-0040 | including | 51.9 | 52.5 | 0.6 | 27.05 |

| TGC-0040 | 56.1 | 56.7 | 0.6 | 1.44 | |

| TGC-0040 | 65.4 | 69 | 3.6 | 23.1 | |

| TGC-0040 | including | 66 | 66.3 | 0.3 | 85.87 |

| TGC-0040 | and | 67.2 | 67.5 | 0.3 | 125.31 |

| TGC-0040 | and | 68.4 | 68.7 | 0.3 | 13.93 |

| TGC-0040 | and | 68.7 | 69 | 0.3 | 46.89 |

| TGC-0040 | 82.5 | 82.8 | 0.3 | 64.65 | |

| TGC-0040 | 85.5 | 87 | 1.5 | 2.47 | |

| TGC-0040 | 90.9 | 91.2 | 0.3 | 4.66 | |

| TGC-0041 | 16.8 | 19.8 | 3 | 1.52 | |

| TGC-0041 | 51.9 | 52.8 | 0.9 | 0.82 | |

| TGC-0042 | 24 | 25.2 | 1.2 | 0.92 | |

| TGC-0042 | 39 | 39.6 | 0.6 | 1.94 | |

| TGC-0042 | 47.4 | 51 | 3.6 | 3.96 | |

| TGC-0042 | including | 50.7 | 51 | 0.3 | 31.99 |

| TGC-0042 | 52.8 | 54.6 | 1.8 | 11.82 | |

| TGC-0042 | including | 53.7 | 54 | 0.3 | 64.24 |

| TGC-0042 | 56.1 | 57.3 | 1.2 | 2.32 | |

| TGC-0042 | 60 | 63 | 3 | 5.52 | |

| TGC-0042 | including | 61.8 | 63 | 1.2 | 11.1 |

| TGC-0042 | 64.5 | 66.6 | 2.1 | 7.19 | |

| TGC-0042 | including | 64.5 | 65.1 | 0.6 | 17.34 |

| TGC-0042 | 68.5 | 72.4 | 3.9 | 4.46 | |

| TGC-0042 | including | 68.5 | 69.7 | 1.2 | 8.25 |

| TGC-0042 | 73.6 | 95.2 | 21.6 | 7.14 | |

| TGC-0042 | including | 76.3 | 78.1 | 1.8 | 7.47 |

| TGC-0042 | and | 82 | 92.5 | 10.5 | 12.06 |

| TGC-0042 | which includes | 83.2 | 83.5 | 0.3 | 19.99 |

| TGC-0042 | and | 85.9 | 86.2 | 0.3 | 11.88 |

| TGC-0042 | and | 88.6 | 88.9 | 0.3 | 19.92 |

| TGC-0042 | and | 89.5 | 90.1 | 0.6 | 15.26 |

| TGC-0042 | and | 90.4 | 91.9 | 1.5 | 42.05 |

| TGC-0042 | which includes | 90.4 | 91 | 0.6 | 19.98 |

| TGC-0042 | and | 91 | 91.3 | 0.3 | 24.93 |

| TGC-0042 | and | 91.3 | 91.9 | 0.6 | 72.68 |

| TGC-0042 | 97.6 | 99.7 | 2.1 | 0.96 | |

| TGC-0042 | 110.8 | 112.3 | 1.5 | 2.49 | |

| TGC-0042 | 118 | 120.1 | 2.1 | 52.05 | |

| TGC-0042 | including | 118.6 | 119.2 | 0.6 | 177.66 |

| TGC-0042 | which includes | 118.9 | 119.2 | 0.3 | 345.34 |

| TGC-0042 | 122.5 | 122.8 | 0.3 | 0.61 | |

| TGC-0042 | 124 | 124.6 | 0.6 | 2.88 | |

| TGC-0043 | 33.3 | 34.5 | 1.2 | 5.72 | |

| TGC-0043 | including | 33.3 | 33.6 | 0.3 | 9.15 |

| TGC-0043 | 66.3 | 70.2 | 3.9 | 10.13 | |

| TGC-0043 | including | 66.3 | 68.1 | 1.8 | 19.74 |

| TGC-0043 | which includes | 66.3 | 66.9 | 0.6 | 38.58 |

| TGC-0043 | and | 66.9 | 67.5 | 0.6 | 12.69 |

| TGC-0043 | 84 | 85.5 | 1.5 | 1.02 | |

| TGC-0044 | 1.8 | 2.7 | 0.9 | 2.37 | |

| TGC-0044 | 36.6 | 39 | 2.4 | 8.87 | |

| TGC-0044 | including | 36.6 | 37.5 | 0.9 | 16.81 |

| TGC-0044 | 40 | 40.3 | 0.3 | 1.19 | |

| TGC-0044 | 47.6 | 47.9 | 0.3 | 0.57 | |

| TGC-0044 | 64.4 | 65.3 | 0.9 | 1.3 | |

| TGC-0044 | 74 | 74.6 | 0.6 | 1.02 | |

| TGC-0044 | 76.1 | 76.4 | 0.3 | 0.94 | |

| TGC-0044 | 80 | 80.3 | 0.3 | 0.66 | |

| TGC-0045 | 3.3 | 4.5 | 1.2 | 1.48 | |

| TGC-0045 | 39.3 | 39.6 | 0.3 | 1.2 | |

| TGC-0045 | 44.1 | 44.7 | 0.6 | 1.78 | |

| TGC-0045 | 57.9 | 58.8 | 0.9 | 2.74 | |

| TGC-0045 | 62.1 | 63 | 0.9 | 33.99 | |

| TGC-0045 | including | 62.7 | 63 | 0.3 | 100.89 |

| TGC-0045 | 67.8 | 68.7 | 0.9 | 2.47 | |

| TGC-0045 | 75 | 75.6 | 0.6 | 5.94 | |

| TGC-0045 | including | 75 | 75.3 | 0.3 | 9.3 |

| TGC-0045 | 82.5 | 83.1 | 0.6 | 1.09 | |

