|

|||||||||||||||||||

|

Blog sub category

|

|||||||||||||||||||

|

Original Source: http://www.321gold.com/editorials/moriarty/moriarty011819.html

Bob Moriarty

Archives

Jan 18, 2019

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way – in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only.

Those memorable words penned by Charles Dickens in 1859 begin the story of the times leading up to the French Revolution and ending in the Jacobin Reign of Terror. The Tale of Two Cities may be back for an encore. So might the Reign of Terror.

The earth’s very first worldwide revolution began in Paris on November 17th 2018. The immediate cause was an increase in taxes on diesel and gasoline. The French government levied higher taxes on diesel of 7.6 cents per liter in 2018 with a planned increase of an additional 6.5 cents effective on January 1st 2019. Gasoline taxes rose by 3.9 cents in 2018 and were due to go up 2.9 cents more with the turn of the New Year.

Globalization has caused a mass migration all over the world from rural areas and small towns to the large cities. As the migration took place, the balance of political power shifted and the rural areas had less and less of an impact on the decision making process.

French law requires all vehicles be equipped with neon yellow vests for safety if the automobile is disabled or the driver needs to change a tire. Yellow vests or Gilets Jaunes are in every car in case of emergency. Any emergency will do, even a protest.

The protests began simply with a demand that the increases in fuel taxes be rescinded. From Paris other groups of the Gilets Jaunes sprang up spontaneously all over France in village squares and in the ubitiquous traffic circles controlling the flow of traffic rather than red lights found in most countries. People in the streets protesting actions of the government are the ultimate form of direct democracy.

There were no leaders. As times some labor unions and politicians have attempted to coopt the movement without success. The Yellow Vests reject centralized power no matter where it comes from. All of the protests came directly from local residents angry at their lack of voice.

By and large it was peaceful from the beginning with pretty much the exception of the actions of the police. Most people in most cities simply walked around talking to other Yellow Vests. As time went by the list of demands grew to include the resignation of French President Emmanuel Macron as well as other changes in forms of taxation and benefit modifications.

Naturally the elite in government smiled as the requests for change grew out of control. They knew that as the demands expanded the chance of them being enacted declined. Under pressure Macron agreed to postpone or cancel the fuel tax increase and went along with some minor modifications to minimum wage and retirement benefits. But he soon tired of the sops to the masses and began to harden his position.

The Yellow Vest movement is simple. The people want more say in how the government affects their lives. Over the past week the stakes may have risen as the French Prime Minister Edouard Philippe announced support for a new law banning unapproved protests. The idea was not complicated. It’s ok to riot but you need to fill out forms in triplicate and get government approval first. I have a suggestion for the Gilets Jaunes, “Don’t hold your breath.”

The Yellow Vest masses seemed to have touched a nerve with angry people all over the world. There have been similar protests in Taiwan, Israel,Brussels, Canada, Spain and no doubt many other locations. It is a worldwide revolution and it will only grow.

As long as there have been groups gathered together for protection the elite have ruled. It didn’t matter if it was the head of a clan, a Pope, a king or eventually presidents and prime ministers. The elite ruled and the peasants could stuff themselves with cake if they didn’t like the lack of bread. But the elites have always been out of touch with what the people, the mob, the masses want.

When the peasants went hungry for long enough because of mismanagement of government, they manned the barricades and sharpened their pikes. In the end after every revolution all they managed to accomplish was change one group of elites with a different group of clueless elites. Look at the elections in the US and the UK. One party rules, then the other party rules, then it goes back again. Nothing ever changes.

Who do the Yellow Vests think will take over if they boot Macron? I can tell you right now it will be another brain dead idiot determined to line his own pockets until he gets the boot.

This process of rule by elites has led to the bizarre situation in the US where a tiny group of determined Neocons managed to subvert the entire political and military establishment of the country on behalf of a meaningless little shit for brains country in the Middle East. No more than thirty total they still took total control of the establishment involving the nation in one meaningless and expensive war after another. It has gotten so stupid and out of control that the very first law considered by the US Congress and US Senate in 2019 was a bill to make boycotts of Israel illegal.

You may still boycott the Mormons and Buddhists. It’s legal and OK to boycott the Pope or Donald Trump should you wish. And advocating boycotts of Hillary will still be allowed. You can boycott whoever and whatever you wish. Except for Israel. Twenty-six states have already incorporated rules requiring loyalty oaths to Israel. In Europe you may not question the Holocaust. If you even debate what happened, you may go to jail.

Now that’s power.

In an ominous move on the part of the French government just took action that might morph a peaceful protest against petty taxes into a violent reign of terror and a resurrection of the guillotine. And a lot of heads of the former elite swinging from long pikes.

