Rumble: https://rumble.com/v6zpqwa-blood-in-the-streets-bob-moriartys-platinum-silver-junior-miners.html

Vancouver, British Columbia–(Newsfile Corp. – December 17, 2025) – West Point Gold Corp. (TSXV: WPG) (OTCQB: WPGCF) (FSE: LRA0) (“West Point Gold” or the “Company”) is pleased to announce the results for three holes from the high-grade zone at Northeast (NE) Tyro, part of the ongoing 15,000 metre (m) drill program at its flagship Gold Chain Project in Arizona. The Company is reporting assay results for three drill holes (658m), GC25-82 through GC25-84.

Highlights:

“Drilling at NE Tyro continues to return better than expected grades. Importantly, grades appear to be improving at depth as the veining coalesces, typical of low-sulphidation epithermal gold systems. These results continue to demonstrate continuity of high grades, expanding the high-grade zone to depth and along strike to the northeast. We expect these results to positively impact the grade profile and the overall scale of our upcoming maiden resource. Drilling continues at NE Tyro,” stated Derek Macpherson, President and CEO.

Table 1: Drill Results

| Holes | From (m) | To (m) | Width (m) | Grade (g/t Au) |

| GC25-82 | 138.7 | 234.7 | 96.0 | 0.42 |

| GC25-83 | 158.5 | 175.3 | 16.8 | 8.30 |

| including | 167.6 | 173.7 | 6.1 | 17.61 |

| GC25-84 | 120.4 | 144.8 | 24.4 | 5.92 |

| including | 132.6 | 144.8 | 12.2 | 10.51 |

Note: All widths shown are downhole; true widths are approximately 60-70% of downhole widths.

Figure 1: Plan view of the Main Tyro vein showing geology and drilling conducted in 2021, 2023, 2024 and 2025. Note the location of Hole Nos. GC25-82, GC25-83 and GC25-84.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/278291_2e529fe224e6aaa8_002full.jpg

Figure 2. Longitudinal perspective of the Tyro Main and NE Zones Showing Core and RC Drilling to Date. Holes GC25-82 through GC25-84 are highlighted and described below.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/278291_2e529fe224e6aaa8_003full.jpg

Summary

These results follow the ongoing 15,000 m drilling program at the Company’s Gold Chain project in Arizona, which is focused on expanding the higher-grade zone at NE Tyro laterally and downward, as identified in Q2 of 2025. The three holes comprising this release, GC25-82 through GC25-84, represent 658 m of 3,229 m drilled to date of the 15,000 m program.

All three holes in this release have extended gold mineralization to depth from 50 to 90 metres. These results, in context with previous drilling, suggest a coalescing of veins and veinlets downward and to the northeast with a marked increase in gold grades, i.e. GC25-78 with 22.9 m of 1.56 g/t Au and GC25-84 with 24.4 m of 5.92 g/t Au, including 12.2 m of 10.51 g/t Au (Figure 4). This coalescing of veins and veinlets is common in many epithermal vein systems. Along with the increased gold grades at depth, close inspection of the drill cuttings reveals an increase in varicolored chalcedony, crustiform banding, adularia and illite(?)-pyrite alteration in the wallrock.

Hole GC25-83

Hole GC25-83 traversed the Tyro NE vein/zone about 30 to 50 m below GC25-49 (62.5 m at 4.73 g/t Au), revealing a more defined vein structure with the strongest vein developed at the footwall contact, likely an important fault. The hole intersected 16.8 m of 8.30 g/t Au at 158.5 to 175.3 m, including 6.1 m of 17.61 g/t Au (Figure 3).

Figure 3: Cross-sectional view of Hole GC25-83 down-dip from Holes GC25-49 and GC21-14

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/278291_2e529fe224e6aaa8_004full.jpg

Hole GC25-84

Hole GC25-84 was drilled to test the vein system about 90 m below Hole GC25-78 which traversed 22.9 m of 1. 56 g/t Au (Figure 4). This hole encountered a more discrete, compact mineralized package composed of quartz-calcite-(adularia) vein from 120.4 m to 144.8 m (24.4 m) containing 5.92 g/t Au. Quartz veinlets and breccia give way to vein and breccia toward the footwall contact with 6.1 m at 15.1 g/t Au. Elevated percentages of varicolored chalcedony + adularia appear to correspond to higher gold grades (up to 25.1 g/t Au).

The strengthening or consolidation of the vein at the footwall contact has been observed in other surrounding holes. The results indicate that the mineralized zone has coalesced into a more discrete mineralized package or vein in the relatively short distance of less than 150 metres.

Figure 4: Cross Sectional View of Hole GC25-84 down-dip from Holes GC25-77/-78.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/278291_2e529fe224e6aaa8_005full.jpg

Hole GC25-82

Hole GC25-82 was designed to test the deeper projection of a broad zone of quartz-calcite veinlets observed in Hole GC25-60 (50.3 m @ 1.29 g/t Au) about 65 m deeper into the vein system. A broad zone of veining was encountered from 138.7 m to 234.7 m (96.0 metres) at 0.42 g/t Au (Figure 2). These results, in conjunction with GC25-60, suggest that the Tyro NE zone is horse tailing as it approaches the ‘bend’ where mapping, surface sampling and drilling have identified, but not defined, a ‘stepover’ into the Tyro Main zone. Additional drilling will be needed to better define the extent of this broad, low-grade zone.