| TGC-0045 | 86.1 | 88.5 | 2.4 | 1.33 | |

| TGC-0045 | 93.3 | 94.2 | 0.9 | 2.29 | |

| TGC-0045 | 105.6 | 105.9 | 0.3 | 0.87 | |

| TGC-0047 | 4.8 | 5.4 | 0.6 | 2.55 | |

| TGC-0047 | 41.7 | 44.4 | 2.7 | 1.41 | |

| TGC-0047 | 48.6 | 49.2 | 0.6 | 1.12 | |

| TGC-0047 | 53.1 | 54 | 0.9 | 1.83 | |

| TGC-0047 | 61.5 | 61.8 | 0.3 | 0.67 | |

| TGC-0047 | 69.9 | 70.2 | 0.3 | 2.68 | |

| TGC-0047 | 72.3 | 73.8 | 1.5 | 0.94 | |

| TGC-0047 | 77.7 | 78.6 | 0.9 | 2.71 | |

| TGC-0047 | 81 | 81.9 | 0.9 | 1.44 | |

| TGC-0047 | 84.3 | 84.9 | 0.6 | 0.89 | |

| TGC-0047 | 91.5 | 91.8 | 0.3 | 0.56 | |

| TGC-0047 | 96 | 96.6 | 0.6 | 2.8 | |

| TGC-0047 | 98.4 | 98.7 | 0.3 | 0.61 | |

| TGC-0047 | 100.5 | 101.4 | 0.9 | 23.16 | |

| TGC-0047 | 100.5 | 100.8 | 0.3 | 59.63 | |

| TGC-0047 | 102.6 | 107.7 | 5.1 | 1.54 | |

| TGC-0047 | 110.4 | 111 | 0.6 | 1.08 | |

| TGC-0047 | 113.1 | 114.9 | 1.8 | 0.94 | |

| TGC-0047 | 123.3 | 126 | 2.7 | 21.14 | |

| TGC-0047 | including | 124.5 | 126 | 1.5 | 37.08 |

| TGC-0047 | which includes | 124.5 | 124.8 | 0.3 | 45.88 |

| TGC-0047 | and | 124.8 | 125.4 | 0.6 | 67.59 |

| TGC-0047 | 127.2 | 128.4 | 1.2 | 0.99 | |

| TGC-0047 | 131.7 | 132.3 | 0.6 | 0.54 | |

| TGC-0047 | 134.7 | 138.3 | 3.6 | 1.39 | |

| TGC-0047 | 143.7 | 144.3 | 0.6 | 2.44 | |

| TGC-0051 | 16.2 | 19.2 | 3 | 10.15 | |

| TGC-0051 | including | 16.8 | 17.4 | 0.6 | 19.15 |

| TGC-0051 | and | 18 | 18.6 | 0.6 | 16.29 |

| TGC-0051 | and | 18.6 | 19.2 | 0.6 | 9.57 |

| TGC-0051 | 23.7 | 24.3 | 0.6 | 1.77 | |

| TGC-0051 | 49.5 | 52.8 | 3.3 | 19.43 | |

| TGC-0051 | including | 49.5 | 50.1 | 0.6 | 8.35 |

| TGC-0051 | and | 50.1 | 50.7 | 0.6 | 80.87 |

| TGC-0051 | and | 51.9 | 52.8 | 0.9 | 8.69 |

Table 4. Composited results from grade control drillholes in the Zone 5 area (grade >0.5 g/t Au)

| Hole ID | From | To | Interval (m) | Au (g/t) | |

| TGC-0037 | 24.8 | 27.2 | 2.4 | 0.95 | |

| TGC-0037 | 29.6 | 29.9 | 0.3 | 0.57 | |

| TGC-0037 | 30.5 | 30.8 | 0.3 | 0.56 | |

| TGC-0038 | 27.5 | 27.8 | 0.3 | 0.53 | |

| TGC-0038 | 30.5 | 30.8 | 0.3 | 0.61 | |

| TGC-0046 | 21.2 | 21.5 | 0.3 | 3.33 | |

| TGC-0049 | 29.4 | 35.1 | 5.7 | 4.07 | |

| TGC-0049 | including | 30 | 32.1 | 2.1 | 9.15 |

| TGC-0049 | which includes | 30.3 | 30.9 | 0.6 | 16.71 |

| TGC-0049 | and | 31.2 | 31.8 | 0.6 | 8.88 |

| TGC-0049 | 41.5 | 42.1 | 0.6 | 1.77 | |

| TGC-0049 | 43.3 | 45.1 | 1.8 | 7.59 | |

| TGC-0049 | including | 43.9 | 44.5 | 0.6 | 16.87 |

| TGC-0049 | 47.2 | 47.8 | 0.6 | 0.87 | |

| TGC-0050 | 26.7 | 30.9 | 4.2 | 9.39 | |

| TGC-0050 | including | 27.6 | 30.6 | 3 | 12.78 |

| TGC-0050 | which includes | 27.9 | 29.7 | 1.8 | 18 |

| TGC-0050 | which includes | 27.9 | 28.2 | 0.3 | 10.04 |

| TGC-0050 | and | 28.8 | 29.1 | 0.3 | 12.83 |

| TGC-0050 | and | 29.4 | 29.7 | 0.3 | 67.3 |

| TGC-0050 | 34.5 | 35.7 | 1.2 | 0.83 | |

| TGC-0052 | 27.3 | 28.8 | 1.5 | 0.77 | |

| TGC-0052 | 34.5 | 34.8 | 0.3 | 0.67 | |

| TGC-0052 | 40.2 | 40.5 | 0.3 | 78.03 | |

| TGC-0052 | 50.1 | 50.4 | 0.3 | 1.62 |

Table 5. Collar coordinates and dates of completion for grade control drillholes reported in this release. Coordinates are in Fiji map grid.

