Ottawa, Ontario–(Newsfile Corp. – July 11, 2024) – Gold79 Mines Ltd. (TSXV: AUU) (OTCQB: AUSVF) (“Gold79” or the “Company”) is pleased to announce that it has received the assay results from its recently completed trenching program along the Tyro Main Zone which has confirmed our understanding of the geology, added new potential high-grade targets for the next drill campaign and extended the zone along strike to the northeast.

Highlights from the program include:

- Confirmed the geologic model where the White Spar Fault intersects the Tyro Main Zone. Trench 1 (T1) returned 39.7m of 1.14 g/t Au including 9.5m of 2.08 g/t Au. In 2023, drilling returned 51.1 g/t Au over 9.1m (GC23-28) about 40 to 50m below these surface exposures.

- Identified new fault structures intersecting the Tyro Main Zone trending north to northwest (similar to the White Spar fault), providing additional high-grade potential zones.

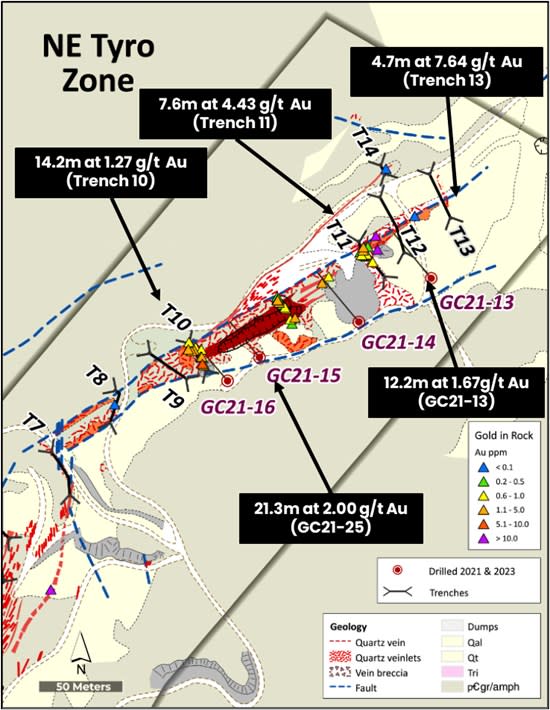

- Extended the Tyro Main Zone to the northeast by approximately 40m with Trench 13 (T13) returning 4.7m of 7.64 g/t Au, where it remains open to the northeast.

Derek Macpherson, President and CEO stated, “The data collected in this low-cost exploration effort has improved our understanding of the Tyro Main Zone geology, particularly the impact of the White Spar fault on the SW portion (Decimal Hill Zone) and the high-grades previously drilled at this intersection. With this data, we are starting to plan the next phases of drilling potentially allowing Gold79 to deliver a maiden resource that would be higher-grade and larger than the current deposits in the region.”

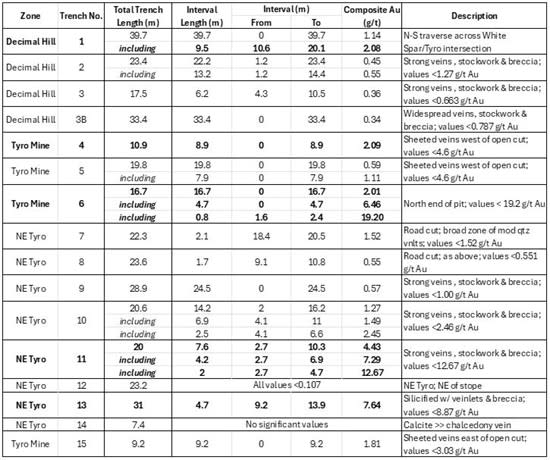

A total of 15 trenches were excavated across 358m with a total of 217 chip-channel samples collected. Highlights of the analytical results are presented in Table 1.

Table 1. Summary of the Tyro Main Vein trenching program.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/216119_1.jpg

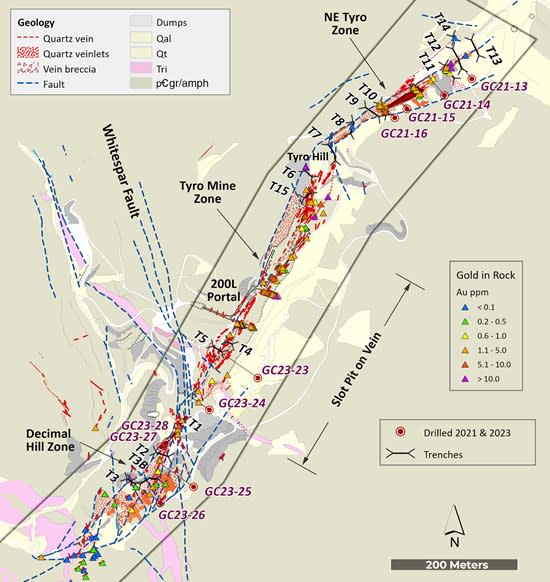

In addition to the sampling, all trenches were mapped with the results presented in Figure 1.