As reported on the 13th of January, some units of the riot police have been issued fully automatic G36 rifles. If and when some fool policeman starts shooting at the protestors, a bloody war will have started. Eventually more and more of the police will realize they are shooting their own citizens. At that point they will start shooting politicians.

There is a simple and bloodless solution that the elite will hate and the

Gilets Jaunes of all countries will love. But to understand it, you must also understand why these protests have expanded so quickly.

Until the Internet came along twenty years or so ago, the elite ruled because they controlled the narrative. Americans believed that Kennedy was killed by a lone assassin, Vietnam was fought to save the Vietnamese from godless Communism, nineteen hijackers led by a guy with terminal kidney disease living in a cave in Afghanistan managed to win the most effective battle in history.

Then the Internet gave everyone a voice. Every damned fool given a new keyboard for Christmas by momma could go out on chatboards and say whatever idiotic things they wanted and remain anonymous so they didn’t have to account for their stupidity to anyone. If they wished, they could and did watch porn from the confines of their government office if that is what they did for a living. Communication was instant and total.

A few people posting on the Internet actually made sense. The Internet is not a Mecca of accurate information. But some of the voices made sense and if you ignored the clutter and listened to the bells that peeled with the ring of truth eventually a false flag operation that would have passed with flying colors fifty years ago would be exposed in minutes today.

More and more of the middle class realized the actions of governments and central banks were destroying their financial security. There was nothing new to that; governments have always waged war first on their own people. Throughout history people have resented their standard of living being destroyed by the elite.

But they couldn’t do a damned thing about it. They might be angry but they had no voice.

Eventually they could take a marvelous weapon right at hand such as the Yellow Vests and make them a symbol of protest. But they still didn’t have a solution that was both reasonable and possible until a genius named Etienne Chouard came up with a magic bullet.

Monsieur Chouard teaches college in Marseilles France on the southern coast. For years he has advocated adoption of something he calls theCitizens Initiative Referendum or CIR. The CIR only asks that citizens be allowed to choose the rules and regulations by which they are governed and the best way to achieve such direct democracy is by way of the referendum.

The concept is brilliant. A certain number of signatories on a petition would allow for a referendum to be published and voted on.

The Swiss did it in 2016 with the idea of a guaranteed basic income for all. It was suggested that all Swiss citizens be granted an automatic 2,500 SF monthly. Naturally the Swiss being the Swiss, they also understood that someone had to pay for that largess and it would be by themselves. Governments don’t have any money; all they do is take it from one group and hand it to another. 77% of Swiss voting soundly rejected the idea.

A worldwide revolution has been started. It’s pretty much led by the middle class who feel government policies are destroying them financially. If and when the police start shooting at protestors, protestors will start shooting back. It has all the potential for being the greatest war in history. The governments will eventually lose as the police and military change sides.

A well thought out CIR would solve the issue. It is both practical and workable. The elites will hate it because they will lose their franchise on power and money. The people will love it because it makes them responsible for their own decisions. They should be allowed direct democracy because they are the ones paying for it.

In the end the world will owe a giant debt for the ideas of Etienne Chouard. It may not be a perfect solution but it is a solution. The alternatives are far worse.

###

Bob Moriarty

President: 321gold

Archives

321gold Ltd

![]()

![]()

Rover Metals (TSXV: ROVR)(OTCQB: ROVMF) (“Rover Metals” or the “Company”) is pleased to announce that it has completed its OTCQB listing and will commence trading under the symbol “ROVFM” on the OTC Markets.

In connection with our U.S. listing, the Company is also pleased to announce that it will be working with newsletter writer, Bob Moriarty of 321 Gold acclaim, over the next 12 months.

