|

|||||

Blog sub category

|

|||||

VANCOUVER , March 4, 2019 /CNW/ – Rover Metals Corp. (ROVR.V) (ROVMF) (“Rover Metals” or the “Company“) is pleased to announce its intention to complete a non-brokered private placement of units (the “Units“) at a purchase price of $0.08 per Unit, for aggregate gross proceeds of up to CAD$1,250,000 (the “Offering“). Each Unit shall consist of one common share in the capital of the Company (a “Common Share“) and one Common Share purchase warrant (a “Warrant“). Each Warrant shall entitle the holder to acquire an additional Common Share at a price of $0.15 per share for a period of 24 months following the date of issuance.

Rover Metals anticipates using 80% of the proceeds of the Offering to finance exploration activities at the Cabin Lake Gold Project and remaining use of proceeds for general and administrative expenses.

The Company may pay finder’s fees in accordance with the policies of the TSX Venture Exchange in connection with the Offering.

Rover Metals anticipates relying, in part, on the exemption from the prospectus requirements provided in BC Instrument 45-534 – Exemption From Prospectus Requirement For Certain Trades to Existing Security Holders (the “Existing Shareholder Exemption“). The Company may also rely on other available prospectus exemptions.

Rover Metals has set March 1, 2019 as the record date for determining shareholders entitled to participate in the Offering in reliance on the Existing Shareholder Exemption. If the Offering is over-subscribed, Units will be allotted on a first come first served basis. Qualifying investors who wish to participate in the Offering should contact the Company using the contact information set forth below. It is anticipated that the Offering will close in one or more tranches commencing on or about March 15, 2019 .

All securities issued under the Offering will be subject to a hold period of four months and a day from the distribution date, in accordance with applicable securities laws. Completion of the Offering is subject to the receipt of all applicable approvals, including the approval of the TSX Venture Exchange.

About Rover Metals

Rover Metals is a natural resource exploration company specialized in gold that is currently focused on the Northwest Territories of Canada , one of the most mining friendly jurisdictions in North America . The Cabin Lake Group of High Grade Gold Projects are located within 20km of Fortune Minerals’ (FT.TO) planned NICO Project gold processor.

You can follow Rover Metals on its social media channels Twitter: https://twitter.com/rovermetals, LinkedIn: https://www.linkedin.com/company/rover-metals/, Facebook: https://www.facebook.com/RoverMetals/, and CEO.ca: https://ceo.ca/rovr for daily company updates and industry news.

ON BEHALF OF THE BOARD OF DIRECTORS OF ROVER METALS

“Judson Culter”

Chief Executive Officer and Director

Statement Regarding Forward-Looking Information

This news release contains statements that constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Rover’s actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur. Forward-looking statements in this document include statements regarding Rover’s expectations regarding the issuance of Units and receipt of regulatory approval therefor and the use of proceeds from the Offering. There can be no assurance that such statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements, and readers are cautioned not to place undue reliance on these forward-looking statements. Any factor could cause actual results to differ materially from Rover’s expectations. Rover undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS NEWS RELEASE REPRESENTS THE EXPECTATIONS OF THE COMPANY AS OF THE DATE OF THIS NEWS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE THE COMPANY MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OF THIS RELEASE

View original content:http://www.prnewswire.com/news-releases/rover-metals-corp-announces-non-brokered-private-placement-of-up-to-cad1-250-000–300805708.html

