Ross McElroy the COO and Chief Geologist for Fission 3.0 (TSX.V: FUU | OTCQB: FISOF) sits down with Maurice Jackson of Proven and Probable to discuss the value proposition of Fission 3.0 and their Property Bank. In this interview Mr. McElroy provides the macro economics for uranium and how one may allocate their uranium holdings in a Uranium Project Generator with a Property Bank with projects located in high-grade uranium districts, with proven management and technical team that has a 20 year history of delivering success to shareholders.

VIDEO

AUDIO

TRANSCRIPT

![]()

Original Source: https://www.streetwisereports.com/article/2019/03/16/prospect-generator-in-position-for-uranium-turnaround.html

Maurice Jackson: Joining us for a conversation is Ross McElroy, the COO and chief geologist for Fission 3.0 Corp. (FUU:TSX.V; FISOF:OTC.MKTS): A Uranium Project Generator and Property Bank. Ross McElroy, glad to have you back on the program to share the value proposition of Fission 3.0. Before we begin, Ross, I’d like to begin with some basic fundamentals regarding uranium. For someone new to the uranium sector, what is uranium, and where is it used?

Ross McElroy: Uranium is really all about energy. The way we use uranium is for nuclear fuel. That’s basically the fuel that runs reactors.

Globally nuclear power constitutes between 15% and 20% of the electrical requirements. That’s really where the majority of the uranium is used. There is some uranium that’s used for strategic purposes on a country by country basis, more for the Department of Defense reasons. But really, the vast, vast majority of uranium is used to fuel nuclear reactors.

Maurice Jackson: Provide us with some metrics on how abundant uranium is in the Earth’s crust, and correlate that to the average grade that is found versus the grade that is needed to define an ore deposit in a future mine?

Ross McElroy: Well, uranium is actually one of the most abundant elements in the Earth. It’s kind of ubiquitous. You’ll see it throughout the Earth’s crust; there is trace amounts of uranium present primarily in volcanic and igneous rocks and sedimentary rocks.

On a deposit level, there’s actually a number of uranium deposits around the world, in every continent on the planet and in many countries. On a global basis, the average grade of a uranium deposit worldwide is around 0.1 to 0.15% U308.

Now, if you compare that to say, the deposits in Canada, they’re orders of magnitude higher grade in Canada. We’re talking orders of magnitude that are 10 to 20 times that of the global grade.

Although I’ve given you the average grade, most of those deposits at those lower grades, the average grades are really uneconomic deposits. We need grades that are generally much higher than the 0.1%–0.15% if it’s going to be an economic deposit. And that’s what Canada has. Canada has very high-grade deposits, so the economic metrics are just that much more attractive in Canada.

Maurice Jackson: Now that we’ve identified uranium’s utility, what can you share with us from a supply and demand perspective?

Ross McElroy: Well, it’s fairly simple to understand what the demand for nuclear energy is, in other words, uranium. We can just multiply the number of reactors around the world that are currently operating, and the known fuel consumption rate for a 1000 megawatt reactor is just under 500,000 pounds of uranium a year. If we look at the global reactors, there are around 450 reactors around the world. You can see that the need for uranium on an annual basis is around the realm of almost 200 million pounds of uranium.

Maurice Jackson: How does the nuclear plant in Fukushima, Japan, fit into this narrative?

Ross McElroy: Japan historically, up until the Fukushima event in 2011, was one of the main users on a country basis worldwide. Japan I think consumed almost 20% of the world’s nuclear power, in other words, 20% of the world’s annual production of uranium was used to run the Japanese reactors.

In 2011, of course, we had the magnitude 9 earthquake followed by a tsunami, and that’s what damaged the Fukushima facility. Interestingly enough, even with that magnitude of an earthquake and the soon-to-follow tsunami, the reactor still did not breach. The housing that surrounded the reactor was damaged, and this is where some of the radiation leaks came from, but the reactor itself actually held, and so the damage was actually very, very limited and manageable.

What happened is overnight, Japan shut down all of its nuclear reactors, in other words, all 52 reactors I think they had working at that time, went offline. That caused disruption to the supply/demand situation globally.

What’s happened since then is Japan is slowly coming back on. Japan’s alternatives for power are pretty limited as the country doesn’t have very much of its own resources, if any at all. It imports whatever energy that it needs, be it in natural gas now, in nuclear.