| Hole ID | Date Completed | Easting | Northing | Elevation | Azimuth | Dip | DEPTH |

| TGC-0037 | 20-Apr-23 | 1876438 | 3920585 | 117 | 82.5 | -0.5 | 55.4 |

| TGC-0038 | 25-Apr-23 | 1876439 | 3920584 | 117 | 95.2 | 0.0 | 50.0 |

| TGC-0039 | 27-Apr-23 | 1876437 | 3920744 | 139 | 294.2 | 8.0 | 120.1 |

| TGC-0040 | 5-Apr-23 | 1876269 | 3920756 | 153 | 92.3 | -13.0 | 92.3 |

| TGC-0041 | 8-Apr-23 | 1876269 | 3920756 | 152 | 92.1 | -24.5 | 101.7 |

| TGC-0042 | 13-Apr-23 | 1876269 | 3920757 | 153 | 90.4 | 0.0 | 155.2 |

| TGC-0043 | 17-Apr-23 | 1876269 | 3920757 | 153 | 87.1 | -13.4 | 95.6 |

| TGC-0044 | 20-Apr-23 | 1876269 | 3920757 | 154 | 81.4 | 20.0 | 86.0 |

| TGC-0045 | 25-Apr-23 | 1876269 | 3920757 | 153 | 76.4 | 5.3 | 122.1 |

| TGC-0046 | 28-Apr-23 | 1876439 | 3920584 | 118 | 95.4 | 13.6 | 61.7 |

| TGC-0047 | 2-May-23 | 1876269 | 3920757 | 154 | 72.4 | 15.4 | 170.7 |

| TGC-0048 | 8-May-23 | 1876437 | 3920744 | 139 | 296.2 | 2.0 | 42.4 |

| TGC-0049 | 4-May-23 | 1876438 | 3920586 | 117 | 66.6 | 0.5 | 89.5 |

| TGC-0050 | 5-May-23 | 1876438 | 3920586 | 118 | 66.5 | 14.2 | 56.5 |

| TGC-0051 | 10-May-23 | 1876269 | 3920757 | 152 | 87.2 | -26.6 | 125.6 |

| TGC-0052 | 8-May-23 | 1876439 | 3920583 | 118 | 121.1 | 20.4 | 61.2 |

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/169899

- Hole APC-53 was drilled from Pad 10 with the aim of stepping out to the northeast at depth along the recently discovered high-grade Contact Zone in the Apollo system. Prior to intercepting the Contact Zone downhole, a new bulk tonnage high-grade, sheeted, precious metal vein system was discovered beginning directly from surface with results as follows:

- Further along drill hole APC-53, the Contact Zone was intersected as planned. A remarkably continuous long zone of high-grade gold-silver-copper mineralization was cut in the hole and included a very high-grade section with assay results below:

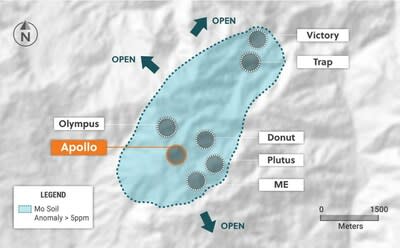

- The Contact Zone along the southeastern edge of the system has now been extended to 370 metres (previously 150 metres) and remains open to the northeast for further expansion. Additional drill holes testing the Contact Zone have been completed with assay results expected in July 2023. Furthermore, hole APC-53, has increased the overall dimensions of the Apollo porphyry system to the northeast (see Figure 1).

- Three additional drill holes intercepted high-grade gold-silver-copper mineralization. Holes APC-50 through APC-52 confirm that shallow high-grade mineralization begins at or near surface from drill Pads 9 and 10. Furthermore, all three holes added volume to the block model at shallow elevations where no prior drilling had taken place with assay results as follows:

Ari Sussman, Executive Chairman commented: “Hole APC-53 is very significant for the Company. Firstly, we have discovered a high-grade and bulk tonnage sheeted vein system located above the Apollo porphyry system. The vein system has potential to be traced over significant distances to both the northwest and to the southeast and if drilling corroborates this potential, the overall footprint of the shallow mineralization at Apollo would expand significantly. Follow up drilling is underway from Pad 10 with hole APC-63 stepping out at a shallow angle further to the northeast.

“Secondly, the thick intercept in APC-53 testing the contact zone cut remarkably high grades and displayed excellent continuity over a long interval. This interval is the second highest grade intercept (grams x metres) ever drilled at the project and has more than doubled the known strike length of the high-grade Contact Zone.

“With drilling now fully transitioned into expansion mode for the Apollo porphyry system and the testing of newly generated targets, we are truly excited to see what other potential may lie ahead.”

