|

|||

|

|

|

|

|||

|

|

|

Vancouver, British Columbia–(Newsfile Corp. – January 17, 2019) – Group Eleven Resources Corp. (TSXV: ZNG) (OTCQB: GRLVF) would like to cordially invite you to visit us at Booth #913 at the Vancouver Resource Investment Conference (VRIC) to be held at the Vancouver Convention Centre West (1055 Canada Place, Vancouver) on Sunday January 20 – Monday January 21, 2019.

The Vancouver Resource Investment Conference has been the bellwether of the junior mining market for the last twenty-five years. It is the number one source of information for investment trends and ideas, covering all aspects of the natural resource industry.

Each year, the VRIC hosts over 60 keynote speakers, 350 exhibiting companies and 9000 investors.

Investment thought leaders and wealth influencers provide our audiences with valuable insights. C-suite company executives covering every corner of the mineral exploration sector as well as metals, oil & gas, renewable energy, media and financial services companies are available to speak one on one. This is a must-attend for investors and stakeholders in the global mining industry.

For more information and/or to register for the conference please visit: https://cambridgehouse.com/vancouver-resource-investment-conference

We look forward to seeing you there.

For further information:

Group Eleven Resources Corp.

Spiros Cacos

+1 604 630 8839

s.cacos@groupelevenresources.com

www.groupelevenresources.com

Vancouver, British Columbia–(Newsfile Corp. – January 17, 2019) – Miramont Resources Corp. (CSE: MONT) (OTCQB: MRRMF) (FSE: 6MR) (“Miramont” or the “Company”) is pleased to announce that it intends to complete a non-brokered private placement of up to 2,857,143 units (“Units“) at a price of $0.35 per Unit for aggregate gross proceeds of up to approximately $1,000,000 (the “Private Placement“). The Company intends to use the proceeds from the Private Placement for its planned drilling activities at Cerro Hermoso, advancing the Lukkacha project and general working capital purposes. Closing of the Private Placement is expected to occur on or before January 31, 2019 (the “Closing Date“).

Each Unit will consist of one (1) common share (each, a “Common Share“) in the capital of the Company and one (1) transferrable common share purchase warrant (each, a “Warrant“). Each Warrant will entitle the holder to purchase one Common Share at a price of $0.50 per Common Share until the date which is two (2) years from the Closing Date. The Company may pay certain finders a fee for introducing eligible participants to the Private Placement.

All securities issued under the Private Placement, including securities issuable on exercise thereof, are subject to a hold period expiring four months and one day from the Closing Date.

The Private Placement is subject to certain conditions including, but not limited to, the receipt of all necessary approvals, including the approval of the Canadian Securities Exchange.

About Miramont Resources Corp.

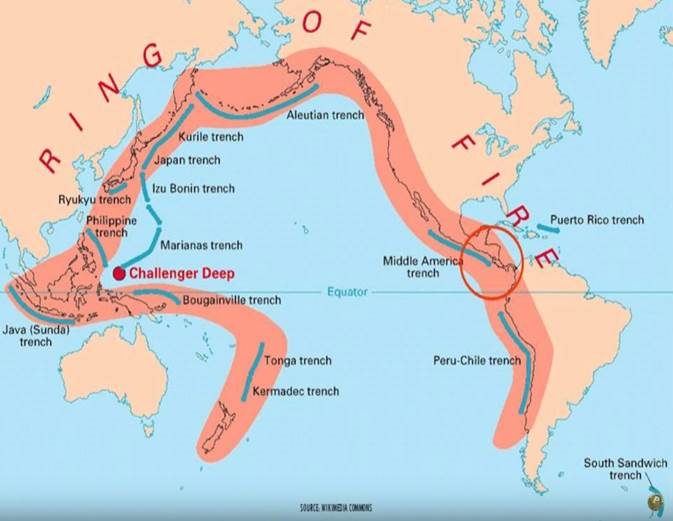

Miramont is a Canadian based exploration company with a focus on acquiring and developing mineral prospects within world-class belts of South America. Miramont’s key assets are located in southern Peru. The Cerro Hermoso property hosts a 1.4km diameter breccia pipe targeting gold – polymetallic mineralization, while the Lukkacha property is targeting porphyry copper mineralization.

On behalf of the Board of Directors,

MIRAMONT RESOURCES CORP.

“William Pincus”

William Pincus, President and CEO

For more information, please contact the Company at:

Telephone: (604) 398-4493

info@miramontrresources.com

www.miramontresources.com

Reader Advisory

This news release may include forward-looking information that is subject to risks and uncertainties. All statements within, other than statements of historical fact, are to be considered forward-looking, including statements with respect to the use of proceeds from the Private Placement. Although the Company believes the expectations expressed in such forward-looking information are based on reasonable assumptions, such information is not a guarantee of future performance and actual results or developments may differ materially from those contained in forward-looking information. Factors that could cause actual results to differ materially from those in forward-looking information include, but are not limited to, fluctuations in market prices, successes of the operations of the Company, continued availability of capital and financing and general economic, market or business conditions. There can be no assurances that such information will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. The Company does not assume any obligation to update any forward-looking information except as required under the applicable securities laws.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES. ANY FAILURE TO COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A VIOLATION OF U.S. SECURITIES LAWS.

