Dr. John-Mark Staude of President and CEO of Riverside Resources (TSX: RRI | OTC: RVSDF) sits down with Maurice Jackson of Proven and Probable to discuss the company’s successes in 2018 and the projected catalyst’s for 2019. Dr. Staude will provide updates on a number of fronts, new exiting opportunities that look into significantly increase shareholder value.

VIDEO

AUDIO

TRANSCRIPT

Original Source: https://www.streetwisereports.com/article/2019/02/19/prospect-generator-plans-to-expand-jurisdictions.html

Source: Maurice Jackson for Streetwise Reports (2/19/19)

John-Mark Staude, president and CEO of Riverside Resources, talks with Maurice Jackson of Proven and Probable about successes in 2018 and the outlook for 2019.

John-Mark Staude, president and CEO of Riverside Resources, talks with Maurice Jackson of Proven and Probable about successes in 2018 and the outlook for 2019.

John-Mark Staude: Thank you, Maurice.

Maurice Jackson: We brought you on today to highlight some of Riverside Resources successes of last year and the company’s outlook for 2019. But before we begin, for first time listeners who is Riverside Resources?

John-Mark Staude: Riverside is a prospect generator. We’ve been working for 12 years, finding projects and finding partners through the prospect generator business. We’ve been able to expose ourselves to great upside while limiting the downside risk.

Maurice Jackson: You referenced that you are a prospect generator. There’s a lot of ambiguity regarding prospect/project generators, therefore speculators often overlook them in their portfolio. What type of competitive advantages does a shareholder have with a project generator over traditional exploration companies?

John-Mark Staude: I think the first thing is you’ve got a tight share structure, key that other people are spending the money. The second is you get a lot of shots, multiple different projects going simultaneously. Third is you don’t have the management teams that have to continually go back and refinance, so they can be focused on discovery for the shareholders. Those three things make prospect generators one of the better ways to invest in mineral exploration.

Maurice Jackson: Let’s revisit 2018 and share some of the successes of Riverside Resources that will serve as catalysts for 2019.

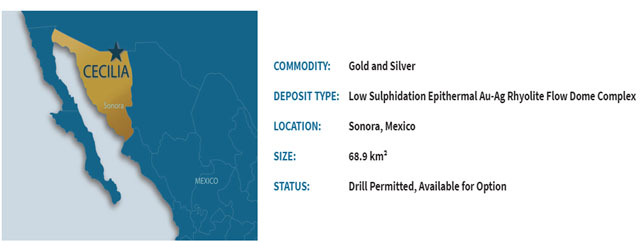

John-Mark Staude: I think the first thing was that we were able to leverage off of our previous work on copper, so that in 2019 we’ll be able to generate new big strategic alliances. I think the second thing was we signed a letter of intent with Sinaloa Resources, and now in 2019 we’ll have the definitive agreement and the go forward drill program. I think a third thing was the work that we did on Cecilia. High-grade gold mineralization, very good geology. Now in 2019 we can see drilling. So we have lots of catalysts in 2019. We’re really excited about this coming year.

Maurice Jackson: Speaking of 2019, let’s discuss the outlook for this year. What is new and what does Riverside Resources have planned this year?

John-Mark Staude: I believe one of the key things is a new strategic alliance. Getting a strategic partner will be awesome, and I think we have that in our sights. I think the second thing will be drilling. We have now got a definitive agreement progressing with Sinaloa Resources, and we’ll have additional new assets added into the portfolio. We’ll also diversify beyond Mexico. We’ve done well in Mexico, but we’ve also been successful previously in porphyry coppers in Canada and large gold systems in Arizona, and I think in 2019 we’ll again see us diversify beyond Mexico to capture great new opportunities.

Maurice Jackson: I want to expand further on the value preposition of Riverside Resources here. Germane to this discussion are the prices of gold, silver and copper. Twofold question. What are some of the catalysts you see that will change these prices, and what type of impact can we expect that this will have on Riverside Resources?

John-Mark Staude: One of the catalysts we see now is some of the uncertainty around trade and some of the uncertainty particularly in the gold price and with this gold price we actually see that has been rising up; that for us is excellent. We have gold assets in the ground, and gold potential to grow. So I think the gold will be a really key way to do this.

Maurice Jackson: Let’s be a little bit more specific for current and prospective shareholders. What type of competitive advantages does Riverside Resources have in the natural resource space included in this discussion with the prices moving?

John-Mark Staude: One of the competitive advantages we have is knowledge. We have knowledge, we have been able to find gold. We’ve been able to find copper. We’ve been successful. We’ve worked in this region and made discoveries that have then been built into mines. That’s a competitive advantage. The second is we’re all running. We’re in the position, we didn’t have to stop during the downturn times. We’ve been able to continually keep the same strong technical people. I know, Maurice, you’ve actually been out to site, other people come out to site. We can really demonstrate out on site the great development and ease to do the work. I think our turnkey ability has been shown by strategic alliances we’ve done in the past, and many projects we’ve been able to turn over. So in 2019, that creates great chance for catalyst rising gold prices, with potentially rising copper prices, with copper demand from electric cars, other copper usage. Riverside’s in an awesomely great position.

Maurice Jackson: Speaking of site visits, yes, I was there in April 2018 at the Cecilia, and I noticed there a lot of the intangibles that don’t show up on the balance sheet. Could you share some of those with us?