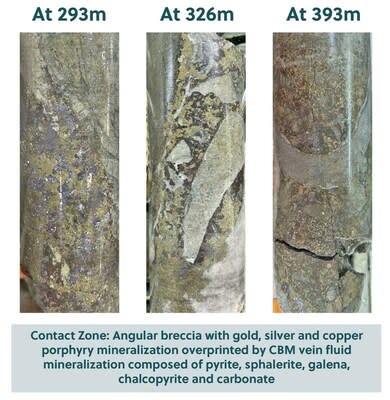

TORONTO, June 13, 2023 /CNW/ – Collective Mining Ltd. (TSXV: CNL) (OTCQX: CNLMF) (“Collective” or the “Company”) is pleased to announce assay results for the first four holes drilled from newly constructed Pads 9 and 10 within the Apollo porphyry system (“Apollo”) at the Guayabales project located in Caldas, Colombia. Apollo is a high-grade, bulk tonnage copper-silver-gold system, which owes its excellent metal endowment to an older copper-silver and gold porphyry system being overprinted by younger precious metal rich, carbonate base metal vein systems (intermediate sulphidation porphyry veins) within a magmatic, hydrothermal inter-mineral breccia and diorite porphyry bodies currently measuring 435 metres x 395 metres x 915 metres and open for expansion.

Details (See Table 1 and Figures 1- 5)

The 2023 Phase II drilling program is advancing on schedule with twenty-two holes completed and results announced. A further seven holes have been drilled and await assay results from the lab. The objectives of the 2023 program are to define high-grade mineralization and the dimensions of the Apollo porphyry system near surface, expand the overall size of the system through step-out and directional drilling and drill test multiple new targets generated through grassroots exploration. Since the announcement of the discovery hole at Apollo in June 2022, a total of 54 drill holes (approximately 22,997 metres) have been completed and announced.

This press release outlines results from four new holes testing the Apollo system. APC-50 and APC-51 were shallow holes drilled from Pad 9 and were designed to test gaps in the current mineralization block model. APC-52 and APC-53 were also drilled into untested areas from Pad 10 with APC-53 designed to step out along the Contact Zone (where the inter-mineral breccia ends at a contact with quartz diorite porphyry and is overprinted by multiple zones of sheeted CBM veins) to the northeast.

APC-50 was the first hole ever drilled from Pad 9 and was completed at a maximum downhole depth of 264.20 metres. The hole was designed to test the eastward extension of the shallow portion of the central high-grade core of the deposit where no drilling had yet to be completed. The hole intercepted angular breccia commencing at 53.30 metres downhole (30 metres vertical) with sulphide mineralization flooding the matrix and consisting of chalcopyrite (up to 1.3%), pyrite (up to 1.5%) and 1% pyrrhotite. The complete assay results for the hole are summarized in Table 1 with highlights as follows:

- 137.70 metres @ 2.60 g/t gold equivalent from 53.30 metres downhole (consisting of 0.74 g/t gold, 52 g/t silver and 0.66% copper) including:

The hole outlines the presence of shallow mineralization with high copper grades and adds volume to the mineralization block model as this area had not previously been drill tested. As expected, a well-defined post mineral dyke was encountered from surface until the start of mineralization.

APC-51 was drilled to the south from Pad 9 and was designed to test the extension of high-grade mineralization at depth within the southern portion of the Apollo system. The hole was drilled steeply to a maximum downhole depth of 435.65 metres and intercepted mineralized breccia from 163.30 metres downhole (160 metres vertical). Sulphides impregnating the breccia matrix consisted of chalcopyrite (up to 1%), pyrite (0.5%-1.5%) and pyrrhotite (1.2%) with assay results as follows:

- 112.55 metres @ 2.26 g/t gold equivalent from 163.30 metres downhole (consisting of 1.27 g/t gold, 22 g/t silver and 0.41% copper) including;

The hole confirms the continuity of the high-grade zone in the south part of the Apollo Porphyry System and again adds volume to the mineralization block model as the area had not been previously drill tested.

APC-52 was the first shallow hole drilled to the west from Pad 10 and was designed to test for shallow mineralization in an untested area of the current mineralization block model. Surprisingly, the hole encountered a robust sheeted vein system directly from surface before transitioning to breccia until a downhole depth of 190.20 metres (160 metres vertical). The intercept begins with iron oxide veinlets and veins within porphyry host rock down to 20 metres followed by disseminated sulphides of pyrite (0.3%-1.0%) and pyrrhotite (0.1%-0.3%) within crackle brecciated quartz diorite associated with strong sericite-chlorite alteration to 56 metres downhole. From 56 metres, typical angular breccia was encountered with high-grade copper-silver-gold mineralization relating to a sulphide matrix of chalcopyrite (0.5%), pyrite (up to 1%) and 0.5% pyrrhotite. Additionally, the hole was overprinted by late stage CBM sheeted vein fluid with sphalerite and galena sulphides in association with carbonate. A zone with a higher percentage of chalcopyrite (+2%) was also encountered downhole from 157 metres to 182.80 metres with overall assay results as follows:

- 190.30 metres @ 2.46 g/t gold equivalent from 1.9 metres downhole (consisting of 1.19 g/t gold, 43 g/t silver and 0.41% copper) including;

APC-53 was drilled from Pad 10 to a final downhole depth of 602.45 metres and was designed to test the high-grade Contact Zone at depth to the northeast of previously announced Contact Zone holes APC-41, APC-42 and APC45 (refer to press releases dated April 25, 2023 and May 30, 2023). Surprisingly, the hole intercepted a robustly enriched zone of north-west and east-west trending overprinting sheeted CBM veins from surface to 145 metres depth. This new discovery is located above the Apollo porphyry system and has potential to be traced in all directions while adhering to a north-west to south-east trend. The mineralization in this new zone relates to sheeted and stockwork carbonate and base metal veinlets and veins with the principal sulphides consisting of sphalerite (0.3%-1%), galena (0.3%-1%), pyrite (0.3%-1.5%) and pyrrhotite (0.2%-0.6%). Further downhole at 232.95 metres depth (225 metres vertical) below this new discovery, the Contact Zone was intercepted over 329.75 metres and consisted of mineralized angular breccia with abundant chalcopyrite (up to 2.5%), pyrite (1%-7%) and 1% pyrrhotite as well as CBM vein system sulphides such as sphalerite (0.2% to 3%) and galena (0.1% to 3%). An extremely high-grade subzone of 56.60 metres was encountered at 277.65 metres downhole with an abundance of CBM vein sulphides flooding the matrix. Assay results for APC-53 are as follows:

- 145.0 metres @ 2.11 g/t gold equivalent commencing from surface in the newly discovered vein system, and

- 329.75 metres @ 3.10 g/t gold equivalent from 233 metres downhole (consisting of 2.30 g/t gold, 42 g/t silver and 0.16% copper) in the Contact Zone including;

APC-53 is an important exploration hole in the context of the Apollo system as it has:

- Expanded the footprint of the shallow mineralization with the discovery of the new outcropping vein system. The vein system is being driven from the porphyry engine at depth and has potential to be extended over significant distances along strike to the northwest above the Apollo porphyry system and to the southeast. Drilling is currently underway to trace the vein system to the northeast and northwest with follow up holes planned shortly to the south of APC-53.

- More than doubled the length of the high-grade Contact Zone, which now measures 370 metres and is open along strike to the northeast. Two additional holes testing the Contact Zone have been completed with a third hole currently being drilled.

- The Contact Zone has the potential to extend to deep vertical depths given its metal endowment is being driven exclusively by a source intrusion. Directional drilling will begin in early Q3 at Apollo and will target the depth extensions of the zone.

- Extended the Apollo porphyry system to the northeast by 35 metres in this location.

Apollo Drill Program

Seven additional holes have been completed at the Apollo system with assay results expected in the near term. All holes intersected bulk tonnage mineralization over significant core lengths.

The Company presently has three diamond drill rigs operating at the Apollo project. A fourth drill rig is expected to be at the project in June 2023 and is going to test new exploration targets identified around Apollo as well as other targets at the Guayabales project.

The Apollo target area, as defined to date by surface mapping, rock sampling and copper and molybdenum soil geochemistry covers a 1,000 metres X 1,200 metres area and represents a large and unusually high-grade copper-silver-gold porphyry system. Mineralization styles include early-stage porphyry veins, inter-mineral breccia mineralization and multiple zones of porphyry related late stage, sheeted, carbonate-base metal veins with high gold and silver grades. The Apollo target area is still expanding as the Company’s geologists have found multiple additional outcrop areas with porphyry veining, breccia, and late stage, sheeted, carbonate base metal veins. (See press release dated April 18, 2023)

Table 1: Assay Results for APC-50, APC-51, APC-52, and APC-53

| Hole # | From (m) | To (m) | Length (m) | Au g/t | Ag g/t | Cu % | Mo % | AuEq g/t* | CuEq %* | ||

| APC-50 | 53.30 | 191.00 | 137.70 | 0.74 | 52 | 0.66 | 0.002 | 2.60 | 1.39 | ||

| incl | 64.95 | 93.50 | 28.55 | 0.87 | 79 | 0.93 | 0.003 | 3.55 | |||

| and incl | 180.70 | 187.70 | 7.00 | 2.74 | 9 | 0.05 | 0.002 | 2.90 | |||

| APC-51 | 163.30 | 275.85 | 112.55 | 1.27 | 22 | 0.41 | 0.002 | 2.26 | 1.20 | ||

| incl | 198.25 | 219.35 | 21.10 | 1.50 | 39 | 0.72 | 0.002 | 3.25 | |||

| and incl | 260.80 | 275.85 | 15.05 | 2.72 | 13 | 0.14 | 0.002 | 3.08 | |||

| APC-52 | 1.90 | 192.20 | 190.30 | 1.19 | 43 | 0.41 | 0.001 | 2.46 | 1.31 | ||

| incl | 56.95 | 91.00 | 34.05 | 4.73 | 26 | 0.12 | 0.001 | 5.16 | |||

| and incl | 157.00 | 182.80 | 25.80 | 0.46 | 138 | 0.75 | 0.002 | 3.76 | |||

| APC-53 | 0 | 145.00 | 145.00 | 1.79 | 22 | 0.03 | 0.001 | 2.11 | |||

| incl | 21.00 | 58.30 | 37.30 | 2.91 | 15 | 0.02 | – | 3.06 | |||

| and incl | 89.40 | 114.80 | 25.40 | 3.03 | 52 | 0.07 | 0.002 | 3.80 | |||

| and incl | 129.00 | 144.40 | 15.40 | 2.96 | 24 | 0.04 | 0.001 | 3.28 | |||

| and | 232.95 | 562.70 | 329.75 | 2.30 | 42 | 0.16 | 0.001 | 3.10 | |||

| Incl | 277.65 | 334.25 | 56.60 | 8.58 | 97 | 0.21 | 0.001 | 10.05 | |||

| 410.70 | 429.80 | 19.10 | 3.08 | 19 | 0.04 | – | 3.32 |

| *AuEq (g/t) is calculated as follows: (Au (g/t) x 0.97) + (Ag g/t x 0.016 x 0.88) + (Cu (%) x 1.87 x 0.90)+ (Mo (%)*11.43 x 0.85) and CuEq (%) is calculated as follows: (Cu (%) x 0.90) + (Au (g/t) x 0.51 x 0.97) + (Ag (g/t) x 0.009 x 0.88)+ (Mo(%)x 6.10 x 0.85) utilizing metal prices of Cu – US$4.10/lb, Ag – $24/oz, Mo – US$25.00/lb and Au – US$1,500/oz and recovery rates of 97% for Au, 88% for Ag, 85% for Mo, and 90% for Cu. Recovery rate assumptions are speculative as limited metallurgical work has been completed to date. A 0.2 g/t AuEq cut-off grade was employed with no more than 15% internal dilution. True widths are unknown, and grades are uncut. |

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, Collective Mining is a copper, silver, and gold exploration company with projects in Caldas, Colombia. The Company has options to acquire 100% interests in two projects located directly within an established mining camp with ten fully permitted and operating mines.

