- A profitable quarter and more on the horizon

- A strategic joint venture suggests continued success

- Rising interest in diamonds- A hard asset

- Dubai is a buyer of the unpolished stones

- Diamcor Mining (DMIFF) and undervalued OTC stock

A diamond is a solid form of the element carbon, with its atoms arranged in a crystal structure called a diamond cube. Most natural diamonds form over one billion years in the earth’s mantle, between 93 and 155 miles below the surface, and pressure transforms the carbon into stones.

An unpolished diamond is in the stone’s natural state while polishing processes the stone into the jewels that are a “girl’s best friend.” De Beer’s iconic slogan, “A diamond is forever,” dates to 1947 and has become a symbol of love as engagement, wedding, and anniversary jewelry contains the stones. Aside from its use in jewelry, diamonds are critical for industrial cutting and polishing tools. In today’s markets, the case for investing in diamonds has become compelling.

Diamcor Mining Inc (DMIFF) is a Canadian producer with significant ties with the international diamond industry. The company recently reported a profitable quarter, which could lead to a higher stock price over the coming months and years.

A profitable quarter and more on the horizon

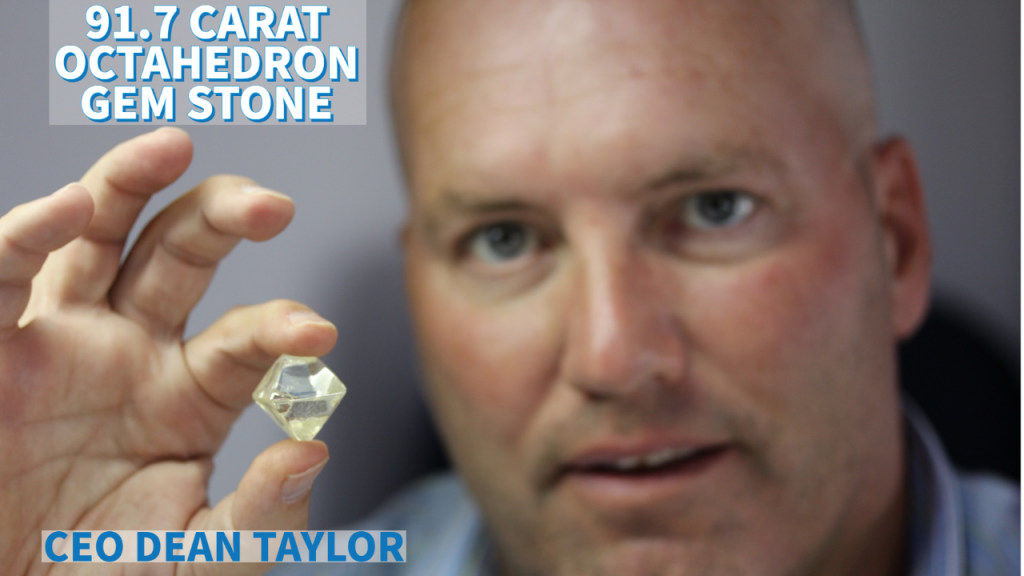

Diamcor Mining, Inc. reported third-quarter results showing growth and profits in late October. Operating results improved quarter-over-quarter with the sale of 3,776.33 carats of rough diamonds, up from 3,061.70 in Q2 2022. Third quarter revenue of around $2.1 million was higher than the $557.6 thousand in Q2.

Meanwhile, the company sales averaged $556.08 per carat in Q3 compared with $182.11 in Q2. The jump in the per-carat price came from selling a 59.35-carat gem quality unique rough diamond to a Middle Eastern investor.

Diamcor’s CEO, Dean Taylor, said, “We are very pleased with the continued quarterly growth achieved again for the period ending September 30, 2022, and remain optimistic given the recent announcement of the delivery of 5,833 carats for the first tender and sale of this quarter (Q4 2022).” The Q4 sale is already 54.5% above the carats sold in Q3 and could result in another profitable quarter when Diamcor reports results in early 2023.