It’s important for Japan to be able to operate these factories that they’re running. I mean, it’s an exporting country around the world, so it does have high energy requirements. It also has the requirements for inexpensive power.

Japan is coming back on to the scene as far as nuclear power. There are eight reactors that are currently back up and operating, and 17 reactors that are in the near-term licensing for approval to get them restarted again.

I think the bottom line is, prior to Fukushima, Japan depended on nuclear energy for at least 25% of its electricity demands. I think by the time 2030 approaches, Japan is supposed to be right back up to those same levels. The country is coming back on, it has always been an important major consumer of nuclear power. I think we’ll see it right back to the equation again in the very near future.

Maurice Jackson: Uranium, next to gold, is known as the other yellow metal, and here’s why. Ross, let’s step back to the bull market in uranium. If one was selective with the uranium holdings, they would’ve had generational changes in their portfolio. What was the spot price during the last bull market?

Ross McElroy: Well, in 2002, uranium was around, I don’t know, about $15 a pound. This is on the spot market. That’s what uranium was trading for.

In 2003–2004, we really saw the lift off of the price of uranium. In fact, it peaked at 2007 to around $140 a pound. It went almost a 10-fold increase in the price of the commodity between 2003 and 2007. The peak at 140 didn’t last particularly long, but it had a slower decline until about 2008—2009, it stabilized, and then it peaked back up again.

Really, it was holding steady. I guess this is the point I would want to make, is that we were starting to see a steady state price of between $50 to $70 a pound, and then the Fukushima event hit that we talked about in 2011, and that really threw the whole pricing structure right out the window. We’ve been working on our recovery ever since.

Maurice Jackson: What is the spot price for uranium today?

Ross McElroy: Currently we’re about $28 a pound for uranium. It has recovered; we’re off the bottoms of $17, $18 a pound just a couple of years ago. Uranium is making its way back.

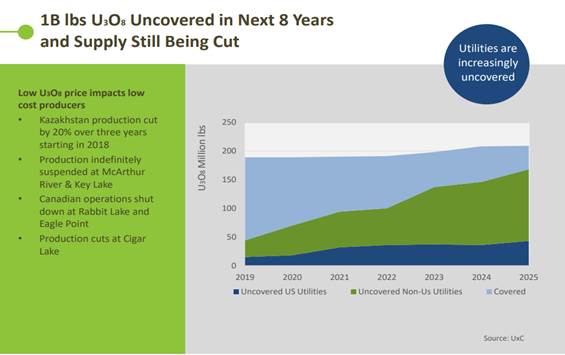

Maybe the important point here to note is we’re still at prices that the majority of mines around the world are not profitable. Even the lowest cost producers are really not operating in an environment where they can make money with uranium prices what they’re at right now.

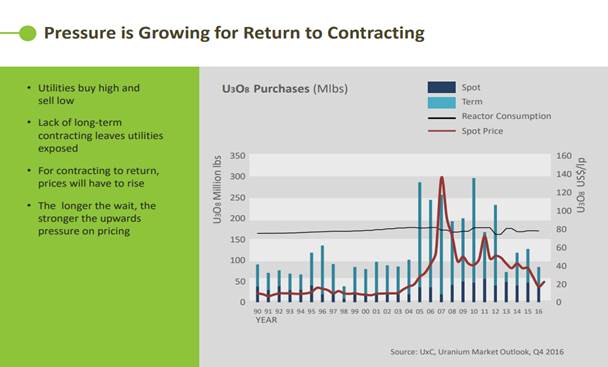

What we’ve seen is that the supply is starting to be restricted as the producers are taking a lot of that uranium off market; they’re not supplying it to the utilities at this cheap price, because it’s not a working business model to lose money in the long run on the mining of the commodity.

We are seeing an improvement in the price of uranium, and it’s been about a year and a half in the making. It’s gone up from the $18 that I mentioned to about $28 a pound, but it certainly has a lot more room to move upwards even before we can start to get production back online to meaningful levels.

Maurice Jackson: What is that spot price that companies right now, uranium companies I should say, for them to earn their cost of capital? Is the number around $60 for a spot price of uranium?