The Company’s flagship project, Guayabales, is anchored by the Apollo target, which hosts the large-scale, bulk-tonnage and high-grade copper-silver-gold Apollo porphyry system. The Company’s near-term objective is to drill the shallow portion of the porphyry system while continuing to expand the overall dimensions of the system and test new targets on the property.

Management, insiders and close family and friends own nearly 45% of the outstanding shares of the Company and as a result, are fully aligned with shareholders. The Company is listed on the TSXV under the trading symbol “CNL” and on the OTCQX under the trading symbol “CNLMF”.

Qualified Person (QP) and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 (“NI 43-101”) and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock, soils, and core samples have been prepared and analyzed at SGS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

Information Contact:

Follow Executive Chairman Ari Sussman (@Ariski73) and Collective Mining (@CollectiveMini1) on Twitter

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements about the drill programs, including timing of results, and Collective’s future and intentions. Wherever possible, words such as “may”, “will”, “should”, “could”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict” or “potential” or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties, and assumptions. Many factors could cause actual results, performance, or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, Collective cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and Collective assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Neither TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

WE SELL PRECIOUS METALS

Physical Delivery

BRINKS Depository Accounts

Precious Metals IRA’sWebsite| www.provenandprobable.com

Call Me |855.505.1900 or email: Maurice@MilesFranklin.com

Precious Metals – https://www.milesfranklin.com/

Ottawa, Ontario–(Newsfile Corp. – June 9, 2023) – Gold79 Mines Ltd. (TSXV: AUU) (OTCQB: AUSVF) (“Gold79” or the “Company”) is pleased to announce the closing of a first tranche of its non-brokered private placement financing, raising gross proceeds of $210,000 through the issuance of 7,000,000 units at $0.03 per unit. Each unit consists of one common share of the Company and one whole common share purchase warrant. A total of 7,000,000 warrants were issued, with each warrant entitling the holder to purchase one common share of the Company at a price of $0.05 per share until June 8, 2025. The warrants are callable after the statutory hold period, at the option of the Company, in the event that the 20-day volume-weighted average price of the Company’s common share meets or exceeds $0.08 for ten consecutive trading days based on trades on the TSX Venture Exchange and Alternative Trading Systems. Subscribers will be notified of the call provision being triggered and will have a 30-day period to exercise the warrants.

Derek Macpherson, President, CEO & Director stated, “We are thankful for the ongoing support of our existing shareholders and Company management and directors who have demonstrated their continuing commitment to the Company by subscribing for a component of the financing. We anticipate a final closing of the placement in a few weeks’ time.”

No finder fees or commissions are payable in connection with this first tranche closing. This private placement is subject to the final approval of the TSX Venture Exchange. All securities issued in the first tranche of the placement are subject to a statutory hold period until October 9, 2023.

Officers and directors of the Company including Derek Macpherson, Gary Thompson and John McNeice participated in the private placement and acquired 4,700,000 units for $141,000. The participation of these insiders in the private placement constitutes a Related Party Transaction within the meaning of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The board of directors of the Company, with Messrs. Macpherson and Thompson abstaining, determined that the transaction is exempt from the formal valuation and minority shareholder approval requirements contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101 for the related party transaction, as neither the fair market value of securities issued to the insiders nor the consideration paid by the insiders exceeded 25 percent of the Company’s market capitalization. The Company did not file a material change report in respect of the transaction 21 days in advance of the closing of the private placement because insider participation had not been confirmed. The shorter period was necessary in order to permit the Company to close the private placement in a timeframe consistent with usual market practice for transactions of this nature.

It is anticipated that approximately 35 percent of the aggregate proceeds raised under the offering will be used for exploration expenditures related to the Gold Chain, Arizona, project; approximately 30 percent will be used for land management costs and property payments; approximately 15 percent will be used to pay management fees to Company officers; and, approximately 20 percent will be used for working capital and general corporate purposes

The securities issued in the private placement will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) and may not be offered or sold within the United States or to or for the account or benefit of U.S. persons, except in certain transactions exempt from the registration requirements of the U.S. Securities Act. This press release does not constitute an offer to sell, or the solicitation of an offer to buy, securities of the Company in the United States.

Early Warning Report

Derek Macpherson of Toronto, Ontario acquired 3,000,000 units through Kanaga Capital Corp. (“Kanaga”) and joint actor Olive Resource Capital Inc. (“Olive”) acquired 2,000,000 units in the private placement. In total, 5,000,000 units at a price of $0.03 per unit were acquired for an aggregate purchase price of $150,000. Each unit consists of one common share and one common share purchase warrant of the Company. Each warrant is exercisable for $0.05 per share until their expiry on June 8, 2025. As noted above, all securities issued to Kanaga and Olive pursuant to the placement are subject to a statutory hold period which expires October 9, 2023.

Immediately prior to the private placement, Mr. Macpherson and joint actors Kanaga and Olive owned 9,854,000 common shares of the Company, representing 5.7% of the then issued and outstanding common shares of the Company. As a result of the private placement, Mr. Macpherson’s and joint actors’ ownership of the issued and outstanding common shares of the Company increased from 5.7% to 8.2% on an undiluted basis. In addition, if Mr. Macpherson and joint actors were to exercise all of their warrants and stock options of the Company, they would own 26,541,500 common shares of the Company, representing 13.8% of the issued and outstanding common shares of the Company on a partially-diluted basis, assuming no further common shares of the Company have been issued.