|

|

|

|

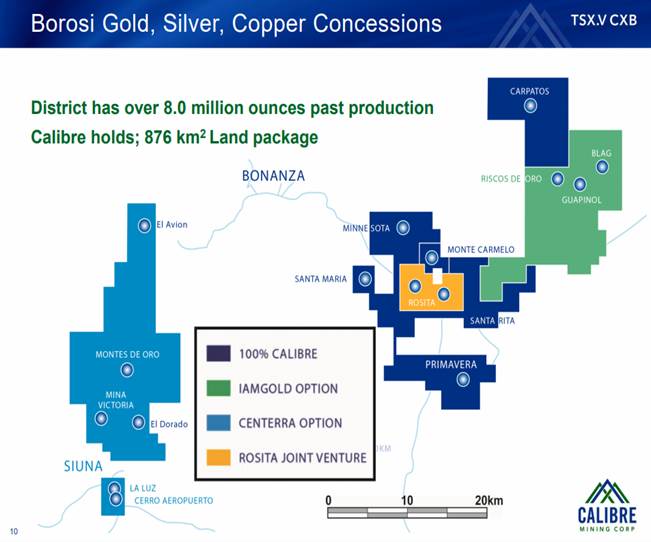

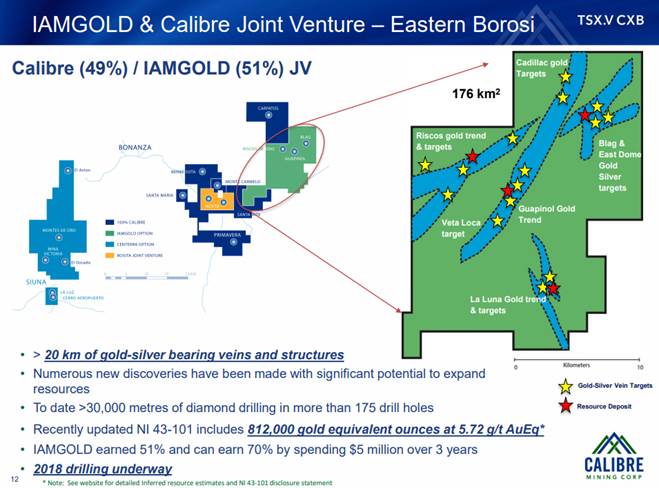

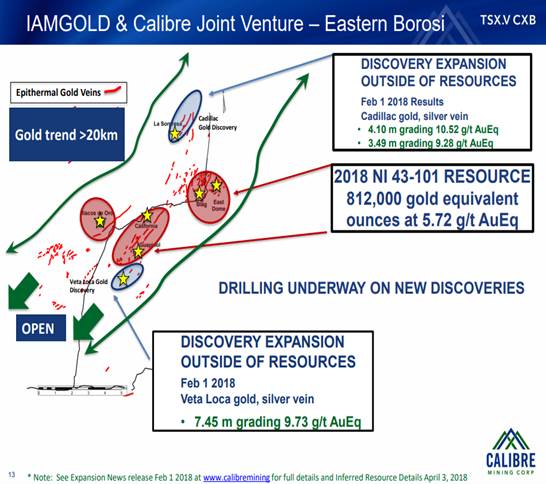

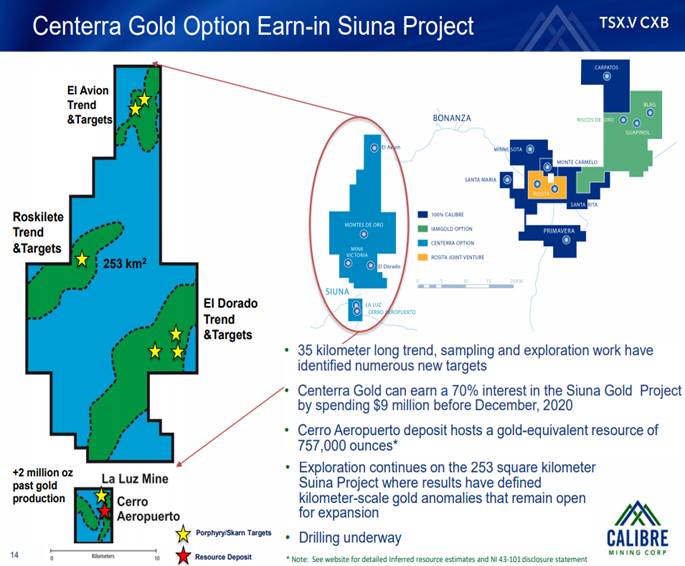

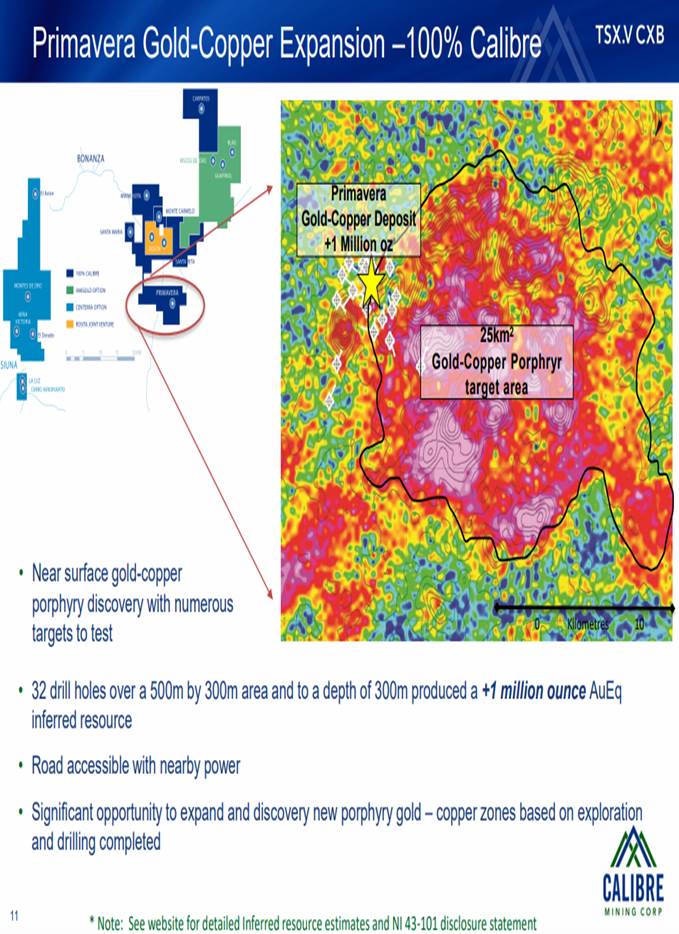

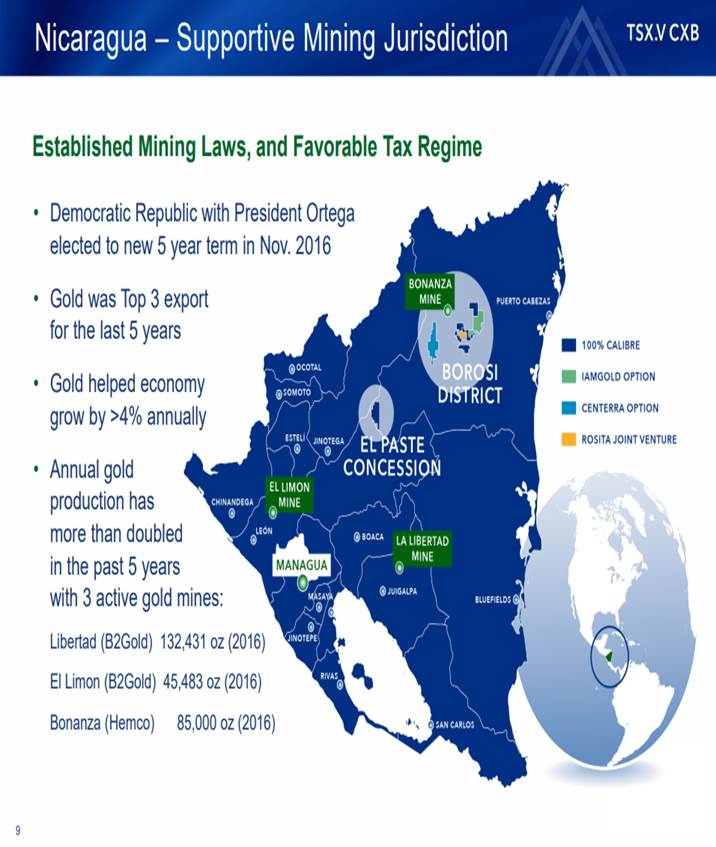

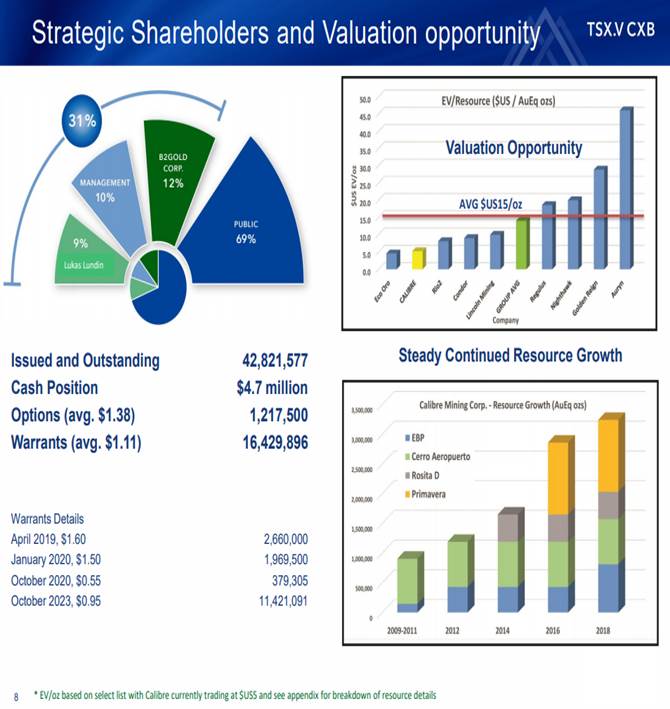

Ryan King, Vice President Corporate Development of Calibre Mining sits down with Maurice Jackson of Proven and Probable to discuss the value proposition on their flagship Borosi Project covering over a massive land position of 800 square kilometers in Nicaragua.Today’s interview is the most comprehensive interview to date on Calibre Mining. The Borosi Project hosts the Eastern Borosi, Siuana, La Luz, and Primavera projects, which Mr. King will discuss in great detail, along with the relationship and contractual obligations of Calibre Mining’s Joint Venture partners (Centerra Gold, IAMGold, Rosita Mining)on these projects respectively. We discuss in detail each member of the Board of Directors, Management, and Technical team, which is comprised of a number of key members of the recent success of Newmarket Gold, which recently went from a $10 Million Market Cap to $1 Billion Market Cap and was sold to Kirkland Lake Gold . Finally, we will delve into the capital structure of Calibre Mining. Important to note, Calibre Mining has $0 Debt, and a Management and Board with proven success of optionality and arbitrage.

Original Source: https://www.streetwisereports.com/article/2019/01/16/exploring-for-world-class-gold-silver-and-copper-deposits-in-nicaragua.html

Source: Maurice Jackson for Streetwise Reports (1/16/19)

Ryan King, vice president of corporate development at Calibre Mining, sits down with Maurice Jackson of Proven and Probable to discuss his company’s joint ventures, exploration in Nicaragua and strategic plans.