Qualified Person

Robert Johansing, M.Sc. Econ. Geol., P. Geo., the Company’s Vice President, Exploration, is a qualified person (“QP”) as defined by NI 43-101 and has reviewed and approved the technical content of this press release. Mr. Johansing has also been responsible for overseeing all phases of the drilling program, including logging, labelling, bagging and transport from the project to American Assay Laboratories of Sparks, Nevada. Drillholes have a diameter of about 10cm, and samples have an approximate weight of 5 to 10kg. Samples were then dried, crushed and split, and pulp samples were prepared for analysis. Gold was determined by fire assay with an ICP finish, and over-limit samples were determined by fire assay and gravimetric finish. Silver plus 15 other elements were determined by Aqua Regia ICP-AES (IM-2A16), and over-limit samples were determined by fire assay and gravimetric finish. Both certified standards and blanks were inserted on site along with duplicates, standards and blanks inserted by American Assay. The results summarized above have been carefully reviewed with reference to the QA/QC results. Standard sample chain of custody procedures were employed during drilling and sampling campaigns until delivery to the analytical facility.

About West Point Gold Corp.

West Point Gold is an exploration and development company focused on unlocking value across four strategically located projects along the prolific Walker Lane Trend in Nevada and Arizona, USA, providing shareholders with exposure to multiple discovery opportunities across one of North America’s most productive gold regions. The Company’s near-term priority is advancing its flagship Gold Chain Project in Arizona.

For further information regarding this press release, please contact:

Aaron Paterson, Corporate Communications Manager

Phone: +1 (778) 358-6173

Email: info@westpointgold.com

Stay Connected with Us:

LinkedIn: linkedin.com/company/west-point-gold

X (Twitter): @westpointgoldUS

Facebook: facebook.com/Westpointgold/

Website: westpointgold.com/

FORWARD-LOOKING STATEMENTS:

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. The use of any of the words “could”, “intend”, “expect”, “believe”, “will”, “projected”, “estimated” and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company’s current belief or assumptions as to the outcome and timing of such future events including, among others, assumptions about future prices of gold, silver, and other metal prices, currency exchange rates and interest rates, timing of the Company’s maiden resource estimate, favourable operating conditions, political stability, obtaining government approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, availability of drill rigs, and anticipated costs and expenditures. The Company cautions that all forward-looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, many of which are beyond the Company’s control. Such factors include, among other things: risks and uncertainties relating to West Point Gold’s ability to complete any payments or expenditures required under the Company’s various option agreements for its projects; and other risks and uncertainties relating to the actual results of current exploration activities, the uncertainties related to resources estimates; the uncertainty of estimates and projections in relation to production, costs and expenses; risks relating to grade and continuity of mineral deposits; the uncertainties involved in interpreting drill results and other exploration data; the potential for delays in exploration or development activities; uncertainty related to the geology, grade and continuity of mineral deposits; the possibility that future exploration, development or mining results may vary from those expected; statements about expected results of operations, royalties, cash flows, financial position may not be consistent with the Company’s expectations due to accidents, equipment breakdowns, title and permitting matters, labour disputes or other unanticipated difficulties with or interruptions in operations, fluctuating metal prices, unanticipated costs and expenses, uncertainties relating to the availability and costs of financing needed in the future and regulatory restrictions, including environmental regulatory restrictions. The possibility that future exploration, development or mining results will not be consistent with adjacent properties and the Company’s expectations; operational risks and hazards inherent with the business of mining (including environmental accidents and hazards, industrial accidents, equipment breakdown, unusual or unexpected geological or structural formations, cave-ins, flooding and severe weather); metal price fluctuations; environmental and regulatory requirements; availability of permits, failure to convert estimated mineral resources to reserves; the inability to complete a feasibility study which recommends a production decision; the preliminary nature of metallurgical test results; fluctuating gold prices; possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, political risks, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks involved in the mineral exploration and development industry, and those risks set out in the filings on SEDAR+ made by the Company with securities regulators. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this corporate press release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, other than as required by applicable securities legislation.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278291

Outstanding Apollo Silver Warrants Expire in July 2026

VANCOUVER, British Columbia, Dec. 18, 2025 (GLOBE NEWSWIRE) — Apollo Silver Corp. (“Apollo Silver” or the “Company”) (TSX.V:APGO, OTCQB:APGOF, Frankfurt:6ZF) is pleased to announce that, through its wholly owned subsidiary, Stronghold Silver USA Corp., the Company has completed all payments required under the Option to Purchase Agreement dated December 21, 2020, as amended January 21, 2023 (the “Athena Agreement”), with Athena Minerals Inc. (the “Optionor”). As a result, the Company now owns 100% interest in thirty-six (36) unpatented lode mining claims comprising part of the Langtry Property, which forms part of the Calico Silver Project, in San Bernardino County, California (the “Athena Claims”).