VANCOUVER, British Columbia, Jan. 17, 2019 (GLOBE NEWSWIRE) — Allegiant Gold Ltd. (“ALLEGIANT”) (AUAU:TSX-V) (AUXXF:OTCQX) reports on the progress of its high-impact discovery drilling campaign. A total of 6 projects located principally in the world-class gold mining jurisdiction of Nevada are slated for drilling over a 10-12 month period, to approximately June 2019. Drilling commenced at the Red Hills project in August 2018 and drilling at a third project, North Brown, was completed in December and final assays are expected within one week. Assay results for Hughes Canyon (the second property drilled) have now been received in full.

ALLEGIANT completed 2,139 meters of drilling in 12 rotary holes at Hughes Canyon. Hydrothermal alteration was encountered in 10 of the 12 holes in several different stratigraphic units in a faulted and folded Mesozoic sedimentary package. Gold and silver values above 0.10 g/t gold encountered in the drilling are available at the following link:

www.allegiantgold.com/nr/2019-01-17-assays.pdf

Overall the drilling results at Hughes Canyon are encouraging and suggest more drilling is necessary, however in the context of prioritizing expenditures on ALLEGIANT’S large portfolio of prospective exploration properties, Hughes Canyon will be abandoned.

ALLEGIANT expects to resume the “discovery drilling campaign” at the 4thproject, Monitor Hills, in about one week.

Qualified Person

Andy Wallace is a Certified Professional Geologist (CPG) with the American Institute of Professional Geologists and is a Qualified Person as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. Wallace has reviewed and approved the technical content of this press release.

ABOUT ALLEGIANT

ALLEGIANT owns 100% of 14 highly-prospective drill-ready gold projects in the United States, 11 of which are located in the mining-friendly jurisdiction of Nevada. ALLEGIANT’s flagship Eastside project hosts a large and expanding gold resource, is district scale, and is located in an area of excellent infrastructure. Preliminary metallurgical testing indicates that both oxide and sulphide gold mineralization at Eastside is amenable to heap leaching.

Further information regarding ALLEGIANT can be found at www.allegiantgold.com

ON BEHALF OF THE BOARD,

Robert F. Giustra

Chairman

For more information contact:

Investor Relations

(604) 634-0970 or

1-888-818-1364

ir@allegiantgold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

Certain statements and information contained in this press release constitute “forward-looking statements” within the meaning of applicable U.S. securities laws and “forward-looking information” within the meaning of applicable Canadian securities laws, which are referred to collectively as “forward-looking statements”. The United States Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for certain forward-looking statements. Forward-looking statements are statements and information regarding possible events, conditions or results of operations that are based upon assumptions about future economic conditions and courses of action. All statements and information other than statements of historical fact may be forward-looking statements. In some cases, forward-looking statements can be identified by the use of words such as “seek”, “expect”, “anticipate”, “budget”, “plan”, “estimate”, “continue”, “forecast”, “intend”, “believe”, “predict”, “potential”, “target”, “may”, “could”, “would”, “might”, “will” and similar words or phrases (including negative variations) suggesting future outcomes or statements regarding an outlook. Forward-looking statements in this and other press releases include but are not limited to statements and information regarding ALLEGIANT’s drilling and exploration plans and results for its properties, including anticipated timing thereof; and the Eastside project’s resource expansion. Such forward-looking statements are based on a number of material factors and assumptions and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to differ materially from those anticipated in such forward-looking information. You are cautioned not to place undue reliance on forward-looking statements contained in this press release. Some of the known risks and other factors which could cause actual results to differ materially from those expressed in the forward-looking statements are described in the sections entitled “Risk Factors” in ALLEGIANT’s Listing Application, dated January 24, 2018, as filed with the TSX Venture Exchange and available on SEDAR under ALLEGIANT’s profile at www.sedar.com. Actual results and future events could differ materially from those anticipated in such statements. ALLEGIANT undertakes no obligation to update or revise any forward-looking statements included in this press release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

For example, Northern Vertex (TSXV:NEE) launched Phase 1 operations at the Moss Mine on a package of patented claims in Arizona approximately 100 hectares in size. They are planning to produce for approximately 5 years at approximately +35Koz Au per year on that ground, with an open pit and heap leach all fit snugly onto that 100 hectare footprint.