Ryan King, vice president of corporate development at Calibre Mining, sits down with Maurice Jackson of Proven and Probable to discuss his company’s joint ventures, exploration in Nicaragua and strategic plans.

|

|

SANTA PAULA, Calif.–(BUSINESS WIRE)–

Limoneira Company (LMNR), a diversified citrus packing, sales and marketing company with related agribusiness activities and real estate development operations, today announced that Harold Edwards, the Company’s Chief Executive Officer, and Mark Palamountain, the Company’s Chief Financial Officer, will be presenting at the 21st Annual ICR Conference, to be held January 14-16, 2019, at the JW Marriott Orlando Grande Lakes in Orlando, Florida.

The Limoneira investor presentation is scheduled for Tuesday, January 15, 2019, at 11:00 am ET. The presentation will be webcast live and archived at www.limoneira.com. Visitors to the website should select the “Investor” tab and navigate to the “Events & Presentations” section to access the webcast.

About Limoneira Company

Limoneira Company, a 125-year-old international agribusiness headquartered in Santa Paula, California, has grown to become one of the premier integrated agribusinesses in the world. Limoneira (pronounced lē mon΄âra) is a dedicated sustainability company with 14,500 acres of rich agricultural lands, real estate properties, and water rights in California, Arizona and Chile. The Company is a leading producer of lemons, avocados, oranges, specialty citrus and other crops that are enjoyed throughout the world. For more about Limoneira Company, visit www.limoneira.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190103005559/en/

Five holes will step out from successful prior drill holes

TSX VENTURE SYMBOL: FUU