Under the terms of the Athena Agreement, the Company had the right to acquire the Athena Claims for an aggregate purchase price of US$1,000,000, payable on or before December 21, 2025. An initial payment of US$15,000 was paid upon execution of the Athena Agreement in December 2020, followed by annual payments of US$25,000 on each anniversary date. Between 2021 and 2024, the Company made the required annual payments. In accordance with the Athena Agreement, payments made within the twenty-four months preceding option exercise were credited against the purchase price, resulting in a final cash payment of US$950,000 to vest 100% ownership of the Athena Claims.

Pursuant to the Athena Agreement, the Company has granted Athena a 1% net smelter return (“NSR”) royalty on future mineral production from the Athena Claims. The NSR applies only to those claims that do not already carry an existing royalty of 1% or greater, and in all cases the total royalty burden on any claim will not exceed 2%. The acquisition of the Athena Claims consolidates Apollo Silver’s land position at the Calico Silver Project (“Calico Project”) and represents a significant milestone in advancing the Company’s silver and critical minerals strategy in the region (see Figure 1).

About Calico Silver Project

The Calico Project is one of the largest primary undeveloped silver projects in the United States. With silver designated as a U.S. critical mineral and continued strong industrial demand highlighting the importance of secure domestic supply, large scale U.S. silver assets may become increasingly strategic. The Calico Project Mineral Resource Estimate (“MRE”) comprises an Measured and Indicated Resource of 125 Moz Ag in 55 Mt at an average grade of 71 g/t Ag the Measured and Indicated categories and 58 Moz Ag in 25 Mt at a grade of 71 g/t Ag in the Inferred category (see Apollo Silver news releases dated September 4, 2025, and October 16, 2025).

Qualified Person

The scientific and technical data contained in this news release was reviewed and approved by Isabelle Lépine, M.Sc., P.Geo., Apollo’s Director, Mineral Resources. Ms. Lépine is a registered professional geologist in British Columbia and a QP as defined by NI 43-101 and is not independent of the Company.

Figure 1: Athena Claims

Outstanding Warrants

As of December 18, 2025, the Company had 34,903,440 outstanding share purchase warrants (the “Warrants”), with five (5) Warrants exercisable into one (1) common share of the Company, in accordance with their terms, at an exercise price of $3.95 per share and expiring July 8, 2026. Investors requiring further information regarding the exercise of their Warrants should contact: (i) if the Warrants are held through a brokerage account or other nominee, such broker or nominee; and (ii) if the Warrants are held directly in registered form, the Warrant agent, Endeavor Trust Corporation, by email at admin@endeavortrust.com and following the instructions set forth in the applicable Warrant certificate. Warrant holders should also consult their financial and tax advisors regarding the financial and tax implications applicable to them prior to exercising Warrants.

About Apollo Silver Corp.

Apollo is advancing one of the largest undeveloped primary silver projects in the US. The Calico Project hosts a large, bulk minable silver deposit with significant barite and zinc credits – recognized as critical minerals essential to the US energy and medical sectors. The Company also holds an option on the Cinco de Mayo Project in Chihuahua, Mexico, which is host to a major carbonate replacement (CRD) deposit that is both high-grade and large tonnage. Led by an experienced and award-winning management team, Apollo is well positioned to advance the assets and deliver value through exploration and development.

Please visit www.apollosilver.com for further information.

ON BEHALF OF THE BOARD OF DIRECTORS

Ross McElroy

President and CEO

For further information, please contact:

Email: info@apollosilver.com

Telephone: +1 (604) 428-6128

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the Company’s strategic objectives, the consolidation and advancement of its land position at the Langtry Property, and the exploration and development potential at the Calico Project. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, “potential”, “target”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on the reasonable assumptions, estimates, analysis, and opinions of the management of the Company made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made. Forward-looking information is based on reasonable assumptions that have been made by the Company as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may have caused actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks associated with mineral exploration and development; metal and mineral prices; availability of capital; accuracy of the Company’s projections and estimates; realization of mineral resource estimates, interest and exchange rates; competition; stock price fluctuations; availability of drilling equipment and access; actual results of current exploration activities; government regulation; political or economic developments; environmental risks; insurance risks; capital expenditures; operating or technical difficulties in connection with development activities; personnel relations; and changes in Project parameters as plans continue to be refined. Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to the price of silver, gold and barite; the demand for silver, gold and barite; the ability to carry on exploration and development activities; the timely receipt of any required approvals; the ability to obtain qualified personnel, equipment and services in a timely and cost-efficient manner; the ability to operate in a safe, efficient and effective matter; and the regulatory framework regarding environmental matters, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking information contained herein, except in accordance with applicable securities laws. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and the Company’s plans and objectives and may not be appropriate for other purposes. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

An infographic accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/ddd1cb0a-9601-41f1-a726-5d5f0f3aad08

VANCOUVER, British Columbia, Dec. 15, 2025 (GLOBE NEWSWIRE) — Apollo Silver Corp. (“Apollo” or the “Company”) (TSX.V:APGO, OTCQB:APGOF, Frankfurt:6ZF) is pleased to provide an update on ongoing community engagement activities at its Cinco de Mayo Project (“Cinco de Mayo” or the “Project”) in Chihuahua, Mexico.

