Vancouver, British Columbia–(Newsfile Corp. – April 12, 2019) – Miramont Resources Corp. (CSE: MONT) (OTCQB: MRRMF) (FSE: 6MR) (“Miramont” or the “Company“) is pleased to announce appointment of Dr. Quinton Hennigh as Executive Chairman of the Company. Dr. Hennigh has served as non-executive Chairman since November 2017. As Executive Chairman, Dr. Hennigh will be responsible for overseeing the control and direction of Miramont. Dr. Hennigh is an economic geologist with more than 25 years of exploration experience with major gold mining firms, including Homestake Mining, Newcrest Mining and Newmont Mining. Currently, Dr. Hennigh is President and Chairman of Novo Resources Corp and serves as a director for Irving Resources Inc., TriStar Gold Inc., Precipitate Gold Corp and NV Gold Corp.

Mr. Tyson King has been appointed as President and Chief Executive Officer of the Company. Mr. King is a co-founder of Miramont and has served in senior management roles since its inception, most recently as Vice-President. Mr. King will be responsible for the day-to-day operations and management of the Company and will report directly to Dr. Hennigh. Mr. King has over 10 years experience in the management of publicly trading and privately held companies in the commodities and natural resources sector. He has been actively engaged in overseeing the operations of numerous companies and has provided consulting services in connection with exploration activities. Mr. King holds a BA in Economics from the University of Calgary.

“I am very pleased to have the opportunity to take on a more active management role in the operations of Miramont” said Dr. Hennigh. “I also look forward to working more closely with Mr. King, who has been a driving force behind Miramont from the outset. Our plans moving forward include a continued assessment of all data from Cerro Hermoso and advancing the highly prospective Lukkacha project. The Company will also focus on identifying new exploration properties in Peru which could be acquired on reasonable terms.”

Miramont also announces that Mr. William Pincus will be leaving the Company and has tendered his resignation as President, Chief Executive Officer and a member of the Board of Directors of the Company. Quinton Hennigh, Chairman of the Board, noted: “The Board would like to thank Mr. Pincus for his service to the Company, especially helping establish Miramont as a Peruvian explorer. Mr. Pincus served with utmost integrity, candidness and forthrightness with all interactions with the board. We wish him well with his future endeavors.”

About Miramont Resources Corp.

Miramont is a Canadian-based exploration company with a focus on acquiring and developing mineral prospects within world-class belts of South America. Miramont’s key assets are located in southern Peru. The Cerro Hermoso property hosts a 1.4km diameter breccia pipe targeting gold – polymetallic mineralization, while the Lukkacha property is targeting porphyry copper mineralization.

On behalf of the Board of Directors,

MIRAMONT RESOURCES CORP.

Quinton Hennigh

Executive Chairman

For more information, please contact the Company at:

Telephone: (604) 398-4493

Facsimile: (604) 815-0770

info@miramontresources.com

www.miramontresources.com

Reader Advisory

This news release may contain statements which constitute “forward-looking information”, including statements regarding the plans, intentions, beliefs and current expectations of the Company, its directors, or its officers with respect to the future business activities of the Company. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions, as they relate to the Company, or its management, are intended to identify such forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future business activities and involve risks and uncertainties, and that the Company’s future business activities may differ materially from those in the forward-looking statements as a result of various factors, including, but not limited to, fluctuations in market prices, successes of the operations of the Company, continued availability of capital and financing and general economic, market or business conditions. There can be no assurances that such information will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. The Company does not assume any obligation to update any forward-looking information except as required under the applicable securities laws.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Category: Blog

Blog sub category

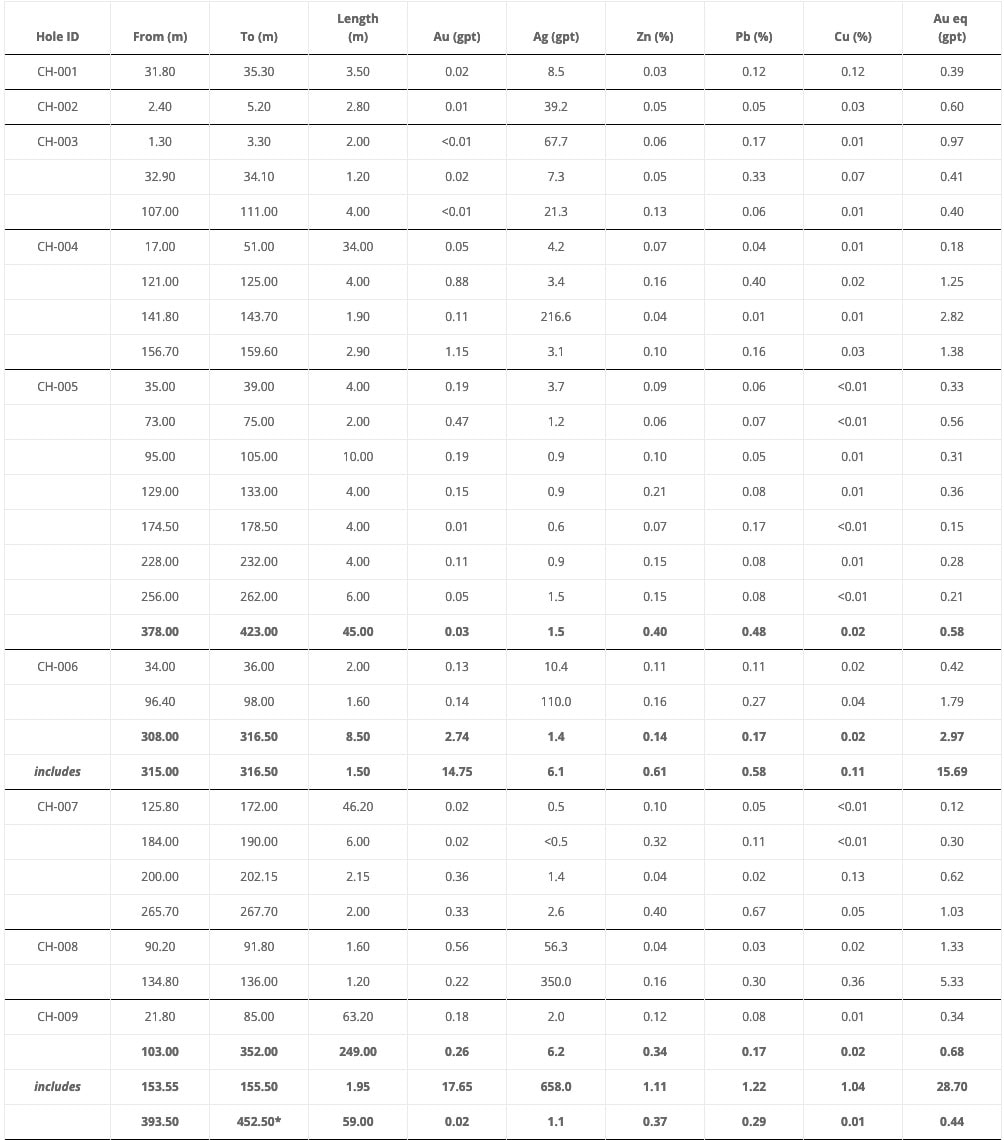

Vancouver, British Columbia–(Newsfile Corp. – April 12, 2019) – Miramont Resources Corp. (CSE: MONT) (OTCQB: MRRMF) (FSE: 6MR) (“Miramont” or the “Company“) is pleased to announce it has received final assays from its 3,679-meter diamond drill program at its Cerro Hermoso polymetallic project located in southern Peru. Results include 249 m of 0.68 gpt Au equivalent including 1.95 m of 28.4 gpt Au equivalent in hole CH-009 (please refer to a table of results below and a nearby plan map showing the location of drill holes).

Highlights:

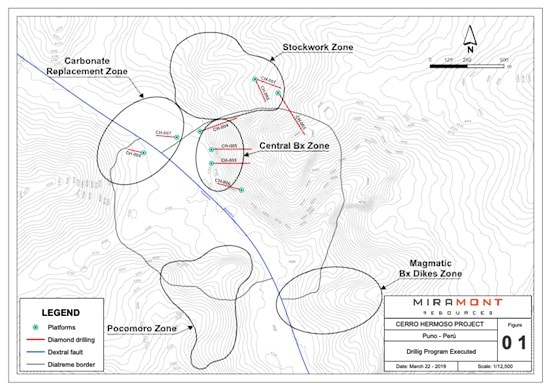

- Drilling tested three principal targets, the Central Breccia Zone (holes CH-004, CH-005, CH-006 and CH-009), the Stockwork Zone (holes CH-001, CH-002 and CH-003) and the Carbonate Replacement Zone (holes CH-007 and CH-008).

- Significant mineralization was encountered in the Central Breccia Zone. Hole CH-009, drilled eastward, encountered 249 m of 0.68 gpt Au equivalent beginning at 103 m including 1.95 m of 28.4 gpt Au equivalent beginning at 153.55 m and a second interval of 59 m of 0.44 gpt Au equivalent beginning at 393.5 m and continuing to the end of the hole. Hole CH-005, situated approximately 100 m north of and parallel to CH-009, encountered 45 m of 0.58 gpt Au equivalent beginning at 378 m. Hole CH-006, situated approximately 250 m southeast of CH-009 and drilled westward, encountered 8.5 m of 2.97 gpt Au equivalent beginning at 308 m including 1.5 m of 15.69 gpt Au equivalent beginning at 315 m. Collectively, holes CH-009, CH-005 and CH-006 demonstrate the presence of a mineralized system within the diatreme that appears open to the northeast, east and southeast under an area of post-mineral cover. The eastern margin of the diatreme lies approximately 600 m beyond the end of these two holes, leaving considerable room for further exploration. A large, sub-surface magnetic feature situated approximately 400 m northeast of hole CH-009 may be an intrusion, potentially related to mineralization.