KELOWNA, BC , Jan. 3, 2019 /CNW/ – FISSION 3.0 CORP. (“Fission 3” or “the Company“) is pleased to announce it will shortly be commencing a 1,850m five-hole winter drill program at its PLN project in the Athabasca Basin region of Saskatchewan, Canada . The program will focus on high-priority targets within a 700m mineralized corridor identified during the previous drill program. All five holes will test the A1 conductor, stepping out 25m and 50m north along strike of PLN14-019, which intercepted significant uranium mineralization. These five winter holes are part of an overall 3,250m PLN program approved for 2019.

PLN is located in the south-west area of Saskatchewan’s Athabasca Basin, immediately adjacent and to the north of Fission Uranium’s PLS project, which hosts the high-grade Triple R uranium deposit. With its proximity to large-scale, high-grade uranium deposits, and with multiple geological and geophysical interpreted features, including an extensive drill-identified mineralized corridor, PLN ranks highly in Fission 3’s extensive portfolio.

News Highlights

Ross McElroy , COO, and Chief Geologist for Fission, commented,

“Our prior drilling has already proven that PLN hosts uranium and, importantly, those results have highlighted the potential for large-scale mineralization. Winter drilling will focus on the approximately 700m mineralized trend and will use a strategy of step outs from one of our previous, successful holes on the property.”

PLN Package: The PLN package consists of a total of 36,537 ha in 37 mineral claims of which Fission 3 has a 90% interest in 27,408 ha (10 mineral claims) and a 100% interest in an additional recently staked 9,129 ha (27 mineral claims). Azincourt Energy Corp. holds a 10% interest in 27,408 ha of the PLN property.