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

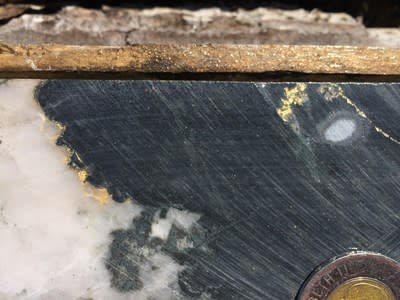

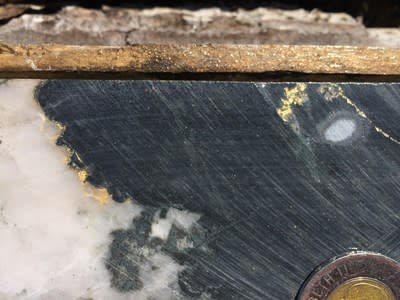

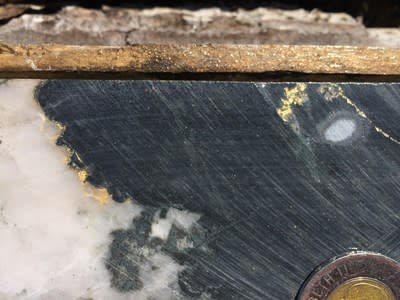

TORONTO , Feb. 28, 2019 /CNW/ – Anaconda Mining Inc. (“Anaconda” or the “Company”) (ANX.TO) (ANXGF) is pleased to announce the final results from the 10,000-metre drill program that began in July 2018 at the Goldboro Gold Project in Nova Scotia (“Goldboro”). Anaconda drilled four holes (BR-18-64 to 67), totaling 1,456 metres (the “EG Drill Program”) to extend the existing Goldboro Deposit towards the east along strike. The EG Drill Program successfully intersected the host fold structure, alteration and mineralization 100 metres east of the current Mineral Resource within the East Goldbrook Gold System (“EG Gold System”). Anaconda also encountered five occurrences of visible gold (Exhibit A, B).

The EG Drill Program intersected a high-grade mineralized zone which included 25.70 grams per tonne (“g/t”) gold over 1.5 metres and 8.00 g/t gold over 3.2 metres up plunge from very high-grade historic assays including 215.74 g/t gold over 3.7 metres (the “High-Grade Zone”) (See photo in Exhibit C). The High-Grade Zone plunges moderately to the east and is located on the south dipping limb of the host fold structure. It extends for at least 150 metres and is open down plunge. High-grade plunging chutes are common at Goldboro , having been intersected elsewhere in the deposit. Furthermore, numerous other mineralized zones were intersected along the south limb of the EG Gold System outside of the High-Grade Zone, with further drilling planned to confirm the geological model for these zones.

A table of selected intersections from both recent and historical drilling are shown in the table below.

“These drill results continue to demonstrate the expansion potential of the Goldboro Deposit as well as the ability to locate pockets of very high-grade continuous mineralized zones. The results from the EG Drill Program, taken together with historical drilling in the East Goldbrook area, indicate that there is a very high-grade zone of at least 150 metres in plunge length, which remains open for expansion down plunge. In our upcoming 5,000-metre drill program, we will take a closer look at this high-grade area to see if we can define it better. With all results received from the 10,000-metre drill program, we are incorporating them into an updated Mineral Resource estimate currently underway by WSP Canada Inc. We expect to publish a new estimate by the third quarter.”

~ Dustin Angelo , President and CEO, Anaconda Mining Inc.

Initiation of a 5,000-metre drill program at Goldboro

The Company will initiate a 5,000-metre drill program at Goldboro beginning in March. The drill program will focus on expansion drilling in the EG Gold System with the goal of growing resources and better defining the extents of the high-grade plunging chutes intersected in the recent EG Drill Program. The drill program will also focus on infill drilling portions of the Boston Richardson Gold System with the goal of converting high-grade Inferred Resources to Indicated Resources. The 5,000-metre diamond drill program will be funded using the proceeds of a flow-through financing completed in July of 2018.

Table of selected composited assays from drill holes reported in this press release:

|

Hole ID |

From |

To |

Interval |

Au |

Gold |

Visible |

Section |

|

|

BR-18-64 |

147.8 |

148.6 |

0.8 |

1.17 |

EG |

9750E |

Current |

|

|

and |

255.3 |

256.0 |

0.7 |

1.45 |

EG |

|||

|

and |

267.2 |

267.7 |

0.5 |

0.54 |

EG |

VG |

||

|

and |

387.5 |

388.0 |

0.5 |

1.33 |

EG |

|||

|

and |

451.5 |

452.0 |

0.5 |

2.05 |

EG |

|||

|

BR-18-65 |

133.6 |

134.1 |

0.5 |

5.69 |

EG |

|||

|

and |

190.0 |

191.0 |

1.0 |

3.37 |

EG |

|||

|

and |

317.7 |

318.3 |

0.6 |

6.41 |

EG |

|||

|

and |

321.5 |

322.1 |

0.6 |

2.53 |

EG |

VG |

||

|

BR-18-66 |

61.0 |

62.5 |

1.5 |

25.70 |

EG |

|||

|

including |

61.0 |

61.6 |

0.6 |

63.33 |

EG |

VG |

||

|

and |

90.0 |

92.0 |

2.0 |

6.37 |

EG |

|||

|

including |

90.0 |

91.0 |

1.0 |

12.08 |

EG |

|||

|

and |

183.6 |

185.0 |

1.4 |

1.22 |

EG |

|||

|

and |

229.0 |

230.0 |

1.0 |

1.36 |

EG |

|||

|

BR-18-67 |

51.2 |

52.2 |

1.0 |

2.42 |

EG |

9850E |

||

|

and |

53.8 |

54.4 |

0.6 |

5.94 |

EG |

|||

|

and |

75.0 |

77.5 |

2.5 |

1.57 |

EG |

|||

|

and |

116.6 |

118.0 |

1.4 |

1.48 |

EG |

|||

|

and |

125.5 |

128.0 |

2.5 |

2.24 |

EG |

|||

|

and |

136.6 |

139.2 |

2.6 |

4.86 |

EG |

|||

|

including |

137.6 |

138.2 |

0.6 |

16.89 |

EG |

|||

|

and |

142.6 |

145.8 |

3.2 |

8.00 |

EG |

|||

|

including |

145.0 |

145.8 |

0.8 |

30.66 |

EG |

VG |

||

|

and |

189.8 |

190.4 |

0.6 |

12.33 |

EG |

VG |

||

|

BR-18-16 |

23.5 |

24.0 |

0.5 |

0.73 |

EG |

9650E |

Previous |

|

|

and |

189.1 |

189.7 |

0.6 |

11.59 |

EG |

VG |

||

|

and |

315.6 |

318.5 |

2.9 |

2.23 |

EG |

|||

|

including |

315.6 |

316.1 |

0.5 |

8.88 |

EG |

|||

|

OSK11-01 |

36.0 |

37.0 |

1.0 |

1.82 |

EG |

9650E |

Historic |

|

|

and |

43.9 |

46.0 |

2.2 |

0.96 |

EG |

|||

|

and |

61.0 |

62.0 |

1.0 |

0.76 |

EG |

|||

|

and |

86.0 |

88.0 |

2.0 |

1.81 |

EG |

|||

|

and |

128.0 |

130.0 |

2.0 |

0.58 |

EG |

|||

|

OSK11-02 |

117.0 |

118.5 |

1.5 |

137.77 |

EG |

VG |

||

|

including |

117.0 |

117.5 |

0.5 |

412.00 |

EG |

VG |

||

|

and |

127.0 |

128.5 |

1.5 |

0.65 |

EG |

|||

|

and |

174.0 |

175.0 |

1.0 |

1.28 |

EG |

|||

|

and |

179.5 |

183.0 |

3.5 |

1.76 |

EG |

VG |

||

|

including |

182.0 |

183.0 |

1.0 |

4.55 |

EG |

|||

|

and |

199.5 |

200.5 |

1.0 |

0.77 |

EG |

|||

|

and |

235.5 |

236.5 |

1.0 |

2.28 |

EG |

|||

|

OSK11-03 |

17.0 |

18.0 |

1.0 |

0.54 |

EG |

9900E |

||

|

and |

38.0 |

39.0 |

1.0 |

1.28 |

EG |

|||

|

and |

46.0 |

47.0 |

1.0 |

2.87 |

EG |

|||

|

and |

49.0 |

50.5 |

1.5 |

2.02 |

EG |

|||

|

and |

143.0 |

143.7 |

0.7 |

4.28 |

EG |

|||

|

OSK11-04 |

42.0 |

43.0 |

1.0 |

0.69 |

EG |

|||

|

and |

140.0 |

140.5 |

0.5 |

35.10 |

EG |

VG |

||

|

and |

193.9 |

197.5 |

3.7 |

215.74 |

EG |

VG |

||

|

including |

193.9 |

194.4 |

0.5 |

1570.00 |

EG |

VG |

||

|

and |

205.0 |

206.0 |

1.1 |

2.00 |

EG |

|||

|

and |

213.0 |

224.5 |

11.5 |

1.24 |

EG |

VG |

||

|

including |

223.0 |

224.5 |

1.5 |

6.23 |

EG |

|||

|

and |

230.3 |

231.5 |

1.2 |

0.58 |

EG |

This news release has been reviewed and approved by Paul McNeill , P. Geo., VP Exploration with Anaconda Mining Inc., a “Qualified Person”, under National Instrument 43-101 Standard for Disclosure for Mineral Projects.

All samples and the resultant composites referred to in this release are collected using QA/QC protocols including the regular insertion of standards and blanks within the sample batch for analysis and check assays of select samples. All samples quoted in this release were analyzed at Eastern Analytical Ltd. in Springdale, NL , for Au by fire assay (30 g) with an AA finish.