- Holes CH-001, CH-002 and CH-003 in the Stockwork Zone encountered narrow intervals of anomalous mineralization. Miramont sees limited potential for broader zones of mineralization in this area. Similar short intervals of anomalous mineralization were encountered in holes CH-007 and CH-008 targeting the Carbonate Replacement Zone, indicating limited potential in this area.

- Miramont is currently undertaking a thorough review of results from drilling at Cerro Hermoso with the intent of determining the best path forward.

Dr. Quinton Hennigh, Miramont’s Chairman said: “First pass drilling has confirmed the presence of a large mineralized system at Cerro Hermoso. Mineralization within the Central Breccia Zone appears open to the northeast, east and southeast as well as at depth. A nearby magnetic anomaly suggests the system is driven by a buried intrusion. Over the coming weeks we plan to compile, review and interpret all data from the latest program.”

The table below presents anomalous intercepts in all nine diamond drill holes completed at Cerro Hermoso. Some intercepts from holes CH-001 through CH-006 were previously reported in a news release dated March 28, 2019.

*End of hole

Au eq calculated using 81.25 gpt Ag = 1 gpt Au, 1.4237% Zn = 1 gpt Au, 2.1518% Pb = 1 gpt Au, 0.6485% Cu = 1 gpt Au)

Analytic Protocols and QA/QC

Assays were completed first by SGS and then by ALS Laboratories in Peru. Future samples will be analyzed by ALS as primary laboratory. Miramont follows rigorous sampling and analytical protocols that meet industry standards. Core samples are stored in a secured area until transport in batches to either SGS or ALS prep labs in Arequipa, Peru. Sample batches include certified reference materials, blanks, and duplicate samples are then processed under the control of ALS or SGS. ALS samples are analyzed using the ME-ICP61 (a technique that provides a comprehensive multi-element overview of the rock geochemistry), while gold is analyzed by AA24 and GRA22 when values exceed 10 gpt. Over limit silver, copper, lead and zinc are analyzed using the OG-62 procedure. SGS samples are analyzed using the ICP 40B method while gold is analyzed by FAA515. Over limit silver, copper, lead and zinc are analyzed using the AAS41B procedure.

National Instrument 43-101 Disclosure

The technical content of this news release has been reviewed and approved by Dr. Quinton Hennigh, P.Geo., Chairman of Miramont and a Qualified Person as defined by National Instrument 43-101.

About Miramont Resources Corp.

Miramont is a Canadian based exploration company with a focus on acquiring and developing mineral prospects within world-class belts of South America. Miramont’s two key projects are Cerro Hermoso and Lukkacha, both located in southern Peru. Cerro Hermoso is a diatreme-hosted copper dominant polymetallic prospect. Lukkacha is a classic copper-porphyry prospect.

On behalf of the Board of Directors,

MIRAMONT RESOURCES CORP.

“Quinton Hennigh”

Quinton Hennigh, Chairman

For more information, please contact the Company at:

Telephone: (604) 398-4493

Facsimile: (604) 815-0770

info@miramontresources.com

www.miramontresources.com

Reader Advisory

This news release may contain statements which constitute “forward-looking information”, including statements regarding the plans, intentions, beliefs and current expectations of the Company, its directors, or its officers with respect to the future business activities of the Company. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions, as they relate to the Company, or its management, are intended to identify such forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future business activities and involve risks and uncertainties, and that the Company’s future business activities may differ materially from those in the forward-looking statements as a result of various factors, including, but not limited to, fluctuations in market prices, successes of the operations of the Company, continued availability of capital and financing and general economic, market or business conditions. There can be no assurances that such information will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. The Company does not assume any obligation to update any forward-looking information except as required under the applicable securities laws.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Map 1

To View an enhanced version of this Map, please visit: https://orders.newsfilecorp.com/files/5945/44047_1341a750b4c22a72_002full.jpg

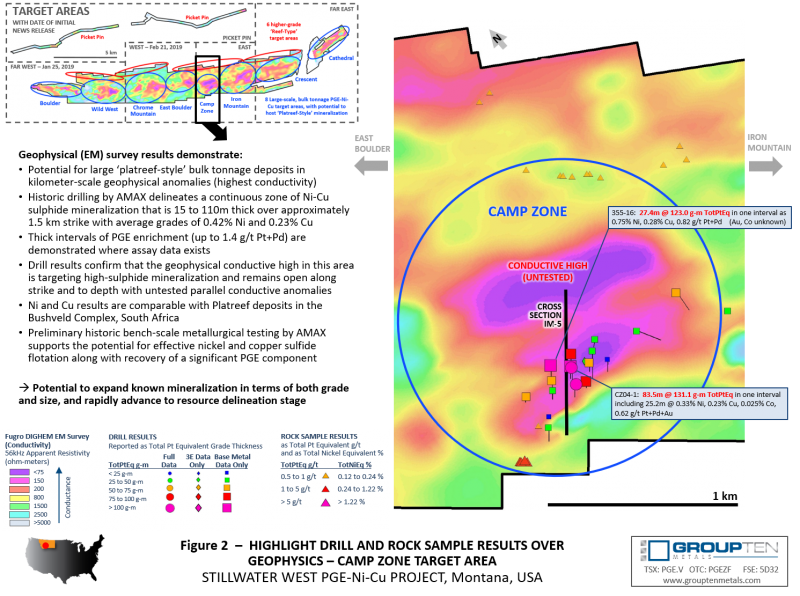

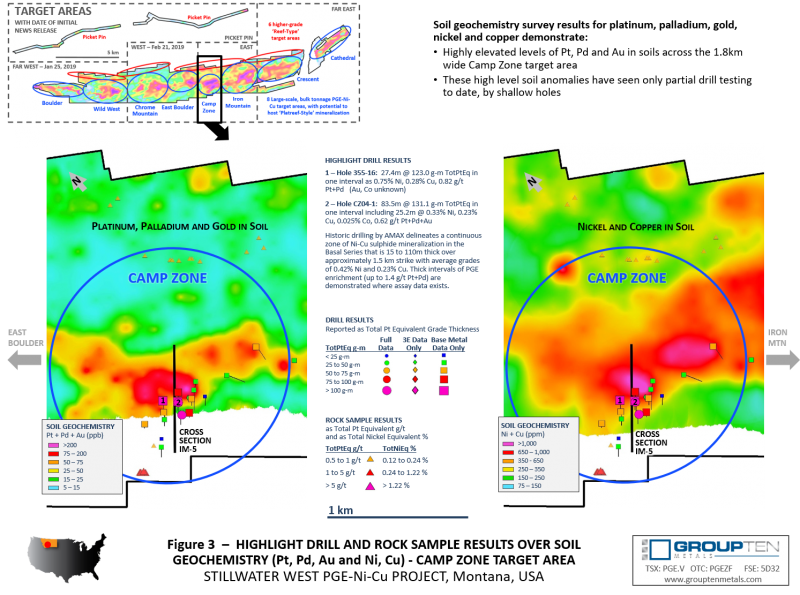

Vancouver, BC – Group Ten Metals Inc. (TSX.V: PGE; US OTC: PGEZF; FSE: 5D32) (the “Company” or “Group Ten”) announces results from the Camp Zone target area on the east side of the Stillwater West Project in Montana, USA. This is the third in a series of planned news releases to report results of 2018 exploration programs and on-going data synthesis and modeling work at the Company’s flagship platinum group element-nickel-copper (“PGE-Ni-Cu”) project adjacent to Sibanye-Stillwater’s high-grade PGE mines in the Stillwater Igneous Complex. Highlights include:

- Drilling by AMAX in the late 1960s and early 1970s includes nine holes which delineate a continuous zone of nickel-copper sulphide mineralization in the Basal Series ranging from 15 to 110 meters in thickness over approximately 1.5 kilometers strike with average grades of 0.42% nickel and 0.23% copper. Platinum and palladium assays, completed as composite samples over select intervals only, demonstrate thick intervals of enrichment, confirming the potential for Platreef-style deposits in the lower Stillwater Complex.

- Nickel and copper grades in these drill holes are comparable to those in the Platreef deposits. Limited data is available for platinum and palladium although select intervals were composited with intercepts of up to 1.4 g/t Pt+Pd. Additional drilling will be needed to better define PGE content.

- These drill holes confirm that the geophysical conductive high in this area is targeting high-sulphide mineralization which remains open along strike and to depth with untested parallel conductive anomalies.

- Initial bench-scale metallurgical results from the Camp Zone completed by AMAX are very encouraging and demonstrate that, though Stillwater West is still an exploration stage asset with a lot of room to grow, preliminary testing supports the potential for effective nickel and copper sulphide flotation along with recovery of a significant PGE component.

