- Significantly Expands Footprint at AM-13

- Discovers new Manto-Style Target: AM-15

- Approval of US $4.8M Fully Funded 2025 Budget

Vancouver, British Columbia–(Newsfile Corp. – February 25, 2025) – MAX RESOURCE CORP. (TSXV: MAX) (OTC Pink: MXROF) (FSE: M1D2) (“Max” or the “Company”) is pleased to announce assay results from composite channel samples and expansion of the exploration target footprint at AM-13 to 1,500 by 100 metres. In addition, Max reports the discovery of a new Manto-style target, AM-15 and the approval of a fully funded 2025 exploration budget of US$ 4.8 million all for the it’s wholly-owned Sierra Azul Copper-Silver Project (formerly known as the Cesar Project) located in Northeastern Colombia (refer to Figures 1 to 6 and Tables 1 and 2).

Highlights

- AM-13: Exploration Target Increased to 1,500m by 100m

- Copper-silver mineralization identified over 1,500m of strike and open ended

- New composite channel assay results include:

- 1.6% Copper & 6 g/t Silver over 55.0m (CS11)

- 1.6% Copper & 7 g/t Silver over 49.0m (CS08)

- 1.0% Copper & 6 g/t Silver over 26.0m (CS01)

- The 100m wide mineralized body rises over 300m in elevation between El Cedro and Mapurito valleys suggesting significant depth potential

- Manto-style mineralization and alteration, similar to deposits in the Tocopilla – Taltal region of northern Chile, where a mineralized corridor extends well over 100-km and hosts several economic deposits including Mantos Blancos estimated to contain 500mt at 1% Copper (Reference material on the Mantos Blancos deposit available here)

- AM-15: Discovery of New Manto Style Target Proximal to AM-13

- The new AM-15 discovery is located approximately 1,000m northwest of AM-13

- Early work suggests a large target footprint with five mineralized outcrops already identified over a 100m by 300m and open in all directions

- High priority target based on potential size, grade and proximity to AM-13

- US $4.8 Million Exploration Budget for 2025

- Fully funded by Freeport McMoRan Exploration Corporation (“Freeport”)

- Three components to the 2025 exploration program:

- Drill Target Development

- District Scale Exploration

- Basin Scale Prospectivity Analysis

Max cautions investors copper-silver mineralization at Mantos Blancos is not necessarily indicative of similar mineralization at Sierra Azul.

“The 2025 exploration season is off to an exceptional start with the significant footprint expansion at AM-13 of over 30% coupled with the exciting new discovery of AM-15 underscore the potential of large-scale copper silver discoveries within the Sierra Azul Project,” commented Brett Matich, CEO of MAX.

“The US $4.8 million budget for 2025, fully funded by Freeport, is an increase of 14% compared with 2024 and is focused on the development of priority targets for drilling and the identification of new significant size targets along the Serra Azul Project’s 120 km long mineralized trend,” he concluded.

Image showing extended footprint of AM-13 in relation to the AM-15 discovery

Figure 1: AM-13 & AM-15 Target Zone

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/242241_maximg1.jpg

Topography and composite assays from channel samples collected along the strike of the AM-13 target

Figure 2: AM-13 Target Longitudinal Section

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/242241_maximg2.jpg

Cross section showing composite assays of channel samples collected from the AM-13 exploration target in El Cedro Valley

Figure 3: AM-13 Target Cross Section

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/242241_maximg3.jpg

Work at AM-13 has identified an open-ended 1,500m by 100m exploration target, which is defined, in part, by numerous outcrops of high-grade copper and silver mineralization (refer to Table 1 and Figures 2 & 3). The potential for significant size and grade at AM-13 has elevated it to one of the highest priority targets on the Sierra Azul project.