Samples analyzing greater than 0.5 g/t Au via 30 g fire assay were re-analyzed at Eastern via total pulp metallic. For the total pulp metallic analysis, the entire sample is crushed to -10mesh and pulverized to 95% -150mesh. The total sample is then weighed and screened to 150mesh. The +150mesh fraction is fire assayed for Au, and a 30 g subsample of the -150mesh fraction analyzed via fire assay. A weighted average gold grade is calculated for the final reportable gold grade. Anaconda considers total pulp metallic analysis to be more representative than 30 g fire assay in coarse gold systems such as the Goldboro Deposit.

Reported mineralized intervals are measured from core lengths. Intervals are estimated to be approximately 80-100% of true widths.

A version of this press release will be available in French on Anaconda’s website (www.anacondamining.com) in two to three business days.

ABOUT ANACONDA

Anaconda Mining is a TSX and OTCQX-listed gold mining, development, and exploration company, focused in the prospective Atlantic Canadian jurisdictions of Newfoundland and Nova Scotia . The Company operates the Point Rousse Project located in the Baie Verte Mining District in Newfoundland , comprised of the Stog’er Tight Mine, the Pine Cove open pit mine, the Argyle Mineral Resource, the fully-permitted Pine Cove Mill and tailings facility, and approximately 10,150 hectares of prospective gold-bearing property. Anaconda is also developing the Goldboro Gold Project in Nova Scotia , a high-grade Mineral Resource, subject to a 2018 a preliminary economic assessment which demonstrates a strong project economics. The Company also has a wholly owned exploration company that is solely focused on early stage exploration in Newfoundland and New Brunswick .

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking information” within the meaning of applicable Canadian and United States securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects”, or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “does not anticipate”, or “believes” or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, or “will be taken”, “occur”, or “be achieved”. Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in the annual information form for the fiscal year ended December 31, 2017 , available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Anaconda does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE Anaconda Mining Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/February2019/28/c4384.html

I recently got a copy and read Bob Moriarty’s new book called “Basic Investing in Resource Stocks: The Idiot’s Guide”, and thought I would do a quick review…

The book covers everything from the current state of the world, the metals, the different kinds of resource companies, how to go about investing and what tools that are important to use. It was an easy book to read, and I as a resource stock investor, really liked the content for a couple of reasons;

First (and most importantly) of all, this is not a “feel good book” that says a bunch of stuff, but at the same time, says nothing concrete at all. It’s a pragmatic one, written by a long term resource company investor. Bob has been in this business for a long time and has seen it all. He has seen the ups and downs of commodity cycles, and he has run across all types of people and companies. He knows all the shady tricks and all the pitfalls that most of us will have fallen into, on our way to (hopefully) enlightenment.

Bob explains key concepts with the help of anecdotes and real life examples, which makes them easier to understand, and will hopefully come in handy when the reader comes across different subjects in the future (like counter party risk).

While reading it, I made sure to copy/paste some key quotes into a word document, that I (especially) thought were important to always keep in the back of my head. Well, that document ended up being about five pages long, and that’s excluding Bob’s two lists with words of wisdom, where he synthesizes the main take aways.