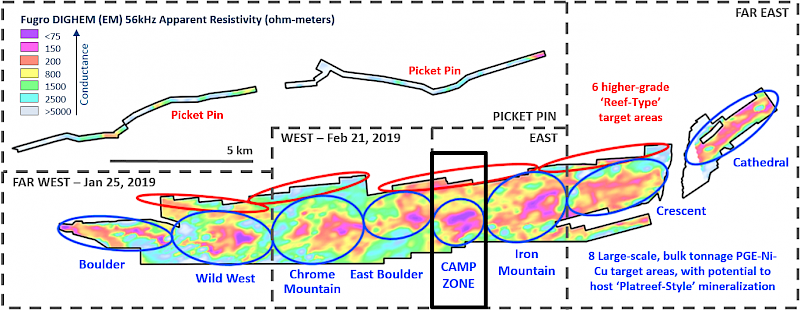

Michael Rowley, President and CEO, commented, “We are pleased to report results of our work to date in the Camp Zone target area of the 25-km-long Stillwater West Project (see Figure 1) which, like the four target areas announced previously, displays widespread platinum, palladium, gold, nickel, copper and cobalt mineralization in drill and rock sample results across highly conductive kilometer-scale geophysical anomalies with coincident highly elevated levels of metals in soils. The Camp Zone target area is among the most developed at Stillwater West Project and is, along with the Chrome and Iron Mountain target areas, a priority for work in 2019. We see the potential to rapidly expand on previous work in terms of both size and grade through the application of the geological model we have developed. The scale of these targets, and the geological similarities to the Bushveld Complex of South Africa, demonstrate the potential for discovery of a major new bulk-tonnage “Platreef-style” PGE-Ni-Cu deposit in the famously metal-rich Stillwater Complex.”

Figure 1 – 14 Target Areas Across the 25-Kilometer Width of the Stillwater West Project

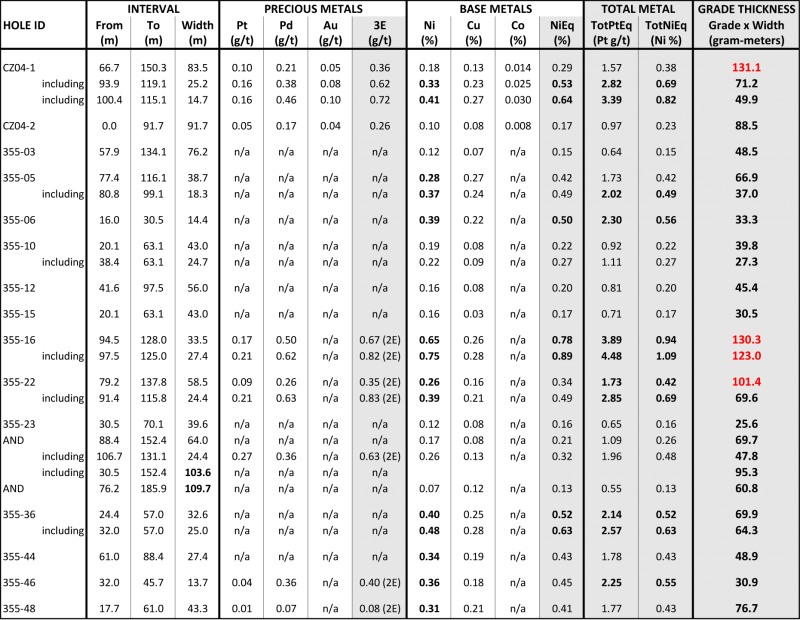

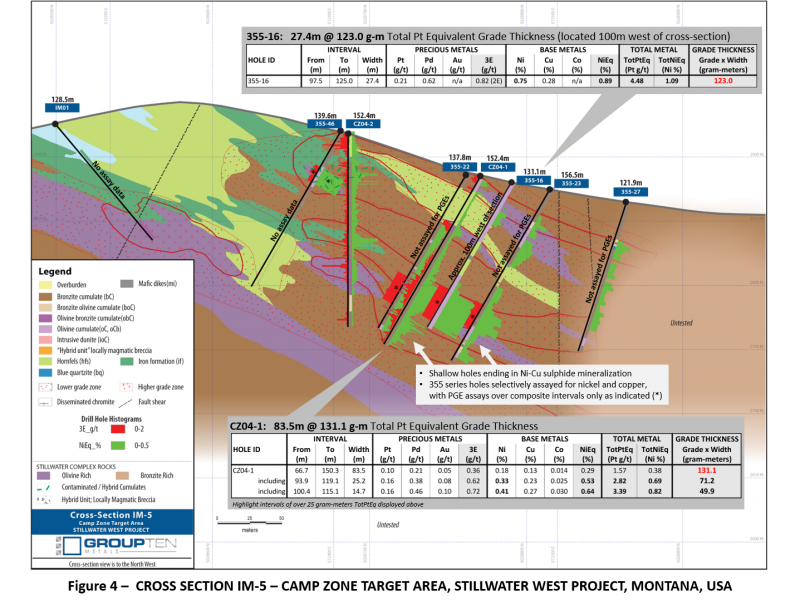

As shown in Figure 1, the Camp Zone target area covers 1.8 km of strike length and represents one of eight major electromagnetic geophysical conductors defined across the 25-kilometer length of the Stillwater West project. Most of the work to date at Camp Zone has focused on disseminated to net-textured sulphide mineralization within cumulates of the Basal Series and adjacent country rocks. Drilling by Amax in the late 1960s through mid-1970s focused on exploration for nickel and copper. Platinum and palladium analyses were completed on some intervals on a composite basis with assays up to 1.4 g/t Pt+Pd, and select holes report PGE assay results composited over long intervals including hole 355-16 which returned 27.4m at 123.0 gram-meters Total Platinum Equivalent (TotPtEq) grade thickness (0.75% Ni, 0.28% Cu, 0.21 g/t Pt and 0.62 g/t Pd, equivalent to 4.48 g/t TotPtEq, or 1.09% Total Nickel Equivalent).

Table 1 – Highlight Mineralized Drill Intercepts from the Camp Zone Target Area

Intercepts with grade thickness values over 25 gram-meter TotPtEq are presented above. Intervals with 2E data have composite platinum and palladium assays only. Total Platinum Equivalent (TotPtEq g/t) and Total Nickel Equivalent calculations reflect total gross metal content using metals prices as follows (all USD): $6.00/lb nickel (Ni), $3.00/lb copper (Cu), $20.00/lb cobalt (Co), $1,000/oz platinum (Pt), $1,000/oz palladium (Pd) and $1,250/oz gold (Au). Values have not been adjusted to reflect metallurgical recoveries. Total metal equivalent values include both base and precious metals, where available. Results labelled ‘n/a’ were not assayed for that metal. Total platinum equivalent grade thickness was determined by multiplying the thickness (in meters) by the Total Platinum Equivalent grade (in grams/tonne) to provide gram-meter values (g-m) as shown. CZ04 series drill holes were conducted by Group Ten’s QP and are not considered historic. 355 series drill are considered historic and have not been independently verified by Group Ten.

Subsequent drilling in 2004 within the footprint of the historic Camp Zone holes confirms the presence of broad zones of nickel and copper sulphides and also identified significant associated precious metal and cobalt mineralization with hole CZ04-1 returning 83.5 meters at 131.1 g-m TotPtEq including 25.2 meters at 2.82 g/t TotPtEq (or 0.69% TotNiEq). This hole comprised 0.33% Ni, 0.23% Cu, 0.025% Co, and 0.62 g/t 3E (as 0.16 g/t Pt, 0.38 g/t Pd, 0.08 g/t Au).

Like the Hybrid Zone target area at Chrome Mountain (announced February 21, 2019), past work in the Camp Zone target area provides the Company with drill-defined wide intervals of mineralization that have typically only been tested to less than 150 meters of depth. These zones remain open in all directions and the adjacent soil and geophysical anomalies remain untested (see Figure 2).

The Company is targeting a Platreef-type setting at the Camp Zone where bulk-tonnage sulphide mineralization in the Basal Series of the complex may be associated with interaction between the layered basal magmatic system and the basement country rocks. Interaction and assimilation of basement country rocks is an important component of the Platreef deposits in the Bushveld Complex, where the country rocks may be in place as the footwall or occur as large rafts within the layered magmatic stratigraphy. The potential for this setting at the Camp Zone is supported by deep conductive geophysical targets along with historic drilling just south of the Camp Zone, where hole IM01 drilled through iron formation starting at surface, in what had been interpreted as basement country rocks, before returning to mineralized layered ultramafic rocks below (see Figure 4).

The multi-kilometer geophysical, geochemical and geological signatures present compelling bulk-tonnage targets in this type of setting for PGE-enriched Ni-Cu sulphides in the lower Stillwater Complex stratigraphy. The Camp Zone target area is a priority for follow-up work in 2019 based on the potential for large-scale disseminated and massive nickel and copper sulphide mineralization enriched in PGE, gold and cobalt. Group Ten sees the potential to expand known mineralization in terms of both scale and grade and rapidly advance these areas to resource delineation stage through the application of a systematic approach and the predictive geologic model developed to date.

About the Stillwater West Project

The Stillwater West PGE-Ni-Cu project positions Group Ten as the second largest landholder in the Stillwater Complex, adjoining and adjacent to Sibanye-Stillwater’s world-leading Stillwater, East Boulder, and Blitz platinum group elements (PGE) mines in south central Montana, USA. With more than 41 million ounces of past production and current M&I resources, plus another 49 million ounces of Inferred resources1,2, the Stillwater Complex is recognized as one of the top regions in the world for PGE-Ni-Cu mineralization, alongside the Bushveld Complex and Great Dyke in southern Africa, which are similar layered intrusions. The J-M Reef, and other PGE-enriched sulphide horizons in the Stillwater Complex, share many similarities with the highly prolific Merensky and UG2 Reefs in the Bushveld Complex, while the lower part of the Stillwater Complex also shows the potential for much larger scale disseminated and high-sulphide PGE-nickel-copper type deposits, possibly similar to Platreef in the Bushveld Complex3. Group Ten’s Stillwater West property covers the lower part of the Stillwater Complex along with the Picket Pin PGE Reef-type deposit in the upper portion, and includes extensive historic data, including soil and rock geochemistry, geophysical surveys, geologic mapping, and historic drilling.