Figure 1: Geologic map of the Tyro vein system showing recently completed trenches (T1-T15), Phase 1 and Phase 2 drill hole locations and surface rock sample gold values.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/216119_69da767954f31a63_002full.jpg

Summary

The trenching program has provided Gold79 a combination of better geologic control and a higher sample density. The result is greater confidence that the White Spar fault was active at essentially the same time as the Tyro Main vein but movement continued after the Tyro vein allowing for downward offset of the Decimal Hill zone. This better explains the gold values at Decimal Hill (Table 1: T1, T2, T3 and T3B). Additionally, the results serve to better constrain the limits of gold-bearing veins surrounding the shallow pit; important widths and grades have been documented on 3 sides (Table 1: T4, T5, T6 and T15). In the NE Tyro zone, trenches have exposed broad zones of chalcedony veining and breccia with variable widths and grades (Table 1: T7 thru T12). Most importantly, the northernmost trench, T13, identified beneath alluvial cover a zone of silicification hosting quartz veinlets and breccia with 7.64 g/t Au over 4.7 metres. This brings meaningful gold grades closer to our Frisco Graben target where the suspected gold zone is concealed beneath vapor-dominated alteration.

The Tyro Main Zone is composed of several gold-bearing stages emplaced into a NE-trending, steeply dipping structural corridor which has seen repeated movement. This low sulfidation, epithermal vein system can be divided into 3 zones (SW to NE; Figure 1): 1. Decimal Hill; 2. Tyro Mine Zone; and, 3. The Tyro NE Zone. These zones are essentially defined by north-northwest-trending faults which were likely operative both during and after the Tyro mineralizing events.

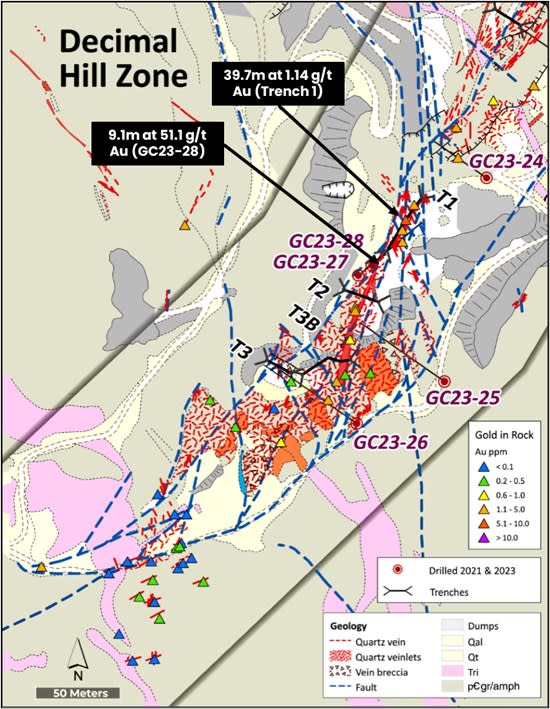

Figure 2. Geologic map of the Decimal Hill Zone showing mine workings, drill holes, trenches and surface samples.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/216119_69da767954f31a63_003full.jpg

Decimal Hill Zone

The Decimal Hill zone, covering about 300 metres of the Tyro Main vein southwest of the mine, is situated at the intersection of the Tyro and White Spar structural corridors (Figure 2). In addition to the structural intersection, the area hosts the convergence of several rhyolite dikes whose faulted contacts may have provided avenues of ingress to the gold-bearing fluids. This zone is characterized by both north- to northeast-trending veins and breccia and NW-trending veins and breccia. The veins here lack the textural banding, adularia and reveal diminished gold values (i.e. <3 g/t Au; Figure 3).

This trenching campaign, along with the geologic mapping, has confirmed that the Decimal Hill Zone contains both NW- and N-NE-trending veins suggesting that both structural corridors were operative prior to and during the mineralizing stages. The White Spar trend clearly hosted a greater component of post-mineral movement. This later movement is manifested by relatively small offsets of the veins along the Tyro structural corridor resulting in the structural juxtaposition of high-level vein textures and gold grades (Figure 3) with textures and gold grades more indicative of the ‘bonanza’ or boiling zone (i.e. Tyro Mine zone; Figure 4).