Over several months, the Company held productive discussions with elected representatives of the Ejido Benito Juárez (the “Ejido”), Municipio de Buenaventura, and other leaders and community groups in the region. The objective of these discussions was to regain public support for mineral exploration and mine development at Cinco de Mayo, and more specifically, to rescind the property access ban imposed by the Ejido in November 2012 and to establish a long-term access agreement. This agreement is anticipated to provide important economic and community benefits to the Ejido, including annual payments, environmental value, and preferential employment and service opportunities, in exchange for unrestricted access for the Company to explore, develop and potentially mine the resources at Cinco de Mayo.

As part of Apollo’s efforts to introduce a plan of responsible development in cooperation and partnership with the local communities, informational materials are being distributed to members of the Ejido, outlining a plan of long-term collaboration and shared benefits associated with continued exploration and future operations at the Project. This phase of community engagement is expected to continue early into the new year, whereupon the Company remains hopeful for, and looks forward to, a general assembly of the Ejido in early 2026 to vote on rescinding the property access ban and approving a long-term access agreement.

Overview of Key Topics Presented to the Ejido

Long-Term Benefit Framework

The draft framework under discussion includes the following high-level concepts:

Employment, Training, and Local Procurement

The materials emphasize the Company’s commitment to maximizing local participation:

These initiatives are intended to help build sustainable economic opportunities for the region.

Environmental Protection and Water Stewardship

Environmental responsibility remains central to all Project planning. Commitments communicated to the Ejido include:

These commitments apply at every stage of work, from exploration through to eventual operations and closure.

“With a renewed interest in responsible mineral exploration and mine development being promoted at all levels of Mexican government, there is no better time to bring a strong plan of shared economic benefit to the communities around Cinco de Mayo,” stated Ross McElroy, President and CEO. “As one of North America’s better CRD deposits, with a well established history, Cinco de Mayo holds great opportunity for all.”

About Cinco de Mayo

Cinco de Mayo is an approximate 25,000 hectare property located in the north central part of Chihuahua State, Mexico, approximately 190 kilometres northwest of the state capital of Chihuahua City in the Municipio de Buenaventura. The Project is prospective for and hosts carbonate replacement type deposits including the Upper Manto Pb-Zn-Ag (Au) deposit, which consists of two parallel and overlapping manto deposits referred to as the Jose Manto and the Bridge Zone. An independent technical report and Mineral Resource estimate (“MRE”) on the Upper Manto deposit was prepared in 2012 by Rosco Postle and Associates (“RPA”). At a NSR cut-off of US$100/t, Inferred MRE was estimated to total 12.45 million tonnes at 132 grams per tonne silver, 2.86 per cent lead and 6.47 per cent zinc and 0.24 gram per tonne gold (See Apollo’s news release dated March 7, 2025). The total contained metals in the historical resource were 52.7 million ounces of silver, 785 million pounds of lead, 1,777 million pounds of zinc and 96,000 ounces of gold. See cautionary statement below.

A potential new discovery, called the Pegaso Zone was not included in the 2012 Historical MRE. Apollo’s technical team considers this intersection as a high priority target that has potential to be a significant new discovery. The Company’s initial review of historical data suggests that the Pegaso Zone could indicate a larger and higher-grade resource at depth.

Qualified Person

The scientific and technical data contained in this news release was reviewed and approved by Isabelle Lépine, M.Sc., P.Geo., Apollo’s Director, Mineral Resources. Ms. Lépine is a registered professional geologist in British Columbia and a QP as defined by NI 43-101 and is not an independent of the Company

About Apollo Silver Corp.

Apollo is advancing one of the largest undeveloped primary silver projects in the US. The Calico project hosts a large, bulk minable silver deposit with significant barite and zinc credits – recognized as critical minerals essential to the US energy and medical sectors. The Company also holds an option on the Cinco de Mayo Project in Chihuahua, Mexico, which is host to a major carbonate replacement (CRD) deposit that is both high-grade and large tonnage. Led by an experienced and award-winning management team, Apollo is well positioned to advance the assets and deliver value through exploration and development.

Please visit www.apollosilver.com for further information.

ON BEHALF OF THE BOARD OF DIRECTORS

Ross McElroy

President and CEO

For further information, please contact:

Email: info@apollosilver.com

Telephone: +1 (604) 428-6128

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Historical Mineral Resource Estimates

This 2012 historical MRE referenced above is considered historical in nature and the reader is cautioned not to treat this estimate as current Mineral Resources, nor should they be relied upon. They are included here as an indication of the mineralization of the Project. A qualified person has not done sufficient work to classify the historical estimate as a current mineral resource and the Company is not treating the historical estimate as a current mineral resource.