Mineralization is observed filling fractures and vesicles within an andesitic tuff (a type of porous volcanic rock) that has undergone chlorite and epidote hydrothermal alteration. The mineralized rock strikes between 40° and 50° and, on average, dips at 70° NW. The mineralized unit rises more than 300m between the El Cedro valley and the Mapurito valley 1,200m to the northeast, suggesting the potential for significant depth extent.

Primary copper bearing minerals include native copper, chalcocite and bornite (refer to Figure 4). Trace amounts of bitumen (a type of organic material) were also observed in the mineralized rocks which is believed to be critical to the deposition of copper minerals from fluids that circulated within the Cesar-Rancheria basin. The presence of native copper and chalcocite indicates the mineralized fluids were sulphur poor leading to the precipitation of these high-grade ore-forming minerals.

The alteration of the host rocks and the copper bearing minerals observed at AM-13 appear to be similar to the Manto deposits of northern Chile, including Mantos Blancos, which began production over 60 years ago and is estimated to have contained a total of 500mt at 1.0% Copper (Reference material on the Mantos Blancos deposit available here). Manto Blancos is one of a series of 8 Manto copper-silver deposits in the Jurassic age volcanic and volcano-sedimentary rocks of northern Chile (Reference material on Manto deposits of northern Chile available here)

Figure 4: Mineralized Specimen from Mapurito Valley

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/242241_d7e4292b44aa7898_005full.jpg

Table 1: Summary of AM-13 Composite Channel Sample Assay Results

| Rock Channel Sample No. | Sample Method | Width | Copper | Silver |

| (m) | (%) | (g/t) | ||

| AM-13_CS01 | chip-channel | 26.0 | 1.0 | 5 |

| including | chip-channel | 7.0 | 1.6 | 9.6 |

| AM13_CS08 | saw-cut-channel | 55.0 | 1.6 | 6 |

| including | chip-channel | 15.0 | 3.4 | 14 |

| and | chip-channel | 5.0 | 3.5 | 16 |

| AM-13_CS11 | chip-channel | 49.0 | 1.6 | 7 |

| Including | chip-channel | 14.0 | 2.6 | 12 |

| and | chip-channel | 10.0 | 2.3 | 10 |

| AM-13_C12 | chip-channel | 12.0 | 1.2 | 6 |

| including | chip-channel | 4.0 | 1.6 | 6 |

| AM-13_C13 | chip channel | 12.0 | 0.7 | 6 |

| Including | chip-channel | 3.0 | 1.4 | 14 |

AM-15: New Discovery – Potential Manto-Style Parallel to AM-13

Max also announces the discovery of a new target, AM-15, located approximately 1,000m to the northwest of AM-13 (refer to Figure 1). Early work suggests an exploration target extending over 1,000m with five mineralized outcrops already identified over a 300m by 100m (refer to Table 2).

Similar to AM-13, mineralization is found filling fractures and vesicles of an andesitic tuff. Ore forming minerals include chalcocite, malachite and azurite (see Figure 5). Chlorite, epidote and albite alteration along with the presence of bitumen are also observed.

Table 2: AM-15 Highlight Composite Assay Results

| Rock Channel Sample No. | Sample Method | Width | Copper | Silver |

| (m) | (%) | (g/t) | ||

| AM-15_CS01 | chip-channel | 2.0 | 4.0 | 35 |

| AM15_CS02 | chip-channel | 12.0 | 0.7 | 7 |

| AM-15_CS03 | chip-channel | 10.0 | 0.7 | 7 |

| AM-15_C04 | chip-channel | 5.0 | 0.8 | 4 |

The proximity to AM-13, along with its potential size and grade have made AM-15 the focus of the target development team. Work to extend the footprint of AM-15 is underway and several additional mineralized outcrops have been discovered. Initial follow-up exploration at the target will include geological mapping, sampling and trenching.