Ross McElroy: I believe you are correct. We’re seeing prices that globally, they have to be in the $60 to $70 a pound really to bring on any meaningful production.

One of the clues that I look at when we look at the best uranium mines out there, the lowest cost producers, those would be McArthur River deposit in Canada’s Athabasca Basin in Northern Saskatchewan. That is one of the best uranium mines in the world, certainly the largest highest-grade operating mine. Cameco took that offline because of the prices of uranium where they were at, they weren’t making any money on the mining of this deposit.

There are some indications that Cameco won’t turn that mine back on into being a producer until the price of uranium is somewhat north of $40, maybe $45. Something in that realm.

I don’t have an exact number there, but it does tell you that if you’re going to even bring back the best of those deposits, you really need prices that are something of $40 to $45. As we mentioned earlier, the price for many of the other deposits around the world are probably closer to $60 or $70. You can see, there’s still lots of room for improvement.

Maurice Jackson: The current price of uranium does not support the fundamentals. What correlations do you see today that may exceed the returns from the last bull market?

Ross McElroy: Well, it’s sort of an elastic situation. I think that the longer that we keep depressed prices, yet the demand is still there and growing, reactors are being built, the need to fuel these reactors, that’s not stopping.

In fact, it’s growing. You have the primary suppliers of uranium, i.e., the mines that are not supplying it, the longer that the prices are low, the more rapid that climb will be in the price of uranium when it does correct.

I think there’s a possibility, as I’ve heard some analysts call it, a violent reaction upwards to the price of uranium. I think we’re going to see some substantial price increases within some short vision of time, maybe a year or two or three. Something in that realm that I think will be quite meaningful.

We’ll see what happens, but the longer it stays depressed, the more likely and quicker the rise will be when it does come.

Maurice Jackson: Ross, you’ve provided a compelling case on the fundamentals for uranium. I know readers may be asking, how will all of this demand for uranium be met? Mr. McElroy, please introduce us to Fission 3.0.

Ross McElroy: Fission 3.0 is a uranium explorer. This is a company that we spun out of Fission Uranium Corp. (FCU:TSX; FCUUF:OTCQX; 2FU:FSE), our larger company, back in 2014 when we bought out our partner on the Patterson Lake project, and in so doing with that process from that arrangement, we spun out our non-core assets, the more grassroots exploration projects.

We’ve been able to build up an exploration portfolio, primarily focused in the Athabasca Basin. Remember, the Athabasca Basin is Canada’s only producing uranium field. That’s where the McArthur River deposit is, this is where Fission Uranium has the Triple R deposit. There’s some fantastic deposits out there.

That’s what we’re exploring for in Fission 3.0. We’re looking for the next high-grade uranium deposit in the Athabasca Basin.

Maurice Jackson: You referenced that you’re a project generator. There’s a lot of ambiguity regarding project generators. Please share the virtues and why Fission 3.0 took on the project generator business model?

Ross McElroy: Project generators are really all about sharing the risk. In our case, what we do very well is pick ground. We’ve been able to strategically stake ground in the Athabasca Basin, we’ve made discoveries on two of our properties, the first one in the company called Fission Energy that we made the discovery at our Waterbury Lake property, and later on in Fission Uranium Corp on our PLS property.

That have been situations where we’ve had joint-venture partners sharing the risks, sharing the costs with others. To use the model, what we do is we use our brands and other peoples’ money. That’s really what we’re good at, that’s basically the model that we have.

We have a very highly trained technical team that’s exceptional at picking out high-quality projects. We attract other people who are looking to get into the uranium business, looking to partner up with a team such as ours and join us for the ride to make a discovery.

It’s really all about sharing risk. That’s really what the project generator model does. It’s our land, and we partner with good quality people that can fund a project, and that’s how they earn into it as well.

Maurice Jackson: Do you currently have a joint-venture partner? If yes, who and what are the terms of the relationship?

Ross McElroy: We have had joint-venture partners in the past, and very successful ones. As I mentioned earlier on our Waterbury project, we had a partner with the Korean utility called KEPCO. It earned in by spending a certain amount of money on the property each year over the course of a three-year period.

What we did with that, we were able to make a discovery, using the money in that project, we made a discovery, built up the resource estimate on there, and eventually sold that asset. That was how our shareholders were able to take advantage of our monetizing on the property.