See my interview with Bill Martinich, Mine Manager, where we discuss all this looking at an aerial photo of the site. https://ceo.ca/@Newton/15-minutes-with-bill-martinich-mine-manager-nee-northern-vertex

I suggest that patented claims in mining-friendly states like Arizona are a particular class of mineral exploration assets that deserve a premium. The devil’s in the details for exploration properties, but the Silver Nickel Mining Company have assembled such a portfolio and it’s worth a close look.

The Silver Nickel Company is not a prospect generator for the Howe Street public markets, but they have assembled a portfolio of patented claims in Arizona, USA. This is a great place for mining, as with the example of the Moss Mine.

What’s more, Silver Nickel has some interesting ideas about acquiring land that could be resold residential development. That raises some questions about the ability to build a mine there in the future, but it’s an interesting idea that makes me think bold real estate investment companies could take an interest here. However, I am thinking primarily about people who understand and invest in mine exploration and development when I talk to the Silver Nickel guys, as in our interview here, https://ceo.ca/@newton/newtoninterviews-silver-nickel-co-patented-claim-holders-in-arizona

I’ve introduced Silver Nickel to several public companies and the answer is consistently the same: the claims are too small and expensive. I understand the person who said, “The million $ price tag for exploration ground is probably something we would not take on.” but I wonder why? Surely there’s exploration ground in Arizona that’s worth millions of dollars? Maybe people are scared off by the large amount of data-verification that would be required to get these projects ready for prime-time? Maybe I haven’t found the right buyer yet.

There must be investors out there who can imagine the potential of what Silver Nickel Company has and are willing to bring expertise necessary to determine if that potential is something worth exploring? It’s a long and winding road, but some people are keen to strike out on it.

If you dig even deeper into the Silver Nickel story, then you will find that they have developed a sleuthing process to pick good patented claims off the garbage pile. They know how to navigate tax offices and the foreclosure process in a way that takes years of time and effort, but allows them to secure ownership of things like the Moss Mine for very little cost. The intellectual property in that and their geological understanding of Arizona alone could be very valuable to the right group who seeks to understand and help the John Rothermel and Neal Hawkins.

Watch our interview above for more.

John and Neal said in the interview that they’ve run the Silver Nickel Company as if it was their own money, because it was. I think they’ve built something special here and see great potential to use what they’ve done to seed public companies with great exploration projects. Easier said than done!

Please contact me on CEO.CA if you would like to discuss all this further and watch for some field footage from an intrepid young geologist I met who may make the trek to run around a few of the prospects with John in Arizona this summer.

![]()

Rover Metals (TSXV: ROVR)(OTCQB: ROVMF) (“Rover Metals” or the “Company”) is pleased to announce that it has completed its OTCQB listing and will commence trading under the symbol “ROVFM” on the OTC Markets.

In connection with our U.S. listing, the Company is also pleased to announce that it will be working with newsletter writer, Bob Moriarty of 321 Gold acclaim, over the next 12 months.