A strategic alliance suggests continued success

Anyone with even slight knowledge of the worldwide diamond business knows two names, Tiffany and De Beers. Tiffany is synonymous with diamonds, and De Beers is the South African mining and marketing giant.

Diamcor has established a long-term strategic alliance and the first right of refusal with Tiffany & Co. Canada, a subsidiary of the parent Tiffany & Co. headquartered in New York. The agreement is for Tiffany to purchase up to 100% of the future production of rough diamonds from the Krone-Endora at Venetia Project at the current prices determined by the parties on an ongoing basis. Tiffany provided Diamcor with financing to advance the project. Moet Hennessy Louis Vuitton (LVMH) is a publicly traded company listed on the Paris Stock Exchange (Euronext) which owns Tiffany & Co.

Meanwhile, the Krone-Endora at Venetia Project comprises approximately 5,888 hectares directly adjacent to De Beer’s flagship Venetia Diamond Mine in South Africa. In February 2011, Diamcor acquired the Krone-Endora at Venetia Project from De Beers Consolidated Mines Limited. In September 2014, the South African Department of Mineral Resources granted a Mining Right for the Krone-Endora at Venetia Project for 657.71 hectares of the Projects total area of 5,888 hectares. Diamcor has applied for additional mining rights for the remaining hectares.

Tiffany is a high-end retail leader in diamonds, and De Beers is a wholesale giant. Diamcor has established a joint venture with the retail leader and is a neighbor of a producing leader.

Rising interest in diamonds- A hard asset

Bain & Company is a US management consulting company headquartered in Boston, Massachusetts. The company provides advice to public, private, and non-profit organizations. In Bain’s report on The Global Diamond Industry 2021-2022, the consulting company said, “A brilliant recovery shapes up.” Some of the report’s highlights include:

- Revenues recovered across the diamond supply chain in 2021, exceeding pre-pandemic levels.

- Profit margins in every segment recovered, including in mining and retail sales.

- Rough diamond sales rebounded by over 60% in 2021, surpassing pre-pandemic levels.

- Rough and polished diamond prices reached the historical average in 2021 but lagged industry peaks.

- Prices for higher-quality polished diamonds outperformed lower-quality diamonds.

- In 2020, rough diamond production declined, falling to 111 million carats. In 2021, output grew to 116 million carats, still 20% below the level in 2019.

- Rough diamond sales grew by 62% in 2021. Strong demand from cutters and polishers caused miners to increase production volumes and release diamonds from inventories.