I guess we could say the same at the PLS project, which we now own 100% of it, but that was also a partnership. We shared in the risk early on and in the money early on with our partner. We eventually bought them out in 2014. That was another example of a successful joint venture partnership.

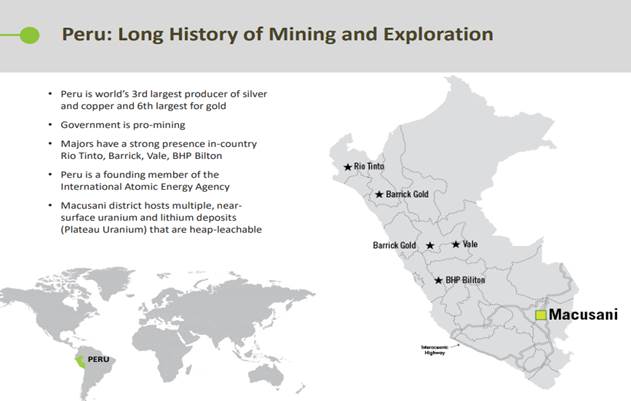

Each one of the deals would be a little bit different from each other. It is a model that we think works very well. I will note that in our property down in Peru as well, we have a partnership that we’re still looking to finalize the deal. This is one where another group has approached us, said it’s interested in the potential of a property down in Peru. It will spend a significant amount of money having us as the operator. Hopefully we’ll make a discovery down in Peru as well.

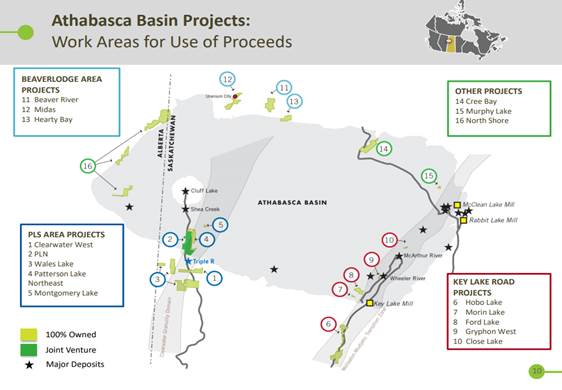

Maurice Jackson: Well, you’ve just alluded to my next question. Fission 3.0 has 18 projects in its project bank. Now, it is strategically located in premier, high-grade uranium districts in Canada and Peru. Mr. McElroy, introduce us to the Fission 3.0 Project Bank (click here).

Ross McElroy: We have 18 properties in the Athabasca Basin. Our properties, we think that everywhere in the Athabasca Basin has the potential to host high-grade uranium projects.

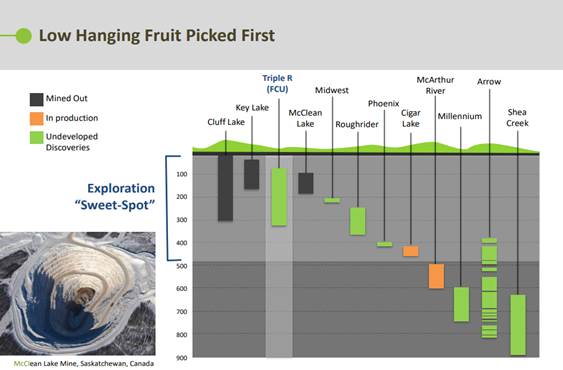

One of the keys that we seek to identify are deposits that will be shallow. In other words, the closer a deposit is to surface, the easier it is to build a case that this could be a project that could go into production. It’s an easier mine to develop the closer it is to the surface.

Really deep deposits are challenging. They still exist, but they’re challenging. Eventually they cost more money to find and cost more money to get out of the ground. They’re just another level of challenge.

If you look at our 18 properties, they’re all in and around the edge of the Athabasca Basin, where we’ve had a great deal of success finding near-surface mineralization.

Our PLS project that hosts the Triple R deposit in Fission Uranium is a great example of a near-surface deposit. The mineralization starts at 50 meters below the surface, so 150 feet below the present-day surface is where the high-grade mineralization starts. That makes it a potentially open-pit deposit, which is generally low cost and gives you a lot of flexibility.