Mr. Macpherson acquired the securities for investment purposes. Mr. Macpherson may, depending on market and other conditions, increase or decrease his beneficial ownership of the Company’s securities, whether in the open market, by privately negotiated agreements or otherwise, subject to a number of factors, including general market conditions and other available investment and business opportunities.

The disclosure respecting Mr. Macpherson’s shareholdings contained in this press release is made pursuant to National Instrument 62-103 and a copy of the report in respect of the above acquisition will be filed with applicable securities commissions using the Canadian System for Electronic Document Analysis and Retrieval (SEDAR) and will be available on Gold79’s SEDAR profile (www.sedar.com). A copy may be obtained by contacting Gold79 as noted under “Contact” below.

About Gold79 Mines Ltd.

Gold79 Mines Ltd. is a TSX Venture listed company focused on building ounces in the Southwest USA. Gold79 holds 100% earn-in option to purchase agreements on three gold projects: the Jefferson Canyon Gold Project and the Tip Top Gold Project both located in Nevada, USA, and, the Gold Chain Project located in Arizona, USA. In addition, Gold79 holds a 32.3% interest in the Greyhound Project, Nunavut, Canada under JV by Agnico Eagle Mines Limited.

For further information regarding this press release contact:

Derek Macpherson, President & CEO

Phone: 416-294-6713

Email: dm@gold79mines.com

Website: www.gold79mines.com.

Book a 30-minute meeting with our CEO here.

Stay Connected with Us:

Twitter: @Gold79Mines

Facebook: https://www.facebook.com/Gold79Mines

LinkedIn: https://www.linkedin.com/company/gold79-mines-ltd/

FORWARD-LOOKING STATEMENTS:

This press release may contain forward looking statements that are made as of the date hereof and are based on current expectations, forecasts and assumptions which involve risks and uncertainties associated with our business including any future tranches or future private placements, the uncertainty as to whether further exploration will result in the target(s) being delineated as a mineral resource, capital expenditures, operating costs, mineral resources, recovery rates, grades and prices, estimated goals, expansion and growth of the business and operations, plans and references to the Company’s future successes with its business and the economic environment in which the business operates. All such statements are made pursuant to the ‘safe harbour’ provisions of, and are intended to be forward-looking statements under, applicable Canadian securities legislation. Any statements contained herein that are statements of historical facts may be deemed to be forward-looking statements. By their nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties. We caution readers of this news release not to place undue reliance on our forward-looking statements as a number of factors could cause actual results or conditions to differ materially from current expectations. Please refer to the risks set forth in the Company’s most recent annual MD&A and the Company’s continuous disclosure documents that can be found on SEDAR at www.sedar.com. Gold79 does not intend, and disclaims any obligation, except as required by law, to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

NOT FOR RELEASE OR DISTRIBUTION IN THE UNITED STATES OR

FOR DISSEMINATION TO U.S NEWS WIRE SERVICES

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/169349

Vancouver, British Columbia, June 08, 2023 (GLOBE NEWSWIRE) — Terra Balcanica Resources Corp. (“Terra” or the “Company”) (CSE:TERA) has agreed to settle outstanding debt in the amount of CDN$77,923 (the “Debt”) owing to an arm’s length creditor by issuing an aggregate of 916,749 common shares in the capital of the Company (the “Common Shares”) at a price of $0.085 per Common Share (the “Shares for Debt Transaction”). The Board of Directors has determined it is in the best interests of the Company to settle the outstanding Debt by the issuance of the Common Shares in order to preserve the Company’s cash for ongoing operations.

Closing of the Shares for Debt Transaction is subject to customary closing conditions and intends to close as soon as practicable. The Common Shares to be issued pursuant to the Shares for Debt Transaction will be subject to a hold period of four (4) months and one (1) day from the date of issuance.

About the Company

Terra Balcanica is a polymetallic exploration company targeting large-scale mineral systems in the Balkans of southeastern Europe. The Company has 90% interest in the Viogor-Zanik Project in eastern Bosnia and Herzegovina, 100% of the Kaludra and Ceovishte mineral exploration licences in Serbia. The Company emphasizes responsible engagement with local communities and stakeholders. It is committed to proactively implementing Good International Industry Practice (GIIP) and sustainable health, safety and environmental management.

ON BEHALF OF THE BOARD OF DIRECTORS

Terra Balcanica Resources Corp.

Aleksandar (Alex) Mišković

President and CEO

For further information, please contact amiskovic@terrabresources.com, or visit our website at www.terrabresources.com.

Cautionary Statement

This news release contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). The use of any of the words “will”, “intends” and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Such forward-looking statements should not be unduly relied upon. Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors. The Company believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct. The Company does not undertake to update these forward-looking statements, except as required by law.

VANCOUVER, BC / ACCESSWIRE / June 8, 2023 / Metallic Minerals Corp. (TSX.V:MMG)(OTCQB:MMNGF) (“Metallic Minerals” or the “Company”) is pleased to announce that Wolfgang Maier, Ph.D., recognized in both academic and industry circles for his expertise in geoscience and, particularly, magmatic systems has joined the Company as Senior Geological Advisor.

