Author: admin

China: Why is it so Successful?

Granite Creek President & CEO Tim Johnson stated, “We are very pleased with the success of our inaugural drill program on the recently combined Carmacks and Carmacks North project. The opportunity presented by the expansion potential of an already significant resource at Carmacks combined with the discovery potential at Carmacks North has positioned our shareholders with excellent exposure to the burgeoning copper bull market. I cannot thank and compliment our crews enough for their hard work and dedication to the project including the extra steps taken to ensure safety of all concerned in a very trying 2020 exploration season. We look forward to building on these results during an expanded 2021 program and will be relaying our plans to the public as they are finalized and confirmed.”

Timothy Johnson, President & CEO

Telephone: 1 (604) 235-1982

Toll Free: 1 (888) 361-3494

E-mail: info@gcxcopper.com

Website: www.gcxcopper.com

Metallic Group: www.metallicgroup.ca

Press Release

Corporate Presentation

https://youtu.be/rzeWjjffaH0

About EMX. EMX is a precious and base metals royalty company. EMX’s investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company’s common shares are listed on the NYSE American Exchange and the TSX Venture Exchange under the symbol EMX. Please see www.EMXroyalty.com for more information.

For further information contact:

David M. Cole

President and Chief Executive Officer

Phone: (303) 979-6666

Dave@emxroyalty.comScott Close

Director of Investor Relations

Phone: (303) 973-8585

SClose@emxroyalty.comIsabel Belger

Investor Relations (Europe)

Phone: +49 178 4909039

IBelger@EMXroyalty.com

Welcome Back Copper

The price of copper has hit an 8 year high this morning at US$3.78/lb.

Copper is back to levels not seen since 2013, with the current market rally driven by = US stimulus driving economic + lower inventors + inflation expectations.

Source: Bloomberg

Hot Chili’s Costa Fuego copper resource in Chile is the largest copper resource held by an ASX-listed company, outside of the control of a major miner.

Costa Fuego’s resource stands at 2.9Mt of contained copper metal, 2.7Moz gold, 9.9Moz Silver and 64kt molybdenum (3.5Mt CuEq metal).

The Company looks forward to an exciting year of news flow from an aggressive, fully funded, 40,000m drilling programme which aims to establish Costa Fuego as the only Tier-1 copper developer on the ASX.

A strong period of news flow has begun and the Directors look forward to providing regular updates on our multiple activity streams.

Cortadera Copper Project

Cortadera’s maiden Mineral Resource positions Hot Chili with the largest copper Mineral Resource and one of the largest gold Mineral Resources for an ASX-listed emerging company.

The Cortadera maiden Mineral Resource of 451Mt at 0.46% copper equivalent (CuEq) takes the total Mineral Resource estimate for Costa Fuego (Cortadera, Productora & El Fuego) to 724Mt at 0.48% CuEq for 2.9Mt copper, 2.7Moz gold, 9.9Moz Silver and 64kt molybdenum. Cortadera also contains a higher grade component of 104Mt at 0.74% CuEq, and this has strong potential to continue growing rapidly with further drilling.

LinkedIn Website

Hot Chili Limited

Head Office (Perth)

First Floor, 768 Canning Highway,

Applecross, Western Australia 6153P: 08 9315 9009

Chili Limited website. www.HotChili.net.au

Share – Facebook

Tweet – Twitter

Share – LinkedIn

Forward

Press Release

Corporate Presentation

https://youtu.be/JzycCBaEpMg

Millrock President & CEO Gregory Beischer commented, “We are building a great exploration team that will be dedicated to responsibly and effectively exploring the Fairbanks District for gold deposits. While there is a lot of advance work to do, such as the recently completed airborne geophysical survey, discoveries are made with the drill bit. We look forward to getting started on our drilling programs as soon as possible, and Treasure Creek is a great place to start. The prospects we will drill are literally within sight of the great Fort Knox gold mine and we have great indications of gold beneath the Treasure Creek claims.”

FOR FURTHER INFORMATION, PLEASE CONTACT:

Melanee Henderson, Investor Relations

(604) 638-3164

Press Release

Corporate Presentation

https://youtu.be/G-4twSt6v8c

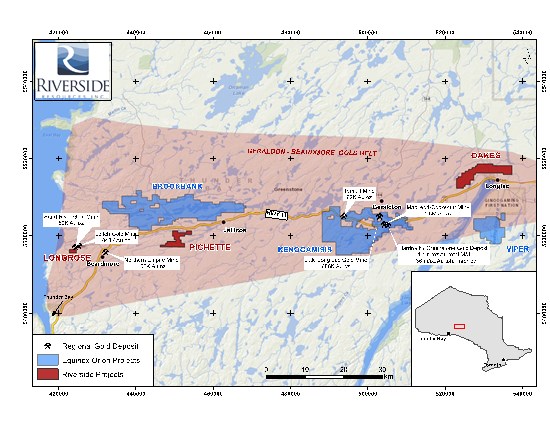

Riverside’s President and CEO, John-Mark Staude: “We are pleased to sell our mineral claims and join these projects with iMetal Resources’ portfolio of Abitibi gold projects toward building a strong collaborative business. Collectively these projects will create an exploration company with tremendous upside for high-grade gold in some of the highly endowed greenstone gold belts of Canada’s top two gold producing provinces. Riverside retains a 2.5% NSR on each property plus a significant share position in the equity of iMetal; collectively giving Riverside shareholders exposure to future project and corporate successes as iMetal moves towards active exploration and drilling programs across this combined portfolio.”

For additional information contact:

John-Mark Staude

President, CEO

Riverside Resources Inc.

info@rivres.com

Phone: (778) 327-6671

Web: www.rivres.com

Raffi Elmajian

Corporate Communications

Riverside Resources Inc.

relmajian@rivres.com

Phone: (778) 327-6671

Web: www.rivres.com

Press Release

Corporate Presentation

https://youtu.be/EV13Ds-AqX4

“There is no shortage of drill ready targets on the East Preston Project. It will be exciting to continue to drill these targets and focus in on the most responsive areas within the identified structural corridors,” said Exploration Manager, Trevor Perkins.

Target corridors at East Preston Uranium Project, Western Athabasca Basin Saskatchewan:

https://skyharbourltd.com/_resources/maps/nr-20210118-figure1.png“We are pleased to continue our exploration drilling at East Preston,” said Alex Klenman, President and CEO of Azincourt. “There have only been a dozen holes drilled so far, it’s still early on in the exploration drill phase. The project contains dozens of high quality, priority targets, and we believe the data generated so far suggests each round of drilling we conduct is getting us closer to discovery. We are on the right path, at a large enough, suitably located land package, situated among large cap uranium companies. There are no doubts that East Preston presents a compelling exploration proposition,” continued Mr. Klenman.

2021 Drill Target areas at the East Preston Uranium Project:

https://www.skyharbourltd.com/_resources/maps/nr-20210209-figure1.pngFor further information contact myself or:

Spencer Coulter

Corporate Development and Communications

Skyharbour Resources Ltd.

Telephone: 604-687-3376

Toll Free: 800-567-8181

Email: info@skyharbourltd.com