This is the sort of thing that we’re looking for in Fission 3.0. We’ve got very good properties that are in known mining districts, conversely, we have a good portfolio of ground around the southwest side of the basin where our PLS project in Fission Uranium is hosted, and also NexGen’s Arrow deposit, it’s all in that same area. We have the significant land package that surrounds that area.

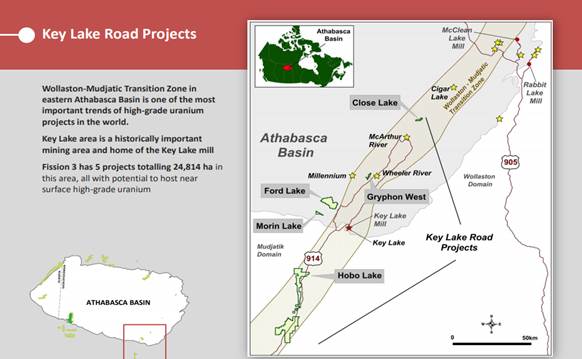

We also have a good strategic land package in and around the Key Lake area on the southeast side of the basin. This has been, and still currently is the hot bed of uranium mining in Canada right now. This is the side of the basin where the McArthur River and Cigar Lake deposits are located.

McArthur shut down for economic reasons waiting for higher uranium prices. It was an operating mine up until about a year ago, and Cigar still is in operation. You’ve also got the Key Lake mine.

It’s a strategic area to have a good land package. We think there’s lots of opportunities in and around land in that area to make a new discovery.

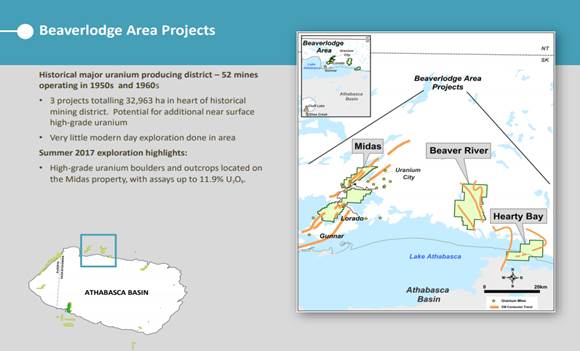

And probably third for us is the land package that’s up in the northwest side of the basin, in the old uranium city Beaverlodge district where uranium mining in Saskatchewan first got started back in the 1950s and was the going concern back in the ’50s and the ’60s, I think there were about 52 operating mines up in that area, pretty small scale most of them, but still lots of high-grade uranium. That’s an area where we think that there’s still plenty of exploration potential.

Between all those areas, we’re going to be active and we’re going to be looking for the next high-grade uranium deposit in Saskatchewan.

Maurice Jackson: Speaking of being active, is there active drilling going on right now in these projects?

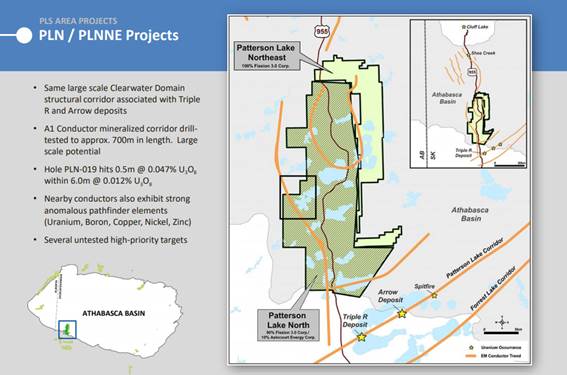

Ross McElroy: There is active drilling. We did drill in the southwest side of the basin. We were drilling in January on our PLN project. That project is just immediately north of Fission Uranium’s PLS project.

You’re really talking about the same area where the latest discoveries have been found, where you’ve got the Triple R deposit, you’ve got NexGen’s Arrow deposit. These are two of the best new deposits that have been found in the Athabasca Basin in the last 15 years.

We have a package around there called PLN, and we did drill six holes in there earlier this year. It has the potential to host another one of these fantastic deposits, so we are going to continue looking there. We see all the signs present that tell us that this is where we’ll make that discovery.