Note 1: Report on Montana Platinum Group Metal Mineral Assets of Sibanye-Stillwater, November 2017, Measured and Indicated Resources of 57.2 million tonnes grading 17.0 g/t Pt+Pd containing 31.3 million ounces and 92.5 million tonnes grading 16.6 g/t containing 49.4 million ounces. Grade thickness was determined by applying the reported minimum mining width of 2.0 meters to the M&I grade of 17 g/t Pt+Pd for an average grade thickness of approximately 34 gram-meter (g-m).

Note 2: Public production records from Stillwater Mining Company from 1992 to present.

Note 3: Magmatic Ore Deposits in Layered Intrusions—Descriptive Model for Reef-Type PGE and Contact-Type Cu-Ni-PGE Deposits, Michael Zientek, USGS Open-File Report 2012–1010.

About Group Ten Metals Inc.

Group Ten Metals Inc. is a TSX-V-listed Canadian mineral exploration company focused on the development of high-quality platinum, palladium, nickel, copper, cobalt and gold exploration assets in top North American mining jurisdictions. The Company’s core asset is the Stillwater West PGE-Ni-Cu project adjacent to Sibanye-Stillwater’s high-grade PGE mines in Montana, USA. Group Ten also holds the high-grade Black Lake-Drayton Gold project in the Rainy River district of northwest Ontario and the highly prospective Kluane PGE-Ni-Cu project on trend with Nickel Creek Platinum’s Wellgreen deposit in Canada‘s Yukon Territory.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies, with a portfolio of large, brownfields assets in established mining districts adjacent to some of the industry’s highest-grade producers of platinum, palladium, silver and copper. Member companies include Group Ten Metals (TSX-V: PGE) in the Stillwater PGM-Ni-Cu district of Montana, Metallic Minerals (TSX-V: MMG) in the Yukon’s Keno Hill silver district, and Granite Creek Copper (TSX-V: GCX) in the Yukon’s Carmacks copper district. The founders and team members of the Metallic Group include highly successful explorationists formerly with some of the industry’s leading explorer/developers and major producers and are undertaking a systematic approach to exploration using new models and technologies to facilitate discoveries in these proven historic mining districts. The Metallic Group is headquartered in Vancouver, BC, Canada and its member companies are listed on the Toronto Venture, US OTC, and Frankfurt stock exchanges.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley, President, CEO & Director

Email: info@grouptenmetals.com Phone: (604) 357 4790

Web: http://grouptenmetals.com Toll Free: (888) 432 0075

Quality Control and Quality Assurance

2018 rock chip samples were analyzed by Bureau Veritas Mineral Laboratories in Vancouver, B.C. Samples were crushed and split, and a 250 g split pulverized with 85% passing 200 mesh. Gold, platinum, and palladium were analyzed by fire assay (FA350) with ICP finish. Selected major and trace elements were analyzed by peroxide fusion with ICP-EB finish to insure complete dissolution of resistate minerals. Following industry QA/QC standards, blanks, duplicate samples, and certified standards were also assayed.

2004 drilling was conducted by Group Ten’s QP while working for Beartooth Platinum. Pre-2001 drill results are considered historic and have not been independently verified by Group Ten. Mr. Mike Ostenson, P.Geo., is the qualified person for the purposes of National Instrument 43-101, and he has reviewed and approved the technical disclosure contained in this news release.

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, and future plans and objectives of the company are forward-looking statements that involve various risks and uncertainties. Although Group Ten believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Dear Shareholders,

You’re receiving this email as you are amongst our seed and IPO shareholder group. First off, I wanted to thank you again for all of your support in helping to get Rover Metals to where we are today.

Today we announced our intent to acquire the Toquima Project in Nevada, USA. Our technical team has valued the historical resource at Toquima as follows:

- 200,000 ounces gold (at or near surface)

- 40,000,000 ounces silver (at our near surface)

Kinross has been operating the Round Mountain mine (16MM ounces Au produced) nearby since 2003. Toquima lies on the same Caldera Margin approx. 15 km away. We see significant blue sky potential for gold exploration.

The business case for the Toquima Acquisition is that Rover needs to address the following issues:

- Acquire a lower cost per meter exploration project to offset the more expensive exploration costs of our existing NWT, Canada assets. Even with a high-grade gold northern project (Cabin Lake), a southern asset is needed.

- A U.S. asset is now needed to follow completion of U.S. listing (Q1 completed)

- A subset of this is access to U.S. retail capital to finance future exploration and growth along with the additional liquidity of the U.S. market

- Canadian capital markets for Sub $10MM market cap companies remain weak. We intend to try to finance our NWT assets through Flow-through funds later this business quarter.

- Address seasonality issues of our existing NWT assets. The Toquima Project is available for year-round exploration. December to mid-April is the most cost-effective window to be operating our NWT projects.

- Feed the Public Markets News Machine with year-end exploration news.

We are currently offering a $0.06 Unit Financing with a Full Warrant (at $0.12 for five years). If you have interest (for example, in averaging down your position), please let me know.

Judson Culter, CPA, CA, CPA(WA)

CEO | Rover Metals

(TSXV: ROVR)(OTCQB: ROVMF)

While silver prices continue to languish around the $15 level, the less publicized signs that an eventual rise in price eventually must occur continue to emerge.

SRS Rocco reports how silver production is down again. Which is going to eventually have to impact the price.

To find out why, click to watch the video now!

Chris Marcus

Arcadia Economics

“Helping You Thrive While We Watch The Dollar Die”

www.ArcadiaEconomics.com

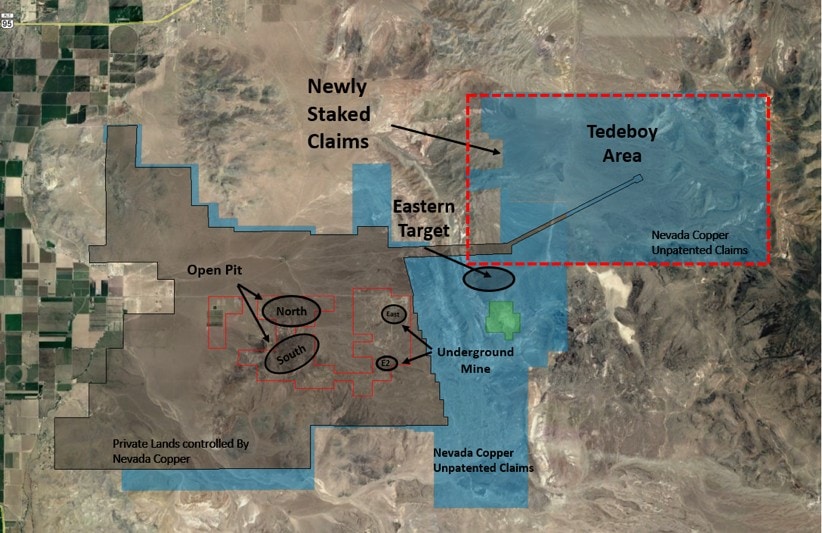

April 11, 2019 – Nevada Copper Corp. (TSX: NCU) (“Nevada Copper” or the “Company’’) is pleased to announce plans for a $3 million exploration program in 2019 at its 100%-owned Pumpkin Hollow copper project in Nevada, USA. The program has the following goals:

- Newly-staked land exploration: drill-test high-priority areas including Tedeboy and East targets where areas of both porphyry and skarn-style copper mineralization have been identified at surface

- Open pit exploration: drill-test open extensions to the Open Pit ore body and follow up on successful 2018 results

- Open pit advancement: Infill drilling of in-pit Inferred resource material with objective to increase resource tonnage and grade

Matt Gili, Chief Executive Officer of Nevada Copper, stated “While our operations team focuses on putting our underground mine into production in Q4, 2019, our experienced geological team is executing on our exploration and expansion goals. The new program has been designed in line with our corporate philosophy of pursuing smart, low-cost growth options. It will encompass drilling some of the high-priority targets in underexplored areas of the Pumpkin Hollow project, including newly-staked ground that has encouraging copper showings on surface. In addition, we will also be targeting areas of potential growth in and around the open pit via exploration and expansion drilling.”

2019 Exploration Program Details

Newly-Staked Land Exploration and East Target (see news release dated February 22, 2019)

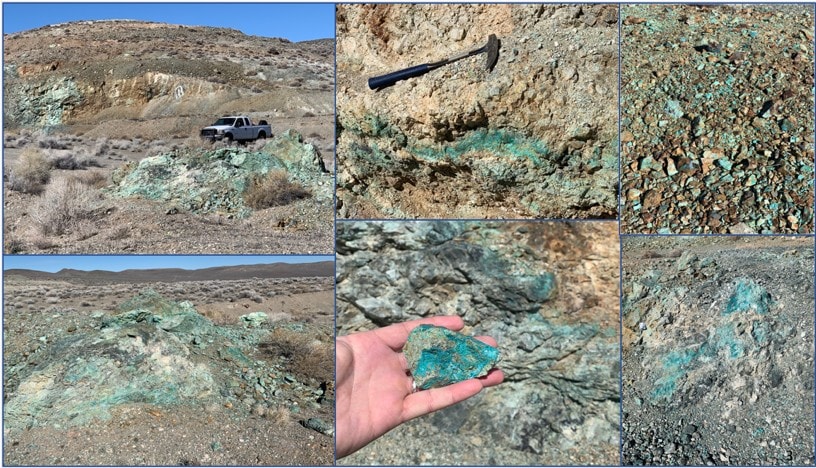

In February 2019, the Company expanded its land position by 32% with the staking of 5,700 acres of Federal Land to the northwest of its prior land position (shown below Figure 1), known as the Tedeboy Area. This area contains porphyry-style alteration and copper oxide mineralization at surface with multiple zones of copper mineralization sampled in outcrops and trenches.

