Special Thanks: Brian ‘Griz” Testo of www.grizzlydiscoveries.com

Original Source: https://dailyreckoning.com/the-gold-bull-cycle-has-just-begun/

Cycles surround us. In markets, astronomy, and our lives.

Every day is a circadian cycle for us all. Our bodies move through phases based on our exposure to light or darkness.

Markets are also remarkably cyclical, responding to the environment around them. Interest rates, regulation, monetary policy and investor psychology all play important roles.

Precious metals are no different. The sector’s performance ebbs and flows over time.

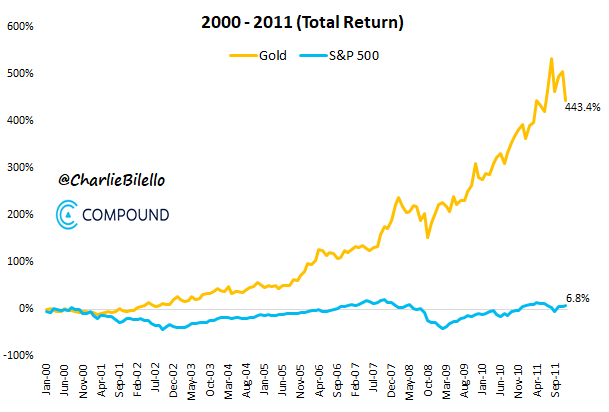

From 2000 to 2011, gold crushed the S&P 500:

Source: Charlie Bilello

An even better example is from 1972 to 1980 when gold returned 1,256% to the S&P 500’s 97%.

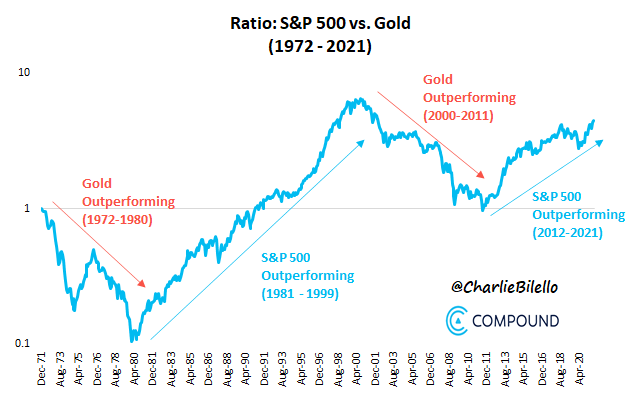

Of course, stocks take their turn in the spotlight too.

From 2012 to 2021, stocks returned 336% vs gold’s 16%. And from 1980 to 1999, stocks were absolutely dominant as gold went dormant for nearly two decades.

Over the past few years, both have done well.

The point here is that it’s a cycle.

Just take a look at the chart below. It shows the ratio of S&P 500 performance vs gold through 2021.

Source: Charlie Bilello

I believe we switched back to precious metals mode at the beginning of this year. And if this is the beginning of a fresh cycle, we may be in for another 7-plus years of precious metals outperforming stocks.

Given the magnitude of what we’re facing, it could go on longer than that.

Catalysts and Causes

Periods where gold outperforms tend to be chaotic.

Past catalysts have included a crash at the end of a major bull market (1971 and 2000), and an inflationary shift in monetary policy (1971 and 2000).

Wars often play a part as well, as they did in the 1970s (Vietnam and others), and the early 2000s (War on Terror). Wars spike deficits and increase the monetary supply. They also drive safe-haven demand from both central banks and investors.

I believe our situation today fits the bill.