As we’re speaking right now, we’re drilling over in the Key Lake area that I described earlier. This is over on the southeast side of the basin, about 200 kilometers to the east of the PLS drilling. That is a program where we’ll drill probably eight or nine holes, just south of the Key Lake Mill and the old historical Key Lake deposits. There’s areas of activity there. We’ll continue drilling throughout the rest of 2019 on a number of our projects.

Fission 3.0 is active. We were able to raise some significant money early in the year, in late 2018. We’re going to be active. This is how we’ve been successful in the past, is by being aggressive, looking in places where people probably haven’t looked for a while or never even thought to look, and putting our technical team to work. Yes, you’ll see pretty good news flow out of Fission 3 this year.

Maurice Jackson: Ross, let’s expand the narrative on the project bank portfolio and go south into Peru. What can you share with us there?

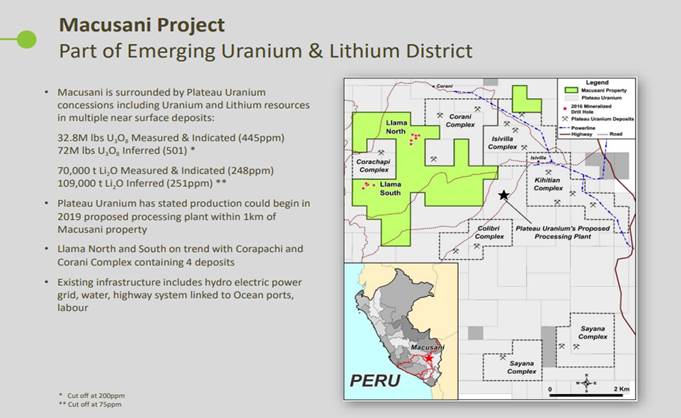

Ross McElroy: Peru is a really interesting area. Where our projects are is called the Macusani Plateau, located in southern Peru, near the Bolivian border. The Macusani Plateau has shown at least over 100 million pounds in near-surface uranium deposits.

There’s a company down there that’s quite dominant called Plateau Energy. Plateau has been able to stake a lot and consolidate a land package in the area, and consolidated all these old deposits. It has amassed around 100 million pounds of uranium in these uranium deposits.

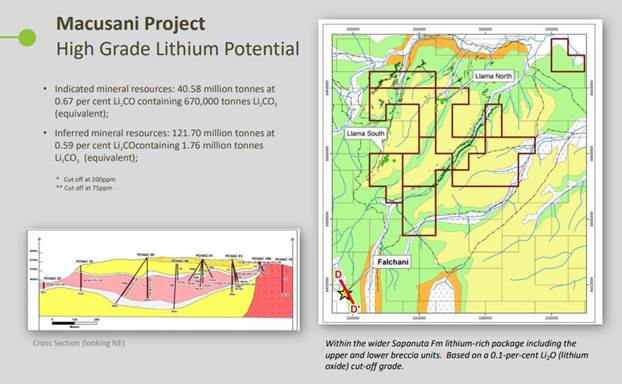

However, even more significant, Plateau made a discovery of high-grade lithium in the same area, and in fact, that’s within five kilometers of our southern property boundary on our Macusani plains. Not only do we have the potential now to host near-surface uranium deposits, and we have shown in fact that we do have mineralization on our property for uranium, we’ve mapped it, we’ve drilled, we’ve trenched and found high-grade uranium, but now the potential’s there for hosting high-grade lithium.

This is really a new dimension that we have down in that area, that we wouldn’t have had say, two or three years ago when we were last down drilling. You’ve got uranium, and now we have lithium. It’s a very interesting up-and-coming area as well.

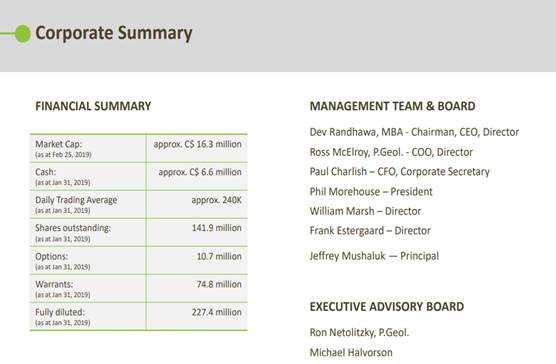

Maurice Jackson: Switching gears, Fission 3.0 has the right projects in the right place at the right time. But that’s only part of the story. Equally important are the people that are responsible for increasing shareholder value. Mr. McElroy, please introduce us to your board of directors.