Cautionary Statement Regarding “Forward-Looking” Information

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the rescission of the 2012 access ban; the negotiation terms, value and potential execution of an access agreement with the Ejido; the timing, nature, and results of exploration and development activities at Cinco de Mayo; the exploration potential of the Project, including the potential discovery and significance of the Pegaso Zone; interpretations of historical data; the potential size, grade, continuity, and extent of mineralization, including at depth; potential future mining operations; the expected economic and social benefits to the Ejido and surrounding communities; and the Company’s future plans, strategies, and objectives. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, “potential”, “target”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on the reasonable assumptions, estimates, analysis, and opinions of the management of the Company made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made. Forward-looking information is based on reasonable assumptions that have been made by the Company as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may have caused actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks associated with mineral exploration and development; metal and mineral prices; availability of capital; accuracy of the Company’s projections and estimates; realization of mineral resource estimates, interest and exchange rates; competition; stock price fluctuations; availability of drilling equipment and access; actual results of current exploration activities; government regulation; political or economic developments; environmental risks; insurance risks; capital expenditures; operating or technical difficulties in connection with development activities; personnel relations; and changes in Project parameters as plans continue to be refined. Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to the price of silver, gold and barite; the demand for silver, gold and barite; the ability to carry on exploration and development activities; the timely receipt of any required approvals; the ability to obtain qualified personnel, equipment and services in a timely and cost-efficient manner; the ability to operate in a safe, efficient and effective matter; and the regulatory framework regarding environmental matters, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking information contained herein, except in accordance with applicable securities laws. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and the Company’s plans and objectives and may not be appropriate for other purposes. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Advancing one of the largest undeveloped primary silver assets in the U.S. in a rising silver and critical minerals market.

Vancouver, British Columbia, December 11, 2025 – Apollo Silver Corp. (“Apollo Silver” or the “Company”) (TSX.V:APGO; OTCQB:APGOF; Frankfurt:6ZF) is pleased to announce details of its 2026 Exploration and Project Development Program (the “2026 Program”) at the Company’s Calico Silver Project (“Calico” or the “Project”) located in San Bernardino County, California. The 2026 Program is designed to advance both the exploration potential and project development initiatives at Calico at a time when the silver market sentiment is strengthening and the metal’s recent designation as a U.S. critical mineral is drawing renewed attention to secure domestic supply. As one of the largest undeveloped primary silver assets in the U.S., Calico is well positioned within this evolving landscape.

The 2026 Program advances prospective exploration and project development at Calico in support of longer-term planning for processing, mine design, and permitting. Project development activities will focus on metallurgical studies, geotechnical work, and the initiation of development-stage permitting, and will include a drilling program designed to provide material for geotechnical analysis and metallurgical testing. Planned exploration activities include exploration drilling, property-scale mapping and sampling, and both airborne and ground geophysical surveys.

Highlights of the 2026 Program:

“Our 2026 Program positions Apollo Silver to advance Calico at an opportune moment,” said Ross McElroy, President and CEO of Apollo Silver. “Silver’s addition to the U.S. critical minerals list and the current strength in precious-metal markets highlight the importance of responsibly developing domestic supply. Calico hosts one of the largest undeveloped primary silver deposits in the United States. The exploration program will allow us to evaluate the blue-sky potential of the Project, while the planned metallurgical, geotechnical, and geophysical work will further strengthen our technical understanding and support the next stages of its advancement.”

2026 Project Development Program

The 2026 project development program at Waterloo includes a 4,500 m HQ diameter core drill program aimed at obtaining sufficient material and data for on-going geotechnical and metallurgical analysis, and the initiation of development level permitting activities. The permitting activities will begin in 2026 and will form the foundational start of a long-term permitting process, which is designed to keep the regulatory progress aligned with technical advancement.

Core Drilling – Waterloo (Geotechnical & Metallurgical)

A 4,500 m HQ diameter core drilling program is scheduled to begin in mid-Q1 and continue through Q2 2026. Drill core will be used for:

Metallurgical Studies

Metallurgical test work will continue throughout 2026 and will focus on:

Underground Volume Survey

Calico is host to numerous historic small-scale, high-grade vein hosted mining operations that were active from ~1880 to 1894, some in close proximity to the Waterloo and Langtry deposits. A LiDAR survey of historical underground drifts and tunnels at Waterloo is planned for Q4 2026 to enhance the knowledge of precise location and scale of historic workings with respect to the current day deposits. This information should provide important data to assist with improved resource classification, as well as provide critical information for future mine development.

2026 Exploration Program

The 2026 exploration program at Calico includes core drilling, geological mapping, ground gravity and IP surveys, and airborne magnetics geophysical surveys, all designed to map geological features and interpret controls of mineralization at both a deposit and property scale across the Waterloo and Mule properties. Results will be used to assist in generating future drill targets.

Exploration Drilling

The Company plans to complete 1,000 m of NQ diameter core drilling to test the Burcham gold target located on the east side of Waterloo, in the area of the historical Burcham Mine. The work is scheduled for Q1–Q2 2026 and is designed to evaluate the potential for expansion of the existing gold resource.

Geological Mapping

Geological mapping will continue throughout 2026, and work will include:

Geophysics

A multi-method geophysical program is planned for Q1, Q2 and Q4 2026. Surveys will include both airborne and ground surveys which will assist to resolve the subsurface interpretations and potentially help define and prioritize targets for future drilling. Activities will include:

Laboratory Analysis

Petrographic studies and soil/rock assays will run through Q1 to Q3 2026 which will support geological mapping and aid in drill target refinement.

Qualified Person

The scientific and technical data contained in this news release was reviewed and approved by Isabelle Lépine, M.Sc., P.Geo., Apollo Silver’s Director, Mineral Resources. Ms. Lépine is a registered professional geologist in British Columbia and a QP as defined by NI 43-101 and is not independent of the Company.

About Apollo Silver Corp.

