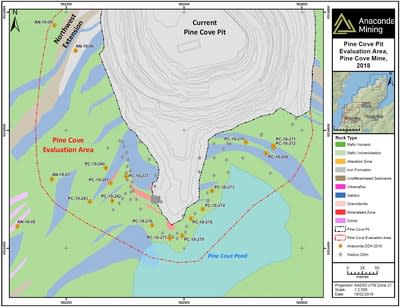

TORONTO , Feb. 20, 2019 /CNW/ – Anaconda Mining Inc. (“Anaconda” or the “Company”) (ANX.TO) (ANXGF) is pleased to announce the results of a 3,434-metre drill program that began in November, 2018 and included drilling around the Pine Cove mine (Exhibit A and B) and the Stog’er Tight mine (Exhibit C) (“Pine Cove” and “Stog’er Tight” respectively) at the Company’s Point Rousse Project in Newfoundland (“Point Rousse”). A total of 33 drill holes (the “Drill Program”) successfully infilled and extended mineralization near the margins of the existing pit outlines at both mines, as part of an on-going evaluation of potential pit expansions at both Pine Cove and Stog’er Tight. Anaconda extended the strike of the shallow, southern end of the Pine Cove Deposit, by approximately 100 metres, and extended mineralization in the Northwest Extension of the Pine Cove Deposit by 75 metres. At Stog’er Tight, the Company confirmed mineralization, including visible gold occurrences, adjacent to the ultimate pit design, down dip of the current mineral reserves.

Highlights from the Drill Program include:

Stog’er Tight:

- 6.45 grams per tonne (“g/t”) gold over 5.0 metres (65.0 to 70.0 metres) in hole BN-18-288;

- 1.89 g/t gold over 12.0 metres (64.0 to 76.0 metres) in hole BN-18-290; and

- 2.46 g/t gold over 8.0 metres (79.8 to 87.8 metres) in hole BN-18-292.

Pine Cove:

- 2.50 g/t gold over 9.0 metres (17.0 to 26.0 metres) in hole PC-18-271;

- 1.73 g/t gold over 9.0 metres (5.0 to 14.0 metres) in hole PC-18-281; and

- 1.50 g/t gold over 5.0 metre (10.0 to 15.0 metres) in hole PC-18-269.

“We are very pleased with the step-out drilling done at Pine Cove and Stog’er Tight. Based on historical drilling and the current drill results, we see the potential to continue mining on the southern and western side of the Pine Cove pit without compromising our tailings storage activities. In addition, we are encouraged by the possibility of adding more ore on the northern portion of the Stog’er Tight Deposit. In the coming weeks, we will incorporate these drill results into our resource models and determine whether we can extend the mining operations at Pine Cove and Stog’er Tight beyond our existing mineral resource plan.”

~ Dustin Angelo , President and CEO, Anaconda Mining Inc.

Selected highlights from previous drilling in contiguous mineralized zones within the unmined portion of the Pine Cove Deposit include:

- 8.75 g/t gold over 6.5 metres (15.5 to 22.0 metres) in hole PC-90-078;

- 2.66 g/t gold over 15.9 metres (6.0 to 22.0 metres) in hole PC-15-257;

- 2.59 g/t gold over 15.9 metres (41.6 to 57.5 metres) in hole PC-90-036;

- 2.00 g/t gold over 17.2 metres (22.4 to 39.6 metres) in hole PC-04-133; and

- 6.11 g/t gold over 5.0 metres (31.3 to 36.3 metres) in hole PC-92-107.

A table of selected composited assays from the Drill Program is presented below.

In addition to the drilling adjacent to the Pine Cove mine, the Drill Program included 1,812 metres in 12 diamond drill holes (AN-18-06 to 17) to explore the area between the Pine Cove mine and the Anoroc Prospect located approximately 800 metres southwest of the Pine Cove Deposit. Historic channel sampling and several historic diamond drill holes at Anoroc, including 9.92 g/t gold over 2.0 metres in hole AN-90-01, had previously intersected host rocks, alteration and mineralization similar in style and character to those of the Pine Cove Deposit. Drilling at the Anoroc Prospect intersected Pine Cove-like alteration and, locally, low grade mineralization, including 1.11 g/t gold over 5.5 metres (AN-18-13), but did not encounter significant assays to justify further exploration work at this time.