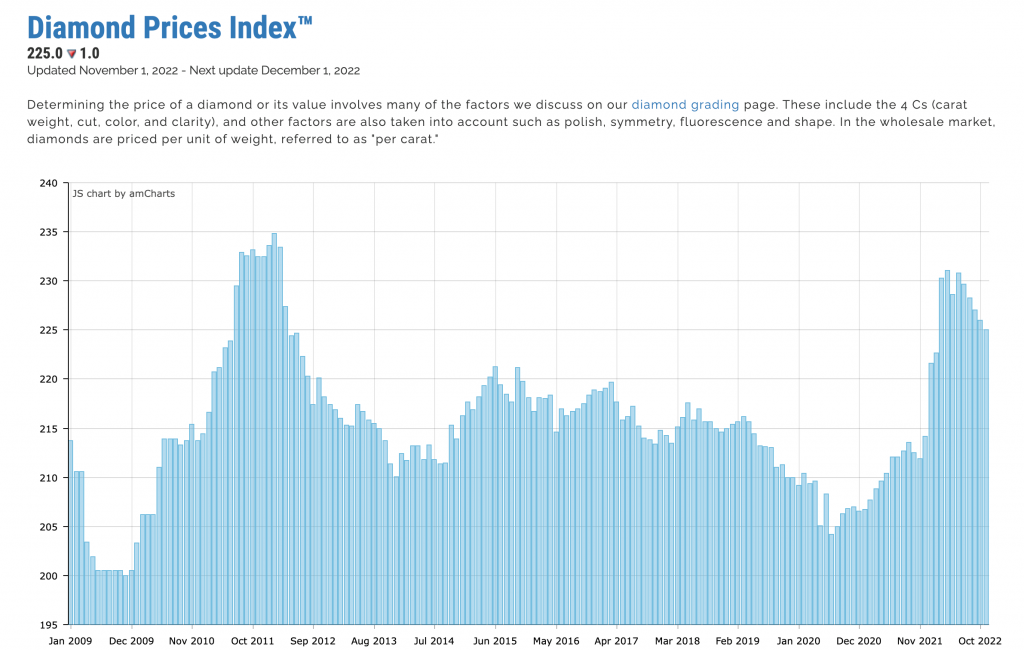

While diamond prices have come down since April 2022, they have remained at the highest since April 2012.

Source: Diamondse.info

The index does not differentiate between the qualities of diamonds, but it presents an overall picture of price trends in the sector.

The following factors have increased interest in diamonds as an investment or keepsake over the past months:

- The leading stock market indices have declined in 2022, leading investors to seek other asset sectors.

- Inflation has been at its highest level since the early 1980s. Diamonds are a hard asset with a long history as a store of value.

- While the US dollar has appreciated against other world currencies, faith in fiat foreign exchange instruments has declined.

- Russia is, by far, the world’s leading producer of diamonds. The war in Ukraine, sanctions on Russia and Moscow’s retaliation against “unfriendly” countries supporting Ukraine have increased supply concerns, improving the outlook for diamond prices.

- Companies like the Diamond Standard Fund are tokenizing, managing, storing, securing diamonds for investors, and have IRA-eligible investment programs.

Markets across all asset classes reflect the geopolitical and economic landscapes. In late 2022, the events and trends continue to favor higher diamond prices, even though they are sitting at the highest price level in a decade.

The Middle East is a buyer of the unpolished stones

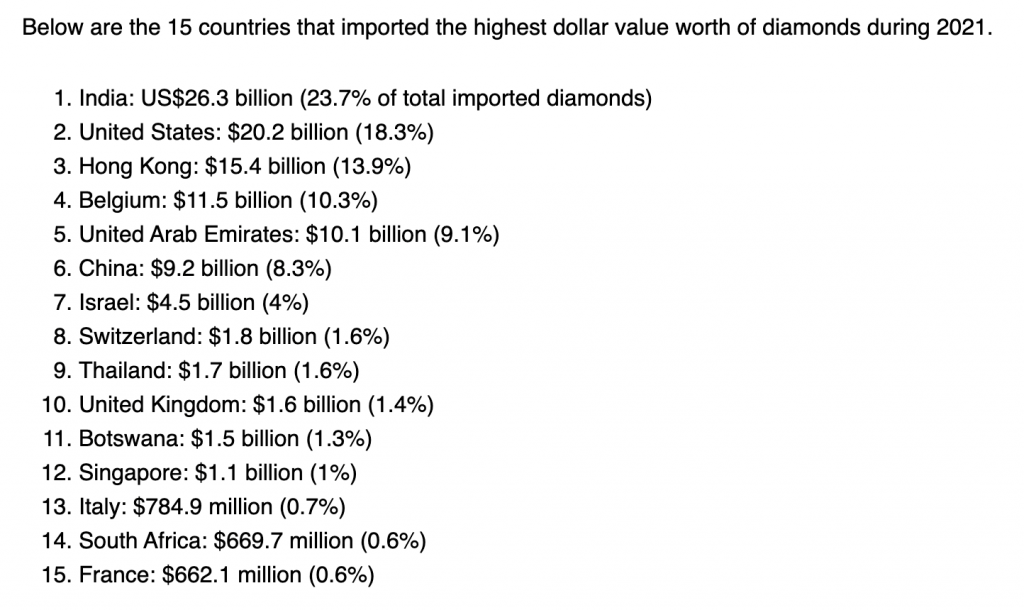

In 2021, the countries that imported the most diamonds were:

Source: Worldsstopexports.com

These fifteen countries imported 96.5% of all diamonds in 2021. The United Arab Emirates was the fifth leading diamond-importing country, and the UAE imported more diamonds than the world’s second-leading economy, China. Diamcor’s recent sale of a 59.35-carat unpolished diamond was to a buyer in Dubai.