Apollo Silver is advancing one of the largest undeveloped primary silver projects in the US. The Calico project hosts a large, bulk minable silver deposit with significant barite and zinc credits – recognized as critical minerals essential to the US energy and medical sectors. The Company also holds an option on the Cinco de Mayo Project in Chihuahua, Mexico, which is host to a major carbonate replacement (CRD) deposit that is both high-grade and large tonnage. Led by an experienced and award-winning management team, Apollo is well positioned to advance the assets and deliver value through exploration and development.

Please visit www.apollosilver.com for further information.

ON BEHALF OF THE BOARD OF DIRECTORS

Ross McElroy

President and CEO

For further information, please contact:

Email: info@apollosilver.com

Telephone: +1 (604) 428-6128

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements regarding the scope, timing, and expected results of the 2026 exploration and project development program; planned drilling, mapping, sampling, geophysical surveys, metallurgical test work, geotechnical studies, and permitting activities; potential improvements to silver recoveries; the potential to expand the gold resource at Waterloo; and the anticipated benefits of the planned work programs. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “anticipate”, “believe”, “plan”, “estimate”, “expect”, “potential”, “target”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on the reasonable assumptions, estimates, analysis, and opinions of the management of the Company made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made. Forward-looking information is based on reasonable assumptions that have been made by the Company as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may have caused actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks associated with mineral exploration and development; metal and mineral prices; availability of capital; accuracy of the Company’s projections and estimates; realization of mineral resource estimates, interest and exchange rates; competition; stock price fluctuations; availability of drilling equipment and access; actual results of current exploration activities; government regulation; political or economic developments; environmental risks; insurance risks; capital expenditures; operating or technical difficulties in connection with development activities; personnel relations; and changes in Project parameters as plans continue to be refined. Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to the price of silver, gold and barite; the demand for silver, gold and barite; the ability to carry on exploration and development activities; the timely receipt of any required approvals; the ability to obtain qualified personnel, equipment and services in a timely and cost-efficient manner; the ability to operate in a safe, efficient and effective matter; and the regulatory framework regarding environmental matters, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking information contained herein, except in accordance with applicable securities laws. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and the Company’s plans and objectives and may not be appropriate for other purposes. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Central banks have crossed a symbolic line: their combined gold reserves now exceed their U.S. Treasury holdings for the first time in nearly three decades.

The crossover underscores a gradual diversification away from dollar-denominated securities and toward hard assets.

This visualization tracks how these shares have evolved from the 1970s to today. The data comes from Crescat Capital macro strategist Tavi Costa.

After the end of Bretton Woods, soaring real interest rates and the rise of the petrodollar steered reserve managers toward U.S. Treasuries through the 1980s and 1990s.

In the 2000s, the dollar’s depth and liquidity reinforced that preference. Since 2022, however, heavy official gold buying has picked up again — 1,136 tonnes in 2022, a record — with 2023 and 2024 maintaining historically strong accumulation. The trend is even more striking considering that nearly one-fifth of all the gold ever mined is now held by central banks.

| Date | Foreign Central Banks’ Gold Holdings As a % International Reserves | Foreign Central Banks’ U.S. Treasuries Holdings As a % International Reserves |

|---|---|---|

| 1/30/1970 | 48% | 13% |

| 1/29/1971 | 43% | 23% |

| 1/31/1972 | 36% | 32% |

| 1/31/1973 | 39% | 31% |

| 1/31/1974 | 50% | 17% |

| 1/31/1975 | 50% | 15% |

| 1/30/1976 | 44% | 18% |

| 1/31/1977 | 41% | 20% |

| 1/31/1978 | 41% | 23% |

| 1/31/1979 | 44% | 18% |

| 6/30/2025 | 24% | 23% |

‹12345…34›

As political uncertainty and geopolitical risks continue to fuel safe-haven demand, this purchasing momentum has also lifted prices: gold surpassed $4,000 an ounce for the first time ever in October 2025.

Crossing above Treasuries signals that reserve managers are prioritizing durability, portability, and neutrality over yield.

According to the IMF, gold’s share of global reserves climbed to about 18% in 2024, up sharply from mid-2010s levels, reflecting a structural reweighting toward tangible assets.

Seen as an alternative to heavily indebted fiat currencies, especially the U.S. dollar, the share of gold in central bank reserves has increased most among emerging market economies. China, Russia, and Türkiye have been the largest official buyers over the past decade.

Website: https://www.grizzlydiscoveries.com/

Email: info@grizzlydiscoveries.com

Phone: 780-712-3559

Click Image to view file:

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Today, gold prices sit roughly 40% above their previous inflation-adjusted peak seen in 1980.