Ross McElroy: Thank you, and I appreciate that. We do have a very successful team. Our founder of Fission 3.0 is also the same CEO and founder of Fission Uranium, and previously Fission Energy before that, and Strathmore.

Dev Randhawa has been involved in this company right from the get-go in its first iteration back in 1996, and also heading up Fission 3.0. Dev is the longest running CEO in the uranium sector.

Myself, I’ve been involved with Dev 12, 13 years now. We’ve had a great successful relationship. We’re able to raise money, raise attention, put that money to work, make discoveries, and basically build shareholder value right from the bottom up.

This is the group that I think, we’ve been able to deliver in the past, and we’re going to be able to deliver shareholder value as we move forward in this much improving uranium sector.

A lot of the same players that we’ve had all the way along, still keep also in the Fission 3 group.

Maurice Jackson: Who is on your management team?

Ross McElroy: The management team is composed of our CEO Dev Randhawa and chairman. I am the chief operating officer, and also the chief geologist. We have maintained the same structure that we have in Fission Uranium, is the same that we have in Fission 3.0. It’s a fairly lean team. Phil Morehouse is president of Fission 3.0. We kept a pretty lean mean machine in Fission 3.

Don’t forget, we’ve had up until just recently in the last six months, it’s been a very quiet company, there hasn’t been a lot of exploration activities in the uranium sector. I think as we start to ramp up, with our level of activity increasing, we’ll start to draw more and more people into roles and developing roles within the company as we begin to be active, get out and start marketing the story more, get on the ground and back that up with real results, we’re going to continue to build our team.

Maurice Jackson: Before we move on to your impressive technical team, in the natural resource basis, why is it wise to follow proven winners? Ross, you alluded to it earlier, you and CEO Dev Randhawa have a proven pedigree of success. How were shareholders rewarded as far as returns for their loyalty to sticking with your team?

Ross McElroy: Well, if you owned the original company at the beginning, which would’ve been Strathmore Minerals, and you’d held on it to all the way throughout, over the last 20 years since about 1996, 97, you’d probably own about five different companies right now.

What’s happened is we’ve moved on to a new phase, we’ve made discoveries, advanced projects, sold different projects to different groups. What we’ve been able to do is form new companies, split off new companies in what they call a butterfly transaction.

You have shares in the new company, still maintain your shares in the old company, so you would’ve received essentially what would look like dividends in the way of different shares for five different companies since that time. The shareholders that have been loyal and sticking with us would’ve succeeded quite handsomely all the way along.

Maurice Jackson: Your technical team is exceptional. I had an opportunity to meet them in the summer of 2016 at the site visit there. Please, introduce us to them.

Ross McElroy: We’re very, very proud of this group. This has been the team we’ve had, the same core group of people with us since 2010. With that same group, we were able to make our discovery on the Waterbury Lake project, and then followed up in 2012 with the discovery of PLS. It’s the same group that is very core and important to us in Fission 3.0.

I do head up the team and the technical group, so I would be the team leader or chief geologist for the technical team. My right hand guy is Raymond Ashley, he’s the VP of exploration. Ray is an excellent geoscientist who I’ve had the pleasure to work with for over 30 years in this sector, so we’ve been working pretty close together. Definitely a proven mine finder.

We’ve basically held the same group of people together on the project managers, all the structural scientists, geochemists. We’ve kept the same core group together over the last almost 10 years or so.

To me, that’s really the key. You want a team that works together well, good chemistry with each other, the ability and the environment to think outside of the box. Really, the goal for each and every one of us is to responsibly make world-class discoveries. That’s what we’re all about.

We’ve got an excellent team. All the key people are listed on the website. You’ll be able to go there and see the roles of the various groups there in the technical team, but there’s about seven or eight of us that have been able to be what I consider the core team for the last decade or so.

Maurice Jackson: Let’s get into some numbers. Please share your capital structure.

Ross McElroy: In Fission 3.0, we have 142 million shares outstanding. We were able to raise a significant amount. We have just under $7 million in the treasury right now, that’ll allow us to be active over the next two years or so.

Maurice Jackson: What is your burn rate?