Rock specimen showing chalcocite, malachite and azurite mineralization

Figure 5: AM-15: Mineralized Andesitic Tuff

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/242241_d7e4292b44aa7898_006full.jpg

Freeport McMoRan Funded US $4.8 Million Approved Exploration Budget for 2025

The 2025 exploration program at the Sierra Azul has three objectives: Drill Target Development, District Scale Exploration and Basin Scale Analysis.

Drill Target Development

The Drill Target Development program will focus exploration on priority targets located in all three districts of the Sierra Azul Project: AM, Conejo and URU (refer to Figure 6). The goal of the program is to prepare the selected targets for drilling. The work program is well under way and includes detailed geological mapping and soil sampling as well as planned ground geophysical surveys and detailed structural analysis.

The initial focus of the target development 2025 campaign will be to continue exploration of the Company’s top priority targets: AM-13 and AM-15. Detailed mapping to date, has identified mineralized outcrops over large areas at both targets. Work to delimit the targets and establish continuity of the mineralization is on-going.

District Scale Exploration

The District Scale Exploration Program commenced in 2024 and is designed to systematically evaluate the entire Sierra Azul Project area with the goal of identifying additional priority targets for follow-up. The program has two components: soil and stream sediment sampling.

The district-scale soil sampling program comprises a total of 3,646 samples collected at 50m intervals along lines spaced 2,000m apart (refer to Figure 6). The sampling campaign commenced in 2024 and approximately 27% of the planned samples have been collected.

Soil samples are initially analyzed in the field using XRF technology. This has led to the discovery of new mineralized outcrops in the Conejo District. Laboratory analysis of the samples is also being conducted and will identify more subtle copper anomalies and trends that can be followed up with detailed mapping and soil sampling.

Stream sediments samples are also planned for 2025 and will complement the district-scale soil sampling program. 200 stream sediment samples will be collected along the valleys that drain into the eastern margin of the Cesar-Rancheria basin.

Basin Scale Analysis

An analysis of the evolution of the Cesar-Rancheria basin is being conducted to identify additional areas prospective for copper. The Cesar-Rancheria basin stretches for more than 250 km, has demonstrable potential for significant copper deposits and remains largely unexplored.

A model of the geological and structural evolution of the Cesar-Rancheria basin is being developed using existing information including, seismic data, oil well logs, satellite imagery and regional geology. The results of the analysis will be used to identify areas within the basin that have the right combination of factors required to develop large scale copper deposits:

- good structural development to allow the mineralized fluids to move through the geological column.

- presence of a chemical reductant that will cause copper minerals to precipitate from the fluids and

- permissive rock types to host the copper minerals.

Map of Sierra Azul Project showing priority targets and district-scale soil sample lines

Figure 6: AM-15: Map of Regional Soil Sample Lines at Serra Azul Copper Silver Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3834/242241_d7e4292b44aa7898_007full.jpg

Background

The Sierra Azul Copper-Silver Project comprises three districts: AM, Conejo and URU. Collectively the three contiguous districts stretch over 120 km in NNE/SSW direction (refer to Figure 4). Max Resource’s land tenure at Sierra Azul includes 188 km2 of mining concessions and 1,141 km2 of mineral concession applications.

On May 13th, 2024, Max announced that it had entered into an Earn-In Agreement (“EIA”) with Freeport, a wholly owned-affiliate of Freeport-McMoRan Inc. (NYSE: FCX) relating to Max’s wholly owned Sierra Azul Copper-Silver Project. Under the terms of the EIA, Freeport can earn an 80% interest in the Sierra Azul Copper-Silver Project in two stages by spending an aggregate amount of $50 million and paying a total of $1.55 million in cash to Max.

AM District

Starting in the far north of the Jurassic basin, classic stacked red bed outcrops with extensive lateral continuity have been sampled over many kilometres within the AM District culminating in a mineralized corridor that extends over 15km (Max News Release dated May 25, 2023 and Max News Release dated June 22, 2023). Highlight values of 34.4% copper and 305 g/t silver from outcrop samples have been documented in the sedimentary sequences. The Company confirmed that stratiform red-bed style mineralization continues at depth with two scout drill holes completed earlier this year (Max News Release dated April 4, 2023). In addition, Max has discovered a Manto-style target, AM-13, which has significant size potential. Initial assay results from AM-13 included 48m of 1.8% copper and 7.2 g/t Silver (Max News Release dated August 20, 2024).