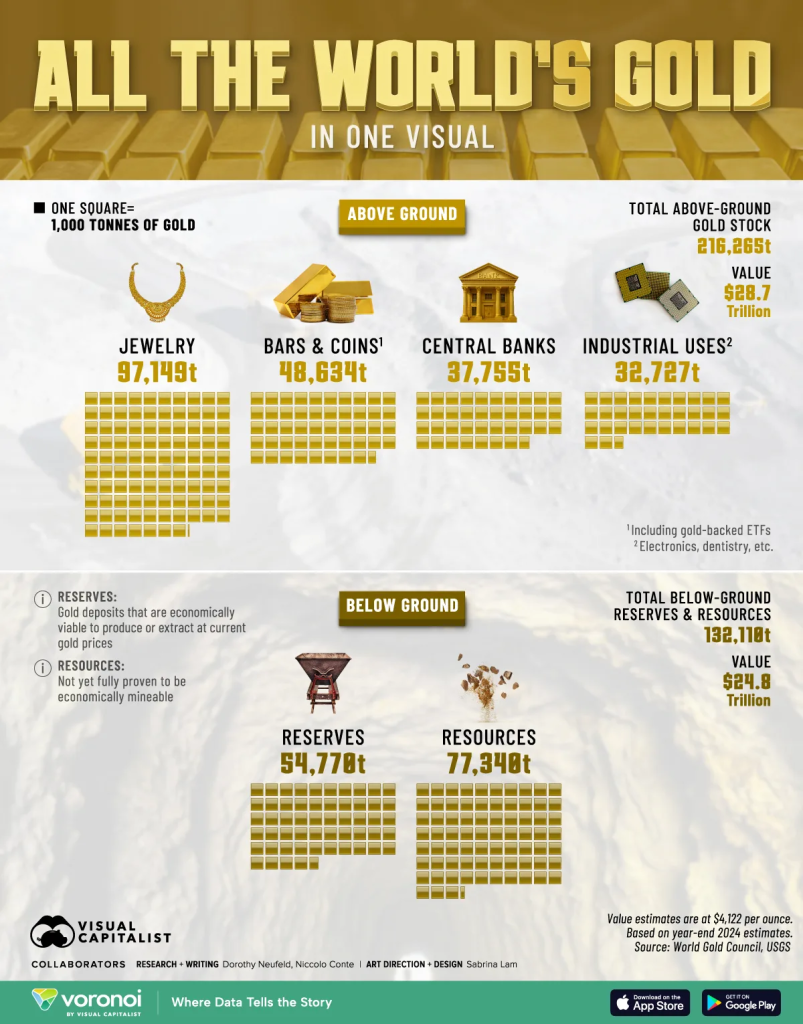

Despite tumbling 54% from the October 20th high of $4,380, gold remains at historically elevated levels, as investors rely on the metal as a reliable store of value. In total, the world’s above-ground gold stock would fit into a cube approximately 22.3 meters tall (73 feet).

This graphic shows the global supply of gold as of year-end 2024, based on data from the World Gold Council.

Below, we show all the world’s gold, covering both above and below-ground stock:

| Category | Tonnes of Gold (t) |

|---|---|

| Jewelry | 97,149 |

| Bars and coins (including gold backed ETFs) | 48,634 |

| Central banks | 37,755 |

| Industrial uses (electronics, dentistry, etc.) | 32,727 |

| Reserves | 54,770 |

| Resources | 77,340 |

Jewelry is the largest category of above-ground gold, at 97,149 tonnes.

Last year, India was the largest buyer of gold jewelry globally, with 560 tonnes in purchases. China ranked second, with 510 tonnes. Across the region, gold is deeply intertwined with major life events such as weddings and cultural traditions.

Bars, coins, and gold-backed ETFs make up 48,634 tonnes of gold, exceeding central bank holdings (37,755 tonnes) by a substantial margin. Overall, the U.S., Germany, and Italy held the most gold in their central bank reserves as of year-end 2024.

Meanwhile, industrial uses such as electronics and dentistry make up 32,727 tonnes. Many semiconductor chips, for instance, use gold for coating or bonding wires thanks to its conductivity.

Source: https://www.visualcapitalist.com/all-of-the-worlds-gold-in-one-visual/

Vancouver, British Columbia–(Newsfile Corp. – December 4, 2025) – Elemental Royalty Corporation (TSXV: ELE) (NASDAQ: ELE) (“Elemental” or the “Company”) is pleased to announce that Bronco Creek Exploration Inc. (“BCE“), a wholly owned subsidiary of Elemental, has executed an option agreement (the “Agreement”) with First Quantum Minerals Limited (“First Quantum“), an Ontario, Canada, corporation (TSX: FM) for the Hachita project (the “Project“) in order to explore for porphyry copper-gold style mineralization in southwestern New Mexico, U.S.

The Agreement provides Elemental with an execution payment, staged option payments, and required work commitments on the Project during the earn-in period. Additionally, upon earn-in for the Project, Elemental will receive a 3% net smelter return (“NSR“) royalty interest, annual advanced royalty (“AAR“) and milestone payments, providing the Company with a strong foundation for future upside as the Project advances.

Highlights

The Project was acquired by staking of open ground after recognizing untested targets in the underexplored Sylvanite District during regional generative exploration efforts in the Laramide belt of southwestern U.S. The agreement serves as another example of generating compelling district-scale opportunities and organically growing the company’s royalty portfolio through its royalty generation efforts and technical expertise.

Commercial Terms Overview

Under the terms of the Agreements, First Quantum can earn 100% interest in the Project by providing: a) an execution payment totaling US$50,000, b) option payments totaling US$750,000, and c) cumulative exploration expenditures of US$6,000,000 over the five-year term of the option agreement.