|

|

|

|

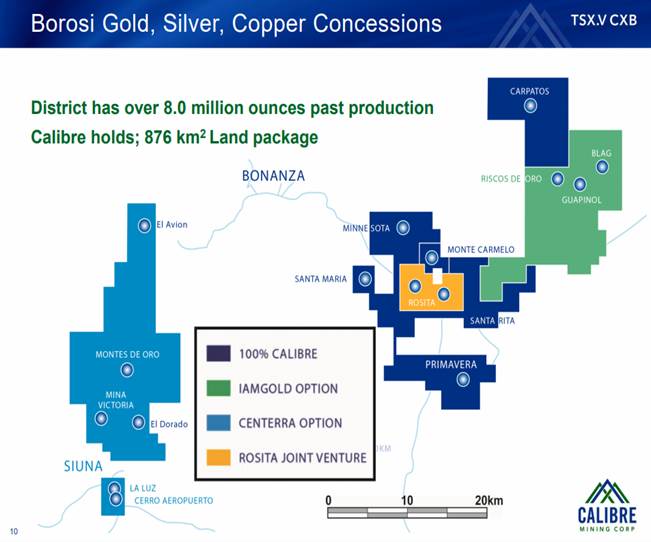

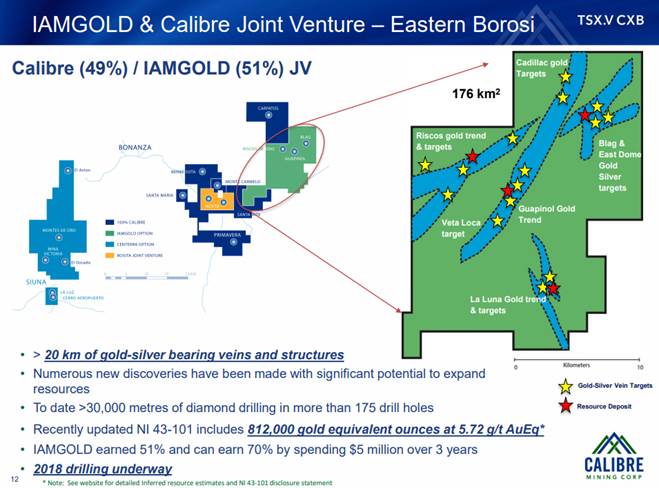

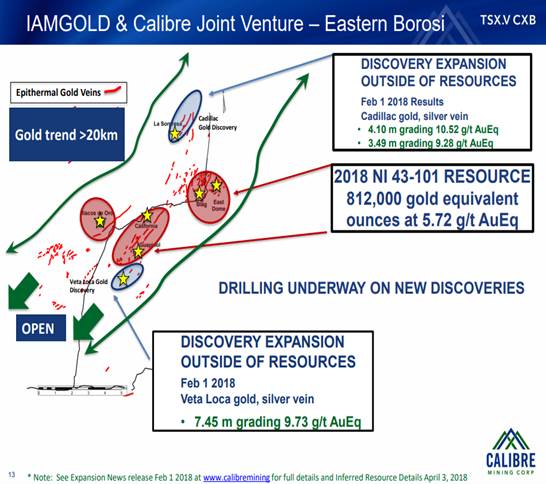

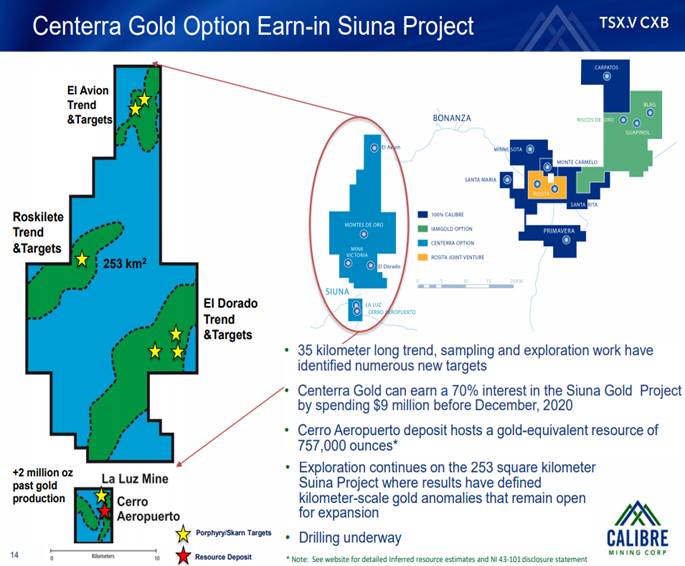

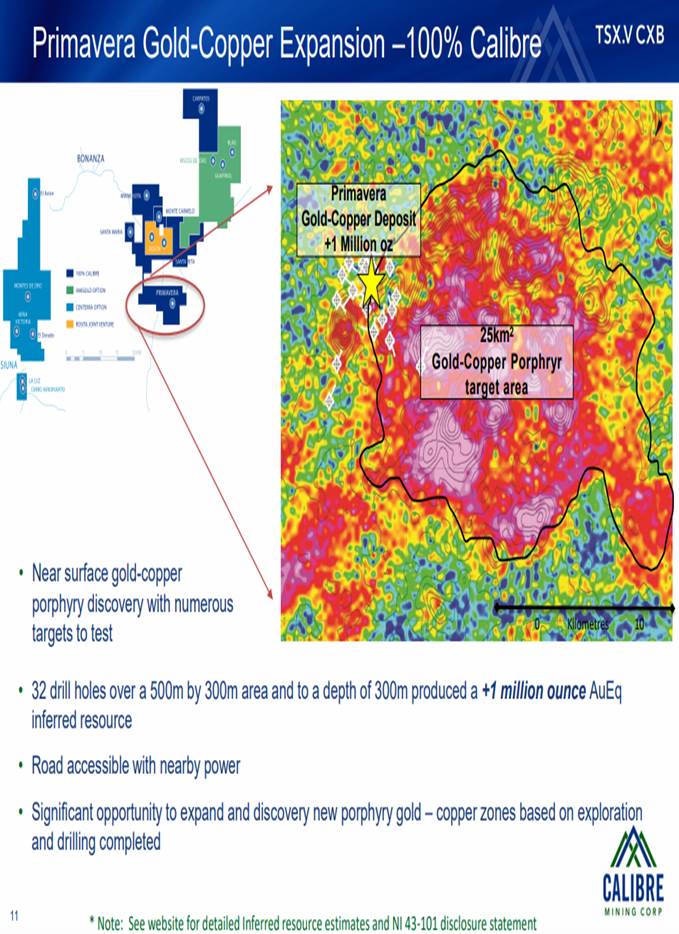

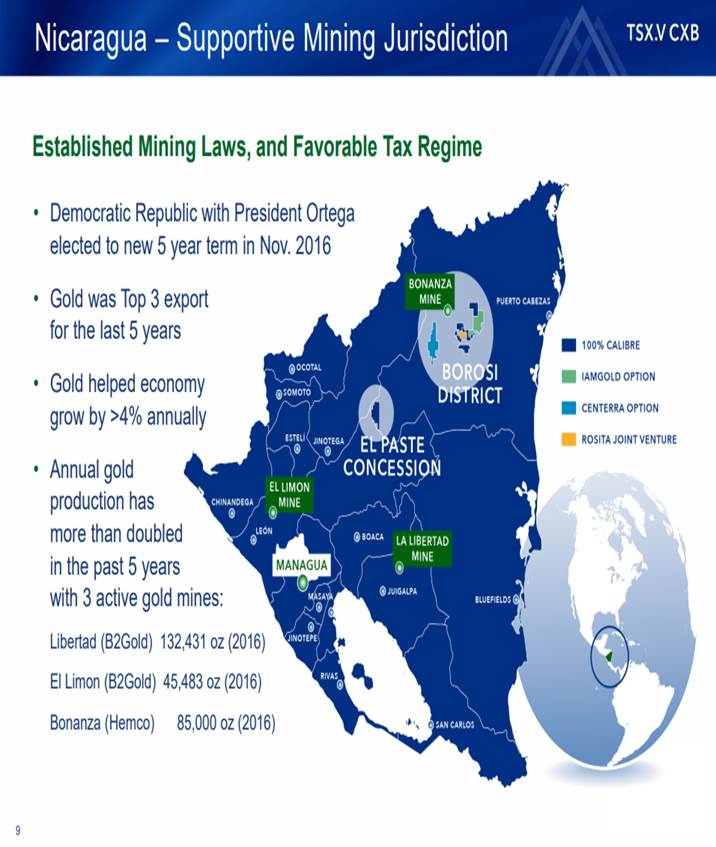

Ryan King, Vice President Corporate Development of Calibre Mining sits down with Maurice Jackson of Proven and Probable to discuss the value proposition on their flagship Borosi Project covering over a massive land position of 800 square kilometers in Nicaragua.Today’s interview is the most comprehensive interview to date on Calibre Mining. The Borosi Project hosts the Eastern Borosi, Siuana, La Luz, and Primavera projects, which Mr. King will discuss in great detail, along with the relationship and contractual obligations of Calibre Mining’s Joint Venture partners (Centerra Gold, IAMGold, Rosita Mining)on these projects respectively. We discuss in detail each member of the Board of Directors, Management, and Technical team, which is comprised of a number of key members of the recent success of Newmarket Gold, which recently went from a $10 Million Market Cap to $1 Billion Market Cap and was sold to Kirkland Lake Gold . Finally, we will delve into the capital structure of Calibre Mining. Important to note, Calibre Mining has $0 Debt, and a Management and Board with proven success of optionality and arbitrage.