Dr. Maier has 30 years of global experience and, in addition to authoring or co-authoring 144 publications which have received more than 7,000 citations to date, he has been a contributing author or editor of numerous books, monographs, and geological maps. Dr. Maier studied geology at the Ludwig Maximilian University of Munich, Germany and at Rhodes University, South Africa, including doctoral studies on the Bushveld Complex in 1992. He taught igneous petrology and economic geology at the Universities of Pretoria (South Africa), University of Quebec at Chicoutimi (Canada), UWA (Australia), and Oulu (Finland) before joining Cardiff University in 2013, where he is currently a professor with the School of Earth and Environmental Sciences. As part of his academic pursuits, Dr. Maier is keenly interested in increasing the efficiency and sustainability of both exploration and mining.

Dr. Maier commented, “I am very impressed with the potential of Metallic Minerals’ North American projects and excited to contribute to the exceptional teams assembled by the broader Metallic Group of Companies. Getting on the ground at Metallic’s La Plata site and Stillwater Critical Minerals’ Stillwater West project this summer will be an excellent opportunity to connect in person and to study first-hand the compelling geology represented by both these assets.”

Metallic Minerals President, Scott Petsel, stated, “Dr. Maier, brings not only his experience and knowledge to Metallic, but he puts passion and energy into everything he does. From our first encounter, where he made immediate contributions to our understanding of the presence of platinum group elements as part of the mineralization at the La Plata Project, Colorado, I knew he would be a great advisor to our already strong team. We welcome Dr. Maier and look forward to working with him on Metallic Projects as we anticipate announcement of an updated resource estimate at the La Plata Copper-Gold-Silver-PGE project in Colorado, as well as start of 2023 drilling and completion of modelling towards an inaugural resource at the Keno Silver Project in Yukon, Canada.”

Yukon Mining Alliance 2023 Property Tours

Metallic Minerals will once again be participating in the Yukon Mining Alliance Property Tours and Investment Conference in Dawson City on July 19th. Select tour participants will visit Metallic’s Keno Silver Project adjacent to Hecla Mining’s Keno Hill operations on July 17th, as well as our Australia Creek alluvial gold property, currently under lease to Parker Schnabel’s Little Flake Mining as seen on Discovery Channel’s Gold Rush television program. More information about the YMA Property Tours and Conference can be found here. For more information about Metallic’s lease agreement with Little Flake Mining, click here.

About Metallic Minerals

Metallic Minerals Corp. is a leading exploration and development stage company focused on copper, silver, gold and other critical minerals in the La Plata mining district in Colorado, and silver and gold in the high-grade Keno Hill and Klondike districts of the Yukon. Our objective is to create shareholder value through a systematic, entrepreneurial approach to making exploration discoveries, growing resources, and advancing projects toward development.

At the Company’s La Plata project in southwestern Colorado, the 2022 inaugural NI 43-101 mineral resource estimate identified a significant porphyry copper-silver resource containing 889 Mlbs copper and 15 Moz of silver. Results from 2022 expansion drilling intercepted the longest and highest-grade interval ever encountered at La Plata and one of the top intersections for any North American copper project in the past several years. An updated NI 43-101 resource estimate for the La Plata project incorporating these results is expected in Q2 2023. In the 2023 Fraser Institute’s Annual Survey of Mining Companies, Colorado ranked 5th globally for investment attractiveness and 2nd in the USA.

In Canada’s Yukon Territory, Metallic Minerals has consolidated the second-largest land position in the historic high-grade Keno Hill silver district, directly adjacent to Hecla Mining’s operations, with more than 300 Moz of high-grade silver in past production and current M&I resources. Hecla Mining Company, the largest primary silver producer in the USA and third largest in the world, completed the acquisition of Alexco Resources and their Keno Hill operations in September 2022. Hecla is targeting to start production at the Keno Hill operations by Q3 2023. Metallic is anticipating the announcement of inaugural mineral resource estimate at Keno Silver in the second half of 2023.

Metallic Minerals is also one of the largest holders of alluvial gold claims in the Yukon and is building a production royalty business by partnering with experienced mining operators, including Parker Schnabel of Little Flake Mining from the hit television show, Gold Rush, on the Discovery Channel.

All of the districts in which Metallic Minerals operates have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits in the region, as well as having large-scale development, permitting and project financing expertise. The Metallic Minerals team has been recognized for its environmental stewardship practices and is committed to responsible and sustainable resource development.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: www.mmgsilver.com

Phone: 604-629-7800

Toll Free: 1-888-570-4420

Email: cackerman@mmgsilver.com

Forward-Looking Statements

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, statements about expected results of operations, royalties, cash flows, financial position and future dividends as well as financial position, prospects, and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, unsuccessful operations, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration, development of mines and mining operations is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

VANCOUVER, BC / ACCESSWIRE / June 6, 2023 / Irving Resources Inc. (CSE:IRV)(OTCQX:IRVRF) (“Irving” or the “Company“) is pleased to announce high-grade assays from three drilled diamond drill holes recently completed at Omui, part of its 100% controlled Omu Au-Ag Vein Project, Hokkaido, Japan.

New High-Grade Veins Encountered at Nanko:

Hole 22OMI-003, drilled from north to south at an inclination of -60 degrees to test a deep-rooted vertical resistivity anomaly, encountered two high-grade veins. The first, 13.87 gpt Au and 121.74 gpt Ag (15.43 gpt Au Eq) over 1.67m, started at a downhole depth of 378.91m, and the second, 8.49 gpt Au and 270.00 gpt Ag (11.95 gpt Au Eq) over 0.57m started at 490.20m (see table below for a complete summary of significant assays from the Winter 2022/2023 diamond drill campaign). These intercepts, the two deepest yet encountered at the Nanko target, clearly demonstrate that high-grade veins extend in excess of 400m providing very encouraging confirmation that Omui is a deep-rooted vein system. Estimated true width of these veins is estimated at 50-70% of down-hole width.