John-Mark Staude: I think one of the ones is relationships. When you come out to the site you can see how well we get along with the local people. I think the second is ease of access, you can see that we have the gate keys, we have the ease to get to the projects, paved roads into the area’s infrastructure. It’s so easy to look at a map, but in reality when you go out and see that you can drive on paved roads, when you have power lines, when you have water, when you have all of that stuff. I think the other intangible is our team. When you can see that we have the people in the back of our company that do the work for many other supporting groups, can really do a good work. Riverside has a sought-after team. I think those are in some of the intangibles that really make Riverside unique.

Maurice Jackson: Speaking of your team, a lot of them are seasoned in their tenure. Talk to us about how many years they’ve been with Riverside.

John-Mark Staude: Riverside’s been going 12 years and some of them been going with us ever since the beginning. Many of them have worked with me before Riverside. I used to work at Teck Resources, prior to that at BHP, and even prior to that back in the 1990s at Magma Copper, and some of these individuals that work with me today worked with me back then. We’ve been friends up to 30 years, and we’ve been able to be involved and we therefore we know we have trust, we know what we can count on, and we know we have the skills that deliver excellent projects, and the excellence to trust in what we’re doing.

Maurice Jackson: Speaking of Mexico, there’s a new president. What type of impact do you foresee the new administration having on Riverside Resources?

John-Mark Staude: It’s interesting, we were a bit concerned initially, back when the elections happened, hearing about socialist different movements and things, but really interesting, since December 1st when he’s been elected, it’s actually been pro capitalism, pro-development. There continue to be noises going back and forth about different issues, and they’ll have to get settled out. But we’re actually quite positive about the new president AMLO, and we’re also quite president about his words and efforts that he says towards helping develop favorability towards investments. So, we actually see that this new administration will be able to be a good push for the mining industry. We’re pretty pleased with what’s happening now.

Maurice Jackson: Switching gears slightly, to make the Riverside Resources project portfolio come to fruition, joint venture partners have to be willing to commit to projects. What is their current level of commitment that Riverside Resources is seeing right now?

John-Mark Staude: Right now, the first thing is the really big strategic alliance we have coming. Second is a drill program and funding with Sinaloa Resources. We’ll come up with the news release coming out quickly here as we finalize the definitive agreement, which we’ve not yet finalized, but we’ll get that done, and that’ll actually be a major program. We’ll also find that we have work on the copper, gold and silver assets, and we’re working on spinning out our transaction for one of our other properties. So, we actually see quite a few number of flows of capital coming in, and quite a few catalysts in 2019 due to the partner spending.

Maurice Jackson: You touched on it briefly, how does amalgamation fit into this narrative, and how realistic is the proposition of amalgamation?

John-Mark Staude: So at this point what we’re talking about is actually taking one of our assets into another company. We’ve been working on it now. Two aspects, one is the capital and the other is the other party, the ability and interest to be able to carry it forward. We’re working on that now, and I think it’s fairly realistic to do. It’s not something that we’ve put all of our eggs into, but it would be a great step for Riverside to give our shareholders another set of shares, another strategic way of increasing shareholder value. I think we have the right team on the other side. This will be a really exciting transaction going forward.

Maurice Jackson: John-Mark, what do you see as the biggest challenge for Riverside Resources, and how would you mitigate that situation?

John-Mark Staude: One of the big challenges is getting more partners in Mexico, and the way we’re mitigating it is by doing work again outside of Mexico, and by doing that we have our skills and we have Freeman Smith, our Vice President, Exploration, lives in Vancouver, knows the Canadian portfolios and Canadian assets, and we live in Vancouver, Canada, so it really fits for us to be able to diversify. That diversification really helps our shareholders as well. It helps us being in Mexico, and leveraging off of our knowledge in other places as well, using our skills. We’re in a great position for 2019.

Maurice Jackson: Let’s touch on the capital structure here briefly. John-Mark, Riverside has a proven record of being a good steward of capital. Remind us how many shares outstanding there are, enterprise value, and where does the company stand financially?

John-Mark Staude: Riverside has almost 45 million shares out, after going for 12 years. That’s remarkable. Financially, we have $1.5 million cash, and the market is actually very low right now. So myself, I’m buying more shares. We’re at a low in the market conditions right now, and I think there’s great upside right now. Our enterprise value is only $5 million. Our market cap is $7 million. We’re in a good situation to have a good leverage to the upside now.

Maurice Jackson: Last question. What did I forget to ask?

John-Mark Staude: Well, you always ask great questions. I think one of the other things is what do we actually see in the next news release? I think the next news release for us will be the signing of a deal. Signing of deals is great. Those are the momentum steps that we like. Also, the addition of a new asset. We’re excited by that. So I think we have two new things coming on, short term, that will really make a difference for Riverside.

Maurice Jackson: Dr. Staude, for someone listening that wants to get more information on Riverside Resources, please share the contact details.

John-Mark Staude: We’re at www.rivres.com, or give us a call at (778) 327-6671.

Maurice Jackson: As a reminder, Riverside Resources trades on the TSX, symbol RRI, and on the OTCQB, symbol RVSDF. As reminder, Riverside Resources is a sponsor of Proven and Probable, and we are proud shareholders of Riverside Resources for the virtues conveyed in today’s message. And last but not least, please visit our website, provenandprobable.com, where we deliver mining insights and bullion sales. You may reach us at contact@provenandprobable.com.

Dr. John-Mark Staude of Riverside Resources, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Riverside Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Riverside Resources is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click herefor important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Riverside Resources, a company mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.