Original Source: https://www.streetwisereports.com/article/2019/01/16/exploring-for-world-class-gold-silver-and-copper-deposits-in-nicaragua.html

Source: Maurice Jackson for Streetwise Reports (1/16/19)

Ryan King, vice president of corporate development at Calibre Mining, sits down with Maurice Jackson of Proven and Probable to discuss his company’s joint ventures, exploration in Nicaragua and strategic plans.

Ryan King, vice president of corporate development at Calibre Mining, sits down with Maurice Jackson of Proven and Probable to discuss his company’s joint ventures, exploration in Nicaragua and strategic plans.

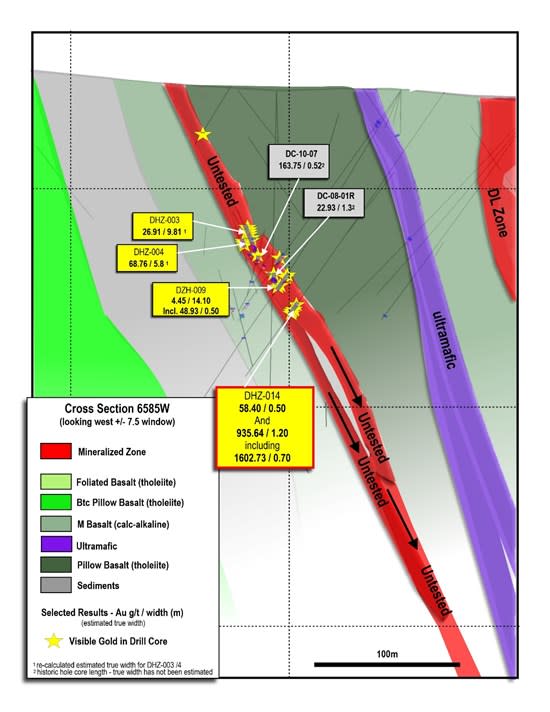

Vancouver, British Columbia–(Newsfile Corp. – January 16, 2019) – Great Bear Resources (TSXV: GBR) (the “Company” or “Great Bear”) today reported drill results from the Hinge Zone (“DHZ”) and South Limb Zone (“DSL”) at its 100% owned Dixie Project in the Red Lake District of Ontario. Results include 1,602.73 g/t gold over 0.70 metres (approximate true width) at 150 metres vertical depth. An image of the gold mineralization in DHZ-014 is shown in Figure 1.