The property, just inside the Athabasca Basin, is prospective for high-grade uranium at shallow depth. The property is adjacent to, and part of the same structural corridor as Fission Uranium’s PLS project, host to the Athabasca’s most significant major, shallow-depth, high-grade uranium deposit. Previous drill results show large scale potential. Drilling in 2014 identified a mineralized corridor associated with the A1 ~700m in strike length, where results returned significant mineralization and pathfinder elements (uranium, boron, copper, nickel and zinc) and included hole PLN14-019 which intercepted 0.5m at 0.047% U3O8 within 6.0m @ 0.012% U3O8.

Wales Lake Update: A total of 586m of drilling in 2 holes were completed on the southwest and northeast areas respectively of Block C of Wales Lake in December. Both holes targeted basement electromagnetic conductors that were defined by airborne and ground geophysics. The drilling indicates that the southwestern area of Block C appears to have a higher potential for hosting mineralization.

Hole WL18-001 is an angled hole located on the northwest striking major conductor trend in the southwestern corner of the property. The hole was drilled to a depth of 305m and encountered bedrock at 165.5m . Bedrock consisted of alternating sequences of quartz-chlorite-garnet gneiss and sulphide rich quartz-feldspar-biotite-garnet gneiss. Basement geology appears to be roughly flat lying to gently dipping. Intervals of moderate to strong hematite and chlorite alteration occur throughout. Several narrow intervals of fault gouge within strongly foliated regions were encountered throughout. No anomalous radioactivity was encountered.

Hole WL18-002 is an angled hole located in the northeast corner of the property. Similar to that seen in WL18-001, the basement geology appears to be roughly flat lying to gently dipping. The hole was drilled to a depth of 281m and encountered bedrock at 143m . Bedrock consisted of broad sequences of orthogneiss and granodiorite/granitoid. Minimal chlorite alteration is present to a depth of 195.7m . A narrow interval of anomalous radioactivity associated with a pegmatite vein was encountered from 170.0 to 170.5m . Radioactivity in drill core peaked at 500 cps and downhole gamma survey peaked at 3,239 cps. It is likely the radioactivity is from thorium in the pegmatite rather than uranium.

Wales Lake

|

Hole ID |

Block |

Area |

Collar |

Hand-held Scintillometer Results On |

Basement Unconformity |

Total Drillhole |

||||

|

Az |

Dip |

From (m) |

To (m) |

Width (m) |

CPS Peak Range |

|||||

|

WL18-001 |

Block C |

SW |

235 |

-76 |

No Significant Radioactivity |

165.5 |

305.0 |

|||

|

WL18-002 |

Block C |

NE |

89 |

-76.6 |

170 |

170.5 |

0.5 |

500 |

143.0 |

281.0 |

Wales Lake: The 100% owned Wales Lake property comprises 30 claims in 3 non-contiguous blocks totaling ~35,440 hectares and is accessible by road with primary access from all-weather Highway 955. Similar to Fission Uranium’s PLS property, Wales Lake occupies the same stratigraphic position within the Clearwater Domain and represents relatively shallow depth basement hosted target areas outside of the margin of the Athabasca Basin. From west to east the 3 blocks are referred to as A, B and C respectively. Block A is the westernmost and is located ~30km west of Fission Uranium’s flagship high-grade Triple R uranium deposit. Block B is located a further ~6km to the east and Block C is located a further ~7km to the southwest.

Natural gamma radiation in drill core that is reported in this news release was measured in counts per second (cps) using a hand-held RS-121 Scintillometer manufactured by Radiation Solutions. The reader is cautioned that scintillometer readings are not directly or uniformly related to uranium grades of the rock sample measured and should be used only as a preliminary indication of the presence of radioactive materials. All intersections are down-hole, core interval measurements and true thickness is yet to be determined.

Samples from the drill core are split in half sections on site. Where possible, samples are standardized at 0.5m down-hole intervals. One-half of the split sample will be sent to SRC Geoanalytical Laboratories (an SCC ISO/IEC 17025: 2005 Accredited Facility) in Saskatoon, SK . Analysis will include a 63 element ICP-OES, and boron.

All depth measurements reported, including radioactivity and mineralization interval widths are down-hole, core interval measurements and true thickness are yet to be determined.

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and reviewed on behalf of the company by Ross McElroy , P.Geol. Chief Geologist and COO for Fission 3.0 Corp., a qualified person.

About Fission 3.0 Corp.

Fission 3.0 Corp. is a Canadian based resource company specializing in the strategic acquisition, exploration and development of uranium properties and is headquartered in Kelowna, British Columbia . Common Shares are listed on the TSX Venture Exchange under the symbol “FUU.”