Ross McElroy: The burn rate, because it’s exploration, it’s pretty discretionary spending. We have $7 million that we have in the treasury right now, that’ll certainly carry us over the next two to three years of pretty aggressive exploration spending on our key projects. We can dial that kind of number up, and we can dial it back as conditions warrant. That’s the benefit of being in exploration.

The burn rate is actually pretty minimal. In other words, we run a pretty lean shop as far as the number of management and corporate costs. Really, the majority of the costs are exploration spending, which is really entirely discretionary.

Maurice Jackson: How much debt do you have?

Ross McElroy: We have no debt. We’ve not taken on any debt. Basically, the money that we raise have been through equity share offerings. No debt in Fission 3.0.

Maurice Jackson: Who are your major shareholders? What is their level of commitment?

Ross McElroy: When we spun off Fission 3.0 back in December of 2014, it was the same shareholders that were shareholders of Fission Uranium, were the same shareholders in Fission 3.0. We would’ve had a lot of the same loyal, large shareholders, including JP Morgan, even investment from others that we’ve had along the way. It’s been the same loyal group.

We have significant new shareholders now with the financing that we did back in 2018, which was led by the Sprott Global Resources Group out of California. I think we have some new players back to the game, but we have a lot of shareholders that have been with us over the long haul.

These are people that have a good vision of the uranium sector. They know that the good times are around the corner. It’s a point that we believe really strongly, and we think that the sector is improving a great deal.

This is how our loyal shareholders are going to be rewarded, by being a much better market with an aggressive team like Fission 3.0, and the new shareholders will probably be long term loyal shareholders too if we’re successful and able to build value for them as well.

Maurice Jackson: What is the float?

Ross McElroy: Fully diluted, we have 227 million shares. We’ve got shares outstanding, we’ve got options and warrants that we’re a part of financing as well, so 227 million shares out in total. We trade around 240,000 shares a day, I think that’s our average volume.

Maurice Jackson: Multi-layered question. What is the next unanswered question for Fission 3.0? When can we expect a response? What determines success?

Ross McElroy: Well, we are going to be successful through work. We know that a better market should buoy the price up of everybody involved in the nuclear sector. They’re starting to get some life back in the exploration world.

Really, we’ve always built value by our success. We’ve been successful with making discoveries. We now have the money, we have the team, we’re putting them to work. I would look to us as being one of the most dynamic uranium explorers out there. That’s something that I think people can follow, they can see our news release cycle, they’ll see how we’re marketing our story, and just look at the results. I think they’ll speak for themselves.

We’re looking at our projects, we’ll be active throughout the calendar year. I think the news flow will be very strong and steady. People that are interested in following the company will always see that there’s a continuing narrative out there. We want to take advantage of this and improve the uranium market, the fact that we are well financed, and we have the properties that we want to explore. I think there’s a very good opportunity for readers to look at Fission 3.0 as a sector leader in the uranium exploration business.

Maurice Jackson: Mr. McElroy, last question. What did I forget to ask?

Ross McElroy: I think we’ve covered a lot of ground here, and a lot of important ground. One of the takeaways that I want readers to know is we really do believe in the nuclear sector. We think that we have turned the corner and that conditions are improving.

If people are looking to invest in the uranium sector, I think it’s important for them to look at a group that has done it before. Your track record is very indicative of what your future has the potential to look like. I always find myself, when I’m investing, I like to back teams with a proven track record.

We have that in our group. We’ve got an exceptional management team. We’ve done it before. We’ve been able to capitalize on our discoveries by selling assets. We have a unique technical team that has the ability to make discoveries.

So better sector, very good team. Strong management. Those are the ingredients we need to be successful.

Maurice Jackson: Ross, for someone listening that wants to get more information about Fission 3.0, please share the website address.

Ross McElroy: Our website address is www.fission3corp.com.

Maurice Jackson: For direct queries email ir@fission3corp.com, or you may call (778) 484-8030. Fission 3.0 trades on the TSX:V, symbol FUU, and on the OTC, symbol FISOF.

For audience, we’ve been proud shareholders of Fission 3.0 since 2014. Last but not least, please visit our website, provenandprobable.com, for mining insights and bullion sales. You may reach us at contact@provenandprobable.com.

Ross McElroy of Fission 3.0, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Fission 3.0. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click herefor important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.