Figure 1: Image of 1,602.73 g/t (51.29 ounces per tonne) gold in Hinge Zone drill hole DHZ-014. The image is selective and is not representative of the gold mineralization hosted on the property.

To view an enhanced version of this Figure 1, please visit:

https://orders.newsfilecorp.com/files/5331/42231_6696894dc44bf92d_002full.jpg

Chris Taylor, President and CEO of Great Bear said: “Our Hinge and South Limb Zone are part of a continuous gold vein system which is interpreted to extend along 300 metres in strike length and has been drill tested to a depth of 212 metres. The zone remains open in all directions and occurs immediately south of a regional east-west trending D2 fold hinge and associated structures which extends for approximately 10 kilometres into undrilled areas. For comparison, the Red Lake-Campbell complex (Red Lake Gold Mine) also occurs proximal to a regional D2 fold where shear zones developed and acted as primary hydrothermal fluid conduits, across a 3.2 kilometre by 2.2 kilometre area. Great Bear’s 2019 drill program is fully funded, and results will continue to be released regularly in batches as the program progresses.”

Hinge zone hole DHZ-014 intersected a 10.1 metre wide vein zone (approximate true width). Visible gold was observed at both its upper and lower contacts (Table 1). The vein zone is part of the larger Hinge/South Limb vein system, which parallels an ultramafic unit and deep-seated fault at the centre of the Dixie gold system (Figure 2). The DSL/DHZ vein system has been intersected in 28 drill holes across 300 metres of strike length to-date and is open along strike and at depth. The D2 fold axis that appears to be a significant gold control has been traced through geophysical methods across more than 10 kilometres of strike length. DHZ-014 was drilled to test Great Bear’s 3D vein model, which accurately predicted veining would be present within 15 metres of the actual intercept.

Table 1: Detailed assay results including both metric and imperial units from across the complete mineralized zone in Hinge zone drill hole DHZ-014. Interval begins at 150 metres vertical depth.

| Drill Hole | From (m) |

To (m) |

Width* (m) |

Gold (g/t) |

Gold (oz/t) |

Width* (ft) |

|

| DHZ-014 | top contact | 176.50 | 177.00 | 0.50 | 58.40 | 1.87 | 1.64 |

| 180.70 | 186.60 | 5.90 | 190.78 | 6.11 | 19.36 | ||

| vein interval | 181.80 | 185.10 | 3.30 | 340.90 | 10.91 | 10.83 | |

| lower contact | 183.90 | 185.10 | 1.20 | 935.64 | 29.94 | 3.94 | |

| including | 184.40 | 185.10 | 0.70 | 1602.73 | 51.29 | 2.30 |

* width is determined to be 95-100% of true width based on intersection points of the drill hole intercept with the geological model and oriented drill core data. Complete assays of zone below in Table 3.

Other results include additional gold intervals from previously reported Hinge and South Limb drill holes (see news release of December 12, 2018), identified during assaying of the entire drill holes, and are provided in Table 2. 8 of 19 drill holes completed in December 2018 across 220 metres strike length of the South Limb and Hinge zones intersected intervals of greater than 15 g/t gold.

Table 2: Additional gold intervals from drill holes previously released by Great Bear from the Hinge and South Limb Zones. Original results were provided on December 12, 2018.

| Drill Hole | From (m) |

To (m) |

Width (m) |

Gold (g/t) |

Vertical Depth (m) |

Zone | |

| DHZ-012 | 275.60 | 277.60 | 2.00 | 2.73 | 223 | Hinge | |

| including | 275.60 | 276.15 | 0.55 | 6.02 | |||

| DSL-014 | 100.50 | 102.00 | 1.50 | 4.16 | 81 | South Limb | |

| and | 163.50 | 166.50 | 3.00 | 4.85 | 132 | ||

| including | 164.50 | 166.50 | 2.00 | 7.17 | |||

| and including | 164.50 | 165.50 | 1.00 | 13.33 | |||

| and including | 164.50 | 165.00 | 0.50 | 25.82 | |||

| DSL-015 | 165.85 | 170.80 | 4.95 | 1.21 | 156 | South Limb | |

| including | 169.50 | 170.30 | 0.80 | 5.45 | |||

| and | 173.00 | 173.50 | 0.50 | 9.33 |

* width is determined to be 95-100% of true width based on intersection points of the drill hole intercept with the geological model and oriented drill core data.