ON BEHALF OF THE BOARD

“Ross McElroy”

________________________

Ross McElroy , COO

Cautionary Statement: Certain information contained in this press release constitutes “forward-looking information”, within the meaning of Canadian legislation. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur”, “be achieved” or “has the potential to”. Forward looking statements contained in this press release may include statements regarding the future operating or financial performance of Fission 3.0 Corp. which involve known and unknown risks and uncertainties which may not prove to be accurate. Actual results and outcomes may differ materially from what is expressed or forecasted in these forward-looking statements. Such statements are qualified in their entirety by the inherent risks and uncertainties surrounding future expectations. Among those factors which could cause actual results to differ materially are the following: market conditions and other risk factors listed from time to time in our reports filed with Canadian securities regulators on SEDAR at www.sedar.com. The forward-looking statements included in this press release are made as of the date of this press release and Fission 3 Corp. disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Fission 3.0 Corp.

|

|||||||||||||||||||

|

On the First Day of Christmas my true love gave me a Partridge in a Pear Tree. Fortunately, the partridge was resting in a pear tree in the Anadarko Basin at the STACK in central Oklahoma. That led me to look deeply into an Oil & Gas Company named Jericho Oil, which smartly bought prolific, enticing land packages when Oil was at its absolute lows. “Never Waste a Good Crisis”. Brian Williamson, a well-groomed CEO, heads up a very experienced field crew and boasts a very loyal, savvy investor following, who know Oil. Currently shares can be shrewdly purchased for JCO (Jericho Oil) at 43 cents which is nearly it’s 52-week low. Buy Low, Sell High!!! Oil will rebound!!!

On the Second Day of Christmas my true love gave to me 2 Turtle Doves. My good fortune led me to where they were nesting in a prospective, massive land package on Pamlico Ridge outside Hawthorne, Nevada. It is owned by Newrange Gold (NRG). Past results were outstanding and there is much anticipation from the recent drill program which was just completed. I therefore bought some shares of NRG at 15 cents. Top flight management and an extremely mining friendly jurisdiction in Nevada which includes close proximity to the needed infrastructure. Shares are very tightly help by management and insiders adds to the appeal and they are a top pick for 2019 !!!

On the Third Day of Christmas my true love gave to me 3 Turtle Doves. As luck would have it, they came from a bramble bush in Sycamore Canyon, Arizona. That led me to look into a company named Arizona Silver Exploration (AZS). After some very encouraging grab samples, they are awaiting the eminent drill permits which will lead to an early Q-1 drill program. CEO & Geo, Greg Hahn has an excellent track record, the ultra-tight share structure (30 Million Shares) and consistent insider buying makes this an attractive buy at AZS – 8 cents.

On the Fourth Day of Christmas my true love gave to me 4 Calling Birds. It turns out the birds were nesting at a rapidly growing mining property, Kwanika owned by Serengeti Resources (SIR). They are awaiting a pre-feasibility study which should be awesome with the added fantastic drill results which were put to market in late 2018. This should really make 2019 an exciting time to own shares. CEO Dave Moore was a previous winner of Prospector of the Year and knows how and where to drill. Having a loyal and deep pocketed partner Daewoo, a mining giant from South Korea to foot the bills sure tamps down the risk. I bought some additional SIR shares at 17 cents today.

On the Fifth Day of Christmas my true love gave to me 5 Golden Rings. To my great fortune they were found in a shallow pond at a mine site named Goldboro, in Nova Scotia, owned by Anaconda Mining (ANX). The Goldboro Property has released some very encouraging drill results and will feed a super-efficient mill. They are awaiting more results of an ongoing aggressive drill program. They are guided by the real originator of the “Art of a Deal”, Jonathan Fitzgerald, who has some aces up his sleeve for 2019 and will be wheeling & dealing. I bought additional shares today of ANX for 22 cents.

On the Sixth Day of Christmas my true love gave to me 6 Geese a Laying. As luck would have it the geese were resting on a mountain in Japan. It turns out the property is owned by Irving Resources (IRV) named after a beloved cat who hates mailman … but has taking a liking to the Geese. Go figure!!! The company is owned by a savvy, bundle of dynamite, Akiko Levinson, who is partnered with a GEO you might have heard of, none other than Quinton Hennigh. If you haven’t heard of him you have no business investing in Juniors. Literally everything “Q” touches turn into Gold. A very tight share structure and an upcoming drill program in the Omu Mine, that produced awesome amounts of Gold, bode great things for 2019. I purchased shares today of IRV for $1.80. In past years I made a killing with this dynamic duo with Gold Canyon Resources. I am anticipating history repeating itself in 2019.

On the Seventh Day of Christmas my true love gave to me 7 Swans a Swimming. Luckily for me they were floating in a lake on a property in Elko, Arizona. This property holds massive amounts of Vanadium. The CEO, of First Vanadium (FVAN) Paul Cowley wrangled the property from the previous owners when Vanadium was $3 a pound. Now this “in vogue mineral” which strengthens steel and powers batteries presently commands $26 a pound. A soon to be released Pre-Feasibility Study promises exciting things in 2019. A very tight share structure adds to the allure. I purchased shares today of FVAN at 77 cents.