Anyhow, I thought it would be a good idea to mention a few of the quotes that I had saved, and perhaps add on a few comments of my own. So I asked him for permission to do so and got this response:

“Any way you wish. The whole purpose of the book is to help investors. Anything that broadens their education is fine with me.

– Bob”

Suffice it to say, Bob would really like to see better informed investors. Better informed investors leads to more money in the hands of investors, more capital for honest and good companies, and less money in the hands of crooks (or “lifestyle companies” as Bob calls it)… A win-win-win.

“Someone has to pay for every mistake in one form or another, and it will be a lot cheaper for you if you listen as I explain how foolish I have been.”

… This is the reason why I never throw away books. They contain synthesized knowledge based on decades of experience and research. It’s good to make mistakes when you also learn from them, but it’s of course way more costly than learning from others mistakes. The key is to really understand what and why something went wrong though. If you make a mistake yourself, you will probably have a painful memory that reminds you not to “do that again”, but learning from others means you really have to hammer in the essence of said mistake.

“There is one thing I should include here: the basic liquidity of the market is an indication of where you are. At market bottoms you can’t give shares away; at tops, the market has total liquidity. So if you can sell shares easily, that is often a great indication of when to sell”

… This is an important concept to internalize; If there are no buyers, there is no greed, and possibly even big discounts in place. If a stock is doing well and there are tonnes of bids, then you know that you are not the first one in. With that said, this is more of a swing tactic to use when nothing has changed for a company on a fundamental basis, since there will of course always be bids if a company that just released company making news (That will take at least some time to be reflected in the share price).

“I’m going to show you how to do it, but you have to discard almost all of what you think you know. You have to learn the basics of investing that no one has ever bothered teaching you. You know how to add. You know how to read. You probably have some special skill that someone is willing to pay you for doing well. But as far as I know, there are no classes on how to invest, and if you are to profit, you have to know the basics.”

… This points out the fact that there is no class or golden formula out there that will allow you to beat the market. Believe me, I have taken finance and economics classes, and pretty much the only concepts that stuck and was worth its salt was “NPV” and “Opportunity Cost”, but nothing really to prepare me for investing in the resource sector.

“I don’t make any money because I am so smart; I get all my profit because other people are so foolish.”

… He points out that he has not done well for himself because of his smarts, but rather by not being foolish, unlike the herd. Human psychology is the enemy, and one must learn how to fight ones impulses, like fear and greed. Common sense and avoiding pit falls is the name of the game, so limit the costly mistakes that the majority will make, and most of the battle will be won already… Easier said than done of course(!)

“What I’m trying to say is that investing in juniors and making a profit has far

more to do with timing than with the commodity, the management, or country risk.

Those factors are all interesting but the phase of the investment cycle as measured

by sentiment is far more important.”

… This was a gruesome lesson to learn for me personally, but market psychology (cycles) trumps all. When the cycle is up, everyone allows themselves to price in a rosy future for any company (and they buy accordingly). When the cycle is down, investors instead only focuses on risks and no price seems low enough to price them in (and they sell accordingly). It makes me think of another quote by Bob that goes something like this: “At a bottom, everyone is looking for a reason to sell”.

“As an investor, you must use every possible sentiment indicator you can get

your hands on.”

… the importance of sentiment is something that Bob mentions a lot in this book, and something I am slowly trying to cement in the back of my head. Unloved (for whatever reason) or unknown stocks is what one should look to buy.

“Investment advice and information comes in two flavors, signal and noise. That which is signal gives you potentially valuable information that you can use to make intelligent investment decisions. But noise does little more than confuse the listener. Not everything you hear or read helps you.”

… This is important because there might be bulls, bears, pumpers and/or bashers that harp on about certain things that might be trivial for a company in the grand scheme of things. This is noise vs signal concept also includes daily vs longer term stock movements, as Bob describes it in the book. A stock might go up or down on any given day based on nothing, and should thus be considered noise. Buffet famously mentions that “mr market” is schizophrenic and that he loves to take advantage of short term declines (noise). Suffice it to say, the signal vs noise problem is something that is prevalent from micro (company fundamentals) to macro (trends) and should be something to take into account at all times.