- Objective: Demonstrate the potential of both existing and newly-staked lands and test multiple new targets, including both porphyry and skarn mineralization

- Key activities:

- Airborne geophysics survey, and mapping and sampling

- Drill test Tedeboy and East Targets (see Figure 1.)

Figure 1. New Ground Exploration Activity

Figure 2. New Ground – Surface Outcrops

Open Pit Exploration

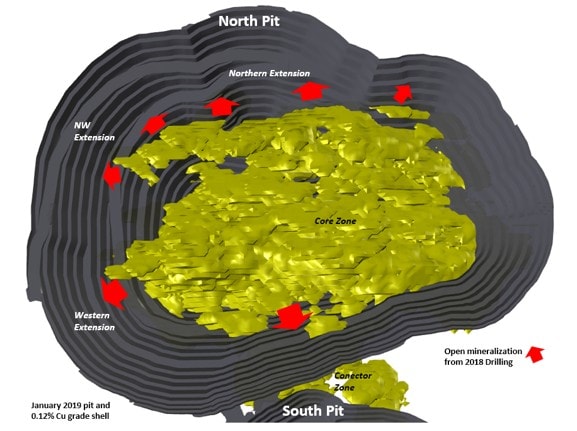

Following on the success of the 2018 drilling program, the Company has identified several directions of open mineralization around the current Open Pit, notably to the north and the west. Additionally, the Company intends to increase its understanding of the area immediately between the North and South pit boundaries, known as the “Connector Zone”.

- Objective: Continue to test open extensions to the Open Pit ore body, following the successful extensions identified in 2018

- Key activities:

- Drill test the new, shallow mineralization in the Northern & NW Extension areas, discovered during the summer 2018 drill program (see news release dated September 24, 2018)

- Drill test a possible offset of mineralization west of the Open Pit

- Drill test the connector zone between the north and south pits

Figure 3. Open Pit Exploration Activity

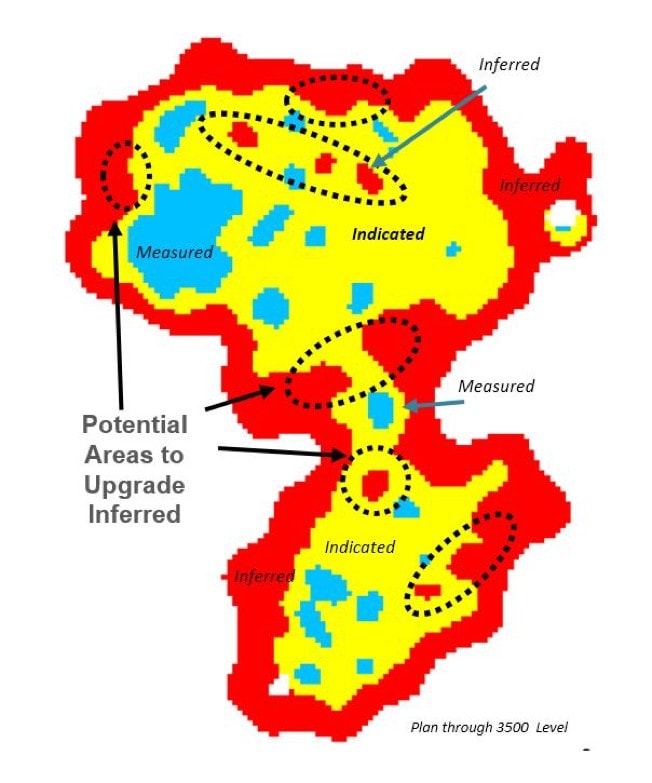

Open Pit Advancement

Current work on the resource model has identified several areas within the Open Pit shell where increased drilling density may add to the resource model as well as potentially convert some of the Inferred Resource to the Indicated Resource category. Additionally, as we go into detailed engineering, the Company recognizes the need to drill test areas of potential future infrastructure locations to verify no mineralization will be sterilized by their positioning.

- Objective: Infill areas of in-pit inferred material, with the aim of increasing the Open Pit resource tonnage and grade

- Key activities:

- Drill areas classified as waste and Inferred Resources with goal to convert to Indicated Resources zones in pit

- Drill areas classified as waste and Inferred Resources to Indicated Resources with goal to convert in open areas along the open pit borders.

- Drill mineralized areas with goal to upgrade areas of poor core recovery

- Drill-test targets that fall within proposed infrastructure

Figure 4. Open Pit Advancement Activity

Underground In-Fill Drilling

While not part of the current year exploration budget, the underground near-mine exploration continues to hold significant potential for adding new mineral resources and extending the mine life of the Underground Project through in-fill drilling. We plan on initiating this drilling commensurate with underground mine activities as the underground drilling platforms are developed.

Please visit our website at www.nevadacopper.com for updated construction progress photos and additional project information.

Qualified Persons

The information and data in this news release was reviewed by Greg French, P.G., VP Exploration and Project Development for Nevada Copper, who is a non-independent Qualified Person within the meaning of NI 43-101.

About Nevada Copper

Nevada Copper’s (TSX: NCU) Pumpkin Hollow underground project is in construction with a view to commencement of copper production in Q4, 2019. Located in Nevada, USA, Pumpkin Hollow has substantial reserves and resources including copper, gold and silver. Its two fully-permitted projects include a high-grade underground project (under construction) and a large-scale open pit project.

Additional Information

For further information please visit the Nevada Copper corporate website

(www.nevadacopper.com).

NEVADA COPPER CORP.

Matthew Gili, President and CEO

For further information call:

Rich Matthews,

VP Investor Relations

Phone: 604-355-7179

Toll free: 1-877-648-8266

Email: rmatthews@nevadacopper.com

Cautionary Language

This news release includes certain statements and information that may contain forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts are forward-looking statements. Such forward-looking statements and forward-looking information specifically include, but are not limited to, statements concerning: the ongoing construction of the underground mine, the commencement of production at the underground mine, and other plans of Nevada Copper with respect to the development, construction and commercial production at the Pumpkin Hollow project, ongoing exploration activities and the objectives and results thereof.

Often, but not always, forward-looking statements and forward-looking information can be identified using words such as “plans”, “expects”, “potential”, “is expected”, “anticipated”, “is targeted”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or the negatives thereof or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements and information are subject to known or unknown risks, uncertainties and other factors which may cause the actual results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements and information.

Forward-looking statements and information are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks and uncertainties relating to: history of losses; requirements for additional capital; dilution; adverse events relating to construction and development; cost overruns; loss of material properties; interest rates increase; global economy; no history of production; future metals price fluctuations, speculative nature of exploration activities; periodic interruptions to exploration, development and mining activities; environmental hazards and liability; industrial accidents; failure of processing and mining equipment to perform as expected; labor disputes; supply problems; uncertainty of production and cost estimates; the interpretation of drill results and the estimation of mineral resources and reserves; changes in project parameters as plans continue to be refined; possible variations in ore reserves, grade of mineralization or recovery rates may differ from what is indicated and the difference may be material; legal and regulatory proceedings and community actions; accidents, title matters; regulatory restrictions; permitting and licensing; volatility of the market price of the Company’s common shares; insurance; competition; hedging activities; currency fluctuations; loss of key employees; other risks of the mining industry as well as those factors discussed in the section entitled “Risk Factors” in the Company’s Annual Information Form dated March 29, 2019. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements or information. The Company disclaims any intent or obligation to update forward-looking statements or information except as required by law. Readers are referred to the full discussion of the Company’s business contained in the Company’s reports filed with the securities regulatory authorities in Canada. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that could cause results not to be as anticipated, estimated or intended. For more information on Nevada Copper and the risks and challenges of its business, investors should review Nevada Copper’s annual filings that are available at www.sedar.com.

The Company provides no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Vancouver, British Columbia – (April 10, 2019)

Rover Metals Corp. (TSXV: ROVR) (OTCQB: ROVMF) (“Rover Metals” or the “Company”) is pleased to announce that it has entered into a non-binding letter of intent dated April 10, 2019 to acquire (the “Transaction”) all of the issued and outstanding shares of Centennial Mining, an arm’s length Nevada corporation, from a private US-based entity (the “Vendor”) in consideration of the issuance to the shareholders of the Vendor of 40,000,000 common shares in the capital of Rover Metals (the “Consideration Shares”). The Consideration Shares will be distributed to the shareholders of the Vendor, resulting in no single person holding more than 9.79% of the issued and outstanding common shares of the Company following the completion of the Transaction (post Transaction individual ownership does not give consideration to the number of shares to be issued in connection with the Company’s current private placement financing disclosed below).

Centennial Mining owns, among other things, a 100% interest in the Toquima precious metals property (the “Toquima Property”) located in Corcoran Canyon, Nevada, USA.

Completion of the Transaction is subject to a number of conditions. Such conditions include the execution of a definitive agreement; completion of satisfactory due diligence; receipt of requisite shareholder and director approvals, as applicable; and receipt of all required regulatory, corporate and third party approvals, including the approval of the TSX Venture Exchange (the “TSXV”) as the proposed Transaction may be a “Reviewable Transaction” under TSXV Policy 5.3 – Acquisitions and Dispositions on Non-Cash Assets. As a result of such conditions, there can be no assurance that the Transaction will be completed as proposed or at all

The Consideration Shares issuable on closing of the Transaction will be subject to a hold period of the greater of 12 months and the period stipulated by the TSXV.