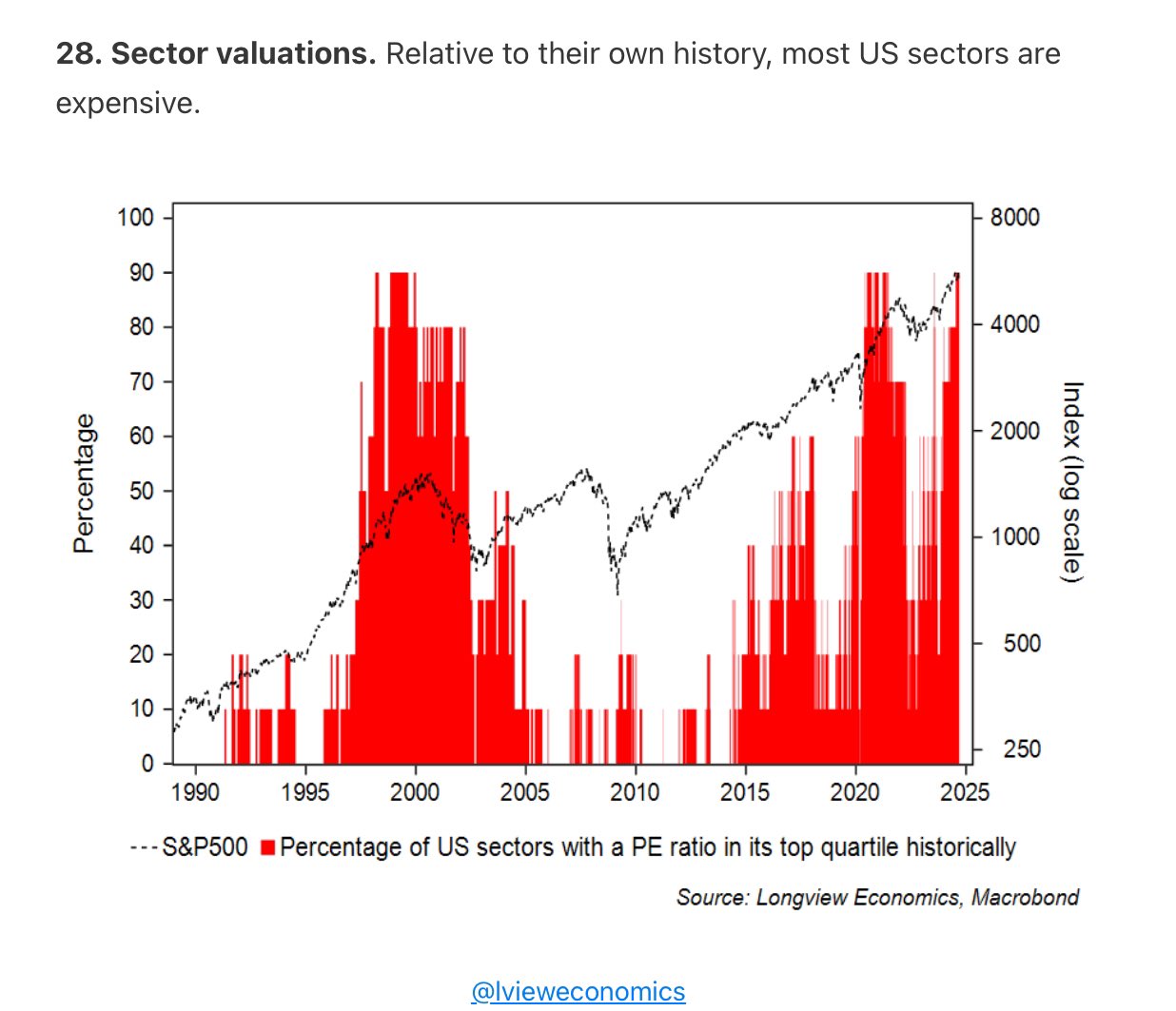

Stocks are still doing well, for now, but markets look expensive. The chart below, from Longview Economics, shows that 90% of U.S. stock sectors are in their top quartile (25%) of historical valuations.

Source: Longview Economics on X

Stocks are richly valued across almost the entire board. This tends to happen near market peaks. And I don’t see any positive catalysts hiding around the corner to drive sustainable real growth.

Of course, the broad bubble in U.S. stocks could go on for longer than we expect, but at this point, I’m more focused on precious metals and even certain foreign markets.

To be clear, I do own U.S. stocks and will continue to.

But during times like these, I lower that exposure and boost my allocation to alternatives, particularly gold and silver.

Macro Looks Bullish for Gold

The U.S. and many other countries are reaching a tipping point with debt. Total global debt just reached $315 trillion, which is 333% of global GDP.

The Federal Reserve just switched into easy-money mode and is likely to fire up formal QE in the near future. China’s central bank just injected massive liquidity to boost its sluggish economy. More countries will follow suit, and global liquidity is poised to surge.

In addition, we have multiple wars and conflicts raging in Yemen, Ukraine, Israel, Iran and beyond. Nascent proxy wars between the US and Russia are quietly breaking out in multiple African countries.

Military spending is booming, with Russia increasing its annual defense spending to 40% of its total budget. And China’s defense spending now rivals the U.S. in terms of purchasing power parity (PPP). Naturally, the U.S. is no slouch in this area and is also ramping up spending and production.

Durable Catalysts

The stage is set for a powerful precious metals bull market cycle. The problems facing the world are not going away anytime soon. Even if all the conflicts end tomorrow, and they won’t, we’re still facing a structural debt problem of unprecedented magnitude.

Further conflict and spending will just add gas to the fire.

For now, markets seem complacent that all is well with the economy. It won’t last forever. If we get a nice pullback in gold and silver here, and we may well, it’ll be an amazing opportunity to stack up. I will continue to buy on pullbacks.

See my previous Daily Reckoning articles here.