The book covered more subjects than I first thought and is an invaluable source of knowledge for anyone investing in this sector. There are loads of quotes and bullet points that I myself am planning to print out and put up on the wall, since keeping the common (human) pitfalls in mind at all times is a very big step towards beating the market.

You can buy Bob’s new book for $7.49 (Kindle) or $12.99 (Paperback) through my affiliate link HERE or you can buy it HERE for the same price (if you don’t want me to get the few cents in commission.)

(I have not received any payment to write this article. Bob was kind enough to send me a copy for free and I thought it was a good idea to write about the book coupled with some thoughts of my own.)

Best regards,

The Hedgeless Horseman

Follow me on twitter: https://twitter.com/Comm_Invest

Follow me on CEO.ca: https://ceo.ca/@hhorseman

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vancouver, British Columbia – February 13, 2019: GSP Resource Corp. (TSX-V: GSPR) (the “Company”) is pleased to announce the results of the Fall 2018 soil sample program at the Olivine Mountain Project. Assays have been received from an extensive geochemical soil survey program undertaken in Fall 2018 and have established the presence of strong Copper-in-soil anomalies coincident with interpreted geophysical anomalies. Notably, the geochemical survey results have established several drill targets at the Olivine Mountain Project. The recommended initial drill program is for up to 1,000 meters of NQ Core drilling directed at four main targets and is budgeted at approximately CAD$250,000 (including site preparation, supervision and analytical work). GSP Resource Corp. President and CEO, Simon Dyakowski commented: “base metals values in the soil sample grid, in particular – Copper of up to 678ppm, are very encouraging. The results are coincident with the interpreted geophysical anomalies identified in GSP’s Spring 2018 airborne and ground survey programs. Four drill targets are considered of interest for the presence of related massive sulphide deposits and we expect to commence the permitting process shortly.”

Olivine Mountain Copper-in-soil Results Map:

Olivine Mountain Nickel-in-soil Results Map:

Fall 2018 Geochemical Survey Results Summary*

GSP crews constructed approximately 100 line kilometers of grid over the favourable geophysical anomalies, with lines oriented in an east-west direction, and spaced 100 meters apart. Sample stations were established at 50 meter intervals along all lines. In total, approximately 1850 soil samples were collected. All samples were submitted to the laboratories of MS Analytical in Langley, B.C. for analysis. Methods included a one acid, 41 element Ultra Trace level ICP analysis for 41 elements including Au, Co, Cu, Ni, Pd, Pt and V. Plots of each element were made, highlighting anomalous zones by colour and size. The following are elemental thresholds:

| Au(ppb) | Co(ppm) | Cu(ppm) | Ni(ppm | Pd(ppb) | Pt(ppb) | V(ppm) | |

| Possibly Anomalous | 10 – 50 | 50 – 100 | 50 – 100 | 50 – 100 | 25 – 50 | 25 – 50 | 175 – 200 |

| Probably Anomalous | 50 – 100 | 100 – 200 | 100 –250 | 100 – 250 | 50 – 100 | 50 – 100 | 200 – 250 |

| Definitely Anomalous | 100 – 386 | 200 – 253 | 200 – 678 | 250 – 900 | 100 – 230 | 100 – 190 | 250 – 443 |

Copper values are considered very strong, believed to be indicative of significant mineralization in underlying bedrock. Cobalt, nickel, platinum and palladium values are moderate to strong and are also believed to be indicative of respective mineralization in underlying bedrock. There is a relatively close relationship of copper to cobalt and palladium and nickel to platinum and palladium. Gold is related to both copper and nickel. There is very little sympathy of copper to nickel. These relationships probably reflect the zoning nature of the metals in bedrock.

Olivine Mountain Compilation Plan Map:

Compilation of Results*:

Six significant geochemical anomalies are interpreted from the copper and nickel plots:

Conclusions and Recommendations*:

Four of the anomalous targets are worthy of drilling and the following hole locations are recommended:

L83700N@55800E – vertical diamond drill hole to 200 meters.

L85100N@55300E – vertical diamond drill hole to 200 meters.