Judson Culter, CEO at Rover Metals, states: “The Toquima Property brings Rover Metals a lower cost per meter precious metals exploration project to offset the somewhat more expensive and seasonal exploration costs of our existing Northwest Territories, Canada assets. Additionally, having recently completed our U.S. OTCQB listing we need a U.S. based asset in a mining friendly jurisdiction. The Toquima Property is available for year-round exploration.”

Trading in the Company’s common shares has been halted by the TSXV at the Company’s request. The halt is expected to continue pending the completion of certain pending conditions and the TSXV’s review and acceptance of materials regarding the satisfaction of such conditions.

This is an initial press release. The Company plans to issue a further press release once it has completed the pending conditions and provide the information prescribed by applicable policies of the TSXV related to the Transaction.

About the Toquima Property, Nevada, USA

The Toquima Property is a gold and silver project located northeast of Tonopah, in central Nevada, USA. The Property comprises 253 contiguous, unpatented mineral claims with an area of approximately 1,958.6 hectares (ha) (4,840 acres). Eight (8) Core claims are under option from Shasta Gold Corp.,19 CX claims are under option from MinQuest Inc., and 226 AR claims were staked in 2016 by Centennial. All claims are in good standing until August 31, 2019.

The Property has been explored since 1970. Between 1970 and 2011, a total of 123 holes, both core and reverse-circulation, with an aggregate length of 17,895 m (58,712 ft) were drilled on the Property. Of this total, approximately 11,500 meters in 78 holes have been drilled within the Silver Reef Zone, the most significant of the known mineral occurrences on the Property. Two historical resource estimates in the context of National Instrument 43-101 exist for the Property. The first was done in 1984 by Copper Range Exploration and estimated 4 million short tons at grades of 2.91 opt Ag and 0.014 opt Au, (3.6 million metric tonnes grading 100 g/t Ag and 0.48 g/t Au). This historical resource estimate was done by hand and none of the key assumptions, parameters, and methods used to prepare this historical resource estimate are available. The second historical resource estimate was done in 1988 by Echo Bay Explorations Inc. which reported “probable” and “possible” resources of 1,251,808 short tons at an uncut grade of 7.22 ounces per ton (opt) Ag and 0.026 opt Au, (1,135,621 metric tonnes grading 247.54 grams per tonne (g/t) Ag and 0.891 g/t Au). A qualified person has not done sufficient work to classify this historical estimate as a current mineral resource, and Rover is not treating them as a current mineral resource.

The Toquima Property is located on the eastern edge of the Toquima Range, a NNE-trending range typical of the Basin-and-Range Province. Most of the Toquima Range is underlain by volcanic rocks of Upper Oligocene to Lower Miocene age, comprising ash-flow tuffs ranging in composition from dacite to high-silica rhyolite. Structure in the Toquima Range is dominated by the generally NE-trending range-front faults on the east and west edges of the range, smaller NE-trending faults, older NW-striking pre-Basin-Range faults, and the circular faults and caldera margins of the Toquima Caldera Complex.

The Toquima Range and the San Antonio Range to the south contain the Northumberland -Tonopah gold-silver belt that hosts at least ten gold-silver mines and properties in addition to the Toquima Property, including Round Mountain (Kinross), Gold Hill, Northumberland, Manhattan, Belmont, and Tonopah. The Property exhibits similarities with most of the other Au-Ag properties in the belt: low-sulfidation epithermal mineralization in caldera margin and/or range front fault zones in veins, stockworks, and breccias hosted in hydrothermally-altered felsic volcanic rocks. Mineralization in the Silver Reef Zone is hosted in the Late Oligocene-age Corcoran Canyon Tuff dated at 27.7 Ma and the Trail Canyon Tuff dated at 23.6 Ma. Three types of felsic intrusions are present on the Property, one or more of which may be related to mineralization.

Exploration on the Property over the last 46 years has outlined the Silver Reef Zone and discovered other mineralized zones. The Silver Reef Ag-Au deposit, a potentially economic zone of pervasive quartz-adularia-sulfide veining, stockwork, and disseminated mineralization accompanied by intense quartz-sericite-pyrite alteration, occurs in a NE-trending, northwest-dipping, zone 500 m wide and 600 m long and has been defined by surface mapping and sampling as well as drilling.

Elsewhere on the Property, exploration identified four additional mineralized zones: Zone M/N is located west of the Silver Reef zone and consists of pervasive quartz-sericite alteration and quartz-adularia veining in a NE trending zone about 800 meters long. Zone R/S is a large area of strong quartz-sericite alteration on the western end of the Property, with anomalous rock and soil assay values. Zone L comprises an ENE-trending Au-Sb-As soil-rock anomaly 100 m long, over a silicified breccia zone. In Zone F, Echo Bay reported rock assays up to 30 g/t Ag, NW of Silver Reef. Although Echo Bay’s subsequent soil samples did not generate an anomaly, Bullion River reported one Au-anomalous rock sample in a rhyolite intrusion.

Technical information in this news release has been approved by Raul Sanabria, M.Sc., P.Geo., VP of Exploration at Rover Metals Corp. and a Qualified Person for the purposes of National Instrument 43-101.

Private Placement

The Company also announces that it has re-priced its previously announced private placement (the “Private Placement”) (see Rover’s March 4, 2019 press release). The Company announces that it will seek to raise an aggregate of $1.25 million through the issuance of up to 20,833,333 units of the Company (each a “Unit”) at a price of $0.06 per Unit. Each Unit will be comprised of one common share in the capital of the Company (a “Common Share”) and one Common Share purchase warrant (a “Warrant”). Each Warrant will entitle the holder to acquire one additional Common Share at an exercise price of $0.12 for a period of five (5) years from the date of issuance.

The Company currently anticipates that the net proceeds of the Private Placement will be allocated as follows: 65% for Toquima Project, 15% for Cabin Lake, and 20% for general and administrative expenses. Rover Metals anticipates closing the Private Placement in multiple closing and as funds are received.

About Rover Metals

Rover Metals is a natural resource exploration company specialized in precious metals that is currently focused on the Northwest Territories of Canada, one of the most mining friendly jurisdictions in North America. The Cabin Lake Group of High Grade Gold Projects are located within 20km of Fortune Minerals’ (TSX:FT) planned NICO Project gold-cobalt processor.

You can follow Rover Metals on its social media channels

Twitter: https://twitter.com/rovermetals

LinkedIn: https://www.linkedin.com/company/rover-metals/

Facebook: https://www.facebook.com/RoverMetals/

CEO.ca: https://ceo.ca/rovr for daily company updates and industry news.

ON BEHALF OF THE BOARD OF DIRECTORS

“Judson Culter”

Chief Executive Officer and Director

For further information, please contact:

Judson Culter

Email: judson@rovermetals.com

Phone: (604) 449-5347

Statement Regarding Forward-Looking Information

This news contains statements that constitute “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Rover’s actual results, performance or achievements, or developments in the industry to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur. There can be no assurance that such statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements, and readers are cautioned not to place undue reliance on these forward-looking statements. Any factor could cause actual results to differ materially from Rover’s expectations. Rover undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Wednesday, April 10, 2019

TORONTO, ON / ACCESSWIRE / April 10, 2019 / Anthony Milewski, Chairman and CEO, Cobalt 27 Capital Corp. (TSX-V: KBLT) (OTCQX: CBLLF) (FRA: 270), met with the London Metal Exchange’s Product Development department to discuss their electric vehicle battery materials initiatives. The London Metal Exchange (LME) is the world centre for industrial metals trading. With the launch of its new cobalt contract, we reached out the LME with some questions that we felt investors and Cobalt 27 shareholders would find interesting.

What is the London Metal Exchange and what does it offer as a platform?

The London Metal Exchange (LME) is the world centre for industrial metals trading. The prices discovered across the LME’s three trading platforms – the Ring, the inter-office ‘telephone’ market and LMEselect, our electronic trading platform – are used as the global reference price and, both the metal and investment communities use the LME to transfer or take on risk, 24 hours a day.

The LME has had a cobalt contract since 2010. Why is the Exchange launching a new cobalt contract now?

The LME launched its physically-settled LME Cobalt contract in 2010, which has been a steady performer amongst a core group of supporters for a physically settled contract. That said, the LME has also seen growing appetite for a cash-settled contract over recent years with the rise in demand for Electric Vehicles (EVs) and battery metals. Last year, we consulted the market in order to identify the best risk management solutions. Following extensive engagement with the market, on 11 March 2019, we launched a cash-settled LME Cobalt (Fastmarkets MB) contract, to complement our existing physically-settled offering. This new cash-settled contract is settled against the Fastmarkets MB Standard Grade index, allowing market participants who have exposure to the aforementioned price in their physical contracts, to hedge across the cobalt value chain with no basis risk.

What are the differences between the new cash-settled LME Cobalt (Fastmarkets MB) contract and the existing physically-settled LME Cobalt contract?

There are several differences between the two contracts, but the most relevant are the settlement structure, settlement price and prompt date structure.

Designed to mirror physical trading, daily prompts enable users of the physically-settled LME Cobalt contract to accurately hedge their physical transactions down to the day.

The LME Cobalt (Fastmarkets MB) contract settles on the last business day of each month in accordance with the LME trading calendar, out to 15 months, to the price of the Fastmarkets MB Index. In contrast, the physically-settled LME Cobalt contract offers daily prompt dates out to three months, weekly prompt dates between three and six months, and monthly prompt dates from the sixth month onward out to 15 months.