Table of selected composited assays from drill holes reported in this press release:

|

STOG’ER TIGHT |

||||

|

Hole ID |

From (m) |

To (m) |

Interval (m) |

Grade (g/t) |

|

BN-18-287 |

68.7 |

71.7 |

3.0 |

0.78 |

|

BN-18-288 |

65.0 |

70.0 |

5.0 |

6.45 |

|

and |

75.0 |

78.0 |

3.0 |

1.44 |

|

BN-18-289 |

69.0 |

73.0 |

4.0 |

2.70 |

|

BN-18-290 |

64.0 |

76.0 |

12.0 |

1.89 |

|

and |

91.5 |

92.5 |

1.0 |

0.48 |

|

BN-18-291 |

72.0 |

75.0 |

3.0 |

5.12 |

|

BN-18-292 |

79.8 |

87.8 |

8.0 |

2.46 |

|

Hole ID |

From (m) |

To (m) |

Interval (m) |

Grade (g/t) |

|

PINE COVE |

||||

|

PC-18-269 |

10.0 |

15.0 |

5.0 |

1.50 |

|

PC-18-270 |

25.0 |

26.0 |

1.0 |

1.23 |

|

and |

32.0 |

34.0 |

2.0 |

0.67 |

|

and |

38.0 |

40.0 |

2.0 |

1.45 |

|

PC-18-271 |

17.0 |

26.0 |

9.0 |

2.50 |

|

PC-18-272 |

31.0 |

36.0 |

5.0 |

0.61 |

|

and |

39.0 |

41.0 |

2.0 |

1.05 |

|

PC-18-274 |

39.0 |

40.0 |

1.0 |

0.83 |

|

PC-18-275 |

4.0 |

6.0 |

2.0 |

1.46 |

|

and |

11.0 |

12.0 |

1.0 |

0.85 |

|

and |

16.0 |

20.0 |

4.0 |

0.89 |

|

PC-18-276 |

2.7 |

7.7 |

5.0 |

0.84 |

|

and |

37.0 |

38.0 |

1.0 |

1.36 |

|

PC-18-277 |

5.0 |

8.0 |

3.0 |

0.99 |

|

and |

12.0 |

15.0 |

3.0 |

1.91 |

|

PC-18-278 |

8.0 |

9.0 |

1.0 |

1.16 |

|

PC-19-280 |

24.0 |

27.0 |

3.0 |

0.75 |

|

and |

30.0 |

31.0 |

1.0 |

0.84 |

|

PC-19-281 |

5.0 |

14.0 |

9.0 |

1.73 |

|

PC-19-283 |

77.0 |

78.0 |

1.0 |

1.07 |

|

ANOROC |

||||

|

AN-18-06 |

15.1 |

33.1 |

18.0 |

1.52 |

|

including |

17.1 |

27.1 |

10.0 |

2.35 |

|

and |

17.1 |

18.1 |

1.0 |

13.60 |

|

and |

35.1 |

36.1 |

1.0 |

0.64 |

|

AN-18-13 |

7.9 |

9.0 |

1.1 |

1.78 |

|

and |

31.0 |

32.9 |

1.9 |

0.72 |

|

and |

37.0 |

39.0 |

2.0 |

1.09 |

|

and |

54.5 |

60.0 |

5.5 |

1.11 |

|

including |

57.0 |

58.0 |

1.0 |

4.98 |

|

AN-18-14 |

7.0 |

8.0 |

1.0 |

0.92 |

This news release has been reviewed and approved by Paul McNeill , P. Geo., VP Exploration with Anaconda Mining Inc., a “Qualified Person”, under National Instrument 43-101 Standard for Disclosure for Mineral Projects.

The company would like to thank the Department of Natural Resources, Government of Newfoundland and Labrador to their assistance in portions of the 2018 exploration drill programs through the support of the Junior Exploration Assistance Program.

All samples and the resultant composites referred to in this release are collected using QA/QC protocols including the regular insertion of standards and blanks within the sample batch for analysis and check assays of select samples. All samples quoted in this release were analyzed at Eastern Analytical Ltd. in Springdale, NL , for Au by fire assay (30 g) with an AA finish.

Reported mineralized intervals are measured from core lengths. Intervals are estimated to be approximately 80-100% of true widths.

A version of this press release will be available in French on Anaconda’s website (www.anacondamining.com) in two to three business days.

ABOUT ANACONDA

Anaconda Mining is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in the prospective Atlantic Canadian jurisdictions of Newfoundland and Nova Scotia . The Company operates the Point Rousse Project located in the Baie Verte Mining District in Newfoundland , comprised of the Stog’er Tight Mine, the Pine Cove open pit mine, the Argyle Mineral Resource, the fully-permitted Pine Cove Mill and tailings facility, and approximately 9,150 hectares of prospective gold-bearing property. Anaconda is also developing the Goldboro Gold Project in Nova Scotia , a high-grade Mineral Resource, subject to a 2018 a preliminary economic assessment which demonstrates strong project economics. The Company also has a wholly owned exploration company that is solely focused on early stage exploration in Newfoundland and New Brunswick .

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking information” within the meaning of applicable Canadian and United States securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects”, or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “does not anticipate”, or “believes” or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, or “will be taken”, “occur”, or “be achieved”. Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in the annual information form for the fiscal year ended December 31, 2017 , available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Anaconda does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE Anaconda Mining Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2019/20/c3596.html