L82600@56500E – vertical diamond drill hole to 200 meters.

L82800N@55200E – vertical diamond drill hole to 200 meters.

The drill program should allow a contingency of 200 meters for an additional hole or deepening of initial holes, therefore the recommendation is for a total of 1000 meters. Core drilling should be NQ size. The cost estimate of 1000 meters includes roads, site preparation, supervision and analytical work should be approximately CAD$250,000.

*Sections quoted from a Summary Report – 2018 Work Programs on the Olivine Mountain Property, by John R. Kerr, P.Eng, dated February 12, 2019.

Quality Assurance / Quality Control: Samples were sent to MS Analytical (an ISO 9001:2015 and ISO 17025:2005 accredited laboratory) in Langley, BC. Soils were dried and screened through an 80 mesh screen to remove rocks and other matter. A 20g aliquot from the minus fraction was weighed and digested using weak aqua regia and then analyzed by ICP-ES/MS (IMS-117). Analytical results were verified by the insertion of certified reference materials, blanks and duplicates.

Qualified Person: The scientific and technical disclosure contained in this news release has been reviewed and approved by Christopher I. Dyakowski, P.Geo, a “Qualified Person” as that term is defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About GSP Resource Corp.: GSP Resource Corp. is a mineral exploration company focused on the acquisition, exploration and development of mineral resource properties. The Company has an option to acquire a 100% interest and title to the Olivine Mountain Property located in the Similkameen Mining Division, 25 km northwest of Princeton, British Columbia.

Contact Information – For more information, please contact:

Simon Dyakowski, Chief Executive Officer

Tel: (604) 619-7469

Email: simon@gspresource.com

Cautionary Statement Regarding “Forward-Looking” Information.

This news release includes certain statements that constitute “forward-looking information” within the meaning of applicable securities law, including without limitation, statements that address the Olivine Mountain Project, obtaining drill permits, cost of potential drill program, comments regarding the timing and content of upcoming work programs, and other statements relating to the business prospects of the Company. Forward-looking statements address future events and conditions and are necessarily based upon a number of estimates and assumptions. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “might” or “will” be taken, occur or be achieved), and variations of such words, and similar expressions are not statements of historical fact and may be forward-looking statements. Forward-looking statement are necessarily based upon a number of factors that, if untrue, could cause the actual results, performances or achievements of the Company to be materially different from future results, performances or achievements express or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of metals, anticipated costs and the ability to achieve goals, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company’s planned exploration activities will be available on reasonable terms and in a timely manner. Forward-looking statements are subject to a variety of risks and uncertainties, which could cause actual events, level of activity, performance or results to differ materially from those reflected in the forward-looking statements, including, without limitation: (i) risks related to gold, platinum, palladium, copper and other commodity price fluctuations; (ii) risks and uncertainties relating to the interpretation of exploration results; (iii) risks related to the inherent uncertainty of exploration and cost estimates and the potential for unexpected costs and expenses; (iv) that resource exploration and development is a speculative business; (v) that the Company may lose or abandon its property interests or may fail to receive necessary licences and permits; (vi) that environmental laws and regulations may become more onerous; (vii) that the Company may not be able to raise additional funds when necessary; (viii) the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; (ix) exploration and development risks, including risks related to accidents, equipment breakdowns, labour disputes or other unanticipated difficulties with or interruptions in exploration and development; (x) competition; (xi) the potential for delays in exploration or development activities or the completion of geologic reports or studies; (xii) risks related to environmental regulation and liability; (xiii) risks associated with failure to maintain community acceptance, agreements and permissions (generally referred to as “social licence”), including local First Nations; (xiv) risks relating to obtaining and maintaining all necessary government permits, approvals and authorizations relating to the continued exploration and development of the Company’s projects; (xv) risks related to the outcome of legal actions; (xvi) political and regulatory risks associated with mining and exploration; (xvii) and risks related to current global financial conditions. These risks, as well as others, could cause actual results and events to vary significantly. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, the loss of key directors, employees, advisors or consultants, volatility in metals prices, adverse weather conditions, equipment failures, failure of counterparties to perform their contractual obligations and fees charged by service providers. Investors are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements. The forward-looking statements included in this news release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

|

|||

|

OTTAWA, Feb. 21, 2019 (GLOBE NEWSWIRE) — Orezone Gold Corporation (ORE.V) (“Orezone” or the “Company”) is pleased to provide an update on its development schedule and achievements at its 90%-owned Bomboré gold project (“Bomboré”) together with progress on its 2019 Sulphide Expansion Feasibility Study (“2019 FS”).