Cash settlement is a method used in certain futures and options contracts where, upon expiration or exercise, the seller of the financial instrument does not deliver the actual physical underlying asset but instead transfers the associated cash position. For sellers who do not wish to take actual possession of the underlying cash commodity, cash settlement is a more convenient method of transacting futures and options contracts. Cash settlement is also preferred by financial investors who bring additional liquidity reducing the bid-offer spread, and thus lowering the cost of trading.

And what about the physical delivered contract? What will happen to that now?

The LME recognises the ongoing market support for its physically-settled cobalt contract which has seen a steady uptake in recent months, with an increase in both trading volumes and stocks, and as such it will continue to offer a physically-settled option alongside the new cash-settled LME Cobalt (Fastmarkets MB) contract.

Physical settlement enables short position holders to deliver warrants – a warehouse warrant for the storage of metal, issued by a LME-listed warehouse and in a form approved by the Exchange – against their positions, whilst long position holders will receive warrants, and ultimately, take physical delivery of the metal or close out their position.

Physical settlement is preferred by a number of market participants such as cobalt producers who prefer the option of physical delivery, and the steady growth of the battery metals market in recent years has opened up the cobalt market to a number of new market participants wanting to gain exposure to the cobalt price and have the tools available to manage their price risk. In recent months we have heard of a number of cobalt producers who are interested in listing their brands on the LME and as part of our ongoing commitment to lowering barriers to market entry and serving the physical market, the LME has recently waived all brand listing fees for cobalt producers wanting to enter the market and list their brands on the LME. This waiver will last for 6 months, until October 2019, and any producers interested in listing on the LME should reach out to the team who will be happy to discuss this in more detail.

Who is the new cash-settled contract for?

Over the past few years, we have seen extreme volatility in the cobalt market which has a knock-on effect on the entire value chain, causing operational concerns – increasing financing costs, increasing counterparty risk and, ultimately, increasing the price of goods for consumers.

Furthermore, the significant growth in EVs in recent years has bought new players to the metals market, with considerable capital to invest in this space. Up until now, these new market participants have struggled to manage their exposure to the cobalt price, especially along the forward curve, as they have not had the tools available to them. The new cash-settled LME Cobalt (Fastmarkets MB) contract provides exposure to the Fastmarkets MB Cobalt Standard Grade price, helping market participants to manage risk along the entire cobalt value chain. A few examples of market participants who can benefit from these hedging tools include:

- Miners, traders and hydroxide producers, as well as traditional consumers like the super alloy industry, whose procurement contracts are linked to the Fastmarkets MB Cobalt Standard Grade index

- Cobalt sulphate producers and consumers whose procurement contracts are linked to the Fastmarkets MB Standard Grade price, including the EVs and Lithium-ION batteries industry

As liquidity grows, we expect a number of financial participants including funds and money managers to take an interest in the contract.

The LME Cobalt (Fastmarkets MB) contract will be available to trade 24 hours a day across the LME’s telephone market and from 01:00-19:00 London time on LMEselect, the LME’s electronic market.

What liquidity can we expect?

Building liquidity is always the biggest challenge for new exchange-traded products generally, and especially for small markets like cobalt, but we expect liquidity to grow progressively as our members deploy the infrastructure upgrades that allow them to access this market.

As observed in similar markets, we expect to see the majority of initial liquidity on the telephone market. However, over time we hope to see an increase in the amount of physical players benefiting from the contract and contributing towards an increase in on-screen liquidity and deep order book – providing the transparency and exposure that market participants require.

We have also introduced a new membership category of Registered Intermediating Brokers (RIBs). These are brokers who facilitate trades between two parties – either LME members or clients – helping to grow liquidity in smaller niche markets such as the cobalt market. We have seen in the past how RIBs have greatly supported the initial liquidity in other new markets such as LME Steel Scrap and LME Steel Rebar, playing an integral role in helping these markets to grow.

For more information about the LME’s cobalt offering, please contact one of the team at product.development@lme.com

I welcome shareholders to get in touch with any comments.

Anthony Milewski,

Chairman and CEO

Cobalt 27 Capital Corp.

About Cobalt 27 Capital Corp.

Cobalt 27 Capital Corp. is a leading battery metals streaming company offering exposure to metals integral to key technologies of the electric vehicle and energy storage markets. The Company owns physical cobalt and a 32.6% Cobalt Stream on Vale’s world-class Voisey’s Bay mine, beginning in 2021. Cobalt 27 is undertaking a friendly acquisition of Highlands Pacific which is expected to add increased attributable nickel and cobalt production from the long-life, world-class Ramu Mine. The Company also manages a portfolio of 11 royalties and intends to continue to invest in a cobalt and nickel focused portfolio of streams, royalties and direct interests in mineral properties containing battery metals.

For further information please visit the Company website at www.cobalt27.com

Forward-Looking Information: This interview may contain certain information which constitutes ‘forward-looking statements’ and ‘forward-looking information’ within the meaning of applicable Canadian securities laws. Forward-looking statements address future events and conditions which involve inherent risks and uncertainties. Actual results could differ materially from those expressed or implied by them. Examples of forward looking information and assumptions include future estimates of the worldwide supply and demand for cobalt and other metals and the effect that these changes could have on the short term and long term price of cobalt and other metals on the world markets, statements regarding the future operating or financial performance of Cobalt 27 including the net present value, metal recoveries, capital costs, operating costs, production, rates of return and payback. Forward looking statements involve known and unknown risks and uncertainties which may not prove to be accurate. Such statements are qualified in their entirety by the inherent risks and uncertainties surrounding future expectations. Among those factors which could cause actual results to differ materially are the following: market conditions and other risk factors listed from time to time in Cobalt 27 Capital Corp.’s reports filed with Canadian securities regulators on SEDAR at www.sedar.com.

In some cases, forward-looking statements can be identified by terminology such as “may”, “will”, “should”, “expect”, “projects”, “plans”, “anticipates” and similar expressions. These statements represent management’s expectations or beliefs concerning, among other things, future operations and various components thereof affecting the economic performance of Cobalt 27. Undue reliance should not be placed on these forward-looking statements which are based upon management’s assumptions and are subject to known and unknown risks and uncertainties, including the business risks discussed above, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. Accordingly, readers are cautioned that events or circumstances could cause results to differ materially from those predicted.

Links: Some of the posted entries on in this interview may include links to 3rd party websites. Cobalt 27 has not reviewed all websites linked to or from this Site and is not responsible for the contents of any such websites. The inclusion of any link does not imply endorsement by Cobalt 27 of the linked website or its content. Use of any such linked website is at the user’s own risk.

SOURCE: Junior Mining Network

View source version on finance.yahoo.com: https://finance.yahoo.com/news/lmes-cobalt-contract-history-cobalt-130000903.html

April 10, 2019

Vancouver, B.C., Granite Creek Copper Ltd. (TSX.V: GCX) (“Granite Creek” or the “Company”) announces that the Company’s common shares have commenced trading on the Frankfurt Stock Exchange under the symbol “A2PFE0”. The Company’s common shares continue to be listed on the TSX Venture Exchange under the symbol “GCX”.

President & CEO, Tim Johnson, stated, “With the Frankfurt exchange being amongst the world’s largest by market capitalization, this listing will significantly expand our shareholder base and access to international capital. The Company continues to pursue a number of initiatives with respect to the Stu Project and we are looking forward to providing additional updates over the coming weeks as we approach the start of the 2019 field exploration season.”

About Granite Creek Copper

Granite Creek is a Canadian exploration company focused on the 100%-owned Stu Copper-Gold project located in the Yukon’s Carmacks Copper District which covers 111 square kilometres adjacent to Capstone Mining’s high-grade Minto Cu-Au-Ag Mine and Copper North’s advance stage Carmacks Cu-Au-Ag project. More information about the company and the Stu Copper project can be viewed on the Company’s website at www.gcxcopper.com.

About the Metallic Group of Companies

The Metallic Group is a collaboration of leading precious and base metals exploration companies focused on high-potential, brownfields exploration assets adjacent to high-grade operating mines in proven in North American districts with excellent infrastructure. Focusing exploration in these proven brownfields districts increases the probability of new discoveries and allows for rapid advancement of resources to create value.

Member companies have highly experienced management and technical teams with track records of successful discovery and project development, including capital markets and financing expertise. Metallic Group professional backgrounds include former leadership positions with Barrick Gold, Goldfields, Stillwater Mining and leading explorer/developers NovaGold, Trilogy Metals and Wellgreen Platinum. Company leaders have been credited with the discovery, or expansion and advancement, of several major deposits in North America, and have significant ownership positions in the companies.

The Group and its members are headquartered in Vancouver, BC, Canada, with company stocks currently listed on the TSX Venture, US OTC, and Frankfurt stock exchanges.

FOR FURTHER INFORMATION PLEASE CONTACT:

Timothy Johnson, President

Telephone: 1 (604) 235-1982

Toll Free: 1 (888) 361-3494

E-mail: info@gcxcopper.com

Website: www.gcxcopper.com

Metallic Group: www.metallicgroup.ca

Gowest Announces $8 Million Investment By Fortune Future Holdings Limited

April 9, 2019, 7:45 am

TORONTO, ONTARIO – (April 9, 2019) Gowest Gold Ltd. (“Gowest” or the “Corporation”) (TSX VENTURE: GWA) announced today that Fortune Future Holdings Limited (“Fortune”) has agreed to purchase, on a non-brokered private placement basis, common shares of the Corporation for aggregate gross proceeds of $8,000,000 (the “Private Placement”).