Figure 3: Sample No. 0743 (1.15 g/t Au): Hydrothermal breccia composed of Precambrian granite and multi-stage vein fragments including quartz-replaced lattice texture, massive white chalcedony and crustiform-banded chalcedony-adularia rimming massive quartz fragments, Decimal Hill Zone.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/216119_69da767954f31a63_004full.jpg

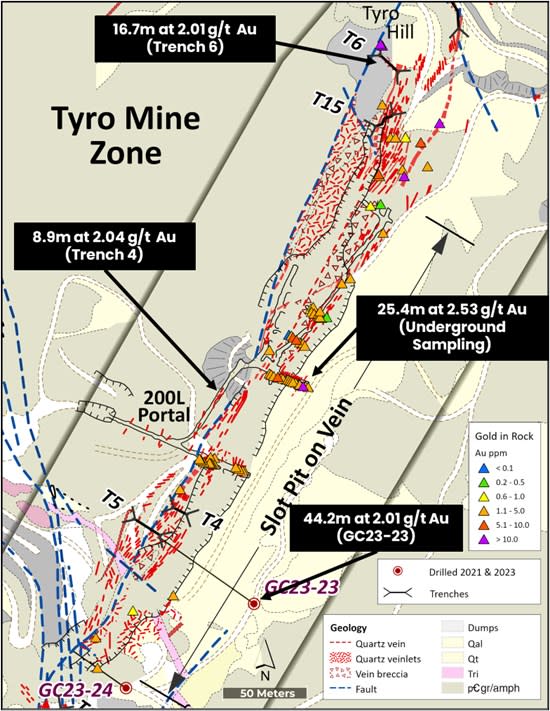

Tyro Mine Zone

The Tyro Mine Zone, shown in Figure 5, a N30oE-trending zone of sub-parallel and sub-vertical veins, veinlets and hydrothermal breccia, extends from the White Spar fault intersection to the top of Tyro Hill, a distance of about 430 metres (Figure 5). The zone hosts most of the mining activity conducted between 1915 and 1941 and in the 1980s. This includes the Tyro Shaft, reported to be 500 feet deep, the 200 Level and a slot pit developed on the highest-grade portion of the vein. The 200 Level defines the lowest level of selective production although there was some development along the vein to the 300 Level. The 200 Level defines the bottom of the slot pit and hosts a broad zone, 20 to 30 metres wide, of NE-trending chalcedony-adularia-calcite veins (Figure 4). Only two holes have been drilled beneath the Tyro Mine Zone, Hole Nos. GC23-23 (44.4m at 2.01 g/t Au) and GC23-24 (25.9m at 2.27 g/t Au).

Figure 4. Sample No. 0184 – 13.27 g/t Au: Crustiform-banded quartz-chalcedony-adularia vein with internal hydrothermally brecciated vein fragments cemented by olive-green chalcedony, Tyro Mine Zone.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/216119_69da767954f31a63_005full.jpg

Figure 5. Geologic map of the Tyro Mine Zone showing mine workings, drill holes, trenches and surface samples.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/216119_69da767954f31a63_006full.jpg

Northeast Tyro Zone

The Northeast Tyro Zone extends from the top of Tyro Hill (Figure 1) at N60oE for about 300 metres where it disappears beneath an alluvium filled valley before it intersects the Frisco Mine fault, the southwest margin of the Frisco Graben. This zone commences at the intersection of a NNW-trending post-mineral fault (Figure 5) where the Tyro structural corridor rotates clockwise about 30o and flattens slightly to 70-80 degrees southeast. The initial 100 or so metres of the vein is characterized by a zone of silicified amphibolite and granite with weak to moderate chalcedony veinlets and stockwork. Trenches T7 and T8 were cut across this zone (Figure 5) with locally anomalous gold values. Trenches T9, T10 and T11 traverse a broad zone of strong quartz-chalcedony veins, stockwork and vein breccia with variable gold values, i.e. T11 – 7.6m @ 4.43 g/t Au. Between T10 and T11, a 60 metre segment of the vein complex, up to 5m wide, has been stoped to about 20m below the surface. Drilling beneath this zone by Gold79 in 2021 traversed up to 21.3m @ 2.0 g/t Au (GC21-15). The NE extent of the Tyro vein is obscured by dumps and alluvium where T13 was excavated to identify a concealed extension to the vein. Trench 13 traversed a zone of silicified amphibolite and granite containing quartz-chalcedony veinlets and breccia with 4.7m @ 7.64 g/t Au. The Tyro structure remains concealed by alluvial deposits for about 400 metres to the northeast where it intersects the Frisco Mine fault characterized by high-level silica-clay-hematite alteration.