A cross section through the Hinge Zone is shown on Figure 2. A map showing the Dixie gold zones and current drill results is shown on Figure 3. A long section through the South Limb and Hinge zones is shown on Figure 4. All assays received from the mineralized zone in DHZ-014 and a description of the observed geology are provided in Table 3.

Figure 2: Cross section of Hinge Zone showing central ultramafic and adjacent drill results to-date. Dixie Limb Zone is located to the right of this image and also parallels the central ultramafic.

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/5331/42231_6696894dc44bf92d_003full.jpg

Figure 3: Plan map of the Dixie Gold System showing the drill collar locations and hole traces of currently reported gold results.

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/5331/42231_6696894dc44bf92d_004full.jpg

Great Bear is currently undertaking a fully-funded 30,000 metre, approximately 150 drill hole program that is expected to continue through 2019 and 2020. A second drill rig will be added to the project in early 2019 to accelerate this work.

Additional photos of mineralization are provided at the Company’s web site at www.greatbearresources.com.

Webinar

Great Bear will host a webinar to discuss the Company’s recent drill results and its recently released 3D model. The webinar will take place on Thursday, January 17th at 11:00am PST/2:00pm EST. Management will be available to answer questions following the presentation. Online access and dial-in numbers are:

Readytalk Platform (access at the time of event):

* http://www.readytalk.com/join

* Access code: 5147677

Dial-In Numbers:

* Canada: +1-647-722-6839

* United States: +1-303-248-0285

* Access Code: 5147677

Figure 4: Long section through the DHZ/DSL as drilled to-date showing currently reported drill results.

To view an enhanced version of Figure 4, please visit:

https://orders.newsfilecorp.com/files/5331/42231_6696894dc44bf92d_005full.jpg

Table 3: All assay intervals and geological description of each interval of DHZ-014 in the vein zone.

| Drill Hole | From (m) |

To (m) |

Gold (g/t) |

Description |

| DHZ-014 | 176.5 | 177 | 58.4 | High-Fe Tholeiitic Pillow Basalt with quartz veining with visible gold |

| DHZ-014 | 177 | 177.5 | 0.066 | High-Fe Tholeiitic Pillow Basalt |

| DHZ-014 | 177.5 | 178.5 | 0.027 | High-Fe Tholeiitic Pillow Basalt |

| DHZ-014 | 178.5 | 180 | 0.023 | High-Fe Tholeiitic Pillow Basalt |

| DHZ-014 | 180 | 180.7 | 0.031 | High-Fe Tholeiitic Pillow Basalt |

| DHZ-014 | 180.7 | 181.2 | 0.297 | High-Fe Tholeiitic Pillow Basalt |

| DHZ-014 | 181.2 | 181.8 | 0.385 | High-Fe Tholeiitic Pillow Basalt |

| DHZ-014 | 181.8 | 182.4 | 2.955 | Quartz Vein |

| DHZ-014 | 182.4 | 182.9 | 0.285 | Quartz Vein |

| DHZ-014 | 182.9 | 183.4 | 0.169 | High-Fe Tholeiitic Pillow Basalt |

| DHZ-014 | 183.4 | 183.9 | 0.367 | Argillite |

| DHZ-014 | 183.9 | 184.4 | 1.715 | Argillite |

| DHZ-014 | 184.4 | 185.1 | 1602.73 | Quartz Vein with 3-5% visible gold |

| DHZ-014 | 185.1 | 185.6 | 0.137 | Quartz Vein |

| DHZ-014 | 185.6 | 186.1 | 0.337 | Calc-Alk Massive Basalt |

| DHZ-014 | 186.1 | 186.6 | 0.119 | Calc-Alk Massive Basalt |

About Great Bear

The Dixie property is located approximately 15 minutes’ drive along Highway 105 from downtown Red Lake, Ontario. The Red Lake mining district has produced over 30,000,000 ounces of gold and is one of the premier mining districts in Canada, benefitting from major active mining operations including the Red Lake Gold Mine of Goldcorp Inc., plus modern infrastructure and a skilled workforce. The Dixie property covers a drill and geophysically defined 10 kilometre gold mineralized structure similar to that hosting other producing gold mines in the district. In addition, Great Bear is also earning a 100% royalty-free interest in its West Madsen properties which total 3,860 hectares and are contiguous with Pure Gold Mining Inc.’s Madsen property. All of Great Bear’s Red Lake projects are accessible year-round through existing roads.