The rise in crude oil prices has filled the coffers of Middle Eastern producers with cash. With crude oil prices at the highest level in years, revenues continue to flow to the oil-rich area, providing the funds for diamond and other hard asset purchases.

Diamcor Mining (DMIFF), an undervalued OTC stock

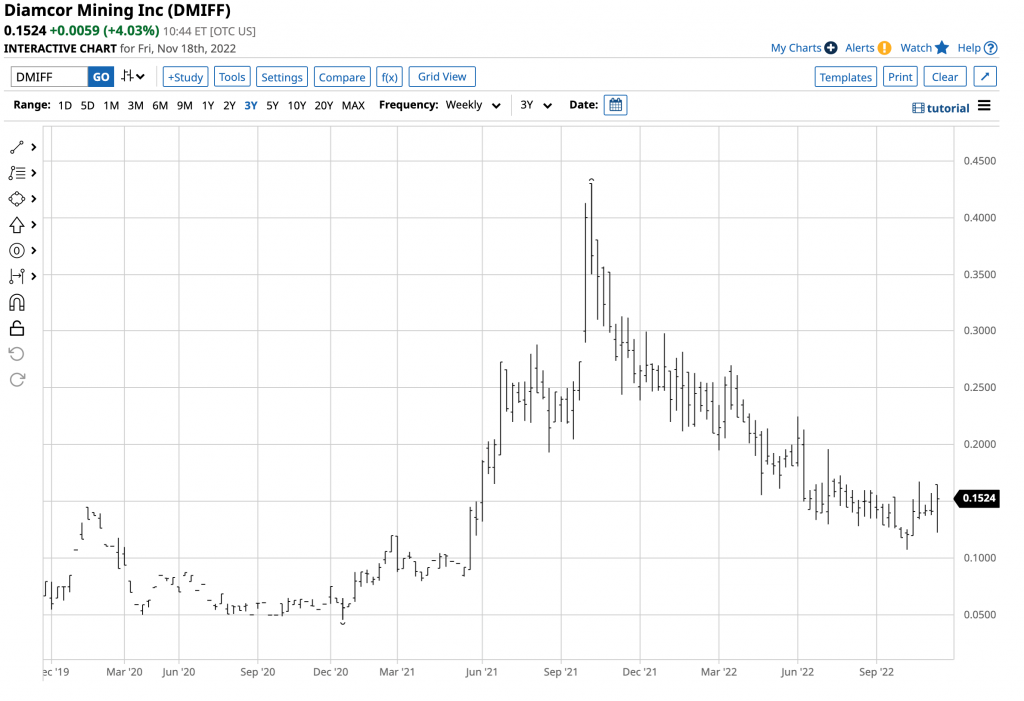

At 15.24 cents per share on November 18, Diamcor Mining shares on the over-the-counter market reflect a $17.711 market cap. An average of 86,040 shares trades daily.

Source: Barchart

The chart highlights DMIFF shares reached a low of 4.60 cents in December 2020 and a high of 43.0 cents in October 2021. In 2022, the shares traded between 10.76 and 29.81 cents. At 15.24 cents, DMIFF shares were below the midpoint of this year’s trading range on November 18.

While DMIFF is a penny stock with associated risks, the following factors favor a rise in the share price over the coming months:

- Diamcor is profitable and its production, and revenues are growing.

- The interest in the diamond market is robust as investors look for hard assets to combat the highest inflationary pressures in decades.

- The war in Ukraine continues to cause supply concerns for the international diamond market.

- The strategic alliance with Tiffany & Co. and mining assets next to De Beers increase Diamcor’s odds of future success.

- Mining companies have not had a positive beta with the overall stock market. Oil, metals, and other mining companies have outperformed the stock market in 2022, a trend that will likely continue.

At 15.24 cents per share, DMIFF could be a diamond in the rough as the company’s recent Q2 report justifies a higher share price.

Written By: Andrew Hecht, on behalf of Maurice Jackson of Proven and Probable.

Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This document does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.