Project Development Update

The Company recently completed a detailed review of all project development and construction activities at Bomboré with the goal of optimizing the project development and expenditure schedules. Based on this review, the Company has prepared a new project development schedule that further minimizes project execution risks.

Specifically, the optimized development schedule provides a number of significant benefits including:

The key aspect of the review that allowed for a later construction start was the decision to better coordinate the start of the OCR excavation before the onset of the rainy season. This OCR excavation will now commence in Q1-2020, concurrent with major plant earthworks and the TSF construction. Furthermore, with recent completion of the Front-End Engineering and Design (“FEED”) work, all major equipment lead delivery times have been fully identified and incorporated into the schedule as have major construction timeline requirements. The overall impact of this revised schedule is that commissioning and plant start up is now scheduled for Q2-2021.

As a result of this detailed review, the Company expects 2019 project expenditures to be significantly reduced from spending under the original project schedule. The Company is budgeted to spend US$25.2 million on project development for 2019 which will include costs for early stage construction works (e.g. main access roads and camp improvements), FEED completion, construction of Phase I RAP resettlement villages and associated infrastructure, and advancement of permitting efforts for the sulphide expansion and P17S satellite deposit. The Company anticipates a further spend of US$5.0 million for corporate G&A, the 2019 FS report, and project financing efforts.

With a 2018 year-end cash balance of over US$31 million, the Company is fully funded for this upcoming year which the Company will utilize to secure the remaining financing required to construct Bomboré.

RAP Construction Update

RAP construction is progressing with beaconing of houses on the main resettlement sites completed and brick fabrication by local construction contractors well-advanced in preparation for house construction as ongoing foundations are completed. The required Phase I RAP is scheduled for completion by November 2019 which will allow one additional crop harvest by local communities before relocation commences which has been very well-received by local community members.

The Company plans to provide ongoing details and photographs of RAP construction activities on its website throughout 2019.

Sulphide Expansion Feasibility Study Update

The independent 2019 FS is being completed by a team of highly qualified engineering and environmental firms: Lycopodium Minerals Canada Ltd. (study lead), AMC Mining Consultants (Canada) Ltd., Knight Piésold and Co., Roscoe Postle Associates Inc. (“RPA”), Base Metallurgical Laboratories Ltd., and Antea Group. RPA is updating the 2017 Mineral Resource Estimate to incorporate the previously excluded “Restricted Zones” and to expand the resource estimate at the high-grade P17S sulphide target for the additional drilling completed during the 2016 to 2018 period.

The 2019 FS will incorporate the combined oxide and sulphide circuits, and will be based on an expanded plant throughput of 5.2 million tonnes per annum (“Mtpa”) as opposed to the 4.5Mtpa used in the 2018 feasibility study. The sulphide plant will be constructed in Year 2 of oxide operations and sulphide feed will commence in Year 3 at a planned rate of 1.2Mtpa.

Recently completed metallurgical testwork has confirmed the ore grind and gold recoveries from work undertaken in earlier studies. Work indices and abrasion indices have also been confirmed for the various sulphide materials.

The current work for the 2019 FS includes detailed mine scheduling, water balance and waste rock storage designs, and an update of the environmental and permitting studies to provide essential data for the Environmental Social Impact Assessment (“ESIA”) update necessary to permit the expanded mine plan.

![]()

The latest trend away from the dollar includes an effort by Russia to reshape the landscape of OPEC.

Which certainly given the other actions of Russia in the past year continues to demonstrate their frustration with U.S. and the current Wall Street system.

To find out more, click to watch the video now!

Chris Marcus

Arcadia Economics

“Helping You Thrive While We Watch The Dollar Die”

www.ArcadiaEconomics.com

|