On the Eighth Day of Christmas my true love gave to me, 8 Maids a Milking. To my chagrin turns out the old bats were stumbling drunk and passed out in a mine owned by McEwen Mining (MUX). For those who don’t know CEO Rob McEwen, he is past leader of Goldcorp who went on to found this emerging powerhouse. Rob takes only a Dollar a year in salary, so he makes money only if the share price performs. I am expecting big things from this company when the Gold price shoots up. Shares today of MUX can be had for $1.79, a recent financing closed at $2.25 …only Rob can pull that off. His past successes bode well for future fortunes to be made in 2019. McEwen owns some excellent properties in some of the most mining friendly countries in the World.

On the Eighth Day of Christmas my true love gave to me, 8 Maids a Milking. To my chagrin turns out the old bats were stumbling drunk and passed out in a mine owned by McEwen Mining (MUX). For those who don’t know CEO Rob McEwen, he is past leader of Goldcorp who went on to found this emerging powerhouse. Rob takes only a Dollar a year in salary, so he makes money only if the share price performs. I am expecting big things from this company when the Gold price shoots up. Shares today of MUX can be had for $1.79, a recent financing closed at $2.25 …only Rob can pull that off. His past successes bode well for future fortunes to be made in 2019. McEwen owns some excellent properties in some of the most mining friendly countries in the World.

On the Ninth Day of Christmas my true love gave to me 9 Ladies Dancing. Turns out they were dancing as they got into the spiked punch provided by 10 Lords. They stumbled upon a nice prospective piece of land in B.C. owned by Black Tusk Resources. A young management team known as “Da Boyz”, led by Richard Penn, who truly understands how to market, promote and raise capital. With only 20 Million shares outstanding and awaiting the results of a channel & sampling program from the old Slocum Mining District, TUSK is a sleeper at 22 cents.

On the Tenth Day of Christmas my true love gave to me 10 Lords a Leaping. As happen stance would have it, these guys came across the same spiked punch and passed out in pit located in the Dominican Republic. Fortunately, this property is owned by Precipitate Gold (PRG)and with the government waking up again to how important and crucial mining is for their economy. This makes the very nice prospective land package that CEO Jeff Wilson amassed adjacent to Barrick, seem like a game changer. The Dominican has been known to hold some epic Gold pockets and this sleeper, PRG can be had for 12 cents.

On the Eleventh Day of Christmas my true love gave to me 11 Pipers Piping. It seems they got hold of some spoiled eggnog and needed to rest and landed in pit in Guyana, South America. As fortune would have it, it is owned and operated by Sandspring Resources (SSP). With 10.4 Million ounces of Gold and being situated in an English speaking, very mining friendly jurisdiction along with some deep pocketed partners, this optionally play makes SSP an attractive purchase at 21 cents

On the Twelfth Day of Christmas my true love gave to me 12 Drummers Drumming. These guys it turns out got some moldy fruit cake from last year and they needed a place to rest and recoup in Chihauhau,Mexico on the property of Golden Goliath (GNG). CEO Paul Sorbara acquired this land over 30 years ago, he has recently sold similar property to Fresnillo and now has close to $2 million to drill. A land package that he has been hoping and waiting to drill for a long time. This sleeper company GNG can be had for 2 cents – (yes you read it right – 2 cents).

I would like to say, Merry Christmas from my family to yours. While 2018 has been a horrible for Junior Resource stocks, I believe 2019 will be the year when it all comes together. The price of Gold is closing in on on $1,270 and finally many key technical factors will kick in. Then certainly Gold will get some much needed and welcome wind in its sails. I can’t stress enough how fast and furious these Junior Miners can explode when the stars line up.The good Lord knows we have been waiting a long time and we will see the fruits of our patience rewarded bountifully in 2019. Mark my Words !!!

My website www.kdblueskymarketing.com hopefully will be a go to place for mining news and companies that I sniff out which are unloved, under-valued and prime for take-off in 2019.

In the 12 days of Christmas I have attempted to introduce some of the companies I believe in. I feel they are very under valued at this time. Some are sponsors of my website and hopefully, some will consider partnering with me to get the word out to a segment of the market which needs attention, support and most of all respect.

Kevin Dougan is an investor and close follower of the Junior Resource sector. I attend several trade shows a year and network and share info with some of the sharpest minds in the business. I AN NOT A FINANCIAL ADVISER. Please consult you own financial adviser when making investment decisions. If you would like to subscribe to my monthly FREE newsletter it is available on my home page at www.kdblueskymarketing.com