Drill core is logged and sampled in a secure core storage facility located in Red Lake Ontario. Core samples from the program are cut in half, using a diamond cutting saw, and are sent to Activation Laboratories Ltd. in Ancaster Ontario, and SGS Canada Inc. in Red Lake, Ontario, both of which are accredited mineral analysis laboratories, for analysis. All samples are analysed for gold using standard Fire Assay-AA techniques. Samples returning over 3.0 g/t gold are analysed utilizing standard Fire Assay-Gravimetric methods. Certified gold reference standards, blanks and field duplicates are routinely inserted into the sample stream, as part of Great Bear’s quality control/quality assurance program (QAQC). No QAQC issues were noted with the results reported herein.

Mr. R. Bob Singh, P.Geo, Director and VP Exploration, and Ms. Andrea Diakow P.Geo, Exploration Manager for Great Bear are the Qualified Persons as defined by National Instrument 43-101 responsible for the accuracy of technical information contained in this news release.

For further information please contact Mr. Chris Taylor, P.Geo, President and CEO at 604-646-8354, or Mr. Knox Henderson, Investor Relations, at 604-551-2360.

ON BEHALF OF THE BOARD

“Chris Taylor”

Chris Taylor, President and CEO

Inquiries:

Tel: 604-646-8354

Fax: 604-646-4526

info@greatbearresources.ca

www.greatbearresources.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This new release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements.

We seek safe harbor

TORONTO , Jan. 16, 2019 /CNW/ – Treasury Metals Inc. (TML.TO) (“Treasury Metals” or the “Company”) is pleased to announce that it has entered into a Memorandum of Understanding (“MOU”) with Eagle Lake First Nation in relation to the Company’s Goliath Gold Project in Northwestern Ontario (the “Project”).

The MOU is a framework agreement between Eagle Lake First Nation and Treasury Metals to facilitate effective communication, engagement, and negotiation between the Parties with respect to the Project. The MOU will serve as an avenue to facilitate Eagle Lake First Nation’s meaningful continued participation in the federal environmental assessment and regulatory approval process for the Project. Further, the MOU provides a structure for additional opportunities and pathways to participate in the Project through employment, training and business development, financial participation and environmental and cultural protection.

Greg Ferron , CEO of Treasury, states, “A key goal of the Goliath Gold Project is to reflect the knowledge and input of all stakeholders and Indigenous communities in the development of the Goliath Gold Project and Eagle Lake First Nation’s regional experiences, and local traditional knowledge will help with the development of a socially and environmentally responsible Project.”

On behalf of Eagle Lake First Nation, Chief Arnold Gardner commented, “Signing an MOU with Treasury Metals is a positive step moving forward toward building trust with the community of Eagle Lake First Nation which is an important step in the process.”

To view further details about the Goliath Gold Project, please visit the Company’s website at www.treasurymetals.com.

Follow us on Twitter @TreasuryMetals

About Treasury Metals Inc.:

Treasury Metals Inc. is a gold focused exploration and development company with assets in Canada and is listed on the Toronto Stock Exchange (“TSX”) under the symbol “TML” and on the OTCQX® Best Market under the symbol TSRMF. Treasury Metals Inc.’s 100% owned Goliath Gold Project in northwestern Ontario is slated to become one of Canada’s next producing gold mines. With first-rate infrastructure currently in place and gold mineralization extending to surface, Treasury Metals plans on the initial development of an open pit gold mine to feed a 2,500 per day processing plant with subsequent underground operations in the latter years of the mine life.

About Eagle Lake First Nation:

The Eagle Lake First Nation is situated on the northeast shores of Eagle Lake and is located in the heart of the Canadian Shield in the boreal forests and lakes of Northwestern Ontario . The community is approximately 25 km southwest of Dryden and is accessible via Highways 502 and 594, and is a two hour drive from the U.S. border. Eagle Lake’s total on-reserve population as of December 2018 is 238.

The people of Eagle Lake are governed by a Chief and three Council members, elected every two years under the Indian Act. Eagle Lake is part of the Grand Council Treaty #3 which was signed on October 3 , 1873. Grand Council Treaty #3 covers 55,000 square miles.

Eagle Lake First Nation is located within the Grand Council Treaty #3 territory with a land base of 55,000 square miles in Northwestern Ontario . Eagle Lake First Nation of Eagle Lake is also referred to as Migisi Sahgaigan (Ojibway translation of Eagle Lake ).

For further information about the community of Eagle Lake First Nation please visit: http://www.eaglelakefirstnation.ca/.

Forward-looking Statements

This release includes certain statements that may be deemed to be “forward-looking statements”. All statements in this release, other than statements of historical facts, that address events or developments that management of the Company expect, are forward-looking statements. Actual results or developments may differ materially from those in forward-looking statements. Treasury Metals disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, save and except as may be required by applicable securities laws.

SOURCE Treasury Metals Inc.

View original content: http://www.newswire.ca/en/releases/archive/January2019/16/c7365.html

david |

|||||||||||

|

|||||||||||

|

|||||||||||

|