Figure 6. Geologic map of the Northeast Tyro Zone showing mine workings, drill holes, trenches and surface samples.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/216119_69da767954f31a63_007full.jpg

Closing of Private Placement Financing

The Company has closed its non-brokered private placement financing previously announced on April 11, 2024 and May 6, 2024. Gross proceeds of $718,250 was raised through the issuance of 2,873,000 units at $0.25 per unit. Each unit consists of one common share of the Company and one-half common share purchase warrant. A total of 1,436,500 whole warrants were issued, with each warrant entitling the holder to purchase one common share of the Company at a price of $0.30 per share until May 3, 2026. The warrants are callable, at the option of the Company, in the event that the 20-day volume-weighted average price of the Company’s common shares meets or exceeds $0.50 for 10 consecutive trading days based on trades on the TSX Venture Exchange and alternative trading systems. Subscribers will be notified of the call provision being triggered and will have a 30-day period to exercise the warrants.

Cash finder’s fees of $4,200 were paid and 16,800 finder warrants were issued. The finder warrants are exercisable at $0.30 per share and expire May 3, 2026.

This private placement is subject to the final approval of the TSX Venture Exchange. All securities issued in the placement are subject to a statutory hold period until Sept. 4, 2024.

Officers and directors of the Company participated in the private placement and acquired 900,000 units for $225,000. The participation of these insiders in the private placement constitutes a related-party transaction within the meaning of Multilateral Instrument 61-101 — Protection of Minority Security Holders in Special Transactions. The board of directors of the Company, with participating directors abstaining, determined that the transaction is exempt from the formal valuation and minority shareholder approval requirements contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101 for the related-party transaction, as neither the fair market value of securities issued to the insiders nor the consideration paid by the insiders exceeded 25 percent of the Company’s market capitalization. The Company did not file a material change report in respect of the transaction 21 days in advance of the closing of the private placement because insider participation had not been confirmed. The shorter period was necessary in order to permit the Company to close the private placement in a time frame consistent with usual market practice for transactions of this nature.

Qualified Person / Quality Control and Quality Assurance

Robert Johansing, M.Sc. Econ. Geol., P. Geo., the Company’s Vice President, Exploration is a qualified person (“QP”) as defined by NI 43-101 and has reviewed and approved the technical content of this press release. Mr. Johansing has also been responsible for the trenching program including sample collection, labelling, bagging and transport from the project to American Assay Laboratories of Sparks, Nevada. Samples were then dried, crushed and split, and pulp samples were prepared for analysis. Gold was determined by fire assay with an ICP finish, over limit samples were determined by fire assay and gravimetric finish. Silver plus 34 other elements were determined by Aqua Regia ICP-AES, over limit samples were determined by fire assay and gravimetric finish. Gold standards and blanks were inserted into the sample chain along with QAQC procedures conducted by American Assay. Standard sample chain of custody procedures were employed during field work until delivery to the analytical facility.

About Gold79 Mines Ltd.

Gold79 Mines Ltd. is a TSX Venture listed company focused on building ounces in the Southwest USA. Gold79 has four gold projects, two of which are partnered with major gold producers (Kinross at Jefferson Canyon and Agnico at Greyhound). Gold79 is focused on establishing a maiden resource at its Gold Chain project in Arizona and advancing its Tip Top Project in Nevada.

For further information regarding this press release contact:

Derek Macpherson, President & CEO

Phone: 416-294-6713

Email: dm@gold79mines.com

Website: www.gold79mines.com.

Book a 30-minute meeting with our CEO here.

FORWARD-LOOKING STATEMENTS:

This press release may contain forward-looking statements that are made as of the date hereof and are based on current expectations, forecasts and assumptions which involve risks and uncertainties associated with our business including any future private placement financing, the uncertainty as to whether further exploration will result in the target(s) being delineated as a mineral resource, capital expenditures, operating costs, mineral resources, recovery rates, grades and prices, estimated goals, expansion and growth of the business and operations, plans and references to the Company’s future successes with its business and the economic environment in which the business operates. All such statements are made pursuant to the ‘safe harbour’ provisions of, and are intended to be forward-looking statements under, applicable Canadian securities legislation. Any statements contained herein that are statements of historical facts may be deemed to be forward-looking statements. By their nature, forward-looking statements require us to make assumptions and are subject to inherent risks and uncertainties. We caution readers of this news release not to place undue reliance on our forward-looking statements as a number of factors could cause actual results or conditions to differ materially from current expectations. Please refer to the risks set forth in the Company’s most recent annual MD&A and the Company’s continuous disclosure documents that can be found on SEDAR at www.sedar.com. Gold79 does not intend, and disclaims any obligation, except as required by law, to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/216119