Conejo District

Midway south, the Conejo District is the most recent to be recognized and is characterized by structurally controlled mineralization hosted in intermediate and felsic volcanic rocks. Numerous mineralized outcrops have been discovered over 3,700m at the primary target in the district with surface samples averaging 4.9% copper (2% cut-off). No drilling has been conducted at Conejo, but it has emerged as an area of focus for the Company.

URU District

Mineralization within the URU District is hosted in intermediate volcanic rocks and is structurally controlled, similar to deposits in the Central African Copper Belt. At URU-C, a 9.0m of 7.0% copper and 115 g/t silver surface discovery was confirmed at depth by drill hole URU-12, which intersected 10.6m of 3.4% copper and 48 g/t silver. At the URU-CE target, 750m to the east, 19.0m of 1.3% copper discovered in outcrop was confirmed by drill hole URU-9, which intersected a broad zone of copper oxide returning 33.0m of 0.3% copper from 4.0m, including 16.5m of 0.5% copper (Max News Release date January 24, 2023).

Qualified Person

The Company’s disclosure of a technical or scientific nature in this news release was reviewed and approved by Tim Henneberry, P.Geo (British Columbia), a member of the Max Resource advisory board, who serves as a qualified person under the definition of National Instrument 43-101.

About Max Resource Corp.

The Company’s wholly owned Sierra Azul Project sits along the Colombian portion of the world’s largest producing copper belt (Andean belt), with world-class infrastructure and the presence of global majors (Glencore and Chevron). Max has an Earn-In Agreement (“EIA”) with Freeport-McMoRan Exploration Corporation (“Freeport”), a wholly owned affiliate of Freeport-McMoRan Inc. (“NYSE: FCX”) relating to the Sierra Azul Project. Under the terms of the EIA, Freeport has been granted a two-stage option to acquire up to an 80% ownership interest in the Sierra Azul Project by funding cumulative expenditures of C$50 million and making cash payments to Max of C$1.55 million. Max is the operator of the initial stage. The USD $4.8 million 2025 exploration program for the Sierra Azul Project is funded by Freeport.

The Company’s Florália DSO Project is located 67 km east of Belo Horizonte, Minas Gerais, Brazil’s largest iron ore and steel producing State. Max’s technical team has significantly expanded the Florália hematite geological target from 8-12mt at 58% Fe to 50-70mt at 55%-61% Fe. Max Brazil has now commenced inaugural drill programs at the Florália DSO Project, consisting of approximately 1,000m of diamond and 800m by a mobile power auger rig.

The Company has added an Australian entity, Max Brazil, to hold the “Florália DSO Project” through the existing Canadian and Brazilian holding entities. As announced on January 31, 2025, Max Brazil has received in-principle advice on suitability from ASX Limited (the “ASX”) to advance plans for admission to the official list of the Australian Securities Exchange.

Max cautions investors the potential quantity and grade of the iron ore is conceptual in nature, and further cautions there has been insufficient exploration to define a mineral resource and Max is uncertain if further exploration will result in the target being delineated as a mineral resource. Hematite mineralization tonnage potential estimation is based on in situ high-grade outcrops and interpreted and modelled magnetic anomalies. Density value used for the estimate is 2.8t/m³. Hematite sample grades range between 55-61%Fe. Hematite mineralization tonnage potential estimation is based on in situ hematite outcrop interpreted and modelled magnetic anomalies. Density value used for the estimate is 2.5t/m3. The 58 channel samples were collected for chemical analysis from in situ outcrops in previously mined slopes of industrial materials. Channel samples weighed in average 14 kg. Chemical analysis was performed at ALS Laboratories. Metal Oxides are determined using XRF analysis. Fusion disks are made with pulped samples and the addition of a borate-based flux. Max did not insert standards or blanks in the assay stream and is relying on ALS’s lab QA/QC.