The Private Placement is subject to the completion of a consolidation of the outstanding common shares of the Corporation (the “Consolidation”), on a one (1) for ten (10) basis, prior to the closing of the Private Placement. Pursuant to the proposed Consolidation, holders of common shares of the Corporation will receive one (1) post-Consolidation common share in exchange for every ten (10) pre-Consolidation common shares outstanding immediately prior to the Consolidation. The Consolidation will affect all holders of common shares uniformly and will not affect any shareholder’s percentage ownership interest in the Corporation.

The common shares to be issued to Fortune pursuant the Private Placement will be issued at a price of $0.45 per share on a post-Consolidation basis (being equal to $0.045 per share on a pre-Consolidation basis).

Details of the Private Placement

In connection with the Private Placement, the Corporation has received, and accepted, an irrevocable subscription from Fortune for the full amount of the Private Placement.

Pursuant to the Private Placement, the Corporation will issue to Fortune an aggregate of 17,777,777 common shares at a price of $0.45 per share on a post-Consolidation basis (being equal to 177,777,777 common shares at a price of $0.045 per share on a pre-Consolidation basis). On April 8, 2019, the closing price of the common shares of the Corporation on the TSX Venture Exchange (“TSX-V”) was $0.0375. During the prior month, the common shares of the Corporation traded on the TSX-V between $0.03 (low) and $0.04 (high).

Fortune is an investment company based in Chifeng City, Inner Mongolia, China, focused on investment in companies engaged in the exploration for, and the mining and sale of, mineral resources. In addition to its primary office in Chifeng City, Fortune has branches in Hong Kong and Beijing and is involved with various mining projects throughout China, Mongolia, Nigeria and Algeria. Fortune is incorporated under the laws of the British Virgin Islands.

Fortune made its initial investment in the Corporation in June 2014 and currently holds ownership of greater than 10% of the outstanding common shares of the Corporation. As of the date hereof, Fortune holds 85,000,000 common shares of the Corporation representing approximately 19.8% of the outstanding common shares of the Corporation. Fortune was previously a “control person” of the Corporation. Assuming the completion of the Private Placement, and no further issuances of common shares by the Corporation prior to the closing date, Fortune would hold 26,277,777 common shares on a post-Consolidation basis (being equal to 262,777,777 common shares on a pre-Consolidation basis), representing approximately 43.3% of the outstanding common shares of the Corporation.

Pursuant to the terms of the Private Placement, closing is to occur following the receipt of requisite shareholder approvals for the Private Placement and the implementation of the Consolidation (as described in greater detail below). There are no material conditions to the closing of the Private Placement, other than: (i) the receipt of required shareholder approvals (for the Private Placement and Consolidation); (ii) the receipt of required regulatory approvals, including the approval of the TSX-V; (iii) the requirement that there be no material adverse change with respect to the Corporation prior to the closing of the Private Placement; and (iv) the requirement that the representations and warranties of the parties given in the subscription agreement in respect of the Private Placement be true and correct, in all material respects, as of the closing date of the Private Placement.

Assuming the completion of the Private Placement, Fortune will have the right to appoint, and to have nominated by the Corporation for election at each annual meeting of shareholders, that number of directors or the Corporation as will represent a majority of the board of directors (the “Board”), so long as Fortune holds greater than 30% of the outstanding common shares of the Corporation. Pursuant to the terms of its initial investment in the Corporation, Fortune held a contractual right to appoint two directors to the Board.

The approval of the Private Placement follows an exhaustive search and evaluation of potential sources of capital undertaken by management and the Board over the past number of months. The terms and conditions presented to the Corporation by Fortune pursuant to the Private Placement have been determined by the Board to be reasonable in the circumstances of the Corporation; in particular having regard to the current challenging financial and operational circumstances affecting the Corporation and the difficult market conditions affecting junior mining issuers generally. No alternative commercially reasonable financing options of the magnitude of the Private Placement were identified the Corporation. In the opinion of management and the Board, the Private Placement represents the best financing option available to the Corporation at this time.

After consideration of all relevant circumstances, the Board (with the representatives of Fortune abstaining) has approved the Private Placement and has determined that the Private Placement is in the best interests of the Corporation.

Among other factors considered by the Board in approving the Private Placement: (i) the issue price of the common shares represents a premium to the recent trading price of the common shares on the TSX-V; (ii) the Private Placement presents lower-execution risk given Fortune’s familiarity with the Corporation and its operations and no further due diligence is required to be conducted by Fortune; (iii) the investment by Fortune may assist the Corporation in its efforts to raise additional funds, including by way of additional “flow-through” investment in the Corporation; (iv) shareholders will continue to participate in any future appreciation in the value of the common shares of the Corporation; and (v) the significant investment by Fortune confirms its long-term commitment to the Corporation and to bringing its 100% Bradshaw Gold Deposit (“Bradshaw”) into commercial production

The proceeds of the Private Placement will be used by the Corporation for the continued development of Bradshaw. The proceeds of the Private Placement alone will not be sufficient to bring Bradshaw into commercial production. The Corporation is continuing to pursue additional financing opportunities to cover this anticipated funding shortfall and also to advance, in parallel, exploration opportunities both at and near Bradshaw.

All of the securities issuable in connection with the Offering will be subject to a hold period expiring four months and one day after date of issuance.

The securities offered have not been registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons absent registration or an applicable exemption from registration requirements. This release does not constitute an offer for sale of securities in the United States.

Completion of the Private Placement remains subject to receipt of the approval of the TSX-V.

Minority Approval of Private Placement

By virtue of the fact that Fortune holds ownership of greater than 10% of the outstanding common shares of the Corporation and therefore is a “related party” of the Corporation pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”), the Private Placement will constitute a “related party transaction” of the Corporation under MI 61-101. As such, the Private Placement is subject to the minority approval requirements of MI 61-101 and will require the approval of shareholders of the Corporation, excluding Fortune (and any related parties of Fortune), prior to the closing of the Private Placement. As the Corporation is listed only on the TSX-V, the Private Placement is exempt from the valuation requirements of MI 61-101 by virtue of the exemption contained in Section 5.5(b) of MI 61-101.

Further, given that Fortune will hold greater than 20% of the outstanding common shares of the Corporation following the completion of the Private Placement, the Private Placement is subject to the approval of shareholders of the Corporation, excluding Fortune (and any related parties of Fortune), pursuant to the Corporation’s shareholder rights plan (the “Rights Plan”). The terms of the Rights Plan are set out in the Amended and Restated Shareholder Rights Plan Agreement, dated as of May 5, 2017, between the Corporation and TSX Trust Company, as rights agent. Specifically, the Private Placement is subject to the shareholders of the Corporation, excluding Fortune (and any related parties of Fortune), approving the Private Placement as a “Shareholder Approved Financing” in accordance with the Rights Plan.

The Corporation intends to call a special meeting of shareholders of the Corporation (the “Meeting”) as soon as possible for the purpose of obtaining the requisite shareholder approvals for the completion of the Private Placement. The Board recommends that shareholders vote in favour of the Private Placement.

Further information regarding the Private Placement will be contained in the management information circular to be prepared in respect of the Meeting. The management information circular will be filed under the Corporation’s profile on SEDAR (www.sedar.com) at the time that it is mailed to shareholders. All shareholders are urged to read the management information circular once it becomes available, as it will contain additional important information concerning the Private Placement.

The parties expect that the Private Placement will be completed shortly after the Meeting, subject to satisfaction of all conditions precedent to the closing of the Private Placement.

Consolidation

As indicated above, the completion of the Consolidation is a condition precedent to the closing the Private Placement. The completion of the Private Placement, among other purposes, will allow the Corporation to comply with the policies of the TSX-V, which generally prohibit the issuance of shares at a price of less than $0.05 per share.

If approved and implemented, the Consolidation will occur simultaneously for all of the Corporation’s issued and outstanding common shares and will occur prior to the completion of the Private Placement. The Consolidation will affect all holders of Common Shares uniformly and will not affect any shareholder’s percentage ownership interest in the Corporation. As the Corporation currently has an unlimited number of common shares authorized for issuance, the Consolidation will not have any effect on the number of common shares that remain available for future issuance. If the Consolidation is implemented, the exercise price and number of common shares issuable under outstanding incentive stock options and common share purchase warrants issued by the Corporation will be proportionately adjusted.

The Corporation intends to seek approval of shareholders for the Consolidation at the Meeting. The Consolidation will require the approval of not less than two-thirds (2/3) of the votes cast by the holders of common shares present in person or represented by proxy at the Meeting. The Board recommends that shareholders vote in favour of the Consolidation.

About Gowest

Gowest is a Canadian gold exploration and development company focused on the delineation and development of its 100% owned Bradshaw Gold Deposit (Bradshaw), on the Frankfield Property, part of the Corporation’s North Timmins Gold Project (NTGP). Gowest is exploring additional gold targets on its +100‐square‐kilometre NTGP land package and continues to evaluate the area, which is part of the prolific Timmins, Ontario gold camp. Currently, Bradshaw contains a National Instrument 43‐101 Indicated Resource estimated at 2.1 million tonnes (“t”) grading 6.19 grams per tonne gold (g/t Au) containing 422 thousand ounces (oz) Au and an Inferred Resource of 3.6 million t grading 6.47 g/t Au containing 755 thousand oz Au. Further, based on the Pre‐Feasibility Study produced by Stantec Mining and announced on June 9, 2015, Bradshaw contains Mineral Reserves (Mineral Resources are inclusive of Mineral Reserves) in the probable category, using a 3 g/t Au cut‐off and utilizing a gold price of US$1,200 / oz, totaling 1.8 million t grading 4.82 g/t Au for 277 thousand oz Au.

Forward-Looking Statements