Upon option exercise by First Quantum, Elemental will retain a 3% net smelter royalty on the Project; 1% of the royalty may be bought back for a total of US$5,000,000 on or before the fifth anniversary of a published resource. First Quantum will make Advanced Annual Royalty payments to Elemental of US$100,000 upon each anniversary of the closing date until the completion of either a Feasibility Study or a Development Decision. In addition, First Quantum will make Project milestone payments consisting of: a) US$500,000 upon completion of a Feasibility Study, and b) US$2,500,000 upon a development decision.

David M. Cole, Chief Executive Officer of Elemental, commented: “This transaction on the Hachita Project represents another excellent example of Elemental’s impressive technical expertise in identifying prospective targets in underexplored jurisdictions and thereby attracting world-class exploration partners. We look forward to working with First Quantum to advance Hachita and seeing the project progress further through a formal exploration campaign. Project generation remains a core tenet of our business model as we continue to build our portfolio of royalty interests.”

Hachita Project Overview

Hachita is located approximately 95 km SE of Lordsburg, New Mexico, in the Sylvanite Mining District. The Hachita project targets Laramide porphyry copper-gold and skarn mineralization in an underexplored district in the eastern portion of the Laramide Porphyry Belt. Multiple square kilometer overlapping alteration zones, robust geochemical anomalies, and coincident geophysical responses indicate the potential for two distinct targets on the Project: a porphyry copper-gold system at the Western Target and a copper-gold skarn system at the Copper Dick Extension (“CDE”) Target.

The Western Target is a porphyry copper-gold system exposed at surface with widespread sericite-pyrite alteration, locally abundant quartz veins, and copper oxide mineralization. Complex porphyry-style alteration zonation is exposed over a two by three square kilometer area, indicative of large-scale hydrothermal system. The system is faulted and rotated by post-mineral normal faults. The observations to-date are consistent with the shallower, upper pyrite halo portion of the porphyry system preserved in the northwest with portions of the deeper parts of the system outcropping to the southeast. The proximal, higher temperature and potentially higher-grade core of the system representing the primary target here has yet to be found. Airborne drone magnetics delineated a magnetic low which correlates well with the outcropping sericite-pyrite alteration zone. Additionally, historical induced polarization (“IP“) data displays a strong chargeability response within the target area, which may represent increasing sulfide content at depth.

The Copper Dick Extension Target is a copper-gold bearing garnet-pyroxene skarn target exposed at surface near the historical Copper Dick Mine. Mineralization at the mine is truncated to the north by a post-mineral normal fault, indicating the skarn mineralization and the Cretaceous carbonate host rocks that serve as an ideal host may be preserved at depth in the hanging wall. Historical IP data support this interpretation; a strong chargeability response over the Copper Dick Extension Target may represent the presence of sulfide mineralization at depth.

This transaction is an example of the execution of the royalty generation business model in providing turn-key and drill ready exploration projects to partner companies in exchange for royalty interests and pre-production cash flow.

David M. Cole

CEO and Director

For more information, please contact:

| David M. Cole | info@elementalroyalty.com |

| CEO | |

| Tara Vivian-Neal | info@elementalroyalty.com |

| Investor Relations |

TSXV: ELE | NASDAQ: ELE | ISIN: CA28619K1093 | CUSIP: 28619K109

About Elemental Royalty Corporation.

Elemental is a new mid-tier, gold-focused streaming and royalty company with a globally diversified portfolio of 16 producing assets and more than 200 royalties, anchored by cornerstone assets and operated by world-class mining partners. Formed through the merger of Elemental Altus and EMX, the Company combines Elemental Altus’s track record of accretive royalty acquisitions with EMX’s strengths in royalty generation and disciplined growth. This complementary strategy delivers both immediate cash flow and long-term value creation, supported by a best-in-class asset base, diversified production, and sector-leading management expertise.

Elemental Royalty trades on the TSX Venture Exchange and the Nasdaq under the ticker “ELE”.

Neither the TSX-V nor its Regulation Service Provider (as that term is defined in the policies of the TSX-V.) accepts responsibility for the adequacy or accuracy of this press release.

Qualified Person

Michael P. Sheehan, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

Cautionary note regarding forward-looking statements

This news release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology.

Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties and contingencies.

Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Elemental Royalty to control or predict, that may cause Elemental Royalty’ actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: the impact of general business and economic conditions, the absence of control over the mining operations from which Elemental Royalty will receive royalties, risks related to international operations, government relations and environmental regulation, the inherent risks involved in the exploration and development of mineral properties; the uncertainties involved in interpreting exploration data; the potential for delays in exploration or development activities; the geology, grade and continuity of mineral deposits; the possibility that future exploration, development or mining results will not be consistent with Elemental Royalty’ expectations; accidents, equipment breakdowns, title matters, labour disputes or other unanticipated difficulties or interruptions in operations; fluctuating metal prices; unanticipated costs and expenses; uncertainties relating to the availability and costs of financing needed in the future; the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations; currency fluctuations; regulatory restrictions, including environmental regulatory restrictions; liability, competition, loss of key employees and other related risks and uncertainties. For a discussion of important factors which could cause actual results to differ from forward-looking statements, refer to the annual information form of Elemental Altus for the year ended December 31, 2024. Elemental Altus undertakes no obligation to update forward-looking statements and information except as required by applicable law. Such forward-looking statements and information represent management’s best judgment based on information currently available. No forward-looking statement or information can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276952