For more information visit: https://www.maxresource.com/

For additional information contact:

Tim McNulty E: info@maxresource.com T: (604) 290-8100

Rahim Lakha E. rahim@bluesailcapital.com

Brett Matich T: (604) 484 1230

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for statements of historic fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law.

Forward-Looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-Looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company’s control. There are no assurances that the commercialization plans for Max Resources Corp. described in this news release will come into effect on the terms or time frame described herein.

The Company undertakes no obligation to update forward-looking information if circumstances or management’s estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company’s filings with Canadian securities regulators, which filings are available at www.sedarplus.ca.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/242241

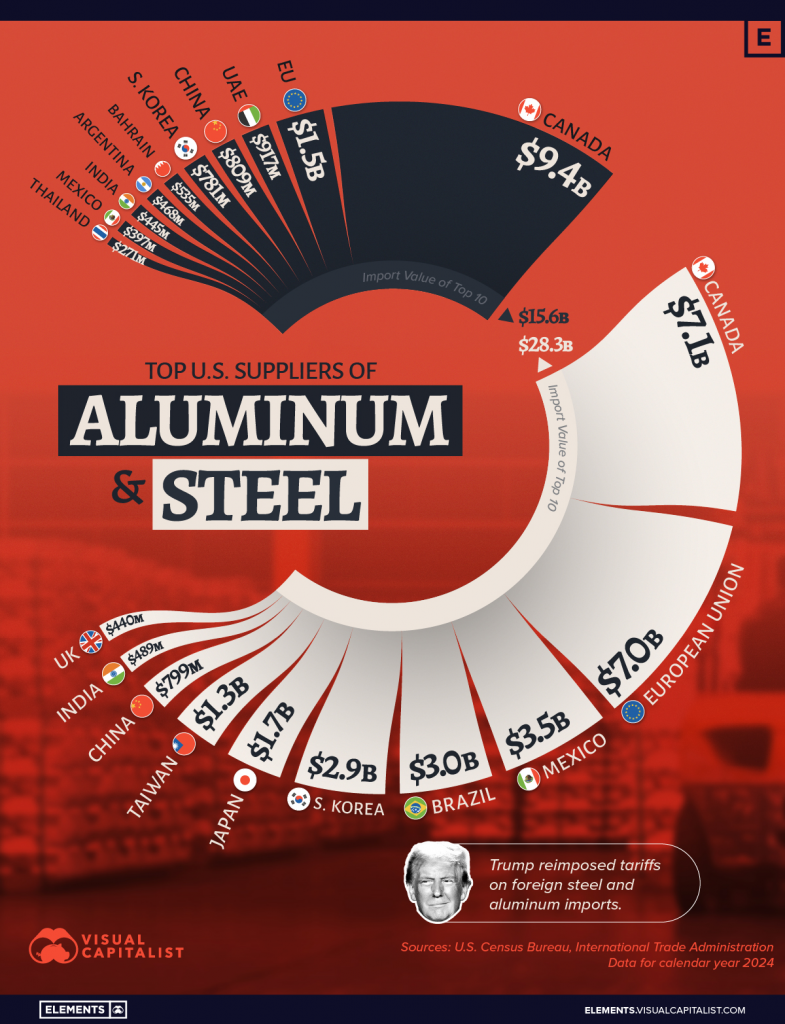

Canada

Canada Mexico

Mexico Brazil

Brazil China

China Taiwan

Taiwan South Korea

South Korea Germany

Germany Japan

Japan India

India European Union

European Union UAE

UAE Bahrain

Bahrain Argentina

Argentina Thailand

Thailand UK

UK